Having a newfound interest in modern technology, my Dad asked me the other day, “If you wanted to hear just three specific songs on your computer, is there a way to do it so that it’s free?”

Such a simple question, and yet the answer will always differ.

The beginning of the answer is, “Yes,” but thereafter, everybody will have a different method and opinion.

For example, I’m sitting here this morning, having heard a Johnny Cash song last night, and deciding that I want to listen to his voice for the next couple of hours while writing this blog. So, I used my method of obtaining his music.

I went to YouTube, found the song “Hurt,” which was released by Nine Inch Nails in 1995, but famously covered by Johnny Cash in 2002 before his death. Then I copied and pasted the URL into a “Youtube to MP3” converter, and downloaded the file. Then I transferred the file to a folder on my hard drive called “DAVEZMP3Z,” which I’ve had since university, and then finally, opened the file in iTunes.

So, that’s my method.

And yeah, Napster is still down. Trust me, I checked.

I haven’t had the time or the wherewithal to learn Spotify, and while I have it on my phone, and I use to play songs from “Frozen” for my daughter in the car, I’m just not a phone guy. I’m a laptop guy. And I have almost 10,000 MP3’s on my laptop and hundreds of custom-made playlists dating back two decades, so, you know what? Screw Spotify. I’ve got my method, and it works.

There are more modern, more efficent ways, and, yes, the 20-year-olds are reading this and laughing. Well, I was 20-years-old once, and I was downloading songs on Scour and playing them through Winamp while the 39-year-olds were buying CD’s.

I don’t know if there’s a “right” and a “wrong” in all of this.

Yes, I could use Spotify like the rest of the world. But doesn’t my system work? Haven’t I accumulated enough music, all of which I know, and like, to make my method worthwhile?

Somewhere in here there’s a healthy combination of an opinion on my method as well as an interpretation of correctness.

It’s simply not so cut and dry.

When the TREB numbers came out on Tuesday, I feel as though market onlookers already had their minds made up as to what they wanted the numbers to say, and this was before they even saw the numbers.

Case in point: the discussion that followed on this blog. The readers, as they typically do, began to “cherry-pick” numbers, as one reader put it, to back their arguments. These arguments, I find, are based partially on their findings but partially on the views they are predisposed to holding as well.

I sat down to look at the TREB numbers without any preconceived notions, save for one. Namely: the market is down.

“The market?” What does that mean?

I’ve mused about this in the past. The media always love to refer to “the market,” while using different metrics, depending on the argument they want to make. If they want to say the market is colder when it’s actually hotter, they can say “The market is down 11%,” while quoting sales, even though prices are up. They can also use month-over-month instead of year-over-year, or vice versa.

In my mind, “the market is down” across the board.

Sales, listings, prices, and general activity and interest.

Showings are down. Offers are down. And I would be willing to bet that clicks on virtual tours, emails to friends with “check out this listing” are down, and real estate agent man-hours are down too.

The market is down across the board, according to every single metric. But is anybody surprised by this? We’re in a goddam pandemic! Everything is down, except for the divorce rate, financial losses, domestic abuse, recreational drug use, suicide, debt, and general moral. Yeah, that’s dark, I know. But it can only get better from here.

So acknowledging that the market is down, what is down, and how much? Let’s take a look.

Starting with the month-over-month stats, we can see that while March held up fairly strong over February, given the COVID slowdown didn’t begin until the last third of the month, April was absolutely hammered across the board:

Keeping in mind that this is one month, and the market isn’t shaped by a single month, we can’t ignore how bad April was.

With an average sale price in the GTA of just over $910,000, we saw that drop to $821,392.

I would argue against some of the blog readers who posted on Tuesday that “prices are down 10.8%,” since I know, through experience, that they simply are not. Again, everybody has their own way of interpreting the data, and a person who wants prices to fall so he or she can afford to buy a property will see what he or she wants to see. But I would stake my reputation on the fact that you can’t simply walk into any house or condo in the GTA and expect to pay 10.8% less in April than in March.

An average is an average. It’s a metric, but it’s not one hundred percent applicable to price.

Anecdotally, if you asked me, “My $625,000 condo sale from March 9th; what would I expect to get on April 28th?” I would say perhaps $590,000. So what is that, 5.6%? Okay, so I’ll acknowledge that prices are down, but not to to the extent that some cherry-picked metrics might show, such as the 14.1% decline in average condo sale price. You’re nuts if you think a downtown Toronto condo is going to sell for 14.1% less in April than in March.

Then again, consider that in the month of April, we were in a gooddam pandemic! Anybody who would expect to sell a house or condo during a quarantine of society for the same price as they would have obtained before the quarantine began, is insane.

And trust me, these people exist. I’ve talked to them.

Year-over-year, the sales and listings numbers look the same, but they’re not quite as exaggerated when it comes to sales:

The part that many folks are missing in all of this is simply sample size.

I’m not convinced that when we go from 9,000 sales to 3,000 sales, we can draw an inference from “sale price” to “value.”

If the New Orleans Saints roll into Atlanta to play the Falcons, and they only have 17 players from their 53-man roster, they can still fill out a team, and they’re probably missing an equal number of good players and bad players. But can we really judge their effectiveness the same way?

Poke holes in my analogy if you want to, but you get the point.

Now some would immediately argue, based on anecdotes, that “the 905 is dragging down the average.” I probably would have been one of these people, since a colleague of mine in Oakville said, “House prices are down 10-20% from February.”

But the numbers don’t show that!

Looking at February prices instead of March, since we really want to compare to pre-pre-COVID, we can see that the 905 doesn’t show as much of a decline in the numbers as the 416.

