Just as my “year-end” blog posts are thematic, ie. the “Top Five Blog Posts” and the shortly-thereafter, “Top Five Real Estate Stories,” I usually feature some sort of early-2019 themed blogs as well.

Either predictions, questions, stories, or themes, I feel the best way to jump into the new year, of real estate blogging, is to offer up some discussion points…

…that we can all disagree on!

Kidding! Just kidding.

It’s been two weeks since we’ve all been in the same (virtual) room. I missed you guys!

Raise your hand if you had too much time with family over the break. Anyone? Anybody care to admit it?

I actually felt cheated this holiday season, since I didn’t spend as much time with family as I thought I would. My daughter was very sick after Christmas, with a fever that lasted for days, so we had to cut short our family-bonanza and stay home to care for her. If I ever watch another episode of “Paw Patrol,” it will be too soon. Seriously. How about five hours per day of that goddam show, in attempts to keep my child’s delirium at bay!? I can’t stand the characters anymore. That kid, Alex? Yeah, he drives me nuts. His entire existence is based upon making mistakes that the Paw Patrol has to clean up. And Mr. Porter? There’s something off about that guy. I wouldn’t trust him.

Post New Year’s, however, things were better. And what child doesn’t love opening Christmas presents one full week after Christmas, right? That’s how sick she was – she refused to open presents! So was she ever a happy camper on New Year’s day.

This was the first year we went out and cut down our own tree, which is something I might do every year, forever, or, something I will never do again. This tree basically dried up by mid-December, and by Christmas, the needles would literally fall off with a medium-sized exhale from your mouth. Our fingers had the touch of death, it was actually somewhat fascinating – seeing every last pine needle fall off a branch, just with a gentle touch.

This might be overkill, but I can’t resist. Plus, I don’t think words do this tree justice:

My wife hates taking the tree down every year; if it were up to her, we’d still have it up in February. But this year, with the pine-needle-extravaganza combined with her debilitating O.C.D., she was standing at the door with a saw and a garbage bag by January 1st. Our tree is sitting on the curb as we speak, and I actually saw a couple of passer-byers stop, point, giggle, and then laugh away. Yes, our tree is nothing but brown branches, without a green needle in sight.

I went 16 days without working out, I ate more pizza and Swiss Chalet than I care to mention, I was in bed on New Year’s Eve at 11:40pm (I actually forgot about the whole ‘midnight’ thing), and I spent way too much money on 1950’s hockey cards.

So those are my holiday stories, folks. Perhaps we could add the one night that I got tipsy and watched Home Alone, laughing like I was 5-years-old, and reciting every single line from memory, and I think the holiday recap is complete.

Now here we are with a new day, a new dawn, and a new……….real estate market.

Damn. That just doesn’t have the same “ring” to it as the Michael Buble song.

To start 2018 here on Toronto Realty Blog, I wrote “Predictions For The 2018 Toronto Real Estate Market.” I think that in attempts to avoid predictability, I should probably switch up the theme, so this year I’m going to look at “Ten Burning Questions.”

However, I would be remiss if I didn’t look back at my 2018 predictions, not only to remind readers what some of the hot topics were coming into the year, but also to look at how right, or how wrong, I was.

So for those of you that were hoping to see those “burning questions” today, I’m sorry. I’m a tease.

We’re going to start this 3-part blog series by looking back at my 2018 predictions, just to put the market in perspective.

There’s method to the madness, trust me.

Perhaps Bruce Lee’s “Empty your cup” analogy isn’t 100% accurate here, but I can’t help but feel like we can’t look ahead to 2019 before first emptying what’s left in the tank of 2018.

Plus, it will give some of you an opportunity to say “I told you so,” and who doesn’t love that?

I made five predictions coming into 2018, so here they are, and here’s how they turned out…

2018 Prediction #1: The average home price will increase in Toronto, in 2018.

This was wrong.

Dead wrong.

With a “peak” average home price in April of 2017 around $920,000, the November price was down to $761,757 at the time I wrote this blog, and the year-end price was looking like it would come in around $820,000.

