I’m turning 40-years-old this year.

And I’m having a baby literally any day now.

Am I getting old? Am I just stressed-out? Or have I always been as cynical as I find myself to be today?

Maybe I’m in a period of self-reflection right now, but I honestly don’t know if I’m a rational, logical, honest individual, or if I’m bitter and pessimistic. The examination of today’s topic is a prime example.

Under the “Ontario Housing Supply Action Plan,” the Ontario government released a guide to Co-Owning a home, and I think it’s the most insane idea ever hatched by this government. And there’s a long list from which to choose…

Call me a cynic, or call me an old-man, or even call me a pessimist, but I’m sorry; the idea of five 20-somethings pooling their money to buy a house and live problem-free is a pipe-dream, and one that I would expect from a politician. Ordinarily, I might not care, except in this case, I feel as though the taxpayers will be picking up the tab when all these arrangements fall into disarray.

When I was at McMaster University from 1998 to 2002, I lived alone. Even in first-year, when living in a dorm was apparently the best way to make friends, meet girls, party like a rock star, and live the campus lifestyle, I still shunned the idea of sleeping in a 10 x 12 cell with a person I’d never met before. Then in years 2 through 4, I continued to live in a 1-bedroom apartment off campus, and watch all of my friends complain incessantly about their roommates.

My brother and his “best friend” roomed together in first-year university, and upon the conclusion of that last semester, they never spoke again.

Two of my best buddies lived together in fourth-year, and things got so bad that one of them moved out before the year was even over. It affected their relationship for years to come.

We were all young, however. And maturity comes with age.

But two nights ago, when a client told me that three of his 25-year-old friends were pooling their money to buy a house together, I just shook my head.

“I got as far away from that idea as I could,” my client told me.

Good decision.

Maybe I was the loser who lived alone at university, and maybe I’m the 39-year-old going on 79-years-old as we speak, but I can’t help but think that “co-buying” is a great idea in theory, but a miserable one in practice.

Unless the government believes that the legal profession desperately needs help, and is attempting to create more work in the areas of contract and partnership agreements, dispute resolution, mediation, arbitration, and litigation, then I have no idea why the government put out this ridiculous guide.

It’s 14-pages long, read the whole thing – trust me you’ll want to:

“Ontario’s Housing Supply Action Plan: Co-Owning A Home”

This guide is extremely rudimentary, which I believe underscores the exact reason why most people are ill-prepared to co-own! If you know nothing about co-ownership, and need a 14-page PDF to explain how you and a group of people can split the payment of property taxes, then you are far, far from ready to co-own!

Let’s take a look at some of the highlights, shall we?

–

Benefits

Co-ownership housing expands the options available to individuals and families and provides a range of benefits, including:

■ affordability: people can pool resources to buy a house, making home ownership more affordable. It also provides a way to build equity and the security that comes with owning your home

■ access to more neighbourhoods: people have more housing location options within their budget (for example, residential communities with predominantly single detached homes)

■ more efficient use of housing stock: smaller households can maximize the space available in larger houses and heritage properties by co-owning them with others

■ community: enables groups of people to voluntarily create a community environment with facilities, indoor and outdoor common spaces and services that meet their needs

I don’t disagree with any of this, but that’s not the point.

The “benefits” are obvious, but with a high potential failure rate, and risks that greatly outweigh the rewards, why tease people with the benefits?

How about an example of who Co-Buying would work for?

Example 2: Access to homeownership

A group of young adults buy a house in a community of single detached homes. By pooling their resources, they can make a 20% down payment on the house allowing them to avoid mortgage insurance. The co-owners contributed different amounts towards the purchase price, so the percentage of the house each owns varies. This co-ownership arrangement will allow each person to build equity and eventually buy houses of their own. If major renovations are made to the house, the costs will be split based on the percentage of ownership. Ongoing operating costs are shared equally, as are basic responsibilities for the care and upkeep of the house.

