What happened to the doomsday scenarios?

Where are the catastrophic real estate market predictions now?

Naysayers, doomsdayers, market bears, and real estate cynics, I have to ask a simple but serious question: what happens if interest rates don’t rise?

And a fifty-dollar follow-up question: what happens if rates actually decline?

It seems like only a few short months ago that Canadian real estate enthusiasts were predicting the demise of the overall market, even in Toronto and Vancouver, which is tantamount to saying that the entire village is going to starve, including the King & Queen.

A few short years, perhaps.

And while I can dig up any number of articles talking about the impending market collapse due to upcoming interest rate hikes, I can’t help but stop here and take stock of where things currently are with respect to rates, and by association, the overall real estate market.

With my clients now locking into 2.64%, five-year, fixed-rate mortgages once again, it seems like those “unlucky” folks paying (gasp!) over 3% were merely shadowy-figures in our dreams. Rates did go up, as we have discussed for the last two years, but not only did the real estate market seem to remain unaffected, but the period for which rates were increasing felt like a very, very short time.

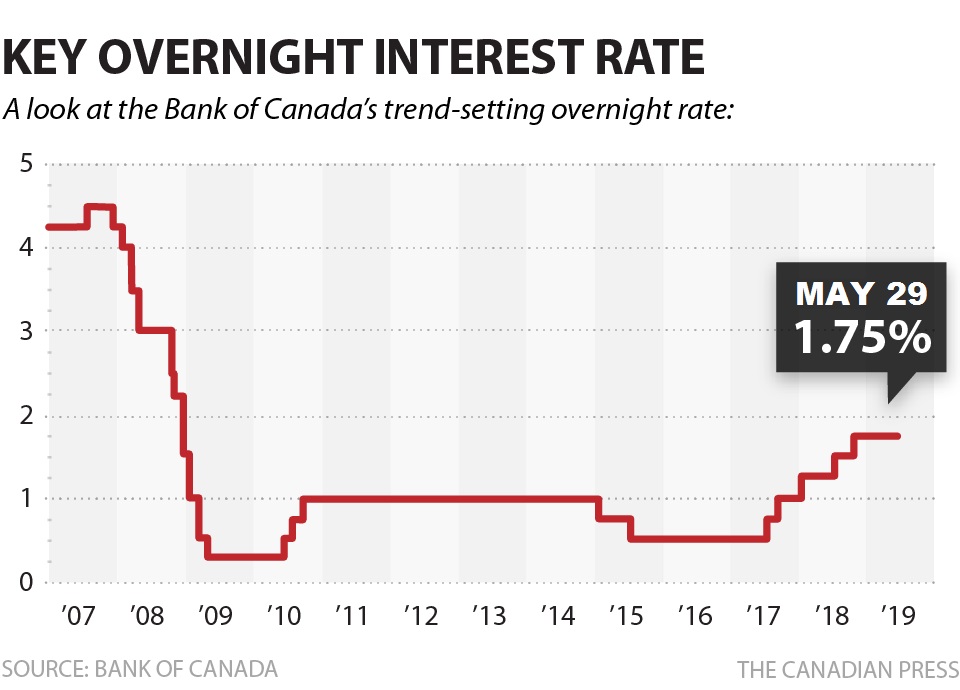

After over four full years of an overnight lending rate of 0.50% from the fall of 2010 to January 2015, the Bank of Canada increased the rate five times, each time a quarter-point, or 25 basis points.

The first increase was in July of 2017, which took the rate from 0.50% to 0.75%, and the Bank of Canada turned around a little more than one month later and increased the rate another 25 basis points in September.

In January of 2018, the rate went up another 25 basis points, which marked the third increase, totalling 0.75%, inside of a half-year.

Two more increases of 25 basis points came, in July and October of 2018 respectively, which meant that the rate had more than tripled from 0.5% to 1.75% in 15 months.

That should have had a monumental effect on the Canadian real estate market, and while some will suggest that it did, I would argue that the effects varied geographically, and that additional mortgage policies (the stress test, for one!) had as much of, if not more of an impact.

A quick refresher on rates in the last dozen years:

We’ve been hearing stories about “When rates were at twenty-one percent” for years now, if not decades. But very few, if any of us, believe that day will come again. Ever. Period. Full stop.

What many people do think is coming, or perhaps did, was rates that would be high enough to have an adverse effect on the real estate market. And you know what? 125 basis points surely wasn’t “it.”

