I swear, if I hear the words “Trump tariffs” again, I’m going to throw something.

Call me naive or tell me my head is in the sand, but is it really that newsworthy? Do we really need to see this atop every single news feed, every day, in perpetuity?

“David, of course it is! The world is sitting on a knife’s edge!”

Alright, I will admit, we’re certainly entering into a very interesting time.

The United States has a new(ish) president who is doing a complete 180 on the policies enacted by the previous administration

Canada has no prime minister and no leader at the moment and will be entering into an election.

Ontario will more than likely also be entering into an election this year, despite objections from the Green Party.

That’s a lot.

Yup. It certainly is.

But what are we supposed to do? Just put the world on pause until the proverbial “dust settles?”

I was chatting with a client last week who said that after Trump takes office there will be “more certainty.”

I responded that I respectfully disagree. There won’t be any certainty, in fact, there will be nothing but uncertainty for the next four years.

Abnormal becomes normal.

On Trump’s first day in office – will he enact 25% tariffs?

Maybe. Maybe not. But either way, what clarity does that bring?

Trump did not enact tariffs.

So is that it? Time to celebrate?

As I told my client the other day, “Trump will come in, probably not enact tariffs, but will continue to talk about it, even if just to create a buzz and/or to hear his own voice. That will not provide any certainty. But regardless of what happens in the United States, we have no prime minister! We have a two-month leadership convention ahead, then an election – maybe, then a new prime minister – eventually, and then an election at the provincial level as well.”

How in the world are things about to get more certain?

Fast forward to the end of 2025:

-We have a new prime minister

-We have a new mandate for the government of the province of Ontario

-We have twelve months of the US President under our belts, come hell or high water

Maybe then we can say that we have certainty?

If you think back to the COVID-19 pandemic, one of the most over-used and eventually overly-annoying catch phrases was the words, “….in these uncertain times.”

It was tacked on to the end of everything.

You could go out to dinner, pause while looking at the menu, and say, “I’m finding it very hard to decide between the branzino and the filet mignon……in these uncertain times.”

So aren’t we used to uncertainty by now?

I certainly am. Pardon the pun…

December’s inflation data was released this week and the rate fell to 1.8% from the 1.9% figure posted in November.

Of course, the GST Holiday was said to have contributed significantly to the decline:

With food excluded, December’s inflation rate came in at 2.1%.

Call this a caveat, an asterisk, or a reason to explain away the fifth straight month that inflation has been at or below the 2.0% target set by the Bank of Canada if you want to, but it likely increases the odds of a cut to the lending rate on January 29th.

Earlier this week, some friends of Bosley Real Estate came in to present their economic update.

Thanks to Outline Financial for allowing us to use their slides!

