“What’s it going to take to make this market turn the other way?” I was asked last week by a reporter from the Wall Street Journal.

There are several ways to answer that question.

Cynically, figuratively, literally; with empirical evidence and economic data, or with anecdotal evidence from working in the market each and every day.

This post is sure to stir the conversation. So: what’s it going to take?

I’ve gone from bullish, to bearish, and back again, a few times over the last three years.

I went to business school, and did a minor in economics, so while I don’t profess to be a genius, I do have a general, basic knowledge of economics, as much of a nerd as I am, I read books on economics and market cycles in my spare time (and even on my Honeymoon…).

One of the things I’ve learned, that I just can’t seem to get over, is that “most” real estate market cycles generally average eight years, and in Toronto, we’re going on two decades now.

I got into the business in late 2003, and was actively selling by 2004.

I’ve told this story before, so if you’ve heard it, feel free to skim. But when I got my real estate license, an older friend of mine told me, “This is an AWFUL time to be getting into the business! The market is going to absolutely crash, dude! It’s just basic economics! This cycle is pooched! It’s been eight years, and prices are gonna drop 40%!”

That was in 2004, and since then, prices in Toronto have more than doubled.

You wouldn’t believe the comments I had to deal with back then. A family friend told us, “You should sell your house today, and then in three years, buy it back for half the price.” We kept the family home, and it added about 70% in value before we sold it. I don’t know what it would be worth now, since a developer tore it down and built two homes in its place, but I’m sure there would be even more money on the table, and no, it never dropped half its value so we could buy it back…

“Buy it back for half price,” I was told. That was just insane!

Wasn’t it?

Or was that a reasonable statement, at the time?

I wrote in last Monday’s blog that, “I no longer hear the people shouting that a 30-40% market drop is coming.” They were in abundance all through the 2000’s, but in the last couple years, they seem to have disappeared.

One of my regular blog readers, “Potato,” commented:

“I apologize for my negligence, David.

Prices are going to drop ~30% in Toronto. It will not be fast, but the magnitude will make up for the multi-year wait and grind. Even afterwards, identifying the “trigger” will be fuzzy, and more about storytelling than anything else.”

So there are still people predicting a massive drop in prices, but let’s say a 2004 home that was worth $500,000 is now worth $1,000,000. If a 30% drop in home prices in Toronto did come true, that house would be worth $700,000, which would still represent a $200,000 increase (40%) over that 2004 price. So for all the doomsdayers in the early 2000’s, they’d still be catastrophically wrong, and would have lost out on a tax-free capital gain that can’t be made anywhere else on planet earth.

But let’s not look back anymore. Let’s look forward, and ask again:

What is it going to take for prices in Toronto to drop?

And don’t just give me, “They have to drop – they just have to.”

I’ve heard that way too many times before.

Give me an identifiable reason, backed up with evidence (whether it’s hard data or not), why prices in Toronto are going to drop.

Or, give me a reason not as to why, but how.

I think we would all agree that if interest rates increased, affordability would be lower, and fewer people would choose to buy move-up houses. Fewer first-time buyers would be purchasing homes, and might choose to rent instead, and the number of people looking to buy would be lower overall, thus putting downward pressure on prices.

But what if interest rates didn’t increase, or they did so very, very gradually, over a long span of time? What could make the market drop then?

I spoke to a writer from the Wall Street Journal last week at some length, and neither of us could really find a reason as to how the market could drop, other than, “It simply has to.” I told him that from what I can see out there in the market for single-family homes, I just don’t see it happening.

I’ve made this point before, over and over, but I’m going to make it again.

In Toronto, we never, ever, ever see this:

Imagine what the market is like in an area where one out of every two homes on the street is for sale. Whether this is Florida, Arizona, or another, we haven’t seen anything like this in Toronto in decades (if ever…), and I don’t expect to see this any time soon.

