When we redesigned the Toronto Realty Blog a couple of years ago, one of the suggestions made was to include that new feature that we see at the top of most online articles these days:

9 minute read

I often look at blogs that I have written and thought both, “It won’t take that long to read,” as well as, “You can’t read it that quickly!”

In the case of some of my year-end blogs, I worry about people being scared off.

87 minute read

Yeah, that’s probably not good for business.

Then again, if you’re looking to be entertained for a long period of time, and you’d like to be informed about all things real estate as well, I can’t think of 64 minutes better spent than reading today’s blog post. Or last Thursday’s.

Before I detail the top five real estate stories of 2024, I first wanted to look back at last year:

Top Five: Real Estate Stories Of 2023:

5) Condos, Development & Pre-Construction

4) Changing Business Practices Amid A Changing Market

3) Landlords & Tenants

2) Pricing

1) The Future Of Housing In Toronto

Alright, so there’s some overlap this year, but not nearly as much as there has been in past years.

So without further adieu, get a refill of your coffee and settle in for the next 58 minutes.

Hope you enjoy!

–

#5: The Death Of Pre-Construction Condos

There are only two times that you’re allowed to celebrate death:

1) When famed WWF wrestler, The Undertaker, falls into a casket and you know that he’s playing possum and will return shortly.

2) When you’ve been pointing out the pitfalls of pre-construction condominiums in Ontario for fifteen years and the market for them finally flames out.

For that reason, my cheerleading is fully warranted!

Hooray!

I didn’t expect this to be such a big story coming into 2024, but then again, a casual onlooker to either TRB or the real estate market in general still might not feel that this was a “top” story this past year.

Perhaps it didn’t produce enough headlines. Perhaps those headlines weren’t bloody enough.

But when you look at the impact that the death of the pre-construction condo industry had on the overall real estate market, both current and future, you’ll soon see why this is such an important story.

March 28th, 2024, I wrote: How Is The Market For Condominium Assignments?

I offered this at the very start of the blog post:

Through twenty years in this business, I have never sold a pre-construction condo.

Then, I offered something even better!

I offered a 13-year-old video of me, filmed on a shaky handycam, standing in front of a whiteboard, wearing a chocolate brown suit, comparing pre-construction condos to cake mix:

I know what you’re thinking……”He hasn’t changed a bit!”

I continued to predict the year ahead for the pre-construction condo market, citing the following headline as a sign of more pain ahead:

“Pre-Construction Condo Buyers Forced To Off-Load Units For As Much As $150,000 Less Than They Paid”

The Toronto Star

March 26th, 2024

Then, I showed real-life examples of pre-construction condo “investors” looking to unload assignments, like this one:

Things got worse.

Much worse…

April 8th, 2024, I wrote: TRB Pre-Construction Review: “Freed Hotel & Residences”

This was mind-blowing.

Imagine after reading the above – about investors looking to dump pre-construction condominium assignments, then reading about a developer attempting to sell pre-construction units for upwards of $2,400 per square foot!

The timing could not have been more awkward.

It reminded me of this famous scene:

Act like y’all don’t know, but seriously, imagine pre-construction investors begging to lose money all across the city while a developer simultaneously looks for record pre-construction prices.

June 17th, 2024, I wrote: TRB Pre-Construction Review: “REINE”

While the prices here pale in comparison to the Freed project noted above, it was still mind-blowing to see a developer asking $1,333 per square foot for micro-condos in Mississauga!

It wasn’t long before we started to see hard data being released about the slow death that pre-construction was dying, suddenly becoming a much quicker and more noticeable death.

Urbanation is the go-to for all real estate statistics and their headlines in 2024 have been explaining the pain…

February 1st: GTA New Condo Sales Fell To 15-Year Low In 2023

April 22nd: GTHA New Condo Sales Fall 71% Below 10-Year Average

July 18th: Slowest First Half For GTHA New Condo Sales In 27 Years

October 18: GTHA New Condo Sales Fall To Nearly 30-Year Low In Q3-24

That last report noted:

New condo sales fell 81% year-over-year.

New condo sales were 87% below the latest 10-year average for Q3 periods.

Like I said: the death of pre-construction condo sales.

Some of the city’s uneducated might cheer this. You know the type. The real estate haters. The ones who spraypaint signs with development applications. The folks who don’t understand economics. But ultimately, if people aren’t buying pre-construction condos, then condos don’t get built. For a city with a massive shortage in housing, this is a recipe for disaster in the medium term.

