With a shift in the market heading into the fall, one of the biggest questions, aside from price, has been with respect to how properties are listed and sold.

In the spring, even the crummiest condo was being listed artificially low, and receiving multiple offers.

How are things going to play out in the fall? Will we still see under-pricing, and hold-backs on offers, that allow agents to place those ridiculous “SOLD OVER ASKING” banners on their signs? Or will we see a change in the way properties are being listed?

Let me show you how things look thus far…

You’ve seen my toothpaste video, right?

The video from my 2015 series, “What if the whole world worked the same way as the Toronto real estate industry?”

I suppose I was somewhat inspired by a Jerry Seinfeld routine I heard years ago about people who own dogs.

Seinfeld said something to the effect of, “If aliens came down from another planet, what would they think? They see us, walking behind the dog, the dog is leading us in whatever way it wants to go, and when the dog defecates, we bend over and pick it up with our hand!”

So often in life, I use that same line of thinking “If aliens came down from another planet, what would they think?”

But perhaps not as dramatically, I would phrase it as, “If somebody who knew nothing about this became informed, how would they interpret this?”

And thus, my Toothpaste video was born.

Imagine somebody looking to buy a property in Toronto, with no clue about how the market, worked, looking at a house listed for sale at $699,900.

Not only are they told that it will sell for more than that number, but they’re also told that the seller would never accept the posted price (in a million years…), and that they’re not permitted to offer on the property until a day and time of the seller’s choosing.

To evaluate that in a different context, I asked, “What if this is the way toothpaste was sold?”

What if you went to Shoppers Drug Mart and tried to buy a tube of Colgate, but were told that the drug store was looking for more than the $1.99 price listed on the shelf, and that they weren’t prepared to sell that particular tube of toothpaste right then and there.

Apples and oranges, I know.

But sometimes, in order to see just how crazy something is, you have to look at it in a completely different context.

For years, the buyer pool here in Toronto has lamented how homes are sold.

The listing hits the market, there’s an “offer date,” and you wait to see how many bidders you’ll compete against.

At the peak of insanity, bully offers were running rampant, and most quality listings were selling within 24 hours of being exposed to the market, despite the “offer date” being specified on the listing.

This fall, with the market changing, many of us wondered whether or not we’d see properties being listed with offer dates, or whether we’d see a trend towards reviewing offers any time.

Keep in mind, of course, this changes the strategy involved when it comes to price.

If your house is “worth” $800,000, you can list it at $699,900 with a hold-back on offers, or you might choose to list it at $799,900 with offers any time if you can’t stomach the idea of under-listing at a price you’d never consider.

Many buyers in May and June, when the market had changed, still wanted to under-list at $699,900, for fear of “leaving money on the table” if they listed at $799,900 and sold at $799,900, but with a built-in Plan-B that if they didn’t get their price on offer-night, that they would re-list the following week for some number around $800,000, be it $799,900, or $819,900 with a built-in negotiating cushion.

Now as we head into the fall, I feel as though buyers would be wise to pick a course of action, and stick to it, otherwise they risk confusing and alienating the buyer pool.

We’re only into the second week of the fall market; the first real, full week back.

But already, I’m seeing a change in the way properties are being listed. And if one good thing comes out of this market, it’s that we’ll stop seeing those ridiculous “Sold Over Asking” banners that agents put on their lawn signs, when everything sells over asking if it’s priced 15% below fair market value!

Based on Monday’s blog, you can clearly see that I have no life, and love crunching numbers, so I decided to check up on what percentage of freehold properties in the central core are holding back offers.

Here’s the criteria:

1) These are properties listed for sale on Monday or Tuesday.

2) I have not cleaned the data – I have not removed re-lists, or properties you wouldn’t expect to be under-listed and/or with a hold-back, like multiplexes.

