Why did I think that I could these blogs a reasonable length? Do I really not know myself after all these years?

Let’s pick up right where we left off on Monday, shall we?

–

Discussion Point #3: The Mortgage Market

Here’s yet another constant in our world of real estate: just as people love to talk prices as it pertains to real estate, there’s always some off-handed discussion about changes in the mortgage market, and how that could have an up/down, back/forth, better/worse impact.

So often with mortgage chatter, there’s no true origin of a statement or opinion; it’s always, “I heard they’re going to make changes to the stress test?”

You heard?

From who? When? Where? What changes? And who are “they” anyways?

The fun part about discussing the mortgage market is that there’s a seemingly-infinite amount of “potential changes” that could be made. Interest rate, the stress test, qualification requirements, the Big 5 banks, private lenders, B-lenders, special incentives and programs, variable versus fixed, 25-year vs. 30-year, and maybe we’ll bring back the 40-year amortization soon? Yes? No?

And we haven’t even touched on the nitty-gritty that only those in the lending sphere actually understand. How do stated-income applicants qualify? Why do B-lenders have so fewer requirements than A-lenders? Who is monitoring the private lenders?

Much of the talk over the last month has been about the potential for changes to the mortgage stress test, based upon a mandate letter that Justin Trudeau sent to Bill Morneau in early December. Click the link if you want to read the letter in full.

About halfway down the massive “to-do” list, we see this:

Review and consider recommendations from financial agencies related to making the borrower stress test more dynamic.

Now it’s anybody’s guess what “more dynamic” means, and frankly, I’m a bit frustrated by the lack of clarity on this. But it’s politics. Should we be surprised that the mandate isn’t clear and concise?

FYI – the word “tax” appears in this document 16 times, but I digress…

The media picked up on this topic mid-month:

“Finance Minister Bill Morneau To ‘Review And Consider’ Changes To Mortgage Stress Test”

From the article:

Prime Minister Justin Trudeau has asked Finance Minister Bill Morneau to consider changes to the mortgage stress test that Canada’s real estate industry has criticized for being a drag on the housing market.

A mandate letter sent by Trudeau to Morneau — which was released Friday, along with letters sent to other ministers — says the finance minister will “review and consider recommendations from financial agencies related to making the borrower stress test more dynamic.”

The review was not among the commitments the Liberals made during the fall federal election, but the Conservatives had pledged to “fix” the test to help first-time homebuyers and those renewing their mortgages. Trudeau and the Liberals will need support from the other parties to pass legislation after having their majority in the House of Commons reduced to a minority in October’s vote.

The article later states, “It was not specified which test the mandate letter refers to,” so at least it’s not just me who is noting the lack of clarity in this letter from one trust-fund pal to another.

Bottom line, we’re left to wonder what, if any, changes are coming to the stress test, and which test at that.

I have mixed feelings on the stress test itself.

On the one hand, I don’t like the government meddling in the market. I also don’t like them making it harder for Canadians who require mortgages to qualify, when foreign cash-buyers are left free to reign supreme.

On the other hand, we Canadians take on far too much debt as it is, and this simply serves as a safeguard from oneself, like a law requiring one to wear a seatbelt, even though common sense would dictate one would do so regardless. And considering that the CMHC insures all high-ratio mortgages, and Canadians are all at risk as a result, a safeguard in the form of a stress-test is the responsible thing to do.

Perhaps a “tinkering” of the test makes the most sense, and would represent a happy medium.

As for what other changes could be afoot?

In order to save time and sanity here, I’m going to ask my mortgate broker to put some thoughts together on this subject for a post next week.

Discussion Point #4: Purpose-Built Rentals

Here’s a topic that really runs hot and cold!

Remember when it was determined, both by the media and by frustrated renters throughout the city, that “purpose-built rentals,” rather than condominiums, would save the City of Toronto?

Well, I’ve seen these sentiments run rampant, then fall flat, only to be opined from the top of a soapbox once more.

I’m not sure where we fall on this topic now, but I think it’s going to be a major discussion point once again in 2020.

Of course, there is this common misconception that purpose-built rentals will be cheaper than condominiums, and at the risk of bursting the bubble of any would-be renters that feel the construction of pupose-built rentals will ensure their housing affordability for years to come, I have to ask why people make this assumption?