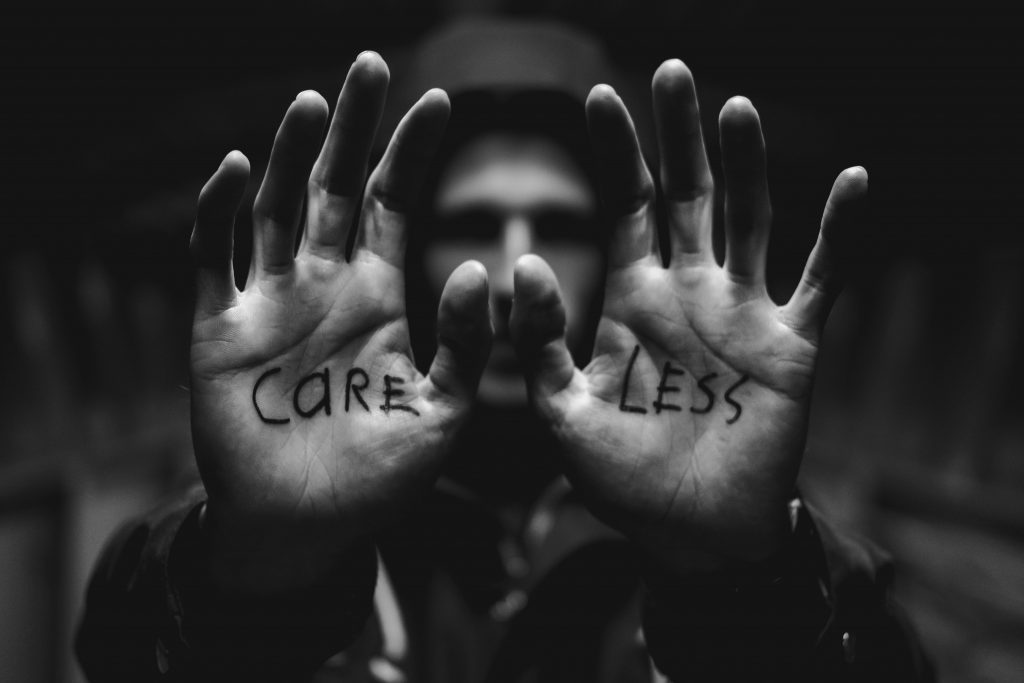

And this is the photo that accompanied the example:

They look like nice people.

The guy with the blonde mohawk, tuning out the other four as he looks at a photo of his friend’s lunch on Instagram is probably well aware of a “shotgun clause” and how it works, and I’m sure he has the money to buy out the other four owners when a dispute arises.

What could go wrong?

More than half of this guide is teaching people what this arrangement actually is, which as I mentioned above, is problematic.

The last four pages are dedicated to explaining all of the responsibilities, liabilities, and dare I say – potential pitfalls.

I won’t reprint everything in the guide (but again, I do encourage you to read the whole thing), so here are the titles and headings of each section:

Develop A Legal Contract

- Ownership structure and decision-making process

- Use of the property

- Financial and insurance arrangements

- Home operation and upkeep

- Co-owner negligence or misconduct

- Dispute resolution

- Entry/exit provisions

Buy Or Sell A Home

- Costs

- Get professional services

Finance A Co-Ownership

- Sharing costs

- Joint and several liability

- Corporate ownership

Home Operation And Upkeep

- Ongoing house costs

- Contributing to a bank account

Regulatory Considerations

- Ontario Human Rights Code

- Building Code

- Building permits

- Zoning by-laws

- Adding a second unit

- Shared living spaces

–

These are merely the headlines, folks.

There’s fourteen pages of this stuff, and it makes my eyes bleed just thinking about just how many people are ill-equipped to deal with owning a house with multiple other parties.

Pick ANY one of the bullet points above, and we’ll play a game called, “How could this go wrong?”

The biggest issue will be when to sell the property, no doubt.

What if one person wants out after a year? Does the house get sold? Can the four other owners buy out this one individual? Do they have the means legally, ie. was this thought of in advance? Do they have the means financially, ie. the money to do so, or the ability to get financing?

