Can you guys please humour me for just a moment today?

I mean, if you made the mistake of expecting not to read a “folksy intro” at the onset of today’s blog post, then that’s on you. But here goes, regardless…

If you played Zelda for the original NES, please let me know in the comments section below today.

This game made its debut in 1986 and immediately became a fan favourite!

The Zelda franchise has, apparently, spawned dozens of games over the years, but I say “apparently” because I never got over the first one.

How could you?

It was the only game produced in gold!

As I tell my children today, “before the Internet existed,” if you wanted to know how to beat a certain level of a video game, you had to talk to other kids.

You’d hear rumours of who was the Zelda-guru at school, and you’d seek them out in the school yard at recess.

I started playing this game in 1986 or 1987 at the age of six or seven. I don’t remember the first time I beat it, but I’d have to think it was 1990 or 1991.

My friends and I revived the game in grade eight, circa 1993-1994, and I recall a revitalisation of the passion.

I’m sure I played this off and on in high school as well.

While I did get a “Super Nintendo” in 1992, I never got past the 16-bit games. I tapped out very early on, and what’s more is that I found myself returning to the original NES.

If you showed a child today what NES looks like, they’d lose their minds. But if you showed me, today, what a game looks like in 2025, I wouldn’t even know how to hold the controller.

Over Christmas, my daughter suggested, “Daddy, how about you play Zelda, and I watch?” She reminded me that we did this two or three years ago over the Christmas holidays, and when your daughter requests something like this, you absolutely abide by that request!

Believe me when I tell you this, but I still have my original NES from 1986, and it still works.

On Christmas Eve, I played with my daughter for two hours and explained to her, “What I just did in two hours would have taken me all summer long in 1990, and a hundred hours.”

The next night, we “beat” the game together, as she helped draw a map of Level-9 with a piece of paper, ruler, and pencil, and eventually slay Gannon and retrieve the triforce, and rescue the princess.

I don’t know why, but I absolutely love coming back to the original Zelda, over and over.

I have completely memorized the game, and while I might come off like a guy bragging about making the best mix-tapes on cassette in the year 2025, and thus being tech-savvy with an outdated technology, I think it’s just the familiarity that drives me.

Perhaps it’s nostalgia.

Or maybe it’s got deeper roots than that. Maybe the origin is of the “meant to be” variety; that this was my game, and I was destined to master it well into my 40’s!

That’s the optimistic view.

The pessimistic view would be more of the “one trick pony” variety, which leads me into item number three on my list of “what’s on my real estate mind” in 2026…

3) Pre-Construction Condominium Market

Do you see what I mean?

Is this my real estate Zelda?

Is this a “game” that I’ve been playing since my formative years in the real estate industry?

Am I still trying to rescue the princess?

While my fascination, disdain for, and warnings about the pre-construction condominium industry in Ontario might not date back as far as my Zelda playing days, you might be surprised to see just how far they date back.

Here’s the first blog post I wrote about pre-construction condos, almost two decades ago:

July 16th, 2007: “Nicholson 1-Bedroom, Hoffman 2-Bedroom-Plus-Den, Or DiCaprio Penthouse?”

This was a cynical, sarcastic review of “Festival Tower,” which had launched in June of 2007.

Although it seems like I was far more sarcastic back then…

My opinion, humble as always: If you are one of Toronto’s social elite, and you want your other socially elite friends to marvel at your new, modest, million-dollar purchase, then this building is for you. If you are a seemingly-normal person, without a yacht, cottage, alligator shoes, and the desire to maybe, perhaps, possibly, one day bump into Kevin Bacon in the lobby of your building, then your money is much better suited elsewhere.

If I had to choose between the Susan SARANDON suite of 1250 square feet for close to $900,000 all-in, versus: three above average Toronto condos at $300,000, a 4-bedroom house in Leaside, a mansion in Oakville, or two semi-detached houses in Riverdale, I can tell you there would be a zero percent chance my mail would be sent to a suite named after the star of movie gems such as “Lorenzo’s Oil”….

Geez, that blog post was only 798 words in total. No wonder I wrote five blogs per week back then…

In any event, even a casual reader of Toronto Realty Blog will know that I have been writing about the dangers of the pre-construction condominium industry for as long as I’ve been writing the blog itself, but last year, something really significant happened.