All week, I continued to email my active buyer-clients and say something to the extent of: “Hey guys, another week, and nothing to show for it! Listings are very slow to materialize so far in January, and we’re just not seeing any inventory! Maybe next week? Fingers crossed!”

I’m so tired of sending those emails. I feel redundant, and repetitive.

But the truth is, in most popular neighbourhoods, with single-family homes, we’re not seeing any inventory! Forget about the photo above where a dozen homes are for sale on the same street. Give me ONE great listing to sell!

And what happens when we do get that one great listing? Well, I’d say that 1,000 people view the listing online, 100 of them view the property at the open house or via appointment with their Realtor, 40 of them consider the property aggressively, 20 of them contemplate making an offer, and then 10 of them proceed with an offer on the scheduled day.

This is clearly a function of supply and demand, or rather, the lack of supply, and the incredible demand.

As I told the reporter from the Wall Street Journal last week, “Until this changes, and until we see multiple ‘FOR SALE’ signs on the lawns on the same street, this isn’t going to change.”

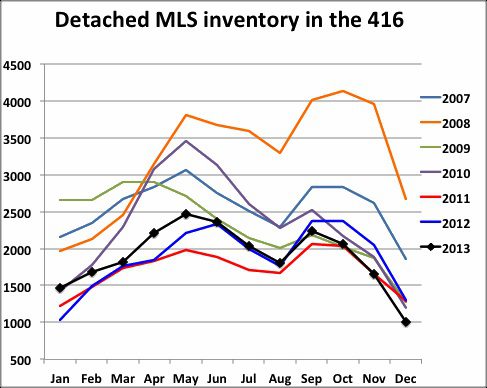

Let’s take a look at inventory levels of detached, single-family homes through the last few years, courtesy of my colleague, Ben Rabidoux:

Inventory levels in 2013 were among the lowest in the past seven years, and at some points, trailed the high by 40-50%.

Another comment on my blog post last week read:

“Corrections tend to affect all properties . Don’t believe for a second that the Beaches or the ridiculously inflated semi detached houses in Leslieville won’t be affected. Have you ever seen a stock market correction? Real estate is not much different in its reaction. Corrections usually effect the market as a whole.”

What is “ridiculously inflated” in this market? If $800K for that semi-detached in Leslieville is insane, then what about the $960,000 it’ll cost if and when the market goes up 20%? Or what about when the house was $600,000 a few years back, before the price increased $200K?

If something was “ridiculously inflated” in 2008 when people were calling for a 50% drop, then can that description be taken back, now that the market has increased by 40%?

I’m asking these questions, and making these statements, not as a salesperson trying to push the real estate agenda, but rather as an interested party, trying to make sense of this market.

How can you argue with the graph above?

With so little on the market, HOW can prices for single family homes change?

“What goes up, must come down.” We’ve heard that line before, and it almost always holds true.

I’m not going to pretend like I truly believe that the housing market in Toronto (and let’s be specific here – we are talking about single family homes, and not condos) will continue to add 8-10% per year, every year, forever. But I do think that this is going to continue through 2014, and into 2015, and I wonder when, why, and how it will stop.

I was a bull, then a bear, now I’m a bull again.

And just like every active buyer in today’s Toronto market, I just wish what is, was not…

Vincent Cheung

at 8:00 am

Just to comment, just like how we see different pockets in Toronto may never see price declines; isn’t it worth speaking in types of dwellings. You speak of detached homes but what are your thoughts on condos?

The average increase in price of 8-10%, is it based on all housing types or just detached?

Are you bullish on condos too?

AndrewB

at 8:34 am

I think the same principle will apply to condos. First, you have to look at location. Then, you have to look at unit type. Well laid out units that are desirable will always be valuable. Shoebox 550 sq ft one bedrooms with no natural light? Probably not.

