It’s a new term, in fact, I just thought of it now.

But there are a ton of new developments in Toronto that consist mainly of one-bedroom units, and this points to one, clear, identifiable buyer pool: INVESTORS.

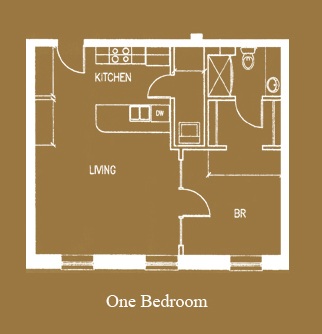

If you build a condo with 84% one bedroom units, the effect it will have on the building is obvious…

The strike at Canada Post hasn’t stopped my condominium’s ability to get us important notices!

I walked through my lobby last night and every single mailbox had a little tape-flag stuck to it, as the concierge and property manager were in charge of getting the “Meeting Notice” in our hands.

“Community Consultation Notice,” said the piece of paper that was handed to my by our night-staffer.

As many of you are aware, the old Greyhound terminal on Front Street is slated for development, and the process is moving along much quicker than anybody anticipated.

Personally, I don’t really care about the development. I live on the second floor of my building with a large terrace that is completely blocked out by the commercial/retail buildings on King Street. I won’t be affected by a 34-storey tower on Front Street.

But when I went to look at a great unit next door at Mozo last month, I couldn’t help but feel sad for the owner (or future owner) since the gorgeous south-facing view of the lake will soon be obstructed by “Greyhound Condos,” or whatever it’s going to be called.

Add “King Plus Condos” to the mix, and our area is booming!

But whereas King Plus Condos offered a unique mix of bachelor, 1-bedroom, 1-plus-den, 2-bedroom, and 2-plus-den units, the development at 154 Front Street east is highly unimaginative.

Here is a copy of the notice I received:

(click thumbnail)

So what we have here is fairly typical of new developments – a “podium” of 5-7 storeys with a couple of giant towers over top. Seems to be all the rage these days…

But the most interesting part, and of course, the entire point of this blog post, is the following:

“The proposed unit breakdown consists of 4 bachelor units (<1%), 449 one-bedroom units (84%), and 84 two-bedroom units (>15%).”

My cynical side is asking – “Why the need for four bachelor units? Is that just to say that they have bachelors? Or does the developer have four mistresses that he plans to put up in crappy little condos?”

A whopping 84% of this building will be comprised of one-bedroom units, and that leads me to believe that this development is designed around investors. More specifically, the developer knows that the best way to sell out a large condominium development is to appeal to speculators.

I’ve long maintained that when it comes to flipping pre-construction properties, the best return comes on the smallest units. I mean, this was back when you could actually make money on pre-construction, but I think I argued that to death in last week’s issue of The Grid…

If you want to keep your pre-construction condominium in the long term and you’re looking for rental yield, then a small 2-bedroom unit will provide the best ROI.

If this is your first investment, that’s when you buy a 1-bedroom-plus-den. The returns are lower here since you don’t get the higher rent per square foot that you’d get if you had a second bedroom and thus a second tenant, and the extra money over that of a simple 1-bedroom is minimal.

Asia and the Middle East have spoken loud and clear – they love investing in Toronto real estate, and they love buying pre-construction condos! But they also love 1-bedroom units, and this is not going unnoticed by developers.

Check out the breakdown of the infamous and doomed One Bloor at the barren, desolate, depressing corner of Yonge & Bloor:

358 one-bedroom units

254 two-bedroom units

132 hotel suites

This is according to www.urbandb.com, FYI.

This is a project that was geared towards speculators and investors (as evidenced by the lineup of people around the block for days and days…), and 59% of the residential units are 1-bedrooms.

There was a time when this was a lot!

But the development at 154 Front Street has shattered that paltry 59% with an 84% of their own!

What about other developments?

DNA3 was certainly geared towards the speculators and investors!

508 1-bedroom units

142 2-bedroom units

23 bachelor units

That’s 75% 1-bedroom units, or 79% bachelor/1-bedrooms, which both appeal to investors.

But I truly think that when you gear your development towards investors by way of constructing 70% 1-bedroom units, you’re basically defining the building before it’s ever created.

Using my dear friend CityPlace as an example, I feel the reason that CityPlace is, and always will be such a slum, is because of the sheer volume of 1-bedroom units that are owned by investors – many of whom have never set foot on Canadian soil.

Consider this: a condominium is only as good as the sum of its individual units, and rental suites are kept in the worst condition.

Why?

Well, you have two parties keeping the unit in terrible repair.

The Landlord is only interested in profits and doesn’t usually add anything of value to the unit. He’s just going to do the bare minimum; sometimes less.

The Tenant doesn’t have any ‘pride of ownership’ whatsoever, and thus has no incentive to keep up the property value. You’re lucky if a tenant will clean up his or her own vomit after one of the many raging keg parties at places like 4K Spadina…

So with BOTH landlord and tenant working hard to ruin the property, is it any surprise that buildings in CityPlace are eventually turned upside down?

This is why I feel that creating a building with 70% or more 1-bedroom units is going to end up labelling it as a “glorified dorm room.”

Maybe not Shangri-La or Trump Tower, but many of the mid-size, mid-price developments are going to be home to nothing but 26-year-old Torontonians who are renting their first condos.