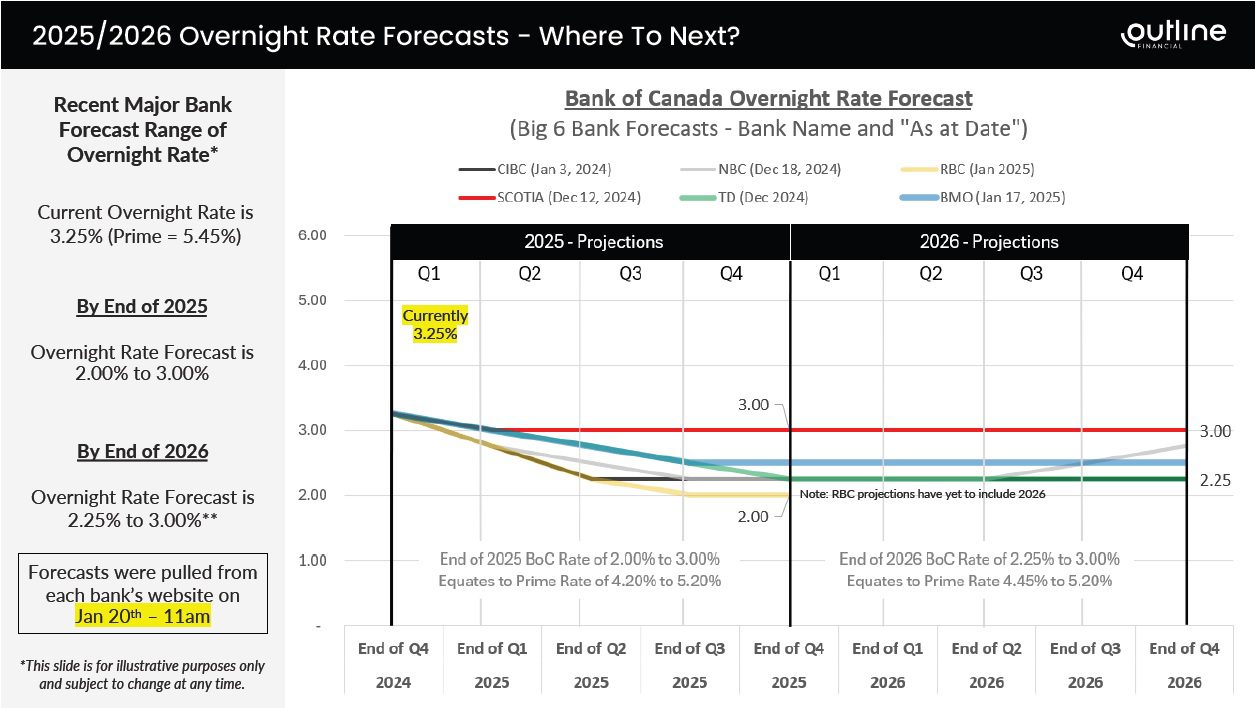

Looking at the year ahead, and into 2026, this is what the major lenders believe is going to happen with the Bank of Canada’s lending rate:

Again, consider that this was drawn up before the inflation data was released, but the banks have not revised their estimates since.

With the Bank of Canada rate currently sitting at 3.25%, only one of the six lenders profiled (the ‘big five’ plus NBC) believes that the rate won’t go below 3.0% this year: Scotia.

Scotia’s prediction is a rate of 3.0% through 2025 and 2026, although I don’t know how much these lenders can glean into 2026 at this point.

On the opposite side of the spectrum, one lender believes that the rate will drop from 3.25% all the way down to 2.00% by the end of 2025: RBC.

For the remainder of the lenders, predictions for the rate by the end of 2025 are:

BMO: 2.50%

TD: 2.25%

CIBC: 2.25%

NBC: 2.25%

Whether you want to take an average of these rates or simply pick your favourite lender, remains your call.

But the consensus seems to be around 2.25% – 2.50%.

That will have an impact on the financial market, real estate markets, the exchange rate with the USD, and of course, the overall economy.

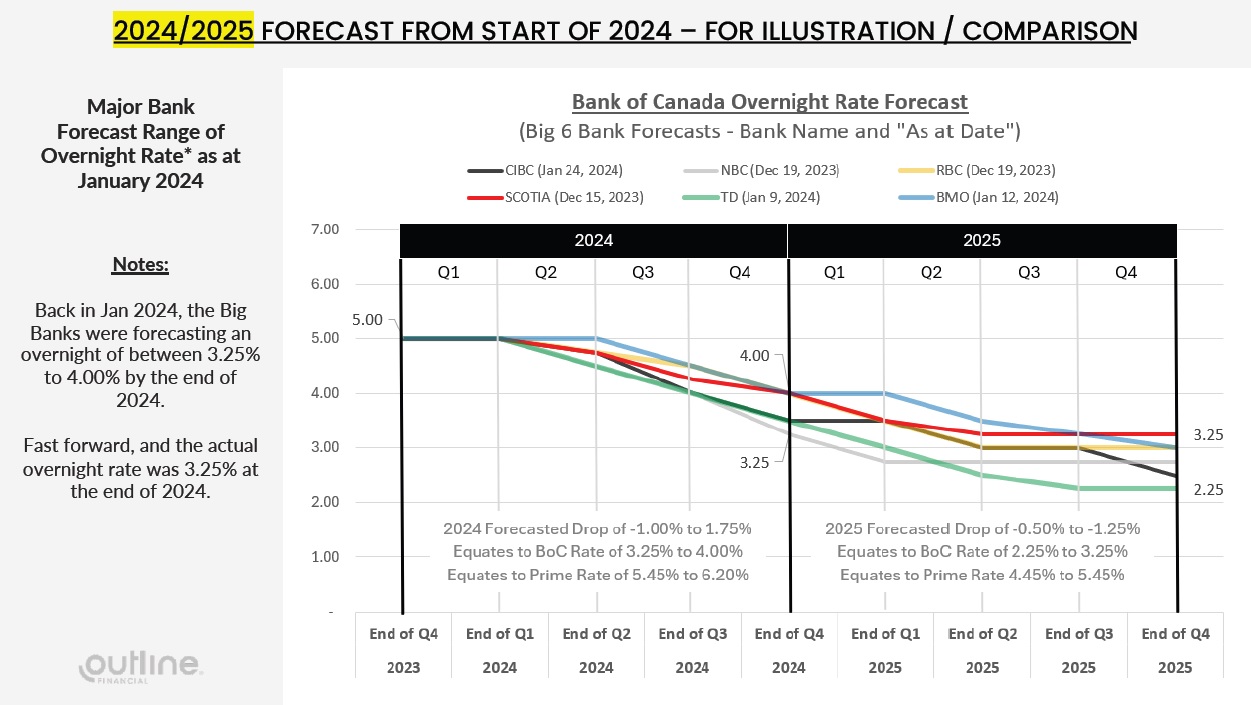

Looking back at the predictions from the start of 2024 is a very interesting exercise!