Philip

at 8:21 am

It would take one of a number of things. Slow, massive global leveraging. Rates would grind higher for 4-5 years and credit stringency at various institutions would increase much more than they already are. Alt – A type Cdn lenders would slowly fade away as they would have a hard time attracting deposits (via CDs) as competing yield product would be priced more attractively. The other option is another global financial shock. The sovereign issues in Europe are actually worse than they ever have been, the currency is closer to losing its hegemony than ever before, and arguably the war drums are also louder than in 2008.

AndrewB

at 8:23 am

From what I’ve been reading, the falling dollar will result in faster paced inflation. With lack of buying power abroad, and wages remaining stagnant, I can see the “cheap money” train coming to a halt. As our dollar loses steam, yes we will make more on export, but that won’t effect the bottom line for Canadians. As essential services and products are bound to start to increase, household GDS is bound to increase to the point where people will be so tight on their life expenses that something has to give.

This and I think that interest rates may go up sooner rather than later. However, Canada just kept prime the same in the hopes that will falling dollar will stimulate growth.

http://www.thestar.com/business/2014/01/23/9_things_to_know_about_a_90_loonie.html

http://www.thestar.com/business/economy/2014/01/23/falling_canadian_dollar_will_spur_inflation_growth_td_economics.html

Vincent Cheung

at 8:42 am

I’d also say remove CMHC altogether and see how the market behaves.

Dave do you usually have any insight to how many of your buyers use CMHC?

jeff316

at 10:59 am

What are you replacing CMHC with? Government will always have a housing policy. That will affect how the market behaves.

Long Time Realtor

at 8:48 am

To my mind there are three main factors that drive the market. Affordability, supplky and demand and employment.

I believe the key factor driving home prices is affordability. Price to rent ratios and price to income metrics have proven to be totally inaccurate, bordering on irrelevancy.

Yesterday we heard from the BoC that the prime rate is unlikely to rise for at least two more years. Thus, affordabilty does not appear not be an obstacle.

How about supply and demand? Theoretically, there is nothing to hold back a flood of fully detached listings pouring on to the market this spring. Even so, it could be argued that much of that flood would be quickly absorbed by pent-up demand. So supply and demand seem the unlikely culprit.

That leaves us with employment. Yes, the December employment numbers were awful. But one month of highly volatile data does not a trend make.

Although perhaps unlikely, the only road block that could possibly derail this market is a sustained spike in the unemployment rate.

Philip

at 9:15 am

Systematic economic shock can affect many of these factors

Joe Q.

at 10:35 am

What do you mean by “price to rent ratios and price to income metrics have proven to be totally inaccurate”? Do you think this data is reported fraudulently?

Long Time Realtor

at 2:42 pm

@ Joe Q.

Price to rent and price to income ratios have proven to be inaccurate as a measure of market sustainability.

The various affordabilty indexes are clearly much more accurate; because they are right.

Joe Q.

at 4:31 pm

LTR writes: Price to rent and price to income ratios have proven to be inaccurate as a measure of market sustainability.

In the current boom, yes. Over the long-term, I’m not so sure. From what I recall, price-to-income ratios in Toronto were very steady from about 1990 to 2002.

The various affordabilty indexes are clearly much more accurate; because they are right.

That is a circular argument, because affordability indices are based on house prices. You can look at the longitudinal RBC Housing Affordability Index for Toronto (page 6 of http://www.rbc.com/newsroom/pdf/HA-0827-2013.pdf). I don’t find this plot terribly encouraging for “market sustainability” (unless one contends that worsening affordability is a measure of market sustainability)

From what I have seen, the metric that best follows housing prices is the ratio of mortgage debt to GDP (though this is also somewhat circular). The data I have seen (1980-present) suggests that as long as Canadian outstanding mortgage debt grows faster than GDP, house prices increase. When they grow at a similar rate, prices flatline or “correct”. As long as “willingness to pay” remains high, and “supply” remains low, the Toronto real estate market will be determined by “ability to pay”, i.e. availability of large mortgages (relative to income).

