Help!

I need somebody.

Help!

Not just anybody.

Help!

You know I need some one…

Seriously though – I do need some help.

I need some one to help me understand the real estate market, because it’s clear that I have absolutely no clue how it works.

Absolutely, positively, no clue. And that’s quite ironic, considering I’ve been in the business for 15 years.

Is this phenomenon new?

When did the real estate market pass me by?

When I was younger, so much younger than today

I never needed anybody’s help in any way

But now these days are gone, I’m not so self assured

Now I find I’ve changed my mind and opened up the doors

So true, John. So true.

Years ago, things were just much simpler.

A music video was entertaining even if it were just four guys singing, with each one poking his head out behind the other’s – trying to look forward, when all the while, the odd guy in the back who rarely ever gets noticed, happens to be holding an umbrella.

No clue what I’m talking about? I don’t actually think that’s possible, but just in case…

Paul looks so happy, doesn’t he?

Anyways…

I need some help here, and I’m being serious. No cynicism, no sarcasm, I need an opinion on this matter that is of the “yay” variety. Naysayers and I will agree, but I need to know who in their right mind would dissent.

Folks, you know that I have never been an advocate of purchasing pre-construction condos, and I’ve been writing about this for literally twelve years.

The prices make no sense, the delays are automatic, the cancellations are out of hand, the material changes are discretionary, the “occupancy phase” is financially crippling, and the “investment” makes even less sense today when developers want 20-25% down than it did a decade ago when you could purchase with 5-10% down.

I can’t believe that people continue to buy into this fly-trap.

Suddenly I’m reminded of the old adage, “The greatest trick the devil ever pulled was convincing the world he didn’t exist.”

Over the last decade, people have posted comments on my older blogs and videos, saying things like, “Oh sure, ABC Building is a bad investment? It’s doubled in value since then!” These people ignore the fact that my entire premise has been based on the fact that buying resale at the same time of a pre-construction purchase would yield a higher return, with far less risk, real liquidity, and control over the investment – which is lacking when a developer forces you to take “occupancy” for up to two years.

So please save me your hindsight-victories, unless you’re going to provide details on the resale opportunities that you passed up as well.

The point I want to make today is that there is a more questionable investment than pre-construction “investing,” and it’s basically pre-construction’s cousin: the assignment.

While browsing MLS this week, I found a listing for a condo assignment in the Entertainment District that made my eyes jump out.

Ready for this?

$1,250,000 for an assignment of an Agreement of Purchase & Sale for a 799 square foot, 2-bed, 2-bath condo with no parking and no locker, scheduled for occupancy in 2021, which probably means 2023.

I’ll save you the calculation – that’s $1,564 per square foot, again, no parking, no locker.

What in the world is happening here?

Help? Somebody?

Help me if you can, I’m feeling down

It makes no sense to me. Just absolutely, positively, no sense.

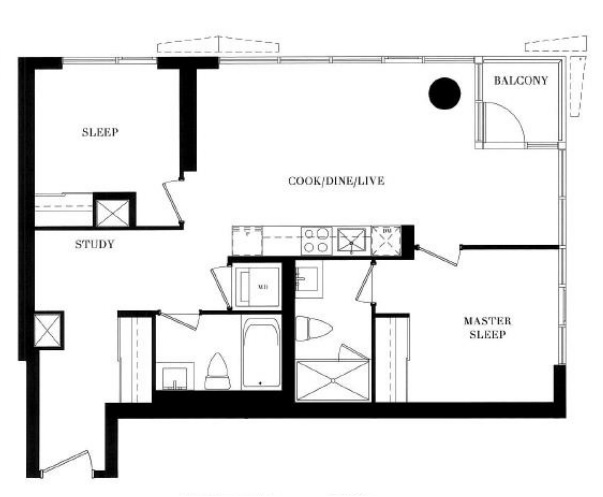

And the floor plan doesn’t exactly scream “buy me” either. Take a look:

I just love that pillar in the corner of the room. Almost as much as I love the “study” which is basically the other side of that HVAC unit that narrows the hallway to about a foot-and-a-half.

The “master sleep” doesn’t exactly scream $1,250,000, does it?

And what are those dotted-lines on the outside of the building? Are those some sort of design elements running up-and-down the side of the condo? Something that makes the building look awesome from an “architectural” and aesthetic standpoint, but merely blocks the view from the inside?

It kind of reminds me of the horizontal stripes that run across the windows of some units in Theatre Park:

X marks the spot, right?

But this unit at Theatre Park, for what it’s worth, is available today for less than $1,100 per square foot, and that’s with parking and locker.

Many other units are available in and around the vicinity of the condo assignment detailed above for similar prices, in buildings that exist.

The assignment?

That is for a non-existent condo.

