We all know that CMHC does not insure mortgages of over $1,000,000, and for a couple of years now, we’ve been working in a market where you must make a minimum downpayment of 20%.

But a colleague and I had a spirited debate the other day about what other changes CMHC could make, and what kind of effect that would have on the market.

Of course, that begs the question: is it CMHC’s job to regulate the real estate market, or simply to provide mortgage insurance?

These “what if” scenarios always stir up a lively debate, and some great feedback from my astute readers, but one of my friends said to me the other day, “What’s the point in even discussing if it’s never going to happen?”

It’s a bit of a defeatist attitude, I suppose.

He told me, “Don’t get me wrong, I love reading your blogs about “what if” interest rates were at 8.99%, and the effect that would have on the market, but that’s N-E-V-E-R going to happen!”

Never is a long time, and I think he means that in today’s economic climate, it’s not anywhere remotely on the horizon.

The Toronto Maple Leafs will win the Stanley Cup again, won’t they?

I mean, I’m sure people said in the 1950’s, “The Boston Red Sox will win the World Series again,” and then they said it once more in the 1960’s, again in the 1970’s, repeated themselves in the 1980’s, once more in the 1990’s, and then just like that…BAM! World Series Champions, 2004.

So why can’t interest rates be at 8.99% again for a 5-year-fixed? Why can’t we talk about it?

Alright, I see my buddy’s point. He suggests that many of the “hypotheticals” we discuss are fruitless, since they’re so far gone.

But on the contrary, I think it keeps the mind sharp.

I think knowing the market inside and out is helpful, no matter how far off the ideas examined.

Case in point, the colleague who said to me, “What do you think would happen if CMHC stopped insuring mortgages over $900,000, rather than $1,000,000?”

Honestly, it’s something I’ve never given any thought to. I don’t think it’s going to happen, but the debate that continued was interesting.

Before we delve into that, however, how about answering the question I brought up at the onset: What is, or should be, the CMHC’s job with respect to the real estate market?

On the most basic level, their job is to provide insurance for mortgages.

But their ability to make wholesale policy changes can completely reshape the market, and they act almost like a regulator, in a way.

With even more powers, they could essentially be the God of the real estate market, determining the fate of mankind.

Now a person with a better understanding of government might point out that it is the Finance Minister who makes suggestions to CMHC for how to implement policies, and thus it’s really a top-down approach from the Canadian government. But then it’s just another, different “God” that can reshape the Canadian landscape, if he or she so chooses.

Well we won’t get into the “what if every buyer had to make a 50% down payment” doomsday, what-if scenarios today.

But I did want to talk about the idea of the mortgage insurance ceiling at $1,000,000 coming down, even if it’s simply for the point of discussion.

I personally believe that when the CMHC stopped insuring properties of over $1,000,000, and thus buyers had to make a 20% down payment on those properties, it put a tremendous amount of pressure on the $800,000 – $999,999 price point, and if there was any hope that the policy change would help cool the market, it backfired.

I saw the $600,000 houses go to $650,000 overnight, and to $800,000 within two years.

The market under $1,000,000 went nuts, and it continues to be the hottest segment of the market.

When my clients purchased a house for $1,006,000 a few weeks back, amidst twelve offers, there were two bids of exactly $999,999 from buyers who had only a 5% down payment, and couldn’t afford to go any higher.

So “what if” that magic $1,000,000 mark was brought down to $900,000? Or to $800,000?

I think the effect would be obvious, and those house prices might cool.

But I also think it would simply put more pressure on the $600,000 and $700,000 houses (what’s left of them), and believe it or not, I think it would start a run on condos.

I know it sounds nuts to say this, but there’s a shortage of “quality” $700,000 condos in the downtown core. There’s a TON of junk, but not so many places that I’d consider selling to my own clients. Trust me – I was out on Saturday, and again on Tuesday night, showing $600 – $900K condos, and most of them were “walk in, walk outs.”

Now in this “what if” scenario where CMHC only provided mortgage insurance up to $800,000, I think a lot more buyers would be looking at condos in the downtown core, where they can still make a 5% down payment. That, in turn, would probably cause prices to rise in this segment, whereas they might level off for houses over $800,000.

It’s amazing how much of an effect the CMHC could have, if only they wanted to.