Paully

at 8:50 am

It is easy to be bearish, but the hard part is knowing when to do it! I look at pricing in Vancouver and think that Toronto still has lots of price-growth possible, even if lots of people don’t think it makes any sense.

I think that you touched on one of the future catalysts earlier this week when you wrote about Cinema Tower and Festival Tower. If some of the huge number of condo investors decide that price growth is slowing and that it is time to exit, condo listings could balloon. That will be the tip of the knife that kills the growth of the market. If condo supply overwhelms demand, which certainly looks possible given the sheer number of new builds going up, prices will fall, as some investors run for the exits. If condo prices fall dramatically, lots of people may decide not to buy single-family, given the growing price disparity between condos and houses. Since demand for single-family falls, prices can fall there too. At the very least, the crazy multiple offer nights will stop. Supply will still be limited in single-family houses, so the fall should be less severe.

It is said that bull markets have to climb a wall of worry. When everyone decides that the market will continue to climb, despite all rational arguments, that is when it will finally end. The fact that you have turned from bearish back to bullish at this point should actually be considered a very bearish signal.

Joel

at 10:03 am

Paully I agree with your comments and i think that this what we will see. I am assuming that many people looking to purchase a sfh are selling their condo first and cashing in on the equity created in it. If the supply of condos increases and the cost lowers there will not be that extra money for these people to move on the their single family home.

That being said, there are enough people in Toronto to absorb the sfh that do come on the market, but we will see the end to the multiple offers. Prices will continue to rise, but at a lower rate. When you factor in 5% mortgages with a down condo market the number of people able to purchase these homes will drop.

AndrewB

at 12:05 pm

Vancouver will always be more expensive than Toronto so I don’t think that their price ceiling can accurately reflect ours. Vancouver is geographically smaller and Coastal Vancouver is wedged in by mountains and water. Thus, there’s physically less space for housing, coupled in with demand for land due to Vancouver’s draw of milder climate, ecology, etc. Toronto is a massive sprawl in comparison, where Vancouver is small.

Patrick

at 8:54 am

David, don’t you think that the major lack of inventory might be indicative of some sort of change? What does it mean when homeowners (sellers) are not interested in selling in what is clearly a sellers market?

My assumption is that they do not consider their next step-up the property ladder as being an affordable step, so they stay in the home that they are comfortable in.

Jason H

at 10:02 am

Patrick, I agree.. I think it’s the “affordability factor” and “being over leveraged in debt”. Prices will continue to climb although.

Ed

at 11:45 am

Patrick, perhaps this a sign of the times. When people realize that maybe they just don’t need more house and decide to stay put and maybe renovate. Certainly the double land transfer tax we have to endure keeps many people from moving within the Toronto boundaries.

The supply/demand balance is also out of kilter because mass immigration to Toronto and so very few SFH’s are being built here.

Yes I can see a time when the average family cannot afford a SFH within Toronto, but that can also be said of hundreds of cities around the world.

Kyle

at 9:57 am

Strictly talking about Single Family Housing in the City’s core:

Longer Term – the trend will keep rising as population grows in Toronto. There is a location premium that grows in all big cities as they become larger and more global. And that’s what we’re seeing happening in the core. Some people have called it the “Manhattanization”. Though i personally think we’re a long way away from being $2500 sq ft, i don’t think $1000 sq/ft is unrealistic in the next 10-20 years. The only thing i can see reducing this location premium is if there is some kind of massive unemployment in Banking, Finance, IT, Legal or Medical. Or something that could more slowly erode the location premium is if companies begin to adopt working remotely or telecommuting and that becomes as common a way of working as physically commuting to an office.

