I suppose fifty-some-odd comments in two days can’t be wrong; this is a topic that requires further discussion.

There were some incredibly insightful comments, and a lot of great ideas thrown around.

Today, I want to look at potential reasons for the lack of supply in our market.

A lot of these points were raised in the comments section of Monday’s blog, but let me throw a couple of my own ideas out there, and then we’ll open the topic to discussion…

It would seem from the comments on Monday’s blog that perhaps I was able to fill a giant need for those who are tired of reading the same-old, same-old, and wanted something “refreshing,” as one reader put it.

As you might assume, I don’t always read the comments. Some are incredibly insightful, and some are monkeys throwing their own feces around.

But there were a few people that commended me for actually adding some data to the conversation about rising real estate prices, and the causes.

Others thanked me for not speculating as most of the media, and frankly most real estate agents and economists, have always done.

Then one or two people actually had the balls to suggest my article was worthless, because I didn’t provide reasons for the lack of supply, and increase in demand.

Sorry. I was busy changing a stranger’s flat tire. And rescuing an old lady’s cat from a tree. And pouring soup at the local shelter…

I honestly don’t know what is a larger cause of the rapid increase in Toronto housing prices: the lack of supply, or the increase in demand.

Every time I waver one way, I draw back to the centre, and then look at arguments for the other side.

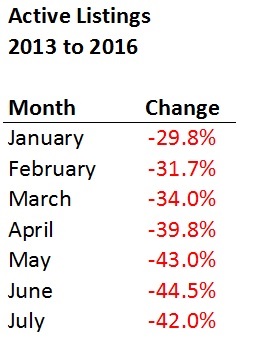

Either way, today, I want to look at the lack of supply in Toronto’s market, and try to figure out reasons why supply is down, among other things, 31.9% in July, year-over-year.

In case you missed Monday’s blog, or if you’re in need of a refresher, here’s what has happened to supply in the past three years, as we look through the first seven months of the year:

Now let’s start the discussion as to why inventory is down.

Big reasons, and small reasons.

Direct reasons, and cause-and-effect.

All is welcome…

–

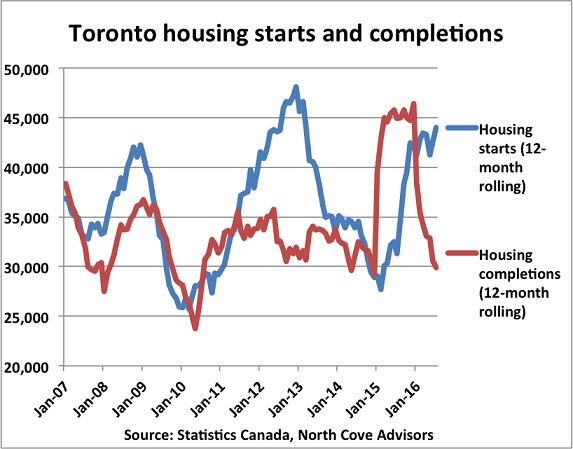

1) Fewer Housing Starts & Completions

This has to be the first reason on anybody’s list, no question about it.

And I asked my colleague, Ben Rabidoux, for the following chart:

Look where we are right now – at a 6-year low for housing completions.

Now we almost want to dig into why, for all of our “whys.”

We want to know why the supply of housing in Toronto is down, but when we establish that a reason is the decrease in housing completions, we’ll also want to know why that is as well.

Why are housing completions down?

This is the fun part – all our our reasons are linked in one way or another.

Point #5 on our list – about transaction costs, is a reason why there’s less “flipping” in Toronto. And less flipping means that there are fewer home-builders and renovators building on spec, and thus they are seeking to build for end-users, who aren’t putting the property back on the market.

Point #2 on our list – about rentals, shows that “completions” aren’t really completions, if they’re rentals.

And so on, and so on, as you’ll see below…

2) More Rentals

This isn’t something we’ve discussed before, but consider the cause and effect of more “investors” buying pre-construction.

All of those “housing starts” and “housing completions” are meaningless in terms of sales. When we talk about “active listings” as we did on Monday, we’re talking about properties available for sale. So if a lot of these pre-construction condos, and even houses (a lot more in 905) are being bought by speculators or investors, who in turn rent them out, then to even look at “housing completions” in the first place is useless.

