Every person who obtains a real estate license and becomes an “agent” starts off as an exceptionally naive individual.

Fact.

And believe it or not, little David Fleming, circa 2004, was no different.

As I’ve written before on this blog many times, I was completely bewildered by the concept of condominium living back in 2004 because this thing called a “maintenance fee” made no sense to me.

I infamously stated, “It’s like paying rent on an apartment that you own!”

But what the hell did I know?

I grew up in a house.

And when I got licensed in 2004, I had probably only ever set foot in a handful of condos.

In real estate, knowledge is learned, experience is gained, and there’s simply no substitute for the process.

So back in 2004, when I saw a $300,000 condo that came with a $300/month maintenance fee, the idea just didn’t resonate.

“You wouldn’t be paying that if you owned a house, I argued.”

Eventually, though, I learned.

Back in 2004, many downtown Toronto condos included electricity, gas, and water in those fees, so if I assumed that each cost $50, then the $300/month fee was really only adding $150 to your tab.

And who pays the concierge? Where does the property manager derive her salary? Who cleans the halls? Who fixes the underground garage door when it breaks?

Oh, I learned pretty quickly!

And after a while, when I began to learn about the insane cost of upkeep on houses, whether that’s windows, roofing, plumbing, heating, cooling, electrical, landscaping, or one of hundreds of aesthetic-based expenditures, I realized that condo maintenance fees were actually quite reasonable!

My first condo was at 230 King Street East and my unit was 585 square feet.

My maintenance fees were $299.92 per month.

I had parking and a locker, and those fees equated to $0.51 per square foot.

Not only that, my fees included all utilities, and by “all” in this city, we mean heat (which is the MLS term for gas), hydro (which is the MLS term for electricity), and water.

The extra $150’ish per month that I was paying went to the upkeep of the building, and I benefited from the 24-hour concierge, the gym, the elevators and parking garage, and the fact that this building was always sparking clean.

I started Toronto Realty Blog in June of 2007 and it didn’t take long for me to start writing about maintenance fees.

April 14, 2009, I wrote: “Ridiculous Maintenance Fees”

From the blog post:

Another example is a unit at 71 Front Street.

For $329,900, we have a 2-bedroom, 2-bathroom unit of about 1150 square feet.

What a deal!

But the monthly maintenance fees are $842.45, and that doesn’t include Heat, Hydro, or Central-Air.

You’re looking at a thousand bucks per month!

In this blog, I was explaining how a condo with high maintenance fees would cost less on a per square foot basis because buyers factor that “extra” expenditure into the price.

That condo at 71 Front Street, at the time, had fees of $0.73 per square foot.

Today, that’s a dream! But back in 2009, I was lamenting how high these fees were.

November 8th, 2012, I wrote: “Maintenance Fee Math!”

From the blog post:

Less than $0.50 per square foot – this, in my opinion, is unsustainable. These $0.41 fees only exist on paper for pre-construction, in brand-new buildings where the fees are going to increase, or in perhaps in 1% of cases – in unique, boutique buildings with no amenities, and a budget made by God himself.

$0.50 – $0.60 per square foot – this is a very reasonable range! Newer buildings might offer $0.52/sqft fees, and of course if they have concierge, gym, and other amenities, and one of heat/hydro is included, that’s fantastic value.

$0.60 – $0.70 per square foot – this is probably the ‘average’ range for downtown condos.

$0.70 – $0.80 per square foot – this is starting to get expensive. There are a lot of fantastic downtown condos that happen to have fees around $0.76 per square foot, and while it’s not yet “expensive,” it’s starting to creep up there. If heat and hydro are separate, then you’d better have some killer amenities to make up for it!

$0.80 – $0.90 per square foot – this is “expensive.” There’s simply no other way to put it.

$0.90 and up – this is “insane.” There’s just no other way to put this, either.

Wow, this really didn’t age well.

$0.60 – $0.70 is average, eh?

Should we have known back then that life might get a little more expensive? Should we have built in some inflationary expectations?

I find it quite interesting that, years later, I ran a similar blog post and took a similar stab at the maintenance fee ranges.

April 13th, 2016, I wrote: “How Much Should My Condo Fees Be?”

$0.50– $0.64 per square foot This is what I would consider “below average.”

$0.65– $0.75 per square foot This is what I would consider “average.”

$0.76– $0.89 per square foot This is what I would consider “high.”

