You bought your house in September of 2020 for $1,300,000. Today, it’s worth $1,537,900.

You paid $600,000 for your 1-bed, 1-bath condo in September of 2020. Today, it’s worth $709,800.

You finally decided to make “the big move” and plunked down $4,200,000 for your North Toronto home in September of 2020. Today, it’s worth $4,968,600.

Does this sound right to you?

Do any of those figures sound right to you, or do all of those figures sound right to you?

The September TRREB stats are out and they are absolutely shocking.

Shocking might be an understatement, if I’m being honest. Terrifying is a fair characterization if you’re a home-buyer, or if you’re just a Torontonian wondering about the future of our city.

If you’re a cynic, a market bear, or one of the folks cheering for a market correction, then “terrifying” is a great word for you to describe a market on the precipice of collapse. But as I’ve been saying for the last seventeen years: it’s not happening.

The federal election showed us that there might be no greater concern in our country than the cost of housing, and that’s especially true in cities like Toronto.

Nanos Research conducted a poll in mid-September and found that 32% of respondents, unprompted, noted that affordable housing is the single-biggest issue facing the GTA.

And the political leaders capitalized on this! They jumped on it, in fact!

Headlines like this one became the norm:

But as we have noted continuously here on TRB, the federal leaders have far, far less to do with housing than those at the provincial and municipal levels.

In fact, I would add that the Liberal “plan” to make housing more affordable is actually going to make it less affordable. Allowing first-time buyers to accumulate $40,000 in tax free savings and increasing the mortgage insurance cut-off from $1,000,000 to $1,250,000 will simply increase demand, thereby increasing prices!

Any “plan,” as we have noted time and time again, must deal with increasing supply.

But that’s hard!

And governments typically don’t take on tasks that are hard, so my assumption is that they probably just won’t do anything. And in four years, when housing prices are further out of control, and it’s time to vote for Prime Minister again, all the parties will give us the same rhetoric about making housing more affordable.

Let’s debate that another day, shall we?

Because we have to analyze the September TRREB stats which start with this:

September set a new all-time record for average Toronto home price at $1,136,280.

How’s that for affordable housing, eh?

Here’s a snapshot of where we stand:

The average home price in Toronto increased by 6.1% from August to September, but those increases are quite normal.

The average home price in Toronto now exceeds the previous record from May by 2.5%.

And on a year-over-year basis, that average home price is up 18.3% over the $960,613 recorded in September of 2020, which was a record in itself.

So at the onset of this post when I asked about a $1,300,000 home purchase in September of 2020 equating to a value of $1,537,900 today, that’s what I was getting at. But while I acknowledge that, on paper, the average home price is up 18.3%, it doesn’t mean that every single property in the GTA has increased in true value by that amount.

Let’s look at the 416 in more detail and break down the year-over-year price increases by market segment:

Here we see that most of the growth is in the detached and semi-detached segments which collectively probably make up 90% of the freehold market. I’m guessing at that, but “townhouse” is an extremely small part of the market.

Again, I might ask where a detached house is really and truly up almost 20% year-over-year.

A $4,000,000 house purchased in September of 2020 on Felbrigg Avenue off Yonge Street, north of Lawrence is not worth $4,800,000 today.

But what about a detached bungalow in East York purchased for $895,000? Is it worth $1,074,000 today? Probably.

I think we’d all be guilty of assuming, or at the very least, hoping that our own detached house is up in value by 19.6%, year-over-year, but these are merely averages.

Regardless, it’s fair to say that the detached segment has seen huge upward momentum in the past three years and that every season essentially sets a new threshold for the average.

Take a look:

That huge downward spike you see in the middle of the chart coincides with the spring-2020 pandemic, but prices popped right back up thereafter.

But check out the various “thresholds.”

We saw support for $1,300,000 in the fall of 2019, which led to support for $1,500,000 in the spring of 2020. The pandemic caused that threshold to be broken, but only momentarily, as the threshold was supported summer through fall in 2020.

And in 2021? We’re seeing support at $1,700,000 with upward trajectory in September.

