Is that a crystal ball?

In the feature photo from today’s blog post, I mean.

And why did I choose one that simply has a reflection of an escalator, inside what looks to be a courtyard like one we’d see leading downstairs to the food court in one of many downtown Toronto buildings?

Perhaps I was trying to avoid being too optimistic. Truth be told, I looked at more photos of crystal balls than I care to count! Most of them feature a beach backdrop or a foreground in a tropical paradise.

But as the Toronto real estate market in 2026 is expected to go, it will be anything but paradise…

I wasn’t going to offer up the “crystal ball” theme in this series of blog posts to start 2026, for fear of coming off like I actually know what’s going to happen. This series is supposed to simply represent what’s happening inside my real estate brain, whether those things are good, bad, or ugly.

But then I read a comment posted over the holidays which really stuck with me, if I may be so bold as to share it:

Thank you, Ace.

While I want to keep ego and bravado out of this, I will admit that it’s very nice to see recognition of something that has been a major thorn in my side for so long.

I’m going to cover this in a subsequent category later on (which should come as no surprise…) so I don’t want to belabour this point right now.

However, this comment and the concept of the “crystal ball” do show me that it’s impossible to discuss what’s on my “real estate mind” without providing you with my two cents, for whatever that’s worth.

In January of 2025, I put together a ridiculously and unnecessarily long three-part series where I offered the following topics of discussion:

1) The spring market

2) Prices

3) The home ownership rate

4) Sales volume

5) Federal politics

6) Interest rates

7) Alternative real estate investments

8) Property flipping

These could be topics of discussion for just about any year, but coming into 2025, this was what I spent time thinking about.

I spent some time going back over my January posts, and I did find one of them very interesting.

In my “Burning Questions For 2022” post, which was the precursor to “What’s On My Real Estate Mind,” my number one point was this one:

How much further can this market possibly push us?

That’s right: numero uno in 2022.

Again, we’re not here to talk about crystal balls, but this was rather timely, wasn’t it?

Here’s part of what I wrote in that section:

Push us?

Yes, push us. How much further can this market go, run, increase, rise, and push, but also how much more can it push us to take on more debt, accept the rate of appreciation, and make personal and financial sacrifices to remain home-owning Torontonians?

Some people assume that because I’m a real estate broker, I automatically want to see the market go up, and nothing but.

Every time I meet somebody, and they ask, “How’s the market?” I usually pause, sigh, take a breath, or do something inadvertently that speaks louder than words could. Then I might say, “It’s been busy,” or something non-committal, since I don’t love talking real estate outside of real estate. If the conversation continues, and I say, “The market is nuts,” or “Prices are out of control,” the response is always the same:

“Well that must be good for you, right?”

I really don’t like the feeling of an “out of control” market being “good” for me. As a by-product, I understand the thinking. But the raison d’être is not a market that’s spiraling into chaos.

I wrote this in January of 2022, which was one month before our twenty-year peak.

I don’t want to use hindsight as a tire-pump here, but it certainly felt like some of us were watching what was happening in the market and wondering, “Can this continue?”

Continuing is one thing, but continuing at that pace was another thing entirely.

All this is to say that this blog feature isn’t so much about predictions as it is about discussion.

Discussion of hot topics, burning questions, trends, issues, and blind spots will help us all to remain alert and attentive to what’s important in the real estate market and associated industries.

Every year, many of the same themes are repeated.

You know I’m going to talk about real estate prices at some point during this two or three-part blog feature, but it’s not going to be the same conversation as it was last year or the year before. The topics might overlap and the themes might be consistent, but the discussion is almost always different.

So let’s kick of 2026’s list of “What’s on my real estate mind” with a new slant on an old topic…

1) Market trajectory

You can tell me that this is simply re-naming “real estate prices” if you want to, but let me tell you why I think it’s different.

