A client recently sent me an “investment opportunity” that wasn’t quite on the same level as the Real Estate Wealth Expo with your boys Pitbull and Sly Stallone, but close.

Unfortunately, this opportunity expired some time ago.

And by that, I mean over 100-years-ago. Take a look at this sales brochure, circa 1914, both in terms of the way houses were marketed as an “investment,” but also the prices, the history, and the character…

Do you like generalizations?

Because I’m about to give you one…

I surmise that just about everybody who attended the 2018 Real Estate Wealth Expo two weeks ago knows a below-average amount about real estate.

And most of you reading this right now, know that I’m sugar-coating it…

I just don’t understand how anybody can listen to that nonsense, and think it’s a good idea.

Pitbull? Alex Rodriguez?

Bright lights, fireworks, confetti, dancers, loud music – this is what helps you make an informed purchase decision in one of the hottest real estate markets on the planet.

But what else should we expect?

A sucker is born every day.

Who in the world hears those incessant radio ads about “making money in real estate, without using your own cash,” and thinks there’s no catch?

Probably the same people that put their “used, broken, and unwanted gold” in an envelope and mail it to a P.O. Box from a television ad, for an indeterminate, un-agreed-upon sum of money in return.

Like I said last week, I could write an entire blog on the Wealth Expo, but I don’t know that it would be productive.

Alas, I only wish we could return to a time when marketing “gimmicks” were simpler, and more honest.

So with that in mind, I’d like to show you something.

It’s a brochure, circa 1914 about “Investment In Houses.”

And it’s the coolest thing I’ve seen in a long time.

I’m a huge history buff, especially when it comes to local history, hence my love affair with Toronto’s St. Lawrence Market neighbourhood, where I’ve lived for the last 12 years.

So I was like a kid on Christmas morning when a client sent me this:

This is, simply put, the coolest thing I’ve seen in a long time.

And that’s coming from somebody who isn’t all that cool…

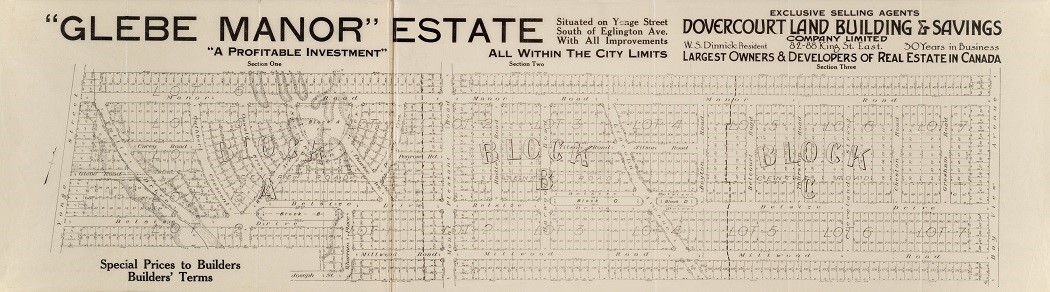

This is a brochure introducing a new development in Toronto called “Glebe Manor Estates.”

If the name “Glebe” sounds familiar, it’s because there’s a Glebe Road in the Yonge & Eglinton area. Except we call this area “Yonge & Eglinton,” or “Davisville Village,” or “Mount Pleasant West,” to it’s appropriately-named neighbour, “Mount Pleasant East,” on the other side of, well, Mount Pleasant.

But when the area was first developed in the 1910’s and 1920’s, the name was “Glebe Manor Estates.”

Here’s the map they provided in the brochure:

You might recognize that as the area bordered by Yonge Street, Manor Road, Bayview Avenue, and Millwood Road.

Post World War II, this was nothing but vacant land, with building lots, severed by the Dovercourt Land Building & Savings, who were the “exclusive selling agents” for both lots and houses.