How can this be? With virtually everybody I speak to, talking about “how hard” the 905 has been hit, I honestly can’t explain this. Here’s one situation where the word on the street does not come even close to meeting up with the numbers provided by TREB.

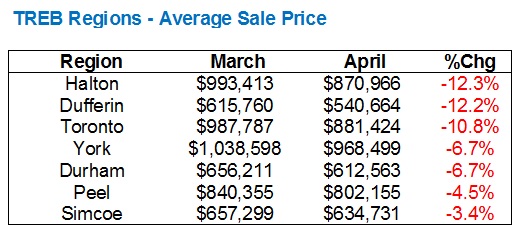

Looking more specifically at these regions, and further breaking down the 905 into Dufferin, Durham, Halton, Peel, Simcoe, and York, we’ll look at the decline, month-over-month, in average sale price in each region:

What in the world is happening in Simcoe, right? Only down 3.4%? Well, I think we can agree that Waubashene, Fesserton, and Coldwater usually peak this time of year…

The irony in that is: I would make an argument that, “Who cares?” what’s happening in Midland or Port Severn when we’re talking about Toronto real estate. Port Severn is nowhere near Toronto, and while the “Toronto” figure that TREB provides us really refers to the GTA, most people merely assume it’s Toronto-proper. But having said this, Simcoe County shows the smallest decline, so my argument would be flawed, statistically, if I suggested that the average cottage price would plummet compared to that of a midtown home.

But would you disagree?

If you had to wager a bet on which property type would keep its value; a) rural Ontario, b) downtown Toronto, which would you have chosen?

Again, this is why we often take statistics at less than face value, and I realize it cuts both ways.

But consider the dramatic drop in sales volume from month-to-month, just for a moment:

First things’ first: with a sample size of fourteen, there are zero conclusions to be drawn from prices in Dufferin region. You just don’t have enough data.

But even an area like, say, Halton, which includes traditional hot-spots like Burlington and Oakville, can’t really be judged based on a mere 338 sales. Strip out those that were in Halton Hills and Milton, and really, how many sales are we talking about? How can you possibly use month-to-month data with any degree of accuracy with such a small sample size?

I realize at this point that it sounds like I’m leading toward a pre-determined conclusion, or to be more blunt, trying to argue a bullish view of the market. But you’ll just have to take my word for it – I’m trying to obtain an accurate view of the data while looking at the market from my view and experiences and the data, all while trying to identify volatility and sample size errors.

In Toronto, we saw a drop from 2,771 sales in March to 1,036 sales in April, so we could suggest that 1,036 sales is still enough to gain an accurate picture of the market, and one might further suggest that every property did, indeed, lose 10.8% of its value.

But since this all began, I maintained that we would see a dramatic shift in the type of property that sells, since I truly believe that most luxury home-owners will choose to wait, if and where they can. I realize that the bears would like to think that there are a lot of people in Toronto who live in $2.5 Million homes, but own and maintain a cottage, have monthly payments on a Porsche and an Audi, and pay private school tuition for two kids, and will thus be living month-to-month during this pandemic. I’m sure these people exist. Of course they exist! But in the quantities that would result in a massive real estate sell-off? I don’t think so. I believe that any would-be downsizer has now put his or her plans on hold, and thus there will be proportionately less sales of homes over $2,000,000, let alone, say, $4,000,000, which unfortunately, TREB doesn’t track.

However, we can use that $2,000,000 figure, in both the overall market and the detached market, to gain a sense of how the numbers changed in April. Furthermore, let’s see if sales of smaller, cheaper condos increased.

Well, it’s as I suspected.

The proportion of $2M+ home sales in the GTA dropped from February to March, and then dramatically from March to April.

The same pattern followed for detached properties over $2,000,000, which, of course, is where we would expect to find true “luxury” sales that have the ability to sway any average.

Finally, the proportion of entry-level condos increased, quite dramatically, I would argue, from March to April. This is what most of us felt last month, seeing lots of cheap units moving, while most of the larger units sit.

In case you doubt this data, or doubt that it could possibly sway an average, let me take this one step further: let’s compare this to 2019.

Oh, hello, guv.

In 2019, we saw the exact opposite pattern.

Through April, the proportion of $2M+ sales in the overall GTA market and in the detached market increased, as opposed to 2020 when they decreased.

And as you might assume, the proportion of cheaper condos decreased by 2.8% into April of 2019, whereas it increased by 14.3% in 2020.

The conclusion I draw from the TREB numbers, while considering the experiences I’ve had in the past two months, along with what I’m hearing from other agents, and seeing and feeling, is this: prices are down. No question. But not nearly to the extent that the TREB numbers show, if you want to take them quite literally. We also need to bear in mind that this was ground zero for how COVID will affect the real estate market and it’s my opinion that this will represent the bottom.

With the DOW Jones dropping as low as 18,000, now having recovered to 24,000, do any of you think it’s going back to 18,000, let alone below?

Disagree if you want, and many of you will. But I believe April of 2020 will, in fact, prove to be the bottom for our market.

Enjoy the weekend, folks! We’ll shelve the interview themes for the time being, as I have some entertaining topics for next week.

Graham

at 8:10 am

iTunes? foobar2000 or nothing.

Ed

at 2:20 pm

any other free sites one could check into? anyone

J G

at 8:30 am

I don’t know how you can say “April 2020 is the bottom of the market”. What are the chances May prices will be lower than April? It’s certainly more than 0%.

Chris

at 8:48 am

“I’m a bit concerned that a lot of people seem to think the worst is behind us, that we are going to re-open and everything will be fine…”

Steve Saretsky

https://twitter.com/stevesaretsky/status/1258597632789774337

I’d take the other side of David’s bet. I don’t think April 2020 will represent the bottom. Job losses are piling up, while temporary government programs are staunching the financial distress.