The takeaway, as I wrote many times through the year, is that we can’t expect developers to sell pre-construction condos for $1,000 per square foot when the cost is $1,100, but that feeds into my #2 story of 2024, which you’ll read shortly.

All told, the death of pre-construction condo sales was a big story in 2024 but it has bigger implications for the years ahead…

–

#4: The Role Of Investors

I played a role this year, as I detailed rather early on in the year.

February 12th, 2024, I wrote: Putting My Money Where My Mouth Is

I’ve referred to this blog as recently as last week, so we don’t need to go here again! But the post started the discussion of investors in 2024, or more specifically, where in the world they had gone!

This was a story throughout the year, and I honestly don’t know why.

It seemed as though the media often had an axe to grind with the folks that many think are to “blame” for the state of the housing market.

Then again, it also seemed like some media outlets were celebrating investors’ pain.

Let’s look at a few choice headlines throughout the year:

Toronto Made A Bylaw To Crack Down On AirBnB And Other Short-Term Renters. Now, Companies Are Instructing Investor Owners How To Evade The Rules

Toronto Star

January 9th, 2024

Yes, evil investors!

Always doing evil!

Toronto’s Condo Market Is In Recessionary Territory As Investors Can No Longer Prop It Up

Toronto Star

July 20th, 2024

One of many, many articles cheering the pain of investors will simultaneously blaming them for any problem in the real estate market.

Toronto Wants More Family-Sized Condos. Here’s Why What’s Being Built Just Doesn’t Work

Toronto Star

August 17th, 2024

Once again, investors are to blame for what’s been built over the past two decades.

Investors Own 65% Of Toronto’s Smaller Condo Units, StatsCan Finds

Toronto Star

October 3rd, 2024

Click-bait.

But what else is new?

Lastly, this one:

Investors Wrecked Havoc On Toronto’s Condo Market, Leaving Us With Tiny Units No One Wants

October 11th, 2024

Toronto Star

This was the one that I really took issue with, but I’ll come back to it in a moment.

First, let’s have a look at this post from the summer.

August 26th, 2024, I wrote: Are Smaller Condo Sizes Breeding Intelligence Or Entitlement?

This was in response to the following article:

“First-Time Home Buyers Are Shunning Today’s Shrinking Condos”

The Globe & Mail

August 18th, 2024

The article interviews folks in their early-20’s, who have no business “demanding” to own a home, and who yet proudly declare that they have no interest in owning a condo.

Of course, all conclusions drawn on today’s condo market go back to the source: investors are to blame.

Investors are buying pre-construction condos, these condos are shrinking, young people don’t want them, and thus we are not to blame a 21-year-old who wants to own a 4-bedroom, detached home in a prime area for being entitled, but rather we are to blame investors for ruining the housing market.

And that’s where this Toronto Star article comes into focus: Investors Wrecked Havoc On Toronto’s Condo Market, Leaving Us With Tiny Units No One Wants

I told you we’d save it for a moment, and let me explain why.

October 15th, 2024, I wrote: Are Investors To “Blame” For Toronto’s Condo Market?

I took issue with the entire thesis of the article, but in a nutshell, this is the problem:

“Investors own almost 60 per cent of condos built since 2016 – and they’ve been dictating what gets built.”

This is a chicken-and-egg situation.

Did the investors “dictate” what gets built?

Or did developers simply build whatever was easiest to sell?

I believe it’s the latter, and ultimately in our system, developers build units they can pre-sell, in a for-profit industry where profits have shrunk to zero in 2024 thanks to over-taxation, poor public policy, and one of the most inefficient rezoning and approval processes you’ll find anywhere in North America.

2024 was truly the year of “blaming investors” for everything wrong with the real estate market.

But don’t forget, it was only a few years ago that we were blaming foreign buyers, with an absolute certainly that they responsible for every problem in the market.

What will it be in 2025?

I shudder to think…

–

#3: Sales

I assure you: that one-word, five-letter title will likely represent the smallest and shortest “story” in any iteration of this TRB feature, past, present, or future.

But while I could have flushed that title out a little bit and referred to the reason we’re talking about sales, or the type of sales, or the worst part of the real estate market to get hit by declining sales, all that would take away from the simplicity.

Sales.

Just, sales.

Or lack thereof, it would seem.