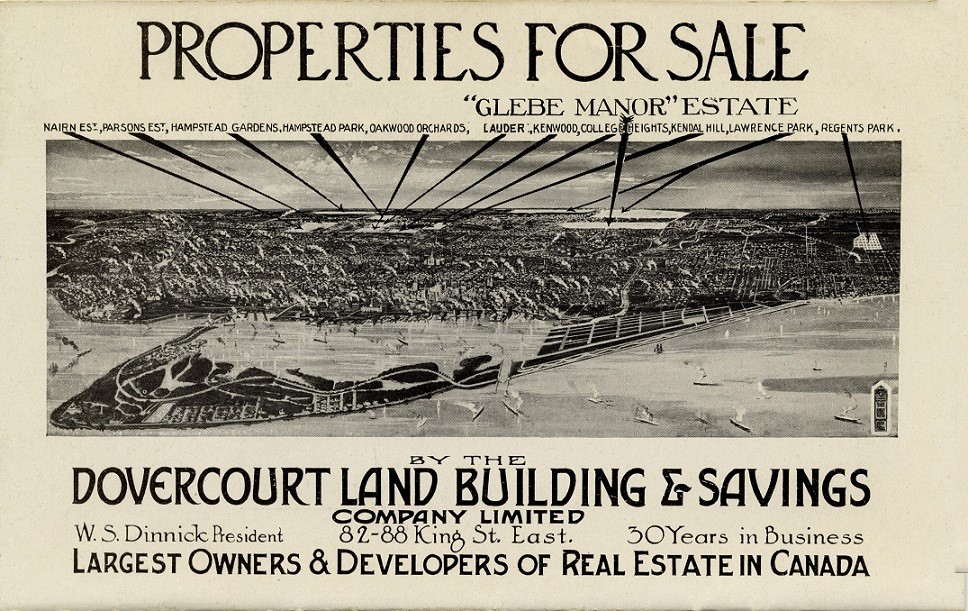

The company had many projects on the go, as evidenced by this awkard attempt at a 3D map of Toronto, taken from the harbour, pointing to their other subdivisions:

They had me at “Largest Owners & Developers of Real Estate In Canada.”

I wonder if that’s like the several hundred Realtors who all claim to be #1?

In any event, the brochure for “Glebe Manor” offered this as the inside leaflet:

How is that for a sales gimmick?

“Exceedingly low prices.”

I wonder if the folks at the Real Estate Wealth Expo would have come to the same conclusion…

And the brochure you see above, some 20-pages, came with this wonderful opening, which I’ll transcribe because the print is so small:

An Introduction To Some Attractive Houses

The houses illustrated on the following pages have recently been built on Glebe Manor Estate.

The property is situated on Yonge Street just north and west of Moore Park District, and a little east of Upper Canada College; within 25 minutes car ride from Queen and Yonge

The illustrations were made from photographs and represent the buildings as they actually appear.

The enclosed plan indicates the artistic way in which Glebe Manor is laid out. Winding streets and Boulevards, Park reservations, an excellent view and pure air, make this property an ideal spot in which to live, affording as it does many of the attractions of country life, with city conveniences. The residences are modern in every detail and the workmanship and material are of the best. If you are in the market for a convenient and attractive home or a safe and profitable investment, one or more of these properties should appeal to you.

The object of this little book is to endeavour to arouse your interest in these little houses some of which are being sold much below their market value. We believe that a little of your time spent looking over some of them will prove very profitable to you. Within the next three months these properties will be quoted at very much higher prices than now asked. The demand for homes in this District will then be at its height. An automobile is at your service. Telephone Main 7281.

That’s verbatim, so excuse any grammatical errors.

–

What I love is this line:

“Within the next three months, these properties will be quoted at very much higher prices than now asked.”

Grammatically awkward, yes. But also the word “quote” as it was used 100 years ago, not to mention the promise of profits.

As for the houses themselves, this is the coolest part.