As John Pasalis and Frances Donald alluded to the other day, it will be in 6+ months, when mortgage deferrals and other programs end, that we see the true impact.

condodweller

at 3:11 pm

I would take the other side as well. I think the chances of April being the bottom is closer to 0% than the other way around.

J G

at 8:39 am

I do agree some types will recover faster than others, my prediction is on semis and towns. Just because 400k condos have the most sales (since that’s what first time buyers can afford) , doesn’t mean prices are going up.

There are many instances where downtown renters are moving out since WFH will be more popular. They move back with parents in the burbs until they are ready to start family.

The most important outcome of this pandemic is the RENT will be down! That will really hurt the condo market, especially in price inflated 416.

condodweller

at 3:30 pm

I think the possible reversal of FOMO is what’s going to affect prices. Unless we see a shallow dip and prices do recover within a year we may see a slow longer term decline in prices for condos as people aren’t rushing out to buy. We may see a similar effect on SFHs to a lesser extent.

I think it was Ben who pointed out that the quoted rent amounts are spot prices i.e. many who rented out in the past are not getting such high rents to begin with as the rule changes limited increases to CPI. This will limit the impact on rents. But I do agree with John that a small number of forced sales can trigger a price decline which I have said in the past as well. The question is to what extent will new buyers will step in to support the prices.

condodweller

at 3:33 pm

I miss spoke in my second paragraph. It won’t limit the impact on rents, they will go down, it will limit the impact on the owner i.e. ability to withstand lower rents and forced sales.

Thomas

at 8:40 am

Winamp made me nostalgic! But I started with double cassette players for recording. On similar lines, I have nephews and nieces who are in their teens and they would simple ‘Ok Google’ or ‘Alexa’ or ‘Ask Siri’ if they wanted to search for something on the internet. I still cant get myself to talk to a device. I have to type that into a browser. However, I have started getting used to Spotify now. It is really good!

In my quest for a home, I noticed that the pocket I am looking at hasnt shown any price depreciation. It fell back from the crazy February levels but prices are still higher than April 2019. I can only attribute that to ‘location’ and ‘demand vs supply’. But I just cant see how this can be sustainable. And people who plan to ‘cash out’ on their home at retirement might be in for some disappointment.

Thomas

at 8:42 am

I should have mentioned that I am looking for detached homes in Durham

J G

at 2:45 pm

My experience to get the best deal:

1) Have financing ready, when the sentiment is the most negative, go in with no condition, big deposit, but lowball! That way even the seller agent will persuade the seller to sell.

2) Find desperate sellers – you can research yourself, properties that was bought in Spring 2017 or recently (flipping gone wrong), your agent should also be able gain valuable info when talking to seller agent. Find an agent you trust.

Graham

at 10:17 am

WinAmp: it really whips the llama’s ass!

condodweller

at 3:40 pm

“And people who plan to ‘cash out’ on their home at retirement might be in for some disappointment.”

People looking to cash out for retirement wont’ be too disappointed considering they probably bought below $400k so if they can only get 1.2 million vs 1.4 shouldn’t be a big deal. Plus they are likely the ones without mortgages and the flexibility to wait for prices to recover.

If prices were at “crazy” levels in Feb wouldn’t you be happy to be able to buy at last year’s prices? We don’t often get a chance to go back in time.

Thomas

at 6:09 pm

“If prices were at “crazy” levels in Feb wouldn’t you be happy to be able to buy at last year’s prices? We don’t often get a chance to go back in time.”

It does re-calibrate the idea of price in one’s mind. Which then leads to fear of losing out and prompts one to pay more and still be contend with it. I am consciously trying not to fall into that loop. I dont mind waiting and renting but I will not spend 40% or more of my income on just housing expenses. And I agree that somebody who bought below $400k is absolutely fine. But that doesnt mean that somebody who buys at $800k today is making the right choice .

Chris

at 8:58 am

“Following a drop of over one million in March, employment fell by nearly two million in April, bringing the total employment decline since the beginning of the COVID-19 economic shutdown to over three million.

In addition, the number of people who were employed but worked less than half of their usual hours for reasons related to COVID-19 increased by 2.5 million from February to April.

The unemployment rate rose 5.2 percentage points in April to 13.0%.

The April unemployment rate would be 17.8%, when adjusted to reflect those who were not counted as unemployed for reasons specific to the COVID-19 economic shutdown.“

https://www150.statcan.gc.ca/n1/daily-quotidien/200508/dq200508a-eng.htm?HPA=1

Pragma

at 10:09 am

What’s the bull argument? Prices should be higher because… prices always go higher? Because I “feel” like they should? Because of immigration (which drops sharply during recessions, especially global ones), because of “investors” who are currently sitting on 6k to 10k empty condos? If you think prices are going to go up, then you think the fair value of Toronto RE is much higher? So at what level would you say Toronto is fairly valued? And what is that based on? I am pretty sure you don’t have a number in your mind because prices can never stop going up(inflation adjusted).

The bearish argument is clear. There is a deep recession coming. There is a large overhang of properties held by “investors” which are sitting empty. Condos that were already cash flow negative will now face dropping rents and low occupancy, and likely dropping prices. Canadians already lead the world in debt to income, we are leveraged to our eyeballs and have been living off rising equity. Nobody has managed to sit at the top of that leaderboard for an extended period (I wonder why?). Credit quality has been weakening as B-lending and private lenders have grown their books. Canada is due for a deleveraging cycle. Canada has had zero productivity growth over the last few years, despite us being a developed nation. More of our income has been going into servicing mortgages(a very unproductive asset) and helocs vs consumption and investment. Car sales and retail are not even keeping up with population growth. Our GDP growth is barely keeping up with our population growth. This is not sustainable. I care about the future of this country, I want it to be a dynamic, productive, innovative, great place to live. Lower prices might not be good for David or Appraiser, but it’s really good for everyone else.

