If I had to explain what is currently going on in the Toronto real estate market, and I had to use a song title to do so, I certainly wouldn’t be without options.

I mean, Simon & Garfunkel‘s classic “Bridge Over Troubled Waters” might be appropriate, but that’s too metaphoric.

Alice Cooper‘s “School’s Out For The Summer” is probably too literal as it pertains to our kids (as well as the inherent prediction), and too metaphoric to explain our market. Plus, I think the market will be back well in advance of summer!

Alice In Chains’, “I Stay Away” could be applied to the buyer mentality out there.

Men Without Hats might encourage those buyers who are looking at properties to adhere to the “Safety Dance.”

If we wanted to be more bullish in nature, then Bob Marley‘s “Everything’s Gonna Be Alright” could apply. This was also covered by Naughty By Nature, FYI.

If we’re looking at all the agents who, for some unknown reason, continue to list properties under fair market value and hold “offer nights,” only to terminate or re-list, then Queen‘s “Another One Bites The Dust” would be a told-ya-so way of cynically looking at the agent’s failed strategy.

For those of us agents who are spending more (too much?) time with our families, and for those would-be sellers who are frustrated by the market slowing down, I can think of no better song than the Ramones‘ “I Wanna Be Sedated.”

In a completely unrelated story, the LCBO was declared an “essential service,” just so you know…

I have no shortage of song titles to apply to the Toronto real estate market at the moment, both those specific to individual segments or market participants, and those applicable to the market in general. But having spent my glorious 18-minute, 3-KM run on Wednesday night thinking about this, the song most appropriate is a classic from Christopher George Latore Wallace:

Correct.

Chris Wallace is “The Notorious B.I.G,” and I can’t think of a better way to explain what’s happened in the Toronto real estate market than things done changed.

Indeed, things have changed significantly in our market, and that’s across the board.

The way we list properties has changed.

The way we show properties has changed.

The way we offer on properties has changed.

The way we submit offers on, and sell properties, has changed.

Closings have changed.

Mortgages have changed.

Everything has changed, as things done changed, and today, I’d like to explain how.

Let’s start with showings, shall we?

