This website isn’t called “Ajax Realty Blog,” and yet I feel that checking in on some of the areas outside the GTA might be prudent at times.

The average price of a detached home in Toronto was $1,053,871 in September, and some of those detached houses could be 2-bedroom bungalows, or even simply land value!

So today, let’s take outside Toronto, and head further east into the “greater” Toronto area, and look at what detached houses cost in Port Union, Pickering, Ajax, and Whitby…

A true believer in capitalism and free markets would hear a complaint about the price of real estate in Toronto, and reply, “If you don’t like it, then move out of the city.”

Some folks, it seems, just might do that.

Maybe others would follow suit if they knew what home prices were like outside Toronto, so I figured we should take a little look-see.

I always talk about the same things when it comes to evaluating single-family, residential freehold properties – schools, parks, transit, and infrastructure.

So with that in mind, let’s look at four houses, in the four areas I mentioned east of Toronto, and check out how they stack up not only in terms of the size of the house, beds/baths, etc., but also in terms of surrounding amenities.

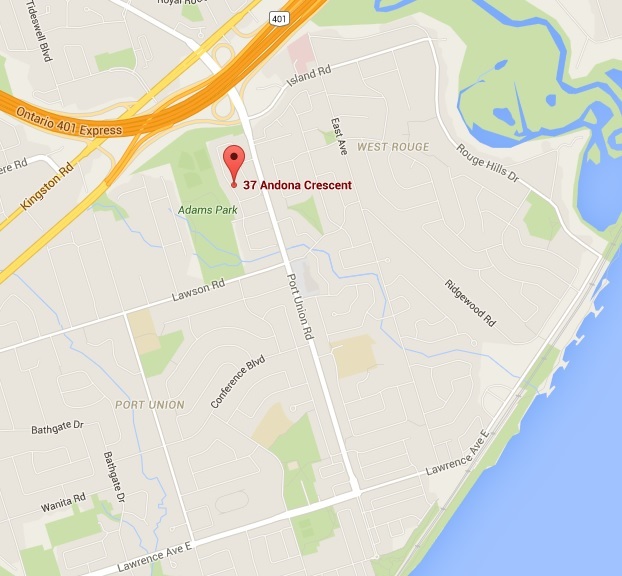

1) Port Union

Okay, fine, you got me. Port Union isn’t exactly a town unto its own, and it’s actually part of Toronto, but I wanted to start here because most people think of this as outside Toronto when it’s actually just on the east-most boundary, and right before Pickering.

37 Andona Crescent is available for sale for $524,888.

-Detached

-3-Bed, 3-Bath

-26 x 106 Foot Lot

-Finished Basement

-Private Driveway

The house is located one block from Adams Park, and is a 15-minute walk down Port Union Road to Joseph Howe Public School (the yellow shade on the map).

Rouge Hill Go Station is at the bottom of Port Union Road, and that’s a 37-minute train ride to Union Station in Toronto.

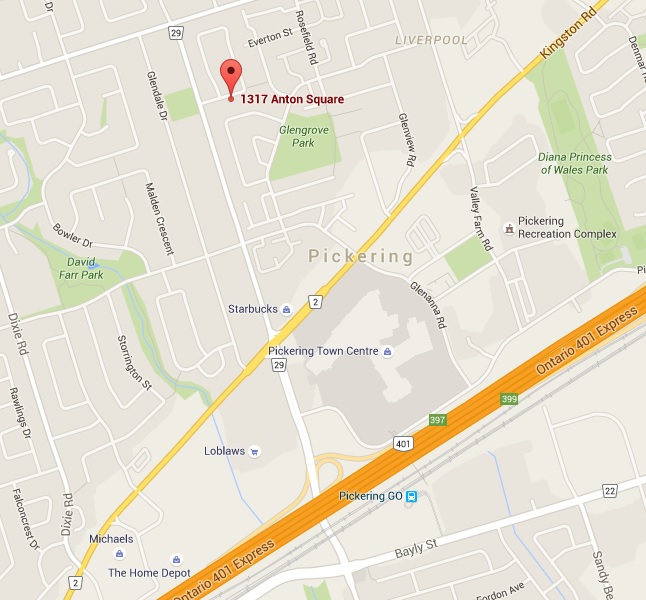

2) Pickering

Go east of the Rouge River, and you’re bordering on Pickering. Go further east – past Frenchman’s Bay, and you’re in prime Pickering!