If you’re familiar with the analogy, “Where there’s smoke, there’s fire,” well, I think that fits.

The smoke finally gave way to fire, and the whole industry went up in a spectacular blaze for all to see.

We discussed this quite a bit throughout 2025, and I have no doubt that it will be a regular topic of discussion in 2026.

But before we get to that, I have to make a confession.

As it pertains to the pre-construction condominium industry, or the discussion of pre-construction condos, I have felt just about every emotion there is to feel over the years. But there’s one that I haven’t felt, er, hadn’t felt, until very recently.

Jealousy.

Simply put, I’m jealous.

I’m jealous of all the writers, columnists, pundits, economists, mortgage brokers, and real estate agents who are now coming out and saying what I’ve been saying for years.

Case in point, the “Living Here” newsletter from the Toronto Star that I received last month, containing this excerpt:

Oh, now we’re looking back at this with shock and awe?

“FORTY PERCENT” with an exclamation mark.

All of these neighbourhood geniuses are coming out of the woodwork with the benefit of hindsight, but where were they when people were literally sleeping in the street to be first in line to buy something for forty percent more than it was worth?

Sorry.

I just needed to get that off my chest.

You can clearly tell this is on my real estate mind for 2026, and not just because of my own personal demons, but rather because this story is only ramping up.

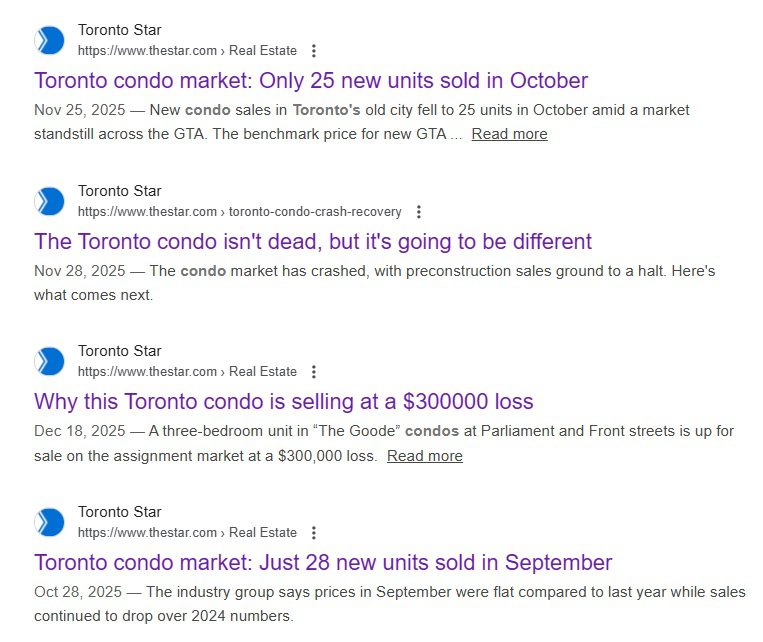

Let me do a quick Google search for “new condos in Toronto” and see what comes up in my news feed:

Okay, so you’re telling me the pre-construction condo market has seen better days?

How about we present some statistics to underscore exactly where we stand right now? I read a great piece in TorontoToday.ca over the holidays that was chock-full of eye-popping stats. HERE is the article, and here are some key figures:

- Only 2,540 new condo units broke ground in Toronto through the end of September 2025, the lowest number since at least 1998. That’s a 79% drop from last year.

- In the first 10 months of 2025, only 714 new condos were sold in Toronto – down 61% from the same period in 2024, and down 86% from the same period in 2023.

- In 2025’s Q1, only 45% of pre-construction units in Toronto had secured buyers, which is down from 85% in the same period in 2023, and down from 94% in 2022. Condos require a 70% sales threshold to access financing.

- Year-to-date, at least 18 condo buildings totalling 4,040 units have been cancelled in the GTHA, with another 20 projects with 4,187 units either in receivership or on hold with a high likelihood of cancellation in the near term.

I could go on, but I think you get the point.

For as long as we’ve worked in a market where condos have been sold before they’ve been built, we have never seen a market this poor.

And I hesitate to even suggest that we’re in a market, because, despite the 714 new condos being sold in the first ten months of 2025, I don’t expect any of those buildings to break ground. Who cares if “Princess Zelda Condos” sells 19 units in October; the only thing that matters is whether or not they’re going to sell the 70% necessary to move forward with the project.

