I can’t possibly think of two bigger opposites in our real estate market than how builders price new homes, versus how owners of primary residences price resale homes.

It’s literally night and day.

The former price high, deliberately set out to be on the market for a long period, and then slowly reduce over time.

The latter price low, strategically set out to be on the market for 6-8 days, then sell on an offer night.

The former will probably see multiple offers, spread out over months, and potentially work with several buyers on offers that end up leading nowhere.

The latter will absolutely see multiple offers, all on one night, and only put pen to paper with the one acceptable offer once it’s time.

I’m not an agent that works with builders on the regular, but I’ve certainly put a lot of buyers into builder homes!

What I find incredibly interesting is that rarely do you see a builder list a property for sale in the same way that we see resale homes listed: priced low with an offer date. But when it comes to renos and “flips,” we do see these sellers follow the resale pattern.

Why is this?

Why is the market so binary in this regard?

Before I get to the answers, or, at least my spin on the question, I want to show you a few recent examples of “builder homes” and how they’re sold.

Here’s a house that just sold very recently:

Alright, so I left the 1992 sale price on there just to tease people.

I was in grade seven, for your information…

So we see that the “lot value,” which was a 1 1/2 storey house, probably built in the mid-1940’s, was purchased in 2016 for $1,400,000. Also note that the property was listed for $1,198,000, again, because this is usually how resale is sold – even if it’s land value!

A new house was built on the lot; 4-beds, 6-baths, and it was listed for a whopping $3,200,000.

That’s not shown in the listing above, but see listing #3 – that was first listed at $3.2M, then reduced to $3.1M, then eventually $2,988,000 before the listing was terminated.

The property was then listed for $2,888,000 with the same brokerage, for 71 days.

The builder then switched brokerages and listed for $2,795,000, sat on the market for over two months, and eventually sold for $145,000 below list, at $2,650,000.

For those playing along at home, this builder sold for 82.8% of the original $3.2M list price.

It also took the builder almost nine months to sell.

Here’s another recent sale:

This looks quite similar.

The lot was purchased for $200,000 over the list price, just like the previous property.

This builder also used multiple agents. The first time, he tried to use a discount firm, but that didn’t work. The house was on the market for almost three months.

Then came the second listing brokerage, although this only lasted 36 days.

The price continued to drop – from $2.8M, to $2.699M, to $2.649M, and then the builder did what many builders do, and said “eff-this,” and re-listed at the same price: $2.649M. We see this a lot in the builder pricing pyramid, and it’s usually the point at which their frustration overtakes their better judgment. For some, it represents their break-even point, or a profit number which is the least they would accept before trying something different, ie. leasing the property, moving into it, etc.

The property had been on the market for ten months before it finally entered the 6th and final listing, at $2,599,000.

As you can see, it sold for $2,487,500.

This is a mere 87.2% of the builder’s original list price, and the home took eleven months to sell.

Trust me when I say that nobody sets out to list for eleven months, and I’m sure there’s a “builder happy medium.” I’m not sure what that number is, but perhaps three months? Maybe four? Sure, a builder would love to sell in a week. Who wouldn’t? But does it make sense for the builder to do so? Is this how to get the most money possible?

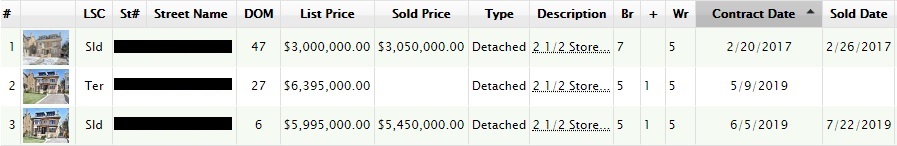

Here’s another recent sale for a “new home” although this technically isn’t all new, since the builder kept the exterior brick. It did, however, take almost two years to build!

The “land value” sold for $3,050,000 in 2017. Yes, land value.

Now there was a house on the lot, of course. And as mentioned, the builder kept the facade, and likely all of the existing brick. But luxury comes at a price, and ingrained in that price is time. This isn’t a quick flip, folks. Not at this level, and not among these buyers.

When it comes to pricing, listings, and the time on market, this house doesn’t really compare to the first two examples. We saw only two listings, and the house sold after a mere 33 combined days through those two listings.

But when it comes to the sale price? This house is right in line with the other two: 84.4% of the original list price.

The drop in price from the original list of $6,395,000 to the new listing at $5,995,000 is substantial at $400K. But getting the house for a further $545,000 under list is impressive.

So did this builder to anything different from a strategy standpoint?

Well for starters, he only had the house listed for 33 days. The carrying cost for this house, presumably, is more than double the first two houses, so being on the market for 9 or 11 months like those first two houses would cost the same as if they were on the market for upwards of 1.5 – 2 years!