1317 Anton Square is available for sale for $534,900.

-Detached

-3-Bed, 3-Bath

-30 x 108 Foot Lot

-Finished Basement

-Private Driveway

The house is located two blocks from Glengrove Park, and a 10-minute walk up Liverpool Road to Maple Ridge Public School, which ranks a 7.8 out of 10 in the Fraser institute’s public school rankings – good for 391st out of 3,037 Ontario schools.

It’s also a 15-minute walk to Pickering Town Centre.

Pickering Go Station is 1.9 KM from the house, and you have to cross the 401 to get there, but from Pickering Go Station to Union Station is only 46 minutes.

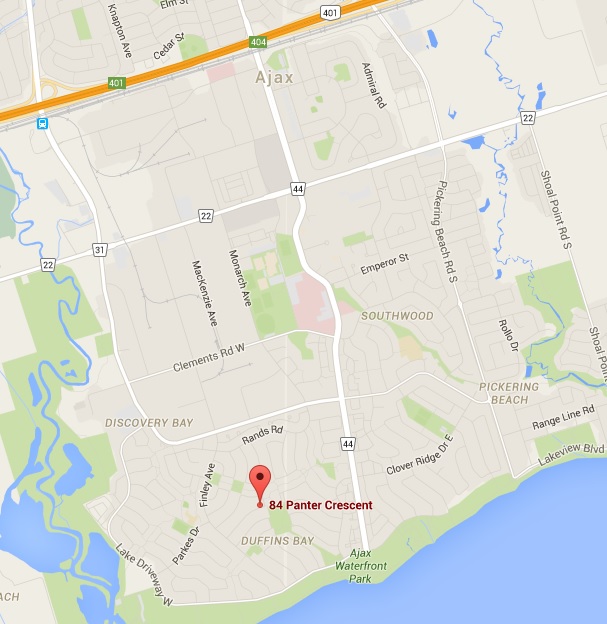

3) Ajax

Pickering and Ajax mesh together, not unlike Burlington and Hamilton, although don’t tell that to the folks who live in Burlington…

83 Panter Crescent is available for sale for $499,900.

-Detached

-3-Bed, 3-Bath

-50 x 100 Foot Lot

-Finished Basement

-Private Driveway

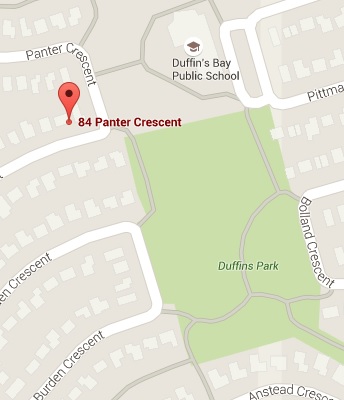

The house is located (and keep in mind – this is Google maps telling me all the travel times), 1-minute from Duffin’s Park, and 2-minutes from Duffin’s Bay Public School.

Duffin’s Bay Public School ranks very high as well – a 7.7 out of 10, or 445th out of 3,037 schools in Ontario.

Let’s zoom in a bit on the location here:

How is THAT for a location?

It’s also a 10-minute walk, or a 2-minute drive down to Ajax Waterfront Park.

Ajax Go Station is a hike, no doubt about it. It’s not walkable (unless 42 minutes is walkable…) but it’s a 12-minute bus, and the Ajax Go Station is a 49-minute train ride to Union Station.

I should probably mention here that there are “express” trains and trains that make far more stops, but the express is 49-minutes, and the “slower” train is 67-minutes.

4) Whitby

Whitby is further north than both Ajax and Pickering, so not as idea for commuting via either the 401, or the Go Train, but some of the neighbourhoods seem more established and traditional than what you find in newer areas of Ajax and Pickering.