My thinking was simple: the market had crapped out in May, June, July, and August, before making a modest comeback in the Fall. Average out the good months with the bad months, and the $820,000’ish average home price was incredibly depressed.

I surmised that we’d see a return to $820,000’ish numbers, which still represented a dramatic drop from that March-April peak of $916,000 and $920,000 and change.

I was wrong.

As I wrote in a December blog post, 2018 would be the first year since 1996 that the average home price declined, year-over-year, which was yet another reason why I predicted a 2018 increase. I suppose the “stick with the trend” mentality can only get you so far!

So how much did the average home price in Toronto actually decline in 2018?

The average home price in Toronto in 2017 was $822,572.

As of this writing, the December stats (and thus year-end stats) were just released by TREB. Talk about cutting it close!

My late-December blog post guesstimated a 2018 final average sale price of $790,000, based on a weighted average of the preceding 11 months. The average home price for 2018 actually came in at $787,300, so I wasn’t that far off.

That’s a 4.29% decline, year-over-year, in the Toronto average home price.

Just as a refresher, here’s the average home price movement since the last time we saw a decrease, and I’ve added in 2018:

So, once again, I was wrong.

But what about the Toronto-416 home price? Do I get a reprieve by looking at the “central core,” which I would probably argue can, and will, survive market forces in the short, medium, and long-term?

This overlaps with my second prediction, so at the risk of being repetitive, let me come back to this at the end of Prediction #2.

–

2018 Prediction #2: The freehold market will outpace the condo market.

Wrong again.

But I would love to meet the person who predicted the opposite coming into last year.

Generally-speaking, houses are more popular than condos, agree? That’s simplistic, but let’s say that if most people had a choice, they would live in a house over a condo, and it’s price that’s stopping them from doing so. It’s also supply.

So coming into 2018, with the same “they’re not building any more houses in Toronto; it’s just cranes in the sky” mentality, I can’t look back and say I should have seen the condo appreciation coming.

So how did the housing market do in 2017 versus 2018?

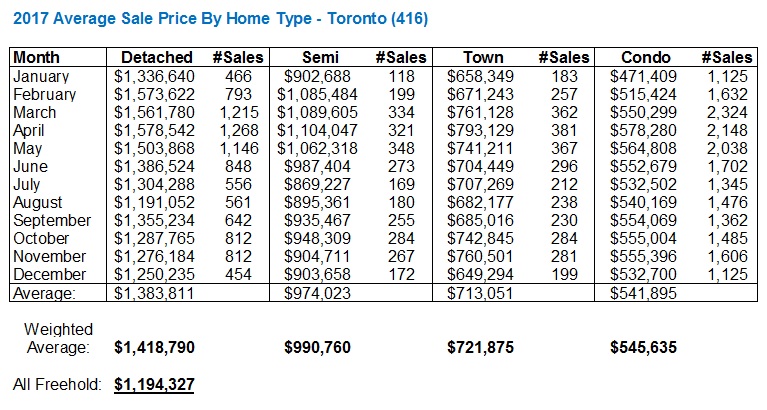

Well, because the Toronto Real Estate Board refuses to provide us with the appropriate data points (let’s just say that on December 31st, they were ringing in 2006…), I took the time to plot each and every month’s sales and sale prices for the four major housing types, in the past 24 months: condo, detached, semi-detached, and townhouse. This is the only way to get true, accurate numbers.

You don’t need the charts to understand the conclusions, but I spent so much damn time on this, I may as well share it!

Here you can see the sale price for each housing type, in each month, and the corresponding number of sales. Why is the number of sales important? Because we need a weighted-average to get an accurate yearly number. If there were 2,000 sales in May, and only 500 sales in December, we can’t simply average the two corresponding months’ sale prices. We need a weighted-average based on sales.

Then I’ve taken a further weighted average of all the all the sale types, and come up with a freehold average for detached, semi-detached, and townhouse, which we can see there is $1,194,327.

That is the true average freehold sale price for 2017. And gosh-darnit, I would love if TREB would make this available, but I won’t hold my breath…

So three things to look at here:

1) How wrong was I with respect to my 2018 prediction that the freehold market would outpace the condo market?