What good is a “completion” if the property is not going to be offered for sale?

3) Less Inventory From The Baby-Boomers

I don’t have concrete data to prove this, so anecdotal evidence will have to suffice.

So consider the three options that Baby-Boomers have when they reach 65-years-old:

a) Sell their house, and buy a condo

b) Sell their house, and buy a smaller house

c) Sell their house, and rent

d) Grit their teeth, and stay where they are

Only option “c” represents a net increase in supply, and I think that option represents a very small percentage of what Boomers are doing.

I’ve worked with a lot of downsizing Baby-Boomers, and so far, I have yet to find the seller who opted to rent.

Most of the Boomers want to keep their money in the real estate market in some way, shape, or form.

And some of my clients have told me, “If I sold my house for $1,500,000, I wouldn’t have the slightest idea what to do with it.” So instead, they buy – whether to live in, invest, or for their kids.

I’ve had a lot of Baby-Boomers sell their house for $1-2 Million, and then turn around and buy for half the price.

I can recall one Boomer who sold for $1,600,000, then bought a $750,000 house that was up for sale, where young buyers were also vying for it. So for anybody that thinks, “Baby-Boomers will sell their house, and move on,” tell that to the young 20-somethings trying to get into the market, that were beat out by my 60-somethings.

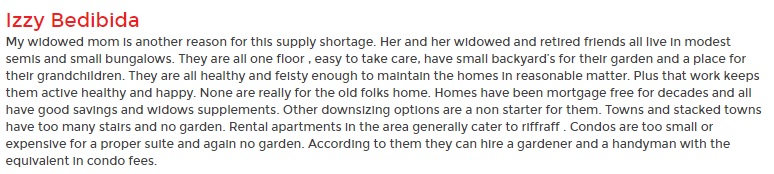

As for option “d,” there was a great illustration of this by a reader on Monday’s blog who gave us the following:

The Boomers simply aren’t giving us the supply that we had expected.

And when they do sell their big family home and decide to rent, which is the only way we get a net increase in inventory, they help all three of their kids buy condos…

4) Prices In The Suburbs

Somebody on yesterday’s blog hit the nail on the head when they said that prices are rising outside of Toronto.

Again, we’re looking for reasons why supply is down, whether it’s a direct reason, or a cause-and-effect.

Consider that over the past half-decade, there’s been a lot of movement outside the city by residents looking for bigger, better, and cheaper.

I’ve personally helped a dozen people move from Toronto to Mississauga, Oakville, or out east to Ajax/Oshawa. These people made those moves because the real estate was cheaper, and thus we increased our supply here in Toronto.

But as time has gone on, that real estate has also increased in value, some of it more than Toronto.

Remember earlier in the year when York Region was the hottest real estate in the Golden Horseshoe?

And if you look at the average sale price in York Region this past July, you’ll see it’s $953,639, whereas Toronto’s is only $690,103. Yes, Toronto is home to many, many condos, and all those $300K units add up when you’re taking an “average.” But if you’re thinking about escaping to York Region, you’re not breaking the bank.

And what of condos?

Here’s an interview with Lanterra CEO Barry Fenton where he says that condo prices in Toronto are up 7%, but condo prices outside Toronto are up 11%.

5) Higher Acquisition Costs For Developers

From the video above, you’ll also watch Mr. Fenton discuss how much building is going on outside the city, rather than in the core, as the acquisition cost of real estate is getting too high for developers to turn a profit.

There’s another interview he did with BNN in December of 2015 where he talked about a piece of land on which he was outbid.

(Video won’t work when I embed here, but it still plays on my December 2015 blog which you can see HERE)

Mr. Fenton says he bid “something like” $330 Million for an office tower on the northeast corner of Yonge & Bloor, but was outbid by $30 Million with an unconditional offer.

Ironic, considering that house and condo buyers are routinely outbid by higher and/or unconditional offers, and the very developers that are creating this real estate for us are also outbid!

But the point is, if Lanterra and other developers can’t acquire property as easily as they have over the past two decades, then they won’t be able to build and complete at the same rate. And alas, inventory levels will decrease…

6) No Land To Build

To follow up on the point above, Mr. Fenton mentioned that he was looking to acquire “an office tower” for $330,000,000.