What if, after five years, one owner wants to buy out the other four? Is there a shotgun clause?

What if one owner wants to build a laneway house, and the other four don’t?

How many times per week does the cleaning lady come, if at all?

Can one of the owners grow weed, since it’s legal now?

Can Hailey watch Hunter’s TV?

Can Hunter have his friends over every night?

What happens when Hunter doesn’t do the dishes?

Jesus, this is like university all over again. Thank god I lived alone…

Imagine five co-owners trying to decide which real estate agent to use when it comes time to sell?

Imagine Bryce’s reaction when Willow starts dating Harper, wow!

And what happens when Willow breaks up with Harper, and then goes back to Bryce?

Get a goddam camera in that house, folks. Because this is like an MTV show, just with higher stakes.

My favourite point from the bullet-list is the “Ontario Human Rights Code.” If that’s not inviting Big Brother into your home, I don’t know what is.

Imagine watching TV in the privacy of your own home; maybe you’re watching hockey and you comment on the amount of elegance and grace that one player took during his dive to the ice. Or maybe you’re watching a movie with a female you fancy, and you make a comment on her level of attractiveness and what you might like to do with her. What if one of your co-ownership partners feels threatened because of your “toxic masculinity” and files a complaint? This is front-cover stuff for the Toronto Star…

There’s just so much that can go wrong here, I honestly have no idea why the Ontario government put this guide together.

Except, that, well, I do.

I do know why they put this guide together, and the reason is worse than the guide itself: they have no other options.

In my mind, improving the deficit left behind by the imbalance of supply and demand has much easier solutions than telling a bunch of people to buy a house together, and then pretending like half of those situations won’t end in litigation.

The Ontario government’s first mistake was trumpeting their “Ontario Housing Supply Action Plan,” since that title ignores demand altogether.

To merely focus on supply, and ignore demand, is irresponsible. Although to be fair to the Ontario government, the federal government have far greater power to address demand, and we do have two different political parties in office.

If you want to decrease demand, and not ruffle the feathers of any Canadians, then finally address foreign ownership and money laundering. I have come to realize over the past two years that money laundering does exist in real estate. I’ve seen it close up. I listed a house last year and watched the buyers massively overpay, and while I’d like to suggest that it was my negotiation skills that got them up in price, I know it was because the price wasn’t as important as the 120-day closing they needed to have the money in Canada. And before you tell me I should have “done something about this,” keep in mind, I was on the sell-side. My duties are to the seller. Without hard evidence, and just an educated guess, what am I going to do?

Besides, it wasn’t until I watched the house sit empty for eight months that I really began to think about the money. After all, it did come from the Middle East.

It’s not my job to sort this out. And while you know I’m not in favour of big government, if we really want to look after our citizens, then this is where the government ought to be spending their time.

As for foreign buyers, I’m tired of seeing the CMHC and other wings of government publish guides with made-up statistics about foreign ownership. I see the names on the listings. I see the buyers at the sales centre. Foreign money is pouring into our country every single day.

The mortgage stress test might have been designed to impact the amount of demand in the real estate market, but it only did so for foot-on-the-ground Canadians. Those buying in cash from the other side of the world weren’t affected.

And what of the supply side?

If China can build a hospital in seven days to address the Coronavirus, maybe we can do a little better job in fast-tracking the building of condominiums?

There’s so much red-tape at all three levels of government, and while I recognize that we, as a society, have accepted this because it creates tens of thousands of jobs, maybe a few less hoops to jump through to build desperately-needed housing is a good thing?

The government needs to re-think existing zoning by-laws, and allow for hyper-density in the downtown core.

If we’re not building on the Greenbelt, then we need to build a hell of a lot more densely downtown.

When it comes to infrastructure, we’re decades behind. You want to increase my property taxes? No problem. Just promise me that money will be spent on subways.

This is the subway map in Tokyo:

Tokyo is also one of the cleanest cities in the world. Go figure.

