Here’s a conversation that I had last week with a colleague, a Canadian Press journalist, and a client.

Same conversation; three different partners.

CMHC says that the Canadian real estate market will see a 9-18% decline in prices over the next twelve months. My thoughts? Comments? Opinions?

Well, I work in Toronto. I think that goes without saying.

As I told a reporter, “I really don’t care what’s happening to townhouse prices in Red Deer, Alberta, right now.”

If the Canadian real estate market dropped 9%, what would that mean for Toronto? I would argue that Toronto could see anywhere from a 2% decline to a 4% gain, all things being equal, which is to say that whatever the “Canadian” market does, Toronto will substantially outpace it.

Headlines are made to draw attention, and one reading, “Canadian Prices To Drop 9-18% In Areas Other Than Vancouver, Toronto, & Montreal” just isn’t as catchy.

A client asked me on Friday, “Do you expect the market to crash more?”

Crash more?

I don’t know which word to italicize.

Crash more? As in, the situation is that dire?

Crash more? As in, there’s already been a crash, and it could continue even more?

Think Seinfeld, folks.

Why would Jerry bring anything?

Why would Jerry bring anything?

In any event, I explained to my client that there has not been a real estate crash, nor is one expected, at least, not here in Toronto.

More specifically, not in the central core.

More specifically than even that, not for a $1,000,000 house on the east side, which he owns.

I told the reporter that if you take “Canada” as a whole, then narrow it to “Toronto,” then you’re talking about two different things. But if you further narrow this to “416,” then even still, you’re refining your data set. Then narrow to “Central Core,” and I think we’re looking at a very different real estate play than merely Canadian real estate, and last but not least, if you narrow this to a 3-bed, 2-bath, semi-detached house in Leaside for $1,350,000, I will be my most-prized hockey card that this is not a piece of real estate that will be down 9% in 12 months, let alone 18.

This isn’t the Canadian Realty Blog, and I don’t sell houses in Yellowknife, Regina, Halifax, or Quebec City. So call me biased when I say that the CMHC “prediction” is inaccurate, or at the very least, misleading. Not intentionally, mind you. But people in Toronto are reading this, and God only knows what conclusions they’re drawing.

There’s been a lot of talk on TRB over the past few weeks about the stock market.

I learned in my youth that there’s no point in engaging another individual in a conversation about personal investments in the stock market, because it’s just mutual masturbation. Two people sit there and talk about how much money they made on this stock, or what they bought that stock for, and it’s a means to no end. Plus, these folks are usually full of crap. Remember being in your early 20’s, feeling like a big deal because you and some buddies went out to The Keg and got your own table like a bunch of big boys? And then somebody brings up the stock market? You all talk shop about buying JDS Uniphase, Research In Motion, or Sun Systems, and you take turns bragging about all your smart moves. Yeah, well, the guy at the table who says the least is likely the one who’s portfolio is doing the best.

Nobody talks about their losses. Ever.

Nobody compares their return to the DOW, S&P, or TSX.

You made 71% in three months on that one stock. But how did your portfolio do, percentage-wise, up against the TSX, over the past 36 months? Dollars to donuts, you didn’t beat the index, but that’s not as good a story as telling your bros that you short-sold Nortel Networks the day before it dropped 19%.

So let me buck the trend here and do what nobody ever does: I’ll tell you about a loss.

My loss.

I have some money in equities in a portfolio looked after by a trusted family member. When the DOW Jones hit 20,000 in February, off a peak of 29,000, he told me, “This is an air pocket. This could be a once-in-a-generation opportunity.”

It certainly could have been.

Or, it could have been a goddam disaster.

The way my portfolio was structured, I wasn’t off a whole lot. Maybe a third of what the DOW/TSX was off. That’s what good money-managers do, and I was granted an exception to get into a top wealth management company with substantially less than their firm-minimum, so lucky me.

But when the opportunity arose to “swing for the fences” after the market fell off a cliff, rather than rearrange the portfolio balance and move a larger percentage out of bonds and fixed income, and into equities, I simply stood pat.

The DOW Jones dropped to 18,000 in March, but after last Friday’s 829-point gain, it’s now over 27,000 – something that nobody saw coming.