Outline Financial was able to pull this from their archives:

This may cause you to ask, “What good are predictions if they can simply be revised?”

Let’s look at the predictions for the end of 2024:

BMO: 4.00%

Scotia: 4.00%

RBC: 4.00%

CIBC: 3.50%

TD: 3.50%

NBC: 3.25%

As we know, the BOC rate at the end of 2024 was 3.25%.

Who would have figured?

National Bank for the win!

If only these folks had entered the TRB Interest Rate Game from last January! That reminds me, we still need to define our 2025 game, but I digress…

Now, what if we compared the 2025 predictions for 2025 versus the 2024 predictions for 2025?

It would look like this:

Scotia: 3.25% (2024) vs. 3.00% (2025)

BMO: 3.00% (2024) vs. 2.50% (2025)

RBC: 3.00% (2024) vs. 2.00% (2025)

NBC: 2.75% (2024) vs. 2.25% (2025)

CIBC: 2.50% (2024) vs. 2.25% (2025)

TD: 2.25% (2024) vs. 2.25% (2025)

Note that TD Bank is the only one of the six lenders who offered the same prediction for the BOC rate at the end of 2025, both at the start of 2024 and the start of 2025.

Alright, so where are interest rates going?

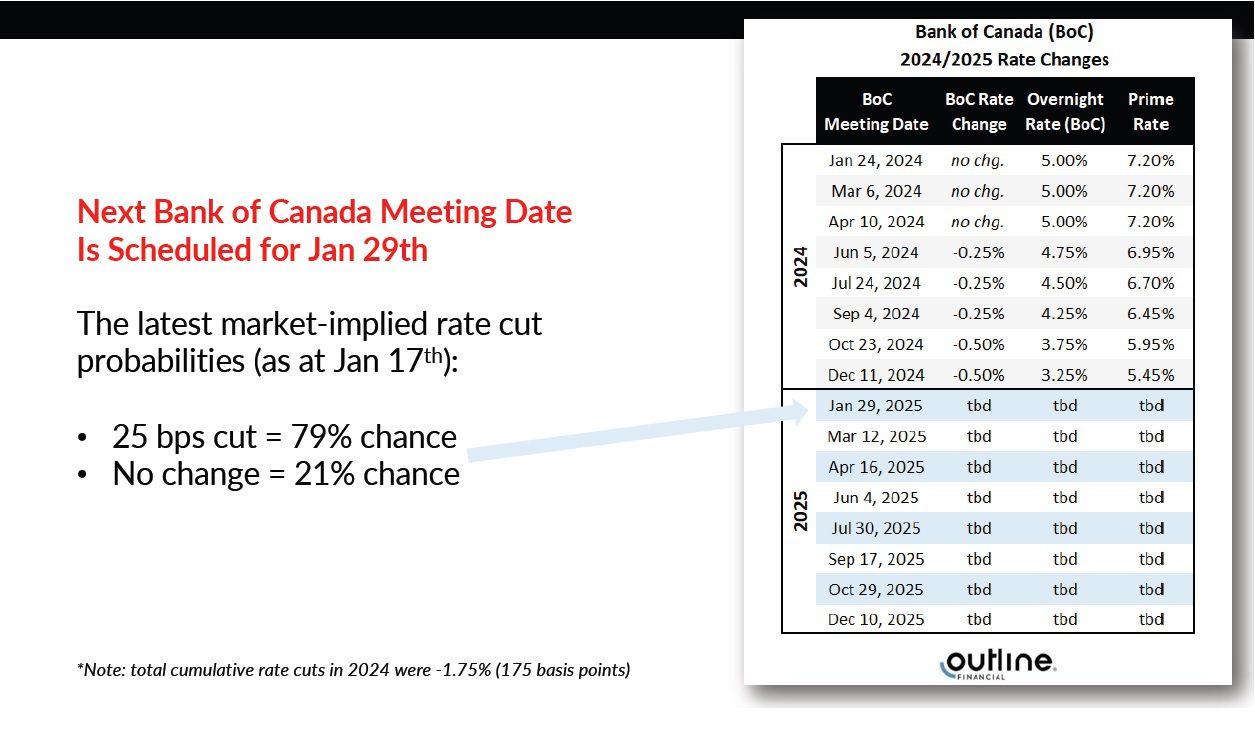

As of January 17th, the probability of a rate cut at the next scheduled announcement by the Bank of Canada on January 29th:

Of course, that was last week.

