I wanted to call this blog post, “Woulda, Coulda, Shoulda,” but by the time you finish reading it, you’ll be sick to your stomach. And any wishful buyer out there, upon seeing what I’m about to show you, will only conclude that I’m a sadistic ass for rubbing, “Woulda, Coulda, Shoulda” in their face.

But I’m not though. I’m just pointing out facts.

However, buyers are so on edge out there right now that one could easily conclude that the following is meant to hurt rather than help. I suppose I’m in no position to tell a buyer how he or she should feel.

Having said that, I want to make a claim that is going to have shock value, be met with cynicism, and instantly encourage a conversation about a market correction.

Ready?

Every property in Toronto is worth 10% more today than it was at Christmas.

And just like that, cue the critics.

But how can anybody take that at face value?

To see a stock move up or down in value with that level of volatility is quite common. But a house? A condo? And in only one month? No way!

Speaking of the stock market, what a month, eh folks?

Free coffee to whoever can tell me which stock this is, without reading further below:

Yeah, that’s what we could call “a real doozie.”

From a peak of $700 per share in November and down by 50% last week.

Netflix has fallen on some hard times!

Experienced investors know that this stock will come back. How long? Twelve months? Twenty-four months? I would bet that the stock trades above $700 once again, but the question is: will amateur investors wait?

Of course not!

Who wants to wait two years? Especially when the DOW starts to rip again in February or March, or whenever we see a comeback.

Amateur traders who get crushed by the market all do the same thing: they try to trade out of their position.

Say what you want about the real estate market, but houses don’t decline in value by 50% inside of two months.

Then again, they can, it seems, increase in value by 10% in a month. Or more.

You think I’m kidding, don’t you?

You want evidence, you say?

Alright, let’s start with something very simple just to highlight how frenetic the real estate market is.

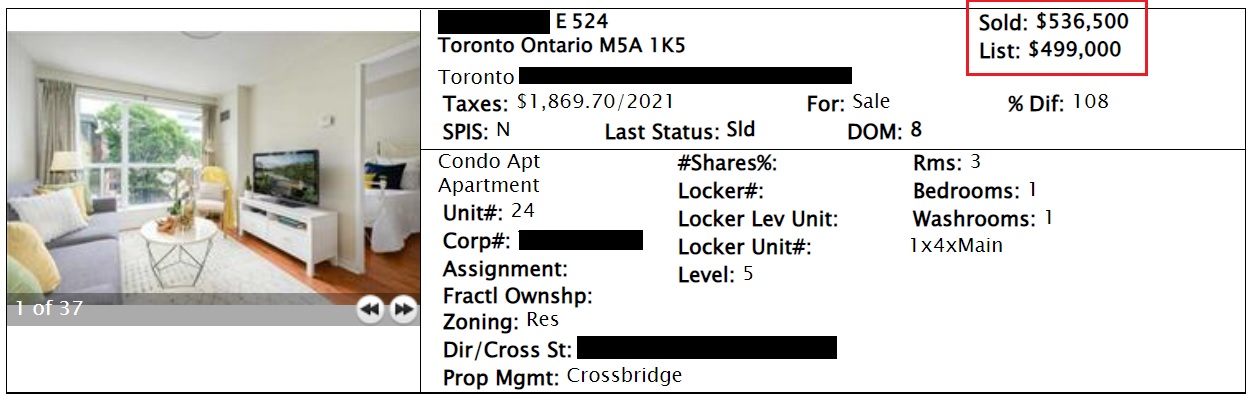

Here’s a condo that sold at the end of July, 2021:

Nice place, nothing special. Just a run-of-the-mill unit in the summer.

It’s very, very rare in real estate that we move from theoretical price appreciation to actual price appreciation inside a short window, since people don’t trade real estate daily, weekly, or monthly like they trade stocks. But it just so happens that this condo sold again last week. Who knows why the seller held it for less than six months, but in any event, here’s the recent sale:

That’s a $68,500 gain in less than six months.

Or 12.8%.

Or an annualized appreciation of almost 26%.

So when you see stats saying, “The average Toronto home price increased by 25% last year,” and you want to think that this is some sort of seasonal bias, rounding error, or inflationary exaggeration, just look at that sale.

Then again, I haven’t even begun to show you what’s happened in only the last month…

When I say, “Prices are up 10% since Christmas,” I’m not exaggerating.