But the loss I’m talking about is an opportunity loss, since I would have, could have, should have bought in at 18,000. Like anybody else with the same idea, we’d all be making it rain dolla-dolla bills, y’all.

But taking away “would have” and “could have,” I don’t believe that I “should have.” Every investor has different goals, risk tolerances, and trajectories. I don’t need to make that play, based on where my other investments are, and based on how I see my own personal financial horizon.

For every person who got shit-rich in the past three months, there’s somebody who went broke.

I heard stories of guys buying on dips with $10 Million plays when the DOW Jones was wildly fluctuating 1,000 points per day. But isn’t this merely gambling? Sure, some people hit big, but what’s the difference between buying on a dip, versus betting heads/tails at the Superbowl?

Having lived through the tech-bust of the early-2000’s, and the financial crisis of 2008, I found this time in the market even more interesting. And throughout this entire experience, the one idea that has stuck with me is the idea of an “air pocket.”

That is how this market was described to me by my cousin who called it back in March, and all along, I’ve wondered how this concept of an “air pocket” relates to the Toronto real estate market. I’m not calling April an air pocket in the Toronto real estate market, since I realize we have a long way to go with respect to COVID, the economy, unemployment, deferred mortgages, and a potential country-wide recession in 6-12 months. But I do want to look at the TREB stats in March, April, and May, and see if this idea has any legs.

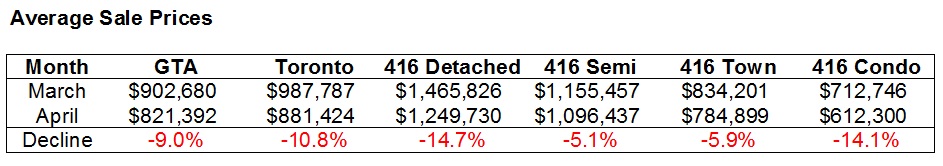

First, let’s look at the pronounced drops, across the board, from March to April:

The numbers, across the board, were dire.

We had this conversation in early-May about the idea that somebody’s home in the GTA is, apparently, “worth” 9.0% less than it was in March.

Those who own the holy grail of real estate, aka a detached home in the 416, were, apparently, staring down the barrel of a 14.7% loss.

But for every person who believed that these numbers were entirely applicable to one’s house or condo, there had to have been two or three people that recognized this for what it was: volatility.

Was a downtown Toronto condo really worth 14.1% less in April than it was in March?

Look at the average drop in the last column, above: that’s over $100,00! Nobody’s $700,000 condo went down to $600,000. No way, no how.

And yet it didn’t stop some people from suggesting otherwise. The bear-claw is ferocious, and when data like this is provided to market pessimists, they’ll use it to their advantage.

I maintained, all along, that this was the “bottom,” of the market, whatever that meant. We talked at length about when the Toronto average home price would rise above the $910,290 at which it peaked in February, and there were some people suggesting it might take fifteen years or more.

Unlike my thoughts on the DOW Jones, which I figured had no real floor, I believed that the shock from COVID would be harshest in April, and that the market would bounce off that floor immediately.

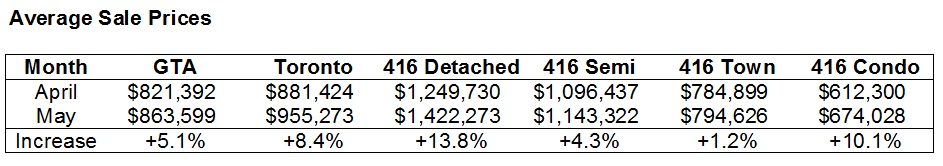

With the May TREB numbers now published, let’s see how April compared to May:

As expected, no?

Very few, if any of the TRB readers believed that the May prices would be lower than April, but some felt that this was merely the start of trend.

Whether the April bottom represented real price drops or merely a dramatic shift in inventory (ie. many more lower-priced properties sold), thus skewing the data and making it look worse, remains to be seen.

But what we do know is that prices increased, month-over-month, most dramatically in the 416-detached and 416-condo markets, where the drops were also the most pronounced in April.

So how does this net out, March to May?