Sure, the price of real estate is often the most important topic or at least the one that concerns people the most, but whereas in other years, we talked about price thresholds, previous pricing peaks, and this sort of “return” to those peaks, this year, I’m more concerned with the overall trajectory of the market.

If you feel the need to read into this further, I’ll go ahead and do it for you:

Last year, I was convinced that the average home price would increase. The conversation was then about when and by how much.

This year, I’m asking a question about the trajectory of the market, specifically, will it go up or down?

That’s the difference.

It simplifies the discussion.

In previous years, we looked at the market peak in February of 2022 and asked, “When will the average home price top $1,334,554 again?”

We picked random, arbitrary thresholds like $1,200,000 and asked, “Will any month top this figure in the year ahead?”

We looked at month-over-month and year-over-year data, discussed spring markets and fall markets, and much of the conversation assumed prices would increase.

That, of course, is on me.

Here’s what I said in this space last year:

Tell me that the 416 average home price will be the same in April or May of 2025 as it was in the summer or fall of 2024.

Go ahead.

Does anybody want to tell me this? Or can I connect the dots for us:

Reducing the BOC lending rate from 5.00% to 2.50% – 3.00% is going to push real estate prices up.

I was wrong. Plain and simple.

But at the risk of acting like the guy in your fantasy football league who missed the playoffs but told you his subsequent scores every week, arguing that he would have won the championship if he were included in the postseason, I’d like to remind everybody what happened when 2025 began.

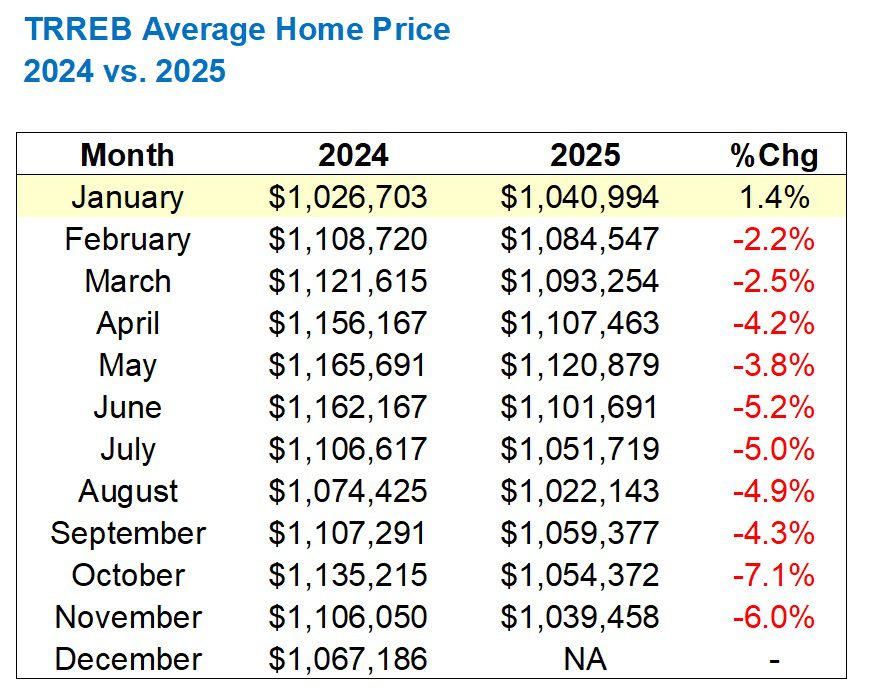

First, consider that the average home price in January of 2025 was $1,040,994.

Why is this important?

Because the average home price the year before, in January of 2024, was $1,026,703.

That means we saw a 1.4% increase in the home price in January.

And then in February, Donald J. Trump took office as the President of the United States, and our whole world changed.

Tariffs, tariffs, tariffs.

That’s all we heard throughout January, and it simply got louder in February.

On February 13th 2025, President Trump announced his “reciprocal tariffs,” and if that weren’t bad enough, he essentially held the world (and Canada!) hostage when he announced that they would take effect on April 2nd, which he named “Liberation Day.”

