Would it ever be reasonable to call our real estate market boring?

I mean, the real estate market isn’t boring, nor will it ever be. It’s real estate! It’s the one thing that we all have in common, in that we all live somewhere, and I would argue that Toronto real estate might give the Toronto Maple Leafs a run for their money in the “most talked about” contest over the last decade.

But comparatively speaking, is it possible that Toronto real estate just isn’t as interesting as it used to be?

Perhaps this is a good thing. Maybe we needed this.

Real estate has dominated the headlines for the last decade and it’s all anybody ever wants to talk about. It’s made some people rich while it’s made others feel inadequate, and all the while, I feel like where a person lives was never supposed to play such a large role in all our daily lives.

So compared to the market that we experienced in February, and the media attention that surrounded it, today’s market is, well, boring.

Sales are down, prices are flat, the sexy “bidding war” stories aren’t being told with regularity by newspaper columnists, and thus there’s nothing for us to get all riled up about.

I spent years wondering why people were so interested in real estate stories, and to some extent, I still do. I understand there’s an element of fantasy to it all, and the human element is part of every story. There’s the interior design angle, the financial angle, and then just the sheer amount of spin and sexiness that the media puts into every story.

I recall a story where there were ten, fifteen, or twenty bids on a particular property, and one bidder offered a pair of Toronto Maple Leaf tickets to the seller if their bid was chosen. That’s sexy, right? Involve a major Toronto sports team, and you’ve got keywords, clickbait, and more eyes on the story.

But what about now?

What does the media do with a market that’s not red-hot, that isn’t bordering on mania, and that’s debatably boring?

Well, it looks like they’ll continue to spin, continue to write eye-catching headlines, and continue to play on fears. Only this time, it’s not fear of missing out, but rather it’s fear of losing everything.

Case in point, here are merely six headlines from BlogTo over the past month and change:

“Experts Say The Toronto Real Estate Market Is Facing A Major Crisis”

“Toronto’s Real Estate Market Is Tanking And Experts Are Pretty Worried”

“Toronto Home Sales Are Tanking And Experts Are Very Worried”

“Toronto’s Real Estate Market Just Took An Absolute Nosedive”

“Condos In Toronto Are Now Sitting On The Market For Shockingly Long As Sales Tank”

“Toronto’s Floundering Real Estate Market is Putting A Hole In The City’s Finances”

And that’s just what I found in five minutes!

I’m continuously asked by clients and readers why BlogTo has such a hate-on for real estate, and I honestly don’t know. Those six articles were written by the same two authors, and I’m willing to bet neither owns their own home.

And that seems to be what Toronto is about, sadly.

Those that don’t own or can’t get what they want are far more likely to hate real estate, hate real estate agents, argue that properties are over-priced, predict the coming “bubble burst,” and clamour for the government to “do something.”

So as I said: maybe this “boring” market is a good thing?

We’re two months through the fall market which is essentially a compact, quick, 3-month cycle. Sure, real estate does sell in December, but as a seller you’re not targeting that month. The only people who typically target December are buyers, and that’s because they feel they can pick through the leftover-bin and look for a deal.

I combed through the October TRREB stats last week, looking for something sexy, but all I found was boring.

Flat, yes.

Stable, sure.

And if I had to pick one word to describe our market right now, it would be “stable.”

Perhaps stability is a better term, and despite talk of a recession, or your every-Saturday read about the real estate market collapse, the conclusion I drew when I looked at the TRREB number last month was that we’ve hit a point of stability.

Here’s the average GTA home price over the last four months:

That’s four month in a row of the average home price falling within a minuscule 1.37% band.

That, to me, is a trend.

That, to me, is stability.

Is stability the opposite of volatility? At times it is, but at other times, we grow accustomed to thinking that a market appreciating out of control is “normal,” and anything to the contrary seems concerning.

Our market is said to have “peaked” in February, with the average home price dropping on a month-over-month basis in March, April, May, and June. The average home price has increased in three straight months, but those increases (+0.4%, +0.7%, +0.2%) are so small that it’s of little significance. What is significant, in my opinion, is that prices remain flat. This seems to be a new baseline for pricing, and whether the average home price goes up or down by 0.4% doesn’t matter so long as there is continued support at this level.

Now, not to undermine what I said above about those small price increases being of little significance, I was watching the October data to see if we witnessed a decline.