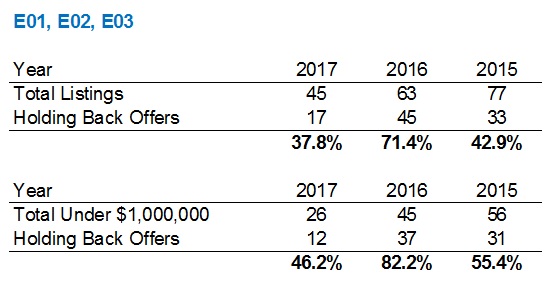

So can you hazard a guess, say, on the east side – E01, E02, and E03, what percentage of new listings on Monday & Tuesday have “offer dates” and are holding back offers?

Throw out any guesses?

And how do you think this would compare to last year?

Alright, I know most of you are skimming or speed-reading, and you’re not stopping to write down a number.

There were 45 new listings on Monday & Tuesday, and only 17 of them have offer nights.

That number, to me, is just shocking.

That’s a mere 37.8%.

Now should we differentiate between all listings, and those that would be most likely to hold back offers?

You might suggest that the lower a property is priced, the higher the chance there is an offer night, and I would likely agree. I did have a client lose out on a $3.6M house last spring, that sold for $4.7M, but last spring was, as we know it, nuts. Usually houses in that price bracket don’t have offer nights, and in E01, E02, E03, where we’re looking, the higher-end homes in The Beaches usually don’t have offer nights either.

So looking specifically at houses under $1,000,000, what percentage of listings have offer dates?

46.2%.

That’s a higher proportion than the overall number of 37.8%, but still shockingly low.

Once upon a time, just about every house listed under $1,000,000, worth its salt, had an offer date.

Of course, what good are these numbers without context?

I went back and looked at what was listed in 2016, and 2015 (I couldn’t resist…), specifically on the Monday and Tuesday of the second week in September, to ensure that we were looking at the exact same time periods as we are this year.

Here’s how things broke down:

Remember the fall of 2016?

A whopping 82.2% of properties listed under $1,000,000 had offer dates. That is what I remember about last fall, and it’s exactly what the spring of 2017 was like too, except the numbers, taken at any point in time, would probably be higher.

The fall of 2015 was red-hot too, and that market didn’t have the swirling winds of change, and seeds of doubt among observers. And yet the numbers were more in line with 2017, than with 2016.

In fact, this chart makes 2016 look like the outlier.

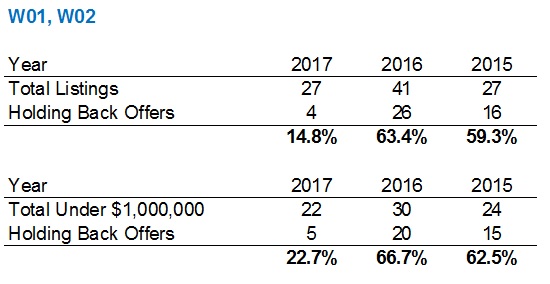

Let me show you how things look on the west side, in W01 and W02:

Shocking!

I’m absolutely floored that only 4 of 27 new listings this week have offer dates.

I’ve gone through the listings one-by-one, and many of these are houses that I think should have offer dates in this market.

What does that tell you about the sellers?

Are they scared of pushing buyers away?

Do they not have the stomach for listing low and holding back offers?

These are price points that should get a ton of attention!

The cheapest nine of the twenty-seven listings, all without offer dates, at $549,000, $619,800, $620,000, $650,000, $659,000, $669,900, $725,000, $729,900, and $749,900.

I think it’s fair to say that this spring, or even last fall, another 4-5 of those nine would have featured offer dates.

Now what about in a the higher price points?

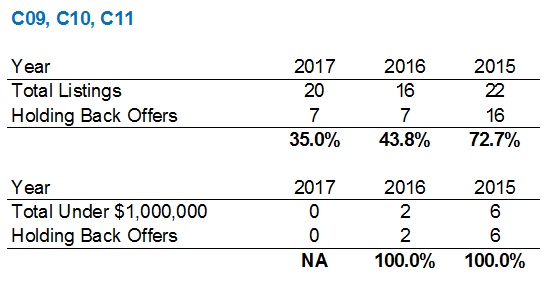

Let’s look at C09, C10, and C11, which includes Rosedale, Moore Park, Leaside, and Davisville Village:

I’m not sure what conclusions we can draw here.