Working in the real estate market in the first four months of 2025 was just non-stop talk about “APRIL SECOND.”

I heard this every day, and it drove me nuts.

Now, I mentioned that the average home price in the GTA increased in January, year-over-year.

What happened in February?

It decreased.

From $1,108,720 in 2024 to $1,084,547 in 2025. That’s a decline of 2.2%

That gap widened in March when the average home price of $1,121,615 recorded in 2024 gave way to $1,093,254 in 2025. That’s a decline of 2.5%.

This continued throughout the spring market, into the summer, and through the fall.

In fact, the only month in 2025 that saw an increase in the average home price was January:

Does it sound like I’m blaming Donald Trump for the results of the 2025 Toronto real estate market?

I certainly hope not, because that wasn’t my intention.

But I’m making a point about market trajectory.

Everything changed in February when President Trump took office, and I’m loath to admit that his talk of tariffs absolutely paralyzed the real estate buyer pool. It completely changed the trajectory of the market.

So where does that leave us?

I’m not sure that everybody is going to love the following parallel, but here goes…

Think back to early 2020, for a moment. Remember when we first heard about this crazy “virus” overseas? Then remember how we heard there was a single case of it in Canada? We were obsessed with this, and it was like a slow creep as it began to take over our lives. Eventually, the rumours, discussions, and fears became reality, and we all know what happened next.

We panicked. We stopped dead in our tracks. We completely froze.

But then we learned, accepted, and above all, adapted.

It became our new reality, and one we had to learn to live within.

I believe that the same patterns took place in 2025 with respect to Donald Trump, his threats, policies, tariffs, and the new economic reality.

In a word, both our lives during the pandemic and our lives in the new economic reality became “normalized.”

I’m not suggesting that our real estate market is going to take off the way that it did back in 2020, but rather I’m suggesting that it would be prudent to consider what happens after a market shock.

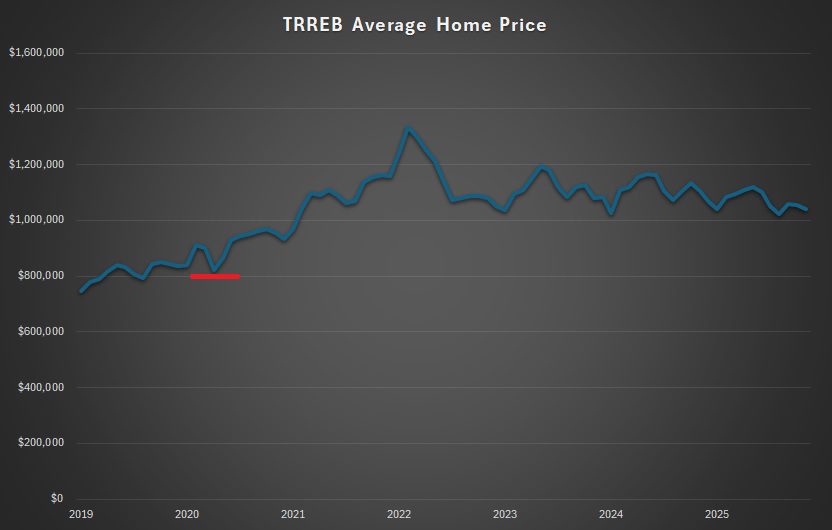

Case in point, remember what happened to the TRREB home price when the pandemic hit?

The average home price in February of 2020 was $910,290. This price was trending up, but the “stay at home order” was issued around March 16th, give or take.

The average home price in March of 2020 was $902,680, representing the appreication in the first half of the month, and then world coming to a halt in the second half.

The average home price in April of 2020 was $821,392. It fell 9.0% in a single month!

But when you plot the average home price from 2019 through 2025, here’s how that pandemic-induced “shock” to the market looks:

It looks like a literal “blip” on the proverbial radar, although at the time, it was a disaster!