An office tower.

This is what condo development is coming to?

Once upon a time, you’d buy a parking lot, and throw up a 40-storey tower.

Now developers are buying entire OFFICE BUILDINGS to tear down and build condos in their place?

There’s just no land to build on anymore!

Remember the article in BlogTO from 2011 called, “That Time When Toronto Was A City Of Parking Lots“?

A lot has changed since this was what Toronto looked like:

In that city, there was not only lots of land on which to build, but developers didn’t have to fight each other for it.

In that city, you can see how population growth is not a problem.

But today’s Toronto is completely maxed out.

After we used up all the space on the ground on which to build, we started to look to the sky.

And now developers can’t find room in the sky, or can’t afford to build in the sky?

Is it any wonder that supply is down?

7) Transaction Costs

A friend of mine told me that this was “the elephant in the room,” but please, don’t let it be! I’m quite transparent about the transaction costs – the acquisition costs, and disposition costs, associated with real estate, the least of which is my own fee for service.

The big two costs are Realtor fees and land transfer tax, but don’t discount the small fees either.

Legal fees on the purchase and sale can cost $3,000, which is a lot if you’re selling for $300,000 and buying for $600,000.

And don’t act like you won’t paint, renovate, redecorate, or buy new furniture. People always forget that moving from a 1-bedroom condo to a 3-bedroom house means they have to spend a ton of money on furniture.

But yes, the big fees should be discussed.

Let’s say you’re selling your $400,000 condo, and buying a $1,000,000 house.

The 5%+HST on the sale is $22,600, or list with a cheaper agent, but you’re still paying over $15,000.

Land transfer tax on that $1,000,000 house is $33,200.

So to move from a $400,000 condo to a $1,000,000 house is going to cost you in the area of $55,000, and that’s before legal fees, before cleaning, painting, and updating the new place, and before furnishing your new $1,000,000 house.

Surely there are one, two, or ten thousand people out there that have realized this, and decided to stay put?

8) Being “Stuck” In Your Starter Home

I think a lot of you can relate to this.

You bought your house for $400,000, with dreams of one day buying a larger house, in the same area or different, for $1,000,000.

Your house is now worth $850,000, and that represents a ton of equity that you can use toward purchasing the new home.

But that new home, which was $1,000,000 when you bought, is now $1,800,000.

All you’ve done is create equity that can be used as a larger down payment along with a much, much larger mortgage.

This has caused some home-owners to renovate and expand, and it’s also created a legion of market bears who are holding on and waiting for the crash.

But that logic gets you nowhere. That’s what we call “Christy Clark Thinking.”

Christy Clark, of course, wants to “make housing more affordable for the middle class,” and thus has effectively banned foreign investment in Vancouver by instituting her insane 15% tax.

I read one economist (for the life of me, I can’t find the article) who said that if housing was really going to be “affordable” for the middle class, it would have to drop somewhere in the neighbourhood of 60-70% in value.

If that happened, there would be a massive depression, and nobody would be thinking about buying larger homes.

So those who are “stuck” in their starter homes are in the same Catch-22.

They can’t hope and prey that the $1.8M home of their dreams drops in value, because then so too would their own $850,000 semi.

–

Okay, I’m over 2,000 words and it’s nearly 2:00am so I have to wrap this up.

But I encourage you (not that you need it…) to comment on the eight points above, or share your own.

Because if I had more time, and the ability to be brief (not happening…) I could come up with a few others for this list.

Enjoy!

Ed

at 9:22 am

re; 3) Less Inventory From The Baby-Boomers

Another option is to sell and get the hell out of Toronto.

I just bought in the Niagara region for 30% of what it would cost here.

It’s not for everyone but it is happening quite a bit.

Geoff

at 9:50 am

what’s the job market like?

Ed

at 10:27 am

for many of the boomers it doesn’t matter. We are here to retire. Great pace of live any plenty of extra equity from the sale of the house in Toronto. Like I said, it’s not for everyone but many are on the move.

Izzy Bedibida

at 10:34 am

He’s retired.

Geoff

at 9:50 am

so not much of an option for many then. and if you’re retired, then you have literally dozens if not hundreds of options, as time isn’t a factor (e.g. everyday I have a 6pm beat the day-care shotclock game with traffic).