I first started to see articles about interest rate hikes, and the effect they would have, really ramp up by the end of 2016.

This one stood out to me (enough to remember it) probably because of the cynical title:

“Grandpa, What’s An Interest Rate Hike?”

This appeared in Maclean’s in December of 2016, which was an ironic time to be suggesting the market might, sorta, maybe, kinda correct, because this was merely weeks before we saw the most incredible run in Toronto real estate prices, perhaps of all time.

The title of the article tells you all you need to know about the author’s slant, which is essentially that it’s been a long, long time since rates have increased, but also that perhaps current mortgage-holders aren’t equipped to deal with the consequences.

From the article:

Nearly a decade of near-zero rates have failed to do what they were intended to do: revive growth and spark inflation. This has led to mounting calls for central bankers to take a different approach, based on the idea that low rates are restricting growth and leave no room for cuts when the next crisis hits. That idea got a high-profile voicing in early December when former Bank of Canada governor David Dodge called on the world’s central banks to coordinate rate hikes. What appeared impossible a year ago suddenly seems inevitable.

When rate hikes do come, they will deliver a shock to a very large number of people. A vast swath of today’s working population—and hence homebuyers—have no inkling of what higher interest rates look like. For roughly a third of workers in Canada, the last time interest rates were as high as even the lowly level of five per cent, it was 2001, when they were still in school—some in university, but a lot of them in kindergarten.

Yet lured by the promise of years of ever cheaper debt, Canadians have loaded up on car loans, mortgages and lines of credit backed by the swelling equity in their homes, positioning them perilously for even a small rate hike. Just this past fall, TransUnion, the credit-monitoring firm, revealed that one million Canadians would not be able to handle even a one-percentage-point increase in rates.

Which raises the spectre of another event that has long been deemed by finance experts as impossible in Canada—a sharp housing correction.

The article is very well-written, and convincing as well.

The article proved to be correct in terms of higher interest rates, but incorrect in terms of the housing correction that would follow.

Some might suggest that there was a correction after April of 2017 here in Toronto, but that decline in prices merely offset some of the preceding increase in prices experienced in a mere four-month period from January to April of 2017.

The market overall has been quite stable since 2016, with highs and lows, and geographic differences, but overall I don’t think anybody would suggest that there was “a sharp housing correction.”

That article above was written in December of 2016, and the CREA HPI Composite Benchmark stood at $557,000. The May, 2019 figure stands at $624,400. That’s not a “sharp housing correction,” but rather an actual increase, Canada-wide.

CREA also has a seasonally-adjusted HPI, which to be fair, is a much better measure of the overall health of a market, especially if you’re comparing a month like December to a month like May! Re-run those two months with the seasonally-adjusted figure, and you get $613,000 and $614,500 respectively.

Either way, the overall Canada-wide market is flat, at worst.

And here in Toronto?

We know that in 2018, the average Toronto home price failed to increase over the previous year for the first time since 1996. But was that due to interest rate increases? In part, perhaps. But entirely? I don’t think so.

And did the Toronto market suffer “a sharp housing correction?” Unlikely.

The HPI Composite Index for the GTA (all Toronto) sat at $693,600 in December of 2016 when the above article was written, just for comparison’s sake. This peaked at $816,400 in May of 2017 when the market went berserk, came down to a low of $743,200 in January of 2018, and is now back up to $794,800.

The 416 figures show a far less modest market: $720,400 in December of 2016, a peak of $830,900 in May of 2017, and currently $879,300 as of May, 2019.

I think you get my point here; the market is strong. The market is very strong in Toronto, extremely strong in the 416, and across Canada it is, at worst, flat.

So is it possible that higher interest rates from 2017 onwards didn’t have an adverse effect on the market?

Is that in any way logical?

If we go month-by-month, or even season-by-season, we can build a case that interest rate hikes, combined with mortgage policy changes, coincided with certain periods of weakness in certain hand-picked markets.

But overall?

Overall, I don’t feel like rate hikes had an effect.

I feel like the mortgage stress test – something I predicted wouldn’t have any affect on my clientele, had a far greater impact than the rate increases themselves.

And now here we are, July of 2019, looking at a slim-to-none chance that rates continue to increase, and actually have a greater-than-average chance that rates decrease in the coming months.