And the original sales took place less than one year ago.

So let’s assume that somebody paid, say, $1,450 per square foot for that floor plan one year ago. Then who is the greater fool: the person who paid $1,450 per square foot for a floor plan when existing units were available for $1,000 per square foot, or the person who is going to purchase this assignment for $1,564 per square foot?

Are any buildings in downtown actually selling for $1,564 per square foot?

No, they aren’t.

Outside of Yorkville, nothing comes even close.

So won’t you please, please help me?

Why would anybody pay this price today?

I don’t understand the market. I don’t understand these buyers.

I feel like I work with logical, rational, sane clients, who buy and sell, and whose thoughts and opinions about the market I share.

Then I go online, looking for floor plans for assignments like the one above, and I see dozens of agents pimping out these pre-construction projects as “great investments” urging people to “act now” and use the agents and their supposed”Platinum V.I.P.” status.

I’m sorry, but who the hell is buying into the King Toronto project at upwards of $1,700 per square foot?

My God, the comments online! What is happening?

People are fawning over this project. Why?

It looks cool, sure:

But how many real estate groupies are acting like they’ve heard of Bjarke Ingels, when they haven’t?

I’ve never heard of them. Or him. Or her.

You could tell me that Bjarke Ingels is the founder of IKEA, and I will believe you.

I feel like the first person to eat avocado toast really enjoyed it, and saw the creativity therein. But the four-hundred-thousandth person simply pretended like he or she had woken up every morning for a year thinking, “I really wish somebody would think outside the box and finally create a breakfast jam-spread type product from a green, high-fat fruit that possesses a subtle flavour and smooth texture.”

The people buying into “King Toronto” are most certainly not doing so because they have been researching developers, architects, designers, and urban planning in Toronto for the last three years, all in the hopes of one day being presented with the perfect opportunity like this one.

And the buyer of that ridiculous 799 square foot, 2-bed, 2-bath, no parking assignment, for $1,564 per square foot in the Entertainment District, will not be a similar real estate genius either.

$1,250,000 for a 799 sqft assignment, possibly ready in three years, with very little liquidity therein.

Help?

Right now, you can currently purchase a 1,335 square foot loft in King East, 2-bed, 2-bath, 10-foot ceilings, with 2-car parking and a terrace, for $1,238,000.

Or a 1,141 square foot, 3-bed, 2-bath condo in prime King West, with a 408 square foot, south-facing terrace, and 1-car parking, for $1,228,000.

Or a renovated, 3-bed, 2-bath, semi-detached house with front pad parking and a basement apartment, steps to the Danforth subway, in the heart of Greektown, for $1,249,900.

I’ll say it again, just in case the point was missed:

When I was younger, so much younger than today

I never needed anybody’s help in any way

But now these days are gone, I’m not so self assured

Now I find I’ve changed my mind and opened up the doors

Those days are gone. Those days when much of, if not most of real estate made sense.

Now people are spending $1.25M for a tiny 2-bedroom condo, on assignment.

For the record, I would never, ever sell this to a client. Never. I would rather have that client listen to my feedback, reject it, and then go and buy through somebody else, just so I could know I did my job.

Help comes in may different forms. And the best part is: it can be both given, and received.

Try as I might to help the buyer pool at large, somebody will purchase that assignment, and units at “The United BLDG Condos” at University and Dundas will sell out at up to $1,900 per square foot.

So help me then: who in the hell is buying this?

A Grant

at 6:09 am

Clearly it’s that “new condo smell” they’re after

Sirgruper

at 8:59 am

The reason they do it…….leverage.

Izzy Bedibida

at 9:35 am

Yes “leverage”. Unfortunately leverage works both ways, and some of these proponents of “leverage” may be in for a “surprise” when it comes to sell.

I would much rather use leverage for buying financial assets. less risk and much more liquid when leverage starts working in reverse.

Michael

at 10:35 am

Sorry but “leverage” isn’t a sufficient answer. I have a hard time believing that most people fully grasp this concept.

As David said, you used to be able to buy into pre construction projects with 5% down if you really pushed hard and the developer needed sales. While most developers wanted 10%, this number continued to increase over time as banks tightened their lending criteria. Now you would be hard-pressed to find a developer that would accept less than a 20% deposit and some of them want 25%. If you can buy a resale property with 5% down, then why would somebody suggest that people buy into preconstruction for “leverage?“

Condodweller

at 1:03 pm

Yeah, if you buy an existing unit you are still using leverage. In fact, you are using more leverage for what it’s worth as you can buy 5% down vs. 20-25%.

Izzy Bedibida

at 1:06 pm

True, and you get a physical unit, not an illiquid piece of paper with vague promises written on it.