Short Term – i think there is a demand hump and supply shortage in the 600K – 1M range. On the supply side, so many people, majority of whom are young families with pre-school kids have bought houses in the core in the last decade, that they are just not ready to move yet. Maybe in the next 4 to 5 years when life events like changes in school, or outgrowing the house, or kids finally moving out, will see supply loosen up. On the demand side, those who used to be able to qualify for a 1M+ home are now buying in the sub-1M range, driving up prices. I thnk that’s why there are so many 800-900K semi’s and row houses selling now. I don’t see much in the near term that will change this situation.

Jason H

at 10:00 am

I’ve said it before:

At some point the debt train has to stop. Affordability is not defined by being able to borrow since it’s proven that the average person is way over leveraged and all we need is some form of catalyst to get the ball rolling (which it seems in the last month or so with a few thousand job losses AND decline dollar).

The reality is I see people say house is still affordable.. Well yeah because people are uneducated on the fact you have to look at more than just the “monthly payment”.

Is it affordable if you load a vehicle for 8 years just because the price is 200 bucks a month? Really?

Is it affordable if you’re 45 and have to mortgage for 25 years to get a 2k per month mortgage?

It’s called rationalizing your inability to understand basic math and economics.

Joe Q.

at 11:09 am

Overall I do agree with Long Time Realtor that “affordability, supply and demand and employment” are all important. I actually think that affordability and employment are really part of demand (poor affordability and high unemployment affect the market by reducing demand).

IMO reducing affordability to an argument based solely on BoC interest rates is misleading. The proportion of buyers who are required to take CMHC insurance is very large. We have already heard many times that the CMHC rule change that denies mortgage insurance for homes above $1M has affected the market significantly. What if the CMHC were to change their minimum down-payment to 10% for all buyers? Alternatively, what if debt-service ratio guidelines were tightened by a couple of percentage points? Either move could precipitate a rapid drop in demand (based on ability to pay for a home) without any change in interest rates.

The other issue that concerns me is the link between condo ownership and home ownership. I know these are two different markets, and David wants to treat them separately, but to the extent that homeowners have their wealth tied up in investment condos, and that condo ownership is an alternative to SFH-ownership, I don’t think they can be too easily disconnected. A breakdown in the condo-speculation cycle is said to have been the major cause of the 1989 housing “correction” in Toronto, but SFH prices also took a major tumble (this in an environment where mortgage rates were not too high by the standards of the previous 10-20 years).

Brian Ripley

at 11:38 am

Vancouver (or Manhattan) real estate pricing is not a good argument for the buy side in Toronto especially in the strata market.

Notice that average strata prices in Vancouver have been in a 6 year trading range and are now closer to the bottom of that range :

http://www.chpc.biz/compare-toronto–vancouver.html

If the buy side is willing to continue subsidizing a negative yield in the form of real estate then bully for them.

What might change that sentiment? I would say if the net income that covers the negative spread changes to the downside, asset prices will follow.

Earnings in Ontario and BC look like they are flattening.

http://www.chpc.biz/earnings-employment.html

I have heard some wags say the CA$ could head to 80 cents; that’s good for exporters, but it will erode the buy side’s ability to subsidize as consumption costs increase.

Ed

at 12:24 pm

What’s it going to take to take down the Toronto market?

How about Olivia Chow for mayor and a majority Wynne government.

In either case cost of living will go up.

Or for a more detailed and scientific analysis on the collapse of the Toronto market.

WWGS- what would Garth say. ha,ha, hee

Sorry I couldn’t resist.

Joe Q.

at 1:15 pm

Cost of living will go up no matter who is Mayor or Premier.

Alex

at 2:24 pm

I know you’re talking about SFH, but I think if the condo market crashed it would affect SFH prices as well. Suddenly all these people that want to sell their condo to afford a SFH can’t, and so the demand drops. If our loonie keeps dropping and the USD keeps rising then maybe the US becomes a better investment vehicle (not necessarily US RE, but other investment opportunities there), and we stop having foreign investors buying up all the condos. If we had less foreign investment we would probably have a lot less condo starts, and suddenly the construction industry cools down as well. Without that foreign investment we lose a lot of money being pumped into the economy, but people won’t have to go into so much debt to buy a home either so locals have more money to spend here. I wonder if it would end up as a net gain, or a net loss for quality of life in the city?