As follows:

A semi-detached house in the 416, on average, is worth 1.2% less in May than it was in March. That is the very definition of a “rounding error,” is it not?

This backs up what we’re seeing in the market every day, which is low-end single-family houses getting a slew of showings and continuing to sell in multiple offers, as they did pre-COVID.

The GTA average is still down 4.3%, with the 416 average having recovered faster, only down 3.3%.

Again, a 3.3% drop is a drop, nonetheless, but insignificant as far as the

One of the most surprising finds in last week’s analysis of “Sales To New Listings” was the strength of the market outside the 416. If I were a betting man, I’d have figured that York Region and Peel Region would have been hammered to due COVID, but the SLNR was actually higher in Peel Region in May of 2020 than in May of 2019.

Try to make sense of that!

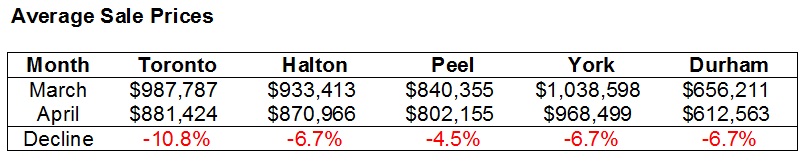

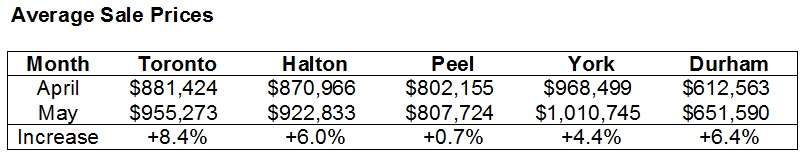

So let’s look at the March-April decline, then the April-May increase, as well as the March-to-May net in Halton, Peel, York, and Durham:

Using Toronto as a reference point, since we’ve already seen this data above, we now realize that the 416 was hit harder than any of the areas outside the core.

Did you see that coming? I sure didn’t!

Is this merely an example of “what goes up, must come down,” ie. the higher they are, the more they fall?

Pessimists will say that Toronto’s market was the most overheated, and thus it came down the most in relation to the others.

But when you see the respective increases from April to May, is the opposite true?

Interesting that Peel Region only increased 0.7%, but then again, the “drop” was only 4.5%.

These numbers all make sense, if we believe in the “air pocket” theory, no?

So when all was said and done, here’s the net, March-to-May figures:

Halton and Durham are rounding errors, right?

A house is worth $933,413 in March and $922,833 in May? That’s the difference between a better/worse agent on any day of the week.

Durham is down less than $5,000? That’s just one designer hand-bag, right?

Save for Peel, which is experiencing the slowest climb “back up,” Toronto leading the pack makes sense, given how pronounced the April drop was.

Let’s compare this to the DOW Jones, just for fun.

Here’s a 6-month chart:

From 29,568.57 in February, down to 18,213.65 in March, and up to 27,110.98 in June

That is an air pocket, and while I believe that what’s happening right now in the United States’ civil war that I’ve been predicting for two years is not being reflected in the DOW Jones, we can’t ignore that 27,000 figure.

Trillions of dollars were injected into the economy to assist this ascent, we know that.

And my cousin has this saying about an ascending market in a time like this; he calls it “climbing the wall of wory.”

With the chaos that’s going on in the United States right now, the DOW Jones still climbed 800+ points on Friday. That is truly “climbing the wall of worry,” as investors buy in.

Now, just to add more perspective, look at a 10-year chart of the DOW Jones:

Yeah, um, see that massive cliff in 2020, followed by an ascent of almost the same size shortly thereafter?

That is an air pocket, my friends!

Anything could happen, and probably will. But if the DOW Jones surpasses 29,000 at any point in the next 4-5 months, which is non-sensical, but could happen nonetheless, then our children will be studying this chart in twenty years, marveling at the blank ink running down the page.

And if the average Toronto home price in June climbs back over, say, $880,000, how can we not refer to the decline in late-March and early-April as an “air pocket?”

I’m not making any predictions on the market here, but rather putting a label to a “what if” scenario in our near future.