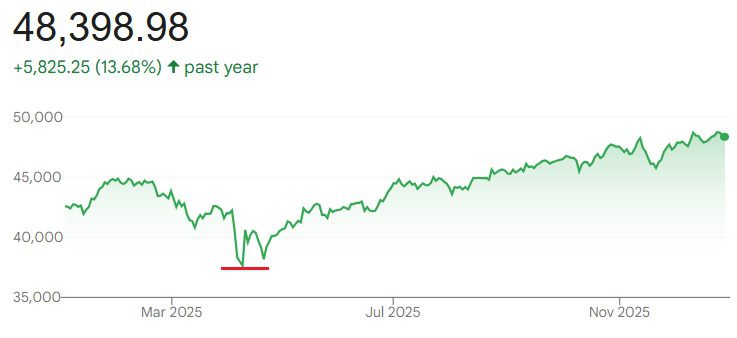

Now, just to flesh out this thought, do you remember what happened in April after Donald Trump’s “Liberation Day?”

The stock market crashed!

The Dow Jones went from 42,225.32 on April 2nd, 2025 down to 37,645.59 by April 8th, 2025. It fell 10.8% in less than a week!

Where is the Dow Jones now?

At the time of writing this post, the Dow sits at 48,398.98.

I remain convinced that the 10.8% drop in April will eventually look like a “blip” on a medium-term chart. In fact, it’s already starting to look that way…

Now, just to show you that I’m not completely biased, I want to entertain an argument that our real estate market will continue to decline.

You know I have this favourite saying, right?

“You can make numbers say anything you want.”

Well, you can make charts say anything you want too.

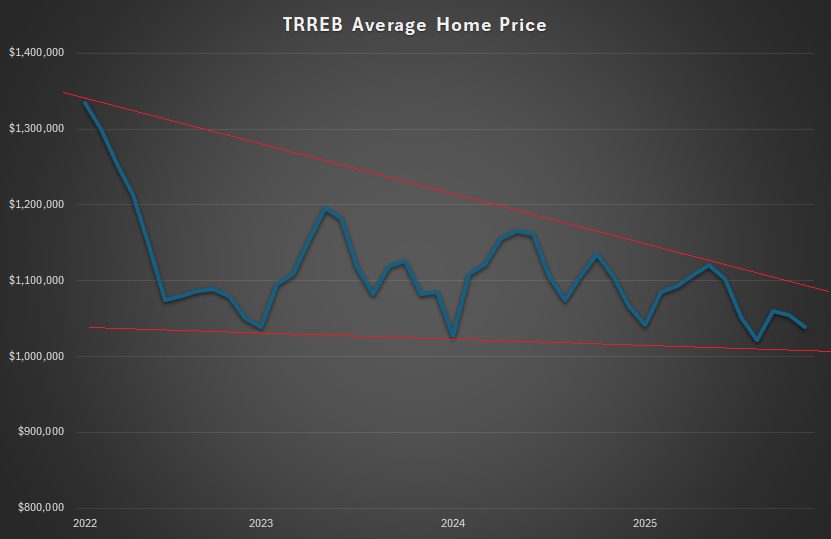

Consider the “TRREB Average Home Price” chart that I showed you above. This plots monthly prices from January of 2019 through November of 2025.

But let’s make a new chart that:

1) Starts at February, 2022

2) Sets the Y-axis at a minimum of $800,000, instead of $0

3) Trace the peaks and valleys

That chart would look like this:

This chart tells a very different story, doesn’t it?

This looks like a market in decline!

But honestly, folks, we could do this all day long.

We could create charts to suggest the market will increase, and then we could create charts to suggest the market will decrease.