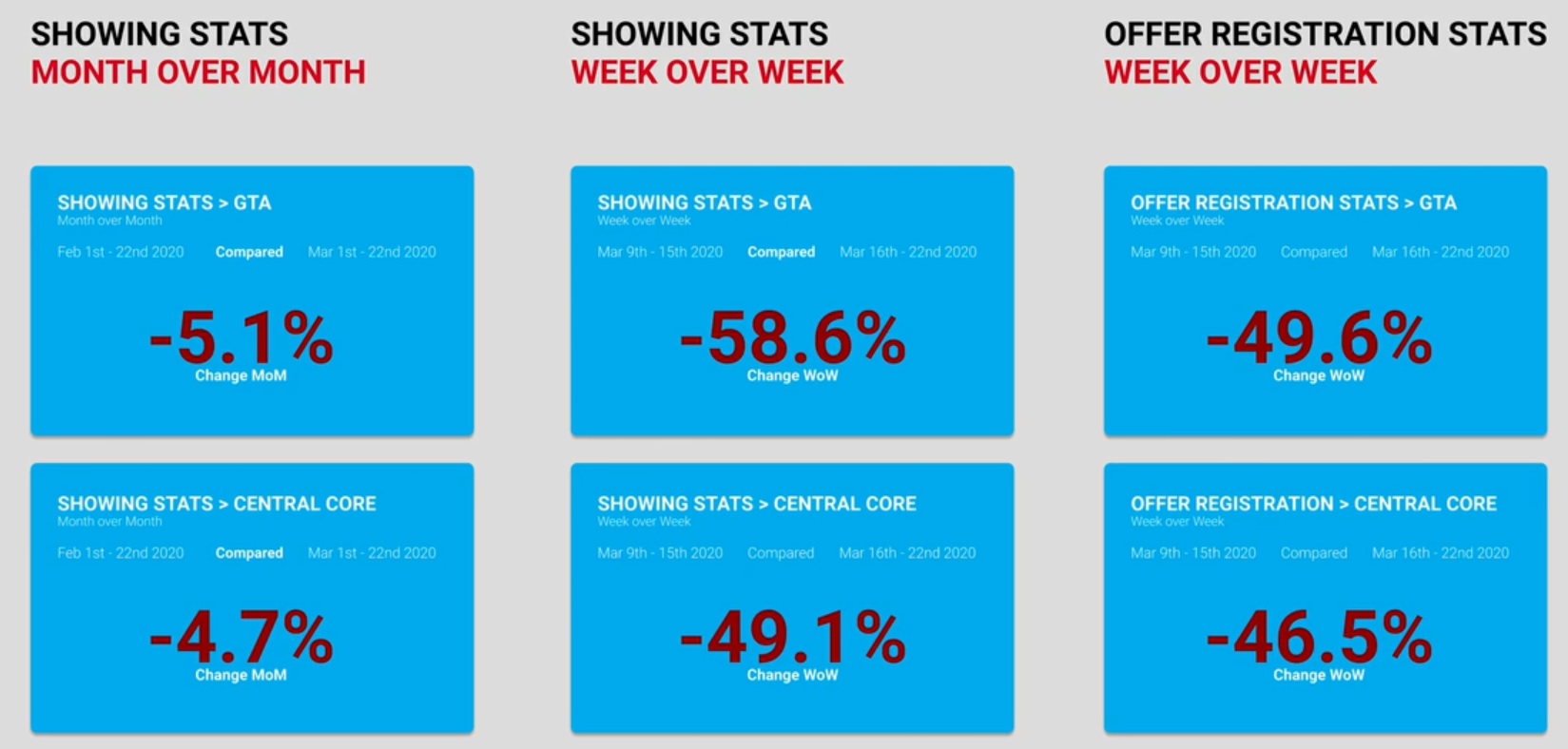

Courtesy of our friends at Broker Bay, who have essentially taken over Toronto real estate as the most-used real estate brokerage software, I’ve got the following infographic to compare thew eek of March 9th to 15th, and the week of March 16th to 22nd:

The month-over-month showing stats don’t really tell the story of what’s happening now, but it’s worth noting that in any month of March in the last decade, showings over February would be significantly higher.

Week-over-week, you can see that showings have been cut in half.

That’s a big number, no doubt about it. If we went from, say, 25,000 showings to 12,500 showings, there’s no underscoring just how huge an impact that is.

However, there’s a HUGE difference between the week of March 16th to 22nd, and this week we currently find ourselves in. And if we were to compare this week – March 23rd to 30th, to that first week in the stats above of March 9th to 15th, I think we’d see that showings have dropped off somewhere in the area of 80-90%.

That brings me to my next point about the new real estate landscape, which is that many brokerages have stopped allowing in-person showings altogether. I won’t name names, because policies are changing daily, but there are several high-profile brokerages in Central Toronto that have enacted policies that there are to be no visits to the property by anybody other than the listing agent.

As a result, we’re seeing virtual tours and Zoom Media walkthroughs by agents take over as the go-to way to show, in many cases.

Then again, we’re still seeing listings come out with no restrictions on showings whatsoever.

My cynical side, which is almost always correct in these cases, would simply point to the brokerage model as the differentiator. The crappy brokerages, and crappy agents, aren’t even putting up a “COVID-19 Showing Procedure” on the listings. They make zero mention of the virus, whatsoever.

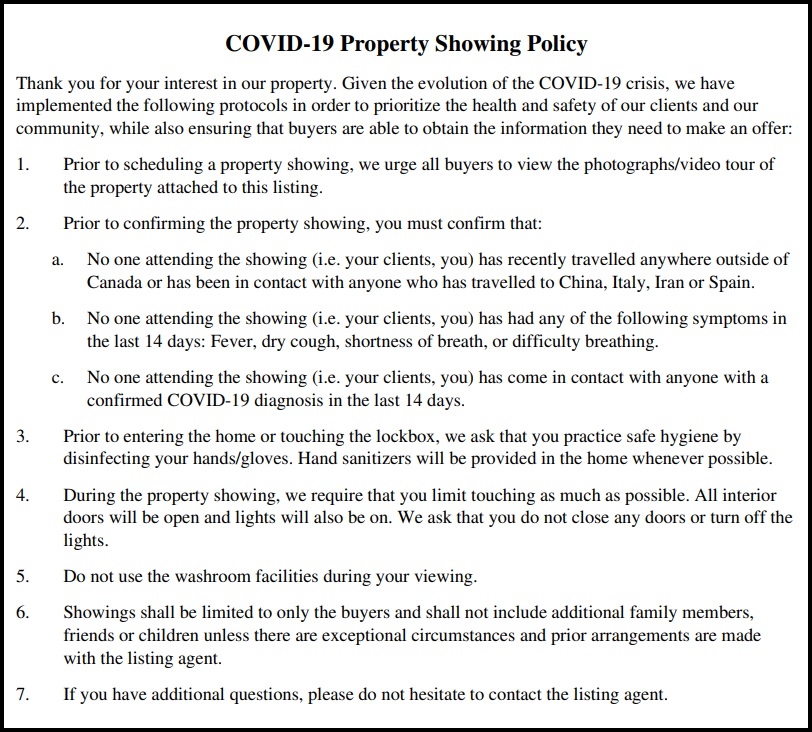

Other brokerages that are allowing showings are putting things like this up as an attachment:

The bottom line regarding showings and listings is this:

Some brokerages are allowing no showings whatsoever.

Some brokerages are allowing showings with serious precautions.

Some brokerages are allowing showings with zero precautions.

Now let’s move on to pricing and strategy, shall we?

This goes hand-in-hand with the showing procedures, of course. Or at least, it should. But as you’ll see below, some agents have no idea that there’s a pandemic going on.