Two Cents

at 9:28 am

David, I think what’s happening is that despite the enormous equity most people have in their houses, people can no longer afford to move, because anything they buy will eat up all that equity and then some. The market is deadlocked.

jeff316

at 10:07 am

Yes. In order to cash in on equity, you need a) your earning potential to have increased substantially since purchasing and/or b) the value of your current house to have outpaced the value of the house you are buying. The rapid increases throughout the GTA have meant that the latter is difficult. Back in 2009, 2011, 2012 it was doable. Not so much anymore.

Kyle

at 10:29 am

The other option is to borrowing again, but it does mean they will be in debt longer.

Julia

at 10:39 am

And that’s exactly our conundrum. We have just under 6 years left on our mortgage which will leave us mortgage free in our mid 40s so the question is should we be adding on $600k in debt and carrying a mortgage until 65??? Or are we better off beefing up our investments? Moving out of the core is out of the question for us as we both work in industries that are in and around downtown and as parents making a long commute is out of the question.

Kyle

at 11:01 am

I hear you Julia, common conundrum being debated with my friends and family these days. Many have seen huge equity gains, and have very small mortgages outstanding. Definitely a first world problem, but it’s interesting the ideas people in that situation have come up with, as it seems to be much more of a lifestyle choice than a financial one. Some have cashed out and moved to cheaper locations or down-sized, others have decided to stay put and do nothing until the kids move out, others have borrowed to reno or move, and others have borrowed to buy cottages and vacation properties.

Libertarian

at 11:41 am

I agree with you about the market being deadlocked. I’m curious to see how this trend plays out going forward. Will the city reach a point where 95% of homeowners are stuck in their current home? If that happens, does demand then drop? (If people don’t sell, they aren’t buyers either.) Will this decrease in demand have any impact on price appreciation? An endless list of possibilities.

In a Different Boat

at 5:59 pm

Except that those houses could be bought by foreigners who don’t increase supply when they buy.

A Grant

at 9:52 am

All this leads me to the question – what can be done about it?

I know most folks here will say “it’s the free market, stupid”. Nothing should be “done” about it, especially by the various levels of government. The problem with that line of thinking is that we’re going to accept that: 1) People will continue to want to own their own home; and 2) prices in neighbourhood in and close to downtown will remain out of reach, then we’ll have to be prepared for:

3) The continued expansion of subdivisions and exburbs as families seek affordable housing.

If we are willing to accept #3 as a consequence of #1 and #2, we need to do more to create the infrastructure necessary to support this expansion away from the core. The type of infrastructure that doesn’t support a car-dependent lifestyle and instead sees a significant investment in public transit. To make this work, this would require a massive amounts of spending, and a change in our collective commuting habits. None of which we appear willing to do.

Where will this leave us 25 years from now?

Kyle

at 10:43 am

There are of course some tangible things that can be done to increase supply, especially on the part of Government e.g. streamline the planning process, change zoning laws, don’t succumb to NIMBY-ISM, allow for sub-dividing, loosen up restrictive land use policies, etc. But that’s only going to help so much, given that all the land in the city has pretty much been built upon. Toronto is now a large global city, but perspectives and perceptions haven’t caught up yet. Particularly by those who seek #3 as an option. If we look at other large cities, IMO what needs to happen is mostly that people need to adjust their expectations to big city reality:

– Average people in other large cities don’t expect to own a detached house in the core, their idea of a home is in a townhouse or a high rise

– In fact average people in large cities don’t expect to own, most rent

– Those that seek to live farther out in larger cities don’t drive to work, they take commuter trains or work remotely. The Government can help by putting in place the infrastructure to support this.

Real estate millennial

at 11:00 am

I made that point yesterday I guess an undergrad from the university of Guelph in real estate, real estate license and AAIC designation doesn’t account for much when you’re only in your mid 20’s. But I can appreciate someone who can see the point I was making. Right on Kyle!

Real estate millennial

at 11:03 am

* AACI

Kyle

at 11:34 am

It was an excellent point you made yesterday, regardless your age.