$0.90+ per square foot Anything “in the 90’s” is what I would consider “really high.”

Notice how in 2009, I wrote that $0.60 – $0.70 was “average” and in 2016, I wrote that $0.65 – $0.75 was “average.”

I don’t think this was by design, but rather the landscape had changed, and my opinions had changed with it.

So what’s changed in the last seven years?

A lot, it seems!

Only, it’s some buildings, and not all buildings, that have been hit hard by the times.

Case in point, let’s go back to my old building at 230 King Street East.

A listing sold last week for full price in mere days, so clearly a popular property, right?

Look at the fees here:

This unit is 585 square feet, and I know this because I lived in the same unit, just several floors down.

That means the fees here now, including parking and locker, are $1.07 per square foot.

According to my blogs from 2009 and 2016, this would mean the fees are “insane.”

And what were they the last time this unit sold?

Here’s the 2008 listing:

That’s $0.57 per square foot.

Some of you will say, “David, you can’t include parking and locker in calculation of fees, it’s not fair.”

Consider that back in 2008, an overwhelming majority of condos had an owned parking space. Back then, fees were calculated with parking, and if you found a unit that didn’t have parking, you’d probably end up adjusting it upwards.

It’s only now, in 2023 (or perhaps this started several years ago) that we expect most smaller units not to have parking, since almost all one-bedroom condos built in the last few years do not have parking spaces.

Regardless, let’s compare apples to apples.

So the unit above has seen the fees increase from $0.57 in 2008 to $1.06 in 2023.

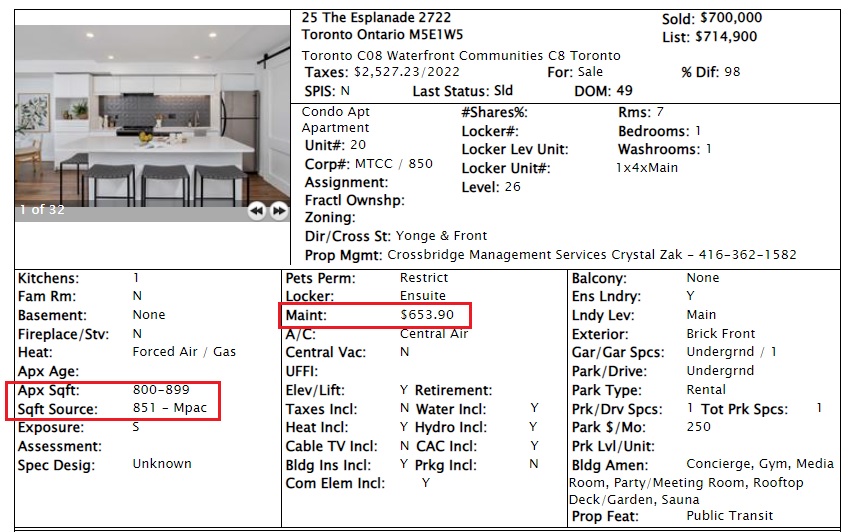

Another building that, “back in the day,” had exceptionally low fees was 25 The Esplanade.

Units here do not have owned parking, as all the parking is rented, but it’s another building where the fees are all-inclusive.

So this time, let’s work from 2008 to 2023 and check out what fees were and now what they are.

Here’s a sale from 2008:

Yeah, I know: $219,000.

That aside, this unit is 851 square feet and the $370 per month fees equates to $0.43 per square foot.

As I said, “back in the day,” this building was known as having among the lowest maintenance fees in the city. I routinely put both end-users and investors in here because the fees were so low, they were all-inclusive, and of course, the location is amazing.

This unit just sold a few weeks ago, so let’s see how those fees look today:

The fees are up to $653.90, and at 851 square feet, that’s $0.77 per square foot.

Now, back in 2008, I’d have said that $0.77 per square foot is “high.”

But today?

That’s quite reasonable!

And no, these units don’t have parking, but the $0.43/sqft back then was low, and it seems the $0.77/sqft today is as well.

So let’s do an experiment, shall we?

Let’s compare three buildings in the same area and we’ll look back to, say, 2016.

I’ll find three properties that have sold in 2023 which also sold in 2016, and we’ll see how much the fees have increased since then.

(just give me an hour here……)

Alright, I’m going to use Liberty Village as our location and I found three condos that sold in the past two weeks that also sold back in 2016.