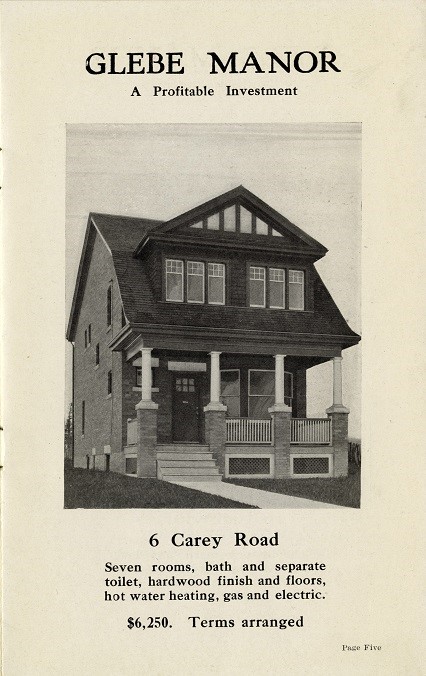

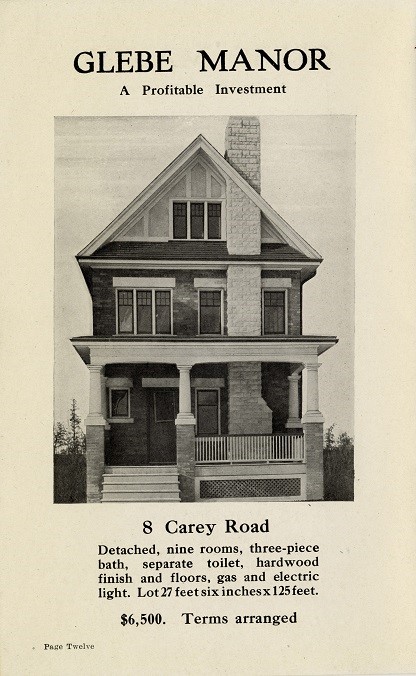

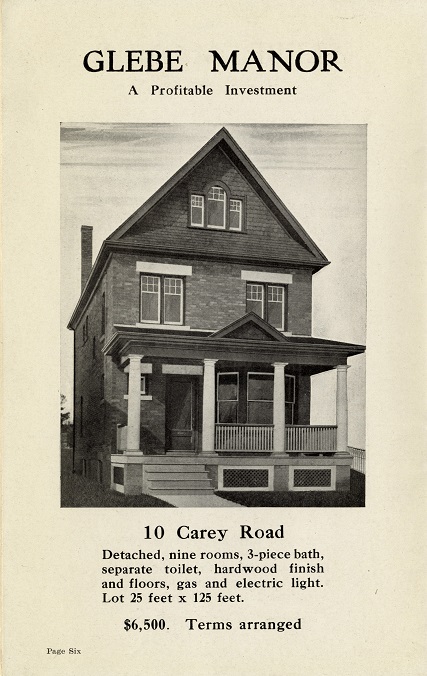

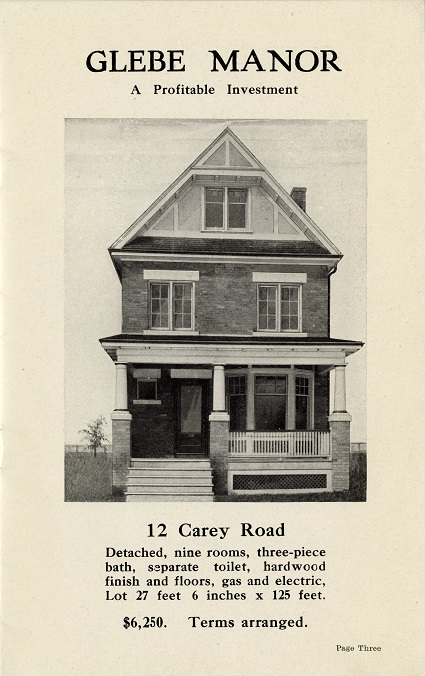

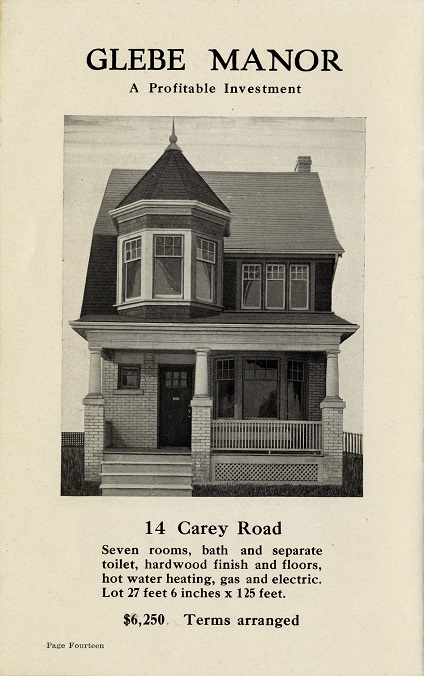

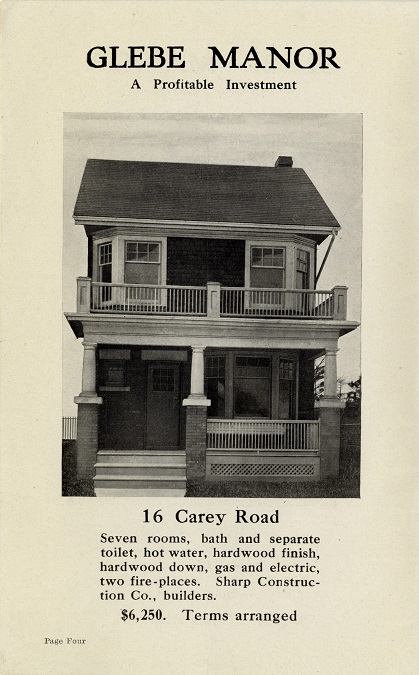

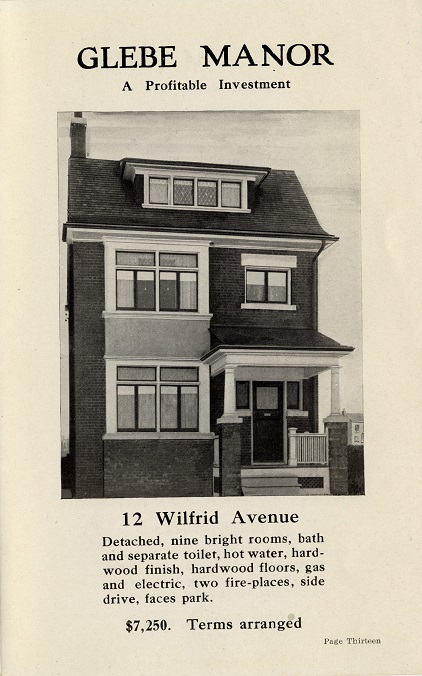