Case in point…

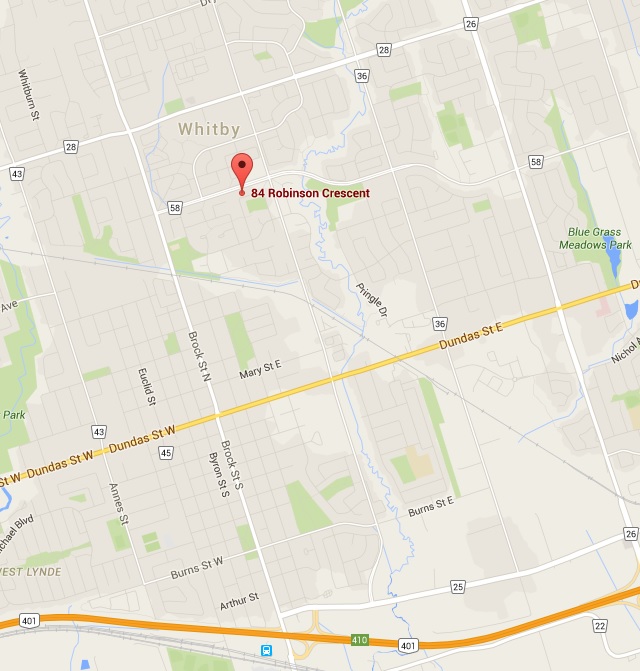

84 Robinson Crescent is available for sale for $499,900.

-Detached

-4-Bed, 3-Bath

-50 x 148 Foot Lot

-Finished Basement

-Private Driveway

The house is located literally across the street from Robinson Park, and is a 13-minute walk to Pringle Creek Park, and to Pringle Creek Public School, which ranks a 7.7 out of 10 by the Fraser Institute, or 445th out of 3,037.

The house is 4.8 KM to the Whitby Go Station, or 8-minutes by car. Transit is a step down in Whitby from Ajax & Pickering, as the area is a bit more spread out.

Whitby Go Station, for what it’s worth, is 57-minutes by express train to Union Station in Toronto.

–

Well there you have it, folks!

Imagine a detached, 4-bedroom house on a 40-foot or 50-foot lot for under $500K? That’s going to start at $1.5 Million in Toronto!

A cynic will tell me, “David, if you move to Sudbury, you can get a house like that for $150,000.”

But we’re still talking Greater Toronto Area here, folks. This is all within a 1-hour train ride to Union Station in the heart of downtown Toronto.

For what it’s worth, I don’t work in Port Union, Pickering, Ajax, or Whitby, so if this blog post convinced you to start looking there, I’m not your guy.

But I think if you own a house in Toronto, you should know what’s going on outside of it as well. It doesn’t hurt to keep up to date, and who knows – maybe you learned something today.

Have a great weekend, everybody!

Anon

at 9:23 am

What about the west end? Would be interested in your observations in that direction…

Carmen

at 4:25 pm

l am in awe how most people in Toronto keep their heads above water. it would scare the crap out of me to have to scrape by month after month. l believe that if l was in that position l would be looking to Guelph, Elora, Fergus etc. For relief, homes are half as much. sell your Toronto home pocket some money,put the kids in a nice school and enjoy life… just saying life is to short .

Marina

at 10:37 am

Second request for the west end here.

The east end is cheaper, so the comparison is more stark, but in a way the west end is more interesting – more affluent neighborhoods, faster train to downtown, proximity to businesses and jobs in Mississauga, etc.

I keep threatening to move to Oakville, but I love my life in midtown.

Kenrick

at 1:53 pm

My thoughts exactly. Etobicoke is the way to go, you get really good value and it is in the process of gentrification in most areas. So in terms of investment potential, lots of upside.

Cedric

at 10:40 am

I live in Ajax and commute to Toronto daily via GO Train. Just thought I’d correct the train ride durations – Express GO Train from Ajax to Union Station is 35 minutes and non-express is 49 minutes. The times shown above from Pickering and Whitby are also too long, but I’m too lazy to look them up.. =)

David (not the David who run's this website)

at 1:33 pm

Hey David, here’s something I’ve always wondered about, if the average detached home in Toronto is +$1M, that means that it doesn’t qualify for mortgage insurance, right? Or correct me if I’m wrong.