While the percentage of listings with holdbacks on offers has decreased from 2016 to 2017, as has been the trend with the East & West areas explored above, the 2016 trend was down substantially from 2015.

I’ve looked through the listings, and while it’s fair to say there were far more properties priced at the lower end of the spectrum in 2015 (as noted with the 6 properties under $1M), there were also several properties in the $1.5-$2M range with offer dates, as well as a couple over $3M as well.

I could go on and look at other areas, but I think you get the picture.

There is a growing trend so far this fall to list properties with “offers any time,” and nowhere is that more evident than on the east side, which was probably one of the hottest areas in the spring.

Now, having said that, I showed two houses on Tuesday night, to two different clients, in two different areas.

Both are under-listed, with offer dates.

One of them has a bully offer registered, as I write this on Tuesday evening.

The big difference with this bully offer: it’s irrevocable at noon on Wednesday.

If this was the spring, I’d be getting the call at 9:45pm, “Hey David, we have a bully offer registered, and it expires at 11:59pm tonight.”

Whoever made the bully offer tonight, and provided the noon irrevocable tomorrow, clearly lost their nerve to go for the jugular. Perhaps that buyer agent was trying to curry favour with the listing agent by not ruining his or her Tuesday night, but a mistake by the buyer agent, nonetheless. Now the door is open for other agents, and other buyers.

So what does it say that I showed two houses tonight, both on the east side, that have offer dates? Two of the 26 under $1 Million, or the 12 under $1M that are holding back offers?

I suppose it says that much has changed since the spring, but a lot has stayed the same.

This is what I meant in last week’s blog when I said, “Conditions will be similar to the spring, and buyers could be caught off guard.”

Not every buyer. Not every house for sale. But some.

Nevertheless, I remain shocked at how many listings are hitting the market with offers “any time.”

If you’re a buyer in W03 right now, you have your pick of the litter, and more power to you.

Barely one week in, and the results are mixed no matter who you speak to. It should be an interesting fall, folks!

Kyle

at 2:21 pm

One of the big differences between today’s market and Spring is the Days on Market (DOM). Today that number trends much higher. Maybe it is chicken or egg, but I wouldn’t expect to see people holding-off offers while DOMs are that high, unless it is a very special property.

McBloggert

at 3:02 pm

I have been really curious to see how the fall plays out – and the fact that so many houses are going up without offer dates does not surprise me based on what inventory I have seen and how they are pricing them.

My thin slice of the areas that I follow – is that most people are struggling to come to terms with the market they are working in or as just unsure what the market is doing at the moment. I think this manifests itself by people listing their house at Spring 2017 levels and maybe even pricing in an additional increase from that number. Then letting it sit. Some of the houses listed in areas I follow are just bonkers numbers – detached from reality numbers.

I assume people are not confident in the market bearing the number they want – if they left it to an offer night. So they’ll list high and wait it out for their price….

My prediction for this fall after seeing the first week and a half is stagnation. I think it will take a while for people to re-calibrate and find the “fair” pricing, which will still be strong but maybe you won’t be asking $2.5M for a 30ft tear down in Lawrence Park South or $5.2M for a 36ft house in need of a reno in Rosedale…

Natrx

at 3:30 pm

the ‘less’ desirable areas definitely have alot more options for the pick’ns. But the ‘hot’ areas will still be competitive. Not to the same degree as last time but still pricey but now more doable.

JCM

at 12:52 am

You’re sounding a little less confident, David. Could it be that inventory is way up already in September and sales are still down by 30% to 35%? I’m looking forward to the dunce cap Instagram

Asking prices are completely divorced from reality. Inventory is way up. Demand is way down. So why do sellers think that asking prices can appropriately reflect sales prices from a speculative frenzy that is by now a distant memory.

Now that prices are falling, buyers are actually considering whether purchases are fiscally prudent, rather than throwing money out of fear. Guess what? Buying at current asking prices is obviously not fiscally prudent. Sales prices will accordingly adjust (and will probably over-correct).

Kyle

at 9:21 am

Lots of hyperbole here.

