Everybody is talking about the upcoming Ontario Provincial budget, and what measures the government will take to “cool the market.”

We talked about this ad nauseam last week, so if you’re tiring of the subject, I do apologize.

But I spent the weekend pouring over data from both Toronto and Vancouver, trying to analyze both markets and see if there are similarities.

According to my data, we are approximately where Vancouver was in November of 2015…

Let me preface this blog post by saying that my crystal ball is currently in the queue at “Fix It Again, Sam.”

I can’t predict the future.

But I can look to Vancouver, a market that peaked, and is now making a comeback, and see if we can draw any similarities.

This is a hot topic, of course, because the Ontario Liberal government is rumoured to be planning a foreign buyer’s tax in Toronto, or Ontario, just like we saw last year in Vancouver.

Whether or not they follow through with this, remains to be seen.

Charles Sousa was quoted last weekend as saying that he would go after “property scalpers,” ie. those that flip pre-construction condos, but made no mention of an FBT.

We all know what happened last year when Vancouver introduced an FBT: their market dropped.

For a period of seven months, the HPI Benchmark for a detached home decreased.

March of 2017 was the first month where the HPI Benchmark increased, and many people think that we’ll see continued increases, with the market gaining back to where it was at the peak in July of 2016, and then some.

An HPI Benchmark is not an average. It’s essentially a “smoother” average, and you can read about the methodology HERE.

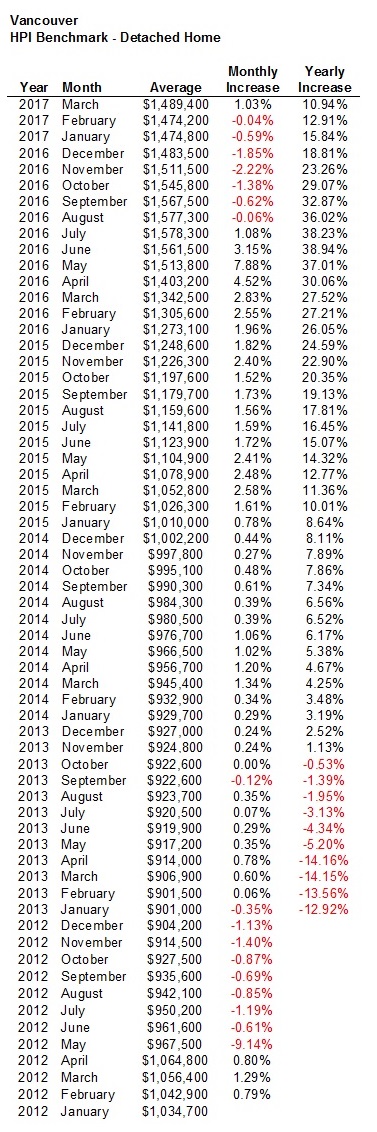

Let’s take a look at Vancouver’s HPI Benchmark for detached homes, going back to the start of 2012:

As you can see, the market hit the peak in mid-2016, when from May to August, the HPI was up a whopping 36-39%, year-over-year.

You might also note that Vancouver’s market dropped in 2012, whereas Toronto’s did not, and that the run-up in pricing in Vancouver was only three years, whereas Toronto’s is twenty-one. But those are other topics, which we can explore later if you’d like.

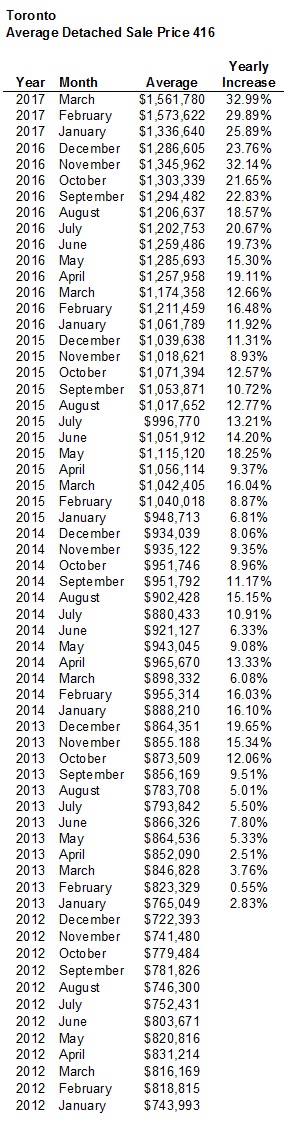

Much has been made of the average home price in Toronto this past month hitting almost 33% for detached homes.

