Gawsh, guys, I mean, where do we begin?

While I know that technically, Thomas won the big “Average Toronto Home Price” bet, before I extend my arm and hand him the trophy, I’m going to pat myself on the back just a wee bit.

If you don’t know what I’m talking about, let me refresh…

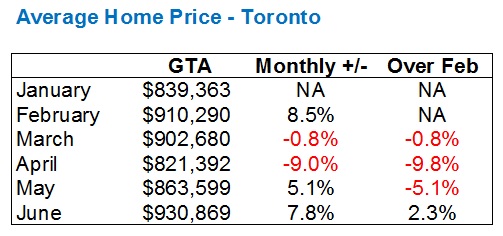

The average Toronto home price in February of 2020 was $910,290.

While this wasn’t quite over the peak of $920,791 in April of 2017, it was as close as we’ve ever seen.

I spent all of January, February, and the first half of March writing blogs about how hot the Toronto real estate market was, and how “only an act of God” could stop it.

Then along came COVID-19.

The average home price dipped to $902,680 in March of 2020, which was interesting, because the “State of Emergency” was declared on March 17th, meaning the last two weeks of the month were negatively affected. Otherwise, I have to think this figure would have been over the $910,290 figure that we saw in February. That is just how strong the first 2 1/2 weeks of March were.

In April, the average home price absolutely plummeted to $820,373.

That’s a drop of 9.9% from the February “peak.”

This was a very difficult time in all of our lives, and across the globe. This wasn’t just the first worldwide-quarantine in our lifetimes, but rather in the history of civilization.

To suggest that anybody knew, with certainty, how the pandemic, or the stock market, or real estate market, was going to pan out, is foolish.

But that didn’t stop all of us from opining on the daily!

As many of you will remember, the market slowed to a crawl in late-March and early-April, so much so that I was forced to find other things to blog about, ie. interviews with my parents on their real estate experiences in the 1970’s through 1990’s, and video interviews with Tony Della Sciucca, Ben Rabidoux, and John Pasalis.

The market changed drastically in April, and not just through my writings here on TRB. Real estate protocols were updated to include “safe” viewings, and it took, in my estimation, until mid-May to see any sense of normalcy return to the market.

But in April, we began to have conversations about the future of Toronto real estate, including, but not limited to, prices.

It all started on April 8th, 2018, in a blog post called “How Are Sales Doing During COVID-19?”

Blog reader Derek shook up TRB forever when he asked, “Should we amuse ourselves with a game?”

Oh, Derek!

You say it like this the TRB readers have the self-control that allows a person to take things lightly!

Derek said:

Should we try to amuse ourselves with a game? I don’t know what metric would be best to use, i.e., avg price or HPI or freehold or condo or GTA or 416 etc., etc., (David or the other smart people can decide the goal posts) Do we take the Feb numbers as the top and work from there? Anyway, someone could define the parameters and we could post our guesses as to how much, if any, prices will change for the chosen metric(s) between top and bottom. Maybe even guess the month the bottom comes?

Derek and Chris bantered about which “goal posts” should be used, considering HPI or Average, then GTA vs 416.

I eventually chimed in with the following:

A very simple measure of the market on which to vote: in what month will TREB average sale price rise above the $910,290 we saw in February? I’ll go on record with October of 2020.

And that started us all off.

Condodweller took his shot:

Crickets. What happened to all the bulls?

True true. Voices are a lot louder when there’s a room full of supportive people standing behind them!

And a healthy back-and-forth ensued.

When Chris made his prediction, I chimed in:

@ Chris

April of 2024?

Come on, you can’t be serious. Four years is an eternity.

Forget $910,290. I will further bet you that the average home price is above $1M by April 2024.

And this went on and on for days.

Potato, anyone?

The 2030’s!

As for the running tally, Chris was so kind as to keep track.

And after I had revised my prediction (caving to peer pressure…), the list looked as follows:

You’re still up there, David, but now there are a few who are ahead of you. Although, you did revise your guess – your original one would have put you just after Thomas.

Here’s the updated list (which you are correct, I have squirreled away in a spreadsheet):

Thomas: June or July 2020

Kyle: Fall 2020 or April 2021

Tony: January or February 2021

David: April 2021

J G: April 2021

Derek: April 2022

Condodweller: Feb 2023

Mxyzptlk: April 2023

Chris: April 2024

Pragma: 2028

Potato: Sometime in the 2030s

Jeff: Never (adjusted for inflation)Did we ever figure out where Ben’s guess landed? He was a bit non-committal on that one, but sounded like a few years.

Winner, Winner, Chicken Dinner!

Thomas!

Way to go, buddy.

Don’t I have egg on my face for caving and revising to next April, but what can ya do. Even if I had kept my October 2020 prediction, Thomas would have beat me.

How did he know?

Or was this merely playing the players, and not the game?

Like betting “one dollar” in Contestant’s Row on “The Price Is Right” when everybody else is high, although, I love seeing the stupid people who don’t quite understand that strategy, that bid $499 when somebody else bid $500. Yup. I was 7-years-old, screaming at the television when this happened…

Credit to Thomas, no matter the strategy, for being years and years ahead of some of the other contestants.

Now: the inevitable.

Readers qualifying their responses, since they’ve been proved brutally, brutally incorrect.

For those not already in the know, the June, 2020 average home price in Toronto was a whopping $930,869.

The “game” that Derek, Chris, and I had devised was a simple one, the exact verbiage of which read:

A very simple measure of the market on which to vote: in what month will TREB average sale price rise above the $910,290 we saw in February? I’ll go on record with October of 2020.

There’s no confusion here.