I’ve had a lot of fun with these market stats over the last couple of weeks, and with the market dynamics shifting from week-to-week, I’m enjoying being kept on my toes. I’ve got a dozen listings on their way to market between now and the end of July, and each one is unique. Each one requires a different strategy, and that is exciting!

I’ve always said, “adversity builds strength and character.”

But I usually say that about people. I never thought I’d be saying it about the real estate market…

Jimbo

at 8:14 am

I don’t think Canadian real estate can have a drop of 9-18% without the Toronto real estate market.

1/(b-a)Integral f(x)w(x)dx where w(x) is a weighting factor due to market size.

Given the size of Toronto and Vancouver markets a decline in all of Canada can’t happen without both of them. That is why I think the CMHC prediction is out to lunch.

J G

at 8:30 am

If the government want the RE market to crash, they certainly can. Just make policy changes.

But that would be tens of thousands of RE professionals out of work. So yeah, it’s not going to happen.

Chris

at 8:48 am

LGJP weekly update:

Sales -32%

New listings -16%

MOI ~2.5

https://twitter.com/johnpasalis/status/1269973039170584576

Appraiser

at 8:59 am

You forgot this quote from his latest analysis:

“New listings are closer to last year’s levels…But inventory continues to remain tight as new listings can’t keep up with demand from buyers” ~John Pasalis

Chris

at 9:11 am

And yet sales are down by double the decline in new listings.

Appraiser

at 1:05 pm

And yet prices keep going up.

Chris

at 3:11 pm

They sure do.

“I would caution against being caught in a bull trap though.” – Appraiser

https://torontorealtyblog.com/blog/join-the-conversation-qa-session-episode-2/#comment-118577

From April 7th to today:

DJI +15.69%

S&P500 +13.18%

NASDAQ +21.30%

TSX +12.09%

Appraiser

at 8:55 am

CMHC’s track record at predicting the future of the real estate market has been as accurate as most of the other “experts.” Which is dismal.

No reason to give it much weight this time either. Although I agree with Re/Max that it was irresponsible.

For some reason the CEO at CMHC Evan Siddall, decided to take on the “real estate industry” early on in his mandate. An ignorant but populist notion that appears to get him lots of likes on Twitter from the haters and bears who regularly pollute the space.

Siddall reads such nonsense as direct support for his deliberately inflammatory rhetoric and appears to revel in it. Good riddance.

Chris

at 9:14 am

“Please question the motivation of anyone who wants you to believe prices will go up (yes, up) with our economy in slow motion, oil being given away, millions of Canadians on income support and a greater % of mortgages not being paid than we’ve seen since the Great Depression.”

– Evan Siddall

Pretty easy to see what your motivation is, appraiser, as a real estate investor, property appraiser, and permabull.

J G

at 9:10 am

To be fair, there are also a lot of RE investors who brag about their gains, ignoring things like carrying cost of their properties. I know someone who owns a downtown house for investment, last year the furnace broke, cost almost 20k to fix.

Anyway, the big negative of investors who are heavy in RE is lack of liquidity. When opportunity comes in the stock market, investors who have financial assets can easily take advantage of them. Perhaps people who didn’t buy in March/April is because their funds were tied up?

S&P 500 is 1% from being even for 2020. Quite a “dead-cat bounce” eh Appraiser?

David Fleming

at 11:01 am

@ J G

I 100% agree.

A real estate investor buys for $500,000, sells for $700,000, and claims a $200,000 gain. Ignoring land transfer tax, real estate fees, legal fees, maintenance and upkeep, vacancy, and net negative monthly cash flow (assuming it’s a rental).

I certainly did not mean to suggest that real estate investors are a completely different animal from stock market investors. I was merely drawing on my own experiences as a young man, and I swear, I could write a book on this.

I was in university during the tech boom/bust and it was wild to be an energetic 20-year-old, hanging out in the “Trading Centre” at McMaster University, heaing guys talk shit non-stop. Then I went to Celestica to work an internship from May of 2001 to August of 2002, and that was even worse. All these guys “investing” during a market bust. The market was dropping every day, they were all in long positions, and they talked endlessly about how much money they were making. I didn’t know much, at 21-years-old, but I knew this didn’t add up. I was making money selling sports and concert tickets on this new site called “eBay” and speculating on new inventions like this thing called the “X-Box,” and they all thought I was nuts. I learned more about life during that 16-month internship than I ever could have imagined!