So before I get to Toronto’s HPI Benchmark, take a look at the average detached sale price in Toronto, 416:

I’ve removed the monthly increase, since it’s an average, not an HPI, and there are far more variations.

But as you can see, from September of 2016 onwards, we’re looking at anywhere from 23%-33% in year-over-year gains.

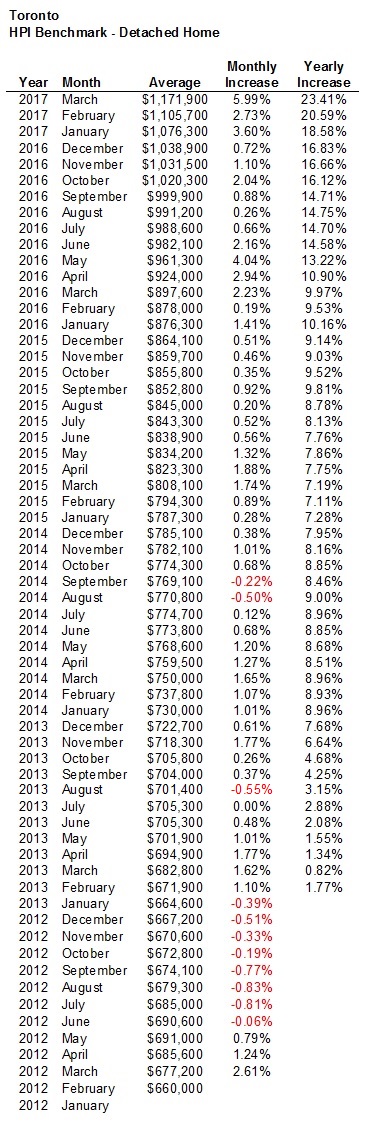

Now let’s look at Toronto’s HPI Benchmark for detached homes, which only began tracking in February of 2012:

The first thing to note, obviously, is that the data is far “smoother” than the average.

But also note that the increases are 10% less for February and March, with the HPI versus the average sale price.

This is important because it shows the market is crazy, but not as crazy as you can make other numbers show.

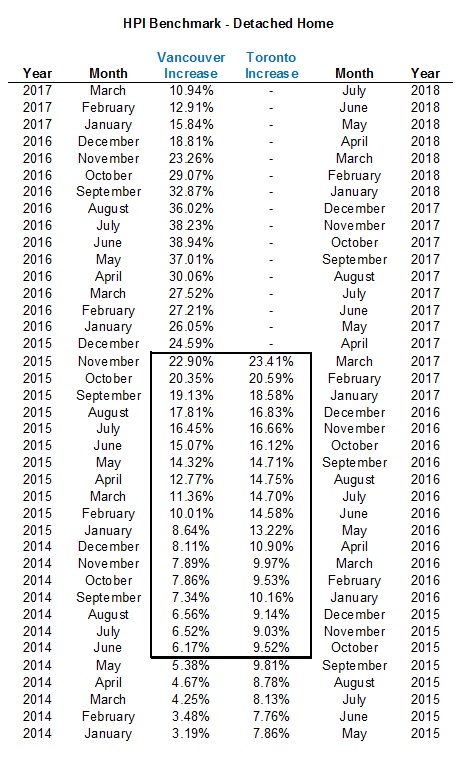

Now in terms of a comparison between Vancouver and Toronto, I propose the following question: by moving the monthly averages up or down, where can we find a similar 18-month pattern between Vancouver and Toronto?