So as we look ahead to 2026, I have three very important, seemingly rhetorical questions about the pre-construction condominim market in Toronto:

1) When does it make financial sense for builders to build again?

2) How will the sales model work in the future?

3) Who is going to line up to buy a pre-construction condo in the future, having seen what transpired in 2024-2025?

If you’re one of the individuals who thinks “greedy developers” are to blame for everything in this city, then just skip to the next section. For the rest of you, I think we can all agree that if developers can’t turn a profit on a condominium, then they’re not going to build one. Right?

Here’s an article you need to read, in case you haven’t already:

“The Toronto Condo Isn’t Dead – But It’s Going To Be Different”

Toronto Star

November 28th, 2025

This is one of, if not the best, articles I read on the pre-construction condo market in 2025, and the authors have dug deep to provide statistics on the market that you can’t find anywhere else, but also that perfectly define the problem.

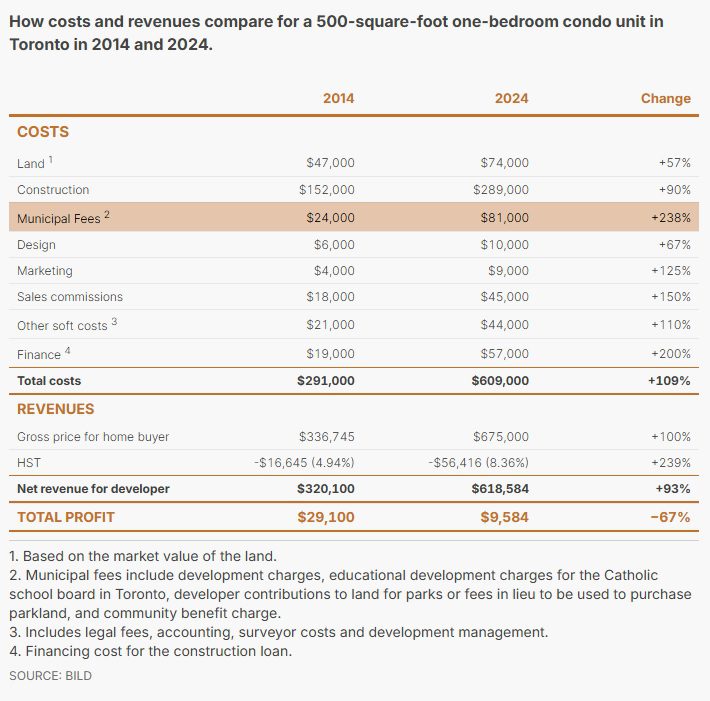

Like this one:

Amazing reporting from the folks at Toronto Star!

This doesn’t just answer questions like, “How much does it cost to build?” or “What does a developer need to sell for to make money?” but rather it paints a literal picture of the bottleneck that exists in our real estate market.

Simply put:

Developers cannot build condos in 2025.

That is where we are.

The graphic above shows that the break-even cost to build in 2024 was $1,218 per square foot, or $609,000 for a 500 square foot condo.

Pricing at $675,000, or $1,350 per square foot, nets the developer $9,584 in profit per unit, and there’s absolutely no way a developer is taking on this project if these are the numbers.

That unit would need to sell for $775,000 instead, which is $1,550 per square foot, in order for a developer to move forward, and there’s no market for pre-construction condos at $1,550 per square foot right now.

So to answer the first question, “When does it make sense for developers to build again?”, I guess your guess is as good as mine. But it’s not 2026, and it’s not going to be 2027, and as we all know, this is going to create a massive deficit in condos in 2029 and beyond.

As for exactly how new condo sales are going to work in the future, this feels like a trick question, doesn’t it?

Because what if I offered you only two answers:

a) The same way as before.

b) A different way.

Both have problems.

We can’t sell condos in the same way as before, since that caused a house of cards to come crashing down.

But we can’t really expect to find a new, magical way, so long as the banks want to remain profitable and without catastrophic risk.

The only way I can think of (gulp!) is for the CMHC to backstop the entire pre-construction condominium industry, which is an idea that rattles me to my core, and yet one that I think has a non-zero chance of taking shape.