Sirgruper

at 12:15 am

Some are less than 20% and it’s always in instalments over time. So say you put down 20% on a $500,000 condo being $100,000 and you unit goes up 10% per year, in two years you can assign the deal on make 100% return. Yes leverage works both ways, but the winners have been winning big for a long time. Long bull market but when it stops, I agree,last in’s will be slaughtered.

Jimbo

at 7:11 pm

The 1929 stock market says different about buying on leverage….

J

at 1:10 pm

“Or a renovated, 3-bed, 2-bath, semi-detached house with front pad parking and a basement apartment, steps to the Danforth subway, in the heart of Greektown, for $1,249,900.”

This is an interesting comparison. The price per sq. ft. of the semi is probably about 1/3 that for some of the above-mentioned condos, if you include the basement. Oh, and you also happen to get some land for free. Toronto SFH’s don’t offer good value by any rational measure such as compared to fundamentals, but the difference in value compared to condos (precon or resale) is substantial.

Condodweller

at 1:22 pm

Is it possible that millennials place a higher value on proximity to work and amenities so much so that they prefer a condo? I am on record saying that condo prices will always trail SFHs but is there a universe where condos could be valued higher than SFHs?

I always preferred condos to houses but would I pay a premium for one? Hmmm..interesting dilemma but all considered, I probably would.

J

at 1:34 pm

That’s certainly true that personal preference could play a role. I think it has more to do with the price point though. More people are able to afford the lower price point, thus more people have been able to bid up these properties. This could also explain why the price per sq. ft. is often lower for 2- or 3-bedroom condos compared to 1-bedroom or bachelor units.

To factor out the location variable we can look at condo sales in the Danforth area. It seems that smaller units in newer buildings can still approach $1,000/sq. ft.

Condodweller

at 1:13 pm

I don’t get it either. Even with the argument that people want the new smell as you can buy off of flippers who tend to wait one year these days to avoid higher taxes and most of them don’t bother renting it out to preserve the “new” status.

I looked at a unit like that which was advertised as never lived in after a year. You also get the added benefits of making sure the unit is registered to avoid occupancy fees and ensuring year one PDI issues have been addressed.

Although it wasn’t the primary driver, my current unit was bought exactly under those circumstances except it was less than a year old. I actually looked at the building pre-construction but decided to hold off until a resale unit came up.

With current cancellations, it’s way too risky to buy precon. As a homeowner, you could be priced out of the market and as an investor, the lack of liquidity for several years makes no sense for any reasonable investor.

M

at 1:43 pm

What taxes would be saved by waiting a year?

Condodweller

at 3:12 pm

capital gains at 50% vs business income at 100%

M

at 6:06 pm

Maybe you should know your profession better. You are in the building business and if you’ve never heard of BIG Bjarke Ingels Group) architects that could be your problem.

I don’t know this building or unit or plan, but they are one of the top firms in the world and that could be why this is better than a shitty cookie cutter condo on King East. You really can’t compare just $PSF.

Not Harold

at 5:22 pm

Real estate is local. Especially when you’re selling residential.

Knowing architects working in other cities is really a thing unless you’re an architect yourself or a larger developer.

Also Starchitect condos rely primarily on local (and less expensive) architects to do the fine detail. That tends to work out poorly for owners and residents. Look at L tower and tell me premium was worth it!

You usually get a worse product for a higher price thanks to the “star’s” involvement and the prioritization of the high concept over functionality. The layouts at the Ritz and Shangri La are far better than the ones shown here, you get a better building & services, and in a better location. Plus you pay less!

MIKEN

at 7:08 pm

We had “irrational exuberance” in the stock market & the USA housing market we now have that in the Toronto condo market. Or “the greater fool theory” last one in gets caught grabbing the knife. This reminds me of clients who were pleading to buy Bre-X & we know how that ended up. Helicopter ride any one?

Frances

at 1:51 pm

Is that what a million and a quarter buys these days? It doesn’t even have a proper kitchen! Or a proper balcony. And the master bedroom is tiny. Good lord!

Whaaa?

at 4:13 pm

Could David (or someone else) perhaps provide some figures to address my (and I’m sure many others’) puzzlement with regard to the small (and shrinking) premium that SFHs appear to hold over condos (particularly in central Toronto) when the condo fees are factored in? My wife is constantly amazed that the price of a resale condo relatively near us (we own a detached SFH near Broadview & Pape) is virtually the same as that of houses in our area, considering the thousands of dollars in condo fees that would accrue over a decade or two. Anyone?

Condodweller

at 5:44 pm

you can do your own research but WRT condo fees, don’t forget that you have to maintain your home too. A lot of things are included in the maintenance fee and like water/garbage/ambient heat etc. plus you get the amenities like a gym/sauna/pool etc.

I have yet to hear a condo owner complain about not being able to afford to heat their home.