Let’s not forget the discussion we had back in May about how rates weren’t increasing, but industry-watchers believed a cut could be coming:

May 24th, The Globe & Mail: “Bank of Canada Done Raising Rates Until 2020, With 40% Chance Of Cut”

Oh, what a difference one month can make!

In May, we were hearing about how there “wouldn’t be any more increases,” and now in June, we’re arguing over if not, but when cuts will come!

This appeared in the Financial Post on June 28th:

“Why Canada Won’t Necessarily Follow Any U.S. Rate Cuts”

From the article:

A lot of people assume the Bank of Canada will tag along if and when the U.S. Federal Reserve goes in a new direction.

“There is a 90 per cent correlation between U.S. and Canadian monetary policy, so of course the Bank of Canada will follow,” David Rosenberg, the ubiquitous chief economist at Gluskin Sheff + Associates Inc., a Toronto-based investment firm, told BNNBloomberg earlier this month when asked if a Fed interest-rate cut would be matched by the Bank of Canada.

But the relationship isn’t as automatic as Rosenberg’s comment makes it sound.

Yes, Canadian interest rates track American borrowing costs because the two economies are so entwined. If the U.S. is struggling and in need of monetary stimulus, then chances are Canada will be struggling and in need of monetary stimulus.

And though Canadian policymakers insist their decisions are independent of the Fed, there are limits to how much their policies can diverge. If the gap grows too wide, changes in the exchange rate and bond yields will alter the direction of the economy, forcing a response from policymakers to keep annual inflation at their target of around two per cent.

Still, the Bank of Canada’s room to manoeuvre is much wider than some tend to think.

I’m not an expert on foreign policy, and/or Canada/USA relations, but that number 90% is about the best odds you’ll get on anything in life, other than death and taxes.

We’re now in a market climate where experts feel that rates are coming down, and the conversation now should switch gears from “if” toward “when.”

In the meantime, the 5-year-fixed rate is coming down, irrespective of what happens with the overnight lending rate, since fixed-rate mortgages rely more heavily on the bond market, which is currently in the tank.

Money is cheaper today than it was last month, or six months ago for that matter, and by a good margin.

A client of mine bought his primary residence last summer and took a variable rate mortgage of 2.55%. That rate currently sits at 3.04% due to the rate increases since then.

And guess what?

He was just pre-approved for a 5-year, fixed-rate mortgage of 2.64% for his pending investment property purchase.

Imagine that!

His variable rate mortgage his 40 basis points higher than his 5-year-fixed?

As he told me, “I don’t have time to dwell on my ‘sky high’ 3.04% mortgage on my home because I’m too busy celebrating the 2.64% mortgage on the condo we’re going to buy and rent out.”

He believes the 3.04% variable, which can be converted to a 5-year fixed at, probably 2.74% today if he wanted to, is still historically rather low.

And the monthly payment on a $500,000 investment condo, with 20% down, goes from $1,690.93 per month down to $1,606.73 per month, at 2.64% rather than 3.04%. It makes it that much easier to carry each month.

Now at the risk of asking a question to which I’ve clearly answered indirectly myself thus far, I’ll ask again: what happens to the market if interest rates decline?

Is there any reason left to expect some sort of “sharp market correction?”

Can policy itself trump rates? Or should we expect to see prices continue to rise as rates fall?

I shudder to think. Toronto condo prices are up 45% in the past three years, which is completely illogical in the face of increasing interest rates during that same time period. So what happens when rates fall?

The market would really, really benefit from “catching its breath” so to speak, but I’m not convinced that’s going to happen if rates come down…

Appraiser

at 6:59 am

Macleans in general and lead housing bear Jason Kirby in particular, have been remarkably wrong about the housing market for a very long time. He and the rest of the the perma-bears just keep making the same dire forecasts year after year after year. Yet there are apparently no consequences to continuously making predictions that never pan out.

Clifford

at 8:30 am

Policy is what affected prices. Stress test has taken a lot of people out of the market. Harsher lending requirements as well. Rates had nothing to do with it IMO.

Mike

at 12:11 pm

Condo prices going up 45% in 3 years is some kind of sick joke. In what type of economic climate should that even be possible?

Appraiser

at 1:03 pm

Answer: An economic climate of full employment, robust immigration and strong demand.

Professional Shanker

at 2:17 pm

Correct answer: An environment that allows the “hoteling” of condos which promotes potential tax evasion – Airbnb.