I’ll go on record saying that I don’t ever expect the CMHC to lower that magic $1 Million mark, but let’s examine a different idea: what if we used a sliding scale?

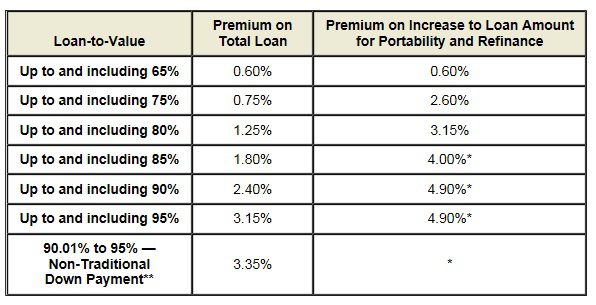

Well consider that CMHC already uses a sliding scale for their mortgage insurance premiums, as follows:

(FYI – the traditional CMHC premiums start at 80% LTV)

So what about a sliding scale for down payments?

“What if” the scenario looked like this:

–

5% down payment for purchase price $0 – $400,000

10% down payment for purchase price $400,000 – $800,000

15% down payment for purchase price $800,000 – $999,999

20% down payment for purchase price $1,000,000++

–

I’m in no way advocating for this, nor do I think it’s going to happen.

I also think that lenders would be lined up left, right, and centre to provide second mortgages. Traditional banks, credit unions, Alt-A lenders – they’d all be trying to ensure buyers can still purchase with only 5% down, by providing loans for the balance, so perhaps that’s another reason why this sliding scale would never be a reality.

But I also don’t really think my idea is all that creative, and yet it’s the first time I’ve ever really discussed it.

I’ve heard some suggestions that CMHC should raise the minimum down payment to 7.5% from 5%, or even to 10%, but that’s not going to accomplish much.

And it’s equally as fair for somebody to suggest that they lower the minimum down payment to 0%, or even offer 107% financing as lenders did back in the early 2000’s. Remember that everybody has a different risk tolerance, and while some people want as little debt as possible, others laugh at these 2.34% variable rate mortgages and wish they could get 107% financing so they could invest their money in a vehicle that returns 10, 15, or 20% per year.

Of course, we’ll always need legislation to protect us from ourselves. That’s why it has to be illegal to drive drunk, rather than just common sense. Or even illegal to drive without a seatbelt for that matter.

It seems that “debt” has become a bad thing, and the government has taken steps to reduce it, make it harder for us to access it, and force us to use more of our own money, rather than borrow from others.

I don’t think CMHC should be looking to make wholesale changes to the mortgage industry in some sort of pointed attempt to change the real estate market.

The 20% down payment on $1,000,000 had the unintended consequence of lighting the market under $1M on fire, and I truly believe that any other changes have the possibility of backfiring as well.

I think we’re going to see little to no changes from CMHC and the Finance Minister for at least 18-24 months, if anybody’s asking me.

And would you not all agree that there’s a better chance that rates drop than the chance that rates actually rise?

Time will tell…

Darren

at 9:52 am

I think that cmhc is doing something it shouldn’t be doing. It is far too easy to access it. It should be strictly for helping new entrants to the market similar to the rules for the HBP. I don’t think it should be allowed for people stepping up the next rung of the ladder. It’s too late now though, a change like that would destroy the market.

Boris

at 11:03 am

100%.

Government regulation in a capital market is one thing.

Government as a participant a la Fannie, Freddie, or the is Federal Reserve in the US bond market is a recipe for disaster.

CMHC appears to be leaning toward the second definition although the Conservatives have been trying to pull it back the other way without extracting too much pain.

jimbo

at 11:09 am

I remember someone predicting the above rule change having the exact effect you describe abov .

Joe Q.

at 12:21 pm

When it comes to interest rates, the whole “it’s NEVER going to happen” attitude scares me. Weren’t lending rates in the 6-8% range for most of the 1990s and early 2000s? Recency bias rears its head…

In any case, David asks what the role of the CMHC is (or ought to be) — I think everyone agrees that its original role was to help lower-income families (especially war veterans in the late-1940s, early-1950s) find affordable housing, either as renters or first-time buyers. Its current role as a provider of mortgage insurance to those who are not first-time buyers is, relatively speaking, a new thing, and has caused its portfolio to grow very quickly over the last decade or so.