IMO, the game-changer for real estate prices will be when people can work substantially remotely. That will totally redefine the term “location, location,location”. Big reason cities are expensive is they are the only places where certain high paid professionals can work.

I don’t think it will be that long before Portfolio Managers will be able to manage from anywhere, a Trader will be able to execute from his home, a Lawyer will be able to meet clients online, an Accountant will be able to keep the books/records and do analysis/reporting in the cloud, etc. Actually they can do all those things already. It’s once again mainly perceptions that haven’t caught up.

lucie

at 12:43 pm

Excellent points Kyle. There are MANY jobs that can be done from a remote or home office. Managers need to allow employees to work remotely more often but employees as well must be able to produce so that the argument made by managers that they need to “see” the employee so that they know they are working will no longer be valid.

A Grant

at 12:04 pm

“Those that seek to live farther out in larger cities don’t drive to work … The Government can help by putting in place the infrastructure to support this.”

The problem is, I don’t see people forgoing their cars unless we disincentive driving (via higher gas taxes, toll roads) and I don’t see the necessary infrastructure being built unless we’re willing to increase taxes (on gas or creating toll roads, for instance…)

I don’t see the political will for it, frankly.

Kyle

at 1:58 pm

I’m a bit more optimistic, with the HOT lanes, Metrolinx RER and Subway and LRT expansions into 905, Union Station expansion. I think the suburbs directly adjacent to Toronto are starting to shift dramatically. We’re even seeing higher density and pricing close to where there is non-automobile transportation. And unless you go way out into the boonies, new development in the suburbs is now taking the form of condos and towns, rather than semis and detched houses.

I think there are already lots of disencentives to driving (long commute times, expensive parking), though to be honest i would be all for more HOT lanes. The problem is there are few alternatives to driving. Again, i think the game-changer will be when people can work a substantial amount of time remotely.

jeff316

at 10:03 am

Well done. I thought the bellowing comments in the last blog post of “don’t identify the problem, analyze it” were ridiculous. You’ve done a good job on this. Two key responses.

1) SUBURBAN PRICES

The only thing more insane than prices in Toronto is prices in some of its suburbs. I’ve long posted on your blog and I’m a total broken record on this point. But it is definitely playing a part.

Now, if you have a tonne of equity it might make sense. Ditto if you are not attached to working in Toronto’s core.

Detached post-war, moderately updated bungalow in Misssisauga? Fork out 800 000$. Think you’re settling when you look at a 1970s semi near Cawthra? Have fun settling for 650 000$. A decent price on a home in Brampton is 400 000$.

Want a townhome in Burlington? Some of those go for 550-650 000$. (Add another 100 000$ for Oakville.) In Burlington, you might be able to score a detached in the workingclass pocket of Mountainside for 500 000$, but it’ll be old, out of date, close to nothing but industrial parks. Elsewhere you’re paying at least 650 000$ unless it is a tear down. (Add another $100 000 for Oakville.)

The whole “I’ll just sell my house and move to Hamilton!” mantra also doesn’t work anymore, because unless you are truly willing to live in the real Hamilton, the nice and new-nice parts of Hamilton are going to cost you a bidding war and at least 450 000$.

And if you are a commuter, add another 250-350$ for your GO Train fare, another $100 in taxes and gas costs (because you will drive more) and consider commuting time and the urban equity for suburban space CBA isn’t so rosy.

2) STARTER HOME

Leaving aside the arguments against home ownership, the best real estate advice I received was to never buy a starter home. Glad I listened to my financial advisor on that one and not my parents, or I’d be stuck in a two bedroom bungalow in an area of town known for rejecting renos and expansions. A starter home never made sense to me. In a sense, I wished I’d stretched a little bit further. Some of the houses that seemed out of reach at the time really weren’t.

Michael

at 1:16 am

Can you explain starter home?

Geoff

at 9:37 am

the idea that you buy what you can afford easily today and compromise, versus going ‘balls to the wall’ and getting the best house (however you define it) you can. I love my house in don mills we bought in 2007, but it wasn’t intended to be the forever home it’s turning into. In retrospect I should have just borrowed another $200K and bought in leaside. C’est la vie.

Joel

at 9:55 am

I have seen the starter home work on both sides. We rented a 1 bed condo for a few years to save up to buy a 3 bed semi which has worked really well for us. I have friends who purchased a starter home (1 bed condo) and made $100K on it, that they used to move up the property ladder.