And if I added, “Some houses are up 30% since November,” you’re going to merely assume this is impossible.

How can a house price increase by 30% in two months?

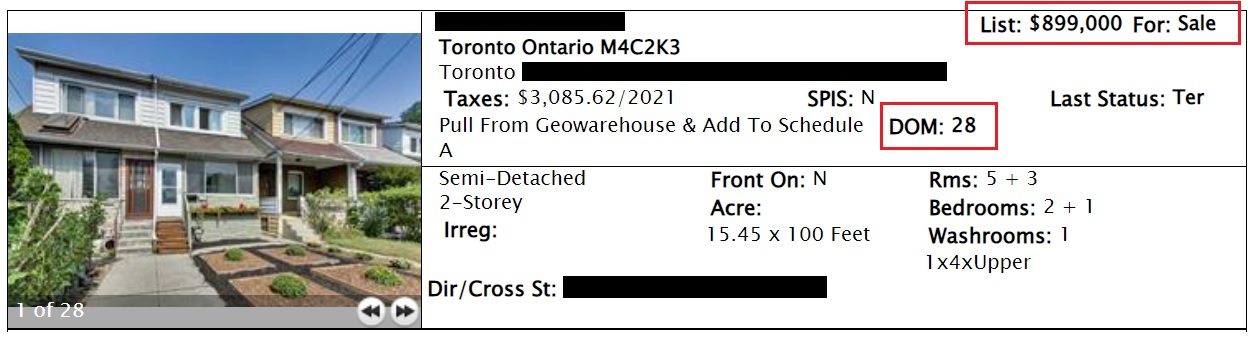

That’s a topic for another day, with reasons ranging from low supply to increased demand, but just have a look at this listing:

This property was on the market in October and it didn’t sell.

On the market for 28 days for $899,000.

Now, let’s say you’re a potential buyer for a property that’s been on the market for 28 days. You’re probably thinking you can offer under the list price, right?

Maybe these guys wouldn’t have sold for $850,000, but I think it’s quite reasonable to assume that after being on the market for 28 days at $899,000, they’d have taken $875,000. So let’s just say $880,000 in November, and it’s a deal.

So what would that property sell for today?

I said that prices are up 10%, so add $88,000 and we’re at $968,000.

Would this house fetch $968,000 today?

Well, I did say that prices are up 10% since Christmas, and this property was on the market and terminated October/November.

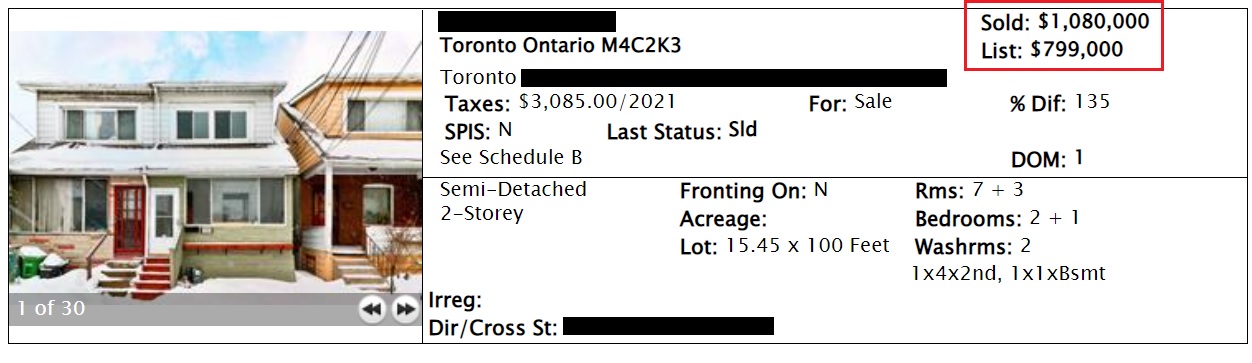

Last week, this property was re-listed for $799,000 with an offer date.

Different agent, same photos, although they did magically find a second bathroom (the old 1-piece in the basement, which is likely a cold, lonely single toilet next to the washing machine…), but it’s the same house, folks. Make no mistake.

At $799,000 this house received an ungodly number of offers and sold for an insane price:

$1,080,000.

That’s $200,000 more than we figured this house woulda, coulda, shoulda sold for in November of last year when it was languishing on the market for 28 days at $899,900.

