What’s that saying, I’m thinking of?

It’s on the tip of my tongue.

I think it goes, “If at first you don’t succeed, try, try, try, try, try, try, try, try, try again…”

Or something like that.

I think I may have added “try” one too many times…

In our city, there are always going to be properties that have been listed too many times, and often we’ll see properties that have been listed so many times, at so many different prices, with so many different agents, you almost begin to think they’re not trying to sell the property.

Case in point, something like this:

This condo was listed for $2,550,000 in 2018.

Despite the market going up, the listing has continued to sit on the market, and has been re-listed four more times, at a lower price each time.

There have also been four different listing agents, but that’s another story.

So while we can always find “crazy” listings like that one, I want to leave that aside for today.

Today, I want to talk about actual listing and pricing strategies in today’s market.

I’ll present various scenarios based on properties that are either on the market or have already sold, and we’ll determine if the listing, pricing, and actions taken by the seller and listing agent could be called a “strategy.”

“Strategy” is defined as:

A plan of action or policy designed to achieve a major or overall aim.

In this case, the aim is not just a sale, but a sale at a particular price, and that’s often the problem.

If a seller wants a billion dollars for his or her property, the “strategy,” or the plan of action or policy designed to achieve an overall aim, isn’t going to achieve anything!

So for the purposes of our discussion today, we’ll have to alter the definition of strategy to include at least some level of realistic expectation, or not.

Here’s our first example:

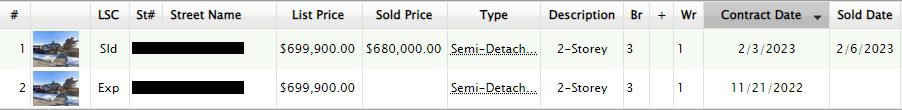

This property was listed for $699,900 on November 21st, 2022.

The property did not sell.

The sellers re-listed for $699,900 on February 3rd, 2022, and the property promptly sold for $680,000 in three days.

Strategy?

Sure, why not?

It’s the most basic strategy out there: be realistic.

But also: be patient.

Be………strategic.

This seller said, “I’m not having any luck here at the end of the calendar year, and with the market slowing down, I’ll terminate and re-list this one month into the new year.”

That’s what happened, and it worked!

Here’s another example:

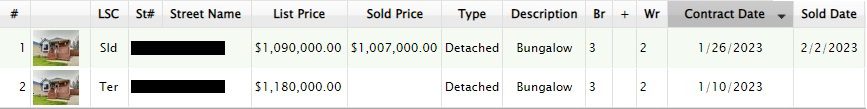

This property was listed for $1,180,000 on January 10th, 2023.

It sat on the market for sixteen days before it was re-listed at a reduced price of $1,090,000.

The property sold seven days later for $1,007,000.

Strategy?

Well, the end result wasn’t great, but there was a strategy here.

They started out high, adjusted, and then sold for what the market would bear.

It’s most certainly not what we’re used to.

In most previous market cycles, we’d see this house listed for $799,900 with an “offer date” and we’d see a high bid of $1,007,000, or perhaps more.

But in today’s market, we’re seeing a lot of sellers and listing agents deliberately list high. Some are merely testing the market. Some are building in a negotiating cushion. And some have absolutely no clue what the property is actually worth so they pick a random price, maybe even based off last year’s comparable sales, and plan to reduce as the listing grows stale.

How about this one:

This is a very simple Plan-A, Plan-B.

“Under-list” at $899,999 with an offer date, and if you get three offers and the highest is acceptable, then you sign it and sell your house. If your “strategy” doesn’t work, then you terminate and re-list the next day at $989,900.

And that’s what happened!

As you can see, they ended up selling for $970,000.

Maybe they wanted more initially but based off a $989,900 secondary list price, I think they accomplished their goal.

Strategy?

Absolutely!

The public doesn’t like it. They feel the seller should be “forced” to accept their initial offering price of $899,999, but that’s not how it works, and it never well – unless our federal government is in power for another two decades, but by then, they’ll own everything anyways, so the point is moot…

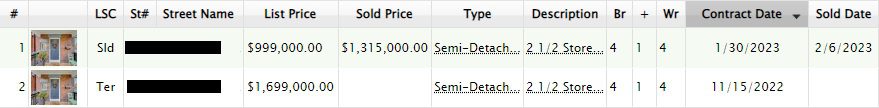

How about this one:

Yikes, I dunno.

They listed for $1,699,000 in November of 2022 and the property sat on the market.

The ridiculous drop to $999,000, with an offer date, is a lot. That’s about as big an under-list as we’ll see.