While the #1 and #2 stories on my list, as you’ll soon see below, were written about countless times on TRB throughout 2024, I don’t believe I wrote a sales-specific post this past year. But that doesn’t mean it wasn’t a huge story.

In fact, just as “sales” were a big story coming into 2024, and on our “burning questions” list in both January and again in September, the story remains just as important today and will remain so again in 2025.

But to understand why, we must first look back at sales activity over the last few years…

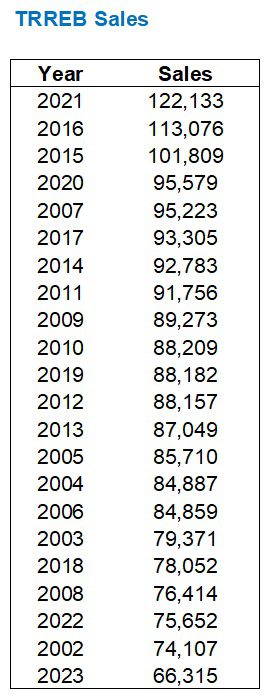

In 2015, we saw a ridiculous 101,809 sales, which broke the previous record of 95,223 set in 2007.

In 2016, the new record was further shattered, as 113,0076 properties traded hands that year.

In 2017, we started the year with an absolute bang, but as history shows, the market slowed significantly in April after the federal government stepped in and attempted to “cool the market,” so sales came in at 95,223, which was still good for #4 all time.

After the “peak” in 2017, sales slowed significantly.

2018 saw only 78,052 sales.

2019 saw an uptick in activity, with 88,182 sales.

Then along came a worldwide pandemic and the market slowed to a crawl, highlighted by the paltry 2,875 sales recorded in April of 2020, which are the fewest of any month since the 1990’s.

As history will also show, the pandemic provided Torontonians with many reasons to transact in the real estate market, with some people moving into the city and others moving out of it, some people switching from a condo to a house, and vice versa, and people deciding that they needed more space to work form home, or less space to maintain.

Amazingly, sales shot through the roof in the second half of 2020, and the year finished at #3 all-time with 95,579.

But that was just the appetizer for 2021!

Whether it was the pandemic, FOMO, low interest rates, or all of the above, 2021 sales came in at 122,133, shattering the 2016-record of 113,076.

Peak insanity hit in February and March of 2022, and then just like it did in 2017, the market completely turned around and went cold. The Bank of Canada began to raise interest rates at an unprecedented pace, and total sales in 2022 came in at only 75,652, which was the second-fewest of all time.

Then in 2023, sales came in at 65,982, which was, in fact, the lowest of all time.

I wrote about this at length at both the end of 2023 and the start of 2024, noting that those 65,982 sales are almost half of what we saw only two years prior.

You’ve likely become quite familiar with this chart by now:

It’s only been two weeks since we last saw this chart!

Although I did update a typo. Free coffee to whoever can spot it. 🙂

The 2023 sales figures were eye-opening, and coming into 2024, I not only expected but went out of my way and predicted that we would see at least 80,000 sales this year.

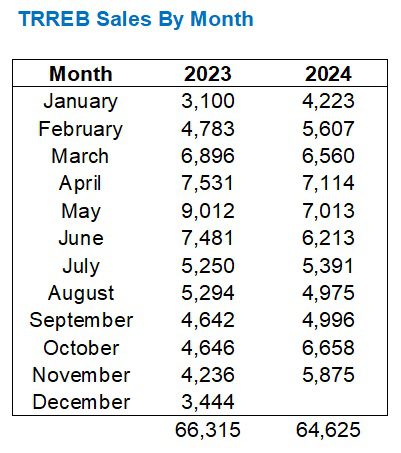

Now, here we are, looking at the following cumulative sales for the year:

If you had told me that 2024 sales would end up within 2-3% of 2023 sales, I would have vehemently argued against you.

And yet here we are!

December TRREB sales have averaged 4,448 from 2002 through 2023 (I’ll save you having to read that chart…), which would place 2024 sales at 69,073.

That would beat out 2023 sales, but still remain the second-fewest of all time.

But can we really expect to see 4,448 sales in December?

We saw 3,117 sales in December of 2022 and 3,444 sales in December of 2023, so if I were a betting man, I would predict about 3,800 sales in December.

That would bring 2024’s total to 68,425, which is only 3.2% higher than the lowest-ever sales figure from 2023.

This is nothing short of shocking in my mind.