For those playing along at home, that’s 22.7% higher in two months.

As I said at the onset, active buyers don’t want to see this! They feel sick to their stomachs just thinking about this concept of “hindsight.”

But that’s the funny thing about hindsight, right? You always feel like you should have seen it coming…

Remember when the pandemic began in February of 2020 and we all started using Zoom? How come we didn’t pour all our money into that stock?

The entire world started using Zoom!

Who among us took our entire net worth and dumped it into this stock?

Trading at $68 to start 2020, the stock was at $75 when the pandemic began.

By the end of March, the stock had doubled to $150.

By May, the stock was over $200.

By the end of the summer, the stock was over $300. Have a look:

Hindsight!

But how come didn’t all see this coming? It was so easy, right? We’re in a worldwide pandemic and “social distancing” is the new phrase on the tip of everybody’s tongue, and our method of communication was going to change.

So raise your hand if you took your whole nest egg and bought Zoom at $75 per share?

Thought so.

That’s the thing about hindsight…

In the 2022 Toronto real estate market, hindsight is this magical thing that seems so obvious after the fact, and yet we all continue to stand around with our feet encased in concrete.

Case in point, this nothing-special listing:

This property was listed for sale in December, remained on the market over Christmas, and was still on the market when January began.

It was tenanted and the photos were of a vacant unit, so when the property came out last week, it wasn’t exactly the same. But the asset itself – the property, was the same. Just nicer photos, cleaner, and without people living there.

So again, we ask, “What could we have bought this property for around Christmas time, having been sitting on the market for four weeks?”

Listed at $599,900, maybe you could have negotiated down to $580,000?

Sure, let’s go with that.

So when the tenant left in January, the unit was re-listed for $569,900 with an offer date.

A member of my team showed the unit and her client was interested.

Knowing that this property was on the market for $599,900, unsold, and that it could have been had for $580,000 before Christmas, what did we think now? What did we offer in the third week of January?

$620,000.

A “bully offer” for $620,000, which was $20,000 more than the property was priced at when it was terminated after 38 days on the market, and $40,000 more than we felt it could have been bought for at Christmas.

Tough one, right?

To pay $40,000 more in the third week of January than this property was “worth” less than one month earlier?

The listing agent said, “Thanks, but no thanks,” exactly as expected, but we had to take our shot. There’s a chance that the seller, who was unsold after 38 days on the market at $599,900, would have loved to see $620,000, unconditional, with a deposit cheque in hand. But any seller who is actively watching the market right now (and that’s easier said than done, trust me) is going to know that really truly, the sky is the limit.

Up, Up, And Away!

Offer night came along and this property received 28 offers.

What did it sell for?

Hold on to your lunch…

Unreal.

$700,000 for a property that was listed for $599,900 only three weeks earlier, which we think could have been had for $580,000.

That’s a 21% increase since Christmas.

What was it that I said at the onset that likely made many of you chuckle in disbelief?

Oh yeah, this:

Every property in Toronto is worth 10% more today than it was at Christmas.

Well, many of you thought I was wrong, and in that, you’re right.

Except you’re wrong about how I was wrong, because some properties are worth more than a 10% bump since Christmas.

So relax, we’re both wrong.

But folks, to quote Randy Bachman…

You ain’t seen nothin’ yet

B-b-b-baby, you just ain’t seen n-n-n-nothin’ yet

Here’s something that you’re never gonna forget

B-b-b-baby, you just ain’t seen n-n-n-nothin’ yet

Nothin’ yet, you ain’t been around

Because here’s something you’re never going to forget, and I mean it.

This is the part where the alarm bell goes off.

I mean, if the alarm bell isn’t sounding about a condo that sells for 12.8% more in January than in July, and if the alarm bell doesn’t sound about a house selling for 22.7% more two months later, and if the alarm bell doesn’t sound about a condo selling for 21% more since Christmas, then we’ve set the bar really, really high. Or low. I don’t know which…