The bearish arguments look at the numbers, the economics, and markets. The bullish ones all seem to rely on feels. The risk is so asymmetric at this point. Look at the actions of BoC, the banks, and CMHC. They seem to be pretty worried, and I think they have a much bigger brain trust working on it than those claiming the bottom is in.

Chris

at 11:45 am

Good points, Pragma. I agree on pretty well all counts. Bullish arguments lately seem to be focused on low sales volumes making pricing data meaningless, or highlighting 2010-era bears (e.g. Garth Turner, Hilliard MacBeth) who were wrong.

Meanwhile, CMHC’s “best case we’re looking at … house prices getting back to their pre-recession levels, at the earliest, by the end of 2022”. Makes you wonder what their base case, and worst case scenarios might look like.

David Fleming

at 1:03 pm

@ Pragma

Lower prices have no negative effect on my business. In fact, if I were able to work in a market where buyers didn’t have to bid against 18 other people for a home, I would do far more business.

Jimbo

at 2:58 pm

Majority of what you have mentioned has been around for 12 years and has had little effect.

I don’t see people defaulting on their houses when they have 50+% equity in their homes and most of the people in Toronto have that much equity. The only ones that wouldn’t are thosewho bought their first home in the last 2-4 years. The rest should be fine.

Chris

at 3:16 pm

Jimbo, there’s obviously a huge factor around today, that hasn’t been present for the past 12 years… changes the calculus dramatically.

I don’t think anyone is expecting the majority of people to default on their homes. But as Ben Rabidoux alluded to the other week, there are more over-leveraged households than you probably think, and it doesn’t take “most” defaulting to impact the entire market.

Jimbo

at 4:32 pm

I do agree that what is happening today in unprecedented and yes it does change the calculus dramatically compared to last year et al. That being said Canada sucks at generating useful statistics so it is hard to read into what is going to happen.

To me how do we define the multivariable model, what gradients(partial derivatives) are important, what rank does a meaningful matrix contain?

I honestly believe that the majority of the people that lost their jobs are the ones that make $20/hr or less and unless they were in the market before 2010 will have little affect on housing. If they have been in the market since 2010 the majority should have enough equity to get them through a slump. Yes banks could shutdown a HELOC but when you have $450k in equity and you have an open $100k HELOC, why would they?

Why do I think the majority are $20/hr or less? I believe this to be true because the hardest hit industries are service related. If you are an Engineer working on a large project, the design still has to happen and you wouldn’t stop work until a project is canceled or completed, the only Engineers that would have anything to worry about are the ones designing condo’s, or office towers. Those working infrastructure, nuclear etc. should be fine. There will be high paying trades people that lose employment because building owners cut funding for maintenance (I’m thinking Refrigeration mechanics, generator mechanics etc.) if it isn’t governed by the Canadian Labour Code as having to be completed (like building air filters every 6 months/elevators) then the contract and work will be purposefully delayed. If this goes on for anther 3-5 months then as a nation I think we are toast and the price of a house won’t matter much.

The statistic that stood out to me on twitter today was only 1% of people making $48/hr or more have lost their employment since March. If that is true then Toronto Households should be safe. The families that rely on that $20/hr secondary income may lose their vehicle to repossession I just don’t see them sacrificing their house when it comes time to pay the bills.

I fully expect POS numbers to go up quite a bit and like I said previous if I was in Toronto I would be looking in the neighborhoods where POS is concentrated to buy a house that is depressed in value but not in POS. I wouldn’t be holding my breath to save 30% on the purchase price (compared to now) but I would jump on a 10% discount if the property was in good shape and feel comfortable. If things get worse you could see 15%-20% but I wouldn’t hold my breath for that either. I think their are too many people waiting and trying to get into the market that any increase in supply will be ate up.

Chris

at 5:00 pm

“I honestly believe that the majority of the people that lost their jobs are the ones that make $20/hr or less”

I agree with you, and the data seems to bear this out. However, it sounds as though many higher earners have seen their incomes decline, as hours have been cut, or been temporary laid-off, which may not be captured in the Labour Force Survey. We can see the extent to which it understates the situation, by comparing the figures – there are 7.6M Canadians on CERB, compared to 3M unemployed per Statistics Canada. Pretty big discrepancy there.

Your argument also seems to hinge a bit on demand remaining relatively static. I don’t anticipate huge numbers of Toronto homeowners to be forced into selling their homes. But equally, you have to concede that multiple sources of demand have just been significantly reduced – AirBnB, immigration, foreign students, speculative investors, flippers, landlords (who earn their rental income from the $20/hr cohort), etc.

“I think their are too many people waiting and trying to get into the market that any increase in supply will be ate up.”

Maybe. Or maybe the old adage will hold true: “Liquidity is a coward, it disappears at the first sign of trouble.” The number of people willing to try to catch a falling knife might be smaller than you think.

At the end of the day, I don’t know what is around the corner anymore than anyone else here. But I wouldn’t be putting my money on April 2020 representing the bottom.

Pragma

at 3:32 pm

That’s not true at all.

Again it comes down to bulls with the “feel” and the true numbers. The rising debt levels would suggest Canadians have been taking on an incredible amount of debt and not responsibly using the equity they’ve built. Debt is going up, consumption is going down. That’s what the data is telling us.