2) While we’re at it, and while we have this data set, how did the Toronto (416) market compare to the overall “Toronto” market that we’re accustomed to hearing about?

3) In Toronto-416, how does the year-over-year average sale price look for the four individual home types (ie. freehold, semi-detached, townhouse, condo)?

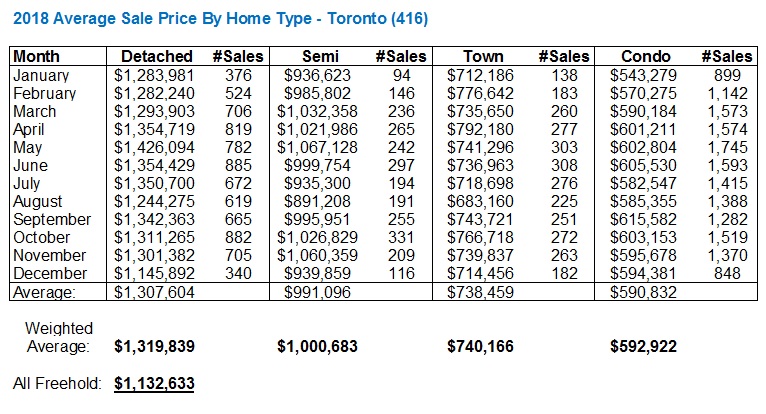

First thing’s first, here is the 2018 data:

Well, I think the bolded numbers pretty much sum it up!

Keeping in mind that we’re looking at the 416 and not the overall Toronto market with respect to the “freehold versus condo” comparison, the data speaks volumes.

The 2018 freehold price of $1,132,633 trails the 2017 freehold price of $1,194,327 by 5.17%.

And the 2018 condo price of $592,922, as you can see, is well ahead of that $545,635 price that the market experienced in 2017.

The freehold market went down by 5.2%.

The condo market went up by 8.7%.

I was wrong, as I said before. But with that out of the way, what conclusions can we draw from all of this, and/or what questions should be asked?

I suppose we’d want know, first and foremost, why the 416-Toronto condo market was so resilient!

Were condos under-valued coming into 2017? And did they remain under-valued coming into 2018?

Does this mean we should expect condos to cool in 2019? By association, should we expect the freehold market to outpace the condo market in 2019?

All good questions, and all with answers that will vary dramatically depending on your interpretation for the last 24 month’s market activity, and your prognostications.

As for the second question asked above – how the Toronto-416 market compared to the overall Toronto market, there’s a huge difference, but I think this could have been easily predicted.

Some of you might doubt the conclusions, since the rhetoric has been nothing but doom-and-gloom all year, but this is a stat that TREB does provide, so go to the Market Watch and see for yourself.

The average sale price in Toronto-GTA is down 4.3%; that’s $787,300 up from $822,587.

The average sale price in Toronto-416 is actually up by 0.2%; that’s $835,422, up from $834,138.

As for the third question, here is where things get interesting.

These stats are from my spreadsheets above, since TREB does not provide a breakdown of the four property types, year-to-date, in the 416:

Freehold – down 7.0%

Semi-Detached – up 1.0%

Townhouse – up 2.5%

Condo – up 8.7%

Basically we’re looking at a market that has seen a 0.2% appreciation overall, where the decrease in average freehold price has been offset by the increase in average condo price, and with the smaller sample-sizes of semi-detached and townhouse helping to round out the final number.

All in all, it was a great year for condos, a down year for detached, and a flat year for the 416 on the whole.

I chalk up part of the reason for the 7% decline in 416-detached homes to far fewer “luxury” homes trading hands, which upsets the balance, but admittedly the overall detached market is down. Now to be fair, it really depends on price once again. If a $1,000,000 semi-detached is up 1% on average, I’m willing to bet the $1,150,000 detached house next door is also up 1% on average as well. I think the $2.8M detached houses at Avenue & Lawrence are down, no question. But we always have to be careful not to paint a whole subset of housing with the same brush.

–

The rest of my predictions were less interesting, and in the interest of time, I’ll summarize.