So then, should we predict another year of sub-70,000 sales in 2025?

Nope!

If I learned anything in 2024, it’s that even when interest rates are declining, most buyers still won’t take the leap. Not until “declining,” in present tense, becomes “declined,” in past tense, will buyers flock to the market, so with interest rate cuts coming on December 11th and January 29th, I expect the spring of 2025 to be massive.

I’m predicting 88,000 sales in 2025.

Lock in that prediction, and we’ll come back to it in twelve months, if not sooner…

–

#2: The Government’s Impact On The Real Estate Market

Is this the #2 story of 2024?

Or is this David’s #2 story of 2024?

Pick your poison, if you so choose, but something tells me that by the end of this section, you’ll agree with me.

Last week, during our “Top Five: Blog Posts of 2024,” I went on at great length about this post:

February 5th, 2024: How Can An Increase In Taxes Mean An Increase In “Affordability?”

That was merely the starting point for the ongoing discussion about how the government impacts real estate in Canada, as I ended up writing eight more blog posts of interest throughout the year.

While that post served as my #5 favourite of 2024 because of the fact that I finally listed off all the taxes associated with real estate in Toronto, it doesn’t take anything away from the following posts.

March 4th, 2024, I wrote: Good Riddance: CMHC Cancels First-Time Home Buyer Incentive

This one was a long time coming, wasn’t it?

And if you recall the post (or click the link above), you’ll see that I chose a “feature photo” of Ronald McDonald hiding in the bushes outside somebody’s house. I believe I searched the term “clown” that morning, and this fantastic photo was the first to come up.

Whoever came up with the idea for the First Time Home Buyer Incentive is an absolute clown. From its development, through consideration, implementation, and oversight, this program was nothing short of a joke.

Then again, our federal government just came up with the idea for a “HST Holiday,” which is being ridiculed across the country and is the exact opposite of what a responsible government would do when also trying to combat inflation and reduce interest rates, but not a single Canadian out there thinks this is anything other than an attempt at vote-buying by a lame-duck government in their final days in office.

The First Time Home Buyer incentive was the same thing: an attempt at vote buying. Maybe it worked. Er, the vote-buying, that is, since the program itself was a flop.

April 1st, 2024, I wrote: Monday Morning Quarterback: The Renters Bill Of Rights

This Bill of Rights really angered me because it’s among the worst political posturing I’ve seen from this government yet.

The ideas within the bill were asinine. It’s as though this bill was written by somebody high on drugs, floating in the sky, viewing a utopia through rose-coloured glasses. That ‘somebody’ also knows nothing about real estate or the rental market.

The bill called for a “nationwide standard for lease agreements,” as though the Ontario Standard Lease, and others like it, doesn’t already exist.

The bill called for a “clear history of rental prices,” as though knowing what somebody paid for the same unit in 2023 or 2003 has any effect on the market.

The bill called for credit bureaus to “consider rental payment history” as though this would make homes more affordable in Canada.

Another day, another example of political posturing by an out-of-touch government.

May 27th, 2024, I wrote: Monday Morning Quarterback: Your Government(s) Are Lying To You About Housing!

This post also got me really amped up, but something tells me you can already tell.

The impetus for the blog was this comment by Housing Minister, Sean Miller in April:

“Canada can and will solve the housing crisis.”

Bullshit.

Absolute nonsense.

The government continues to tax real estate development and construction to death, while stealing from hard-working, law-abiding, tax-paying citizens, and simultaneously blaming individuals, corporations, developers, and any one or any group other than those in power in political offices.

Over the last ten years, new homes in Canada have averaged 197,000.

And yet the Trudeau government promised to build an average of 552,857 new homes every year for the next seven years.

It’s a lie.

And in this blog post, I told the following truths:

- Real estate has been made more expensive, in part, because of the government.

- The construction of real estate has been made more difficult and more expensive, in part, because of the government.

- The act of purchasing real estate has been made more difficult because of the government.

- Following up to point #3, this means the act of selling real estate has been made more difficult because of the government.

July 15th, 2024, I wrote: Monday Morning Quarterback: The Ludicrous “Home Equity Tax”

For this blog post, I chose a feature photo of a thief stealing a wallet out of somebody’s purse, because that’s exactly what the notion of a home equity tax is.

Thievery.

And if you want to turn red this morning, go watch Prime Minister Justin Trudeau sit down with communist and Generation Squeeze founder, Paul Kershaw, to discuss “fairness” in Canada in 2024.