Just like domestic and foreign spec pushed prices of GTA detached to illogical prices, Airbnb has done it to condos. Obviously, stress test has had an impact as well.

The important question to condo investors is what regulations will the city impose, much more important short term than interest rates.

Appraiser

at 3:52 pm

That’s two empty theories in one post. You bears never quit. Congrats!

Professional Shanker

at 5:53 pm

The level of ignorance required in order to dismiss my theory/fact is well I guess expected. Do you have investment condos in Toronto, I thought you did, could be my mistake.

As an investor I would expect you to understand how these regulations effect your returns, short and long term. So far it has been smooth sailing…..

If the city comes down hard on Airbnb I predict a drop of at least 20% over a year, nothing earth shattering here if you understand/witness the effect Airbnb has had on the Toronto condo market. Btw – I hope the city doesn’t as I fear the financial repercussions for our city.

Kyle

at 8:49 am

The best estimate of short term rentals that don’t comply with the City’s new rules is 6500 (https://www.cbc.ca/news/canada/toronto/fairbnb-report-short-term-rentals-entire-homes-lost-1.4971332). Even if every single one of these units decided to pack it in and sell (which is highly unlikely), that is less than one month of inventory (MOI) added to supply.

We are currently at 1.84 MOI, 3 MOI is considered balanced. So your worse case scenario wouldn’t even get us into Buyers’ market territory.

All this to say, a 20% hit is super-unrealistic.

Professional Shanker

at 1:10 pm

The spill over effect would be larger than you estimate. No one predicted/rationalize a price reduction in detached of 25% after the run up late 2016/early 2017 due to the “fair housing plan” but it happened.

The investor (speculator is a better word) appetite for condos is currently at a level not experienced in Canada since the late 80s which Appraiser is quite familiar with.

Kyle

at 1:35 pm

So you’re suggesting those people who are buying (or speculating as you say) precon now, are all betting that the short term rental rules don’t go through?

Doubtful at best, IMO.

Professional Shanker

at 2:43 pm

No, pre con buyers are speculating on the value increasing based on recent historical returns. The returns in recent years have been influenced by Airbnb reducing supply amongst other items of course (strong economy, low employment as Appraiser has correctly pointed out, B20, money laundering, they all count). I believe the Airbnb effect which has lead to further price speculation is much larger than most including yourself believes.

Per Co

Kyle

at 10:15 pm

@ MIke

An undersupplied one…

And the tsunami of millenials hitting their peak home buying years has really just begun.

Professional Shanker

at 12:59 pm

which will coincide with a tsunami of boomers reaching their peak selling years which has just started to begin. Will be an interesting battle between the two and I do not dispute the demand of millennials and immigration policy but I don’t think you can ignore the supply which will come on the market due to boomers.

How this will affect mix/type of housing will be an interesting question….I don’t per say buy the trade narrative of shorting detached burbs in favour of long condos, but I do understand why some believe it.

Kyle

at 1:28 pm

Big differences in how those generations intend to move. Many if not most Boomers, have said they prefer to age in place. Many have decided they are only leaving their homes feet first. And those that don’t cling to their homes, will be looking to downsize (i.e. Sell one thing to buy another, which somewhat offsets). Everything i have seen says very few Boomers can be expected to exit the real estate market all together in the next few years.

On the other hand the 1 in 2 millenials who still live with their parents are reaching their prime home buying years en masse. And when they do, it will be net new demand.

Professional Shanker

at 2:50 pm

On your boomer comments – I don’t disagree with the exception that finances will prohibit them for staying in the GTA as they need the cash flow out of their properties at some point – don’t get me started on the reverse mortgages being offered, if anything I believe products should be developed for elderly who want to stay in their homes, without being gouged at 6% a year.

What happens if millennials never buy in way people expect, countless surveys and polls confirm they do not value home ownership to the same degree as other generations have?

Kyle

at 4:36 pm

Can you share some of these countless surveys and polls showing millenials do not value home ownership? That runs entirely counter to what i’ve seen:

https://www.narcity.com/news/ca/majority-of-canadian-millennials-want-to-own-a-house-and-theyre-willing-to-compromise-to-get-it

Kyle

at 4:41 pm

https://www.canadianrealestatemagazine.ca/news/millennials-interest-in-home-ownership-intensifies-240606.aspx

“Genworth’s study found that another 30 per cent of millennials plan to buy in the next two years.”

http://theconversation.com/canadas-millennials-still-dream-of-home-ownership-and-make-it-happen-97161

Jimbo

at 4:42 pm

This is under the assumption most bombers have enough retirement income to afford servicing their property into the grave.