Is the thought process that individuals are greedy and evil, but corporations are not?

That Jane and Jim the condo-investor are squeezing blood from a stone, but the Real Estate Investment Trust that owns a 250-unit rental building is actually a not-for-profit?

Excuse my cynicism, but it’s borne of truth, and dare I say, reality.

There are many out there who believe, naively, that purpose-built rentals will be, or should be, cheaper than individual condominium units, and I would argue that these folks don’t understand why a developer would build one versus the other.

Make no mistake: a condominium is built in the adventure of profits, but so too is a purpose-built rental. The only difference between one and the other is the return on investment, which is why a developer would choose one versus the other.

The process, the financing, and the return are all vastly different.

While both require the acquisition of land, either through identifying and securing buildable land, or land-banking over many years, the commonalities essentially end there.

A condominium requires pre-sales before the construction can begin, essentially meaning that buyers and investors finance the construction, whereas a purpose-built rental is primarily financed with private money.

Once completed, a condominium is registered as such and “turned over” to the owners, and the developer walks away with its profit.

A purpose-built rental, on the other hand, is held in perpetuity, with the profit returned in bits and pieces, every month, every year, over a long, long period of time.

Many purpose-built rentals are sold to REIT’s or other entities (ie. pension funds) during construction, after occupancy, or even one, two, or ten years down the road. But the idea behind the purpose-built rental is that it’s an income stream, whereas a condominium is a lump sum profit upon completion.

So why would a developer choose one versus the other?

Money.

There’s no other reason.

There are no “nice guys” out there, no matter what their websites say about their involvement in the community, committment to excellence, etc.

Developers will construct purpose-built rentals if, and only if, it makes them more money than constructing a condo. To think otherwise is just silly.

Now how developers can make more money by constructing purpose-built rentals is another story altogether, and ultimately the three levels of government will have a lot to say in this. Recall that in the Liberal Government’s housing plan earlier in 2019 mentioned incentives to developers, and this is the biggest way in which the pendulum will swing in the profit margin.

There were already some incentives in place, of course. But these didn’t get much attention in a non-election year. In 2017, the National Housing Strategy called for $13.75 Billion in loans for the construction of 42,500 rental units between 2017 and 2027.

The federal government can offer tax incentives to developers, and that will have the biggest impact of any potential change.

Then again, If the City of Toronto allows, say, more density or relaxed height restrictions, that could make a difference.

The possibilities are endless, and we could conjure up incentives all day and night.

While we have seen an increase in purpose-built rentals over the last couple of years, if we as a society want to dramatically change the proportion of new condos vs. new rentals, then it’s going to take major incentives from all three levels of government.

There’s one purpose-built rental project that I’ve been watching closely.

In your mind’s eye, can you see the north side of Bayview Avenue, between Hillsdale and Parkhurst? I can. I remember an old, yellow-brick, 3-storey building on the corner. I think it was an apartment, but could have been medical. Then there were a row of bungalows heading north, and then a large townhouse complex at Bayview & Parkhurst.

This is what it used to look like:

And this is what it looks like now:

It happened so fast, as it always does!

One day you’ve got residential dwellings, and the next day there’s a giant hole in the ground.

I would have assumed, like most people, that a shiny, new condo was going to be built on this site. Laird Drive is going to be littered with condos over the next decade as the LRT is completed and commercial/industrial lands give way to residential, so why not Bayview Avenue?

Well, it turns out that this project on Bayview Avenue is, in fact, going to be purpose-built rentals.

What was first proposed back in 2016 as a condominium will now be a 9-storey, 170-unit luxury rental building with ground-floor retail.

Here’s how it will look:

Nine storeys in humble ole’ Leaside might look a bit odd, but I don’t think it will be long before Sunnybrook Plaza gives way to massive condominium towers, so this will be small by comparison.

The last two years have provided us with several notable purpose-built rental buildings which you might recognize.

How about 101 St. Clair Avenue, which is behind “Imperial Square” at 111 St. Clair Avenue West?

This is a 26-storey, 240 unit building, completed in 2019.