The strategy worked though……..right?

They sold for $315,000 over asking, albeit an artificially low asking price, and had they under-priced by another $200,000, we could claim they sold for $515,000, and so on.

So is this a strategy?

Hard to say.

It could have been based on desperation, and since we assume this didn’t actually work, ie. it sold for $400,000 below the initial list price, at best we can call this “a well-executed strategy that did not provide satisfactory results, and at worst, we can call this, “A sale with a complete lack of a strategy, based on unrealistic expectations, that ended poorly.”

Here’s a good one:

I can’t believe this worked.

They listed in September for $999,000 with an offer date, and it didn’t sell.

In October, they re-listed lower, which is insane, for $799,000, with an offer date. And it didn’t sell.

Then in January, they re-listed at $999,000, with an offer date, and they sold it for $1,183,800.

Strategy?

Hell yes.

Hate on them if you want, fine. But they had a set price in mind and they tried three times with three different, albeit similar strategies, and finally sold for an acceptable price.

Again, I feel as though the public doesn’t like this. They don’t like that a seller “gets” to list over and over, without fear of being forced to sell against their will, but that’s the way it is!

Let’s look at a few that are currently on the market.

Here’s a good’er:

These owners paid $900,000 in March of 2022.

Ten months later, after a market decline, they want to sell!

So they priced at $999,000 with an offer date.

That doesn’t work, so one week after the initial listing, they increase the price to $1,225,000 with offers any time.

That didn’t work.

So now their “strategy” is to list at $899,000 with yet another offer date.

Is this, in fact, a strategy?

Sort of. I guess. But not really.

To be fair, I should mention (in case it’s not obvious from the fact that the house gained a basement +1 and a bathroom) that this is a flip. It’s a renovation, and who knows if it was intended to be flipped for profit or if the owners renovated for themselves and now are in the “life happens, we need to move” camp, but either way, it’s a flip.

As we saw in Monday’s blog post, not everybody who buys, renovates, and flips is going to make money.

Despite the videos you’ve watched from douchey-looking assholes on Instagram and Tik Tok, standing in front of their luxury cars, touting the “BRRRR” method (that’s not the sound of a person shivering in the cold, but rather it stands for buy, rehab, rent, refinance, repeat), buying and flipping houses for profit in Toronto is anything but automatic.

So the owners seem to “need” around $1,200,000 or maybe they could eek out a sale at $1,100,000 and not get (too) crushed, but we’ll have to wait and see how their offer date goes to decide if this was a strategy.

Many of you will say, “Whether they sell successfully, or not, this isn’t a strategy,” and that’s fair. But I think that if they pull this off, you might have to give credit where credit is due.

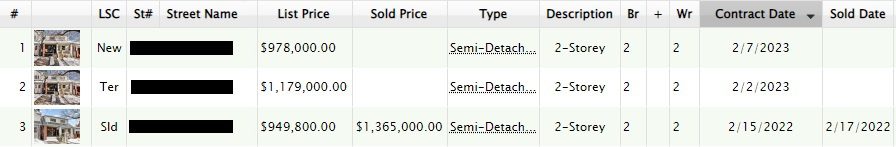

Here’s another one I’m watching:

This is going to be really interesting!

However, we also said that last week when the property was first listed…

This house sold at the peak of the market in February of 2022.

It’s a great house and I remember showing it. $1,365,000 for a semi-detached, 2-bed, 2-bath, was the going rate in February of 2022, but that was then, this is now, and we’re all waiting to see what it goes for.

They listed last week at $1,179,000, with an offer date.

Were they trying to get $1,365,000? Probably not. The listing agent is one of the top agents in the city and I’m sure he or she told the sellers to have realistic expectations.

But the property didn’t sell and the listing was terminated and re-listed for $978,000.

So is this a strategy?

What’s the thinking here?

We don’t know what price the sellers would actually sell for.

If they were willing to take $1,200,000 and they slightly under-priced at $1,179,000, and it didn’t work, then maybe, just maybe, re-listing at $978,000 and holding an offer date will work.

But what if the sellers are looking for $1,300,000 or more? How would under-listing again drive buyers to the home?

Under-listing as a strategy works when there are many buyers out there. But it works to solicit a handful of “dummy bids” at silly, low prices that help to push real buyers up even higher.

So if you’re pricing lower now than you were at before, are you going to attract new buyers? Yes, but likely only the ones that didn’t look at the house at $1,179,000 but will look at the house at $978,000.

This is an agent that sells a ton of listings so there must be inside knowledge here.

