I could already feel the critiques raining down upon me as I first came up with the idea for this blog post.

And it’s not just the perennial market-bears and cynics. The most ardent market bulls will probably do a “slow turn” on this one too.

Interest only mortgages. Am I making the suggestion that this is something to consider? Wasn’t I just telling people last week to be weary of “Dollars 4 Gold” and the like?

To be frank, I’m not suggesting that an interest-only mortgage is something that every buyer should consider. In fact, it probably only applies to 1-2% of buyers out there.

I am suggesting, however, that it does serve a need in the market place, and I might go as far as to suggest that to deny the existence of such a product, or disregard it outright without learning what it’s about, is otherwise ignorant in a market where knowledge is golden.

An interest-only mortgage, as the name suggests, allows a buyer to pay the interest portion of the mortgage each month and not the principal. In many cases, this would reduce the payment by up to half.

Currently, there is only one lender in the market place who provides such a mortgage: Merix Financial.

Interest-only mortgages had completely disappeared until recently, and personally, I’m surprised there wasn’t more of a demand for them.

Let’s say that you have a mortgage payment of $3,360 per month, and that’s comprised of $1,962 in interest, and $1,398 in principal. Are there any among you who feel as though you would benefit from only paying $1,962 per month?

Are there any hands raised?

Here is where most people retreat.

You obviously know that the benefit to a mortgage payment is the paydown of principal, or what I like to call “forced savings,” which we’ll discuss in a broader sense shortly. But for some people in the market, the paydown of principal is insignificant. What if that individual is only interested in the monthly cash outflow?

There is a buyer out there for whom this works.

There is most certainly a buyer out there that feels he or she would benefit from keeping that $1,398 in his or her pocket, to reinvest at a higher rate of return, or use to start a company, or build a better mousetrap, rather than simply paying down principal at 2.99%.

Self-employed individuals who are making money, but don’t show a lot on paper, would benefit the most from this product.

Investors looking to purchase cash-flow positive properties, and have the tenant make their interest payment, might also apply.