3) The “stress-test” will have a short-term effect, but no medium-term effect.

The stress-test definitely did have a short-term effect. I had clients in January that had to scale back their target purchase prices, but only two.

I heard from other agents working with buyers that the situation was a bit more prevalent, but as I said last year, most buyers don’t buy to their max pre-approval, so I didn’t think the decrease in mortgage amount would actually lead to a decrease in purchase amount.

–

4) Banks will change their lending criteria.

I was right about this, but for the wrong reason.

Toward the end of 2018, I saw banks tightening up their criteria in a big way.

And in one specific case, for the sale of a condominium listing, I was asked for a copy of the Status Certificate – are you ready for this? From the bank!

That’s right, the bank wanted a copy of the Status, which is something I have never seen before. They likely wanted to ensure that there were no maintenance fee increases scheduled, or no special assessments for the condo corporation. Perhaps it was a buyer who was right up against the ceiling.

Coming into 2018, I figured banks would change their lending criteria to allow them to lend more.

I always say, “Banks are in the business of loaning money, and they’ll find a way to do so.” If the government enacts measures to curb or restrict lending, the banks will find a way around it. Coming in to 2018, I started to see some banks get creative, but that was short-lived.

Alternative lenders and B-lenders picked up a lot of the slack in 2018.

–

5) The spring market will provide the reverse chronology of 2017.

I nailed this one, as the following chart, updated from my 2018 blog, will show:

–

6) The government is finished meddling in the real estate market.

This was true, for the most part.

Doug Ford did tinker with rent control in late-2018, but we didn’t see anything this past year like we saw in 2017 with the launch of the “Fair Housing Plan,” and there were no major government initiatives enacted this year. You might attribute that to Prediction #7…

–

7) Kathleen Wynne will Wynne another Premiership, and that’s scary for home-owners, and home-buyers.

Wrong about this one too.

I suppose I underestimated the zeal of voters, who I thought would rather be guided by the devil they know, than the devil they don’t.

But in the end, we decided we’d rather have a 1980’s drug kingpin lead the province than a person who wants to tax us to death.

Time will tell if we made the right call.

–

And on that wonderful note, I adjourn until Wednesday…

Appraiser

at 8:15 am

“It’s tough to make predictions, especially about the future.”

― Yogi Berra

Condodweller

at 11:56 am

And yet you boldly forge ahead on each blogpost.

Jimbo

at 10:26 am

I think you underestimated the B20 regulations. They drove more people into condos and townhouses increasing demand with the same supply. Had the same effect as cmhc million dollar ceiling. Drove up the cost of the lower end without affecting the top end much.

To be fair most changes had little effect over the years so most felt as you did.

RPG

at 10:28 am

Your blogs are getting longer and longer. I have no idea how you can do this three times per week.

Alexander

at 10:45 am

My prediction last year :

January 4, 2018 at 3:57 pm

“I do not see any 2018 substantial price increase for detached GTA segment market at all and possibility of 5-8% increase in prices of GTA condo markets only if there will be no more interest rate increases / bank tightenings in first half of the year and no more government intervention on any scale. Also I do not see share of detached houses going up at all, it will be going down in fact. First 3 months will be dead with headlines screaming 20-30% drop in sales, prices, etc and if no major negative events blow up the market in the first half of the year, in the fall it will start recovering – a little bit though. I think David’s forecast are too optimistic.”

I guess I was too optimistic on recovering in the fall and did not expect banks tightening as much as they did in 2018.

Condodweller

at 11:54 am

Happy new year all. Kudos David for admitting you were wrong. These things are more educated guesses than predictions all tough for some it should be more educated than others.

The interesting item about being a perma bull is that the trend will eventually reverse in a cyclical market. Psychologically the longer the trend persists, the longer entrenched the belief will be that it will not reverse.

This is why I find the arguments of some of the perma bulls here dubious when they claim that they have been right for the past 10+ years therefore they will continue to be right going forward. What they don’t realize is that a reversal could have happened any year during the last 10 years.

The question is will they admit that they were wrong. I know, I know, it’s just a soft landing and we’ll continue higher this year. /insert your sarcasm icon here/

“But I would love to meet the person who predicted the opposite coming into last year.”