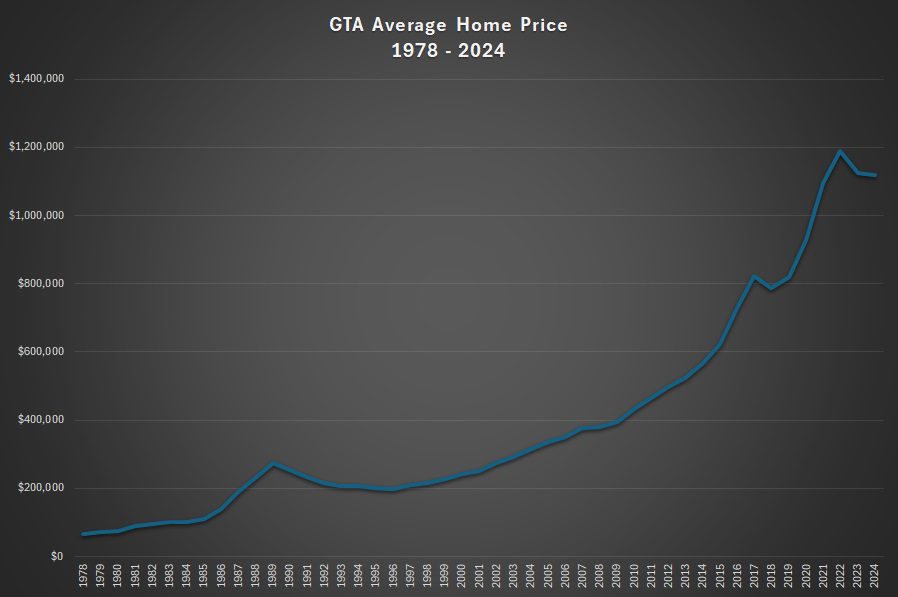

After all, in 2025’s edition of “What’s On My Real Estate Mind,” I showed you this chart:

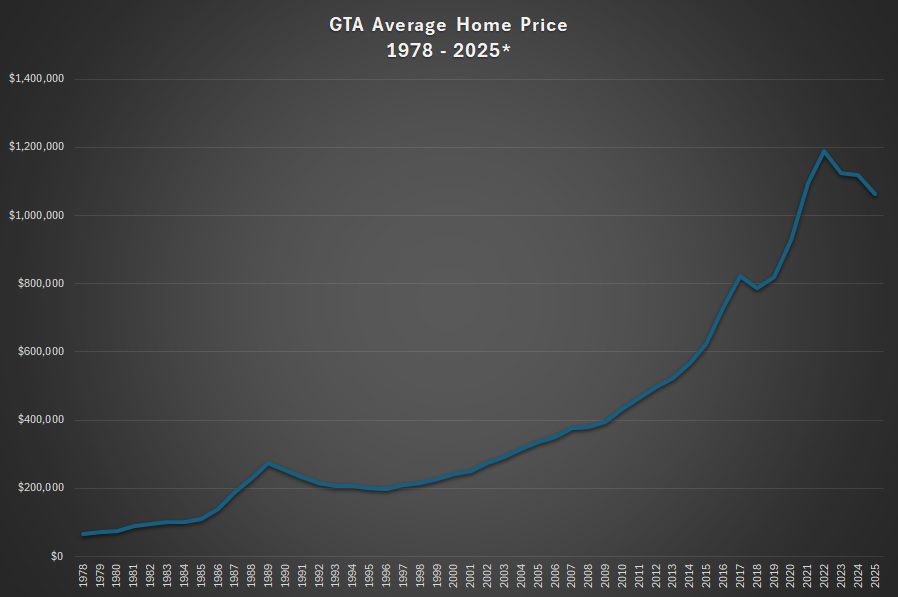

At the time of writing this blog post, I do not have 2025’s average home price.

But let’s assume that the average home price declined by exactly 5.00%.

Here’s how the updated chart would look:

I’ll leave it up to you to decide whether this materially changes the chart or the trajectory therein.

I will also leave it to you to chime in with your predictions on the market trajectory.

If you want one from me, well, here goes:

The average GTA home price in 2026 will be higher than in 2025.