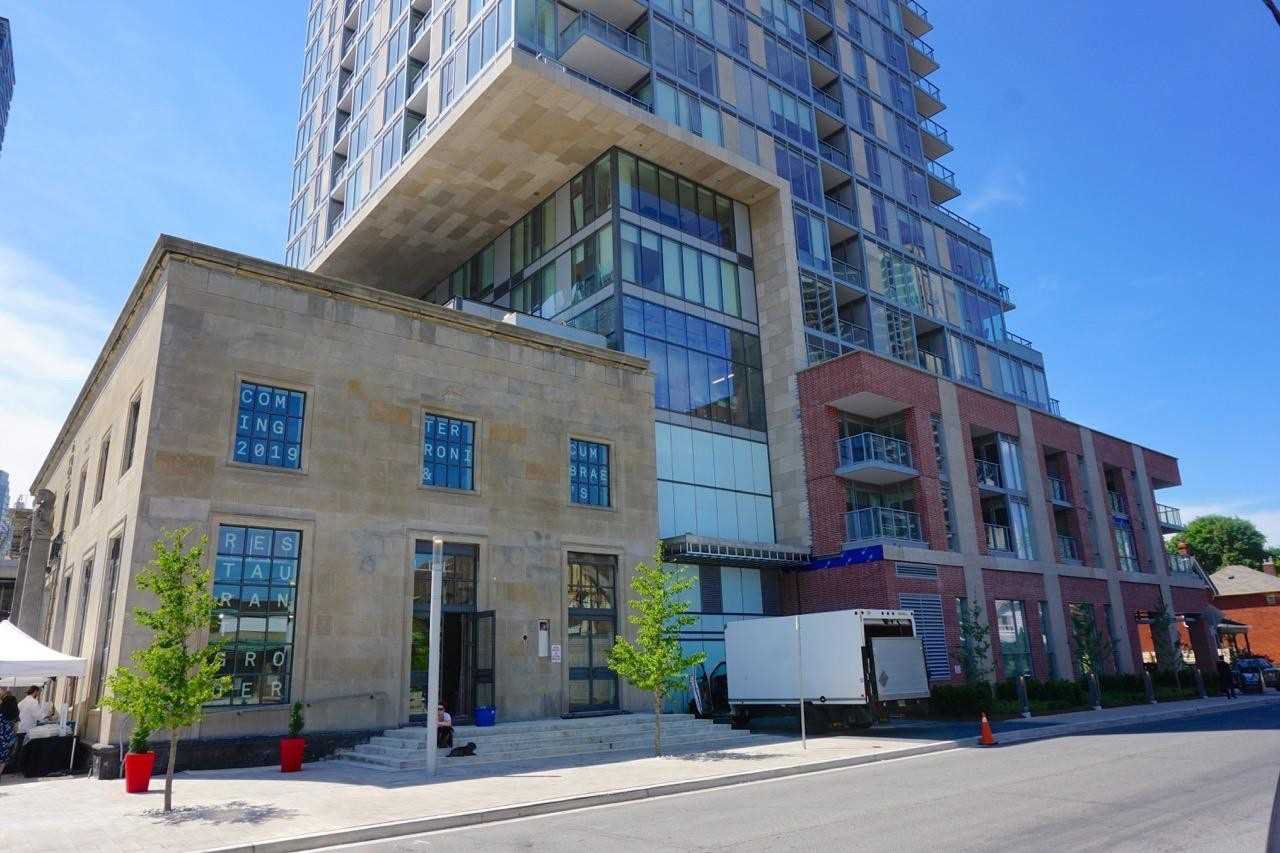

Then there’s 25 Montgomery Avenue at Yonge & Eglinton, aka “Montgomery Square” pictured here:

Also referred to as “The Montgomery,” this building is 27-storeys and 230 units.

25 Selby Avenue was also finished last year:

“The Selby” is a 50-storey, 500-unit purpose-built rental, constructed and still owned by Tricon Capital, a group with almost $8 Billion in assets under management.

That is who’s constructing purpose-built rentals, and while it’s very common for REIT’s or pension funds to buy them, I also think we’re going to see more investment groups involved from the start to the end.

Discussion Point #5: Where is the Toronto condo market going?

Great question, if I do say so myself. And I asked it, but I still think that’s fair…

In early 2018, we were seeing condo prices for new King West, 1-bedrooms, start to push past $1,000 per square foot, which we thought was just downright nuts.