This week, it’s a whole different ball game, right? The world is changing daily!

Well, perhaps I’m being dramatic. But after the inflation data for December was released on Tuesday, the markets were pricing the odds of a rate cut at 82.0%.

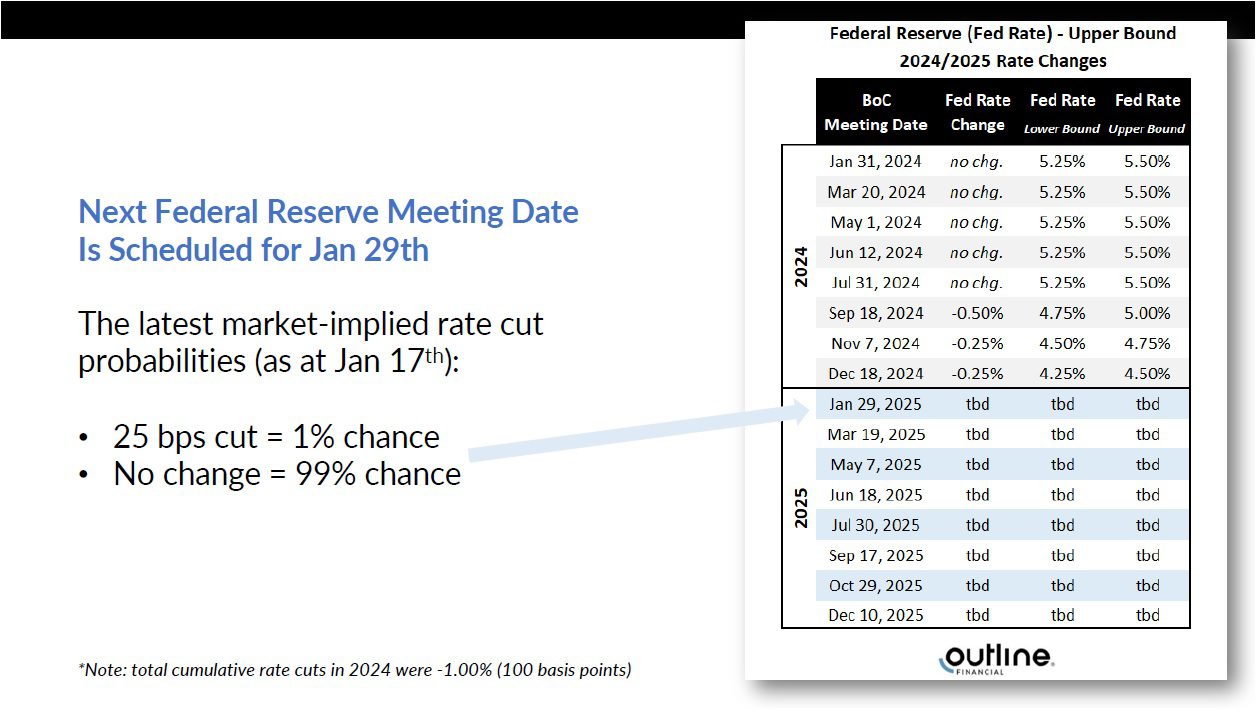

Is the same thing happening in the United States?

Nope…

The United States Federal Reserve is also meeting on January 29th, and the market-implied odds of a rate cut were a paltry 1.0%!

I’d like to know which economists made up that 1%.

It’s not quite as bad as the one voter, out of 394, who did not vote for Ichiro Suzuki‘s entrance into the Baseball Hall of Fame this week (sidenote: all ballots need to be made public, starting next year….) but it still feels like 1% of those surveyed are trying to be the outlier.

