Do you remember January?

I know, it seems like just yesterday, right?

Here we are, moaning and wailing about the heat, when all the while, we forget how cold it was six months ago, and how it got dark outside at 4:45pm.

We’re now passed the halfway point of 2019, and I thought it might be time to look back at a few market sentiments and even predictions coming into the year. We talk far too often about home prices in Toronto, so today why don’t we talk about market rents?

This past January, there was a report that rents in Toronto would increase by 11% in 2019.

For the average renter, this was not only unwelcome news, but unexpected, especially when you consider that legislation was brought into effect in April of 2017 to try to cool the housing market! We’ve talked for days about how that backfired, but the laymen and lay-renters don’t really know this.

The report was issued by Rentals.ca and Bullpen Consulting, and obviously received some media buzz.

Here’s a video as it appeared on City News:

This report suggested that average rent prices in the city of Toronto would increase 11% in 2019, but also that Canada-wide prices would rise by 6% total.

Vancouver was set for a 7% rise, Ottawa 9%, and Mississauga 10%.

Now if you watch the video, you’ll see that two perspectives on the rental market were given: one from Ben Myers of Bullpen Consulting (formerly of Fortress), and Shaun Hildebrand of Urbanation.

Ben Myers predicted that rents would increase by 11%, citing a trend line of rental data over the past two years as his indicator. He believed that the mortgage stress-test was keeping more people in rentals, and of course, record levels of population growth weren’t exactly easing the demand for rentals.

Shaun Hildebrand predicted that rents would only increase by 5%, due to the fact that 24,000 new condos would be completed in 2019, which would be a record for Toronto, and the purpose-built rentals would reach a 30-year high.

Well here we are, halfway into the year, and I figured a reality-check was in order.

The data below is from Bullpen Research & Consulting.

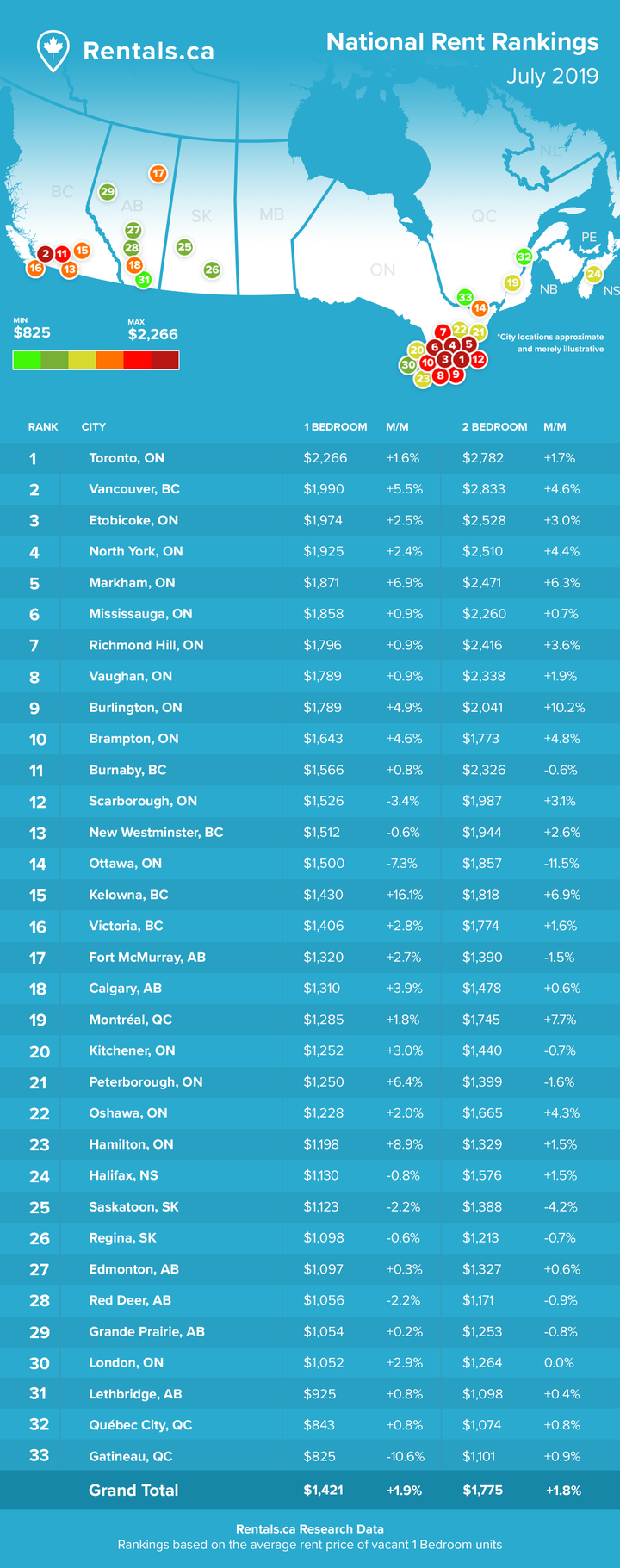

The average monthly rental rate in Canada increased another 1.9% in June after going up 4% in May, according to the most recent National Rent Report produced by Rentals.ca and Bullpen Research & Consulting.

Toronto sits atop the list with the priciest monthly average rent for a one-bedroom home at $2,266 and is second to Vancouver ($2,833) for average monthly rent for a two-bedroom at $2,782.

Median monthly rent for Toronto went from $2,250 in the last quarter of 2018, to $2,300 in the first quarter of this year to $2,350 in the second quarter. Toronto leads all other cities on the list for median monthly rent for the second quarter.