Several people will undoubtedly comment that the size of CMHC’s portfolio is of little concern from a risk perspective (given that arrears rates are so low), and that since the CMHC returns untold billions to the federal treasury each year, it should not be tinkered with. Unfortunately the CMHC has historically been a pretty opaque organization, and so it’s hard to get a detailed look at the statistics about the mortgages in its portfolio. My fear is that this could be an “everything’s okay until it isn’t” scenario.

On the subject of mortgage insurance caps: the CMHC’s imposition of a cap on insured mortgage sizes is not a new thing. Before 2003 the CMHC also imposed caps on at least the highest LTV borrowers, but the size of the cap varied from region to region. I would be interested to find out whether the segmentation of the market (the under-cap portion “going nuts” as David describes) also occurred in that era. Any comments?

Chroscklh

at 3:29 pm

Is could be the recency bias rear ugly head like when Mama Valadaderozki awake from nap but is more likely to be terminal rate to be lower for very long time. 5 & 10 yr bond yield reflect measure of uncertainty for future rate – duration premium. Investor have more confident that fed know what it do, how to manage inflate so think less wild fluctuate in future so less premium require. Also interest rate so low, small change off small base have huge affect. No need raise overnight rate to 4% because half percent would choke economy like I had choke ostrich with senewy, ropey neck (ostrich escape, I have no choice). So while is true interest rate go up yes – is likely not be as high for many, many year. All this stimulus in system, no inflation, still slack. I use think CMHC was acronym for Hockey Night In Canada and I wonder why Cdns always talk this one. Now I realize I can’t spell and I dyslex

Joe Q.

at 10:44 am

Chroscklh speeches wise speech but Joe Q. still wonder whether friend of David know bond market detail, or instead comment like 2003 era when dinosaur and bullabear roamed earth.

Kyle

at 9:30 am

There’s plenty of other evidence out there indicating that “everything is ok”, beyond the miniscule mortgages in arrears rate and recent levels of interest rates. Of course lots of people will simply try to dismiss or discredit such evidence, based on the source not the substance. But i would point out Benjamin Tal has an outstanding track record for making right calls.

http://www.cbc.ca/news/business/canadians-paying-down-debt-quickly-in-low-rate-environment-1.2799771

Appraiser

at 12:24 pm

@ Kyle. Excellent points. The latest mortgage in arrears data from the Canadian Bankers Association flew completely under the radar of the MSM. I know, I know…”if it bleeds it leads” and good news makes for lousy headlines.

However, the facts are clear. Mortgages in arrears in Canada just hit a 6 year low and wonky mortgages in Ontario (by far the largest mortgage market in the country) just fell to 0.18%, the lowest in 24 years!

Joe Q.

at 9:21 am

Kyle — I can’t watch the linked video on my current connection so I’m unable to see the interview with Tal but I agree with you that he is very credible. The numbers I have seen about mortgage-holders making additional payments (generally survey data) seem to vary wildly.

Kyle

at 9:27 am

Here’s the report:

http://research.cibcwm.com/economic_public/download/feature1.pdf

Joe Q.

at 9:36 am

Thank you for providing this. It would be great if the numbers were broken down by CMA, because I suspect that Canada-wide averages mask a lot of interesting “local” data.

Joe Q.

at 11:43 pm

Chart 4 in that report is incredible and Tal lets it pass with very little comment. It suggests that almost an entire 15-year decline in the ratio of principal payments to new mortgage debt origination was erased in a year around 2013. I would love to know more about the original source of the data, specifically about principal payments.

Kyle

at 12:59 pm

CMHC was suppose to make housing more accessible, but instead they’re policies have pretty much done the opposite. They’ve really fragmented the market into different distinct classes. They’ve taken the evenly spaced rungs of the real estate ladder and redistributed them so there are several rungs bunched close together, a big huge gap, another group of rungs bunched together and so on. House prices used to be much more of a continuum, where there was a lot more overlap between condos and starter homes. But even the most “starter” SFH in the core is now twice the average condo price.

Government needs to stop dickering with housing. The unintended consequences pretty much always offset any intended benefit. As Darren has said it’s too late to undo what’s been done, they should just leave it alone now.