I don’t recall if I ever stated this but I did post a couple of times that I thought prices would compress between the various housing types which kind of implies it.

I am not surprised that this came true however it is interesting how perfectly this played out based on your numbers. All though when I think about it I guess it shouldn’t be surprising as the prices between housing types will never cross each other on the pecking order. They act as same polarity magnets always pushing each other away in the other direction.

I think this price compression will continue this year but I wonder if freehold prices will continue to ease because if they do, it will cap condo prices along with the rest of the types in between at some point.

Also, if you have free time or your OCD acts up it would be interesting if you introduced the micro condo as a new category. I have noticed that 400-600sqft units fetch more than large units per sqft where I was looking. I wonder if micro units fetch even higher prices.

Appraiser

at 12:09 pm

Being wrong for 10 years is still cool though…just ask the bears.

Let’s go for another 10!

Professional Shanker

at 1:08 pm

Not sure who predicted prices would fall each year from 2009 to 2018, but I guess you need that to support your argument.

Starting in 2015 – something in the market just didn’t feel right to me (probably not alone here), that is when I started to doubt the continued upward momentum of the market. 2016 was a crazy year nobody could have predicted even the biggest RE pumpers and bears!

Since I started followed this blog in 2017, every perma bull has been wrong including it’s author. That is 2 straight years they have been wrong.

I can’t wait to get to 2019 predictions, David as always you do a great job with your analysis, the segmented breakdown was great!

Kyle

at 1:22 pm

“Since I started followed this blog in 2017, every perma bull has been wrong including it’s author. That is 2 straight years they have been wrong.”

Actually that is wrong. It’s only pulled back for one year not two, and one should also be looking at the magnitude not just the direction.

Annual average prices from TREB

2015 – $622,121

2016 – $729,837 +17.3% Y/Y

2017 – $822,727 +12.7% Y/Y

2018 – $787,300 – 4.3% Y/Y

If someone bought in 2015 they’d still be up close to 27%

Professional Shanker

at 2:05 pm

If I had started following the blog in 2017 I wouldn’t count the price increase from 2016 to 2017 would I?

Review the average price from Dec 2016 ($730k)/ Jan 2017 ($768k) vs. Dec 2018 ($750k) – 2 year period. Prices on average have barely moved, a rolling 3 month average would smooth out anomalies and would be more representative. The detached segment on average has reduced in price during that period, consistent with David’s research above.

I have owned property pre 2015 so please do not confuse my bearish stance vs. FOMO, I try and be as objective as possible. Let’s predict 2019!

Kyle

at 3:23 pm

“If I had started following the blog in 2017 I wouldn’t count the price increase from 2016 to 2017 would I?”

Yes you should. During 2017, the market was up Y/Y every single month except Nov, so at any point in 2017 (with the exception of Nov) any “perma bull” who said the market is up would have been absolutely correct.

The numbers i posted above are full year averages. So from 2016 to 2018 (the 2 year period you speak of), prices are UP 7.8%. I think it is a stretch to say the bulls have been wrong during that period.

While you say you are trying to be as objective as you can, it sure doesn’t sound like it when one reads your comments.

Professional Shanker

at 4:01 pm

When you are comparing YTD averages at the end of 2018 vs. 2016 you are comparing averages which span from 2 to 3 years (Jan 2016 to Dec 2018), that is a fact.

Since Late 2016/Jan 2017 (2017 to 2018) the market has moved sideways, since Spring 2017 the markets has fallen significantly, therefore over the past 2 years (24 months), there is no spin a bull can apply to say that as an investment (pure investment) your house is making you money. Debt fueled assets which do not appreciate in price are poor investments, again just speaking from an investment standpoint not from utility perspective.

Now if you want to discuss a purchase made from Jan 2015 to Late 2016 as being above water, sure that is a bullish argument which is accurate. Bulls win this one.

Kyle

at 4:17 pm

Basically the market went up like crazy, went down like crazy and has been gradually recovering. Even if you take the month of Dec 2016 vs the month of Dec 2018 (The beginning and end of the last 24 months) Aside: Not sure why you are trying to sneak Jan 2017 in there. It is still UP 2.7%.