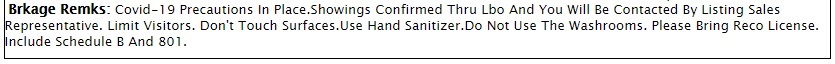

Here’s an example of a listing with showing precautions in place:

Those remarks show that: a) the property is available to show, b) there are precautions in place.

Then we’re seeing listings like this one:

Those remarks show that there are no showings unless there is a conditional offer to purchase.

However, can we assume that perhaps “conditional offer” meant “conditional agreement?”

There’s a huge difference between the two!

Are we saying that the interested buyer must simply draft an offer on a piece of paper and submit it, in order to gain access?

Or are we saying that this offer must be accepted by the seller, ie. the two parties agree on a sale price, deposit amount, closing date, et al, before a viewing?

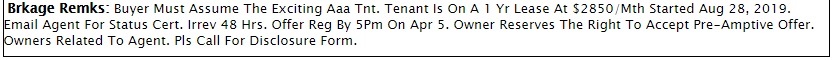

Here’s an example of a total moron:

This person isn’t a moron just because “Pre-Amtptive” is used instead of “Pre-Emptive,” but rather because they’ve described the tenant as……….

…..wait for it…..

…..exciting.

I can only assume they meant “existing,” which is a very different word, both in terms of meaning and spelling, from “exciting.”

So this agent is conducting showings on a tenanted property, during a pandemic?

I read a question in the comments on Wednesday’s blog about whether or not the tenant can say “no” to showings, and I’d say, you’re goddam right you can! If you’re a tenant right now, and the property in which you reside is for sale, under no circumstances should you allow showings. Not a chance. Tell your landlord and his or her agent to eff-off. They have no right to force strangers into your home during this time.

I will also add to the remarks above that they have an offer date set for April 5th, meaning they’re holding back offers for two weeks, and they want 48 hours on the offers. That’s rich.

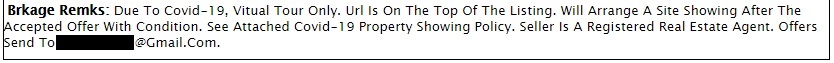

Here’s another example of how showings can be conducted with a conditional offer, except in this case, the offer need be accepted:

That’s different from the second example from the top, right?

One shows “conditional offer” and the other shows “conditionally accepted offer.

Be very careful with this, and triple-check as to which the listing agent expects.

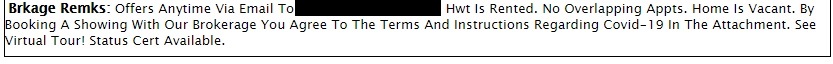

Here’s one where they’ve basically specified, “You agree to the terms…”

We’re starting to see this more for legal purposes, which is borne of fear that a buyer could sue us for allowing them to contract the virus.

Any lawyer will tell you that it would be impossible to prove that a person who felt sick in early-April could trace the acquisition of COVID-19 back to a specific 15-minute period spent in a property anywhere from one to ten days earlier. But some brokerages aren’t taking any chances.

Here’s an example of remarks that would seem to be for a listing in January, ie. pre-COVID:

No mention of COVID-19.

No mention of restrictions on showings.

No difference in pricing strategy.

No difference in offer strategy.

I will almost guarantee this listing is terminated.

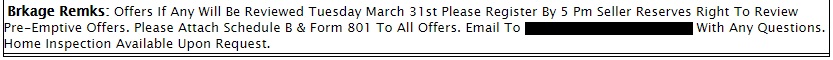

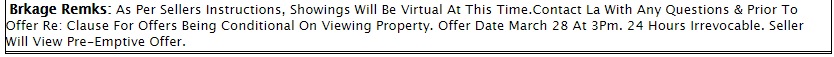

And last but not least, we have brokerage remarks that make zero sense, and show that the agent has twisted him or herself in knots trying to figure out what to do:

So showings are virtual.

There’s an offer date.

Offers should be conditional on viewing the property.

They want 24 hours on offers.

They’ll entertain pre-emptives.

WTF is this?

Is there any clear strategy here?

Would they accept a conditional pre-emptive? If so, then why have an offer date when offers aren’t going to be firm?

Is the property under-priced for competition?

Can we expect competition right now?

This listing is the best example of how many agents are completely unprepared to transact in this market right now, and that’s a larger problem than many would believe.

So what are my team and I doing right now?

We’re not listing.

We’re not listing for many reasons, but mainly because we feel there’s a social responsibility to help this virus pass, and because we don’t feel the market conditions are right to work in the best interests of our sellers.

We had upwards of fifteen listings scheduled for March and April, and only one found its way onto the market.

Unless a seller needs to sell right now, there’s no reason why a listing should be coming onto the market.

And for eff’s sake, there’s zero reason why agents should be under-pricing and holding back offers, with or without in-person or virtual showings.

I’m amazed at just how stupid, ignorant, greedy, and selfish some agents can be. And at the same time, I’m not.