I’ve been to Tokyo. I’ve riden those trains. You can get anywhere by public transit.

I haven’t been on public transit in a decade, and I probably won’t use it any time soon. But I would gladly pay more in taxes to build subways so this city doesn’t fall apart.

There are so many things that our three levels of government can do to decrease the demand for housing, increase the supply of housing, and allow for easier transportation to and from work for those that live further away, that I wonder why the hell they’ve put out a 14-page guide on how to put yourself into a situation that will end in failure.

Co-Buying.

Jesus.

Who thinks of this sh!t?

Somebody at Queen’s Park really, truly thought that this was the answer! This is it! This is how we’ll solve the housing crisis!

And then in three years, when domestic disturbance and litigation is through the roof, it will be up to the Liberals to sort out.

These are not the faces of individuals “resolving disputes,” as the Co-Ownership guide would have us believe:

I already know that three or four real estate agents are going to ask me why I wrote this today.

“Why would you talk yourself out of potential business?”

“Why would you crap on an idea that will get more buyers into the market?”

Why?

Why not?

I’m no con-artist. I’m no schill. I’m a proud Canadian, Ontarian, and Torontonian, and the housing market is a mess.

Stupid ideas like this one aren’t going to help anybody, so I’m calling it what it is.

Maybe I’m also a bit groggy and upset from that damn colonoscopy on Thursday. Perhaps when the drugs wear off, I’ll realize that this was just a weird dream too…

Christopher

at 7:44 am

100% Agree. This is a stupid idea and does nothing to address the underlying issues of housing affordability.

However, I can’t help but feel bad for all of the single people out there who want to be homeowners. It takes a six figure income to buy a one bedroom condo these days, something most people don’t have and even less amongst those in their twenties.

Appraiser

at 8:51 am

You are absolutely correct Christopher. Toronto is becoming increasingly elitist from an income perspective. Renting is a more viable housing option and has been for a while, despite outrageous rents.

More supply is on the way, but will it be enough to move the needle?

Can we achieve the mythical holy grail of housing affordability?

“The city of Toronto defines “affordable housing” as anywhere between 80 per cent and 100 per cent of market value. “Deeply affordable housing” is defined at 40 per cent of market rate. This means that an affordable rental in Toronto or Vancouver equates to around $2,000 per month for a one-bedroom.” https://rentals.ca/blog/2019-rental-market-predictions-from-experts-across-canada

The vacancy rate in Toronto is a minuscule 1.5%.

https://globalnews.ca/news/6416487/canada-rental-apartment-vacancy-rates-low/

Even if the vacancy rate somehow magically doubled to 3% in Toronto, it would still be quite low. The last time vacancy rates were 4% was in the early 2000’s. https://www.torontorentals.com/blog/toronto-vacancy-rates

Verdict: Toronto is and will continue to be an expensive place to live.

Christopher

at 6:22 pm

Yes Toronto will always be an expensive place to live, but that doesn’t mean forever rapidly increasing home prices and rents.

Appraiser

at 7:38 am

“Average Rent for One-Bedroom in Toronto Hits $2300: Report”

https://torontostoreys.com/toronto-rent-report-january-2020/

Chris

at 8:35 pm

The average asking rent of Toronto units listed on rentals.ca hit $2,300 (as reported by Ben Myers of Fortress fame). That is not equivalent to average rent hitting $2,300.

Per CMHC, the gap between asking rent for vacant units and actual rent for occupied units has widened dramatically. In 2014, the gap between average asking and average actual rent for all bedroom types in Toronto CMA was 1.1% ($1,176 to $1,163); in 2016, it was 5.1% ($1,296 to $1,233); in October 2019, it hit 26.2% ($1,833 to $1,453).

Finally, as David has reported here, and other agents (Mark Savel, John Pasalis, etc.) have corroborated , the rental market seems to be cooling.

J G

at 12:43 pm

Being a landlord myself, I can say the best way to get good stable tenants with minimal hassle is to rent below market value.