Increases of 0.4%, 0.7%, and 0.2% are insigificant in the grand scheme of things, ie. comparing to the peak in February.

But as it pertains to what usually happens from September to October, it’s important.

I’m always looking for outliers in the data as indications that the market is doing something unique, and in this case, a decline from September to October would have allowed us to draw conclusions about the market moving the other way.

Why?

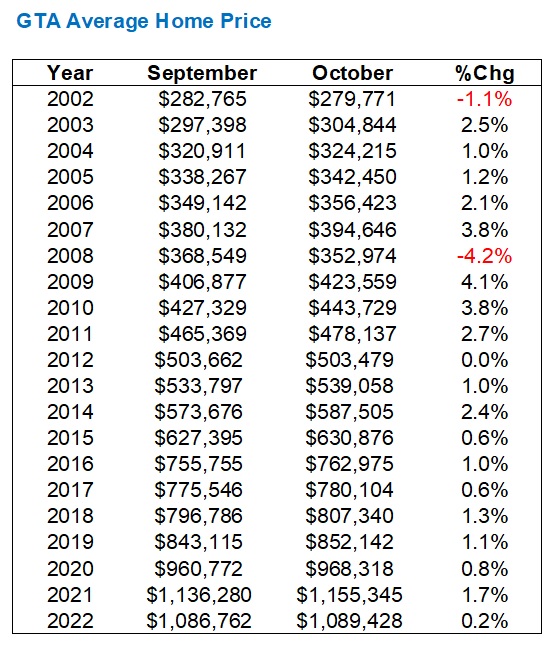

Well, because of this data:

Only twice in the previous twenty years did we see a decrease in average home price from September to October, and one of those years, 2008, was in the middle of a worldwide financial crisis.

Sure, the average home price only increased 0.2%. That’s a rounding error. That might as well be zero, right?

But we didn’t see a decline. That is the story here.

The fall market is typically quite frenetic and the momentum builds as time goes on. September is crazy and it leads to an exceptionally busy October, with prices usually following suit.

If we saw the October average home price decline, it would have signaled that September was the proverbial “dead cat bounce” in the market.

But in the end, we saw in the data what most agents felt out in the market, which is that despite a decline in sales, there’s no significant decline in price.

What of those sales, however?

The media ran with this year-over-year decline of 49.1%, which surely is significant! There’s no way to sugarcoat or explain away that half as many properties sold this year compared to last year, although given the circumstances, it’s not like we expected anything different.

In a fall market context, however, the decline in sales on a month-over-month basis was surprising.

I do believe that the average price story is more important, but what can we say about the 1.5% decline in sales from September to October?

We could say that 1.5% is insignificant, but we could also say that in 15 of the previous 20 yeas, we saw an increase in sales in this market. Have a look:

Total sales decreased on a month-over-month basis but average price increased.

Interesting!

And all the while, “new listings” did what they always do:

An increase in new listings would have been a huge red flag. Er, in this case, a black flag, per the chart above, but you understand what I’m saying.

If this market is going to turn downwards like so many people think, then we’d be seeing a decline in average price, a decline in sales, and a huge increase in new listings.

Not so, however.

A lot of the media coverage has been on Canadian real estate, and when I look at the market in a Toronto context, I tend to tune out the headlines and media voices talking about prices coast-to-coast.

But I also think it’s important to look at the GTA market in the context of each individual region, so as a refresher, let’s check in and see how prices have fared since the “peak” in February:

The GTA-wide price is down 17.7% and that’s significant.

Prices were up a whopping 15.3% from December of 2021 to February of 2022, as we all know. That was the mania that started 2022 and it’s part of the reason why we find ourselves where we currently do.

But with all this talk of a 17.7% drop from February, surely the December-to-February story must be told hand-in-hand, no?

Another story that should be told: the 416 is “only” down 9.7% since February whereas an area like Durham region is down almost triple comparatively.

All averages are made of other averages, and that 17.7% drop, GTA-wide, is made up in part by a smaller 9.7% drop in the 416, and a larger 27.3% drop in Durham, and a 21.3% drop in Peel, and so on, and so forth.

While I’m not trying to make this into an argument about how the 416 is more immune to price corrections than the suburbs, I think we can all draw the same conclusion, and I think we all could have predicted this in advance.

Now, what can we expect moving forward?