I find it hard to believe most will be able to do this.

Kyle

at 4:50 pm

@ Jimbo

Talk to some boomers, for most it’s actually far cheaper to stay in their current house because they don’t have any mortgage left, than it is to rent. And many don’t see the value of downsizing, because transaction costs chew up so much of their equity.

My street of SFH’s is full of empty nesters, with no intention of moving unless forced to due to health.

Derek

at 1:21 pm

How do you define a “sharp market correction”? And when is the last time or period of time that a sharp market correction occurred ?

Professional Shanker

at 2:21 pm

If interest rates decline our economy not just housing has bigger issues – we are in a recession and we are dealing with job losses, etc. Nobody should be hoping for interest rate cuts right now.

If interest rates decline, housing values will follow due to cause (recessionary environment) of the reductions.

John Chen

at 5:50 pm

Or shoot up in the short term before crashing down when the job losses hit.

Appraiser

at 5:58 pm

Toronto New Home Sales Soar 94% To Highest Level In 17 Years

https://www.huffingtonpost.ca/entry/toronto-new-home-sales_ca_5d178fffe4b07f6ca57e17e8

Clifford

at 7:22 pm

Most condos don’t even allow Air BnB so I don’t think “coming down hard” on Air Bnb will affect values all that much.

Professional Shanker

at 12:55 pm

Correct some condos try and restrict Airbnb rentals by passing BOD policies which restrict short term rentals. Let me assure you this does not stop owners from listing on Airbnb, I have first hand knowledge of owners who have and are currently running Airbnb’s out of building with strict short term rental policies.

Don’t believe me go on Airbnb and search some listings – you will come across statements about “keeping a low profile” in the building, which is code for the building does not permit short term rentals.

Derek

at 10:24 pm

Tap tap tap 🙂

anyone know what David means by a “sharp market correction” and when we the North or Toronto have ever had such a thing?

Appraiser

at 6:37 am

Thirty years ago there was a very sharp correction, I remember because I was there. Since then, not so much.

Jimbo

at 8:59 am

I think it is a moot point. The stress test says you qualify at Canada’s 5 year benchmark rate or current rate + 2%, what ever is higher.

I may be wrong but I think the benchmark rate is held at 5.34% and doesn’t fluctuate with prime?

If that is the case everyone will still have 15-20% less purchasing power than before.

We can say it is the stress test that caused all of this but all it really is, is an artificially induced rate. This is what houses would sell for if the rate was at 5% for a five year.

Housing Bear

at 10:19 am

I thought RE would collapse due to its own weight and pull us into a massive recession, or a global slow down would cause a recession which would then trigger a housing crash which would make the recession here worse. The former is the more extreme scenario but I have to admit it does not look like it will go down that way. The market has stabilized, and short of the spike we had in inflation last month, it looks like rates are set to go down.

A few reasons not to get too excited though. 1. Consumer and business insolvencies have been trending up, the past 3 months 2. If the US cuts its because they have to know that something bad is coming down the pipeline – This is Trump’s fault. He has been pressuring them to cut for the past two years, if they cut and its not because of something serious, then it calls their independence into question. 3. Interest rate hikes take 6-8 quarters to really work their way through the economy. First hike was July 2017……. 8 quarters ago. 4. Still a lot of new product near completion and coming online over the next two years.

Some things that could keep prices going – 1. Do Hong Kongers want to GTFO? 2. Academics are actually debating if central banks could pull-off nominal negative rates ( A lot of places already have real negative rates – rates minus inflation) – Whether or not we could ever see negative mortgage rates is another question, but if were actually debating having negative rates on your savings…….. probably not smart to hold any currency anymore.

Professional Shanker

at 1:19 pm

HB – I have been battling with the negative nominal interest rate question myself for about 1 year now…..I didn’t think it was possible but now I seem to understand it is really the only direction the global economy can go, no growth will lead to massive rate suppression and will further lead to the financing of everything which includes real estate (i.e. you may never pay off the principal but rather just finance it at nominal rates until you sell).

Christine Lagarde is certainty the person to push this narrative for the EU…..all you need now is the US champion.

Lil Savage

at 9:39 pm

The world will go to Hell.