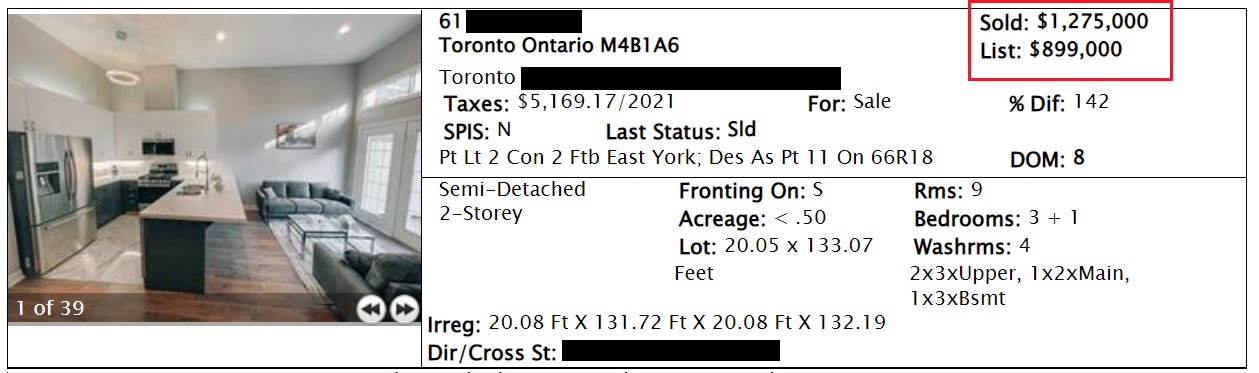

Check out this listing:

Nothing special.

In fact, to be on the market for 26 days and sell for a whopping $99,000 under the list price, clearly this type of real estate isn’t so hot, right?

This property sold last fall and was scheduled to close on February 5th, 2022.

But on January 18th, 2022, the property was re-listed for sale.

How?

As an assignment of the existing agreement of purchase and sale.

We see this all the time with pre-construction condos but almost never with houses.

In fact, I don’t know if I’ve seen this before in the last decade.

So what does a $900,000 house from November sell for in January?

Um, this:

Exact same house, no difference although these people magically found another bathroom, but let’s leave “typos versus misrepresentation” for another day.

Somebody paid $900,000 for this house, was scheduled to close on February 5th, and sold it for $1,275,000 on January 27th. It’s now scheduled to close on March 18th.

That’s a $375,000 profit and they never took possession of the house.

They also never paid land transfer tax.

But do you think they’ll pay capital gains on their $375,000? Topic for another day as well, and boy, are we ever racking up future topics!

This person made a 42% profit on their purchase in three months.

However, assuming all they did was provide a 5% deposit when they bought for $900,000, then that $375,000 profit is calculated based on their 5% deposit, or $45,000.

Their profit is thus 833%.

In three months.

Up, Up, And Away!

This market defies logic, folks.

Cue the talk about the market crash.

Oh, hey, what happened with interest rates anyways?

Bal

at 6:52 am

David – you don’t think there is anything wrong the way prices are going up? do you find all this normal? Just curious…I don’t think this market is healthy….i think balance is needed.

Even if there is no interest rate increase….still market need some balance…..

David Fleming

at 9:05 am

@ Bal

There is nothing healthy about this market.

If I sounded excited in this post, it’s because I find the data fascinating.

The better question is: how did we get to this point? The media loves to “blame” and they’re usually wrong, but do we want to play our own version of that game here today?

Bal

at 10:41 am

Don’t know who is playing the blame game…but I think it is all about buyers Psychology….for some reason buyers feel now or never….furthermore now everyone want investment property.

For some reason i think downtown Toronto Condo market is still down…Everywhere else Condo market picked up…even in Milton condo sold for more than million..

JL

at 5:07 pm

David – glad even you see there’s a problem with 20%+ per year (or month over month!).

I’d actually be more interested with “how/when does it end?”, which I touched on further below. I think you’ll get broad agreement from the group on the drivers (rock bottom low interest, generational wealth transfer, low supply, growth in dual income, population growth, etc, etc) but unless there’s an additional funding source that I’m not aware of, this can’t possibly go on forever, can it?

Appraiser

at 9:21 am

Zoom -Zoom!

At this point I am willing to wave the white flag. I would welcome a correction.

Do I think that one is in the offing?

No.

Bal

at 10:28 am

LOL@ white flag….

Shocking

at 9:25 am

You know those scenes in a movie where the character just snaps and loses all touch with reality? Similarly, the Toronto housing market seems to have reached that point.