Libertarian

at 3:10 pm

Thanks for acknowledging that David, but it’s not just investment properties, but even primary residences. People talk about what they bought 30 years ago and how much it’s worth now. They don’t consider mortgage interest, renovations, maintenance, etc.

That’s why I don’t consider my primary residence an investment. It’s shelter. Everybody pays for shelter, whether it’s owned or rented. I’m happy to own and have a place to call my own, but I know that there’s always something that needs fixing, replacing, updated, cleaned, etc. So besides money, the time and energy spent on my place is even more!

Professional Shanker

at 12:12 pm

JG – you can’t be a real estate bear without acknowledging the froth and utter ridiculous valuation companies are fetching on the S&P or other indexes. The world is in an asset bubble spare no asset, with the exception CDN oil!

J G

at 12:43 pm

1) I have to admit I certainly have had my bad investments. Bought F @15 back in 2015, Sold FB @125 during the 2018 Dec crash, not buying my GTA properties sooner, etc.

2) I think money printing makes absolute valuations irrelevant. Everything will go up when the government is handing out cash, buying bonds/stock etc. Question becomes what is the best investment relatively?

3) I’ve only been a bear on 416 condos for the past few months, but so far the numbers in May and June is not turning out exactly like what I expected. So yes, I could be wrong on this one.

4) All things considered, RE markets moves much slower than stocks. Which is why during volatile times, it’s easier for stock investors to make money. Also if there is any impact on the RE market, it will take longer for it to show.

condodweller

at 2:09 pm

Since we are comparing RE to the stock market I assume we are talking pure investment. I feel like we should put a disclaimer on every post regarding whether the comment is on buying a home or an investment property.

I actually think that lack of liquidity is actually a good thing because it keeps you from making illogical/emotional decisions detached from realty based on minute to minute information. This of course assumes that the initial investment was sound in the first place.

As I mentioned in the past the biggest problem with comparing RE to the stock market is the use of leverage. The end result will always be greatly skewed by leverage.

A prudent investor balances out their investments to reduce risk. This is extremely difficult to do with the amount of leverage used for RE for the average person.

JL

at 12:17 pm

Appreciate the JDS Uniphase reference; haven’t heard that name in a long time, and it certainly brings back memories from that era.

jeanmarc

at 8:57 pm

And the dot.com incubators like CMGI and Lycos. The killer B’s => Broadcom, Brocade and Broadvision. No one can forget the famous Bre-X Minerals scandal back in the mid-1990s.

Appraiser

at 1:02 pm

Genworth says it has no plans to follow CMHC’s mortgage tightening move:

“Genworth Canada believes that its risk management framework, its dynamic underwriting policies and processes and its ongoing monitoring of conditions and market developments allow it to prudently adjudicate and manage its mortgage insurance exposure, including its exposure to this segment of borrowers with lower credit scores or higher debt service ratios,” said Stuart Levings, chief executive officer at Genworth, in a statement.

https://www.bnnbloomberg.ca/genworth-says-it-has-no-plans-to-follow-cmhc-s-move-to-tighten-mortgage-insurance-rules-1.1447262

Chris

at 1:20 pm

“Before everyone celebrates, “no change” may mean in part that @GenworthCanada could have had tighter policies already. We don’t know. @CMHC_ca welcomes competition but will not compete by encouraging over-borrowing.”

– Evan Siddall

https://twitter.com/ewsiddall/status/1270030223980015619

Caprice

at 2:44 pm

Sounds like Evan’s feeling the burn from being outflanked lol. Really, “We don’t know”?? If he really doesn’t know what Genworth’s criteria are, he’s not much of a competitor.

Reminds me of a certain poster here that always has to have the last word.

Chris

at 2:59 pm

He’s been taking flak from realtors and mortgage brokers for years. I doubt he’s “feeling the burn” much now as he approaches the end of his tenure.

And ohh good job Caprice, you caught me! I’m secretly Evan Siddall!

Ed

at 5:15 pm

it’s like a disease.