Here’s the first, and excuse the crude mash-up of the 2023/2016 listings, but I don’t know a better way…

On the left, we have the 2023 listing which shows the fees as $683.83.

On the right, we have the 2016 listing which shows the fees as $464.79.

Since 2016, the fees have increased by 47.1%.

The unit is 881 square feet so the fees are currently $0.78/sqft which is, it seems in 2023, reasonable.

–

Here’s our second example:

On the left, we have the 2023 listing which shows the fees as $659.46.

On the right, we have the 2016 listing which shows the fees as $513.90.

Since 2016, the fees have increased by 28.3%.

The unit is 718 square feet so the fees are currently $0.92/sqft which is, it seems in 2023, is high.

–

Our third example is as follows:

On the left, we have the 2023 listing which shows the fees as $527.95.

On the right, we have the 2016 listing which shows the fees as $425.33.

Since 2016, the fees have increased by 24.1%.

The unit is 700 square feet so the fees are currently $0.75/sqft which is, it seems in 2023, is very reasonable.

–

So when all is said and done, these three buildings saw increases since 2016 of the following:

+47.1%

+28.3%

+24.1%

However, the building with the highest fees on per square foot basis is not the first one, where the fees went up the most since 2016, but rather the second one – with fees of $0.92/sqft.

It’s also worth noting the age of the three buildings:

2013

2006

2014

Is there a correlation here? Do you see one?

The 2013 and 2014-built condos saw increases of 47.1% and 24.1% respectively, so it’s not that the older, 2006-built condo saw the largest increase.

However, the 2006-built condo does have the highest fees at $0.92/sqft.

An older building won’t automatically have higher fees, but they often do.

The truth is: there’s no rhyme or reason to a given building’s condo fees. Two buildings, same age, side-by-side might have completely different fees. You just never know.

So what are the highest fees in the city? And what are the lowest fees?

More importantly, what is the average maintenance fee per square foot in the downtown core?

We’ll answer that, and more, on Wednesday…

Francesca

at 7:42 am

Our maintenance fees are $1345 for 1348 sq feet so very high by your calculations David. Our Yonge and Sheppard building is 35 years old and the fees include all three utilities plus Bell cable and internet. We have full time concierge, visitor parking, indoor pool, gym, squash courts, library room and a huge yard with beautiful landscaping. The cleaning staff is amazing. The last two years they went up quite a bit due to inflation. If I look back ten years ago they were much more reasonable but now the building is older so more things were fixed like new change rooms and lobby and new roof. The higher maintenance fees are definitely keeping resale values from appreciating as much as newer buildings with lower maintenance fees but many of these new buildings in our area only include water now in their maintenance fees and they have a lot less amenities. Many of the people who buy in our condo are small families who value the larger layouts and excellent schools ( which the newer builds aren’t allowed to go to) or seniors downsizing who may not have a mortgage anymore so don’t mind paying the higher fees. On average units in our condo sell for $750-900k for a two bedroom plus den 1300-1400 sq foot condo vs same cost for 800-950 sq foot across the street from us in a five year old building where the maintenance fees are quite low. There we notice a lot of younger couples and university students living there so it caters to an entirely different demographic which I’m sure is probably true with some older vs newer buildings downtown. With inflation driving prices up on everything it will be very hard for condo boards to keep maintenance fees from increasing without jeopardizing the reserve fund or having to cut back on services.

Francesca

at 2:04 pm

Forgot to mention that our property taxes are extremely low. Much lower than newer buildings per sq footage and much lower than a freehold property which I believed is standard for condos vs freehold. So the higher maintenance fees are in a way offset by lower monthly property tax payments. Also all the units own one or two lockers and one or two parking spots. It’s an extra $25 a month per additional parking spot . When we lived in a house the ongoing expenses like roof, furnace, windows, fence etc were expensive so to me saving for these expenses are similar to a condos reserve fund.

Ace Goodheart

at 10:37 am

Looking at this post, if you are paying $1345 for 1348 sq feet you are at 99 cents per square foot. But that is per month, not per year. Per year, you are at $11.88 per square foot.

Looking at a house to compare, say you have the average 3 bedroom Toronto house with around 2000 square feet, that would mean that on a yearly basis, your ownership costs including maintenance and upkeep, heat and utilities would have to be $23,760.00

I find it hard to believe that anyone actually pays that on a house.