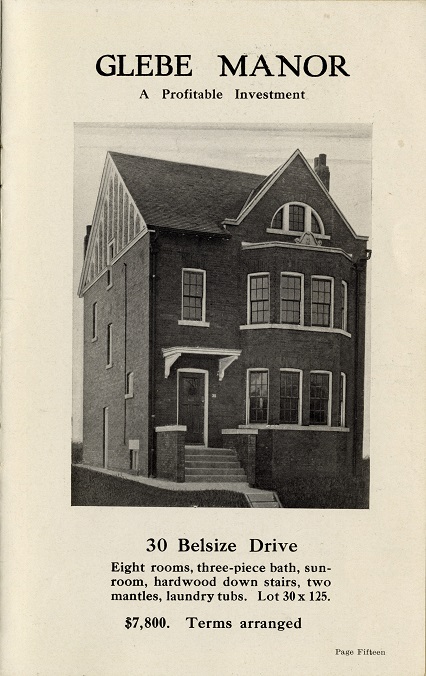

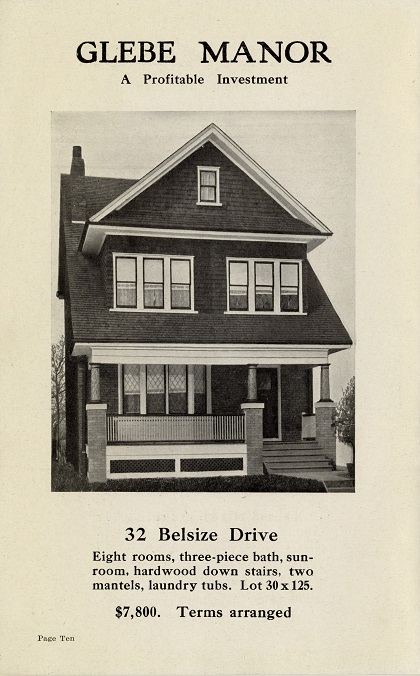

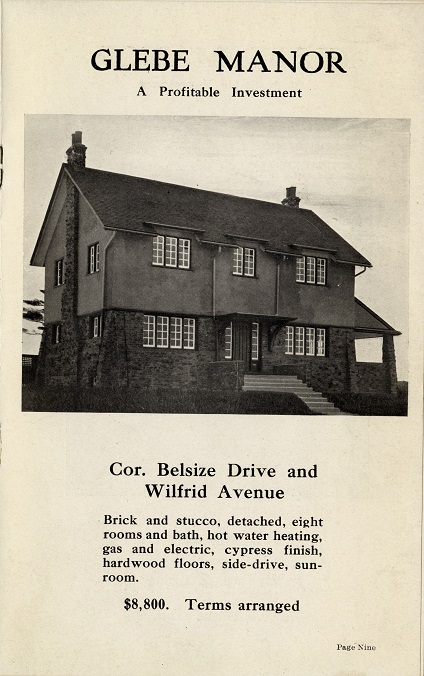

Each of these houses still stands today, so if you know anybody that lives in them, send them the photo:

–

So what stands out to you the most?