Last, but not least, answer me this:

In 2009, one year after the Financial Crisis, when subprime mortgages packaged as marketable securities essentially proved to be fraudulent, who in their right mind walked into their wealth manager and said, “Hello, I’d like to purchase a mortgage-backed security, please”?

Nobody, right?

We would hope!

We would very, very much hope that mankind learned from its mistakes and that witnessing a market collapse, built on a fraudulent investment vehicle, would lead people to avoid ever purchasing that type of investment again.

So how can we look at the pre-construction condominium market here in Ontario and “hope” for anything different?

Either developers find a new way to build and sell condos, or Ontarians just go back and drink from the same contaminated waters as they did before.

Which one are you putting your money on?

We won’t be able to answer that in 2026, but something tells me we’ll be asking the same question in 2027’s version of this post…

4) The Resale Condo Market.

Even though I just sang my heart out in point #3 above, invoking childhood memories of a video game and father-daughter time over Christmas, the resale condominium market has far greater importance in 2026 than the pre-construction condominium market does.

Now, which has a greater importance if we’re looking 4-5 years down the road?

That’s an entirely different story!

But as much as I argued throughout 2025 that, “people need to distinguish between resale condominiums and pre-construction condominiums, when speaking about ‘the condo market’ in general,” we also must analyze how these market segments are linked.

Think of condominiums as a basic product as you would in an economics class, named “widgets,” measured in “units,” or whatever makes your fancy.

Several years ago, there weren’t enough units to satisfy demand, and thus prices increased in response.

Last year, there were far more units than there were buyers for them, and thus prices decreased as a result.

But as the year moved along, the number of units increased, whereas the number of buyers (from what we can tell, as there is no measure of this statistic) seemingly decreased.

Theoretically, this should have put massive downward pressure on prices.

But did it?

Here’s a hot take from yours truly, and it’s one that I haven’t offered yet:

The decline in the condo market isn’t nearly as bad as people are making it out to be.

Oh, you mean the decline in the pre-construction market, where sales are down like 90% from ten-year averages?

No.

I mean the resale condo market.

And in case you’re ready to call “bullshit,” I’m going to shock you with some data.