Victor

at 3:05 pm

Canada Guaranty (CG) also has no plans to follow CMHC.

The majority of monoline lenders insure with GE and CG. So if a deal doesn’t fall within CMHC’s guidelines, the mortgage broker/mortgage advisor can request to send the deal to GE or CG to get it done.

Since all 3 mortgage insurers are not on the same page, I don’t think CMHC’s recent move will have that much of an impact on new business. Time will tell.

PS. David, I’m new to TRB. Great analysis, thank you.

Appraiser

at 3:12 pm

Yes Mr. Evan Siddall, I promise not to celebrate?

Oh and by the way Mr. Siddall, your cover story about Genworth might be true?

https://www.youtube.com/watch?v=BZVgl49yPzg

Appraiser

at 3:22 pm

Hey @Chris did someone order a nothing burger?

Chris

at 3:26 pm

Is the appraisal business that slow that you had to take a job flipping patties?

Appraiser

at 2:56 pm

Market just keeps ‘chuggin along.

“Weekly look-in at 416 sales transactions. Highest week since March 22nd for condos and freeholds…Seems like wheels are in motion now and it kind of feels like a bit of a “delayed spring” market…” ~Scott Ingram CPA, CA

https://twitter.com/areacode416/status/1270012655739318273

Chris

at 3:08 pm

You forgot this quote from his latest analysis:

“Although at lower volumes (again, this past week had 37% lower sales than last year, and last 4 weeks are 50% lower). ” ~Scott Ingram

And this one:

“One look at how housing prices could play out. I don’t think some factors as bad in 416 (e.g. land constraints, I think we’ll still see foreign capital and inst. investors). Agree with factors affecting future demand. And possible #8 & 9 (pent-up demand burst) c/b happening rn.”

https://twitter.com/areacode416/status/1270019245720682500

J G

at 3:59 pm

Another 400 point romp for the Dow, S&P even for the year.

Can I get a market update from Mr. Appraiser? aka dead cat bounce.

jeanmarc

at 9:12 pm

You mean the tech heavy FAANG stocks (represent over 22%) doing a lot of the lifting and thanks to Federal Reserve.

“The broader stock market remains below the all-time high it reached February 19. But Wall Street has bet that huge, unprecedented sums of stimulus from the Federal Reserve and lawmakers will help to ease the economic pain caused by the stay-at-home orders.”

https://www.cnn.com/2020/06/08/investing/us-stocks-rally-nasdaq-record/index.html

jeanmarc

at 9:51 pm

Here’s a first just announced earlier today. 1.99% insured mortgages for those who qualify. Curious as to how many first time buyers will bite at this given possible uncertainty later this fall.

https://business.financialpost.com/real-estate/mortgages/five-year-fixed-mortgage-rate-in-canada-falls-to-1-99-for-first-time

Appraiser

at 7:29 am

Upon further examination it appears that CMHC hasn’t banned borrowed down payments all that much:

CMHC is not banning all borrowed down payments. It will still allow down payment funds that originate from:

A loan from one’s own RRSP (using the Home Buyers Plan).

A HELOC on another property that the borrower owns.

A HELOC on a property their parents own (if the parents gift those funds to the borrower).

Note: CMHC will no longer allow down payment funds from unsecured borrowing. That includes from a HELOC on a property the borrower’s parents own — if the parents loan those funds to the borrower.

“Record Home Prices?: It’s almost like GTA home prices are taking their cues from the stock market. If HouseSigma’s estimate is right and the trend continues, GTA home values could potentially set a record in June.”

https://www.ratespy.com/mortgage-report-june-8-060814245

Kyle

at 9:31 am

Let’s make it a CMHC Combo. Here’s a side of fries to go with the above nothing burger.

https://www.bankofcanada.ca/2020/06/staff-analytical-note-2020-8/

Chris

at 10:09 am

Did you read the Analytical Note you linked to? For one, it says nothing about home prices, or the impact of CMHC’s changes. For two, while they suggest deferrals will help limit mortgages in arrears, even with so many households already financially stretched, they admit that this is highly dependent on a quick recovery – aka no second wave.

“There are similarities in the way the initial economic impacts of pandemics and natural disasters unfold. But their economic recovery can look quite different.