Just as some opportunists decided to buy toilet paper in bulk and resell it from the roof of their cars in strip-mall parking lots, there are going to be agents out there that are just looking to make a buck.

Sidenote: when this is all over, I’m expecting, and hoping, that 5,000 or more bottom-feeding agents will have moved on from this industry. The longer this lasts, the deeper and harder the much-needed enema to the bottom of this real estate industry will be.

Tell me I’m wrong, but isn’t this a little tone-deaf?

That email was sent to me by an agent who works in that brokerage, who called out his or her own brokerage’s actions.

Some brokerages, much to their own financial detriment, are encouraging their agents not to list properties for sale at this time. And yet some brokerages are making it a contest.

When this is all over, many brokerages will be out of business. Many agents too.

While I’m encouraging my sellers not to list right now, I do still have active buyer clients. If a buyer client of mine sees his or her dream home on the market, and the intention behind the purchase is to remain there for a decade and raise a family, then why wouldn’t we consider buying?

Is it a seller’s market right now? No.

Is it a buyer’s market right now? Probably not.

But a balanced market, even if for only a month, is a dream for a lot of people.

I’ve seen listings come out that are perfect for my clients, and while I’m not conducting viewings myself (we have a designated showing agent on our team), I wouldn’t hesitate to have my buyers don masks and gloves and see what they can make of it.

If this sounds hypocritical – that I’m not listing, but I am encouraging buyers to look, it’s not.

I’m not encouraging sellers to sell because they can do so in April, May, or June, when this is over, and order is restored – as well as interest-levels, and prices.

I’m encouraging my buyers to look, in a few cases, if they find a dream property, but only with precautions.

And do I think that some properties out there may be available for less than February’s price? Damn right!

The last point I want to touch on is the AirBnB market.

I have never shown a condo at ICE.

I will never sell a condo at ICE.

From the minute these buildings were registered, I identified these condos as epic piles of crap which I would never, ever, advise my clients to consider. Whether it’s the proportion of renters, the construction, or logistical issues liek the fact that the parking garage is owned by a company separate from the condo, meaning that the concierge can’t address any issue down below, I would never sell in here.

So to hear that all these former AirBnB units are coming onto the market in these towers, and that prices could drop, I say this: I don’t care.

I don’t care what it costs, I’m not buying. In theory, sure, I guess. If my client could get a property for 20% less than it cost in February? I guess. In theory.

But in practice, I have no interest in these buildings, and no interest in the sales or lack thereof inside.

–

One last thing before we break for this week.

I asked on Wednesday if you had any specific questions you wanted me to answer, and you responded.

Many of the questions were general in nature, so the above is answering those questions in a broader sense.

But I figured for Monday, I would address individual and specific questions from the readers in a video.

I’ll post a “Questions” thread in the comments section below, and you guys can ask as many questions as you like, on whatever subjects you like. Try to be specific as you can, otherwise you know I’ll just head off on some tangent about G.I. Joe action figures…

Over the weekend, I’ll set up the camera and answer each and every question in a video that I’ll post for Monday.

I think this is the best way for us to interact and essentially have a two-way dialogue in a time where clarity is of the utmost importance.

We’ll use this one thread for questions, but the regulars can feel free to continue playing cat-and-mouse in the comments section below. I would never want to take away from what, believe it or not, some people find to be the best part about TRB posts. Yep, thanks guys, you’ve stolen my thunder…

Enjoy the weekend!

David Fleming

at 11:33 pm

Questions Thread:

Please feel free to post questions below in this specific thread, and I’ll answer them in a video for Monday’s blog.

David.

Condodweller

at 1:31 am

I guess you caught readers off guard by posting early so I’ll go first.

My question is if you maintain an ongoing relationship with investors whose units you listed for lease, what are you advising them on how to handle tenants who are not going to pay rent? What recourse might they have if the tenant doesn’t pay and he/she just moves out at the end of the eviction moratorium?

Ed

at 8:14 am

Which G.I. Joe action figure would be most suited to destroy the Corona virus and why?

Jenn

at 10:55 am

I love this idea!

My question is this: if you’re one of these buyers who makes an offer conditional on seeing the property, do you have to submit a deposit cheque? And I’d you don’t like what you see when you visit the property how hard is it to get out of the agreement?

Thanks David!

Libertarian

at 12:20 pm

What is your advice to someone who has been trying to sell the last few weeks but did not get any offers? I know that your advice is to re-list in a couple of months, but what if that option is off the table because they have already purchased their new home and now have a deadline to sell.

Do you take 10% off the amount they would have accepted a month ago?

It’s sad to me that they weren’t able to sell a few weeks ago when things were still crazy, so I’m guessing that they received bad advice from their agent at the time. But now the crucial thing to do is maximize selling price. How?