Joe Q.

at 9:46 am

Kyle, what aspect of CMHC policy do you think is most responsible for “redistributing the rungs” of the RE “ladder”? I have a hard time seeing how its policies specifically could drive the divergence between condo and SFH prices (with the possible exception of loan insurance for developers, which CMHC used to provide, but I don’t think was widely used)

Kyle

at 12:11 pm

I think the combined effect of TLTT and CMHC have created stratification in Toronto house prices. The effects i’m talking about aren’t necessarily one-to-one, (as in policy change results in direct market impact). That isn’t typically how real estate works. Real estate prices adjust with long lags. What i’m talking about is how these changes influence buyers’ decisions and behaviours, which as David has pointed out a buyer’s search could take upwards of a year before they finally transact and thus the long lags.

Above the 400K mark, i think the TLTT has really differentiated 2 bedroom condos from starter homes. Once you cross that barrier people seem to want to skip the move up condos and stretch into a starter SFH and stay put longer. This exerts downward pressure on 2 bedroom condos and upward pressure on starter homes. To me this explains why when you look at mls under 500K, South of Bloor from the Humber River to Coxwell, you only find 7 SFH (if you can even call them that) for sale, whereas you can literally find hundreds of 2 bedroom condos.

Above the 1M mark, i think the combination of TLTT and CMHC means those without minimum 200K+closing costs in equity are stuck in the starter SFH market, This again exerts upward pressure on the sub 1M SFH market. And IMO is why 920K gets you this: http://themashcanada.blogspot.ca/2014/08/and-it-went-for-65-brookfield-street.html?q=beaconsfield

while 1.03M gets you this in the same neighbourhood: http://themashcanada.blogspot.ca/2013/10/167-argyle-street-beaconsfield-village.html?q=beaconsfield

Joe Q.

at 4:10 pm

But couldn’t you argue equally well that the effect is coming from supply?

Maybe overall buyer preference for starter SFHs vs. 2BR condos hasn’t really changed, but the fact that the supply of new 2BR condo stock is increasing much faster (I presume) than the supply of new starter SFH stock. This would put pressure on these two categories in the way you describe, without invoking an effect from the TLTT (which is 1% of the sale price or less, when you’re considering homes in the $500k range).

Kyle

at 5:31 pm

Like i said it’s a confluence of things, but IMO the policies have had a major impact. Small downtown rows and semis used to be 500 – 750K, so there wasn’t as big a stretch to go from a 400K 2 bed condo to a starter SFH. Those same “starter” SFH’s have risen to 700K – 1M in roughly 2-3 years. Coincidence? I think not. I use quotes around “starter,” because these days, they are often well above $800K.

As Appraiser points out below, the # of Sales increased in the sub-1M freehold segment (so supply also increased), so for prices of this segment to have moved up the way they did relative to other house forms, demand for them had to increase by MUCH, MUCH MORE than the supply increase.

You need two things to buy a house: Equity and/or Income. CMHC gives a huge advantage to the Low Equity/High Income profile, which has been a growing portion of today’s new buyers. IMO this helps them stretch into these “starter” SFH and the TLTT also incentivizes them to stretch and stay put longer. Until they hit the 1M cap, in which case it shuts them out, again pushing them back down into the sub 1M market. Like i said below on a net i don’t think it changes how much activity transacts in the various price ranges, what i see different is what one gets for their money in the various price ranges. Simply put you have to pay close to double to get marginally more square footage when moving form condo to small starter home, but there’s not much of a hurdle to move from a small starter home to a much bigger, nicer forever home over the 1M mark.

Kyle

at 9:52 am

Some more anecdotal evidence of rung bunching. You can chock it up to supply alone if you want, but i think Governmental meddling has certainly played a large part in this kind of anomalous pricing pressure on the sub-1M segment. Pretty soon, even those starter homes will be pushed beyond 1M (thanks to hopeless people showing up on offer night with their $999K bids), making SFH strictly the domain of the rich and wealthy, while condos become the plebian form of housing.

C3031602 – $550K gets you a nice 1025 sq ft 2 bedroom condo in The Hudson

C3044464 – $950K If you want to move up to a 12.8′ wide rowhouse on Lippincott (i.e. extra $400K gets you about 400 sq ft more than the condo)

C3033101 – $1.2M if you want a brand new 2100 sq ft modern townhouse on Manning. (i.e. extra $250K gets you about 700 sq ft more than the rowhouse)

Joe Q.

at 10:28 am

I understand the argument you are making, Kyle, I just don’t think there is enough data to demonstrate it conclusively.