In 2019, the $1,000 per square foot threshold became the norm.

In fact, it’s probably more eye-popping in 2020 to see prices below that threshold than above. I was just running some numbers for a condo in the Kilgour Estates, and upon seeing “only” $920 per square foot, I thought to myself, “Not bad.”

We’ve become so desensitized to high condo prices that we’ve almost forgot where prices came from.

I’ve made no secret about the fact that I always felt the freehold market would well, well outpace that of the condo market, and that I was wrong about this after the downtown in early-2017. When prices dropped off, I would have bet anything (and did!) that the average price of a semi-detached house on the east side would out-appreciate a 1-bedroom condo. It just had to, I thought!

I was wrong.

And while freehold prices eventually did narrow the gap, the run-up in condo prices, at least on a relative basis, is just unimaginable.

Let’s take a look at 416 prices for the three major property types: Detached houses, Semi-Detached houses, and Condominiums:

If I were to ask, “What jumps out at you first?” you might suggest it’s the pronounced up-and-down in early-2017, noted in both blue and orange. You also might suggest that it’s the lack of volatility on the grey line.

These are, at least in my mind, and through my eyes, the two large take-aways. But that’s visually. If you look at the numbers, there’s one other thing that jumps out at you: condos are winning.

From January of 2014 to November of 2019, the appreciation is as follows:

Detached: +53%

Semi-Detached: +71%

Condominium:+80%

You probably didn’t come to this conclusion from the graphs, although you’re not expected to. In fact, the grey line looks so plain and flat that its relative unspectacularity would lead your eyes to other parts of the chart, and thus away from the fact that the run-up in condo prices is the highest of the three.

But what if we looked at only the last three years?

What if we shortened the time period to simply 2017, 2018, and 2019?

Give this a moment of thought, and tell me, what would you believe to be the difference?

Here’s the chart:

Once again, the eye wants to go to the peak and valley in blue and orange, followed by the flatter grey curve.

So I’ll spare you the math here.

Let’s run the same three stats as we did above:

Detached: +2%

Semi-Detached: +18%

Condominium: +40%

Shocking?

Yes.

Is there another word for it? I’m not sure.

In your wildest dreams, did you ever thing, when the calendar turned from 2016 to 2017, that condo prices would out-appreciate detached house prices 20x?

Perhaps that’s misleading, since January is a down month, or because the “typical” detached house in the central core of the 416, where you live, isn’t up only 2%.

But that’s what the numbers show! And with semi-detached houses, where prices are lower, and where you might expect to see some relative comparisons to the condo market, we’re still seeing that condo price appreciation more than doubled semi’s.

Now that’s what happened.

So where do we go from here?

Many of you will suggest that condo prices have nowhere else to go, while others will muse that prices have nowhere to go, but up! I can actually remember each and every threshold being crossed over the last fifteen years, from the first downtown condo to sell for over $400 per square foot, all the way to the first Regent Park condo to sell for over $1,000 per square foot!

Last June, I wrote a blog post simply called, “The Friday Rant: Help!” And in this blog, I mused about a condo assignment sale, listed at $1,564 per square foot, with no parking, and no locker. Leaving aside my age-old question (“Why the hell have people accepted that pre-construction is MORE than resale?”), I fail to see how, when, or why somebody is going to purchase this property.

My main reason has to do with relative price, ie. that you can buy resale next door for $1,100 per square foot.

But at some point, the reason will have to do with absolute price, ie. how in the world is this affordable?

In the “HELP!” blog post, I also mentioned the flavour-of-the-month project called “King Toronto” which is selling for $1,700/sqft because, among other reasons, a design firm that people are pretending to have heard of, called “Bjarke Ingels,” is attached. It’s also going to be green, so attach words like “sustainable,” and “eco,” and maybe “climate-something,” and perhaps $1,800 per square foot is attainable?

Who is buying this stuff?

And why are they buying it?

Most importantly, if the naive population possessing over-stuffed wallets ever do stop paying 30% premiums for pre-construction projects that come with associated risks that resale properties don’t have, then what does that do to the overall condo market? Maybe it incentivizes developers to build rentals instead?