Francesca

at 12:33 pm

Adding to this question, do you foresee people backing out of closing if they can’t sell their house if they bought already? Or if they can’t get the price they want when selling their house? I’m wondering if we will see more situations like in 2017 after the foreign buyer tax was implemented and buyers were backing out of deals and then sellers were suing buyers. Is this period going to be deja vu of the early 2017 buying frenzy and then the drop in sales and prices?

Daniel

at 1:07 pm

David, do you get a sense that it’s a buyer’s market right now? Are sellers willing to accept market realities?

Chris

at 1:46 pm

I don’t want to put words in David’s mouth, but he does touch on this in his blog post:

“Is it a seller’s market right now? No.

Is it a buyer’s market right now? Probably not.”

Sounds like, in his estimation, it’s a balanced market right now. But David, please correct me if I’m wrong.

Hoob

at 2:14 pm

My RE lawyer discussed with me recently that as an owner of a semi-detached, that is a PART LOT designation with the other half of the semi:

If I buy the other half of the house in my own name, in Toronto, the two PART LOTs apparently automatically merge into a single property and I would have to go through a full severing process to split them again to resell. So if I were to buy the other half, it would have to be at arms length (incorporated LLC, etc.)

Any thoughts on this? It came out of discussion of a clause in a mortgage refinance that precluded me from owning any adjacent properties due to the PART LOT designation of the mortgage property.

daniel b

at 2:51 pm

it is correct that the pin’s merge on adjacent properties. To avoid this you take 0.1% of the ownership of one unit and have it held by a shell co that you own 100%. not sure how this impacts a res mortgage, and it requires maintaining the holdco – ie filing taxes, etc.

Dana

at 2:25 pm

Why do agents get away with saying a property is in a specific ‘desirable’ school district when a quick search of the TDSB website can prove it’s not the case? For that matter, how many buyers truly consider the school ranking or reputation when they’re looking at specific properties?

navyliz

at 8:17 pm

Do you think condo fees will be reduced due to lack of access to amenities like gyms and common rooms or are condos spending this money on cleaning and hand sanitizer. My condo seems to be well ahead in this regard.

Wilson

at 7:06 am

What’s your view on closings for properties that have already sold? How have these been happening? Can the seller refuse to allow an in-person walkthrough? Have you been seen any virtual walkthroughs? How do buyers protect themselves?

Jimbo

at 9:47 am

What is the average house payment for your SFH buyers over the last 3 years Vs the monthly payment for a condo over the last year? I’m assuming you know the DP % of the purchase price. If you don’t know the average financing rate I think 3.15% would be a fair number.

How would this compare to a monthly for a SFH house purchased in 1989 for $300k at 12-18% interest. How did your father’s numbers stack up to this historical when you moved to the bigger house in Leaside, Vs someone moving there now?

When you take the historical numbers and put them into the Canadian inflation calculator and compare this new number to today’s payments, does this give you any insight into how the Toronto buyer has changed since the 80s Vs now or are you surprised by this result?

Leggate

at 12:24 pm

My wife and I are going through a divorce.

We share an investment condo and she is trying to get me to sign a listing agreement for May 1st.

Before COVID i would have been fine with that, excited even, the condo market was doing great.

I feel very uncomfortable commiting to a sale date that is 6 weeks away when things are changing every day, every hour.

She is threatening that she will just get her own agent to sell her half and I will have to get my own because she wants to go to market on May 1st. Is such an arrangement even possible and what does it entail?

Thanks

Derek

at 12:11 am

Great tie-up post, Host!

But, good grief, what a traumatic thought that there are people actually enjoying the comments section ????

Chris

at 9:15 am

What, you don’t find our incessant bickering entertaining?

Derek

at 11:00 am

Well, obviously i do; Though I was the only one!

Chris

at 9:17 am

“Samantha Brookes, chief executive officer of Mortgages of Canada, told BNN Bloomberg that she’s getting more calls from clients wondering what their best options are based on the industries that they work in. Some options may include a deferral, getting an extra line of credit or just refinancing to “keep the roof over their head.”

“I’ve had four clients in one day ask me ‘Am I going to lose my home?’” she said.

As many homeowners evaluate their payment options, some buyers are just flat-out walking away from deals because their situation has suddenly changed.

But the mortgage market is also showing signs of a significant divide happening – those looking to refinance or defer payments and those viewing the economic downturn as a real estate buying opportunity with home prices likely declining in the coming months.

However, Butler thinks some people should hold off looking to buy a house in the near term as prices could continue to move lower.

“If it’s going to be a situation where if you’re closing on a property today, you’re probably going to be able to buy it for 10 per cent less down the line,” he said. “There are a lot of headwinds here. Oil’s not going to spring back to life, employers have done massive layoffs. This chronic unemployment is going to remain for months. The one thing that hurts real estate more than anything else is unemployment.”

Butler added that it’s unlikely for financial conditions to return to normal once COVID-19 is resolved and people can return back to work.