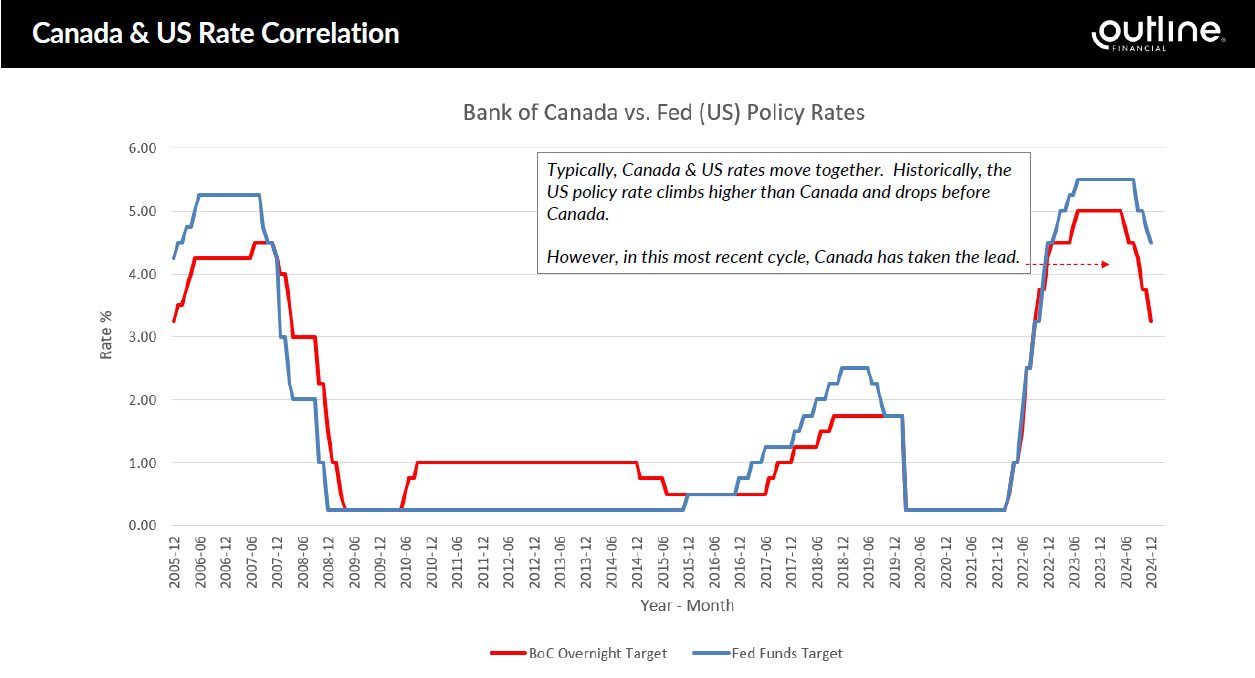

It’s worth noting, as the folks at Outline Financial did, that the policy rate of the US Federal Reserve usually declines ahead of the policy rate of the Bank of Canada, but that hasn’t happened during this cycle of rate cuts:

Lastly, what’s happening in the market with fixed and variable-rate mortgages?