Assuming the above, a buyer would have to put 25% or $250K as a down payment, leaving the buyer with a $750K mortgage. If the buyer gets a 25 year mortgage, with a 5 year rate of 2.5%, that would workout to roughly $3,360 per month. I’m sure there are better rates than this, but even then, it’s still a lot of money.

What I’d like to know is, who happens to have $250K in cash sitting around for the down payment? Or if they don’t have the cash, where to they get it? A $750K mortgage seems massive, waiting to crush you if you happen to lose your job and can no longer make the monthly mortgage payments because all of your savings got used up for the down payment.

Obviously this is not holding people back because the market in Toronto for these homes is good. What am I missing here? I’ve always wanted to knock on the door of one of those homes and ask the occupants what it is that they do to be able to live in a home like that.

Fro Jo

at 1:52 pm

Yes, I wonder the same thing, very often. Some possibilities:

– The buyers have a source of existing wealth, from inheritance to factories etc

– Parents are helping make down payments.

– The buyers already owned a home that also appreciated substantially during this great bull run, so they are not starting from scratch.

– Many professionals and management types in the city. A family income over $100,000 could reasonably carry the debt and the risk.

– The buyers (and their money) are from outside Canada + any of the above applies + they can take advantage of the low loonie.

I fear the other possibility, which is that many people are leading lives of quiet desperation.

/F

Izzy_Bedibida

at 2:29 pm

I agree with the quiet desperation theme. Several friends bought houses in Vaughan and now don’t have “the luxury ” of meeting for a pint or two at the local Irish Pub. If I supply the beer it’s OK….but the extra gas needed to get to my house means money that won’t be used to pay down the monster mortgage. In my circle this seems to be getting worse.

David (not the David who runs this website)

at 3:21 pm

Izzy, I feel bad for those friends of yours. Sure they have a house but they can’t really live. They may as well sell the house and live in something more affordable. Life is too short to be eating beans out of can every night and not even being able to go see friends. Is having a house that important that you have to forget about everything else in life?

What happens if there’s a market correction and then your friends need to sell for some reason? It could happen. All that sacrifice will have been for nothing.

It’s rather scary to think that’s how some people live. It’s not going to be pretty out there if interest rates ever go up, which is probably one reason why the central banks aren’t too keen on raising them.

David (not the David who runs this website)

at 3:10 pm

Fro Jo, all good points.

Point #4 – what happens if someone in the family loses their job for whatever reason? Could get nasty if the family suddenly finds that they can no longer make the payments.

I’ve been to a few $1M open houses and to be honest, I just don’t see the value. Most of them are nothing special and some are just old, run down crap. I just look at them and and keep going. To each their own, but I don’t get it when it comes to most of them.

Noel

at 11:05 am

Because it’s the land value that is impacting the price, not the state of the house itself.

Kyle

at 2:40 pm

Fro Jo’s list is a good one, but generally speaking i’d emphasize point 3 and 4. First time buyers aren’t buying $1M+ homes, it’s mainly people with equity from another sale. The average budget for a first time buyer is only 318K and their average down payment is only 67K, the 1M+ house is in a completely different class. Pull up a mls.ca listing in any neighbourhood where $1M+ sales happen frequently and click on the Demographics tab and you’ll see most households in those neighbourhoods have incomes that support the prices in those hoods.

Izzy_Bedibida

at 3:26 pm

I agree. In my previously mentioned circle, the demographics show house hold income would support the prices, but all after tax income was consumed with mortgage and related house hold expenses. Hense not having the “luxury” of meeting for a $6.00 domestic pint or two.

David (not the David who runs this website)

at 3:33 pm

Kyle, I agree, those sort of homes are not starter homes. Unless you can pay cash, you need to come up with a huge down payment to get into one of those homes. Even if you’ve just sold another home and you’re moving up the scale, it’s still a huge debt, god help you if you lose your job for whatever reason.

Obviously, there are incomes to support the market activity but it still makes me shake my head when I see those homes. To each their own, buy I just don’t see what’s so special about them to warrant the $1M price tag.

Kyle

at 4:29 pm

@ Izzy

I think that comes down to personal risk tolerance/choice, i don’t doubt there are people who have chosen to max out their available credit to consume housing over other luxuries, but i don’t think that is the norm. The mortgage data show Canadians to be very responsible borrowers as well banks are very tough on approving large uninsured mortgages.