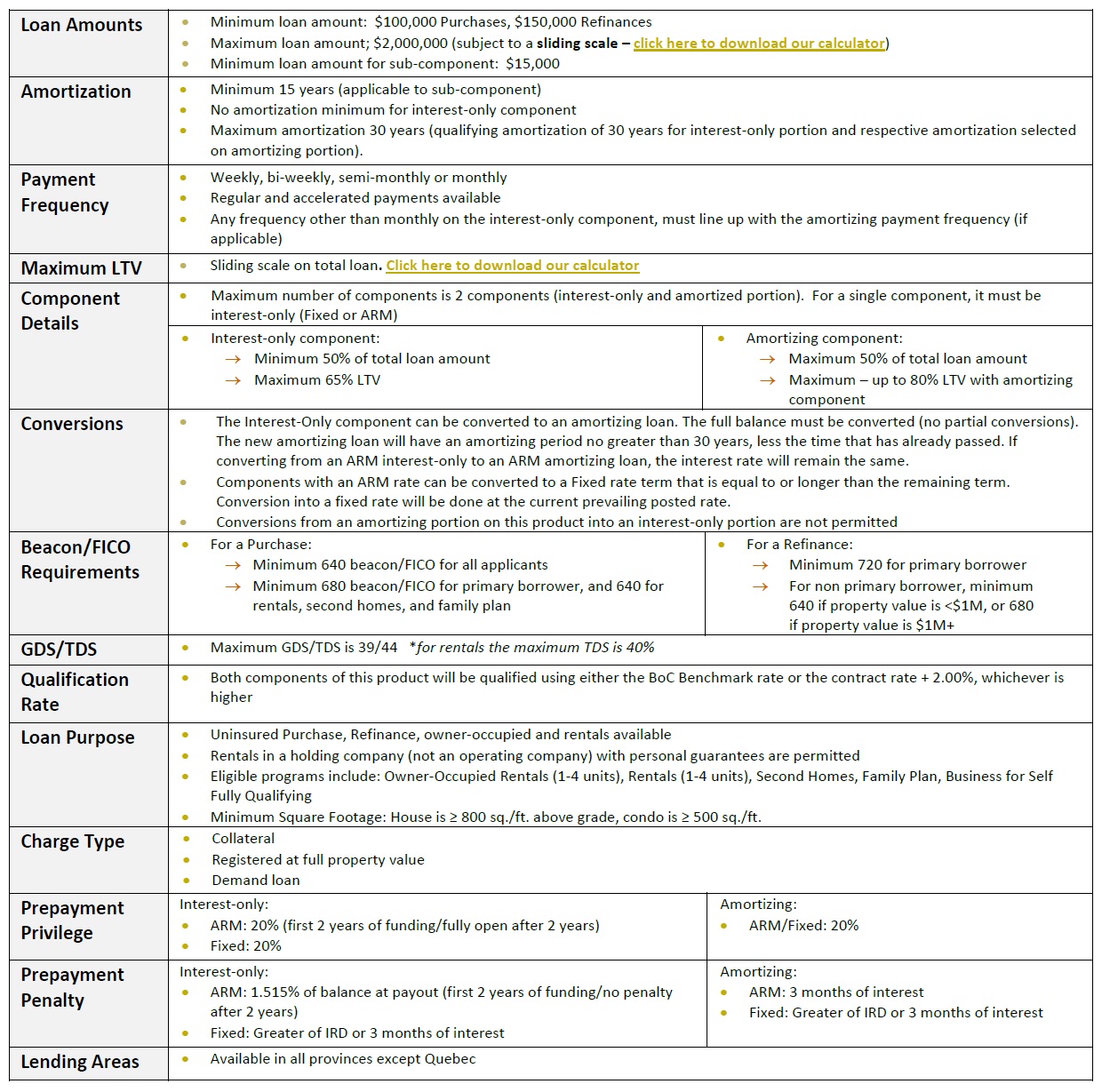

So what are the terms and conditions?

There are many, so I’ll show you just for those who are interested:

(click to enlarge)

Different terms and/or conditions might jump out to each of you, but without question, there’s one that jumps out at me first:

There’s a maximum 65% LTV.

With traditional mortgages, we know you can purchase under $500,000 with a 5% down payment. You can purchase up to $999,999 with a 7.5% down payment. And you can purchase over $1,000,000 with a 20% down payment.

With the interest-only mortgage, you have to come up with a 35% down payment.

And that is the biggest “catch,” if you will. For some borrowers, it completely defeats the purpose.

For those of you asking “why” the down payment is so high, just consider the lender’s risk.

If a typical borrower is making monthly payments and paying down principal, then there’s some “skin in the game,” so to speak, for that borrower. With the interest-only mortgage, the borrower has absolutely no skin in the game. He or she is limited to their down payment, which in some cases, can be as low as 5%.

So what happens if the market crashes?

The reason the lender wants a 35% down payment is so that the property can drop, in theory, up to 30%, without the lender losing any money. Assuming a 5% fee for sale, give or take, the lender’s downside is limited.

The second nugget that sticks out to me?

Maximum loan amount is $2,000,000.

Maybe this is insignificant to the first-time buyers reading this blog, but it shows you that the lender has limits. Would a bank say “no” to a qualified buyer who is purchasing a $6,000,000 house?

This tells me that, for one reason or another, they’re trying to limit their exposure. Perhaps they’d rather have four $500,000 loans than one $2,000,000 one.

Another point worth noting:

For rentals, maximum GDS ratio is 40%

The industry standard here is 42-43%. That might sound like splitting hairs, but once again, we can see how the lender is tightening up a little.

There are a lot of similarities between the Merix interest-only mortgage and that of traditional Big-Five bank mortgages, from the payment frequency, to the charge type, to the prepayment privileges and penalties, etc.

But on the whole, we know what this is – we’re not paying any principal down, and that’s what makes the product so incredibly unique.

I have read countless opinions on the “evils” of interest-only mortgages, and while I wouldn’t recommend this to an overwhelming majority of clients, I do believe there’s a place for it in the market, and I do believe in choice.

What bothers me the most about the criticism of this product is the idea of “forced savings.”

Forced savings is a good idea for many people, in many different walks of life.

For example, the Canadian Pension Plan.

Without going into my typical political diatribe, I will say that there are likely millions of people who have no plans for retirement, and/or refuse to save, potentially because they expect that the government will bail them out, as the government usually does. So forcing people to save for retirement makes sense, for the benefit of the individuals themselves, the government, and the tax-payers who would otherwise be left holding the bag.

But by the same token, I balked when Kathleen Wynne decided that we would have a provincial pension plan.

This, of course, was for two reasons.

One, I didn’t think I needed to save for retirement, and I thought it should be up to me, and not her.

Two, I didn’t trust this particular government to actually keep the money safe, and it would not surprise me one bit if they came up with a plan whereby they “invest” it in expenditures throughout the province, with plans to reimburse it later.

Sure, I probably sound like a Libertarian, but I don’t care. I just didn’t think that Kathleen Wynne was looking to help us in our old age, but rather I thought she wanted our money today.