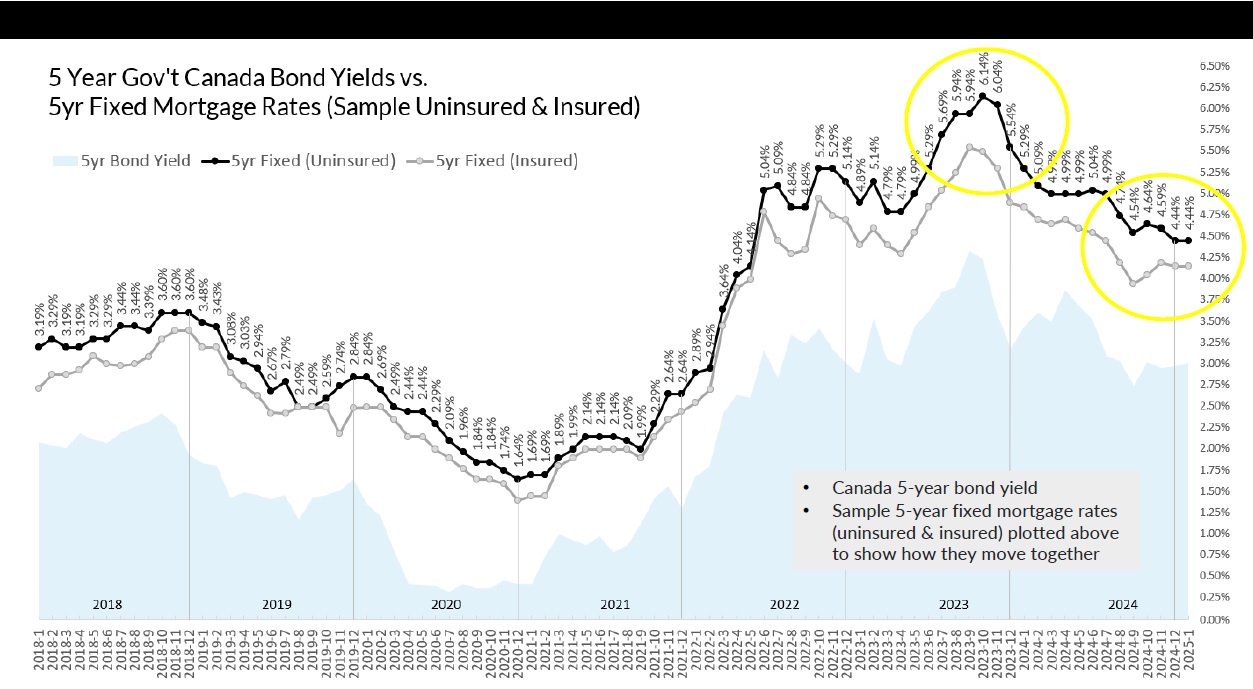

Fixed rates, which are determined by the bond market, have been declining steadily since the summer of 2023 when the 5-year government of Canada bond hit a high of 6.14%.

In January, the bond yield remained unchanged from December at 4.44%. This means that even if and when the Bank of Canada cuts the key lending rate, while the variable rate will decline, the fixed rate likely will not:

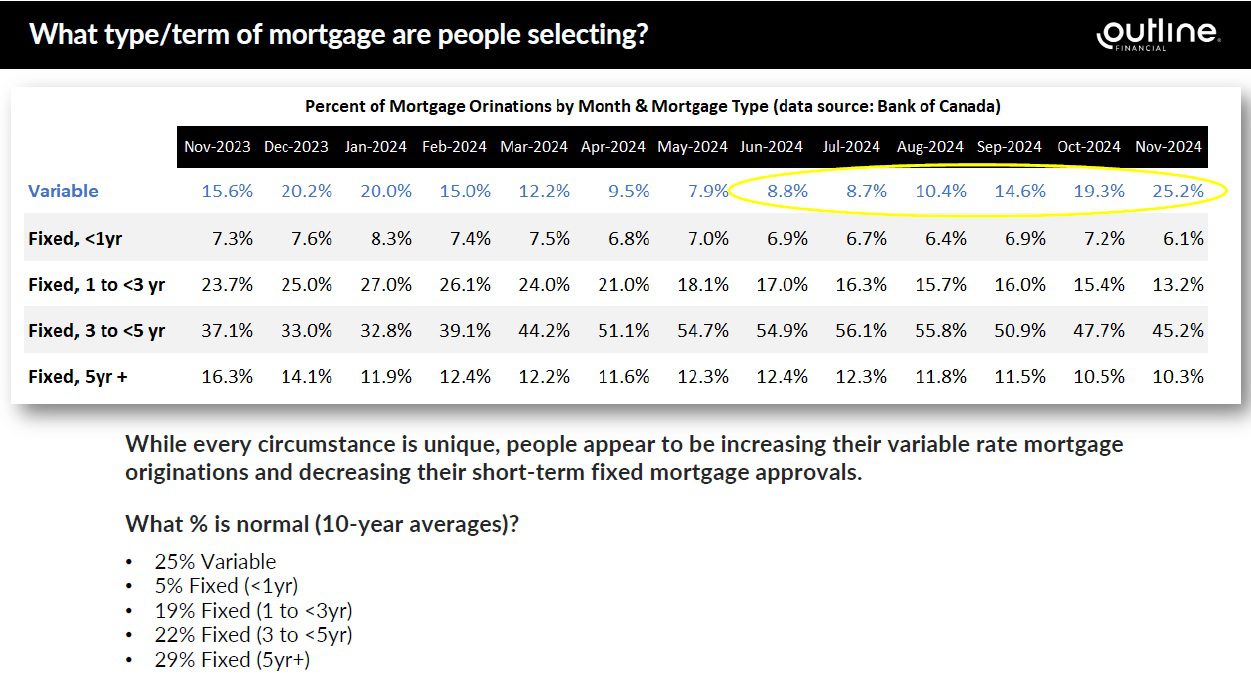

Lastly, the percentage of borrowers taking a variable-rate mortgage continues to climb substantially, now up over one-quarter of all loans.

Meanwhile, the percentage of borrowers taking the time-tested, almost-by-default fixed-rate mortgage is currently bottoming out at only 10.3%:

Phew!

That was a lot of data!

And I hope it made sense to you, not only because it might be boring to many, but also because I’m coming down with a serious cold and I’m not all there.