Come spring of 2022, should we expect to see a new threshold at $1,8000,000? More?

Eat your heart out, market bears. And those on Parliament Hill that tell voters they will “bring real estate prices down,” as though they have the ability or inclination, what – with CMHC backstopping the entire market. Again, topic for another day…

In any event, the 18.3% year-over-year increase in GTA average home price cannot have supported by those figures above. Sure, the 19.6% increase in detached home prices in the 416 is in line, but the other market segments are not.

So what does that mean?

I suppose we have to consider what other districts make up the GTA, since Toronto is merely one.

Some of you already know where I’m going with this, and others will be shocked.

Terrified, maybe.

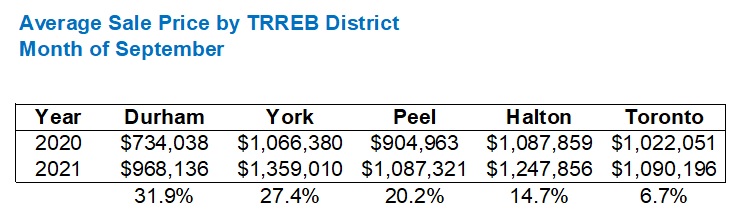

But here’s the year-over-year increase in average sale price in the five main TRREB districts:

Folks, those are not exaggerations.

It’s very possible that somebody who purchased a $700,000, 5-year-old semi-detached home in Durham Region in September of 2020 is now sitting on a $900,000 house.

The stories coming out of Durham Region right now are, well, terrifying.

22 offers on this house, 28 offers on that house.

A colleague of mine said, “I won in multiple offers last week against 35 other bidders; but what did I really win though?”

She’s not wrong. But the $699,900 list price was below recent $850,000 comparables, and her $880,000 bid wasn’t out of line.

As prices in Toronto continue to climb, more and more people are looking to the ‘burbs.

I’m going to put together a dedicated post on this for Tuesday after the long weekend, so stay tuned.

In the meantime, I want to go back to sales and inventory, since that tells a huge part of the story for September.

We know that we have a massive supply problem in this country and this city, and that while demand is high, we need to see higher supply in order for prices to stop climbing.

So what did we see in September?

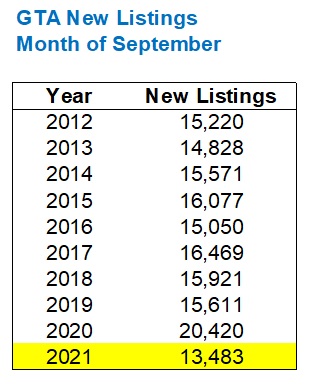

Oh, you know. Just a ten-year-low…

That’s not what we want to see in the largest city in Canada when there’s a “national housing crisis” afoot.

And while you’re free to shoot the messenger here, as long as this continues, we’re going to see price growth.

For what it’s worth, September sales were down year-over-year by 18.4%.

However, sales were down from an all-time-record in the month of September, so we can’t exactly take solace in that, can we?

Here’s the September sales figures dating back a decade as well:

Sales were down 18.4% from 2020, but only 2016 and 2020 saw more sales in the month of September than in 2021.

Let’s look at it this way:

Listings declined by 34.0%.

Sales declined by 18.4%.

If sales are declining at a slower rate than new listings, or demand is declining at a slower rate than supply, then we don’t need an X-axis and a Y-axis to intersect and show us that prices will increase. It’s just common sense.

So how does the ratio of sales-to-listings look?

I suppose that depends on whether or not you’re a Halloween fan…

Absolutely terrifying!

This is the tightest September market in the last decade and it’s not even close. We saw similar conditions in 2016 but as far as the other eight years in this decade go, we saw an average SNLR of 47%.

Let’s not forget that the tight market in the fall of 2016 led to the absolute explosion in prices in the spring of 2017. So if we see the SNLR continue at this pace through the fall of 2021, in tandem with the average home price increasing or, at worst, remaining flat, it could signal an untenable market in the spring of 2022.