Imagine what downtown Toronto would be like if the foreign investors take their money out of our RE market and only people that actually want to live here are buying? Would condos suddenly be full of people actually living there, or would they be half-empty slum towns?

Joe Q.

at 4:35 pm

Benjamin Tal apparently said (reported by several people on Twitter) that less than 5% of Toronto condo buyers are “foreign”. Not sure if this is a per-person or per-unit basis.

ScottyP

at 9:10 am

Many if not all foreign buyers are looking for a reliable means by which to park some of their vast swaths of cash, and couldn’t really care less if prices take a dip or are the place stays vacant.

So in other words, as long as you build the condos, the foreign hordes will come… well, 5% of the buyer pool, at least.

Rob Fjord

at 5:36 pm

japans QE program dwarfs what the US is doing, i think mid 2014 japan begins to export inflation to the world, as well, money velocity is increasing in the US, but interest rate will stay low till 2015, they will rise in canada and US sometime in 2015 or maybe they can hold out till early 2016. US and canada are due for another recession around this time, stagnant wages, higher unemployment, more gutting of the manufacturing sector and rising interest rates, will finally kill the market. Here is my dart throw for the exact top…. feb 02 2015

the drop in toronto will exceed 50%

Potato

at 6:38 pm

So much to say…

First off, just because some people called for a crash when it was unwarranted doesn’t mean that the ones doing so now are wrong… Especially when different data is used to make the cases. I’m not much of a believer in “what goes up must come down” as a reason (though arguments about appreciation vs inflation can sound that way). And 40% over 10 years is quite reasonable… But doubling, eh…

Myself, I was looking to buy in 2003, and didn’t only because it didn’t make sense with my life situation (grad school, uncertainty about where I’d settle down long-term). The math made sense in 2003: you could buy a place, rent it out, and make a profit (with enough of a cusion for one or two things to go wrong along the way).

In 2006 I looked again and it was meh — prices had run up so it was close enough to break-even with renting as to not bother, but not quite so over-heated that it looked like it needed to crash. But that’s just when the after-burners were fired up. By 2008 I became seriously bearish. After that, I have no idea what buyers were thinking.

Interest rates dropped shortly after, forgiving the excesses that didn’t make sense at 5-6%… But then you had to believe in 3% rates forever. And prices kept going up, so that now it doesn’t make sense to buy even if you don’t plan a contingency, and rates do stay low forever.

What corrects all that? Psychology is the ultimate answer, but that’s very difficult to put a metric on. Lots of things can come along to give attitudes and expectations a push, and they’re tough to identify in hindsight (e.g., many people still blame interest rates for popping the 1989 bubble, when it was such a relatively small and temporary rise that that’s hard to swallow — equiv to rates going up ~1% today for a year; but maybe that was all it took to change the mindset and momentum took over).

If rates go back up, that could do it, but that doesn’t mean rates have to go up first. Buyers are by many metrics near the edge of affordability — see the 5-year filter, for example. We’ve also pulled a lot of demand forward, shrinking family sizes as more young people move out on their own into 1-bdrm condos. Simple “buyer exhaustion” (by which I mean the market exhausts the bonus volume of new buyers it pulls forward, not that individual buyers get sleepy) will eventually hit. Indeed, that seems to be happening out West, with prices in Vancouver starting to roil, and Victoria actually falling.

The market is also tearing itself apart. The new condos are so ridiculous now, Toronto’s building activity is higher than what, the next 3 major cities combined? That’s a major positive feedback cycle risk — just slowing down could cause unemployment, which could cause more slowing and unemployment. Condo price growth has lagged that of detached: that can only go on for so many years before people can’t move up anymore and the market seizes.