I’m not getting down with monthly prices, peaks, or thresholds. Let’s just say that I’m quite confident the trajectory of this 2026 market moves opposite to the movement in 2025…

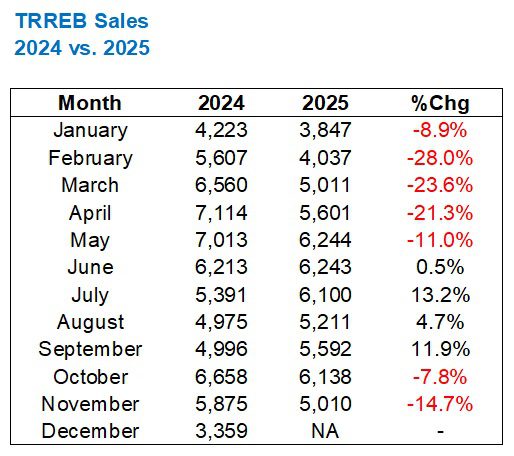

2) Sales Volume

Another oldie, but a goodie!

And if you want to talk about the “most important” subjects in the real estate market in 2026, this would likely be at the very top.

Sales volume has been on my real estate mind for years, however, and I probably wrote about sales more in 2025 than I wrote about prices.

I mean, what’s a bigger story?

a) Substantially fewer people are buying real estate

b) The price of real estate has declined

I dunno, George. I think option “a” strikes my fancy.

This is probably the third year in a row that I’ve made a fuss about sales volume, but it’s for good reason. While the number one reason for the surge in real estate prices in 2020 – 2022 was likely lower interest rates, I think that the sheer number of people buying real estate is just as good a reason.

You might argue that the latter is a by-product of the former, but not necessarily.

As we saw in 2025, when the Bank of Canada lending rate fell from a high of 5.00% down to 2.50%, and sales remained stagnant, it’s not only low rates that motivate buyers.

Others will argue that “FOMO” took over the years 2020 – 2022 and that’s another reason why we saw so many sales. Are we that pathetic as a species? Do we really only do things because other people are doing it?

Wait. Don’t answer that. Up until now, I was having a good day…

Throughout 2025, we tracked cumulative sales on TRB, aiming to extrapolate the data to the end of the year and estimate the total sales volume.

We all know that the peak number of sales came in 2021 when a ridiculous 122,133 properties traded hands in the GTA.

That figure fell to 75,652 in 2022 as we hit peak pricing in February, and a combination of moves and announcements from the federal government, Bank of Canada, and CMHC forced buyers to the sidelines.

Sales fell further in 2023 down to 66,315, which represented an all-time low, before a slight uptick in 2024 saw 67,984 sales.

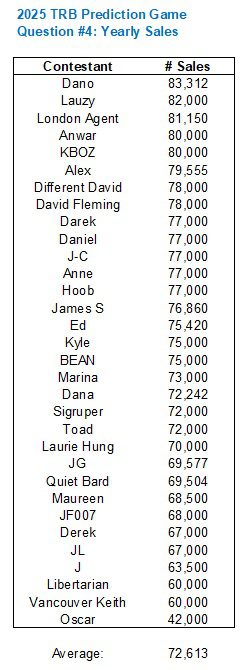

In our 2025 “TRB Real Estate Prediction Game,” I asked the readers to predict how many sales we would see in 2025.

Here’s a look at those predictions:

Of course, this was based on the 67,984 sales recorded in 2024, which I included when I asked the question on TRB.

Although we noted above that the average sale price in the GTA increased in January of 2025 over January of 2024, this surprisingly didn’t translate into an increase in sales.

In fact, sales were down 8.9% in January.

That trend continued.

And continued.

And continued…

Spring sales were absolutely bleak.

But as I noted in the first section above, I have to think that the “Donald Trump effect” was on display here.

Those year-over-year figures did increase as we moved into the summer, but by then, the damage had been done. There was no way that 2025 sales would increase over 2024.