CB

at 10:34 am

I’ll be a #8 for sure that will top up or rebuild instead of selling. I can’t imagine myself eating that land transfer tax.

PJM

at 10:59 am

I and many of my friends are retired and in the 65-75 age bracket. We would love to downsize but the big question is “where do you go”. Most want to stay near family and friends. The issue is the lack of housing options to downsize to. We aren’t ready for a condo or ‘the home’. When something smaller becomes available we are competing with developers for the most part who want to tear down and build new. The cost of these smaller homes is tremendous because they are usually on large lots. That and all the reasons above means everyone is stuck!

GinaTO

at 11:03 am

Yeah, I think we’re heading for a #8 as well. We could sell for a crazy amount of money, but then where to go from there? The next step up is getting higher and higher. Starting to think of an addition, back or top…

David (not the David who runs this website)

at 2:16 pm

One thing that’s not helping with the situation is that the City of Toronto also collects a land transfer tax in addition to the one collected provincially. I’m sure that it has contributed somewhat to the reduced listings since it was introduced. Of course there’s no way that the land transfer tax is ever going to be abolished or reduced at the city or provincial level but it’s one thing that the governments could to do help things out, instead of pulling a “Christy Clark” and introducing yet another tax. I guess all governments must have flunked their economics 101 course or they have a different agenda, but clearly, they have no clue.

I’ve also noticed that there are lots of empty buildings or lots in and around Toronto. There are some buildings in my area (Yonge-Eglinton) on Yonge street south of Eglinton and north of Davisville that have been vacant since before 2000. I’m sure that it’s possible that they could be converted to residential buildings or torn down for yet another condo, but this isn’t happening. This is something that could be done to reduce the shortage of land but is allowed to continue.

I’ve been looking for a house for years but the quality of most of the homes that I’ve seen doesn’t justify their prices. Several years ago I checked out some open houses (semi’s and fully detached) and I’d shake my head and think, “$500k -1M for this place and yet you can see that the shingles are coming off, the electrical and plumbing probably need some work, the foundation is cracked, etc, no thanks, I’m not made of money”. Also many of them had less space than my two bedroom apartment and with all of the costs and repairs, would have been out of my reach. OK, so that $475K semi that I looked at 5 years ago is probably worth more now, but the place was so small that I’d have to get rid of most of my stuff to live there.

My long term goal is to leave the city and rent for next to nothing in a much smaller area and work at my current job remotely, and come into the office once a week for meetings.

If I was lucky enough to own a mortgage free a 1.5 – 2M house, I’d sell it, get the hell out of Toronto and invest the proceeds in some bank, utility, telecom, and REIT dividend paying stocks yielding 4-5%. I’d rent a nice place in some nice, small town somewhere in Ontario, retire and live off the dividends.

Kramer

at 4:48 pm

Toronto is definitely filled with people who feel very entitled to buying a nice house in a nice area at a nice young age. Time to wake up. The landscape is changing beneath our feet. Many cities are way past this change and the affordability is way worse. Toronto is Toronto – it’s world class and it’s amazing. It’s the hub of the best country on earth. It has everything and has everything else within a 2 hour drive. This is really happening… this housing nightmare is not going to end. It will only get worse. But it’s not too late. If you truly need a home, buy one… you’re not going to get your forever home right away, but no one does, this isn’t new. There is lots of great stuff on the market. Expand your horizons. Get in an up and coming ‘hood. Don’t expect a detached house in an established area of the GTA for $650K – those days are gone and not coming back. Adjust. Adapt. There is still opportunity here. This is not New York and not even Vancouver.

Vancouverites would smack a lot of us if we told them there was no opportunity here.

And PS: if you wait for prices to drop 20%… it’s going to be because mortgage rates are significantly higher and it will cost you just as much to buy the house anyways… so let’s go, chop chop.

David (not the David who runs this website)

at 12:07 pm

Kramer, I don’t feel entitled to anything. I’m fine with knowing that I’ll never own a house in Toronto. In fact the last thing I want is a huge mortgage and all my savings tied down by a house, but each to their own.