Inventory is hovering around where it was in 2015 and is lower than it was in 2014. Both those years were heavily skewed to being sellers markets, so while way up from 2016, it is far from being a buyers market.

Kyle

at 9:28 am

Also worth noting that different areas are performing very differently. There are certain pockets of the GTA with a lot of inventory and there are areas where the market is still quite tight.

Per Zolo, for the City of Toronto (416), inventories are only slightly ahead of where they were last year (5,477 vs 5,001). And last year was a year when there essentially was no inventory (listings that were counted in inventory in 2016, were just listings that hadn’t reached their offer night yet). How this translates where the rubber meets the road, is that 416 buyers today don’t really have that much more selection, but they do have more time to make a decision.

McBloggert

at 9:39 am

I would agree with that sentiment. In desirable areas or again the ones I follow (personal bias), there isn’t really that much to choose from and nothing really amazing – pretty underwhelming. I suspect those who don’t HAVE to move are just waiting to see how things pan out before plunging in.

I expect there may be different things happening at different price points; if you have people already in a single family home; but are looking to move up; they can afford to wait until they are confident in what is happening in the market. Which may be locking up some inventory – as there is little pressure urging them to make a decision. However, if you’re in a condo looking to move into an entry level single family home ($700K-$1M+) then there may be more of a frenzy if you’re being moved along by forces of nature (babies).

By November there will be an interesting postmortem to be done on the Toronto’s market and what the future holds.

Kyle

at 10:41 am

I agree, last year, ALL prices ranges, house types, neighbourhoods were moving in the same direction – up. Today, there are way more moving parts, some up some down. Averages hide a lot, time will tell where things net out.

JCM

at 2:09 pm

What’s hyperbolic? Yes, the 416 has not yet been affected as significantly as the 905 (416 inventory is up around 10 or 15% year over year, while sales are down 25%), but if you look at the 905, the picture is much, much grimmer. And the real estate markets in GTA regions ultimately move pretty much in tandem.

In any event, all of the unsold houses from Spring and Summer are currently coming back online in both the 416 and the 905, rates are up considerably, lending is much tighter, and a new new stress test affecting all mortgages is around the corner. Sellers need to wake up — buyers are no longer fearful of perpetually rising prices, so they’re not going to commit themselves to a lifetime of debt. Asking prices need to reflect the new market.

Realtors also need to wake up. Adjusting seller expectations rather than trying to bluff buyers back to the table would be better for business.

Kyle

at 3:26 pm

“And the real estate markets in GTA regions ultimately move pretty much in tandem.” – This is just plain untrue. TREB covers from Burlington to Clarington to Lake Simcoe. Are you telling me Scugog moves in tandem with C01 Toronto?

“Asking prices need to reflect the new market.” – They actually don’t need to reflect the market. Just like BID and ASK prices can be way off the market for a stock. Asking prices either reflect the current market or they don’t get Sold. But not every Seller NEEDS to sell. Even in the hottest market, there are always over-priced listings that keep re-listing and re-listing and re-listing rather than adjust their price, in fact there are many who re-list higher each time. Some Sellers are more interested in getting their number than they are in selling. David once referred to this segment as Dummy Inventory. Once the market figures out it’s direction the Dummy Inventory will either build up, get absorbed or delist. But to be clear Dummy Inventory has no actual impact on the market, because it doesn’t get transacted.

Kyle

at 5:11 pm

Like i said, lots of hyperbole in your original comment, here’s what reality looks like:

https://pbs.twimg.com/media/DJyPpxdVoAABTs5.jpg:large

lui

at 2:01 pm

Two condos in our buildings sold in less than 5-7 days at above asking price with no holdbacks.Sellers set a price they wanted and good for them they got that price and more.No more hold back BS.I know a few agents that been in the industry for over a decade and they are seeing the shift from seller market to a more balance market.They also noticed a bit of fear with rising interest rates and sellers more open to price adjustments if a listing goes stale .

Condodweller

at 11:28 am

Interesting. I guessed 10%. I am surprised that holdbacks are such HIGH percentage. I thought people would have learned from the post spring market.