Not “untenable” if you’re hoping to sell your Toronto home in 2022 and move to King City. But untenable if you’re a buyer, untenable if you’re “patiently waiting for the right home,” and untenable if you’re a politician who promised to do something about home prices.

Even the President of the Toronto Regional Real Estate Board weighed in with this:

“With new listings in September down by one third compared to last year, purchasing a home for many is easier said than done. The lack of housing supply and choice has reached a critical juncture. Bandaid policies to artificially suppress demand have not been effective. This is not an issue that can be solved by one level of government alone. There needs to be collaboration federally, provincially, and locally on a solution.”

Well-said.

Exceptionally well-said, if I may. “Critical juncture” is a nice way of putting it, and personally, I appreciate the challenge laid down by TRREB President, Kevin Crigger, to all three levels of government.

A cynic like me believes that nothing will ever be done by the federal government to stop appreciation in the housing market. It’s simply too difficult and it would have to be done across decades. Therein lies the problem. Politicians are in office for terms, usually 4-years or less. Politicians get elected based on promises with immediate results, mainly because the public is comprised of short-sighted, self-serving individuals who want immediate gratification, and who can blame them? That’s human nature, like it or not. But I will also add that if a Prime Minister Bob puts forth a twenty-year plan and is unseated by Prime Minister Joe four years later, if Joe doesn’t continue down the same path, then that progress is halted in its tracks.

I do not pretend to have a solution, but I certainly will point out the fallacies that others present – especially when they do so at the public’s expense.

Apologies if this blog post took a sour note. It’s usually simply a matter of laying out the statistics, giving you my thoughts and insights on the market, and allowing you guys to discuss and debate.

But we just had a federal election where the number-one concern among voters was housing affordability, and I happen to work in the very industry that is keeping people up at night with these “concerns.” I also wonder how my children will be able to afford a home in twenty years, and while I’m a firm believer in the free market and supply and demand, I think that if the government is going to talk about enacting change in the future of Canada’s housing market, then they should be made accountable when it’s obvious they aren’t doing so.

Folks, the Toronto real estate market is going up, up, and away. It’s not just a critical juncture; it’s a critical mass.

Let’s see how the October stats look in a month and then we’ll pick this conversation back up…

Francesca

at 8:10 am

Having sold our Markham detached house in November 2020 for 1.3 and knowing we could probably get 1.45-1.5 for it today makes me almost regret not waiting a year when last year we rushed to sell worried another lockdown would effect the market like in the spring of 2020. At least I have the consolation of knowing I paid less for our current place in January than I would have paid now. You are only reaping the rewards if you truly cash out and leave the GTA entirely. As for kids ever being able to afford anything, it’s ironic you mentioned that David as my 14 year old daughter is already anxiously talking about that. She loves Toronto and plans to stay here for university and afterwards and is already fretting about what kind of degree she should have in order to get a high enough paying job to live here once she is an adult. We tell her we will probably have to help her out at least with some kind of down payment or she will possibly be a renter for life. There may come a time when renting loses its stigma like in many European countries. Leaving the GTA or renting may be the only feasible option in 10-20 years time. These kids today so many things to be anxious about: climate change, world pandemics, unaffordable real estate etc.

Average Joe

at 11:03 am

For once, I agree. These issues have become so entrenched and intractable that the real estate system won’t change in any meaningful way during my lifetime. But I do think society and preferences will change pretty dramatically in ways that can’t be predicted. Declining standards of living and rapid climate change coming from decades of ridiculous urban planning and credit expansion are going to make for some spicy politics going forward.

Condodweller

at 1:38 pm

“The average home price in Toronto increased by 6.1% from August to September, but those increases are quite normal.”

I like how a 6.1% increase being normal just rolls off the tongue so easily. That 6.1% is not quite the same in $ terms as the $24,400 on a $400,000 luxury home back in the day. Sort of like the 5% fees but I digress.