The price?

How about the term itself, “Terms arranged?” An old-world way of discussing financing, and back then, I’m sure the buyer dealt directly with the developer.

How about the “number of rooms?” Nowadays, we only concern ourselves with the number of bedrooms, and the number of bathrooms. Back then, each of these houses likely had one bathroom, so the point was moot.

What does “separate toilet” mean? Is that the lonely toilet in the basement that we see so often in 2018 in these old houses?

I love looking at this old stuff, I get such a kick out of yester-year.

Too many things in life make us feel old, so here’s something that should, at least, make us feel young…

Appraiser

at 8:09 am

Here’s a now familiar quote regarding home ownership from the builder W. S. Dinnick, in another marketing piece I found online:

“Who Gets Your Wages, You or the Landlord?”

https://backtothepark.wordpress.com/tag/w-s-dinnick/

Chris

at 8:41 am

~$7,000 in 1914, adjusted for inflation, equates to ~$155,000 today. That price would be quite a steal these days.

Sarah

at 9:12 am

I would qualify with 20% down, to mortgage a house at $155,000.00 (single income). But I constantly find myself debating with my parents generation that I am not saving enough and being diligent enough to “set myself up for success” in terms of buying into the market and owning my own home.

Is it really still a debate for the 50+ y/o crowd that home ownership is not nearly as feasible as it was when they were first entering the market? – It is not fair to expect us (millennials) to move to a smaller market, because that is not where the jobs are. Meanwhile, here in Toronto, I’m making an average/above average income for someone of my age and qualification and home ownership is still not feasible. It is a catch 22.

I’m optimistic that I will one-day be able to enter the market, but seeing the “adjusted for inflation” dollar value of these homes frustrates me as it just further proves the point I have being arguing for the last few years.

Chris

at 9:33 am

It would certainly seem that the younger generations face a more difficult economic reality than the older ones did at the same age.

https://globalnews.ca/news/3360458/ontario-economy-young-people-generation-squeeze/

A

at 3:55 pm

Sarah, I empathize with you. Every generation seems to have its challenges. In your generation, it is the combination of stagnant wages/precarious employment/high housing prices posing the challenge of your generation.

Max

at 8:48 am

David, this is gold! I love how they were flogged as “modern houses” back in 1914. Couldn’t you just imagine the NIMBYs back then bemoaning the newfangled buildings that were popping up all around them? Having said that, these houses have stood the test of time. Still solid and desirable after all these years.

Ralph Cramdown

at 9:12 am

1914 modern = central heat, indoor plumbing. NIMBY, back then, was a braggadocio of the well-to-do explaining where their toilets were.

Ralph Cramdown

at 8:56 am

5.4% CAGR over a period where inflation averaged 3%, so 2.4% real. Basis: 75 Hillsdale E. on 31×150 recently sold for $1.97. Based on the brochure, I figure about $8,000 in 1914. Inflation figure from BoC. That for a redevelopable detached house on LAND over a period encompassing “Canada’s century” and Toronto’s rise from colonial backwater to “world class city.” Not too shabby.

More fun rents, cap rates, financing terms and spruiking (scroll around) from 1891 at https://news.google.com/newspapers?id=zTEJAAAAIBAJ&sjid=XjcDAAAAIBAJ&pg=733%2C2615658

TORONTO JUNCTION REAL ESTATE IS NOT BOOMED! It is advancing, and must continue to advance, owing to the steady and healthy growth of the town and the many improvements which are being introduced.

J

at 10:34 am

From 1914 – 2018 an $8,000 investment in the S&P 500 with dividends reinvested would have grown to over $180 million.

craijiji

at 3:23 pm

Disregarding the fact that the S&P 500 itself wasn’t established until 1957 (it was previously a composite index of stocks which grew over time to the current 500), you can’t actually invest in it…You can invest in ETFs or mutual funds that are designed to mimic the performance of the S&P 500, the first of which was the Vanguard 500 which was introduced in 1976.