“The depth of this is unsettling to anyone who’s not a public sector or large corporation employee,” he said.”

https://www.bnnbloomberg.ca/mortgage-market-sees-flurry-of-activity-amid-low-rates-virus-uncertainty-1.1412984

Appraiser

at 9:46 am

Translation:

Loud-mouth perma-bear mortgage broker Ron Butler predicts housing disaster for umpteeth time.

Incidently what evidence does grampa grumpy provide for the statement ” Butler thinks some people should hold off looking to buy a house in the near term as prices could continue to move lower.”

I don’t see any data in his diatribe – do you?

Chris

at 10:13 am

Butler provides his evidence in the very next paragraph quoted. The one where he talks about unemployment, oil prices, etc. It is, of course, a prediction of home prices based on current macroeconomic realities. Akin to your prediction that Toronto would plow right through any downturn or recession with ease.

As for the label grandpa grumpy, with your career experience, seems you’d be close to Butler’s age, no? And you aren’t exactly a cheerful character yourself. Those who live in glass houses…

Appraiser

at 10:20 am

Just another prediction. Yawn,

The latest data available is that prices were 15% ahead of last year.

A 10% drop would be house-bargain heaven?

Chris

at 10:32 am

Yes, were you unaware that Butler was giving his prediction, similar to the ones you gave earlier?

I thought it was pretty obvious that he, like others, was providing an educated guess.

Just as David does in this blog post when he says “Plus, I think the market will be back well in advance of summer!” How come no yawns elicited when a prediction fits your narrative?

Appraiser

at 10:43 am

Data: Facts and statistics collected together for reference or analysis.

Chris

at 10:53 am

Thanks for looking that up in your dictionary, appraiser! Next can you retrieve the definition of “trite”?

Derek

at 5:41 pm

Goin down like a lead zeppelin !!!

Chris

at 9:21 am

“After Years of Hoarding Housing Supply, Toronto Airbnb Hosts Are Panicking

Until two weeks ago, Airbnb was a gentrification juggernaut, devouring homes and watching profits snowball. A McGill study published last year found that Airbnb likely removed 31,000 homes from the Canadian rental market and that hosts here made $1.8 billion in 2018—a 40 percent jump from the previous year. Many of those same hosts can’t fill a single unit now; the coronavirus flushed them out.

A trip through Facebook groups for Airbnb hosts, such as Airbnb Cashflow Secrets—Financial Freedom Without Owning Real Estate, reveals mounting insecurity among members since the coronavirus pandemic started. What must have once come off as a low-risk, low-labour money-maker just melted away, leaving many hosts saddled with rents and mortgages they can no longer afford. Hosts are getting no short-term bookings and no long-term inquiries, they tell me. And they’re angry—at Airbnb.

“This is my main source of income,” said a Waterfront-area host named Jay, who would not give his last name. “I rely on it quite a bit. But all my reservations were cancelled with full refunds without any say from me.”

Jay said he’s since had to reduce his rates to “lower than motel prices” to stay competitive. He’s also started requiring at least a 10-night commitment from guests and is billing his unit as “perfect for self-quarantine.””

https://www.vice.com/amp/en_ca/article/5dma7q/after-years-of-hoarding-housing-supply-toronto-airbnb-hosts-are-panicking

Bal

at 10:01 am

Bank of Canada cut interest rates to..25….so it might be a good sign for the housing but very bad for savings….maybe I should invest more in stocks

Appraiser

at 10:07 am

You beat me to it Bal.

https://www.bankofcanada.ca/2020/03/press-release-2020-03-27/

Chris

at 10:17 am

“The Bank of Canada slashed interest rates for a third time in a matter of weeks, and announced what appears to be a large scale asset purchase program to help shield the nation’s economy from coronavirus fallout.

The move was necessitated by quickly deteriorating conditions, including a flood of new jobless claims last week, that suggest the economy is poised to produce one of the sharpest drops in economic activity in history. The energy-heavy Canadian economy is also having to contend with the crash in oil prices.

The Bank of Canada last cut rates to these levels in 2009, during the global financial crisis. A move toward large scale asset purchases would also be its first foray ever into so-called quantitative easing.”

https://www.bnnbloomberg.ca/bank-of-canada-cuts-key-rate-to-0-25-as-virus-oil-fallout-deepens-1.1413338

Maybe this time the lower rates will be passed on to borrowers? Either way, this seems less likely to be bullish for real estate, and more like an economy on life-support.

Bal

at 10:22 am

Chris- I think one of the reasons for these rate cuts due to oil….

Chris

at 10:26 am

Bal, that’s definitely a factor. Oil is a significant part of our economy. But the number of closed businesses and unemployed Canadians is also certainly a huge reason for this rate cut.

Derek

at 5:43 pm

Boo hoo

Appraiser

at 6:31 pm

@ Derek Why so blue. Interest rates. Equity markets. Both?

Derek

at 6:34 pm

That wasn’t me. An impostor!

Derek

at 6:37 pm

nor was the Zeppelin post…..

Well this could get awkward….

Chris

at 6:40 pm

Well now I don’t know who to believe; Derek, or Derek?