As for being world class, I don’t believe it. Our transit system hardly works and it can take two hours just to drive out of the city. Not to mention that we’re constantly in construction mode because our city council just doesn’t give a damn about anything but their own agenda. Also everything seems to shut down after 9pm, so sure, call it world class but it’s not even close.

Kramer

at 12:38 pm

A fair enough opinion on Toronto. I guess there are a lot of factors to weigh.

And I apologize, if my wording made it sound like I was calling you entitled, I didn’t mean that. I did mean that there is a good portion of the population who is though. I strongly believe that. And I’m not surprised at it, because until 3 years ago it was in reach… But I think those days are done.

I applaud your goal. If my family’s work situation ever allows us to vacate the city, I won’t be far behind you.

Kramer

at 12:44 pm

In fact I was trying to start a new post with that message but replie to yours by accident, hence the double posting.

Good luck to you.

Kramer

at 1:16 pm

But while we’re talking about it 😉

http://www.ctvnews.ca/mobile/canada/vancouver-calgary-toronto-among-world-s-5-most-livable-cities-1.3033775

David (not the David who runs this website)

at 1:43 pm

Kramer, thanks but there’s no need to apologize. I agree that there are some out there who do feel entitled. It just makes me shrug when I see people outbidding each other on very ordinary homes listed for +$1M. I supposed they all believe that their homes will be worth 10x as much in 5-10 years and they’ll make a killing on their homes cause they can only go up in price.

The real estate party is being funded by really low interest rates. The Bank of Canada knows that they can’t really raise them because everyone will go broke, so the party continues but one day there’s going to be one hell of a hang over IF interest rates ever go up. Or maybe we’re in for negative interest rates, won’t that be interesting? If you think houses are out of reach now, hang on cause you ain’t see nothing yet!.

I agree that waiting for prices to drop 20% isn’t realistic, but I won’t be pressured, “chop, chop”, to get on this manic ride. My gut tells me that this “ride” isn’t going to end well. The city and country are not being managed well at all and our so called leaders have no clue. We’ve just been extremely lucky so far but the cracks are starting to show with the oil industry, the rest isn’t far behind.

As for my long term goal, there’s no question that it will be decided for me. I will soon be priced completely out of the city and will have to leave if I don’t want to spend every cent I earn on housing. I’ve never had a raise in a long time and I’ve hit the ceiling for my line of work. So be it, that’s fine with me, I’ll leave this “battle” to those who are better, wiser and wealthier than me.

Kramer

at 3:17 pm

It could definitely end badly if a major shockwave hits, like rapid increase in interest rates or something that hits employment hard in Toronto. In 2008 Toronto had a blip down… If something DIRECTLY hit Canada and Toronto (like rates or Toronto employment) then that blip will be bigger, and from this high a price base will be significant. That’s not good for anyone, homeowner or not, so let’s hope that doesn’t happen. Agreed that this is being fuelled by rates and also immigration and new supply not keeping up and some other elements. As long as if people who are buying can afford the new rates when their mortgages flip over there shouldn’t be a hard crash. Let’s hope everyone’s been nice and responsible. Eek, that’s a bad thing to have to rely on. But I still don’t think things will go back to being “cheap” here ever. There’s just so much demand. Its enormous. Even with 5 year rates at 4% the demand for housing is gonna stay big. Rates will have to really go up hard to crash things all out I think.

And yah, if you want a decent sized house that you don’t have to spend another $100k to renovate, and you don’t want to get a condo instead, then bailing from the city is an excellent choice. my sister in law and her husband looked for 8 months… “Competed” and lost on dozens of houses, finally bought a gorgeous house in Shomberg, they don’t have to Reno an inch of it. And now I envy them because I have $100k of renos to save for and to suck up my life for a year.

Appraiser

at 3:20 pm

I fail to see how the market is “dead-locked” and that people aren’t moving, when there have been record sales every month this year on TREB.

Inventory is low mainly because the days on market statistic has been steadily eroding. It’s hard to build inventory when demand is so strong that listings sell two or three times faster than they used to.