10 years ago our debt to income ratio was at 149 and we did not lead the world. Now it’s at 176 (and rising due to deferred mortgages being added to principles), and we do. Our GDP growth for most of the last 10 years was well above population growth (6/10 years). Since mid 2018 we’ve been hovering around 1.5%. Markets fail at the margins. Yes I’m sure there are many people who have plenty of equity in their homes, there are also many people who took that equity and bought “investment” condos and pre-builds. In a balanced market it does not take much to tip the scales. Per 100 houses we only need an additional 2-3 listings to get deep correction like we did in the 90s. I have not been bearish Toronto RE for 10 years, just the last two years, because that’s what the numbers are saying. This is a credit cycle, we are now moving into the next phase. It is such a compelling sell here.

condodweller

at 3:48 pm

@Pragma When you say it’s a compelling sell here what are you referring to? Investors or home owners? You make some good points but you can’t forget about supply and demand. We have still significant supply issues and even if we lose some demand it might only balance things out. This is why I’m actually more interested how low prices are going instead of when we reattain Feb highs.

Pragma

at 11:18 am

From an investor standpoint. I’ve been watching units for rent over the last few months and there has been an explosion of available houses, basements, and condos available in the last few weeks. Sudden glut of supply!

I think there are a lot of forces working against the S&D dynamic right now as well.

– Supply will continue to increase as new condos are finished

– Thousands of airbnb units will get added to the supply as the short term rental market is dead for now

– Any demand related to job growths will be negative as jobs are lost over the next year

– immigration fades in recessions. If a politician wants to end their career all the have to do is allow lots of immigrants in while the country is hemorrhaging jobs and the unemployment rate is 10+%

Then we have to think about the whole post-lockdown world:

– WFH supply side: companies have made it work. Many will rethink the expensive downtown leases they have. Maybe it makes sense to reduce or rotate the number of people who have to come into the office. Either this is a dynamic that will happen and it’s bearish commercial real estate, or it won’t happen and there’s no effect. I can’t see how its bullish. That empty space will need to be repurposed, more residential?

– WFH demand side. So if people are allowed/encouraged to work from home do you need to live in a small expensive house close to work? Bearish or no effect, but hard to see how you can see it as bullish.

These dynamics will last years. The virus is not going away. It’s a flu. Everyone will get it. There will outbreaks and hotspots. People will be afraid. Markets are driven by fear and greed.

Jimbo

at 4:53 pm

I think the feels on demand are accurate and can’t be discounted, six months of this shutdown sure but by then I think most would be admitting that the demand doesn’t feel pent up and a supply surplus could very well happen.

Here is the problem I have with your Debt to Income Ratio (DIR), 1.76 is not that bad, what scares me is 350% plus. Why do I say that, here is my example:

You earn $80k a year in Halifax and buy a $250k house with 5% down, after CMHC fees you owe $240k’ish on your mortgage, without any other debt you are at a 300% debt ratio. With a payment of $1,400 a month is that person a threat to the economy? How many first time buyers have entered the market in the last 8 years that would have DIR in excess of 300% in all markets with down payments up to 20% down and mortgages of $1,400-$2,300 a month while earning $80k a year or more?

By your estimates then you are saying 150 people in Toronto under stress to sell their properties would drive the market lower? I just don’t see that as an issue. If you tell me 500 people or 10% are under stress to sell each month then I think you have a point. What that point ended up being would be in the air as we don’t get enough access to data points but it would have some sort of impact.

TBH I think we could see an additional 3000-5000 condo’s enter the market over the next 6 months-year to deleverage. I just don’t think that will be enough to drive the market down, it will just open up opportunity for more FTHB’s. Even if those properties are discounted $80k on average it won’t do much to the market when houses are trading hands at over $1 million a pop.

Chris

at 5:02 pm

“six months of this shutdown sure but by then I think most would be admitting that the demand doesn’t feel pent up and a supply surplus could very well happen.”

There’s discussion of that already. From two weeks ago:

“I could be wrong, but something tells me the more likely story in the short term is pent-up supply. I would not be surprised if sellers jump back into the market faster than buyers – there are far fewer frictions on the supply side”

– John Pasalis

https://twitter.com/JohnPasalis/status/1253769450333114369

Hoose Price Bro

at 5:10 pm

The bull argument is that reality itself warps itself around the real estate singularity. People will live in smaller and smaller spaces, pay more and more of their paycheque for shelter, add more and more leverage, and will be rewarded for doing so. Anything goes in the quest for real estate, because rising prices mean there’s no loss or consequence. If the rent hits a wall from local incomes, just rent to tourists. There has been a work-around for every limit the bears think might finally put a cap on the market, and there always will be another work-around to keep the party going.

And they’ve been right so far. So why not forever?

And to be fair to the bulls, they also look at also look at numbers, economics, and markets, but with a different lens. Bears are (usually) worried about the next decade, while bulls are (usually) focused on the next quarter. And again, they’ve been right, and resulting is the only intuitive way to evaluate decisions. “Hoose price, bro.”

Gary

at 10:23 am

Your last point about Dow rebounding to 24,000, despite 15% unemployment does not provide any indicators of how real estate will rebound. The Fed pumped $2.6 Trillion into the bond market the last 6 weeks. Investors with $2.6 Trillion now sitting in their bank accounts have to put it somewhere. Treasuries at 0%? Not! Oil? Not! Real Estate? Not! Leave it in their bank account? Not if they want to keep their job! So what’s left? The Stock Market.

PS: Same story for Bank of Canada ($165 Billion).

jeanmarc

at 11:09 am

The stock market is heavily weighted by Apple, Facebook, Amazon, Google, Microsoft, and Tesla. All of which are very pricey per share. Talking about cash, Warren Buffet’s Berkshire Hathaway has over $130 billion sitting on cash. Wonder why he has not done any M&A as of yet. Even though he suggests the US economy will come out of this but has no idea of when.