Not only that, there was a very real chance that 2025 sales would be even lower than the record-low figure of 66,315 set in 2023.

As I said, I tracked this all year long.

In early-2025, we were pacing 55,000 sales! It would have been crazy!

By December, we were pacing about 64,000 sales, and that data won’t be released until early January. Perhaps I’ll update this blog once we get the data from TRREB.

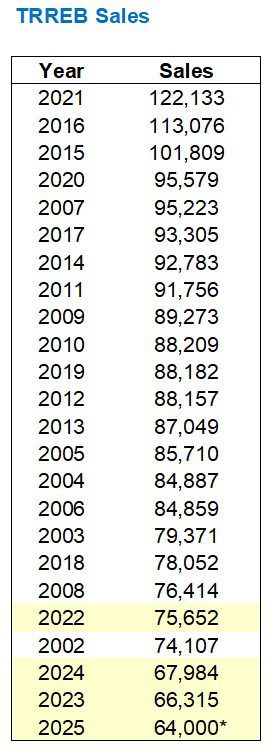

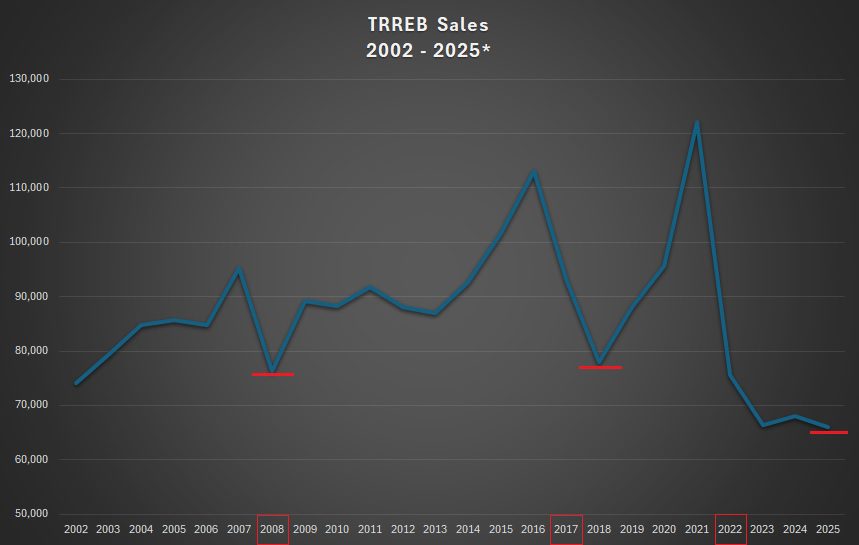

For now, let’s assume 64,000 sales and get an updated look at sales by year, 2002 to current:

That’s uncanny!

And in case it’s not obvious by my yellow highlights, the last four years rank in four of the bottom five spots on our chart above.

Now, when we plot the yearly sales on a chart, something really interesting happens.

Take a look and see if you notice.

Pay special attention to the valleys, with the red underlines, and how they correspond with the years, boxed in red:

Alright, so we know that we saw “market corrections” in each of 2008, 2017, and 2022.

But what’s fascinating about this chart is that the sales data has been taking longer and longer to correct.

The 2008 price correction corresponded with the low point of sales in 2008.

The 2017 price correction led to a low point of sales one year later in 2018.

And the 2022 price correction led to a low point of sales three years later in 2025.

Folks, if you’re looking to me to explain why this happened, then I’m sorry to disappoint.

But in my humble opinion, and in my unscientific estimation, I believe this confirms that sales have absolutely, positively, bottomed out.

Sales will be up in 2026. No question about it.

Maybe I don’t deserve a trophy for predicting, “Sales will be higher than the all-time low record,” but it needs to be said regardless.

The “Trump Factor” has been normalized.

The Bank of Canada policy rate has been cut in half.

January sales are going to be 10-20% higher than last year. So that’s my prediction…

Alright, folks, that was lengthy!