It is flat out wrong to say the Bulls have been wrong for 2 straight years.

Kyle

at 4:20 pm

As well, i don’t think any of the bulls or the author typically advocates or talks about residential homes in Toronto as a pure investment. I don’t ever recall anyone on this board recommending people go speculate on houses that weren’t for them to live in.

Kyle

at 4:35 pm

“Debt fueled assets which do not appreciate in price are poor investments, again just speaking from an investment standpoint not from utility perspective.”

If you actually are trying to be objective as you claim (which seems doubtful from your comments), you would realize the only scenario where this statement would hold is if someone bought a property and just left it empty.

If someone were actually buying a property from an investment standpoint they would VERY likely have earned rent on it and would be holding for a longer period than 2 years. So 2 years of little appreciation does not relegate it to being a poor investment

Professional Shanker

at 6:16 pm

If you see value in the cap rates in Toronto over the past 2 years, then I suggest you purchase investment properties – I have run the numbers and at current market rates under a zero price appreciation scenario the yield is close to a GIC.

Detached prices in the GTA are lower than they were on a 2 year comparison basis all the way back to Sept 2016, this is NOT a bullish case, it is Bearish! The holy grail of the RE market (Detached in the GTA) has a lower average nominal value over the past 27 months. Including interest rates/inflation the value loss within detached is ~5% – not sure how objectively you don’t see this at face value.

If you say from 2015 – than you have an argument but for the past 2 years – you are wrong!

Kyle

at 6:58 pm

So after failing to make your point by gerry-mandering the time period, and then failing to make it by only focusing on appreciation while ignoring all other aspects of return, you’re now going to cherry-pick segments (detached GTA houses) of the market that are down, to make your point? I think you need just stop pretending that you’re trying to be objective. The only person you might be fooling is yourself.

Professional Shanker

at 7:11 pm

What point didn’t I make, from a pure investment standpoint, GTA RE on average was no different than an GIC for the past 2 years? I consider that poor, maybe you don’t. Care to debate this, I doubt it!

And my initial point was that GTA RE price appreciation was weak over the past 2 years and that bulls have been wrong over the past couple years. Since late 2016/early 2017 you have been wrong on your price appreciation estimates (2 years!), you have to own that, but you seem reluctant to.

Objectively I am bullish on holding RE long term – does that make you happy?

Kyle

at 7:48 pm

I’ve admitted that my call at the beginning of 2018 was wrong, i’m owning that – but that is…wait for it…1 year ago.

And i don’t actually care whether your bullish or bearish long term, what i’m saying is that time and again you make these absurdly slanted one sided comments and then try to pretend like you’re being objective, when clearly you are not. Why pretend at all, why don’t you just own it?

Professional Shanker

at 10:16 am

Objectively, current market fundamentals point me in the direction of expecting prices to reduce, I own my opinion, right and/or wrong.

This string is going nowhere, there is nothing to own other than we share different opinions. Onwards and upwards we go Kyle!

Professional Shanker

at 1:42 pm

My prediction for 2018 – average of $770k – within 2% of $787k! Nailed the 905 & interest rate increases.

https://torontorealtyblog.com/blog/predictions-2018-toronto-real-estate-market/

______________________________

Professional Shanker

January 2, 2018 at 6:57 pm

All the factors you mention are known headwinds, which is why I give David respect on his #1 prediction – This IMO this is quite a limb to go out on – are you in California enjoying some of that legal sticky icky? Nevertheless this is a bold prediction as I believe the 905 Detached market is in for a speculator sell off in 2018 which will impact the averages. My call is for average prices to be $770k but this is strictly linked to 2 interest rate increases in the 1st half of 2018.

Chris

at 3:23 pm

Well done, that prediction turned out to be very close!

Appraiser

at 7:24 am

Someone’s been reading Garth Turner and plagiarizing. Pathetic.

Professional Shanker

at 9:57 am

When the credit cycle turns, I have a difficult time believing that in the GTA, we can take on much more debt. Not sure why everyone underestimates the macro lending environment and its correlation to property prices.