David it would be interesting to see inflation/CPI numbers included with these posts for ease of future reference. I wonder if inflation will follow recent patterns and head back down having reached its max going back a long time or if it will continue to climb which if it does, will soon surpass the almost 30 year high. Perhaps the trailing annual rate is still below the bank of Canada’s target of 2% but if August’s 4.1% continues its trend up we’ll be well above the 2% mark for 2021.

Stock markets have already had a few hissy fits when bond rates reached new highs recently. I’m guessing that’s an indication of things to come if rates continue to climb.

With TD increasing its 5yr rates by .2% I’m curious to see what the BOC does going forward to see if those cheap variable rates will also start heading up. Of course, there is lots of time for this to play out so it may be the status quo for at least a few more months anyway.

I wonder what the average mortgage loan amount is these days in the GTA. Initial search shows ~$325k for Q1 2021 for Canada which is up by 20%.

What do we think of the state of the RE market in China? That 300 billion debt Evergrande is about to default on is nothing to sneeze at. We like to complain about occupancy fees but I find it interesting that in China you start paying your mortgage before the condo is built. One developer already defaulted on their bonds and even stopped paying their employees yet buyers are paying mortgages on some of these unfinished units.

Perhaps the Chinese RE status might be a good subject for a future post so we might compare and contrast with ours.

In the meantime, enjoy the ride.

Charlie Ravka

at 2:12 pm

Runaway inflation and high interest rates will bring this house of cards down. Remember the 70’s

Mxyzptlk

at 10:40 am

Toronto real estate prices increased by 157% between 1970 ($29,429) and 1980 ($75,694). Do you expect the same thing to happen over the next decade? If so, how exactly is that “bring(ing) this house of cards down”?

Rea List

at 9:12 pm

Great insight and I enjoy reading your posts. However, I don’t fully agree that supply is the only factor raising prices. For one, as a previous commenter noted, rising interest rates will have an impact. How much will it take, I don’t know. There comes a point when the prices will make the GTA too “unattractive” to even bother living here. Imagine monthly lodging costs (either rent or mortgage+carrying) is 1.5x – double monthly household salary. Will prices keep going up then or people will just leave the city? Endless supply of wealthy immigrants may continue to prop up demand though. There’s always a price limit to everything. The question is what is that ceiling.

Ron Dwyer

at 9:20 am

Thanks. A most informative article as usual. Pretty soon it will connect with the masses that socialism is near dead. The free ride with near zero interest rates will soon be over by our pathetic governments. Collectively we get what we deserve when we give up our freedoms out of fear. With November 11 just around the corner it’s time to remember our forefathers who gave up their lives for our freedoms. What would they think today of this fearful and easily manipulated Society?

David (Not the David who runs this website)

at 9:56 am

Ron, I agree 100% that socialism is a dead concept, but the masses will never get that until our massive debt bomb goes off. The rights and freedoms that our forefathers died for are mostly gone now and the masses don’t see that at all.

The government said in 1917 that income tax was a temporary measure, but we all know that income taxes will never go away. The government says that the restrictions that are in place now are temporary but they will never go away. This is the new normal, where you have to have papers to function in society. It’s Hitler’s wet dream come true and a slap in the face to our forefathers.

My near 90 year old mother recently said that today’s people would never have won WW2, they are too soft and weak for that. It’s sad to think that Canada was a major military powerhouse in WW2, but today it couldn’t fight it’s way out of a wet paper bag and most of our rights are gone for good.

November 11 should be a time to reflect on what we’ve lost and how we’re going to get back our rights and freedoms before even the right to speak of such things is removed entirely.

Charlie Ravka

at 11:20 am

History tells us bubbles always burst. It’s not a matter of if it’s when . Anyone buying a house now at the top of the market shouldn’t be surprised if a correction happens when interest rates climb to fight runaway inflation. A perfect storm is coming together. There is no better time to sit on the fence for a while and see what happens to the economy. Real estate people will always tell you the sky is blue even when you’re seeing storm clouds forming. I’m 70 years old . Not my first rodeo. Don’t think real estate only goes up . There is always a correction.