Disasters tend to be localized and pass relatively quickly. They are also associated with physical destruction of capital that subsequently needs to be rebuilt. This rebuilding process can begin relatively soon after a disaster has occurred, contributing directly to the broader economic recovery.

In contrast, the COVID‑19 pandemic has a global reach, and its aftermath is much more uncertain. Economic activity will undoubtedly rebound as mandated lockdowns are gradually eased. However, this will likely be a sluggish process, meaning some of the macrofinancial effects of the pandemic could linger.

Using the data from the 2016 Survey of Financial Security, we find that one in five households can only make up to two months of mortgage payments using liquid assets and about one-third can make up to four months of payments. We find that households in the occupations most at risk in the near-term—such as sales and trades—also have the weakest financial positions. Almost one-quarter of households in these occupations can only make up to two months of payments.

Ultimately, this exercise illustrates that the effectiveness of deferrals in limiting the rise in arrears depends crucially on the speed of recovery in the labour market.”

This does not seem to paint nearly as “nothing burger” a picture as you would like it to.

Kyle

at 10:28 am

“The economic impact of COVID-19 is often compared with past recessions, but this pandemic arguably has more in common with natural disasters…This contrasts with the 2008 recession, which reflected an underlying fragility in the global financial system that resulted in a lengthy downturn. (which by the way had very little impact to Toronto RE prices)…We see this when we compare the number of recipients of employment insurance (EI) in Fort McMurray, Alberta, after both the 2008 recession and the 2016 wildfires—the costliest natural disaster in Canadian history (Statistics Canada 2017) (Chart 1). The peak increase in the number of EI recipients was much greater after the wildfires than it was following the recession. But this increase had fully reversed within 10 months of the wildfires. In contrast, the peak occurred near the 10‑month mark following the start of the recession.”

The blue line in the last graph pretty much tells you what the Bank of Canada sees the “deferral cliff” (more like a deferral pimple) looking like.

” Once we account for payment deferrals, the picture is much more favourable. With deferrals, the arrears rate remains relatively flat over much of 2020, eventually rising to a peak of 0.5 percent in the second quarter of 2021. ”

Lately every time Evan Siddall and CMHC has spoken or put out a report, the Bank of Canada has responded to basically contradict all their dire projections with far more tempered, better supported and much more responsible messages.

Chris

at 10:42 am

“(which by the way had very little impact to Toronto RE prices)”

This statement isn’t in the Analytical Note. If you’re going to quote someone, you usually don’t insert your own commentary into their quote.

I’ve already shared the quotes from the BoC explaining the differences between natural disasters and this pandemic, as well as how crucial a quick recovery is to mitigating arrears. No need to repeat them, you can scroll up to read.

We’re going on three months of this pandemic and are only just beginning to re-open. That already far outstrips the impact of the Fort Mac fires. A second wave, as many experts are concerned about (particularly given the recent lack of social distancing and protests), would stick a fork in the chances of a fast economic rebound.

Kyle

at 11:00 am

You mean you’ve cherry picked your own quotes from where the report has added qualifiers, but i chose quotes that align to the overall thrust and message of the report.

If you want to dust off your pom poms again for a second wave, you do you. But unless a second wave get s so bad that Ontario ICU’s and ventilators become a scarcity, i doubt we’ll see restrictions going back to April levels.

Chris

at 11:17 am

Yes, as usual, we’ve both picked the quotes that support our position. Quelle surprise.

Falling back on the tired trope of “you’re cheerleading the pandemic!!!” are we?

Nobody is suggesting that we’re heading back to April style restrictions. But the reality is, experts believe a second wave is coming, particularly as people have become so complacent, which will invariably slow our economic recovery as re-opening is stalled. If you want to lash out and bury your head in the sand rather than recognize this as a serious concern, such is your prerogative.

https://www.cbc.ca/news/canada/toronto/opening-reopening-2nd-wave-1.5578858

Appraiser

at 12:16 pm

@Chris

Your negativity bias presents as strongly ingrained. Yes?

Chris

at 12:33 pm

@appraiser

Your negativity bias regarding the stock market presents as strongly ingrained. Yes?