Yes you lose some revenue, but you can use the extra time/energy to take care of yourself, your family, or invest in your career to generate more income.

Kyle

at 9:47 am

This spread is irrelevant. Of course when you average the rent paid across all tenants it will be lower than current rates. Many tenants have lived in the same apartment for years with small annual increases. Their rents no longer represent market rents and they are the only ones who get to enjoy their below market deal

It’s like saying there is a spread between what houses are selling for now, and the average of what the homeowners paid for those houses. Obviously there will be a spread, but the spread is irrelevant until the time machine is invented.

Chris

at 10:38 am

Not sure I agree, Kyle. The spread measured at a single point in time may be dismissed as irrelevant. The trend over recent years, less so.

Many of your comments would, I suspect, hold true for 2014 and 2016 as well; tenants living in the same apartments, with small annual increases, which may no longer be representative of market rents. Yet it was only 2019 that saw the spread hit 26%.

Do you anticipate this gap will continue to widen? Because based on commentary from David, John Pasalis, and others, as well as anecdotal listings on Bungol/HouseSigma, it seems as though some landlords are having to reduce their asking rents to attract a tenant, thus tightening this spread.

Kyle

at 1:22 pm

The spread has increased because actual rents are somewhat anchored while market rents are rising. That’s it, nothing more. I don’t anticipate the direction of the gap because like i said the gap is irrelevant and tells nothing about the current market. In fact the gap is influenced by lots of other factors that has nothing at all to do with the current rental market, such as to what extent are actual rents being anchored by low tenant turnover, by guideline increases vs market driven increases, by how many landlords are getting above guideline increases through improvements, and countless other possibilities.

If you want to know whether rents are softening the asking rent tells you everything you need to know, not the gap.

Chris

at 1:39 pm

I don’t disagree that the gap and market are influenced by lots of factors. However, a couple points:

“The spread has increased because actual rents are somewhat anchored while market rents are rising.”

But that’s always been the case, hasn’t it? I don’t think it is a new phenomenon. I would agree that perhaps it has been exacerbated in recent years due to the imposition of rent control and rent price acceleration, but equally it seems some landlords are asking unrealistic amounts for rent, resulting in them being unable to find a tenant (see John Pasalis’ post on increase in rental listings, David’s comments on rental listings dropping prices, etc.).

“If you want to know whether rents are softening the asking rent tells you everything you need to know, not the gap.”

Again, not sure I would agree. That’s akin to saying asking price tells us everything we need to know about the resale market. If someone lists their home for $1, are we to assume the real estate market is going to plummet?

A much more pertinent measure than either asking rent or prevailing market rent would be the average rent that tenants have signed leases for within the past year. Unfortunately, I don’t know of a source that measures this, at least on large scale. If you do, would appreciate you sharing!

Kyle

at 1:42 pm

” based on commentary from David, John Pasalis, and others, as well as anecdotal listings on Bungol/HouseSigma, it seems as though some landlords are having to reduce their asking rents to attract a tenant”

You answered your own question, if you want to know where rental rates are and where their going just track asking rents not the gap.

Kyle

at 1:49 pm

Requires a subscription

https://www.urbanation.ca/urbanrental-report

Chris

at 2:19 pm

Ah, thanks for providing that source, Kyle! As I don’t work in the industry, not sure I’m willing to pay for a subscription just for my interest’s sake. Cheapness prevails.

Though, did come across this:

“The findings suggest that the high cost of rent is prompting more tenants to share, or move to smaller units and less expensive areas of the region, said an Urbanation press release.

“There’s certainly evidence that (rents) are bumping up against the maximum that the average renter is willing or able to pay,” said senior consultant Joel Conquer.”

As I said above, I suspect we’ll see that spread narrow over coming years. Either through asking rents declining, market rents climbing, or, most likely, a combination of the two.

Izzy Bedibida

at 8:27 am

Co ownership among family members was fairly common when my parents immigrated to Canada decades ago from Southern Europe.