Good news for bulls though – seems like the hikes will subside this year but is that really a good thing at this point in our economic cycle? Many other potential headwinds possible in 2019 which were not there in 2018……

JG

at 8:01 am

Well done on your prediction! Appraiser salty, what was his prediction?

Appraiser

at 9:56 am

Shanker turns out to be a wanker.

Professional Shanker

at 9:57 am

lol – good one!

Appraiser

at 12:42 pm

Lifting other people’s words verbatim without attribution is wank.

Professional Shanker

at 1:42 pm

I will take your attacks as a compliment – attempts to mindlessly discredit one’s opinion when it was approximately accurate. My 905 knowledge couldn’t be obtained first hand could it?

2019 predictions are right around the corner….

Chris

at 2:44 pm

If you’re going to accuse Shanker of plagiarizing from an online blog, it behooves you to provide the link to the supposedly appropriated content.

Chris

at 3:33 pm

With 2018 officially behind us, I will give myself a bear-pat on the back for my correct call in counter to Kyle’s bullish prediction:

“I predict the following. The market will rebound in 2018 and eventually equal or pass last years peak… I’m talking about GTA monthly average. In 2018 i expect it will retest or surpass the $921K we saw in April.” – Kyle

“I suppose I’m taking the other side of your prediction. I don’t know what is going to happen, but I would be surprised if TREB’s GTA Average Price re-attains the $920k level in 2018.” – Chris

https://torontorealtyblog.com/blog/toronto-newspaper-headlines-tell-whole-story/#comment-80463

Closest we came was $808,108 in June, 2018.

Now to wait and see who triumphs between Appraiser and Housing Bear come summer.

Kyle

at 3:50 pm

Yup i was wrong last year. I overestimated the number of high end transactions there would be. Those dried up and didn’t recover the way i had envisioned.

Chris

at 4:00 pm

It happens. I’m interested to see all the predictions for 2019. I suspect yours will remain more bullish than my views, but unlike some, I won’t blindly assume that because you have previously been proven wrong, you will continue to be for perpetuity.

That being said, I will continue to exploit my bragging rights, at least for a little while!

Appraiser

at 12:36 pm

My prediction is that real estate ownership in the GTA will continue to be a good long-term play, both as a home and as an investment.

And by long-term I mean 20+ years. After all, most of us are going to have a roof over our heads for a very long time.

Most “investors” can’t think past next quarter’s earnings.

Either a renter or rentier be. Your choice.

I made mine long ago.

Chris

at 1:59 pm

I don’t recall anyone here, bearish or bullish, claiming that Toronto real estate is a poor long term investment. Assuming you plan on buying a home and residing in it for 20+ years, then yes, I think most would agree it is a fine investment.

Where most of us bearish types are pessimistic is on a short to medium term timeframe.

Hence most predictions discuss the next few years, rather than the next few decades.

Appraiser

at 2:15 pm

“Toronto can’t build office towers fast enough”

“Millennials are choosing first where they want to live and then where they want to work,” he says, adding that Toronto’s core is diverse, welcoming, safe and fun. “Companies don’t want to be further out, even for cheaper rent in a better building. They need to attract and retain top talent and talent is choosing the core.”

https://www.theglobeandmail.com/business/industry-news/property-report/article-toronto-cant-build-office-towers-fast-enough/?utm_medium=Referrer:+Social+Network+/+Media&utm_campaign=Shared+Web+Article+Links

Chris

at 2:37 pm

Not sure how an advertorial from a real estate services company refutes anything I said above…but ok?

Johnathon

at 11:34 pm

My prediction is Ontario consumer insolvency growth rate goes to 6% from 1% as citizens deal with the new interest rate hikes.

Kyle

at 2:52 pm

I don’t understand this argument at all. So help me out. Bears all say home ownership is a good long term investment, if so then when do you get in?

If you think today’s prices are over-valued (even based on a very long term horizon), then short of a crash, what brings this back to your idea of fair valuation, such that you would be willing to get in? If there is no crash, do you bears just keep paying ever rising rent while you wait for it to come back inline to your ideal “fundamentals”?