Kyle

at 11:01 am

When you’re talking about real estate you’re never going to find conclusive one to one evidence. Like i said that isn’t how real estate works, And in fact that isn’t how science works either. In Science, you don’t reject a hypothesis for lack of conclusive evidence. If everything is absolutely plausible, has all manner of empirical support and 0 evidence to the contrary than Science says you don’t jump to some other alternative hypothesis, because you prefer that answer better. If you look at the history of prices in the various segments, the pricing anomolies i am talking about did not exist 5 or 6 years ago, but became particularly pronounced after the CMHC cap came in force. Happy to look at evidence that contradicts what i am saying, but if you don’t have any then you’ve just crossed the over line between bias confirmation into willful blindness.

Andrew

at 3:22 pm

Interesting post – I have two questions/comments:

1. Is it not strange that if you have 20% down, you pay no insurance premium (as you are not being insured), but if (say) you have 15% down you pay a premium (and get insurance for an amount) calculated upon 85% of the purchase price? Should you not only pay (and get insurance for) the 5% extra that needs to be insured? In other words, if 80% of the property value doesn’t need to be insured in some cases, should that not hold true in all circumstances and only the additional loan amount above the 80% be what is insured?

2. More in line with the article above, imagine the inverse to David’s set scenario. Imagine that you just purchased a house of $900,000 that was really an $800,000 house that had its value inflated due to the CMHC rules placing pressure on the market under $1MM. Tomorrow, with little warning (it is just a regulation that does not need to go through a formal public process), the CMHC rules could be amended to increase the maximum insurable value to, say $1,300,000.

In my estimation, in that scenario the value of the inflated $900,000 goes down by some amount since the supply of 5%-down-available houses has quickly increased. Of course, eventually, that loss will be made up by the market rising, but it seems somewhat unsettling to buy into a house that has been inflated due to an administrative rule when that rule could change on little notice and wipe out some amount of the value from you overnight. I have not seen any discussion on this concept in the media – is there merit to my concern?

Name

at 5:50 pm

1. the premium to be paid is on the 85% so it’s a huge incentive for buyers to put down 20% if they have the funds. You don’t see many people put down 15%-19.99%.

2. the argument works in the other direction as well. If the insurable ceiling were to go down to $750k, that $800k home bought for $900k inflated value (“going nuts” premium) drops back to $800k. The premium gets erased almost overnight.

What you are saying rings true in all regulated markets, be it telecom/transportation/RE/etc. A good example at the moment would be the UBER debate. If taxi cab licences sell for $250k today, and suddenly a new competitor (UBER) comes in that skirts the licencing system, what happens to the value of the taxi cab licence plates if UBER is allowed to operate without purchasing taxi cab licence plates?

Beware investments in any industries where your existence depends upon regulation.

Andrew

at 10:14 pm

With respect to the first matter, ignore the choice of 15% (which could have been 5% or 10%), the concept that I was trying to get at was that I find it odd that the first 80% does not need to be insured for those who put 20%+ down, but the minute you cross the 80% threshold you pay on every dollar loaned (including the 80% that other buyers do not need to get insurance for) – it seems strange that you are not insuring only the 80.01%-95% portion of the loan (which is the only part that is supposedly higher risk to the lender/government).

With respect to the second matter, unlike many areas that would only impact a small percentage of the population (like the taxi industry), this particular regulatory matter has the ability to impact a huge percentage of the population (those with real estate under $1MM) and those who, if you believe articles about over-borrowing, are especially vulnerable these days – why is this matter not being discussed more often do you suppose?

jeff316

at 9:14 am

“why is this matter not being discussed more often do you suppose?”

Because it is dependent on hypothetical and risk is a fact of life.

Andrew

at 11:19 am

But we are inundated with discussion of risk in real estate from myriad other hypothetical angles (interest rates rising; condo oversupply; foreign investors; even the lowering of the CMHC ceiling). That can’t be it. It actually seems quite plausible to me that a likely way to let some steam out of the under $1MM market will be to eventually raise the ceiling. Much like TFSA contributions have been tied to inflation, perhaps so should the CMHC ceiling. If, when created, the ceiling was to allow/control the purchase of a certain level of house, the cost of that level of house has now gone up – perhaps so to should the ceiling.