In my old neighborhood it is currently common practice for the South Asian community to co own homes. For many it is the only way. The interesting thing is that the South Asian community is targeting homes from my parents era as they are already set up for co ownership.

As per your points about co ownership, I totally agree with you. It is the latest government fad.

Verbal Kint

at 8:55 am

I’m no Freudian psychoanalyst, but this blog sure is taking an interesting turn.

Dude

at 9:11 am

One Million New people will be living in Toronto in the next 10 years.

If you think 2010-2020 was a crazy time for Toronto, look the f*ck out because we are about to get hit with a damn truck.

Have you tried to drive on Bloor at 11am on a Sunday? Jammed. Have you had to push your way onto a subway every. single. morning? make room for 1,000,000 more people.

But can I build over 3 stories? Not without bribing some goon at City Hall first.

Appraiser

at 9:28 am

One million new Torontonians by 2030 is absolutely realistic and likely on the low side.

Canada’s population grew by more than 550,000 in 2019. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000901

At this pace there will be at least 5 million more Canadians by 2030.

At least 20% of whom will be living in Toronto. Book it.

Francesca

at 2:12 pm

https://www.thestar.com/news/gta/2020/01/31/the-population-of-the-toronto-area-will-hit-8-million-in-the-next-10-years-its-make-or-break-time-are-we-ready.html

Appraiser

at 9:12 am

Had a long conversation with a 59 year old guy in the sauna the other day. He co-purchased a home 20 years ago with his wife’s brother and sister in law. Both couples still occupy the home to this day.

Sauna guy wants to retire next year and move. His brother in law and wife do not want to move. He cannot afford to buy out his brother in law because the house has appreciated so much that the mortgage payments would be excessive. Brother in law cannot afford to buy out sauna guy for same reason.

Verbal Kint

at 11:06 am

#FirstWorldSaunaAnecdotes

Sirgruper

at 10:18 am

A sale can be forced under the Partition Act, Ontario

J G

at 12:53 pm

What the heck has he been doing for past 20 years? Ever heard of work hard/build career/make money the normal way?

I would think any working person who has lived in Toronto for past 20 years(!) should have saved at least 300k for half of a down payment.

Daniel

at 9:25 am

Excellent topic, David!

I too was shocked when I saw this publication from the Ford government.

My question: what have John DiMichele and Tim Hudak said about co-buying? I can’t seem to find anything online. But something tells me they’ll both push the idea.

Pragma

at 9:29 am

I’m not even a realtor but I was well aware of what was happening in Toronto just from talking to my friends and living in a condo downtown. You could see the types of agents walking around the building, you could see the number of students living in an expensive condo was disproportionate, you could see the number of empty condos (from the mail room). I know it’s not data, but you could just see something was off. As a realtor I would have expected you to see this much better than I would as obviously you are closer to the ground. So it’s pretty strange that you didn’t.

Appraiser

at 9:35 am

Prime example of why anecdata is so feeble.

Professional Shanker

at 12:10 pm

sometimes it takes an outsider to point out the obvious, the case in all industries.

Izzy Bedibida

at 3:34 pm

Heard similar stories about separated/divorcing/in a bad relationship couples in the same situation. If a legitimate couple is in that situation, what will happen when 5 roommates with “shared equity” when the arrangement goes sour?

Kyle

at 9:42 am

David you didn’t mention the level of Government most responsible for our housing crisis – Municipal.

Using Tokyo as an example again, they have a 9.2M population, while Toronto has a 2.9M population, but their rents are about the same. The reason is that they can add supply without having to beg, plead and jump through flaming hoops to get approvals.

“The planning framework that underpins this supply is a simple zoning system that allows by-right development, rather than one that relies on granting planning permission for each individual site.”

https://www.citymetric.com/fabric/tokyo-proves-housing-shortages-are-political-choice-4623

Appraiser

at 10:22 am

“Housing is a human right: How Finland is eradicating homelessness Social Sharing”

https://www.cbc.ca/radio/thesundayedition/the-sunday-edition-for-january-26-2020-1.5429251/housing-is-a-human-right-how-finland-is-eradicating-homelessness-1.5437402

Libertarian

at 10:32 am

“Maybe I’m in a period of self-reflection right now, but I honestly don’t know if I’m a rational, logical, honest individual, or if I’m bitter and pessimistic. ”

It’s bitter and pessimism.