But was this the target price all along? I’m not trying to give this builder credit simply because he has deeper pockets than the first two, but rather because I think that this builder could have afforded to keep this property on the market for another month, or two, or six, if there was more money to be had.

Now let’s look at one last example, and try not to cringe at this one:

Okay. Where do we start?

The lot cost $830,000 in 2014.

The sale closed in early 2015, which means this house wasn’t listed for two full years. Perhaps the builder wanted to live in the house for a short while first for tax purposes? Or maybe the construction was just really, really dragging.

The house was first listed for $2,435,000 (the listing shows $2,335,000 but there was a price reduction not shown) and note the date: April 18th, 2017. That is, like, wow, literally the day the market turned. Really, really bad timing here!

We saw a modest $40,000 price change down to $2,295,000, and the property sat on the market through summer.

Then came the fun part: an increase in price, back up $40,000. Just in time for fall! Yeah, I remember that 2017 market like it was yesterday, and people were doing crazy things.

A huge $140,000 price drop followed in November, and I’d say the only smart thing this person did was take the house off the market for Christmas and the slow market cycle.

The house came out again in March of 2018 at a h-u-g-e price drop………..of $6,000.

Then crickets.

For a year.

And the house comes back out in April of 2019 for $2,049,000, another $140,000 price drop.

Then it sold for a further $184,000 less in July after an even three months on the market.

For those playing along at home, that’s 76.6% of the original list price, and the house took two years to sell.

Now to be fair, this doesn’t feel like your typical builder sale. I think this was likely a builder who moved into the house, either by design or necessity, otherwise I have no idea how a person could hold onto an asset for two years.

But this last sale demonstrates how not to sell new construction, whereas I think sale #3 represents a plan of action that was executed, and sales #1 and #2 represent plans that started well, but went awry.

Builders don’t want to be on the market for eight, nine, or twelve months, but many of them end up there.

Why is this?

Well, personally, I think there are two reasons, and the first reason is obvious: builder knows best.

There’s an old saying in real estate when it comes to know-it-all sellers: “Yeah, but this is MY house.”

You see, my house is worth more, and I know this, because it’s my house.

This old saying is actually somewhat outdated, because I see far fewer people in 2019 that overvalue their homes, and/or believe their homes are better than inferior homes, than I saw fifteen years ago. But the logic holds for builders.

Many of the newly-built houses in Toronto are constructed by relative first-timers! Not every builder starts with a crappy IKEA kitchen reno-and-flip on a $500,000 townhouse in Whitby. Some builders find themselves working with big projects the first time around, and they all know best.

They know what layout buyers want, even though they didn’t hire an architect. They know how the house should look from the outside, even though it looks nothing like the houses on either side of it. They know what finishes buyers want, even though the finishes are completely different from all other new builds in the area.

I can’t tell you how many times I’ve walked into a new-build in Midtown, and judging from the finishes, deduced that the builder is from a very different culture, and lives in a very different part of Southern Ontario. And I think, “All this builder had to do was visit a few open houses before he broke ground, and he’d have known what buyers value.”

If there’s a reason “1A,” it would have to be greed. The builder that knows best, also knows what the house is worth, even if that’s 10% more than any rational human would pay.

There’s a house in Leaside that I drive by every weekend when I take my daughter for lunch, and I’ve watched the construction progress from the very beginning. It’s a small, awkward corner lot, not on a great street, and the curb appeal is lacking. The house is narrow, and there’s virtually no yard. I kept wondering what they’d price this house at, and even though I came up with a number that I thought was impossible, they actually priced higher.

But if I could switch gears here for a moment as I get into reason #2, since I certainly do not want to give the impression that I think all builders are greedy bums who don’t know what they’re doing (that’s just some of them), let’s just say that the second reason explains why properties are priced high and why they sit on the market, and it makes perfect sense: you just don’t know what somebody will pay.

If I could segue into a sports memorabilia analogy for just one moment…

Let’s say that in the 1933 O-Pee-Chee hockey set there are only two cards graded PSA-8 of John Smith. And let’s say that both cards sold at auction, and prices were recorded, at $2,248 in 2018 and then $2,557 in 2019. What if a recent submission for a card of John Smith came back PSA-9, and it was, as the term goes in the industry, “One of One,” as in the only one in the world like it?

What would somebody pay for that card?

You have no idea.

It could be $4,000 but it could also be $15,000.

It’s impossible to value.

And while in the sports memorabilia world, this card would go to auction, and would be sold after bidding the price up, a brand-new house in the Toronto market, for which a builder and his or her advisors might not be able to price, will end up being priced high, with the price being worked down.

There’s obviously far more accuracy with a piece of real estate than there is with Baby Boomers and their fantasies (ie. those who have the big money to spend on cardboard encased in plastic), and thus we might see a builder who sets out to build a $2,800,000 house, ultimately decide it’s worth $3,000,000, and then price at $3,300,000 just to see how the market responds.