J G

at 11:21 am

That’s why you buy them when there’s a chance 🙂 I picked up MSFT@140, AMZN@1750, and GOOGL@1100 in March.

Look, I had no idea DOW would bottom at 18000 on March 23rd. But that’s the beauty (and liquidity) of the stock market, I just put in a few thousand into each of these. These companies are money making machines.

With RE, it’s a much larger/longer commitment, also requires a lot more carrying cost and ongoing effort (maintain, dealing with tenant).

jeanmarc

at 1:17 pm

I don’t disagree. Those I listed are always manipulated by big hedge funds and computer driven algorithms pushing them up at every opportunity. Unless you have a decent position on those stocks, it’s hard to make significant money with a few thousand bucks percentage wise. The rest of the market is open to shorting, etc (though Tesla was shorted on numerous occasions before the big pop last fall).

The key is diversity in RE, stocks, bonds, gold, and cash.

Verbal Kint

at 10:50 am

If you’ve got a freakish interest in Toronto real estate, available capital, and a belief that the bottom is in, then you’re a buyer here — it would represent a GENERATIONAL opportunity, especially at these interest rates. The last time unemployment was this high, you were in diapers.

So when’s the closing date?

Haven’t bought anything? Then you’re just claiming you think the bottom is in to generate Jerry Springer style controversy. You wouldn’t really be plumbing new lows just to generate ratings, would you?

Jimbo

at 11:55 am

In my six or seven years of reading he calls it how he sees it regardless of ratings….

Verbal Kint

at 2:01 pm

I’m looking forward to reading about the purchase.

Daniel Sirois

at 12:02 pm

All one has to do is look at the history of prices over time. Prolonged decline in early 90s after historic move up is late 80s. Since then the prices have pretty much gone up, with minor wobbles here and there. If you are trying to time those wobbles, you are in trouble. You are also in trouble if you are buying an option to purchase a $2000/sq ft condo at a later date uncertain. Also obvious is predicting future home prices is impossible given statistically insignificant sample sizes, not to mention the umpteen variables that you have to control for. Just look at comps in the hood.

RJ

at 1:14 pm

Posted unemployment just hit 13% and we’re at the bottom of the market? How is that even remotely possible?

Real estate lags the economy. 700k households have applied for the mortgage deferral program. Canadian Household debt is at an all time high. Canadian GDP is going to get crushed in the coming quarters and a depression is likely at this point.

This is going to get a lot worse before it starts getting better. As savings run out, people can’t refinance investment properties because banks don’t want the risk and investors start dumping properties like AirBnB rentals because the numbers don’t even remotely work for them at current long term rental prices, the market is going to get flooded with inventory.

I think we’ll know how bad it’s going to get around the fall once the mortgage deferral program and CERB run out. Saying this is the bottom now is a huge shot in the dark that ignores pretty much all of the economic data available right now.

condodweller

at 2:55 pm

David you have a bit of a double standard going here. On one hand you say you don’t believe the numbers because you are simply not seeing on the ground i.e. “I would argue against some of the blog readers who posted on Tuesday that “prices are down 10.8%,” since I know, through experience, that they simply are not.” and you couldn’t get a 625k condo for 10% less.

On the other hand when another agent tells you that prices are down based on what he sees you counter by saying the numbers don’t show that and you believe the numbers.

I get that mix/volume will affect averages and that averages are exactly that, averages. But in order to be credible you have to pick one.

“With the DOW Jones dropping as low as 18,000, now having recovered to 24,000, do any of you think it’s going back to 18,000, let alone below?” I wouldn’t bet on it, but I definitely would not want to bet against it. Warren Buffet sold stocks into the bounce and in his annual meeting indicated that things could very easily go below the low depending on how things shake out.

“Disagree if you want, and many of you will. But I believe April of 2020 will, in fact, prove to be the bottom for our market.” You could be right however I think the chances of it happening is very low. Fortunately, you only have to wait about 30 days to find out.

Imstuckinacondo

at 4:12 pm

Love how David straight up fesses up to music piracy.

I would also take the other side of that bet. A retest of financial market lows and real estate price lows is very conceivable, and quite likely in my mind. This current rally is a bull trap.

Appraiser

at 6:11 pm

The bottom was in a couple of weeks ago.

Chris

at 6:20 pm

Oh ok! Everyone, throw away those forecasts from CIBC, DRBS, CMHC, etc., forget about all those warnings of a massive coming recession and high unemployment, and don’t worry about slowing demand for real estate.

Appraiser has assured us that the bottom was weeks ago!

Mark

at 7:48 pm

-Liquidity is a coward, it disappears at the first sign of trouble

INSTEAD of that, remember,

-Scared money don’t make no money.

Kyle

at 8:08 pm

Appraiser successfully called the bottom and was right about it being in the rear view mirror not too long ago. I don’t recall CIBC, CMHC and certainly not any of you bears seeing that one coming.

And it’s actually DBRS as in Dominion Bond (i.e. not Real Estate) Rating Service.

Chris

at 8:22 pm

“Appraiser successfully called the bottom and was right about it being in the rear view mirror not too long ago.”

Sorry, but how exactly has appraiser successfully called the bottom of the market? Without seeing the future, and how sales volumes and prices will evolve over coming weeks and months, how can you declare him successful?

“And it’s actually DBRS as in Dominion Bond (i.e. not Real Estate) Rating Service.”