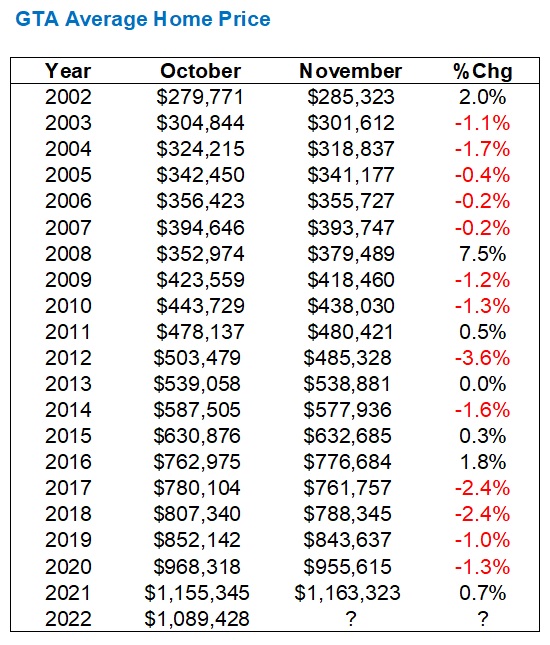

If previous years are any indication, we can expect a decline in average home price in November.

Only 6 times in the previous 20 years have we seen an increase from October to November:

So here comes another if.

If the average home price increases in November, not only will that buck the trend in the previous twenty years, but it will also represent four straight months of increases (albeit moderate) as well as continued “stability” in that average home price.

And even if the average home price declines, say, 0.4%, I’d still argue that stability exists.

Here’s the chart we looked at above, once again:

Any home price over $1,080,000 would still point to that “stability,” in my opinion. And while that only allows for a 0.86% decline, it’s not out of the question.

See you here in a month’s time to find out how smart we all are…

Ace Goodheart

at 12:12 pm

Interesting analysis.

Would be more interesting to see a chart combining historical interest rates, average incomes, and home prices in Toronto.

Having sold two houses in Toronto during the pandemic real estate FOMO mania, I learned a few things on “offer night”

The big thing was, no one bidding on either of my houses, had the money.

If in the words of AC/DC ” money talks BS walks” everyone would have been walking.

During second and third round bidding the “buzz” from below was that folks trying to purchase from me had come up against a “debt wall” and could bid no higher.

That was how people dropped out.

On one high bid case, they could not get a larger cash advance on their credit cards (they were trying to get another 50K to give me but the cards would not, all together, yield that much).

So what I discovered was that ultimate high price for my properties was not determined by how much the very willing buyers HAD but rather how much they could BORROW.

That has me worried now because people cannot borrow as much.

Every time the BoC jacks rates, they are able to borrow less.

In my bidding contests, that would mean lower offers.

There is then also the problem of FOMO being replaced by FOOP (fear of over paying) and of course the dreaded “FOOB” (fear of outright bankruptcy) for people who are afraid that, should they agree on a price, by the time closing date comes around they may no longer be able to close and may have to declare so as to get out of the contract.

Appraiser

at 1:08 pm

Your story is somewhat illogical and difficult to follow.

Kinda like it was made up and you just decided to editorialize.

Ace Goodheart

at 2:21 pm

Not following you.

Have you ever sold a house in Toronto?

You get this “chatter” on offer night, as folks drop out of the bidding process, as to why they dropped out.

Just relaying the chatter. I don’t know if it is still like that or not, I am suspecting not, as it seems offer nights get mostly crickets now.

Back when I sold my two houses (2021) you would list, and then run a week of showings, and you would get hundreds of people coming through. Line ups outside even. Then offer night would result in a large number of hopefuls. The herd would gradually thin out but the folks bailing out would leave a tidbit or two as to why they were leaving the bidding.

That is the “chatter”. Usually it was because they could not borrow any more money.

That is what I mean.

Are there many people out there who actually pay cash for houses? Their own cash? Or is everyone still borrowing?

Ed

at 9:12 am

On another website he claims his sales were in 2017, now they are from 2021.

Ace Goodheart

at 10:45 am

I don’t think that is true. I did not sell any houses in 2017. Perhaps someone is using the same handle as me?

Alexander

at 1:32 pm

I kind of disagree that 40-50% yoy drop in sales is boring. And certainly in the context that BoC is still raising rates … It’s anything but boring…everyone is in nail-biting anticipation – what comes next?

Appraiser

at 3:32 pm

To me such a severe drop in sales, without a concomitant rise in listings, denotes pent-up demand.