Chris

at 6:37 pm

I believe Derek’s was a sarcastic boo hoo in response to the panicking AirBnB hosts. After all, his comment was in reply to the article. And the sentiment seems to be quite ubiquitous.

Derek

at 6:41 pm

Chris, yes, there is not much sympathy at all for the airBnB hosts out there.

Chris

at 6:56 pm

That seems to be the general consensus. As David mentioned in his post, seems likely we’ll see many of them hit the market either for sale or lease. Already look to be quite a few fully furnished rentals popping up in condo buildings well known for being AirBnB hot spots.

Appraiser

at 12:43 pm

“OTTAWA — Prime Minister Justin Trudeau has announced a major increase to the wage subsidy for small- and medium-sized businesses, boosting it to 75 per cent, up from the 10 per cent previously promised.

This decision, to help “qualifying businesses” keep employees on staff, is being back-dated to March 15, with more information coming over the weekend.”

https://www.ctvnews.ca/health/coronavirus/pm-hikes-wage-subsidy-so-smaller-businesses-come-back-strong-1.4870893

Bal

at 12:48 pm

I don;t know despite of all the efforts…I think North America will hit with the recession….It is sad to see so many people are losing their lives…..Pray to God…keep everyone healthy and Safe.

Chris

at 1:50 pm

Good to see, this will help slow the increase in jobless Canadians. As Bal said, unlikely we avoid recession, but for those small businesses that are still operating, a 75% wage subsidy could be a huge help as revenues are likely to tumble.

Federal deficit this year sure isn’t going to be pretty though.

Jennifer

at 1:00 pm

“Sidenote: when this is all over, I’m expecting, and hoping, that 5,000 or more bottom-feeding agents will have moved on from this industry. The longer this lasts, the deeper and harder the much-needed enema to the bottom of this real estate industry will be.”

LOL. the positives of all this….

Appraiser

at 6:43 pm

RBC Cuts Prime: The nation’s largest mortgage lender is leading the way again with a 50-bps drop in its prime lending rate. The change takes effect March 30, 2020. The rest of the Big 6 banks should fall into line today or early next week. This is the third cut in prime rate in one month, which is virtually unprecedented. If the other banks match as expected, it’ll take Canada’s benchmark prime rate down to 2.45%, a level we haven’t seen since 2010.

https://www.ratespy.com/coronavirus-mortgage-update-march-27-032712808

Chris

at 6:50 pm

Scroll down on RateSpy’s page:

“3:15 p.m. Update

Sign of the Times: BMO Bank of Montreal boosted some of its advertised specials by up to 40 bps today:

3yr Fixed: 2.69% to 3.09%

5yr Smart Fixed: 2.94% to 3.34%

5yr Smart Fixed (high-ratio): 2.69% to 2.99%

Few Discounts Left: Variable-rate mortgage discounts are still doing the disappearing act. Online rate leader motusbank just hiked its 5-year variable rate from 2.59% to 2.85%. That leaves Canada Life with the lowest nationally available conventional variable rate, at prime – 0.25%.

No Exception: With the economy in a tailspin, we’re seeing more lenders limit underwriting exceptions. In such cases, borrowers who don’t meet a lender’s standard guidelines are simply being declined as lenders triage huge backlogs of applications.”

Chris

at 7:08 pm

Hey and Scotia just dropped prime too! Although, Rob did have this to say:

“Prime+ Variables: This drop in prime will squeeze bank profit margins further for all sorts of reasons: (A) deposit rates can’t fall by a similar amount and deposits are a vital source of floating-rate funding, (B) big-bank deposit bases are shrinking, (C) banks are being forced to put aside more money for loan losses, and (D) investors fearing credit risk are making banks pay much more than normal for their funding, despite government efforts to restore mortgage liquidity. For these reasons and others, there’s a good chance banks will keep trimming variable-rate discounts to compensate for today’s 50-bps rate drop. Some lenders will now charge prime rate plus a premium (e.g., prime + 0.25%). Fortunately, existing floating-rate mortgagors are immune from that madness and will enjoy the full benefit of today’s 50-bps reduction.”

Appraiser

at 9:53 am

“Wuhan, China, where COVID-19 outbreak was first reported, begins lifting 2-month lockdown” https://www.cbc.ca/news/canada/coronavirus-covid19-canada-world-march28-1.5513542

Chris

at 10:05 am

“According to Chinese government figures, 2,535 people in Wuhan have died of the virus. The announcement that a lockdown in place since January would be lifted came after China said its tally of new cases had hit zero and stepped up diplomatic outreach to other countries hard hit by the virus, sending some of them medical supplies.

But some in China have been skeptical of the accuracy of the official tally, particularly given Wuhan’s overwhelmed medical system, authorities’ attempts to cover up the outbreak in its initial stages, and multiple revisions to the way official cases are counted. Residents on social media have demanded disciplinary action against top Wuhan officials.”

https://time.com/5811222/wuhan-coronavirus-death-toll/

Many have been skeptical for years of China’s GDP figures. Doesn’t seem like a stretch to imagine the CPC may be less than 100% transparent in this case as well.