The average price of a 416 condo in November of 2019 was $659,855.

This is up from $595,678 one year earlier, which is up from $555,396 the year before.

Where is all of this going?

Do I need to start buying $550,000, 1-bed, 1-bath condos in Liberty Village for my kids to move into in the year 2040? Will they cost $1,500,000 by then?

Big-picture, macro-level thinking, combined with logic, and a relative look at the real estate market and the cost of living would suggest that condo prices can’t possibly continue to rise at this rate.

But with low interest rates, organic demand, stagnant supply, and a surging population in the city of Toronto, combined with the fact that the lowest-rung on the real estate ladder always gets the most attention, I have to think prices will, in fact, continue to rise.

So on that depressing note, we’ll adjourn until Friday.

(TO BE CONTINUED…)

condodweller

at 11:21 am

All important and interesting topics which I look forward to reading about and discussing in future 2020 posts.

Regarding the word dynamic I would read that as wanting a variable number based on conditions vs a fixed number.

Funny, I use the seat belt analogy all the time regarding how things that are good for us need to be mandated by law to literally stop us from killing ourselves and others. I might have put that in a past comment. Did you borrow that from me or is it just great minds think alike? 🙂

Graham

at 11:31 am

This morning announcement related to affordable housing and purpose-built rentals down the 401 in London:

https://www.cmhc-schl.gc.ca/en/media-newsroom/news-releases/2020/making-housing-more-affordable-residents-london

Appraiser

at 8:57 am

Very good news indeed. To be emulated elsewhere perhaps?

Appraiser

at 8:53 am

More 20 / 20 Foresight:

Most likely interest rates will vary only slightly this year, in a tight band, which means mortgage rates won’t diverge very far from where they are today.

The stress test will hopefully be normalized, perhaps based on a floating number that everyone can agree upon, as suggested by Rob McLister – “A fairer stress test would be the 5-year Canadian bond yield plus 300 to 350 basis points.”

Also, you’ll notice the big banks have generally been either supportive of or reticent about the new B20 regulations. That’s because the venerable Big 5 have largely benefited from the stress test as currently structured, partially by utilizing an artificial ‘posted rate’ to calculate interest differential penalties and further by entrapping 5-10 % of renewing borrowers.

https://business.financialpost.com/real-estate/mortgages/mortgage-stress-test-first-time-homebuyers-and-retirees

Ken Davenport

at 11:00 am

In other big news:

https://www.thebeaverton.com/2020/01/torontos-expensive-housing-market-forces-harry-and-meghan-to-consider-living-in-barrie/

Mxyzptlk

at 12:23 pm

I’m not sure our neighbours to the north will be thrilled about being invaded by a notorious cult.

https://www.thebeaverton.com/2020/01/local-actress-successfully-deprograms-member-of-hereditary-cult/

condodweller

at 11:31 am

a comment on the article:

“This explains why the banks have just been hiking and hiking interest rates. They are protected by the stress test which keeps people like myself locked in! Too many hikes! It becomes unaffordable and driving many of us just deeper and deeper into debt!!! My GDSR is well beyond 50% whereas when I got my secured line 12 years ago it was at 40%. Only due to hikes. My income did rise but not in keeping with the unsecured lines I have and credit card debt. LOC

‘s went up from 8 or 9% to now about 13%. Thank God my secured floats 1.5% above prime or I wouldn’t have a home. PEOPLE DON’T GET A MORTGAGE GET A SECURED LINE INSTEAD. IT’S WHAT SAVED ME!! ”

As it turns out rates don’t even have to go up for people to get into trouble with their loans! Banks increasing their LOC/ rates will do it nicely.

I have noticed in 2008 that banks quietly raised LOC rates during the recession.

I agree it would be a good idea to tie the stress rate to something the banks can’t tinker with. I also like the idea of allowing first time buyers get a 30 or even 40 year mortgages to help them get into the market. This only costs extra to them yet it allows them to enter the market. They just need to realize despite the fact it costs less on the monthly basis, it will actually cost significantly more in total due to the extended amortization.

Steve

at 9:38 pm

With the stress test in place, buyers had no choice but to bid up lower priced property …. condos.

Clifford

at 10:33 pm

Agreed. The low end benefited immensely from the stress test.