Thankfully, those plans are shelved. And we can save critiques of the Ford government for a later day, because that’s a long post as well…

But back to my first reason, because personally, I don’t need the government’s “help” in forced savings. Many do, but I don’t, and I want that choice.

At the risk of coming off too strong here, I just believe that I know what’s better for me, my money, my personal finances, and my future, than the provincial government. If I want to keep my money for today, and invest it as I see fit, who is the government to say that I need to pay into a provincial pension plan?

I abhor the idea, to its core.

And for that very same reason, if a home-buyer wants to pay interest only on their mortgage, and not pay down any principal, then it should be up to that borrower.

Personal finance critics will absolutely pan this idea.

Market bears and Realtor-haters will suggest that once we start pitching interest-only mortgages, it’s because we’re looking for another con-job to prop up an overheated and ready-to-crash market.

But all I’m saying is that I argue in favour of choice.

And I’m shocked that this product isn’t more readily available.

Through my Google-Fu I found a very well-written article by Robert McLister, who is the founder of RateSpy.com, and somebody who many of you quote on the regular, sometimes in a negative light, sometimes in a positive one.

It seems he beat me to the punch with thoughts on the interest-only mortgage. Here’s his article from earlier this month:

“Interest-Only Mortgages Have Quietly Resurfaced In Canada”

In the article Mr. McLister suggests that paying into an interest-only mortgage has advantages for disciplined long-term investors with no high-interest debt, a 20% down payment, and contribution room in their RRSP.

Here’s his example:

AN UNCONVENTIONAL SAVINGS TOOL

By diverting mortgage payments to higher-earning investments, an I/O mortgage can pad your retirement savings. A case in point is the following strategy for disciplined long-term investors with no high-interest debt, at least 20-per-cent equity and RRSP contribution room.

Step 1: Get a low-cost, interest-only mortgage to slash your monthly payments.

Step 2: Invest that payment savings in your RRSP.

Step 3: Use the tax refunds resulting from these RRSP contributions to make a prepayment on your mortgage each year.

THE NUMBERS

For illustration, imagine you have:

- A $500,000 home appreciating at 2 per cent a year;

- A $400,000 mortgage;

- An RRSP to which you currently contribute $500 a month;

- A 37-per-cent tax bracket;

- An annual return in your RRSP of 4 per cent.

Now, suppose you have two choices for a new mortgage: A regular 3.49-per-cent five-year fixed, or an interest-only 3.88-per-cent five-year fixed.

By paying just interest, your mortgage payments would drop by $505 a month, letting you invest that much more in your RRSP.

To see how redeploying that $505 a month could help, we asked Jason Heath of Objective Financial Partners Inc., to crunch some numbers. Mr. Heath holds the certified financial-planner designation.

After five years, our sample borrower’s pretax net worth, assuming she invested her mortgage payment savings into an RRSP, has grown from that $100,000 down payment to $238,923 with the regular mortgage; and to $243,741 with the interest-only mortgage. That’s almost $5,000 of pretax net-worth gain in just 60 months. But the real magic happens over years of compounding market gains. After 25 years, our sample borrower’s RRSP is well over double what it otherwise would have been. And remember, all the while, she’s also been making annual prepayments toward her mortgage principal.

Once retirement hits, the homeowner can:

- Downsize and pay off the remaining mortgage;

- Keep making the modest mortgage payments from her greater retirement cash flow

- Refinance into a reverse mortgage (worst-case) to eliminate all payments

Reading that scenario, it’s a little bit like the advice in Rich Dad, Poor Dad, which basically argues that you’re a fool if you don’t rent for life.

The author breaks down the costs associated with home ownership, and makes a very convincing case, showing that over a lifetime, renting is far, far cheaper than owning.

The one caveat, of course, is that you have to stay disciplined! If you give up after ten years, and say, “Screw this, I’m buying a house,” then you’re actually further behind.

In Mr. McLister’s case, he’s showing the result after twenty-five years! To utilize this strategy would take regiment and structure that few of us possess.

So what’s the take-away?

For me, it’s simply the concept of choice. If this is appealing to some borrowers out there, then more power to them. An interest-only mortgage is a great way to massively reduce your monthly cash outflow, and this does have a purpose and an advantage among many buyers.

For many of you, this is nothing but fodder.

Although having the knowledge about what’s happening (or not happening) is never a bad thing.