Appraiser

at 10:51 am

Yesterday President Trump held another press conference. Here’s some of what he had to say.

If Your Doctor Spoke Like Trump: Courtesy of Sam Harris. https://twitter.com/SamHarrisOrg/status/1242941582636019714

“So it seems you’ve tested positive for the Chinese virus, the so-called Covid NINETEEN, the Corona—nobody knows what to call it, quite frankly. It’s the most amazing thing, no one knew anything about Corona until a few weeks ago. 1/n

But the moment I heard about it—the Wuhan flu; it’s also the Wuhan, or WuHAAN—that’s a city in China. Many people don’t know that. But the moment I heard about this Chinese flu, I ordered a test. 2/n

And it’s an amazing test. We do better testing than anywhere in the world. Some say the Germans have the best tests, but they don’t. Our tests are even better. 3/n

So you’re positive for Corona. And usually “positive” is a positive word—it’s a very good word, frankly. Everybody thinks it’s good, apart from what you hear on the news—which is fake. It’s largely fake. But in medicine, “positive” is not so good. 4/n

So it’s very confusing. And I’ve always been very clear about that. Some say “positive” is always good, but I’ve never agreed with that. 5/n

So you’re positive for the Corona. But you’ll be fine. Totally fine. You might think you’re going to die—and everybody does die, eventually. But you’ll be fine. You feel fine, right? You won’t need a ventilator. There are no ventilators—but you won’t need one. 6/n

How old are you, 55? You won’t need one. Some people need a ventilator, and they’re amazing machines. Did you know the first ventilator was made by Henry Ford? It’s an incredible piece of equipment. But you’ll be fine. 7/n

The virus gets into your lungs, which is where you breathe. But you have two of them. Some say you have a spare. Some people only have one lung. It’s true. But I don’t talk about spares. I always want both. Given a choice, I want two lungs. 8/n

So I’ve asked nurse—what’s your name, Nancy?—I’ve asked nurse Nancy to keep you comfortable. And Nancy is one of our finest nurses. I mean, just look at her. Incredible, right? 9/n

Nancy, you’re really incredible. You’re not afraid of Corona, are you, the Chinese Plague? I didn’t think so. Nancy will bring you whatever you need. And if you start coughing, do that into your elbow, so you don’t make a mess. Okay, you’re doing great. I’ll see you later.” 10/10

https://threadreaderapp.com/thread/1242941582636019714.html

Chris

at 11:14 am

For those of you who thought Covid-19 was overhyped, or not as bad as SARS:

“ The novel coronavirus disease, COVID-19, has now killed more Canadians than SARS.

As of Friday afternoon, federal and provincial health authorities were reporting more than 4,500 Canadian cases of COVID-19, with 53 deaths.

Back in 2003, the SARS outbreak, which also triggered cancellations and emergency declarations, killed 44 Canadians.

Only laboratory-confirmed cases of COVID-19 are included in the 4,500 case total. There are thousands of other cases awaiting test results – more than 10,000 in Ontario alone, suggesting that the scope of the problem is even wider than the reported case total.“

https://globalnews.ca/news/6742570/canada-coronavirus-deaths-sars/

Derek

at 11:30 am

Here’s an article:

https://business.financialpost.com/real-estate/mortgages/if-you-bought-a-house-before-the-coronavirus-crisis-hit-dont-expect-force-majeure-to-save-you

Chris

at 5:33 pm

“Something odd is going on with mortgage rates: they’re going up, even as the key rate goes down

A second surprise rate-cut this month from Canada’s central bank, has mortgage experts reluctant to predict what is in store for consumers, who are reeling from lost income in the COVID-19 pandemic.

The Bank of Canada’s decision to lower its key rate to 0.25 per cent was primarily aimed at easing the economic shocks of virus containment and plunging oil prices — but its effect on mortgage rates is downright confusing.

Paul Taylor, CEO of Mortgage Professionals of Canada, says there could be a slight reduction in mortgage rates but it may not occur immediately because the banks’ margins on mortgages are already thin and investors are demanding such rates of return, there isn’t enough money to go around.

“So consumers may not see an immediate pass-through of the rate reduction that occurred today,” said Taylor.

“If the market remains turbulent, they may not see any of it.””

https://www.thestar.com/amp/business/2020/03/28/as-the-central-bank-rate-plunges-some-consumers-are-paying-higher-interest-on-their-mortgages.html

Derek

at 6:04 pm

The big 5 cut prime today at least, for the variable mtgs and helocs.

http://www.bnnbloomberg.ca/canada-s-big-five-banks-cut-prime-rates-for-third-time-in-a-month-1.1413791

Appraiser

at 1:41 pm

Life Under Quarantine:

https://twitter.com/LinuxFeller/status/1244234784299274241/photo/1