Ultimately, there’s no bell ringing saying “this is the top, you may disembark now.” That was true in the US, too — for all the hooplah about subprime and non-recourse there, they were just accelerants. The market had to turn over on its own first (and then those factors drove it into the ground in record time).

So simple and yet unpredictable: something will shrink the buyer pool, and change buyer psychology. Maybe just a few years of more modest price growth to reset expectations; more anecdotes of people trying to flip and not even breaking even after fees. Someone talking the market down, or the media doing it collectively by giving more of a voice to bears, and more critically analyzing the bullish press releases. Maybe interest rates or downpayment requirements will go up and force the pool smaller. Or maybe it will just run for another few years until we hit the limit of parents buying condos for their high-school-aged kids.

Rents are already squeezed by incomes, and prices are such that potential investors can’t make decent money by leasing out (unless they count on appreciation). If I had to hang my hat on just one indicator, that would be it.

But I have to admit that it should have happened by now. Low rates opened up huge new swaths of the buyer pool in 2009, but we should have drained that by 2011 or so. I have no idea where the buyers of today keep coming from. Are they stretching too much? Will it be stories of the house poor that finally changes psychology? Overvaluation can persist for as long as the madness of crowds can be fanned. Trying to predict precisely when or how sanity will return is nigh impossible because it’s illogical states we’re dealing with. But it will eventually return.

Geoff

at 9:51 pm

“First off, just because some people called for a crash when it was unwarranted doesn’t mean that the ones doing so now are wrong…” + 1 above.

BUT with a caveat – there are those, many of whom lurk on other blogs or worship at the feet at he who shall not be named but has a beard and a moustache and a thousand facebook friends and probably 3 real ones – who may be calling for a ‘correction’ or ‘collapse’ not because of evidence, but because of their fervent hope that it must be so in order to make their own choices feel better. In social studies I believe this is called confirmation bias, so that’s kind of the counterpoint to the example pointed above.

Scotty

at 2:20 pm

I don’t know who to attribute the quote to, but I came across “You are not stuck in traffic, you are traffic” and applied it to the housing market. My wife and I stopped seriously looking last summer after two years. Everything was ballooning out of our range and we finally realized we were part of the problem. We’re happy renting paying about 1/2 of what it would cost to own something similarly sized. I think it is going to take people like us to opt out and live what may be considered an alternate lifestyle because they are not willing to put every dollar into housing. (Looking at daycare costs will do that too- $150k over 6 years for two small children! There goes a down payment.)

Joe Q.

at 8:18 pm

““You are not stuck in traffic, you are traffic”” — that’s a great one.

ScottyP

at 8:50 am

Unfortunately Scotty, not everyone is as reasonable as you and your wife are.

And because most people “have to have it now” and rationalize “we’ll be able to afford the house we just bought for $200,000 over asking in a year or two, when I get that promotion and your hot crochet business takes off”, well, it’s going to take a significant spike in the prime rate to a) give owners no choice but to sell because their variable-rate monthly payments become impossible to bear; and b) force prospective buyers to wake up and realize there’s no way they should be buying on their present dime in the first place.

Interest rates go up, the economy as a whole suffers (hence why the BoC is so hesitant to change their policy — private consumption being the real engine of the economy), people actually start fearing for the future instead of just saying they fear for the future, perhaps a new “pride of ownership is for brainwashed fools, renting is the way to go!” trend helps speed the process, and suddenly the tipping point arrives, and there are more people wanting to sell than wanting to buy. The media is the only too happy to spread the news, the news begets more selling, the snowball grows bigger, and — ta dah! — It’s 1991 all over again.

Not saying it’s going to happen this way, of course (ha!)… but it is plausible, because so many homeowners are barely hanging on as it is. But it’s going to take a change in BoC policy to provide the impetus.

Until then, the insanity continues….

ScottyP

at 12:16 am

3 words: When Interest Rates Rise.

(Shoot, that was 4….)