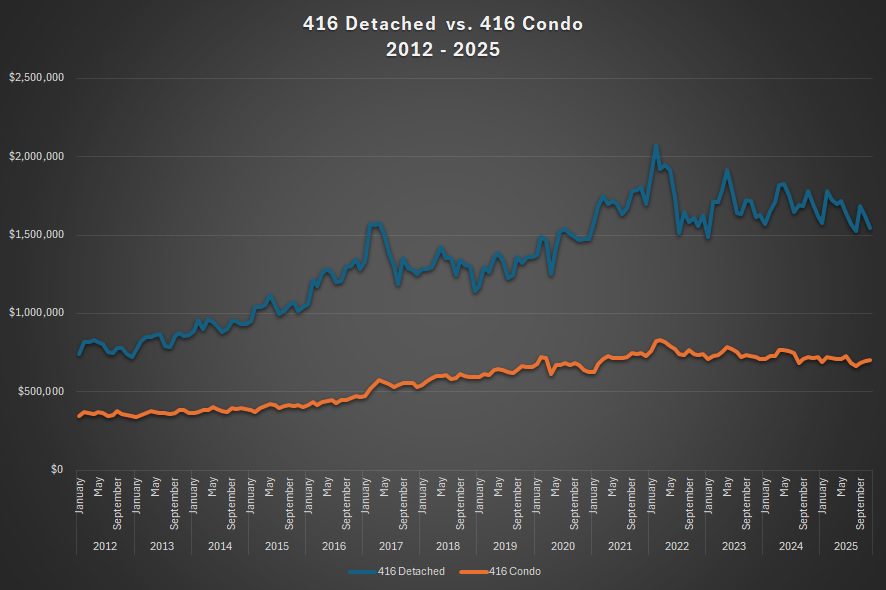

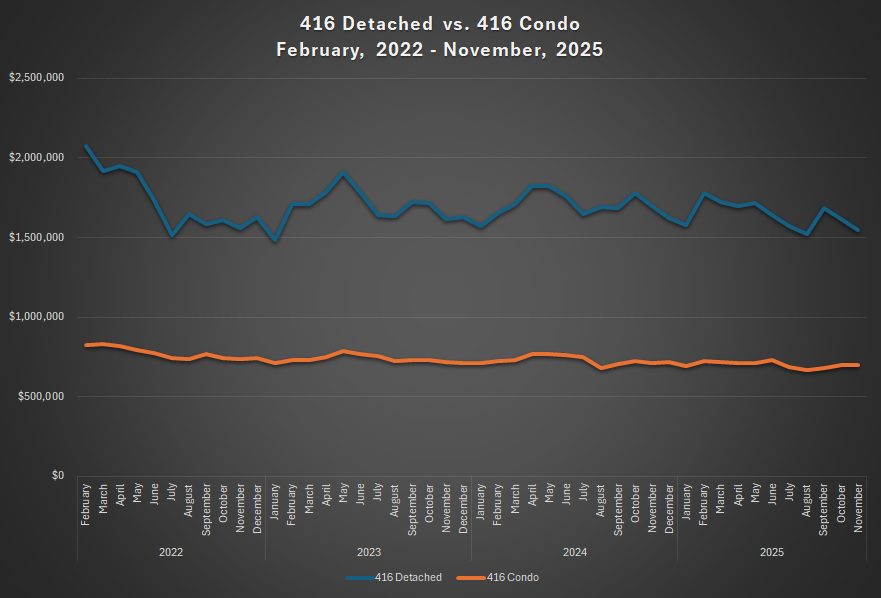

Here’s a chart of the monthly average 416 detached home price versus the 416 condominium price from January of 2012 through November of 2025:

It’s hard to tell from the chart, but it does look like the 416 detached has out-appreciated the 416 condo, right?

Barely.

The 416 detached has increased by 107.8% and the 416 condo has increased by 104.0%.

That’s an absolute wash when we’re dealing with figures this high, over this long a time period.

But when we look at how the market segments have moved since the 2022 “peak,” it gets far more interesting.

Freehold is the holy grail of real estate, right?

And the condominium market is “worse than it’s ever been,” right?

So let’s run the same graph as above, but from February of 2022 through to the most recently available data in November of 2025:

A couple of boring lines, right?

It goes without saying that the detached is way more volatile, not to mention the decline in 2022 was far more pronounced.

But to put some figures to this, let’s include the other two property types as well: semi-detached houses and townhouses.

The comparison looks like this:

If I close my eyes, I can hear Samuel L. Jackson saying, “Say what again!”

Raise your hand if you would have predicted that, since the “peak” in February of 2022, the average condominium in Toronto has declined in price by 10% less than the average detached.

Are there any hands raised?

And listen, I’ll be the first to admit that moving the goal posts a teeny bit will change perspective.

You want to go from February 2022 to October 2025 instead of November, and the detached figure is only down 21.9%, rather than 25.5%. Yeah, for some reason, it got hammered in November.

But even still, the point is made.

The decline in resale condo prices isn’t nearly as bad as people think it is.

There are exceptions to every rule, of course.

I had my eye on a condo on Tecumseth Street that was listed for about $440,000, and for which the identical model sold in February of 2022 for $680,000. That’s a 35.3% decline, compared to what we saw on paper above, at 14.7%.

I should have bought that place, but that’s a topic for another day.

There are condos that have gone down more than 14.7% since the peak, and condos that have gone down less, but if we’re going by the letter of the law here and trusting the statistics, it tells us that the resale condo market has held in exceptionally well over the past four years.

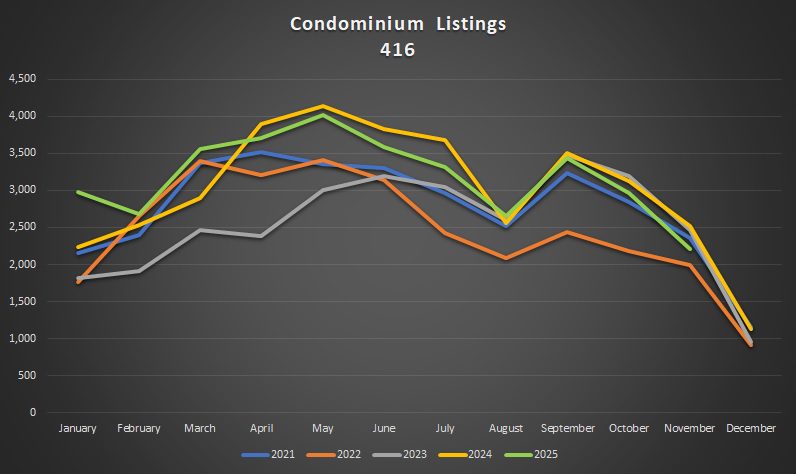

At the start of every quarter, I run a feature here on TRB called, “How Is The Toronto Condo Market?” I’ll be doing that in a couple of weeks’ time, looking at the Q4 data and how 2025 finished up, but for now, I’d like to leave you with one of the charts that’s included in that feature:

Look at how January started.