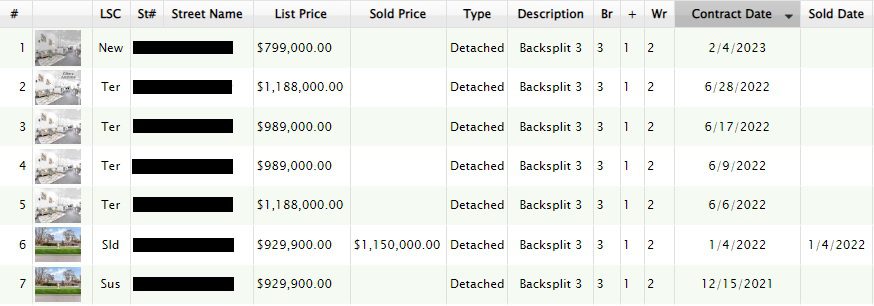

This next one is similar but as opposed to being on their second new listing, they’re on their fifth:

They bought for $1,150,000 in the suburbs in January of 2022.

I don’t know what happened, but they tried to get out four months later and listed for $1,188,000, which wouldn’t even recoup their costs, but such is life.

That didn’t work.

So the lightbulb went off and it became, “Why don’t we just list low and hold back offers?”

So they did that.

TWICE!

That made zero sense. They listed for $989,000 with an offer date in June, didn’t sell, then re-listed a week later – same price, same offer date!

Huh?

That strategy did not bear fruit, so they re-listed for $1,188,000 again and left it on the market to rot.

Last week, they came out at $799,000.

Who are you trying to attract here?

Last, but not least, I don’t think this one is going to end well:

This was on the market until late summer – priced at $1,799,000.

Who knows what these folks realistically want, but “under-listing” at $1,049,000 with an offer date?

I would put a Superbowl-sized wager on this unit being re-listed higher next week.

–

So what did we learn?

Everybody is going to have a different view on what we just read, but I think the conclusion is that many sellers are unrealistic about the market and are scrambling, usually after it’s too late, to obtain a price that they were never going to get in the first place.

Some properties just need to be listed at fair market value with offers any time.

Will sellers accept this? Or will they continue to “strategize” by listing four times at four prices?

Ace Goodheart

at 10:43 am

The thing I notice about the listings history is that the following is happening:

Folks seem to be, for whatever reason, unaware that you cannot simply purchase a house in Toronto, renovate the bathroom, and sell it six months’ later for half a million in profit (and then claim it on your tax return as a capital gain – CRA will come after you on that, and want to impute the whole thing to you as earnings for operating a business, but that is another story….).

These people seem to view renting out the house as a “stop gap” measure while they regroup their offensive and get their troops in order for another go at a sale.

However, the situation that this puts tenants in is very unfair (I am not a tenant’s rights advocate by any measure, however people have to be treated fairly, and this method of selling, leasing, and then kicking out tenants and trying to sell again – or listing while they are still there – is unfair to the folks who you rented to).

I mean, you are either a landlord, or you are not.

I can see why people who choose to rent (or who have to rent) are so upset about this. You expect the person who rents to you, to be doing it for the long term (not so they can cover losses while they regroup for another sale attempt).

At any rate, that is my beef with the current situation.

Steph

at 11:08 am

It sounds like you are a tenant rights advocate, and there’s nothing to be ashamed of. A little compassion for other human beings is a good thing. It doesn’t mean you have to give up all of your assets to the government as is so often the knee-jerk reaction.

As a landlord, I worry about tenants not paying the rent for months on end and not being able to evict them, but at the end of the day, we should all be thinking like you are (about the well-being of honest tenants), and I don’t see anything wrong with calling it what it is – tenant advocacy.

JF007

at 3:01 pm

David what’s your take on the builders who have undercut buyers thereby reducing the appraisal values of their homes and thus an inability to close a new build…Happened in Brampton with one happening again in Oakville now..shouldn’t there be some rule to make sure builder doesn’t undercut a buyer till they close on their property/commitment..something seriously broken in new build market right now.

Rational Actor

at 5:51 pm

Builders are most likely acting rationally and selling inventory for whatever price the market will bear when a given group of homes in a development is released for sale. If we had your proposed rule, then a builder could, in the case of a market downturn, be stuck having to carry later-completed units until earlier sales close because the rule would force them not to sell those units or restrict them to only trying to sell them at now above-market prices. Builders are rational, so they would simply adjust the price of the homes sold earlier in the development to cover this risk. This could actually serve to widen the eventual gap between the sale prices of the earlier houses (now increased by the priced-in risk) and the eventual sale price of the later units once they could be sold, assuming market conditions remain steady throughout the carrying period. This is a bad idea.