Happens to all of us.

Marina

at 10:35 am

That guide is batshit crazy. I might print a copy to class up my bathroom. It’s the right place for it.

First of all, those ladies on the cover? The three standing ones are already planning to off the 4th – you can see it in their eyes.

Second, the breezy tone grates on my last nerve. Oh, you can just buy a house an reno it to house an old folks home. Easy! Here’s a guide to setting up a condominium. My son’s Lego instructions have a more serious tone.

Also, who the hell would want to share housing with FIVE other people? I can’t even get five people to agree on pizza toppings, let alone a housing agreement! The examples of two families sharing or whatever is at least somewhat realistic, but five? yeah, good luck with that. And can i buy tickets to that show?

Finally, you know this is going to be a big “action” item on the government’s list of accomplishments, and it literally means nothing. It’s like putting together an “action committee” or whatever – just means they tried nothing and are all out of ideas.

M

at 11:47 am

Ontario PC taking clues from Poloz and BoC…

https://www.thestar.com/amp/politics/federal/2020/01/23/could-splitting-mortgage-costs-with-investors-make-housing-more-affordable-canadas-top-banker-believes-it-would.html#click=https://t.co/P9kMP4BFrn

Jimbo

at 5:33 pm

I had friends come to me with the idea of co-ownership in 2003/4 but decided it was a bad idea. Too many variables, I was also nervous any one of us could have figured out a way to clear out some equity in the house without the others knowing……. Back then I remember stories of banks putting mortgages on houses that were completely paid off and giving the money to a fake owner.

I hope money laundering is not playing a role in T.O. real estate, the idea of cleaning your money by overpaying on a house just sickens me. Problem is even if you did report it RCMP wouldn’t be able to do anything about it. Seems their larger operations that are meant to catch this activity are being dismantled to focus resources on bigger things…..

cyber

at 8:06 pm

I can see this potentially working for a larger, multi-generational home purchase, by a family that comes from a cultural background where this is a preferred practice, where everyone plans to be based in the same location over the long-term and take care of each other in a true co-living type of situation (e.g. exchanging babysitting now for taking care of parents later in life), and where plan is to continue passing the home on to the next generation as opposed to cashing it out as a retirement asset.

Potentially it could also multiple individuals/households buying a multiplex with intent to convert it into individually-owned condos (though this is quite the process and assessed maintenance fees generally end up quite high to new build condos).

All other circumstances I can think of seem more like a great opportunity to trade near-term home equity building in the near term for stressful situations and expensive legal bills in medium to long term.

Jon

at 2:18 pm

LOL what an insane concept. Not to mention, sharing the ownership of a house with a bunch of other people strikes me as a bit Soviet and offensive to my capitalistic sensibilities. Don’t get me wrong – sharing a house can have its time and place. I shared a house with some college buddies, but it was easy. You have almost no responsibilities and spend your weekends getting drunk chasing girls, who cares if no one does the dishes? Coors is on sale for a dollar a can!

This seems like it could be a hair brained scheme cooked up by a bunch of finance “bros” at Earl’s happy hour who want to participate in housing speculation, but are involuntarily excluded from the market by nature of their limited financial means. “Yo, we should totally split a house in a Summerhill, after a couple years we’ll each bank 50k!, waitress, send some tequila shot for the boys! We’re gonna make mad bank!” It will be “lit” as the kids are wont to say. Not to mention that owning a house will improve your romantic prospects (until she finds out that said house is infested with four other douchebags).

You can speculate in the joys of real estate without the colossal headaches of “co-ownership”, they’re called REITS.

This level of gobbledygook nonsense could only be generated from depths of room temperature IQ Ontario bureaucrats, no one with any intelligence would dare put this insanity on paper.