The other thing to consider is that the first couple of years are typically the toughest on any homeowner even those with small mortgages, but over time the payments become much easier.

@ David

I agree there is risk from job loss, but job loss risk affects every class of homeowner and renters too. Personally i think everyone (not just $1M+ homeowners) should keep an emergency buffer of cash/liquid assets equivalent to a few months income to weather a job loss.

David (not the David who runs this website)

at 4:50 pm

Kyle, I agree, the risk is there for everyone, but if you rent and money becomes a bit short, you just give your 60 days notice and then find something cheaper,and you probably get to keep your credit rating.

If you own and the job loss starts to drag out more than a few months, and it certainly can for anyone, then you have to sell very soon. You may or may not get a good price at that point. If for some reason you can’t sell in time, then great, now you’re jobless, homeless, you’ve also lost your equity and your credit rating. Not a good scene.

Kyle

at 5:33 pm

The scenario you painted is an extreme and somewhat unrealistic one. Currently mortgages in arrears are 0.15% in Ontario. Of the millions of residences in Ontario only 3,008 of them are more than 90 days past due.

The other consideration is that the longer you’ve owned the lower your risk tends to be. People will be most exposed their first couple of years of ownership. They’re basically house poor from closing costs, moving costs, buying furniture/housewares, renovations, etc. But after a few years, they usually have built up savings, the house has appreciated, their incomes have risen while their mortgage payment has remained flat, they’ve paid off some principle, and accumulated other assets. So when a job loss happens there are a lot more options (reduce spending, dip into savings, sells assets, refinance, or sell the house). Plus they always have the option of leasing out their house and then renting in a smaller cheaper apartment.

Joel

at 3:29 pm

A few things;

You only need 20% down to purchase without insurance

Most people purchasing 1 Million plus home are on their second or third property and have made money on their previous properties for the down payment.

The income needed to carry this mortgage is not that high. Two teachers that were married would make $180-$200K between them and could easily afford this mortgage. There are also many other professionals in Toronto that have a household income over 150K with great stability and could afford these mortgages.

daniel

at 3:29 pm

@david not david. I’ll share a bit of perspective from my family and our friends.

We bought our first house in midtown for a good chunk over a million in early 2014. We’re both in our mid-thirties. we’ve both had good jobs since graduating from university and were socking away a lot every year (bit each month and all of our bonuses). Total closing costs were $330k when we bought our house. We had $260k saved, i sold my car for $30k (and bought another but financed it) and our parents lent us the $40k to close the gap. It was a little scary the first year being that exposed. We’ve since saved up a bit of a cushion so we don’t have to worry about unexpected emergencies. We could easily handle a bump in interest rates, we’d just have to trim some luxuries like travel and dining out a bit to cover it. An extended period of unemployment (particularly if it hit both of us) would definitely mess us up. If the RE market is still solid we’d sell, if not we’d take on a boarder and i’d take 3 jobs to cover us.

Many of our friends are couples with both making at least $100k, and many of them make a lot more (doctors, finance, lawyers, work for family business, etc). I know the household incomes through a lot of the nicer neighbourhoods are $200k plus, which doesn’t suprise me. Lots of lawyers, doctors, bay street ppl, media management, senior management, consultants, etc. The tough part i think is that most high earners marry other high earners, further compounding the income gap.

The weird part is being firmly in the 1% yet certainly not living some kind of carefree lifestyle. You’d think $300k is enough for caviar lifestyle, but it’s not in downtown TO. We both drive used cars, pay attention to what’s on sale at the grocery store, etc. That said, i don’t think either of us really mind (not like we’re particularly deserving of not having to worry about money), and we certainly prefer it having to commute in from elsewhere. Plus, where else in Canada could we move and make good money where the housing is substantially cheaper, and where we’d be willing to live? No offense to Winnipeg or anything. If we can hold it all together (career, RE market, etc) for 15 years we’ll then be pretty set. Fingers crossed.

The trolls can now have at me for my candor, but you asked so there it is.