In a neighborhood in North Toronto for the past four or so years you could get a nicely finished semi for around 1.5-1.7 million leading up to this past Christmas. One week ago one just sold recently for almost 2 million, which I am sure is at least $250k more than one in that condition has ever sold for.

I don’t see how this is healthy at all when 1400 sqft semis are selling for $2 million dollars. I wonder what kind of neighborhood this will be like in ten years when no young families can move in and we are unable to move up or out.

What I will be really curious to see is if this price is sustainable when a bunch of similar semi’s hit the market this Spring….

Lauzy

at 9:41 am

It seems to me that buyers are pricing in annual 15 – 20% appreciation into their offer prices. They figure if it’s gonna be worth that much in a year, they might as well offer it now.

Sirgruper

at 9:27 am

On the assignment are they paying HST on the deposit. Are they paying LTT on the higher consideration. Is the profit capital gains or income. Almost the whole industry is getting the taxation of assignments wrong and CRA is checking and reassessing.

Did they rise in January or were they on sale in November and December? Probably both.

Did not have Zoom or anything like it save Zentek but that was pure luck and barely fits the category. At least I didn’t sell when stocks drop. I prefer the ostrich approach and don’t look at statements until things get better.:)

Appraiser

at 12:34 pm

CRA has been scrutinizing assignments and “flips” very closely for at least a decade now. They will consider the transaction an “adventure or concern in the nature of trade” and the proceeds fully taxable as personal or business income, unless you can prove otherwise.

As first described by the SCC in Friesen (J.) v. Canada: one of the requirements of the above definition is that the transaction in question involves “a scheme for profit making”.

Ed

at 9:32 am

That first example you showed us is two different units. The first sale was unit #524 and the second was unit #824.

Suzanna

at 3:25 pm

Noticed the same, two different units #24 and #22. It’s not a “quick resale” at all.

Rosie

at 1:46 pm

Also the assignment is peculiar. The kitchen has been renovated and an additional basement kitchen has been added to make it a rental. So its not quite comparable to a condo assignment. My question is how do the renovate before possession?

JK007

at 9:54 am

was having an interesting chat in my college alumni grp last week where the younger lot was discussing moving out to NB, AB etc just cuz they can’t afford home ownership in Ontario and with remote work being the norm they didn’t see an issue moving away to some these places. i am sure there would be some correction on the back of some sort of dramatic govt announcement to tamp down demand and probably prices will drop by 10-20% but with where the are already don’t think they are going to 2020 levels..

Alexander

at 11:01 am

There were 2 missed opportunities in Canada to stop this crazy market from happening – Bank of Canada should have started to hike rates slowly in the fall and OSFI could have come out with some temporary ideas increasing stress test in November-December when Tiff Macklem did nothing. I did not see any effort to cool it from government and banking side. Quite the opposite. It is so obvious that I do not have to question it any more – it is just a cartel when each party is looking after each other and Canadians are paying more taxes and fees to the government and banks through inflated house prices, transfer taxes and mortgage payments. Banks are increasing their housing portfolios with variable rates that are posed to rise after spring market are over and government will come to the rescue and cool down an overheated market with their April budget innovations and squeeze a little ( or not ) bit of extra tax to cover for all helicopter money that they are throwing last couple of years. Tax and wealth creation in simple form.

Alexander

at 11:08 am

And when young professionals are talking about moving somewhere else – so true. My tenant couple – engineer and doctor – decided they had enough and moved to US last summer. My daughter’s friends are discussing it quite openly as they can not afford to buy a property in GTA and around. US and Europe are the option.

Bryan

at 11:18 am

This market is not at all healthy….. but my guess is that in the short term (ie spring), it is going to be sustainable.

Every time I have seen the Toronto market really explode in the last 10 years or so (namely 2017 and pre-pandemic 2020), it is when all market segments grow at once. Condo prices go up and the people living in condos take their price gains and use them as down payments for bigger properties that they can now afford, driving up the prices of townhouses and semis. The people in the townhouses and semis then do the same thing driving up the price of detached houses and suddenly the entire market starts posting %20+ year over year gains. Those market wide gains eventually lead to big time coverage from the media, generating FOMO among those who were on the fence about jumping onto the bottom rung of the property ladder (or moving up the property ladder)… in turn increasing the buyer pool and perpetuating price growth (and then more media coverage, and then more buyers etc). Such is life when supply is so tight at the best of times…

To me, the key market predictor in this case is condo prices… and boy oh boy. I was gawking the other day at prices in a specific building on the waterfront (sure, it is a small sample). For units listed in 2021, every 1 bedroom that sold went for between $550k and $650k (13 sales), and every 1+1 went for between $720k and $820k (8 sales). Setting aside the fact that 2/3 of a million dollars just “feels” like way too much money for a 20 year old 500 sqft condo, those deals look like steals in hindsight. This week, 2 units went up for sale in the building. Both are rather pedestrian 1 bedrooms with 1 for sale at $780k(offers any time) and another for $690k (holding back offers). Buckle up….