I know for us, the average gas bill in the winter is $133.00 per month, in the summer much less because we are only using the gas stove, not the furnace. Electricity is the opposite, around $150.00 per month in the winter (for the inverter in the loft and a couple of oil heaters in the basement), and around $250.00 in the summer for the air conditioner.

Water and sewage, solid waste removal is always the same, $750.00 per year. Parking is just under $600.00 per year for the parking pad.

Add it all up, and you get around $1200.00 per year for gas, around $2200.00 for electricity, and then the water and sewage and parking, for a total of $4750.00

There is no way you are spending an additional $19,010.00 on building upkeep.

I have found that houses are “30 year plans”. You move in, you spend about 200-300K to update everything, and you are good for 30 years. At the end of the 30 year period, you have to replace everything. That totals around $6500 – $10,000 per year in upkeep. You can do it all at once or you can spread it out.

I think dollar for dollar, a condo is still more expensive to maintain than a house is, for the same square footage.

Geoff

at 8:39 pm

“I think dollar for dollar, a condo is still more expensive to maintain than a house is, for the same square footage.”

Perhaps, but that doesn’t take into account acquistion cost. 6% on $2M is a lot more than 6% on $1M.

Also I think your house math is missing somethings — lawn maintenance, snow shovelling, cable/internet (example above says its included), and then the fact that you don’t need a gym membership, etc – you can’t discount the value of the amenities that you’re paying for, if you’re factoring it into the $11.88 per sq. ft cost.

I think here’s the thing: having lived in both condos and houses, I find house owners often forget all the little things that maintenance fees cover that we pay on a per-case basis (including for example, building insurance) and that condo owners may not be condo owners by choice but by price/location constraints (and yes there are many by choice of course).

Nobody

at 9:30 am

Ace your cost estimates are off and you are forgetting what capital improvements need to be done. You have to look at replacing the roof, driveway, furnace, foundation, windows,etc. Those are VERY big items on a single family house while you are quoting budget kitchen and bath renovations. Home owners are rather notorious for putting off necessary improvements/repairs for decades. Condos have to abide by actuarial life of elements amd insurance driven replacement of defective products like pipes while homes can rely on ignorance and prayer as long as their bank/insurer doesn’t ask too many pointed questions.

As Geoff mentioned you are also forgetting all of the maintenance tasks that frequently end up as chores and monthly expenses at Canadian Tire/Home Depot etc rather than paid services. Patio furniture, flowers, etc etc. The condo toolset is dramatically smaller than the homeowner one and the only powertool is a cordless drill.

Ace Goodheart

at 1:06 pm

This is all true.

It really depends on the house.

With Toronto until very recently it was not advisable to put a “conditional on inspection” clause in an offer to purchase and as a result many people ended up over paying for dodgy houses.

It is also true that pretty much every home owner has had their furnace break down (usually in the middle of the night on the coldest night of the year) or their AC go out (usually on the hottest day of the summer) so the added comfort of a condo board that actually follows guidelines on scheduled replacement of critical elements like HVAC is always nice.

However, a lot of the stuff you pay maintenance on for condos is stuff you never use.

My grandmother lived for 20 years in a condo with a large, expensive to maintain swimming pool.

She was terrified of water and couldn’t swim. Never used it. But she paid for it (including two special assessments for major repairs to the pool and associated equipment).

It’s a mixed bag I guess.

I like having control over what I have to have fixed and when.

But it is true that many home owners leave critical maintenance until the item actually breaks down or becomes unservicable. Who replaces a roof before the water actually starts coming in? Probably almost no one.

Condodweller

at 1:23 pm

@Ace Also, Francesca’s case is not your typical unit. I’m in a two bed 2 bath condo around 1000sqft and my fees are about $16,000 adjusted for 2000sqft per year. We also have decent amenities pool/gym/movie room/party room/concierge/24hr security/library.

You are also missing property taxes that I mentioned which is probably close to double on a house so add in an extra $2000-3000 just for that. My home insurance is less than $300 which I’m sure is significantly more on a house (building insurance is part of the maintenance fee). You add in the large items and they start looking pretty close.

After that it comes down to lifestyle. If I hired a cleaning service to come in once a week I had 0 housework and I loved the fact work was ~25 minute walk from home and the entire downtown was walking distance to everything. You start factoring in vehicle costs and a condo can easily pull ahead.