If so then you better be damn certain that prices will come down soon, because you’re paying a much higher carrying cost in rent every month to keep that bet on and if prices don’t crash and instead rise then there is a high probability of getting priced out of the market, which many a bear has already experienced.

Personally, I don’t get how that is supposed to be the better strategy. It’s like risking long term pain and loss, to spare yourself from potentially slightly over-paying in the short term.

And if you look at Toronto real estate prices over the long term, many who “over-paid” by whatever percent overvaluation the bears ascribe in the last decade are laughing all the way to the bank. While those who chose not to “over-pay” on a purchase are now paying multiples in rent.

Chris

at 3:21 pm

You’re slightly altering the frame of the discussion. I comment frequently on my perceived overvaluation of Toronto real estate. I don’t comment much on the rent vs. buy debate.

When I have waded into this topic, I am pretty clear in my position. It depends. Depends on the individual, their income and savings, their preferences, their intent to remain in that location, their career, their self discipline to save and invest, and a myriad of other factors. There’s no universally right or wrong answer, and the correct choice for an individual can change throughout their lifetime. My ruminations on over valuation should not be taken as personal financial advice.

I’ve previously said, if someone can afford to do so, plans to reside there for a long time, so desires it, etc., go ahead and buy a home. If you plan on moving in the near future, would be financially stretched, have the self-discipline to put away money and invest in a diversified portfolio, etc., maybe it would make more sense to rent for the time being.

There are countless examples out there of how the math of these decisions shakes out, so I won’t reinvent the wheel. Suffice it to say, much depends on unpredictable inputs (interest rates, real estate rate of return, equity rate of return, frequency of moving, etc.), but there is not a clear cut answer, such as owning wins every time and renting loses, nor vice versa.

Finally, do not make the same mistake as appraiser, in assuming that those of us who are bearish today, were the same who were bearish a decade ago and incorrect. Housing bear has clearly stated he sold approx. April 2017. Shanker indicates on this very same blog post that he became bearish in 2015. To point to people like Garth Turner, who were wrong in ~2006, as evidence that we are wrong today, is fallacy.

Kyle

at 4:53 pm

Fair enough, this aligns with what every single one of the bulls here has been saying all along too – The best time to buy a house is when you’re ready to buy a house (i.e. make sense for you financially, and lifestyle wise). And not try to time market conditions.

And ergo if you’re not trying to time the market and are holding long term, whether the market is over or under valued becomes largely moot. If there is even such a thing as over or under valuation.

That said there are a number of bears on here that have admitted to shorting their real estate (i.e. sold in the hopes of buying back lower later). For them, my questioning of such a strategy still holds. Frankly, the odds they’ve bet on don’t make much sense to me.

Chris

at 8:34 pm

Yes, I think most people commenting here would agree with that first paragraph. There’s a small minority who try to time the market, such as Housing Bear. While I can respect his willingness to put his money where his mouth is, I wouldn’t recommend this course of action to others.

Awhile back, after I brought up headwinds I perceived for the Toronto market, Kramer asked me about tailwinds. Toronto, and Canada as a whole, has a great quality of life, with strong institutions, the rule of law, an educated workforce, abundant natural resources, etc., and as such, I doubt many people would view a long-term investment in the region as a bad idea.

These debates about over or undervaluation focus more on the shorter term. The next 1-5 years, roughly. And yes, they’re entirely moot, because most of us are not going to drastically alter our living situation based on the results. I think we just argue because it leads to some interesting discussions. But at the end of the day it won’t change anything, and none of us can see the future.

JG

at 2:50 pm

And captain obvious predicts the S&P 500 index/US Broad Market Fund/ETF will be a good long-term investment.

Com’on Appraiser, your prediction for 2019 please – this is what this blog post is about.

Appraiser

at 5:38 pm

Why? Is there a prize for being lucky?

canadian pharmacy

at 4:01 pm

General Dope Fro this outcome

B

at 8:14 pm

Thanks for the video of the tree. It is surprisingly satisfying to watch the needles come off with the sweep. Loved it!