Name

at 11:40 am

@Andrew

Your argument is flawed. The ceiling should be lowered and will have the same consequences on the $800k home.

The intention to purchase a certain level of house is way below the current ceiling. If, argue, the intention was a $600k home and the ceiling was $750k, then you could argue to raise it to $1mm. But since the intention is $600k home and the current ceiling is $1mm, there is room to cut the ceiling to, say, $800k.

Over time, the ceiling would need to be adjusted to account for inflation, just as everything in the world gets adjusted. Inflation is like a self-fulfilling prophecy…when times are going good!

Joe Q.

at 9:32 am

I’m not sure that it is really correct to say that “if you have 20% down, you pay no insurance premium (as you are not being insured)”. I would suggest that (a) in any case, it is not you who is insured, but your lender; and (b) your lender may still be insured even if you have > 20% down, but they are paying the premium, perhaps through some kind of bulk program. Please correct me if I’m wrong.

Appraiser

at 7:57 pm

Dear David Fleming:

I’m afraid that the available TREB data indicates that there are serious flaws in your argument regarding the effect of the new CMHC lending cap, which is not uncommon considering most of the evidence you’ve presented, while amusing, is strictly anecdotal.

Here’s the actual data year to date: Freehold sales of properties over $1M are running 27% ahead of 2013. Condos sales over $1M are 26% ahead of last year.

By contrast, freehold sales under $1M are a mere 1% ahead of last year and the number of condos sold below $1M are up 5%.

As I’ve tried to illustrate here before,

the much publicized million dollar CMHC mortgage cap is little more than political theatre. It must be remembered that CMHC’s own data indicates that mortgages in excess of $500,000 make up less than 5% of its total portfolio; and those in excess of $950,000 (the 5% threshold) are infinitesimal.

Peter

at 10:11 am

I bet your mom hates you.

Lem

at 1:52 pm

+100000000000000000

There’s making a point, then there’s making a point while being an ass.

Appraiser

at 3:21 pm

It appears that facts and data make some people uncomfortable.

The notion that there are hordes of high-ratio buyers now being shut out of the $1M+ real estate market in T.O. is simply a myth.

There is no doubt that prices have risen across the board. My position is that it is far more likely to be attributable to persistently tight market conditions, rather than the CMHC cap.

I also have no doubt that historically, there were “some” high ratio buyers in the $1M+ price bracket, but so few as to be statistically insignificant.

Unless someone can express a cogent argument to the contrary (rather than personal invective), I remain completely unconvinced otherwise.

Joe Q.

at 9:28 am

Appraiser writes: “It must be remembered that CMHC’s own data indicates that mortgages in excess of $500,000 make up less than 5% of its total portfolio; and those in excess of $950,000 (the 5% threshold) are infinitesimal.”

Is this data for GTA only, or across the country? I have no doubt that $500k+ mortgages make up a single-digit percentage of CMHC’s total portfolio, but when you look at Toronto or Vancouver in isolation, I’d imagine that number to be significantly higher.

Ed

at 11:11 am

Joe Q., Appraiser. Both valid arguements

Appraiser

at 3:45 pm

Unfortunately @ Joe Q., your logic is deeply flawed.

Outside of Vancouver and Toronto, average sale prices are well below $500,000. It stands to reason that the VAST majority of the relatively small number of existing “jumbo” CMHC insured mortgages are accounted for in those 2 markets.

Joe Q.

at 3:55 pm

Yes, that is precisely what I am trying to say. I’m not sure why you think my logic is flawed.

Appraiser

at 5:12 pm

The percentage of CMHC jumbo mortgages cannot be “significantly higher” in T.O. and Van, when the percentage elsewhere is close to ZERO.

In other words, what’s your point?

Joe Q.

at 11:24 pm

I am responding to your comments about the CMHC’s portfolio. In pointing out how little exposure the CMHC has to large mortgages, you mentioned that only 5% of its total Canada-wide portfolio consists of mortgages above $500k.