Keith

at 11:59 am

Thanks for sharing David, and it’s another reminder that the affordability question will resist simplistic ineffective solutions. It puts paid to one sentence solutions – permit faster, tax foreign buyers, tax speculators, add supply, raise interest rates. This is a secular market trend.

When I was growing up, before David was born real estate was not that popular an investment. Most working and professional middle class people had pensions and savings. Interest rates in the seventies and eighties offered a rare real return, CDIC insured. The middle class was all about saving, and putting your money into guaranteed instruments at 7 – 18 percent. Buying investment real estate, and buying a job of dealing with tenants was the route of successful new Canadians, who had a hunger for land ownership that was different than people born in Canada.

Today’s middle class has figured out that owning real assets, at preferential tax rates is the way to go. The stock market doesn’t have a record of widespread, middle class success in terms of consistent profitablility – whether people do it themselves, or work with a broker it’s quite difficult for most people to learn how to make money in the stock market.

Real estate is relatively easy to understand, it’s a big market and financing is more accessible than any other class of investment. Canada remains attractive on a global scale and Toronto will always be the number one destination for students and new Canadians. Every time we have a financial crisis, people with professional jobs, investments and assets keep coming out ahead, while lower income people take the hit. About twenty percent of real estate transactions are for investment purposes, that wasn’t the case twenty five years ago or more. This trend is not going away any time soon.

Libertarian

at 12:37 pm

One small point where I disagree is the properties that had been on the market for weeks – David thinks they could have sold for less than listing (logically, that makes sense, at least in the old days), but I think these properties didn’t sell because the sellers wanted a very high price. So they waited until the new year and got their price.

Therefore, I don’t think it is accurate to calculate the rate of return on the supposed price.

Jennifer

at 1:31 pm

totally agree. highly unlikely that house would have sold in the 8s.

Mxyzptlk

at 2:29 pm

Yes, I absolutely agree as well.

Kyle

at 1:00 pm

The current prices are a reflection of scarcity. The quicker the Province acts on the draft report from their Affordability Task Force, the sooner relief will come. In the report there are some significant recommendations that will help turn Investors into suppliers of housing rather than demanders of it. Such as allowing 4 units per property and raising maximum heights to 4 storeys as of right, eliminating development charges for infill, reducing approval times, and eliminating approvals to convert vacant properties to residential.

Appraiser

at 4:33 pm

Hear hear!

Joel

at 10:09 pm

Allowing 4 units per property is only going to increase the price of the properties. These only allow those with property to leverage and buy more property increasing prices.

Take away capital gains for real estate investments and tax as income as of Jan 1st 2023 if you want to see thousands of properties come to market and investor demand dry up.

Don’t allow HELOC’s or refi’s to fund down payments on investment properties and most will not be able to fund n investment property.

Plenty of easy changes can be made that would actually reduce the values, removing zoning will just increase the value of what is there.

Ryan

at 11:56 pm

Bingo!

Kyle

at 6:56 am

I disagree, i think you’re looking at it too narrowly. The biggest complaints today, are that prices are too high across all property types, and that there aren’t enough suitable properties for families (i.e. the missing middle).

Allowing 4 storeys and 4 units addresses both these concerns, by effectively enabling more rungs on the property ladder between 2 Bdrm condos and SFH.

So you’re right that some of the big detached homes, suitable for converting to 4 units will become even more expensive, but they are already unaffordable to all but millionaires already. And let’s face it they will continue to get more expensive whether these rules come in or not. Instead what you get in return would be:

– many more net new units in established neighbourhoods (i.e. good locations)

– more apartments, which moderates rents

– moderating of condo prices, since Investor demand will be down

– more 1- 3 bedroom “flats”

– more 1- 3 bedroom fully detached laneway and garden suites

– overall much more flexible and varied housing options, that work for people’s lifestyles whether they are singles, couples, families, co-buyers, multigenerational situations, etc.