David (not the David who runs this website)

at 3:39 pm

Thanks daniel, I appreciate your comments, that all makes sense, hope it works out for you.

Good point about high earners marrying other high earners. I guess if you combine the two incomes, you’re good to go. The thing is, if one of you loses their job, or there’s a relationship break up, then what? Would one income be enough to keep it all going?

Kyle

at 5:00 pm

@daniel

I agree with everything you wrote, you covered off a lot of good stuff here. You mentioned that in most of the nicer neighbourhoods, the average household incomes are over $200K, i just want to add that in many cases the incomes of buyers are actually far higher than the average residents’ income of the neighourhood that they’re buying into. Definitely the case in the core, where lots of new money is buying into old hoods.

Noel

at 11:16 am

Hmmm, Sounds pretty carefree to me. My parents never dined out and never went on vacations (same with us kids), both were labourers, took TTC to work for 35 years (took Dad 90 minutes each way), they never owned a car until I was 20, raised a bunch of kids who all went to university. We lived on one floor and rented out the other two. It’s all relative isn’t it?

You appear to have lived a very privileged lifestyle and continue to do so. You live in a house worth well over $1M, both have cars, both went to university, both have good jobs, can afford to dine out and travel and your parents even lent you money to buy your house to boot! If that is not a carefree lifestyle on relative terms then I don’t know what is.

Call this a troll comment if you want. I am just telling it like it is for most people.

daniel

at 5:08 pm

@Noel, i wouldn’t say that crosses into trolling. That said, i hope i made clear that i do have some appreciation of how fortunate we are, or at least don’t feel particularly entitled to any of it.

Also, your calling it a carefree lifestyle doesn’t jibe with my experience. I have a lot of care. We have to absolutely pay close attention and keep our s*&^ together to keep it on the tracks and even then, it’ll take us a bunch of years before we’re not at risk. If your point instead was that most people make a lot less and struggle a lot more then i totally agree. Similarly, i agree that it is all relative. One person’s luxury is another person’s necessity.

Long Time Realtor

at 4:11 pm

First of all the minimum down payment required to avoid CMHC fees was reduced to 20% years ago. Regardless, when examining the $1M+ market it’s best to remember that the CMHC $1M cap was strictly a political move and nothing more.

Historically, only a very small percentage of buyers in this category ever required the insurance, as the vast majority have considerably more than 20% down.

As has been already mentioned, the DP is derived from the sale of an existing property in most cases. By way of proof that the cap is frivolous, it must be noted that it has had little to no effect on the $1M+ market, which has grown tremendously since its introduction.

Also, it should be noted that since there is no positive correlation between higher sale price and risk of default, the entire concept is deeply flawed, like most decisions made for strictly political motives.

David (not the David who runs this website)

at 4:17 pm

It must be really nice to have that kind of $$$$.

Ed

at 2:21 pm

was that the new pick5?

Julia

at 8:33 pm

We bought our first house in Toronto 15 years ago when prices were more reasonable. We lived there for 8 years, during which period we paid off our mortgage. In the meantime, the house doubled in value. That’s how we (and many others) afford $1M+ houses – we just got lucky with the timing.

Appraiser

at 2:07 pm

@ Julia. Very salient comment.

Most people in the GTA that live in $1Million+ homes paid a good deal less; and are literally sitting on found money.

Jim B

at 2:41 pm

@Julia

Like you, my wife and I bought our current house (in so-called Playter Estates, but it’s really just in a small enclave north of Danforth and west of Broadview) in 1998 for $296,000. We paid off our $200,000-or-so mortgage in five years, and the house is probably now worth somewhere in the $800Ks, although it’s a rather modest 1,500 square foot detached. As you say, just lucky.

Kenrick

at 1:57 pm

My parent’s house in Markham where I grew up, reputable builder (Monarch) only required $10,000 down. The house is now worth over a million. This was only 13-15 years ago

steve

at 10:06 pm

Many people pay big for the location … house often gets gutted. Big investment for sure.

king shah

at 7:16 am

Real Estate Toronto, MLS Listings up to date, best homes for sale, latest condos for sale, brought to you by the best local Real Estate Agent!

Website : http://kingshah.com/Durham-real-estate/Pickering