Man, I worked hard in December to avoid getting the same strep throat that my wife, son, and daughter all had. I slept in the damn basement for a week!

But who among us doesn’t get sick in January? This cold is an annual event for me. One that you could most certainly predict.

See you on Monday, folks!

OSCAR LUTGARDIS

at 9:04 am

lmfao are you serious? Are the tariffs newsworthy??

Whadya think happens to rates if the tariffs do hit and Canada retaliates? What happens to the economy?

Derek

at 9:32 am

What happens?

OSCAR LUTGARDIS

at 10:01 am

https://www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.economic-indicators.scotia-flash.-january-17–2025-.html

https://www.ctvnews.ca/business/article/sweeping-tariffs-could-be-3-hit-to-canadian-economy-even-with-carve-outs-report/

Derek

at 10:52 am

Those articles are screaming that today is the best time to both buy and sell a home, assuming you did not buy or sell a home yesterday, which was the previous best time to do so.

OSCAR LUTGARDIS

at 2:25 pm

🤣 😂 😆

sounds exactly like what ol Davey boy wants to hear!!

cyber

at 3:28 pm

Variable goes down, fixed goes up

US consumers buy fewer Canadian goods > Canadian unemployment goes up

On top of Canadian economy having declining GDP per capita for the past two years, and relatively high unemployment rate (real unemployment in 8-10% range in GTA), additional unemployment would USUALLY call for BoC to cut interest rates…

But inflation is also going up at the same time, because Canada will respond with retaliatory tariffs so Canadians will be paying more for US-made goods.

So as BoC cuts interest rate to keep the economy semi-afloat, while the Fed does not – and yield on US treasuries is even more relatively higher vs Canadian treasuries – capital flows from Canadian bonds into US bonds, meaning that Canadian long-term bond yield needs to go UP in order to fund government debt/deficit spending.

This in turn makes Canadian dollar relatively weaker, further pushing up CAD cost for US made goods and pushing up inflation.

Higher unemployment + higher inflation + weaker CAD + low interest rates that cannot be lowered further to “juice” the economy + less immigration = stagflation and a lost decade

Derek

at 4:01 pm

Hey, delving into the weeds with this question, but are rising prices caused by tariffs considered “inflationary” from BOC’s perspective? Seems to be a different animal than rising prices caused by an increase in the supply of money?

cyber

at 5:29 pm

Yes

If people pay more for the same basket of goods, inflation % goes up

Reason doesn’t matter – temporary port strike, COVID supply shock, (temporary?) tariffs, lower exchange rate etc

OSCAR LUTGARDIS

at 6:07 pm

^^This guy fu.cks.^^

Davey boy take some notes you could learn a thing or two lmao

Bryan

at 12:47 pm

I think there are 2 inherent assumptions in your analysis that could throw off the entire conclusion.

The first assumption is that the US isn’t also going to get slapped with an increase in unemployment and a general weakening of GDP/capita. Tit for tat tariffs from their 2 biggest export markets (Canada and Mexico) are going to drive down demand for US products. The US economy is going gangbusters right now but because they are doing this to 2 countries, US exports are theoretically going to be hit twice as hard. This will weaken the USD to a similar degree as the CAD (maybe a little slower) so I don’t personally expect a drastic swing in CAD/USD due to the tariffs. The government of Canada will need to tailor their retaliatory tariffs to ensure this happens or risk catastrophe.

The second assumption is that tariffs are going to lead to long term inflation, which I just don’t think is true. It isn’t as though an additional 25% of tariff would be added each year, continuing to drive up inflation. A year from when they are introduced (or less if they are lifted), the impact of the tariffs will have worked its way out of the YoY CPI calculation, and inflation will plummet in all 3 countries (as the negative impact on consumer wealth is no longer hidden by the one time increase in prices). It would be shocking if even the mighty US economy didn’t need significant rate cuts.

I think your formula is likely true for the first year of tariffs, but after the tariffs fall out of the YoY CPI calculation I think it will look more like:

High unemployment + miniscule inflation (broke consumers and no additional tariffs each year) + slightly weaker CAD vs the greenback (both economies will hurt from the tariffs, Canada slightly more) = BoC and Fed rate cuts (close to in tandem).

Immigration is an interesting one because theoretically more people with more money means more spending which would help to juice the economy…. but it would also hurt unemployment and is politically charged in other ways.

Derek

at 1:50 pm

Bryan, you’re supposed to start your responses with a condescending insult like “Oscarry-Boy” or “Cyberry-Boy”. Assert your dominance. It brings a real gravitas to your posts.