I’m old enough to remember when experts predicted that the incredibly high prices seen in March 2017 would never be seen again? I also recall when the pandemic first began that real estate Armageddon was nigh.

Instead sale prices rose 40% in 2021 alone and then 15% more at the start of 2022!

Toronto being down less than 10% from the peak, is nothing short of remarkable.

Ace Goodheart

at 4:01 pm

Interesting take on the situation.

What do you say about the observed correlation between interest rates and house prices (ie, high interest rates lead to lower house prices, low interest rates lead to higher house prices)?

Could this be an explanation as to why the “experts” back in 2017 were wrong (Ontario introduced its “foreign buyer tax” which sank the market in 2017 as the expectation was, if foreigners were not buying, there would be no sales – however it turned out that not many foreigners were buying anyway)?

Could the 40% price increase in 2021 and 15% increase at the start of 2022 be related to the decreases in the BoC overnight rate during the same time periods?

What are your thoughts on the bond markets? Did the flood of new money introduced into the bond markets by the BoC quantitative easing (ie, money printing) program in 2020 – early 2022 have an effect on house prices?

Do you believe the theory that mortgage interest rates are generally set in the bond markets (where banks go to sell their bundled mortgage bonds at whatever interest rate they can get for them)? How do you think the current bond market environment will influence this (considering it is now possible to get high quality Federal government debt for 3.5%)? Will this have an upward effect on mortgage interest rates? What effect would you expect it to have on home prices?

Different David

at 5:34 pm

I think the difference is this time there are lots of external factors that are pointing to doom and gloom on the horizon.

– A war that is affecting both agriculture and energy prices

– Interest rate + inflation headwinds

– A solid 10+ year run of growth

– All of the COVID spending was artificially propping up the economy. Where we might have had a normal downturn in 2020 or 2021, it was kept afloat by all of the money added to the system.

Right now, people who don’t have to sell wont. However, within the next 12 months, people with “2 mortgages on each of my 5 houses and my condo” are going to start feeling the pain.

David Fleming

at 9:41 am

@ Appraiser & Ace Goodheart

Just wanted to chime in here – I agree with Appraiser on this:

“Toronto being down less than 10% from the peak, is nothing short of remarkable.”

The suburbs are all down over 20% and some Durham is pushing 30%, yet Toronto is down 9.7%?

That’s remarkable.

Ace Goodheart

at 10:21 am

Very true.

Toronto seems to be a tougher market to collapse, even with high interest rates.

The 905 just fell down like a stack of cards, and folks up in the various rural areas that experienced double digit price increases during the now mostly defunct “work from home” era are losing 100K per month on their properties.

My big worry for Toronto is not the resale detached and semi market (which will probably hold up regardless, because they are not building any more detached or semi detached houses here – they can’t no land to build them on), but rather the new build and resale condo markets.

I see large cracks developing in the price floor. Things look to be setting up for a free fall type situation. Remains to be seen how bad it gets, but there are an awful lot of new build condos coming online in 2023, full of units which are on contracts to be purchased by people who cannot close.

Alex

at 6:02 pm

I absolutely laugh when I read BlogTO. I mean no disrespect to Jack Landau who wrote,“Toronto’s Real Estate Market Just Took An Absolute Nosedive” but Jack’s credentials as a real estate expert and economist are… He’s a photographer and all things urban! Not kidding, look it up. So when Jack writes a storey about Toronto’s RE market, I want to throw up yesterday’s egg salad sammy.

Jimbo

at 7:06 pm

Just under 10,000 sales in two months. That is a story, I think.

tspare

at 9:52 am

Great blog post again. So the 3 month would show only the sept numbers are a big outlier. Given so little sales are happening, I don’t think Nov will change the historical trend much. I guess in the end if the job numbers hold up (which looks like they are), there should be no real-estate crash as there is no reason for people to be forced to sale.

Pragma

at 11:23 am

You could also look at those sales and say maybe we’re in a wile e coyote moment. Real estate is a slow moving market and the effect of rising rates take a while to propagate through the economy. There are a lot of pre-construction homes that people were hoping to flip but can’t now(generally owned by GTA “investors”), mortgage terms will be reset at a regular cadence, inflation is running through everything and that willingness to go all in on a house has definitely been tempered. If you have stable prices and declining volumes, that is indicative of weakening fundamentals. Ultimately you need prices to move to where you find volume.