I see it here:

The similarity exists, in my opinion, if we take our recent March of 2017 numbers, and put them up against numbers dating backwards from November of 2015 in Vancouver.

As an 18-month period goes, the numbers highlighted are strikingly similar.

What does this mean?

Well, you are free to draw your own conclusions.

It could mean that the Toronto market should, could, or would start to roll off the peak in January of 2018.

But Vancouver’s peak happened, in part, because of the foreign buyer’s tax.

If Toronto doesn’t introduce a foreign buyer’s tax, you could argue that there’s truly nothing to stop this market, especially given the numbers above.

It could also mean, as some off you will undoubtedly argue, absolutely nothing.

As I said, I don’t have a crystal ball.

But I had a lot of time on my hands this past weekend (who wants to spend time with family when you can put numbers into EXCEL?), and I have a genuine interest in where our market is headed.

I welcome your thoughts…

Boris

at 8:10 am

Interesting anal ysis. It ignores a few facts though – geopolitical events causing capital flows (Chinese capital flows crackdown), the trajectory and expected trajectory of interest rates, and price elasticity differences as a result of supply and substitutable regional markets. I am not saying one thing or the other – that Toronto wont catch the Van style HPA, just saying that there are confounding factors.

Steve

at 8:24 am

Another analysis that can be done is to also look at price of real estate in US dollar terms . You will see that over the last few years , Vancouver and Toronto has not soared as much as people may think if expressed in an international currency

Sevyn

at 9:50 am

I think this actually has very little to do with needs vs wants or supply vs demand. We have been beating this topic like a dead horse for the last 10 years. I think it is purely speculation. My friend and I were on the phone and we said the market now is like the Toronto Blackout in 2002 or 2003 was it? Do you remember what happened? I do – gas stations ran out of gas, grocery stores ran out of groceries, bank machines were down and barbeques were sold out everywhere. People thought the world was coming to an end and we were fighting to get something because we thought there may not be electricity for days. People are thinking they will never be able to buy a home – not that they can afford a home or absolutely need one. Its like an iPhone vs Samsung. I have never heard of a line up for a Samsung phone – only an iPhone which there are many brands of phones to choose from. When something is hot – it is HOT and everyone wants it. In this case, everyone wants to capitalize – whether it be first time buyers, foreign buyers, people who want to upgrade or move up etc. People just want a slice of the pie – doesn’t matter who. And do you not notice all the ‘home’ shows that are on television nowadays encouraging people to buy buy buy? People are lined up for houses on the weekends in the suburbs fighting for a house. If everyone would just calm down and make better decisions and say hey NO I am not doing this – that alone would slow the market down. I call it speculation…. and this SPECULATION is going to continue until the market goes right down. Interest rates will rise and that is when it will become unaffordable. People are stretching themselves too thin just to buy a house. It is sad. Society acts like suddenly its not okay to rent. Everyone cannot possibly buy a home. And believe me the party is going to be over soon!! Just my two cents! Love this blog David!!

Not-You

at 9:20 am

Interesting, but unfortunately the validity of that type of analysis doesn’t go far. Just because the % change in Toronto is similar to an arbitrary point in the past for Vancouver, does not mean that:

a) there is any correlation

b) if there is a correlation, that any of it is explanatory (correlation does not equal causation)

c) we can conclude that Market A will follow the same path as Market B

Saying “these numbers look close to those numbers” isn’t exactly a rigorous statistical analysis of trends and if definitely should not be relied upon for any sort of conclusion about the future direction of the market. It is equivalent to licking your thumb and holding it up to guess what the weather will be like tomorrow.

A

at 7:39 pm

If you actually studied both markets for a while by having your boots on the ground, you did not need David’s analysis to come to at least a theory that Vancouver was the leading market until the FBT.

Sure, comparing two columns is not rigorous stats analysis… but it is still a theory.