Kramer

at 4:49 pm

Toronto is definitely filled with people who feel very entitled to buying a nice house in a nice area at a nice young age. Time to wake up. The landscape is changing beneath our feet. Many cities are way past this change and the affordability is way worse. Toronto is Toronto – it’s world class and it’s amazing. It’s the hub of the best country on earth. It has everything and has everything else within a 2 hour drive. This is really happening… this housing nightmare is not going to end. It will only get worse. But it’s not too late. If you truly need a home, buy one… you’re not going to get your forever home right away, but no one does, this isn’t new. There is lots of great stuff on the market. Expand your horizons. Get in an up and coming ‘hood. Don’t expect a detached house in an established area of the GTA for $650K – those days are gone and not coming back. Adjust. Adapt. There is still opportunity here. This is not New York and not even Vancouver.

Vancouverites would smack a lot of us if we told them there was no opportunity here.

And PS: if you wait for prices to drop 20%… it’s going to be because mortgage rates are significantly higher and it will cost you just as much to buy the house anyways… so let’s go, chop chop.

S is for

at 7:45 am

“What good is a “completion” if the property is not going to be offered for sale?”

This implies people are buying for reasons other than shelter.

Appraiser

at 1:20 pm

TREB mid-month data for August just released. Sales in the 416 are up 10% over the same two-week period last year. Another record month is on the way.

With more people buying and moving than ever before, it hardly seems like a “dead-locked” market, despite anecdotes to the contrary.

It’s all about demand. Overwhelming demand.

Julia

at 2:07 pm

It would be interesting to see the data broken out by detached/semi/condo. I know that in my area (Allenby) there has been very little for sale in the last few months.

Appraiser

at 5:59 pm

Hi Julia, Here’s the breakdown from TREB for number of sales in the 416 mid-month August 2016.

Detached sales up 8.3%, Semi’s down 19.7%, Townhouses up 20.6%, Condo apartments up 16.7%.

Looks like either an extreme shortage of semi’s on the market, or a statistical anomaly, which is not unusual considering a relatively small data set and short time period (two weeks) analyzed.

P.S. Average prices are up double-digits in all categories save condo apartments – which are “only” up by 6.2% (annualized).

Cheers!

Kramer

at 1:22 pm

Another reason why demand is so high…

http://www.ctvnews.ca/mobile/canada/vancouver-calgary-toronto-among-world-s-5-most-livable-cities-1.3033775

Jeff

at 4:14 pm

The one thing that should be commented on about the BC tax is they want to reduce the supply of money, this tax focus on foreign supply. If it limits how much foreign capital there is in the system – you will stop seeing the 10-15-20% gains you see yearly right now, and it will shift back to what local demand can warrant.

BC has to do something, if everyone just brings money from outside the country you are killing off a viable city for young people living and working here. As our generation urbanized we need to ensure the urban area prices reflect what people earn in these urban areas. Something needed to be done, while I don’t think this law will work the way they intended (it should help in the short term until they can come up with something better). If not Vancouver turns into Montreal 2.0 – the majority of the young educated class is locked out of another city. Montreal due to language, Vancouver due to prices (and low wages compared to Calgary and Toronto).

Kyle

at 4:23 pm

I have to disagree with your assessment, Jeff. There are far more expensive cities to live in than Vancouver, and yet they are not devoid of young people, nor has there been a mass exodus of locals.

In a Different Boat

at 5:58 pm

Interesting Point #8. I totally agree, but not everyone is in that boat. I sort of wonder who is in a similar situation to my partner and I. Other than continuing to save, we are ‘hoping’ for a crash in that it would make our ‘dream house’ way more affordable and sooner. We live in a condo, so clearly the equity gains are simply not there, relative to a SF detached. However, most of our equity is cash. In fact, half of our net worth is in our condo, half in cash/investments. Our incomes are pretty good, and add to our net worth much more than equity gains in our condo. So prices go down, but cash stays the same.

Stephen

at 6:50 am

A down market might be a better time to trade up to a more expensive home: say trading a $500K property for a $1M property means a $500K price gap. But if the market goes down by (for ease of calculation) 50%, then it means trading a $250K property for a $500K property i.e. a smaller price gap of $250K (and a smaller mortgage is one is required). Sentimentally homeowners tend to get upset when their homes decrease in value, yet mathematically it might be better to trade up in less than vibrant market conditions. The reverse is true for trading down to a less expensive home; you want to do this when the market is hot.