Finally, a big difference between the two as someone mentioned is that you can defer maintenance on a house until it falls apart where the condo will always maintain the building well. The big issue here is that if you fall on hard times you lose your home because as soon as you can’t afford the maintenance fees you have to either sell and move or the condo corp will sell it for you after you stop paying the fees.

Edwin

at 9:25 am

In 5 years $1 psf fees will be the norm.

The Toronto condo property management model is broken. Toronto condos basically have the highest condo fees in the country, by a lot.

Wilson

at 10:24 am

It’s hard to do an apples-to-apples comparison of maintenance fees because of the varied things that are included in the maintenance fees, and also because maintenance fees are a part of a much bigger issue: the building’s condition vs. the reserve fund. That said, looking forward to wednesday’s results!

Daniel

at 10:55 am

David, what about condos that have rental items and hidden contracts not included in the maintenance fees? Any accounting for that?

Condodweller

at 12:32 pm

In all the condos that I have owned maintenance fees were broken out by parking and locker so that should be straightforward to account for the differences. Locker fees are around $25 and parking is about $70.

I find condo fees are a pretty good approximation of true inflation. It includes energy/services/salaries etc. the only notable item missing is food. One also has to look at these increases in perspective given that they are compounding. My fees typically increase by about 5% each year unless there are one-off items of which there can be many.

Our accountants keep telling us that our maintenance is one of the lowest in the city for both of my units so I guess I’m lucky. Let’s see if they show up on the list. Though I’m going to plead the 5th.

In terms of if it’s worth it, a lot of it is qualitative and depends on each person’s views/needs.

I think a condo with a large terrace is a great alternative to a house.

David, you should do a comparison for an average house and a 2/3 bed condo to see what the expenses are and which is cheaper considering all costs. Prop. taxes, average out large maintenance costs for a house (driveway, roof, flood etc). Account for gym membership pool costs, snow removal fees/lawn care etc.

Francesca

at 2:06 pm

I commented about property taxes above to your point. Home insurance is also significantly less expensive in a condo unit than in a stand alone house.

Market Observer

at 12:53 pm

Do you think that parking can be a detriment in high-fee buildings? For example, a unit with parking may have a $1.20/ft maintenance fee, while one without can stay below the $1 threshold.

Or are buyers astute enough to back the parking maintenance out?

Jenn

at 1:23 pm

What about amenities??

Different David

at 10:01 pm

Amenities pay a huge role in the maintenance fees, as do the number of units.

Large pools (especially indoor ones), full service concierge service, and other high ticket items will directly impact utilities and management fees.

Also, if you have a fixed cost (i.e. salary for a concierge), and split it over 200 units, it is a lot less than if there were only 50 units in the building.

One way to offset some of the costs is if you have a revenue generation tool (guest suite, parking, retail space). If I recall correctly, that’s why 25 The Esplanade had such low fees (because they always filled up their parking with people going to hockey/baseball games, shows, restaurants etc.)

Ace Goodheart

at 12:47 pm

Something you have to watch out for with condo maintenance fees is what is located on the first floor.

I have seen condos where the unit owners are actively subsidizing large, utility hogging businesses that occupy the first floor storefront units.

For example, how much water do you think a fast food restaurant uses, when compared to a private residence? Often there is no distinction. Everyone shares the water bill.

I have also seen situations where the only parking in the building is for businesses, however when the parking garage needs to be rebuilt due to salt damage, they special assess every unit owner (most of whom don’t have cars or parking spots).

Do you actually use the pool? The exercise room? How much do you think it costs per year to run a large swimming pool (you would be surprised)?

You want to have a close look at where the condo fees are actually going. Much of the money you are paying, may not be coming back to you.

JF007

at 10:53 am

ours for our Tridel NYork condo is currently sitting at about .76 p/sqft on a approx 1000 sqft condo but includes amenities, locker, parking and utilities…so fairly decent but has gone up aby about 130-140$ a month since we purchased it in 2014..used to be like .62 so about 22% increase in 8 years

Angela C.

at 1:23 pm

Hello David,

Thank you for this very helpful information.

Since selling my house two years ago, I’ve been trying to decide where to live and whether to buy, or rent in Toronto. I’ve seen apartments I like, but the maintenance fees blow me away. As I would like to live in the High Park neighbourhood, close to amenities, choices are limited, even though I’ve been told this is a good time to buy. Any suggestions you might have will be welcome and appreciated. Thanks!