It is not inconceivable that these two cities have correlation, despite a time lag.

Real estate millennial

at 9:21 am

real estate is driven by both macro and micro econonomic factors in conjunction with each other so isolating one subset of data doesn’t really do much. To explain pricing and trajectory you’d have to look at the totality of the economics on a local basis, Toronto vs Vancouver. Diversity in employment, migration and immigration patterns, land supply, commute time to the central business district, Aggregate job creation those factors explain value and comparing those elements of the 2 cities would give for better clearity going forward. I know this is a residential blog but those are some of the factors looked at on the commercial side when doing a feasibility report or commercial appraisal. I make that point for one reason, those are the opinions of value in the real estate industry (considered expert witnesses by our courts). I have yet to read a report of the softening of those core elements as they pertain to Toronto. So just continue to watch the price appreciation, I can’t be the only one who is curious to see how high prices can go.

matthew arrigo

at 10:15 am

errrr… in your last graphic, on the furthest right column you jumped March 2017 to April 2018… I think you mean the market will peak in January 2018.

David Fleming

at 10:34 am

Just changed that – much appreciated, Matthew!

natrx

at 10:51 am

Alot of listings in ‘suburbia’ including areas like Scarborough that are priced as if only 30% of total listings are available. Listings are also up 70%. I’m seeing houses sit for weeks now vs almost all gone in a week in Feb/March. The main issue is the amount of stock out there with ‘frozen’ or higher expected pricing. Key desireable markets are hot obviously but I’m also seeing less semis going way above $1 mil. Those who bought just 1-2 months ago I bet are feeling a bit of a regret in those hot, overinflated commodity type housing areas.

Joel

at 11:32 am

I am seeing houses sit on the market, but the ones I see sitting are sellers with unrealistic expectations. On my street there is one that is sitting, but it is listed for $500,000 more than a very similar house sold for about 6 months ago.

Some people are not realistic in their pricing, those who are still sell quickly.

CB

at 1:37 pm

I’m getting sent new listings every day and I’m seeing a tonne of re-listings at materially lower prices. Also seeing developers offloading properties before they are fully completed. I feel the momentum moving in the opposite direction.

Kate

at 11:00 am

Crucial information that is lacking is the effect of the ten year multi entry visas given out by the federal government and the impact on real estate purchases in Canada, particularly Vancouver and Toronto.

A

at 6:56 pm

How would you go about measuring the effect? Even if you can measure if by # of visas granted vs increase in homes sold, you will never be able to definitively determine X when you say the # of visas granted accounted for X% of the problem.

Kate

at 7:52 pm

Why would you not just make it a requirement for all multi-entry visa owners to report ownership/purchases/sales of any Canadian real estate? Doesn’t seem complicated.

A

at 11:25 am

You can, but not every country’s citizens require a visa to visit Canada. Your suggestion would not work if US or most Europeans bought property here.

Kate

at 6:18 pm

So let’s start with just the countries with the visas, given that it’s the effect of the multi entry visa information we are seeking.

A

at 11:31 am

Also, X can send Y to Canada to scout real estate. Y gets a visa but X does not, but X is the buyer.

This is another illustration why, when there is no requirement to get a visa to buy property, tying real estate transactions to visas is flawed.

Kate

at 6:14 pm

It seems to me that any agent (with or without visa) would be responsible for reporting any and all transactions and the name of the purchaser. Again, I don’t see this as complicated and it would give Canadians an idea of the extent to which the multi year entry visa is tied to real estate (or isn’t).

Kate

at 2:24 pm

A good read from the South China Morning Post:

http://app.scmp.com/scmp/mobile/index.html#/article/2089031/home

Jack

at 3:22 pm

Of course I don’t know for sure what happens next, up or down or in between, nor does anybody else. I have noticed one thing though just in the last few months: Some senior people in big banks are worried, and they say so publicly. Which is remarkable, as the banks make large profits from inflated home prices.