On the other side of the coin, look at a mid-rise building like The Berczy down at Front & Church:

54 1-bedroom units

107 2-bedroom units

2 bachelor units

Here is a building that has more of an appeal to end-users and where you’ll end up with fewer renters.

A mere 33% of units at The Berczy are 1-bedrooms, and I personally know of three colleagues who purchased larger 2-bedroom units in the building with plans to move there in two years when the building is complete.

So what about something a little more glowing, like Cinema Tower:

101 bachelor units

210 1-bedroom units

105 2-bedroom units

14 3-bedroom units

Only 47% of this building is 1-bedroom units, although when you add in the bachelors – you’re almost at 70%.

But they have at least included 14 3-bedroom units that will serve as their glorious penthouses for the rich and famous, and thus they can drum up some fanfare in the media and try and market the building as something of a “luxury.”

For $800/sqft, I should hope you’re getting luxury, but once again, I digress…

Cinema Tower will have its fair share of renters as well, but at these prices, you won’t be getting the Vans Warped Tour living on floors 7 to 15.

Many of the newer developments are playing off a theme, event, or existing brand (Thompson, Trump) in order to be labelled as something more than run-of-the-mill.

But I believe that with every mid-priced new development that houses 70% 1-bedroom units comes an excellent chance that the building will never anything special.

As for a building with 84% 1-bedroom units – I can’t wait to see how this one plays out!

LC

at 8:40 am

You can thank the realty companies hired by the developers to sell these projects for the explosion of 1 bedroom units….and there are more to come! It’s super easy for them to sell out 1 bedrooms to their long list of brokers with investors waiting for these cheaper units (compared to 2 bedroom). Sales people have no interest in waiting for 2 bedrooms to sell, when they can do practically nothing clearing out the 1beds and invoice for their juicy commission cheques pronto!

Darren

at 9:34 am

‘My cynical side is asking – “Why the need for four bachelor units? Is that just to say that they have bachelors? Or does the developer have four mistresses that he plans to put up in crappy little condos?”’

From what I’ve seen, they will all be on one of the lower floors. They are not making them intentionally, but are just using up extra bits of space on one of the non-typical floors that’s too small to turn into a one bedroom unit.

David

at 9:49 am

34 stories? I believe that’s quite a bit taller than most other condos in the area? I think that’ll be a sticking point for a lot of people…or the St Lawrence Neighbourhood Association.

What ever happened to Post House? Will they be breaking ground anytime soon?

David

at 9:50 am

@Darren – They’re probably guest suites?

JG

at 10:09 am

“Why the need for four bachelor units?”

Its so they can plaster huge signage outside their sales center stating –

‘starting from the low $200,000’s’

When you actually set foot in the sales center, you will realize a ‘decent’ 1bed is selling for $300,000.

Marketing is what I chalk it up to!

David Fleming

at 11:13 am

@ JG

Totally true!

PPD

at 11:18 am

I actually had another theory that I was going to post on the four bachelor units. Darren’s makes sense, but I’m going to go a little more cynical to match Dave’s view. Marketing. They can now put up a giant poster saying “UNITS FROM JUST $199,000!” even though that may be just 4 units. Or whatever the going rate of a bachelor may be. Without those units however the ‘From’ price will be much much higher.

Kyle

at 11:20 am

While i agree with the general thrust of the post. I would say a deeper analysis of each project needs to happen before writing off mostly 1-bdrm buildings as future slums. Most investors are formulaic in their approach, they just want to be able to buy a rentable unit for the lowest $/sq ft, in the best location they can afford. So if a building’s standard finishes are higher, the average size of the 1-bdrm units are larger or better laid out, then these will tend to attract end users instead of investors.

Darren

at 12:08 pm

David: My posting wasn’t clear. I made it sound like I’m talking about this specific project. I meant in general, that’s what I’ve noticed about bachelor suites.

JG also makes an excellent point.

George

at 8:31 am

Does that type of marketing even work? Do people walk into the salesroom and respond with, “Oh I thought these were going to be $200K, but they’re actually $300K. Whatever, I’ll buy one anyway.” If someone is only going to be enticed to care about a property because of a low entry price, then they aren’t likely to spend another $100K for something bigger.

Bamelin

at 11:33 pm

4k isn’t that bad … I live there. It’s certainly alot better than my old digs at 40 gerrard St.

You are right though on the demographics … I’m 35 and feel like one of the oldest residents! Also almost everyone here is renting.

Personally I think the condo market is going to crash and crash HARD.

Bamelin

at 11:37 pm

Oh and my landlord is not in Canada … Middle east I think.

Vil

at 11:58 am

How about 33 mill st? what are the stats on that? As a 26 year old BUYER, I would like to know because I’d like to think I have some pride of ownership. I do not want to move into a crappy frat-house.

BRL

at 4:43 pm

just moved into westside gallery lofts in the WQW area.. not sure the proportion of 1 to 2 bdrm suites but it’s a young crowd, but so far not that badly behsved.. no doubt mostly renters tho’.. perhaps the trick is to get into a good area, at least a half hour walk away from the dt core.? (and Ryerson, George Brown, U of T etc.. )

GST

at 2:38 pm

I bet these ones won’t have positive or even flat cash flow either… anyhow are there any positive cash flow condos left in downtown? What I don’t understand is the rental income from any condos I’ve searched so far is way below the combined mortgage payments, taxes and maintenance fees with a reasonable down payment, I’d say 10%. Are we missing something here? Are the prices too high or rents too low or maybe there shouldn’t be any link at all!? What do you think David?