Bryan

at 12:47 pm

I think to a large extent you have identified one of the largest issues in real estate right now…. and I am not sure why it isn’t something people are talking a lot about. There are not enough rungs on the ladder, and that has led people to use condo investment as a way to bridge that gap.

I picture a 27 year old that had a good job at one of the big 5 banks who scraped together enough to buy a 1 bedroom condo for $500k($50k down, say) in 2016 and is now 32 and living with a significant other in that same (now too small) condo. Even if their $500k condo has appreciated to $700k and even if both of them have good paying jobs, how do they afford the $1.2-$1.5M townhouse or semi that they want to start a family in? The ~$250k in equity(less fees) doesn’t make much of a dent as a down payment, and even if they can qualify for the $1.3M mortgage they will need to come up with ~$6400 a month for it. Just paying the mortgage would account for an entirety of a ~$110k/year before tax income….without accounting for any utilities, living expenses or renovations etc. So what is a young couple to do? They buy a bigger condo to live in, keep the one they have and rent it out…. in the hopes that this will get them to their “dream” semi. They still have $1.3M mortgaged, but they have a tenant paying $2,200 of that $6,300 monthly mortgage so that can survive.

It’s very easy for people to say “investors are hurting the market”, but I don’t think this is the type of person people typically picture when they talk about investors (thinking maybe Scrooge McDuck?). Sure there are Scrooge McDucks out there(and perhaps we should address them), but what is really driving the growth in the investor segment is the BOATLOAD of people who are using condos as a way to invest money to move up the real estate ladder. They are the young couple in the example, they are a 40 something couple with 2 kids looking to move into a detached house from their 3 bedroom semi in greektown…. or maybe they are even parents of a 15 year old wondering how on earth their kid is ever going to be able to buy anything so they purchase a property as an investment for them. All of these types of people “hurt” the ability of the poor souls trying to get on the bottom rung of the property ladder without help, but I struggle to see them as the “villainous investors” that many make them out to be (other than Scrooge McDuck of course). Adding rungs to the property ladder as you suggest, could mean that young couple doesn’t need to have 2 properties and can instead find something in the $1M range that fits their needs for now. The 40-something couple with 2 kids maybe doesn’t need to invest in a condo if there are houses that fall between a $1.5M semi and a $3M detached house. Coupled with an increase in purpose built rentals to slow down rent price growth(and the ability of investors to remain cashflow positive amidst rising prices), and I think the investment “problem” will burn itself out and reach an equilibrium.

Kyle

at 1:21 pm

I think that’s a really good point, about who is now being called an investor. 1 in 5 buyers are being called “investors” because they fall into the category of already owning a property, but i think you nailed it on who these new investors are. They aren’t professional landlords with 40 doors or BRRR’ers. I think they’re folks who kept their condo when they moved up or people locking in a place for theirs’ or their children’s future.

If you give this crowd alternatives to just accumulating more real estate to meet their goals, their behaviour will likely change in ways that reduces demand from them while increasing supply brought to market by them.

Average Joe

at 4:37 pm

At this point everyone has figured the game out. Local government will do anything to prevent building supply. Federal government wants a population of 100 million. The central bank is expanding credit basically forever. The regulators don’t want to be involved and risk their job or private sector opportunities.

JL

at 4:58 pm

I’m on this topic often, but I’m still curious; where/how does the party end, or at least at what level does it stop? Yes, I know its not crashing down or correcting ever (as the RE optimists frequently remind everyone) but should we really expect 20%+ per year for the next decade, and if so, where’s the funding to fuel that growth coming from? (once you’ve squeezed double income, family support, 0% interest, existing equity, etc all to their limits)

Joel

at 10:12 pm

It stops when people can no longer afford. the entry level. No one can buy a 1 bed for $1 million, then no pressure to drive up the condo market and no pressure to push up the semis, then the detached.

The money has come from the increase in values in the condos, that money is put into the semi’s then driven up to the detached. When you need 200K saved to buy a condo, the party ends as there is no longer 5 buyers for every cookie cutter condo.