They have a very unique definition of “fairness,” considering we were told from a very young age not to take things that don’t belong to you.

Those were probably the most angry posts I wrote in 2024.

But then we returned to the topic of taxation in real estate once again.

September 9th, 2024, I wrote: Tax Breaks For Developers Are Not Going To Be Popular Words

This blog post was about the “open letter” signed by a group of prominent housing developers and sent to the three levels of government, highlighting the absurd amount of taxes that are buried in the purchase price of any unit of new housing, and asking the government to reduce the taxes – in exchange for the savings being passed along to the buyer.

What a novel concept!

Except that, as you can tell from the title I chose, it wasn’t going to be a popular idea.

In the fall, we started to see the unwinding or loosening of previously-touted mortgage regulations:

September 23rd, 2024, I wrote: Monday Morning Quarterback: Higher Mortgage Insurance Cap & Longer Amortizations

Some will agree “it was time” to increase the mortgage insurance cap from $1,000,000 to $1,500,000, based on the average home price in Toronto essentially doubling since the cap was put in place, but others don’t like the idea of the government “increasing affordability” by encouraging Canadians to take on more debt.

Later in the month, I was back to my angry posts once again.

September 30th, 2024, I wrote: Testing Theories On The Housing Crisis In 2024

This was based on the Greater Toronto Area Municipal Benchmarking Study that had some fantastic statistics and insights!

Here were the three “theories” that I tested in the blog:

- Theory #1: “Immigration Levels Are Too High Relative To Housing Supply!”

- Theory #2: “It Takes Way Too Long To Get Anything Built!”

- Theory #3: “Nobody Is Building Anymore!”

- Theory #4: “The Municipalities Are Driving Up The Price Of New Construction!”

Spoiler alert: I blame the government, yet again, for driving up the price of real estate, making development difficult and expensive, and over-populating a country already suffering from a housing shortage.

And that brings us to last week…

December 9th, 2024, I wrote: The Increasing Tax Burden On New Ontario Homes

Hopefully by now, you’ve all read the post, as I’ve alluded to it multiple times since I wrote it.

The takeaway is simple: 35.6% of the price of the ‘average’ new home in Ontario is made up of taxes.

It was quite the year for the intersection of the three levels of government and our housing market, er housing crisis.

But something tells me that this will be a topic of conversation in 2025 yet again, just hopefully not to the same extent…

–

#1: Pricing And “Strategies” In A Changing Market

Based on the length of my write-up for #2, it could have easily been considered the #1 topic or story of 2024.

But considering this is a real estate blog and not a political blog (not usually…), I think a story actually about the market has to be at the top of the list, no?

Throughout 2024, I consistently wrote about real estate prices, listings, agents, and what I call “strategies” in parenthesis, because often the strategy is anything but.

Having said that, the first blog I wrote along these lines actually did highlight a strategy that worked.

February 1st, 2024, I wrote: 85 Offers On A Home: What In The World Happened?

The secret sauce wasn’t anything that innovative.

This was just a $1,000,000 house listed for sale at the right time – and for $699,000.

In this blog post, I asked and answered all the “right questions” that an onlooker of this absolute fiasco would want to know.

March 14th, 2024, I wrote: The Psychology Of Real Estate Pricing!

This was a fun one!

It’s always sort of been in the back of my mind, but I finally put pen to paper, er, fingers to keys on this.

In the post, I described “psychological pricing” and traced back the origin of the $0.99 phenomenon, then provided insight as to how we price our listings, such as:

- We always price with $900 below $1 Million, but we drop that $900 once we’re above $1 Million.

- We never use $999 at the end of prices.

- We use $900’s even when the list price is on the quarter or the half.

- We never use 800’s.

- We don’t use 500’s. Except when we do.

- I find even numbers to be confusing.

- Can we talk about the 8’s?

- Lucky 7’s only work in a casino.

- Differentiation can often backfire.

- Random numbers are ridiculous.

- I’m absolutely floored when I see even numbers, like $700,000.

- Is it time to define the “left-digit effect?”

All of these were flushed out in the blog post. Have a read if you have time!

March 25th, 2024, I wrote: The Psychology Of Real Estate Pricing: A Real World Example

This was a solid and necessary follow-up to the post eleven days prior, and examined the twenty bids that were submitted on a property that we had listed for sale with an “offer date.”