Recently released data from Statistics Canada shows that 37% of condominium apartments in the Toronto Census Metropolitan Area (CMA) are not owner occupied. Data released by Canada Mortgage & Housing Corporation (CMHC) last year shows that 33% of condominiums in the Toronto CMA are leased, with a miniscule vacancy rate of 0.7%.

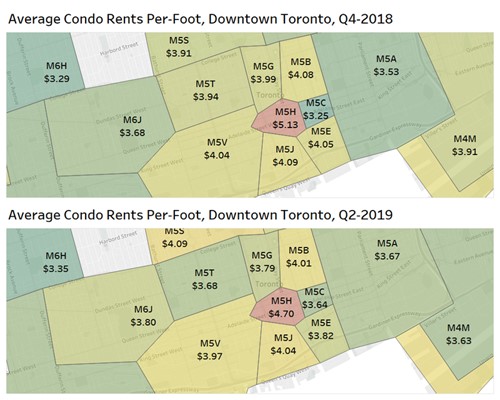

Comparing condo rental rates in several of the prime downtown postal codes in Toronto shows that the investor condo market is softening, as almost all of the areas are experiencing lower asking rent per square foot in Q2-2019 versus Q4-2018, with the exception of M6H and M6J in the downtown west area, as shown in the graphic below.

With the sharp rise in rental rates — especially condo rental rates — there has been an increase in purpose-built apartment construction.

As affordability continues to be a concern, the average size of units offered for rent is shrinking nationally, from over 1,000 square feet in October 2018 to 933 square feet in June 2019.

In Toronto, affordability concerns are resulting not only in tenants settling for smaller spaces, but also choosing to share small suites with one or more roommates much later in life than witnessed in more affordable municipalities.

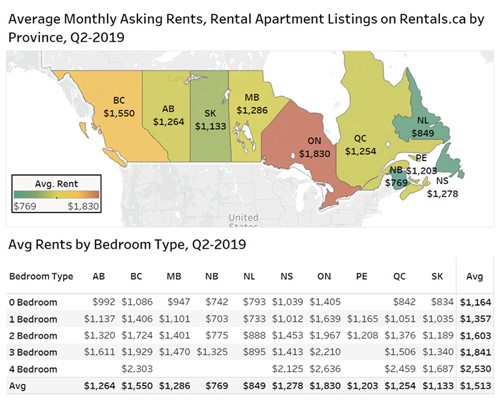

On a provincial level, Ontario had the highest rental rates in June, with landlords seeking $2,279 per month on average (all property types), an increase of 1.6% from May ($2,244).

Ten of the top 12 cities on the list with the priciest rents are in Ontario.

Ontario also led the way for average monthly rent for apartments only in the second quarter at $1,830 — that’s almost $300 more per month than British Columbia (The premium in Ontario over British Columbia is smaller for one-bedroom and two-bedroom units at around $250 per month.)

While June is a prime month for rental listings and demand, the average rental rate for all property types was $1,953 per month and the median asking rent of $1,875 was up from $1,800 in May. But the average rental rate for only apartments declined slightly month-over-month from $1,531 in May to $1,526 in June.

Gatineau, ($825 and $1,101); Quebec City ($843 and $1,074) and Lethbridge ($925 and $1,074) continue to take the lowest spots on the monthly rental list for both one- and two-bedroom homes respectively.

Other takeaways from the June national rent report include:

• The average property listed on Rentals.ca in the second quarter was offered for $1,910 per month, an increase of 2.1% over the first quarter. (Despite a smaller average unit being offered, rents continue to increase.)

• The market share captured by condominium apartments has increased from 18% in Q4-2018 to 24% in Q1-2019 to 27% in Q2-2019.

• Declines in the unemployment rate and immigration and population growth are two big factors keeping rental demand strong.

“Rental rates continue to trend upward in Canada as the economy remains stable and growing, further boosting demand, while the supply being added to the market is well above the existing average rent levels,” said Matt Danison, CEO of Rentals.ca.

“In the second quarter of 2019, the share of listings for condominium apartments on Rentals.ca was 27% of the total, said Ben Myers, president of Bullpen Research & Consulting. “People often overlook the role that investors play in adding much-needed rental supply to the market in Canada’s major urban centres. That said, we’re finally seeing some softening in rent growth for leased condominiums in Toronto, which were booming last year due to rising interest rates, the new mortgage stress test, and a lack of new rental supply.”

The National Rent Report charts and analyzes national, provincial and municipal monthly and quarterly rental rates and market trends across all listings on Rentals.ca for Canada.

The Rentals.ca numbers show vacated properties that better reflect current values. The figures better represent the actual rents a potential tenant would encounter when seeking to rent an apartment.

I’d say now is about the time I’d love to hear thoughts on AirBnB, rent controls, and of course, the idea of (gasp!) people owning condos for investment!

Ironically, I have two rental listings sitting on the market right now. I wonder why that is?

Appraiser

at 9:27 am

Rental rates and purchase prices will come down when supply exceeds demand, which I’m afraid is not in the cards for Toronto for quite some time.

It will take years to catch up to demand, but the city might as well start now by promoting greater density, secondary units, the missing middle, city-owned lands for affordable housing, etc. etc.

There is no silver bullet. It will take a multi-pronged approach to tackle the housing issue.

BillyO

at 12:52 pm

This is exactly it, well summed. Anything else is just noise.

Appraiser

at 9:39 am

“Theoretically the supply and demand for real estate move toward equilibrium over the long term. However, this point of equilibrium is seldom achieved or maintained.”

The Appraisal of Real Estate ~ Third Canadian Edition (Chapt. 9, p. 8)