You and I agree that most of these big CMHC mortgages are for homes in the Toronto and Vancouver areas. In other words, if you look at all the CMHC mortgages in Toronto, the percentage that are above $500k is a lot more than that Canadian average. That is my point — that the CMHC’s biggest mortgages “live” in the cities with the worst housing affordability in the country, making the country-wide averages much less meaningful.

Kyle

at 1:23 pm

Would you not imagine the number of jumbo incomes to be significantly higher in Toronto and Vancouver too?

Joe Q.

at 11:27 pm

Appraiser — Do you have access to break down the data in finer-grained detail? For example, can you look at changes in sales in the $900k-$1M range and compare them to changes in sales in the $1M-$1.1M range.

Appraiser

at 10:01 am

@Joe Q. Here is some TREB sales data by price category for y/y comparison:

$700k – 800k up 22%

$800k – 900k up 23%

$900k – 1M up 28%

$1M – 1.1M up 29%

$1.1M – 1.2M up 30%

1.2M – 1.3M up 29%

Appraiser

at 11:34 am

@Joe Q: At the risk of torturing this topic beyond all recognition, allow me to expound further on the suppsed purpose of the CMHC cap in the first place, and why I have concluded that is has been and continues to be a negligible factor in the Canadian real estate market.

Ostensibly, the cap was instituted in order to mitigate “taxpayer risk” with respect to potential CHMC insured jumbo mortgage defaults. Since there is no correaltion between risk of default and sale price, the notion is dubioius at best. In fact, Benjamin Tal of CIBC indicates in his latest report (cited by Kyle above), that credit score is by far the best indicator of potential default.

With respect to CMHC’s own data indicating that less than 5% of their portfolio includes mortgages in excess of $500k, it would not be outrageous to assume that that there are even fewer mortgages in excess of $600k, fewer still over $700k, and so on. Since it requires a mortgage of at least $800k to invoke the cap, it would be safe to assume that the percentage of CHMC mortgages in this category is miniscule.

I remain convinced that there are very few high-ratio buyers being shut out of the $1M+ market in T.O.

On the contrary, considering the sharp increase in sales above $1M in the past 2 years, the data clearly indicates that there is absolutely no shortage of fully qualified conventional high-end borrowers in the GTA.

Kyle

at 12:48 pm

I 100% agree with Appraiser that on a net basis the cap does not reduce the activity in the 1M+ market. But i do believe there are people being shut out of that market and making the sub 1M market far more competitive. Who I see filling the demand void left by those shut out are move up buyers, who find they have a lot more equity having just sold their semi or row house in the 900’s. This is an example of the rung bunching I mentioned earlier. Not long ago downtown semis and rows used to range from 500 – 750. That whole segment has moved to the 700 – 1M range. Leaving a big gap between 2 bedroom condos and starter SFH.

Appraiser

at 7:00 pm

“Intellectually honest people will accurately acknowledge and reflect the content and meaning of opposing ideas advanced by others whenever they engage in a dialog with, or quote the statements of, those with whom they disagree. In other words, they address themselves to the difference in opinion regarding the ideas under discussion. They are strong enough to understand and present their opponent’s ideas with integrity, while then presenting their opposing opinions and reasoning.

Liars don’t.The intellectually dishonest knowingly distort, misquote or quote deliberately out of context (or support others who do so) to defame, slander and harm those with whom they disagree, often to further an agenda of their own. They sacrifice the important, constructive and honest interplay of ideas to rally the support of other, often less-informed individuals. When unable to successfully defend an idea they dislike, they stoop to lying about the idea itself and attack the person at its source.

Intellectually honest people will accurately acknowledge and reflect the content and meaning of opposing ideas advanced by others whenever they engage in a dialog with, or quote the statements of, those with whom they disagree. In other words, they address themselves to the difference in opinion regarding the ideas under discussion. They are strong enough to understand and present their opponent’s ideas with integrity, while then presenting their opposing opinions and reasoning.

Liars don’t.The intellectually dishonest knowingly distort, misquote or quote deliberately out of context (or support others who do so) to defame, slander and harm those with whom they disagree, often to further an agenda of their own. They sacrifice the important, constructive and honest interplay of ideas to rally the support of other, often less-informed individuals. When unable to successfully defend an idea they dislike, they stoop to lying about the idea itself and attack the person at its source.”

http://corsomd.blogspot.ca/