There’s something to be said for new houses, and this transcends cultures, age groups, and other demographics in the buyer pool. Many of us like “old” in the character-filled, vintage sense, such as a Victorian home or a brick-and-beam loft, but we don’t value that Victorian home in 1960’s shape. We value new. We value pristine. We value a new home like we value an iPhone that comes out of a factory-sealed box, whereby we peel the adhesive-plastic off the screen for the very first time.

And thus I personally believe that many builders, who have time and money, will set out to price their projects not just high, but very high, and sit on the market as comfortably as a Spring Breaker sits on the beach.

So while I’m not saying that the new listing you love is going to sit for 6 months and sell for 89% of list, I am saying that there’s a chance. Do your homework in this market segment more than any other…

Kyle

at 9:07 am

Another reason i think Developers price as high as they do, is they need to in order to make a profit. In the first, second, third and fifth examples that you’ve shown, they probably are barely breaking even or even losing money after all their costs. Certainly none of them are getting rich off of those transactions. In fact most of them, probably could have done better, just by buying the lot, holding it and reselling the lot later.

I also agree with your “builders know best” comment. There are so many garbage flips, where the builder (clearly not an Architect, Designer or even someone with the slightest clue) has chosen something super-tacky that they think is worthy of a premium, that no high-end buyer would ever want or choose for themselves in 2019.

Pretty rare to see well-designed and well-executed flips, where the end result is something that high end buyers would actually pay a premium for. But when builders do understand and deliver what those buyers want, seems they definitely can end up being successful. For example: 442 Heath St E, bought for 1,995,000, sold for 7,550,000 or 76 Roxborough, bought for 1,636,000 and sold for 4,800,000.

SW

at 10:56 am

As an extension of the “you just don’t know what somebody will pay” thought, I’d be curious how finished the house is when the flippers first list at the higher price. You may not care as much about not selling if the house is still 2-3 months away from being done.

I’d also be curious how many of these agents are related parties of the builder (I can think of a few anecdotal examples). Having done some back-of-the-envelope math, new builds at current high-end construction prices ($400+/sq ft) have VERY thin margins after you factor in carrying costs, LTT, commissions, etc.. In my neighborhood, there’s now a shift towards renos/end-user purchases of even dated properties which I suspect is for that reason.

The Rosedale $5.5mm and the Leaside $2.7mm flips were marketed by very successful agents that generally pride themselves (and do a fairly good job) of getting more than asking, so it’s telling that they deliberately chose this pricing strategy – they got very close to asking on 442 Heath, which they also marketed.

At the higher end ($4-5mm+), I always wonder how customized buyers want something, or if they are more willing to take something which they can easily tweak or tailor themselves. This is the category of buyers that is the step above the “busy professional that wants something move-in ready”, will already have their own designers and/or will want to move every few years and decorate as a project.

WB

at 2:17 pm

442 Heath Street was an incredible outlier. This was a real estate agent’s own house, built from the ground up with no expense spared, then lived in for years. This rivals anything in Rosedale or Lawrence Park. You’d have to walk through it. Not to mention the 220 foot deep lot, when houses on the other side of the street are on 100 foot lots and still sell for $4m.

Jennifer

at 12:45 pm

This was just an unnecessary dig at a “discount” firm: “The first time, he tried to use a discount firm, but that didn’t work. The house was on the market for almost three months.”

The other reason for a delay, despite carrying costs, may be so that they can “live” in it for a while to have a better story to say when CRA comes asking where the tax is after they claim the principal residence exemption, cause i dont know but bet most of these new build/flipper properties are listed in some person’s name who is connected to the builder.

Aayushi Verma

at 6:28 am

Fabulous Blog. This information is very useful for any builders. I want to know about the best properties in Bhopal. Because before any investment it is very necessary to have proper knowledge of the best builders in Bhopal.

mundo tuerca peru

at 2:30 pm

No te pierdas las instalaciones recreativas a tu disposición, que incluyen piscina al aire libre y bicicletas de alquiler. Otros servicios de este aparthotel incluyen conexión a Internet wifi gratis, servicio de niñera (de pago) y sala de juegos electrónicos de mesa. Tendrás servicio de recepción 24 horas, atención multilingüe y ascensor a tu disposición. Internacional de Faro) – 2,2 km / 38,7 mi. Las distancias se calculan en línea recta desde el alojamiento hasta el lugar de interés aeropuerto y no siempre son representativas de la distancia real de distancias se expresan en números redondos. Montajes de aire acondicionado y producción de A.C.S. (Agua Caliente Sanitaria).

paul gibbens

at 11:11 am

Great job making this blog as this is really helpfull to any builder.