I’m just imagining the BOC might simply “exclude” the “temporary” “inflation” caused by tariffs if it feels the need to slash the overnight lending rate.

I’m also imagining that any such BOC rate cuts this year ain’t stopping the downward trend in sales and prices. This year will be worse than last. There, I said it.

Bryan

at 4:53 pm

It could be. I feel a bit like the bank of Canada has been doing whatever they feel like and making the numbers match lately. One could make a pretty good argument that they should have been excluding mortgage interest (caused by the rate hikes themselves) from their CPP calculations for the last 2 years and they didn’t. One could also argue that early in the peak of inflation they should have included more in their calculation than their preferred “core” measures. Maybe the political winds blow such that they exclude the tariffs but it feels like they will go with their gut and include/exclude what is necessary to bring that about.

Anwar

at 3:17 pm

David, where do you draw the line and delete comments? Seems like Oscar is trying to find out.

David Fleming

at 2:28 pm

@ Anwar

I would draw the line at comments about my family, but that’s it. Perhaps agressive vulgarilty.

I don’t have a problem with Oscar. He has a contrarian viewpoint and that’s valuable. He’s also right about Cyber – she’s brilliant and I know this first-hand. I probably would have used different words than Oscar, but it’s up to him how he wants people to view him.

cyber

at 10:54 am

@Anwar

While I am not a guy, I actually appreciated both the compliment and the reference to one of my favourite TV shows, Silicon Valley (ironically I have very much been a “Jared” professionally)

J

at 10:17 am

“I’d like to know which economists made up that 1%.”

These odds of rate increases are likely calculated from market bond yields, rather than based on economists’ opinions.

Ace Goodheart

at 10:48 am

Re: Trump tariffs: not happening. The USA will never put a blanket 25% tariff structure on Canadian goods. Trump might have done it, if he had thought of it during Trump 1.0, but Trump 2.0 is a different animal. He has a broad advisor base, many of whom are New York style banker/economists, and they are telling him “no”. He appears to be listening to them.

Politics in North America usually are “whiplash politics”. For four years, everyone cares about something, then things change completely and no one cares. They four years later, we all care again. Political whiplash is a common ailment in our society and many (including myself) suffer from it regularly. We spend months following an election and subsequent change of government, not knowing what to say in conversation.

Do you whisper your thoughts, or shout them? Depends on who is in charge.

At least in Canada, the results of elections are predictable. We can prepare for the incoming Conservative Federal government, because we all know they are going to win.

We also are pretty sure that Ford is getting another mandate when he calls an election in Ontario next week, because, well, who can name the leader of the NDP in Ontario?

Without going to google, how many of you can tell me who the NDP leader is? None, right? How do you vote for a person whose name no one even knows.

We do know the name of the Liberal Leader, it is Bonnie something or other I think? She lives in the Hamptons and summers in Canada? Something like that? Anyone voting for her?

Ford more years. That is how it will go.

At least our elections are predictable

Crofty

at 6:25 pm

The Ontario NDP leader is Marit Stiles, which you (and doubtless many other readers) obviously know (and whom you unquestionably hate). Basically what you’re saying is, we’ve heard of Doug Ford, therefore we’ll vote for him, which is, sadly, correct. Policy? What’s policy? We are all morons.

Ace Goodheart

at 8:45 pm

Ford is anti- woke.

He has my vote on that alone.

He also opposes drug injection sites next door to my children’s elementary school – check mark again.

He is building subways (not street cars) – check

I mean, there’s just so much.

Why would I vote for anyone else?

Marty

at 10:12 am

If you go back to much earlier in 2024 though, ALL the banks were way off on their late-2024 and early 2025 predictions.

…and of course, the now infamous BoC statement some time in 2021 or whenever when they said the low interest rate environment was going to last for a long time, or whatever they said. About 3 months before the huge raises.

So who knows.

Appraiser

at 8:02 pm

For the record the Prime Minister of Canada is Justin Trudeau.

It will soon be Mark Carney.

Anwar

at 1:59 pm

You don’t really believe that.

Vancouver Keith

at 8:27 pm

The TSX is up 2.5% so far this year, so investors are not expecting a tariff driven recession. Trump is a big problem for business and investors, who value stability and certainty from government, not shoot from the hip policy decisions. Four years of this nonsensical style of governance coming. Hopefully Feb. 1st brings minor and sectoral tariffs, or it could get very nasty for Canada.

Steve Mitchell

at 6:37 pm

Well, now that we are in tariff spat the only questions are:

1) how long will it last

2) what will be the damage (on both sides of the border)

I think we are gonna have a BOC rate of 2% and maybe lower before next year.