But if you expected anything less from me today, then it’s on you.

I’ll be back here on Thursday with more of what’s on my real estate mind in 2026, and for now, feel free to offer your predictions and prognostications in the comments section below.

JF007

at 9:24 am

David i think sales and prices have some further declines in thew cards for 2026. My single point or maybe 2 points are reduction in immigrant numbers.66K people left Ontario and i can bet vast majority were renters. that’s a huge number of people leaving. even if we consider them as couples on an average that’s probably a years worth of new condo inventory . To top it off 1-2 million are supposed to have their work visa expiring i believe in next year or two. All this will have huge pressure on the rental, investment and primary home markets IMO. don’t have a crystal ball of my own 🙂 but do think this sector is in for some rough times for next 2-3 years.

David Fleming

at 11:05 am

@ JF007

Your comments about net migration play perfectly into Part III of this blog post! 😀

cyber

at 9:55 am

Not to mention, 2026 will be the “peak of the mortgage cliff” when % increase in monthly payments is highest vs when property was bought (assuming 5 year mortgages). While the monthly payments at renewal have been rising, they’ll be hitting close to 30% in mid 2026.

Combined with close to 9% official employment rate in Toronto, we are poised to have a sustained high rate of inventory, dovish buyers continuing to “wait for the bottom”, and a record number of distressed sellers willing to take a discount just to get out from under the mortgage. These are the folks that set the low point for local comps and give buyers hope for a “steal” if they continue to wait and shop around.

Marina

at 10:09 am

Not a chance. I think we are in for low, low sales for at least another quarter. Between new wars, layoffs, and a dark snowy winter, I don’t think anybody is chomping at the bit to buy yet.

My prediction is sales will maybe start to pick up again in April. Maybe. Depending on what Orange Voldemort does next.

Crofty

at 6:27 pm

“Orange Voldemort” I love it! It’s along the same lines as the Samantha Bee classic from 2017 or so: Cinnamon Hitler.

Peter

at 10:22 am

Happy New Year, David.

Thanks for the exceptionally detailed read this morning.

Looking forward to Thursday, and hoping you’ll discuss Olivia Chow’s most recent tax increase.

Derek

at 10:39 am

Happy New Year everyone!

It’s been a long time since we’ve seen the historic price chart.

I still think we will go through a calendar year in which the sales volume rebounds markedly, but avg. price still drops. This year? Meh.

QUIETBARD

at 6:13 pm

I mean isn’t it possible for the trajectory to look like that of the 1989 – 2005 period where it was basically flat the whole time? Tbh given that interest rate environment is better than it was in 2023 I think house prices should be at least at 2023 levels or higher. However, we still don’t know what the economy, unemployment, GDP, inflation and consumer prices will look like in the coming months. Oh, and interest rates as well.

My prediction is a bifurcation will take place. Nice houses in nice neighbourhoods will sell like crazy. Being nice in 1 of 2 categories will probably lead to a decent result. The rest will sit. It’s hard to tell what will happen to average prices as the lower end condo market will probably keep taking a beating so artificially boosting the average. But I think sales will be higher and DOM of nicer homes will fall. I’ll also revise my predictions in a few months to keep up with the big bank economists. Only fair.

Kish Arora

at 6:58 pm

https://www.bbc.com/news/articles/cqxq32zzq8eo

David, your video chat with BBC news correspondence has been posted on their website. You have now ‘arrived’. Congrats.

David Fleming

at 7:40 pm

@ Kish Arora

It’s funny – I’ve heard the same thing from two other people. BBC seems to be a cut above any Canadian or American media outlet, in the minds of many people…

Derek

at 11:05 am

Will January will see average price drop below $1M?

David Fleming

at 6:36 pm

@ Derek

Oh, you had my attention. Now you have my curiosity…

Derek

at 9:27 pm

Lol I see I used too many “wills” but looking at your old blog post, something like 10/22 Januaries declined from December.