Bal

at 6:34 am

not everyone start with condo….this is not a true logic…..some people start with town semi or detached ……I don’t think jump from condo to townhouse is easy anymore….before pandemic…there was only 200,000k price difference between condo and townhouses….now 600,000 or in some cases even 700,000k…so if condo is 700,000 then next townhouse is 1,400,000….so life is damn tough…..price gap is widen between condo to townhouse….so either Condo price need to increase or townhouse price need to decrease ….

Condodweller

at 12:19 am

@Bal Using this logic should drive up condo prices even more since all the people who used to be able to afford a semi, are now stuck with a condo, albeit maybe a larger one.

As for the question of when the party will stop: when the money runs out i.e. people can’t afford to pay millions for SFH. As we discussed in the past, there is tons of money outside Canada coming in and they can still afford these prices. It’s just that local Canadians have little chance to compete. It’s getting to the point where you have to be independently wealthy to buy a SFH in the GTA.

Sirgruper

at 8:21 am

David and readers

Look at the listing for 23 Myrtle Ave. This will be a good test if there is still a house under a million left in the old City of Toronto. Decrepit row house by the tracks. Also a good reason to have investors in the market place. Under or over?

GinaTO

at 6:12 pm

The stuff of nightmares. Just when I thought it couldn’t get worse, they’re a photo of the bathroom…!!!

Mxyzptlk

at 2:39 pm

As someone who lives near Broadview & Danforth, I follow the Playter/Riverdale/East York RE market pretty closely via HouseSigma. And I hate to say it, but I’d be stunned if this listing doesn’t sell for more than the $749,999 list price, perhaps substantially more. Sure hope I’m wrong, though.

Ed

at 2:34 pm

For those who have access to HouseSigma.

25 Sealcove Dr, Etobicoke.

https://housesigma.com/web/en/map?zoom=13¢er=%7B%22lat%22%3A43.63694481411842,%22lng%22%3A-79.58152770996095%7D&list_type=%5B3%5D&id_listing=1DBW7RDePNDYqlAp

Purchased in May 2021 for $1,285,000.

Just sold again for $1,701,000.

up 32.4% in 8 months

No renos, maybe just a coat of paint.

Bal

at 7:03 pm

you will find many like that on housesigma….. House sold in Ajax single car garage four weeks ago for 1,380,000…Exact same type of houses on the same street…sold for 1,600,000….Damn…..people flipped houses within three months with zero upgrades for 400,000 to 500,000 NET profit…Damn why the hell we are even working…lolol….why did i even send my kids to universities……

Bal

at 7:04 pm

I think i better start smoking weeds and chill….lolol….life is so stressful….lolol

Condodweller

at 12:33 am

My first guess was Netflix. I didn’t know what the price was but I have been hearing people saying to buy it now after the big correction. The second guess was Tesla but the price wasn’t high enough for that. Donate the coffee to a homeless person David.

David, does this mean you’re looking to play the market now? BTW it’s not the first time Netflix has done this type of correction. You are being disingenuous by only showing the recent chart. Do you think people who bought it for $2-$5 and have long since taken out their initial capital care about this drop? Or even $50?

There are lots of opportunities in the stock market to make big money you just have to learn about markets and do your research. I took a flyer on a tech stock last year with the anticipation of a positive earnings report(there was a high certainty). It almost doubled during the days after the report came out. Considering I used 100% leverage my return on the interest for a few months was a similar 900%. No, unfortunately, I didn’t bet the farm on it 🙂

Rosie

at 1:48 pm

David, the assignment is peculiar. It seems as though the kitchen has been updated and a basement kitchen has been added in the time between listings. How does one renovate before possession of the house?

sunshine

at 9:54 am

David, perhaps a topic for pick 5 or blog is properties that should late last year that have been immediately put back on the market. Case in point the my Mother-in-law next door neighbor recently listed and sold their semi. Your typical 3bed two 2 bath semi in Toronto that is in good shape but is dated. listed for ~875k sold for ~950k, in November and closed at the end of January. She had heard that someone bought it with the intention of renovating and selling. Instead she saw a for sale sign back on lawn two days ago, nothing has been touched on the property. i can only assume that the buyer thins they can make a decent return just reselling, even with fees because of the recent price appreciation. I’d love to know if this is a trend at the moment, and yet another sign of how nuts the market is.

sunshine

at 9:55 am

should read *properties that sold late last year