We saw almost 3,000 new condominium listings, which was 33% higher than the next highest on the list, which happened to be 2024.

But by the end of 2024, new listings in November were below those of 2021, 2023, and 2024, and only ahead of 2022.

As we’ve discussed, many would-be condo sellers decided to take their properties off the market, lease them out, and try again in a few years.

But regardless of what happened to the listing and why, the conclusion remains:

We did not have an inventory “problem” by year’s end.

Don’t get me wrong, sales were way down! And thus the absorption rate was way down too – something we’ll explore in the coming weeks in our condo feature.

But none of the data screams, “Condo market in nosedive.”

We’re talking 14.7% here, folks.

I think it’s very unlikely that the average 416 condo price rallies in 2026, but I think there’s a non-zero chance.

At the same time, I think it’s unlikely we’ll see the decline that many people are predicting.

Then again, many of those predicting a further decline are completely unaware of how much (or how little) prices have declined since the peak in 2022, as we proved in this section…

You know, I really wanted to save room for a point called City of Toronto Politics & “Vision,” but it would be impossible to write that without taking out all of my angst, disappointment, and completely legitimate fears of the dystopian future that lies ahead, but I’m trying to be a bit less combative in 2026, so let’s shelve that one…

…for now.

Lord knows we’ll be given ample opportunity to come back to it over the next twelve months!

Thanks for reading, folks! See you back here on Monday for a couple more thoughts…

Daniel

at 8:46 am

Lol Zelda

My misspent youth was wasted on the red ring, which I never ended up finding. None of my friends did either.

I haven’t thought about that in years until now. Wow what a blast from the past.

TT

at 10:12 am

I enjoyed the subtle Pulp Fiction reference more.

David Fleming

at 5:25 pm

@ Daniel

In 1988, the resident “Zelda master” from the school yard told me that in order to find the red ring, I had to first find a book about Zelda that was only sold at a Chinese mall at Brimley and Eglinton. I honestly can’t remember what mall I made my mother drive us to, but I went there with my brother to search for the book, which was a real-life version of searching for the ring.

It was absurd.

We did find a store that sold Nintendo and books on games, and I’m sure I purchased one.

But nothing told me where the red ring was.

It’s in Level 9. I found it when I played Zelda in grade eight when I was 14.

Should have known it was in Level 9. Finding it any earlier would have rendered Link invincible.

I had no clue

Serge

at 12:53 pm

“if we’re going by the letter of the law here and trusting the statistics, it tells us that the resale condo market has held in exceptionally well over the past four years”

Right, the burning question is, why, despite minuscule sales and huge supply, the prices have not budged down up to 50% over 4 years? What gives? This is the biggest “Toronto RE market mystery”.

Derek

at 1:37 pm

Probably many factors. If condos were actually selling at the long term average volume, I imagine the average price could be worse. I think detached prices increased much more, relative to condos, between 2019-22, so that is probably a relevant factor in how non-condos have also dropped more since then.

Serge

at 8:56 pm

There is a well known theory of RE ownership attrition – DDD – Death, Divorce, Displacement (or Debt) – when it happens, people sell at any price and drive avergae prices down. Its rate is constant, while it is not known.

Meanwhile, I believe, at least this force, if exists, should have brought prices down significantly over 4 years.

The theory of 2 bdr condos reported by Markymark below, needs statitistics; but how could it affect the DDD factor? Not clear.

MarkyMark

at 1:44 pm

The theory I heard why condo prices aren’t down that much is that there are more larger (2BR +) condos selling than a few years ago. More studios and 1BR are oversupplied and not selling, therefore total per unit is higher than when speculators were buying all the tiny units.

Ed

at 5:09 pm

makes sense