TL;DR: You couldn’t invest in the S&P 500 in 1914 because it didn’t exist then.

J

at 3:42 pm

Those are valid points. It’s interesting to note that the process of investing in stocks and bonds has gotten vastly easier and less expensive over those years, while the home buying process has stayed about the same (or perhaps gotten worse).

Free Country

at 10:40 pm

Thanks Ralph, I was going to do the math myself but you did it for me.

I disagree, however, when you say 2.4% real appreciation per year, even consistently over so many decades, is a good return on investment. It is a terrible return compared to the stock market, or a 60% stock/40% bond portfolio. And real estate is of course less liquid than the stock and bond market (at least, if you buy liquid assets). And we haven’t even started to take into account the ongoing costs of owning real estate – property taxes, maintenance, new roof every ten years, and renovating and occasionally gutting it to install more than one toilet, cable, stripping out the knob and tube, etc. etc. Purely from an investment perspective, this is a terrible return. But of course, real estate is different – stocks and bonds don’t put a roof over your head or give you a place to sleep or raise a family.

Condodweller

at 12:12 am

I agree that a rebalanced portfolio would have outdone the RE appreciation however one has to compare apples to apples. If it’s an investment you have to include the rental income which should have more than covered the expenses and increased the return. If you lived in it to raise a family you have to consider how much rent you would have had to pay elsewhere. This is the same question of whether to buy or rent/invest just in the rearview mirror. It would be interesting to know how much one of these houses would have rented back then. The newspaper Ralph linked probably has rentals if it had classifieds.

M M

at 11:45 am

Nice brochure! These are very comfortable houses at the expense of being, at that time, in the burbs.

This area is now home to the most expensive postal codes in Canada, and is also home to some of the nastiest NIMBYs is Canada. They have repeatedly fought any density near Lawrence subway station.

hoob

at 2:59 pm

So who’s gonna go on Google Street View Archeology and try and find one of those house models still standing?

Sarah

at 3:06 pm

I did. They are.

hoob

at 3:12 pm

43 Cuthbert Cr is still there: https://goo.gl/maps/1pYiYYTTiuw

30 Belsize Dr is still there: https://goo.gl/maps/iz3ZuZPgAb42

32 Belsize Dr is still there: https://goo.gl/maps/Rkz1miDBfW32

10 Wilfrid Av is still there: https://goo.gl/maps/tXUsY3iZDWS2

12 Wilfrid Av is still there: https://goo.gl/maps/CNXfF7Kc2pN2

Carey Rd block are still there: https://goo.gl/maps/f5tkbgio19J2 and https://goo.gl/maps/VKG1r37aXYT2

Sardonic Lizard

at 4:44 pm

We know that in Canada real estate has become the opiate of the masses. If I had a time machine, I’d go back to 1914 and buy all those houses, then reap the benefits as the masses devoured my overvalued properties in 2016 and 2017.

Steve S

at 11:01 am

Fun article David! Those were the days.

Don’t want to be nit-pickey, but I believe there were buildings in the area post WW2 ( almost old enough to remember, unfortunately), but probably not post WW1.

GetReal

at 4:39 pm

Those were “the days” for what, exactly? White privilege?

Alistair

at 1:02 am

there’s no white privilege around you when everyone else is white. lol.

btw white is derogatory, they are just people from Europe

downtown

at 12:27 pm

I’m pretty sure “separate toilet” means that the toilet is in a separate room, right next door to the sink/shower/bath. When there’s only one toilet in a house, it’s easier for a family to get ready in the morning if those rooms are split, since one person can shower while another person uses toilet.

Condodweller

at 12:17 am

That’s a cool article for sure. It’s amazing that this suburb was a 25 minute “commute” back then. This reminds me that Queen street used to be the north border street of Toronto, err…was it York back then… and the gates in front of Osgoode hall were there to keep the cows out. Fascinating stuff.

Squidward

at 12:02 pm

Here’s a “sales office” at the south-west corner of Yonge and Manor from 1922.

https://gencat.eloquent-systems.com/city-of-toronto-archives-m-permalink.html?key=100654