Yes, I mixed up a pair of letters, meant to say DBRS [Morningstar]. I thought you didn’t like nitpicking? FYI here’s their take:

https://business.financialpost.com/real-estate/mortgages/housing-prices-could-fall-14-in-canadas-biggest-city-by-2022-and-thats-the-moderate-scenario

Kyle

at 8:33 pm

Don’t care about DBRS’ take, anymore than i care about Nike’s, Pizza Pizza’s, Gilette’s or any other random companies take on the Toronto real estate market.

I’m referring to the period when prices bottomed out after the 2017 peak and kept rising until February 2020.

Chris

at 9:07 pm

But apparently you care about the spelling of DBRS.

Ah, so you’re talking about 2017’s decline. Can you share the post where appraiser successfully calls out the bottom?

Maybe he was right about that one, I’ll wait to see the post.

But he was wrong about there being no recession this year, was wrong when downplaying Covid-19, and looks like he may wind up being wrong in his bet with housing bear.

And I would guess he’ll be wrong on his call that the bottom for the current downturn was a couple weeks ago. Time will tell on those last couple.

J G

at 9:36 pm

I’m invested in random companies like AMZN, GOOGL, AAPL. They are taking on Toronto RE and it’s no contest.

Kyle

at 9:57 pm

“Yes, I mixed up a pair of letters, meant to say DBRS [Morningstar]. I thought you didn’t like nitpicking? FYI here’s their take:”

“But apparently you care about the spelling of DBRS.”

Wow, you seem super-annoyed when someone picks a nit with your argument! Funny how that works. Now, can you just imagine if that’s all someone ever did with every one of your comments?

I can’t be bothered to look through year’s of blog history, but i have a pretty good memory of him saying the bottom was in the rear view mirror on more than one occasion.

Chris

at 10:04 pm

“Yes, I mixed up a pair of letters, meant to say DBRS [Morningstar]. I thought you didn’t like nitpicking? FYI here’s their take:”

“But apparently you care about the spelling of DBRS.”

That’s what super-annoyed sounds like to you? Interesting. But no, I was pointing out the hypocrisy, as you have previously railed against nitpicking. I can only imagine your response if I were to point out all of your spelling errors.

Ah, ok, so we are just to trust your word that appraiser successfully called the bottom previously. Got it. Are we to infer from this that he is successfully calling the bottom yet again?

Kyle

at 10:16 pm

“But no, I was pointing out the hypocrisy”

Yeah i actually added that nit on purpose, because i thought it would be funny to see you take exception to your own style of arguing and you did not disappoint.

Sure don’t trust my memory. Instead we should all trust your memory who has been posting here since 2015:

“I first began posting here in 2017” – Chris, 2020

“it was probably around 2016, when I started posting here” – Chris, 2018

Chris

at 10:45 pm

So, after we previously agreed not to nitpick, because you got worked up about it, you decided to nitpick as a joke? Sounds more like you were being hypocritical, and are now backtracking after being called on it. But either way, not a huge deal. I can assure you, I’m far from “super-annoyed” about it.

“Sure don’t trust my memory. Instead we should all trust your memory”

Oh, goodness, no! My memory isn’t very good. Though, I did look more at some of the comments posted by “Chris” around 2015-2016, and I’m not entirely convinced that was me. That one was able to identify some video game quiz David had:

https://torontorealtyblog.com/blog/deals-falling-through/#comment-54329

I’ve never even heard of those games. And it isn’t like “Chris” is a particularly unique name, we’ve had multiple ones posting here even as recently as a few weeks ago.

But, regardless, nowhere in my previous message did I say to trust my memory over your memory. I asked for a reference. Feel free to scroll up to re-read, if your memory is failing you!

J G

at 9:49 pm

Bulls are mad. Stocks are up, RE down, rent down. Have a great weekend everyone!

Btw, instead if calling bottom, I actually bought an investment property in fall of 2018. Not sure if it was the exact bottom but close enough.

jeanmarc

at 9:58 pm

AAPL would be a great play once they release their iphone 12 5G phones. Given that the 90 million iphone users will be replacing their phones (not all at once), instead of putting $500K into an investment condo, you can easily double or triple your investment without any overhead. Don’t forget Apple Watch 6 and new Airpods coming out as well. Lots of people will be drinking their kool-aid … 🙂

jeanmarc

at 9:36 pm

We all need to borrow the Appraiser’s crystal ball.

.when is the next wave coming so we can buy RE on the dip

.when is the DOW going to revisit the 18,000 low

.when is Amazon going to hit $3,000

J G

at 9:39 pm

AMZN will hit $3000 before 416 condo will recover to Feb 2020 high.

jeanmarc

at 10:01 pm

I was actually going to use his crystal ball to get the exact date. No doubt it will be even before any reaching the ave. $910K Feb high.

Professional Shanker

at 10:48 pm

AMZN admits that they will make no money in Q2 (reinvest in safety measures due to the pandemic) but somehow this is bullish.

AMZN and its attached valuation is an asset bubble no different than RE, just need to recognize and accept it.

Thomas

at 7:42 am

It is a small sample size but I have noticed that house sales are picking up in the area of my interest. And they are going at or above asking. Now waiting to see how long this momentum will last

Appraiser

at 11:31 am

Wow, HALF of those making under $16/hr lost their jobs or majority of their hours since Feb. For richest, making over $48/hr, only 1% of them lost jobs or most of hours. This is not an equally shared impact!

~ David MacDonald, Senior Economist, Canadian Centre for Policy Alternatives https://twitter.com/DavidMacCdn

Chris

at 12:22 pm

“Don’t you think, though, we’re all in a huge eco system? And a 20/hour worker spends and pays rent, which somehow trickles to a 40/hour, etc.?”