For example…

“Bank Of Canada Done Raising Rates Until End Of 2020, With 40% Chance Of Cut, Poll Says”

Sirgruper

at 8:42 am

There is a far more popular interest only mortgage out there and the big five offer it being a secured line of credit. Commercial mortgages and most residential private mortgages are interest only too. Principal and interest mortgages for residential purchases are simply the Ontario norm and yes cause forced savings which has proven to add stability to the market place. With choice, you need more knowledge and the forced choice of blended for most, though not libertarian, is probably the wiser route for the system and its participants.

Condodweller

at 11:15 am

If I’m being selfish and only look at it from my point of view, perhaps an interest-only mortgage could make sense for a few percentage of people. OTOH there is the other 97% for whom this could be extremely dangerous.

This is similar to credit scores and work experience. When you need the money and don’t have the credit you don’t qualify, when you have the credit, you don’t need the money anymore. Same with work experience.

An interest-free mortgage is essentially the same as renting except you pay the bank rather than the landlord. Except for the downpayment and the hope of capital appreciation. What you are really doing is making a bet on increasing house prices and interest rates staying low while trying to cheat the qualifying rules.

Mike

at 7:06 pm

I know this is a dangerous thing to say, but in a market like TORONTO where prices have risen for twenty years, I don’t see any real downside to an interest only mortgage. Even during market declines,, average home prices weren’t off by more than 20%. The 1980’s, the early 90’s, and whatever you want to call last year’s marginal drop.

If I’m theory a borrower knows he can make a higher rate of return elsewhere (let’s say a hedge fund manager buying a home) then the idea of forced principal pay down isn’t attractive.

Cool concept. I honestly didn’t know this existed.

Christopher

at 7:46 pm

Interest only mortgages are an excellent way to encourage investment activity. It’s nearly impossible to find a cash flow positive investment property with the minimum 20% down, 25-35% is required to break even every month. An interest only mortgage would make most properties cash flow positive, perhaps investors would re-invest the positive cash-flow into more rental properties. This is either a great or terrible thing depending on your outlook on Toronto real estate…..

Steamwhistle

at 9:35 am

Interest-only mortgages have a pretty long history in certain European countries, particularly urban countries where properties have historically been passed along from generation to generation and people don’t buy/sell much, at LTVs that would give our regulators nosebleeds (sometimes above 100%). It does seem a bit scary to do it in a country where housing prices are so volatile (in any given region, swing of 5% up or down are common). Those mortgages still have terms though, so the bank can opt not to renew after a certain time if LTV levels are breached.

Izzy Bedibida

at 12:36 pm

True. My sister in law lives in Amsterdam, and the mortgage on her condo was structured like that. The Dutch government came out with that mortgage to both encourage home ownership, and not have residents with mortgage payments eating up all disposable income in expensive cities like Amsterdam.

The interest costs come out almost the same over the term of a 25 yr mortgage and selling vs a traditional 25 yr mortgage and selling at the end of the term.

One thing that I have noticed, is that people don’t factor in total interest costs when discussing mortgages and real estate. After my separation, exwife was aghast when she discovered that the total mortgage costs was almost twice the cost of the house. house would have to appreciate quite a bit to cover those costs.

Robert McLister

at 4:38 pm

Good piece David,

A few random thoughts:

* The Interest-only Flex mortgage can be had with just 20% down *if* you put 65% of the property value in the interest-only portion and 15% in a regular mortgage portion. The interest on each portion can be tracked separately for tax and other purposes.

* Depending on which broker you use, the current 5-year fixed rate on the interest-only portion is as low as 3.69%—materially better than an interest-only HELOC at prime + 0.50% (roughly 750,000 households have HELOCs where they pay just interest-only). The current rate on the mortgage portion (if applicable) is as low as 2.99%.

* Interest-only mortgages are wrong for most but very right for some. Your point about affording responsible borrowers a choice should resonate. By letting folks direct their limited cash flow to its most productive use, disciplined borrowers retire better off. It’s that simple. And yes, some critics like to say most people are undisciplined, but everyone deserves a chance to optimize their finances. Banning flexible financing products would be like banning high volatility stocks because some people buy at the top and sell at the bottom.

* You mentioned the investment strategy I wrote about. That’s one of many applications of this product. Another is paying down high interest debt when you’re unable to consolidate it in a mortgage. That’s a much more straightforward use case. Another is business capital for the self-employed. My wife and I are one example. We got a BDC loan a while back to fund our growing business. It cost us prime + 5% (that would be 8.95% if we were taking out the loan today). Refinancing into a 3.69% interest-only mortgage would have been far more beneficial, had it been available at the time.

In any event, hopefully these little nuggets are helpful and seen in a “positive light.” 🙂

Cheers…..rob