May 13th, 2024, I wrote: It’s Almost Re-Listing Season!

This, of course, was a very sarcastic blog about just how many sellers and/or listing agents will list a property, over and over, when it has no chance of selling via those prices or those “strategies.”

This was merely a sign of things to come in the market ahead.

June 3rd, 2024, I wrote: How Not To Sell Real Estate In Toronto

This was a real-life example of how a listing agent and seller completely botched their sale process, while my client and I listed and sold a property in the same complex, at the same time.

As I said above, this was just a sign of things to come through the end of 2024.

I didn’t set out to write so many posts about “bad strategies,” but rather they kept being dropped on my doorstep!

Far too many sellers have illusions of grandeur about not only the value of their homes but also how simple the sale process should be, and far too many listing agents lack the guts to tell these sellers the truth!

July 2nd, 2024, I wrote: Don’t Overplay Your Hand!

This was yet another insane story about a house listed over and over, with different prices, different “strategies,” multiple offer dates, and through the end of 2024, this house is still not sold!

July 22nd, 2024, I wrote: Monday Morning Quarterback: Define “Desperate”

This was in response to a newspaper article about a guy who was “having trouble selling his condo,” that completely ignored all the facts.

The property was massively over-priced.

The seller was incredibly entitled.

The market doesn’t owe anybody, anything.

And so on.

September 12th, 2024, I wrote: Listing For $1.00: A Strategy Destined For Failure

Spoiler alert: that “strategy” didn’t work.

The house didn’t sell.

The house still hasn’t sold…

October 28th, 2024, I wrote: The Worst Listing “Strategy” I Have Ever Seen

Having been in the business for twenty years, and having written on TRB for seventeen of those, it takes a lot to suggest a listing strategy is the “worst ever.”

But the facts don’t lie:

- 11 listings

- 39 prices

- 8 offer dates

- 4 listing brokerages

- 592 days and counting

Last, but not least, I wrote a post mid-fall that essentially “blamed” sellers for the lack of sales in 2024, namely in the fall market, which had been sluggish.

November 4th, 2024, I wrote: It Takes Two To Tango: Why Sales Are Sluggish This Fall

Indeed, there is a buyer and a seller in every real estate transaction.

There is also a buyer and a seller in every attempted real estate transaction, and based on what I’ve seen this fall, working with both buyers and sellers, I can confidently conclude that too many sellers have expectations out of line with the current market, and too many sellers and their “game playing” have combined to keep sales down this fall.

I don’t remember a year in which I wrote so much about these bad listing “strategies” or the games that listings agents have played, often pathetically, always unsuccessfully.

Next year, if and when the market is better, these stories will subside, but they’ll likely be replaced with “you wouldn’t believe what this greedy listing agent did on offer night” types of stories, which are perhaps six of one, and half-dozen of the other.

But some of my favourite posts from 2024 were captured in the list above, so it’s no surprise that this ended up being the “top story” of 2024.

–

Well, folks, after all that, I do believe that a lengthy sign-off isn’t needed!

See you back here at week’s end so that we may say “Goodbye” for 2024!

Milk Man

at 12:14 pm

I am going to give David the benefit of the doubt here as I suspect he correctly meant to write WWF instead of WWE. The WWF incarnation of Taker was far superior to that of the WWE’s.

David Fleming

at 8:11 pm

@ MILK MAN

Damned if you do, damned if you don’t!

It was the WWF when I was watching. When it turned into the WWE, it truly became less of a sports-entertainment program and more of an entertainment program. And the type of entertainment just went in the wrong direction.

Did you watch the Vince McMahon documentary? Fascinating.

hoob

at 1:10 pm

“I didn’t have time to write a short blog post, so I wrote a long one instead.”

Steve M.

at 1:54 pm

small edit here as I believe David meant to say Sean Fraser, the Federal Housing Minister not Sean Miller. An excellent overview that explains the challenges of the housing market.

David Fleming

at 8:12 pm

@ Steve M.

I think I was listening to “Big Ole’ Jet Airliner” when writing this, and the name got mixed up…

Ed

at 1:22 pm

So who won the interest rate cuts contest?

David Fleming

at 8:12 pm

@ Ed

Stay tuned for Friday! 🙂

Sirgruper

at 8:16 am

Agreed. Mr. McMahon is really well done. Will need an update next year with his wife in the Trump inner circle. Thank you for your contribution to the metaphorical real estate ring and entertainment.