– Jake Abramowicz of Mortgage Jake

https://twitter.com/mortgagejake/status/1258795646938517504

Chris

at 12:25 pm

“The Labour Force Survey says 1.99 million CDNs lost their job in April (consensus: 4m). Here’s the number I care about: 7.6 million Canadians have applied for the Canadian Emergency Response Benefit, and 6.75m had done so by April 15th, the time the Survey was conducted. If you want to get a true sense of how many Canadians’ jobs were affected (even if that’s not an official job *loss* but significant reduction in hours, etc), then watch the CERB applications which are high-frequency, real-time and a more nuanced way of understanding this pain.”

– Frances Donald, Global Chief Economist & Head of Macro Strategy at Manulife Investment Management

https://twitter.com/francesdonald/status/1258745294746984451

How many higher earners saw pay reduced? Still employed, still working, but suffered a significant cut to income?

J G

at 1:31 pm

Exactly, those earning $16/hr are paying rent. Rent goes down, condos prices go down.

Bal

at 4:17 pm

Canada undoubtedly in ‘recessionary time,’ federal finance minister says

Chris

at 5:53 pm

Yep Bal, the question is no longer if we’re in a recession – that’s now a given. At this point, the question is how deep and long lasting the recession will be.

Chris

at 5:52 pm

Globe and Mail with an anecdote of lost incomes and subsequent delayed or reduced Toronto real estate demand:

“Millennial couple looking to buy condo in Toronto are without income after the coronavirus took hold”

https://www.theglobeandmail.com/investing/personal-finance/retirement/article-millennial-couple-looking-to-buy-condo-in-toronto-are-without-income/

Bal

at 6:35 pm

Pretty scary and worrisome……

jeanmarc

at 8:17 pm

Funny how everyone thinks the stock market bottomed out in mid March and now rebounded over 24,000 and it’s hunky dory. Ask yourself what really changed between mid March and present.

We all already now the following:

https://markets.businessinsider.com/news/stocks/central-banks-buy-trillion-financial-assets-g7-march-federal-reserve-2020-4-1029113160

US Fed artificially propping up the market. Something could”pop” possibly in the next 6 -12 months which could trigger a huge drop. Once fear creeps back in, watch out.

John Forguson

at 1:32 am

Very useful article. Loved reading it.

http://www.northokanaganhomesearcher.com

Appraiser

at 8:20 am

Some people, Ben Rabidoux for one, find it surprising that there were 800 sales a week happening in the GTA during a lock-down pandemic. If that’s true, then the news about Vancouver’s April sales volumes were “only” down by 39.4% for the month, must be downright remarkable.

BTW The benchmark price for detached in Van is $1.46M.

Here’s a question for the bears and the “analysts”

If Toronto and Vancouver have for decades defied all of the economic parameters usually ascribed to housing, ie. price to income & price to rent ratios et.al., is there any strong evidence to point to why both cities won’t continue to defy financial rationality or as to why they won’t maintain their current status as desirable world-class places to live and extraordinarily expensive?

Chris

at 8:55 am

“Vancouver’s April sales volumes were “only” down by 39.4% for the month“

You forgot to do your research:

“Sales plunged, dropping 39% on a year-over-year basis. That’s in comparison to April 2019 which was the slowest April in 19 years. So yes, sales were downright terrible, the worst on record.”

– Steve Saretsky

https://stevesaretsky.com/wp-content/uploads/2020/05/SS-MonthlyRev-2020-4.pdf

Pragma

at 9:16 am

Yes it’s called a deep recession and a credit cycle.

Appraiser

at 11:29 am

TRREB MLS preliminary data for May 1 -7, 2020, GTA.

740 firm transactions plus 823 conditional sales.

Highest price detached: 10 Ardmore Rd. , $5.4M (2 days on market).

Highest price semi-detached: 524 Euclid Ave., $3.625M (1 day on market).

Highest price condominium: 29 Queens Quay #1404, $3.95M (111 days on market).

Chris

at 11:51 am

May 2019 TRREB reported 9,989 total sales, an average of 322 per day. For a seven day period, that equates to 2,256.

740 firm, plus 823 conditional (under the unlikely assumption that every one closes) equals 1,563 – a decline of 31% from last year.

Where’s the number of listings? Or did you not want to post that?

As for your sales anecdata:

10 Ardmore Rd. – Listed $5,500,000, sold $5,400,000 indeed after two days.

524 Euclid Ave – Originally listed $3,650,000 on March 26, 2020, on the market for 63 days, then re-listed April 30, before selling for $3,625,000. Claiming “1 day on market” is false.

ph1404 – 29 Queens Quay E – Listed January 13, 2020 for $4,650,000, sold May 4 for $3,950,000, or $700,000 under asking.

Frances

at 3:48 pm

Hi David and gang,

Longtime lurker, first-time commenter. You have said that you wouldn’t recommend to any of your clients that they sell in the middle of a pandemic unless they absolutely have to. As someone who owns a 2 bed/2 bath Toronto condo and is considering moving up to a townhouse / small starter home I am seeing a number of appealing listings at very reasonable prices. Surely whatever hit we take on the sale-price of our condo would be offset by the savings on the townhouse as well as the current low interest rates? Although I do note that Condo prices have dropped further than Town and Semi-detached so maybe it’s a mad idea!

jeanmarc

at 3:58 pm

As John P. has stated in his interview and given the situation now, if I “had” to move, I would sell first before attempting to buy anything. At least I know what I have to work before buying. The other issue is that no one really knows where the bottom is (unless you have a crystal ball).

cyber

at 9:04 pm

Unrelated to the actual blog topic, I must commend your choice of song – Johnny Cash’s rendition of “Hurt” is one of, if not THE most moving songs I have ever heard.