No qualifiers for those who said the year 2030.

This is very, very simple: the average home price of $910,290 in February was, in fact, surpassed in June of 2020.

End of story.

Having said that, cue the qualifiers!

Here come the folks that say, “Who cares about one month? Will the price stay there?”

That wasn’t the game.

Folks might say, “Condo prices are still down.”

That wasn’t the game.

Others will say, “Interest rates are at rock-bottom. This is artificial demand.”

That wasn’t the game.

Call me snide, gleeful, or even braggadocious, but I know how market bears and market deniers think, and I don’t want there to be any confusion about this “game” and the results.

Moving on…

Today, I want to look at how prices have fluctuated through 2020. From a torrid start to the year, down to the depths of pandemic-pricing, and up once back again; I want to look at the entire GTA, then 416, then divide the 416 into property types and see which are the hottest, which rebounded, which are lagging, and back again.

Let’s start with the aforementioned Toronto average home price:

The average home price dropped 9.0% from March to April, as we all know, which represented a near ten-percent drop from February!

We saw big month-over-month gains from April to May, and then May to June, and when all was said and done, we’re now 2.3% higher than the “peak” in February.

Who saw that coming?

I read in the comments section on Tuesday some people feel the “data might be skewed,” and this is a fair comment, since I’ve made it before many times. If we’re seeing dramatically fewer condos being sold in this market, then perhaps the figure is somewhat skewed. But how much? $930K vs $920K? Meh. Thomas still wins the bet, and we’re still showing a market resilience the likes of which I’ve never seen, all in the face of a pandemic.

–

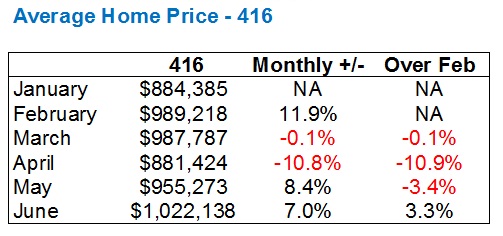

Now what about the 416?

Since most of us care more about “Toronto” than the “GTA” anyways?

Have a look:

The drop was more pronounced, that’s for sure!

10.8% from March to April, wow.

All told, a 10.9% drop from the February peak, which, overall, is in line with the 10.8% drop we saw in the GTA numbers.

The 416 has “recovered” slightly better, however, with a 3.3% increase in June over February, which is 1% above the GTA average.

–

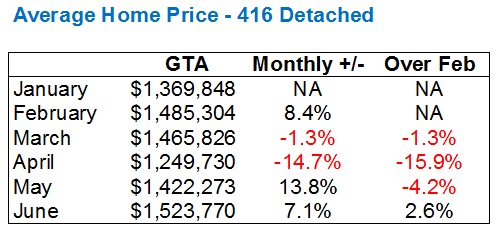

The market for 416-Detached was far more volatile:

A month-over-month drop of 14.7%? Yikes!

That is how bad things were, at least on paper, in April, when the average detached dropped from $1,465,826 all the way to $1,249,730. At the market bottom, detached was down 15.9% from February.

Now sitting at $1,523,770, this is, yet again, higher than February – by 2.6%.

–

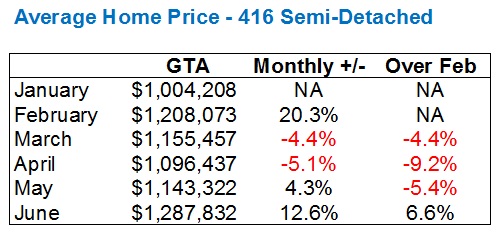

Over the last six weeks, I’ve been telling everybody who will listen – clients, colleagues, journalists, and the like – there’s no market that’s been hotter than the single-family freehold, specifically semi-detached.

$1,000,000 to $1,400,000 is where the heat is right now, and the numbes show it:

First, consider that the 9.2% drop from February to April significantly trailed the 15.9% drop in detached (although this lags behind Row/Townhouse, which you’ll see in a moment).

Second, look at the increase in June over February: 6.6%.

For those folks who think that prices are still soft, you have no clue what you’re talking about.

On paper, the average semi-detached has moved from $1,208,073 to $1,287,832.

In practice, there are areas in the city (Leslieville, as an example), where a $1,250,000 house in February is $1,400,000 right now.

That’s a wee bit more than 6.6%.

The semi-detached market is on fire.

–

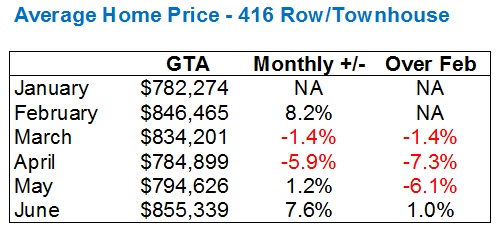

I never read too much into “Row/Townhouse” as a segment, since, technically, the left or right houses in a “row” of three are, by definition, considered “row-houses,” even though they are literally “semi-detached.”

In any event, there’s less volatilty here, and the increase is only 1.0% from February to June.

–

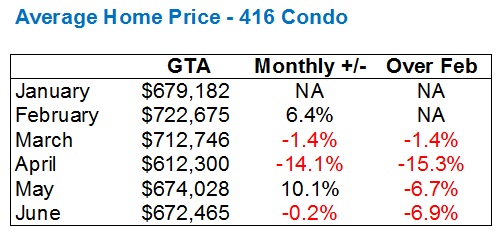

Condos?

What about condos?

Here’s where things get interesting…

The “price over Feb” isn’t the lowest for condos; see 15.3% versus 15.9% versus detached.

The “monthly +/-” also isn’t the worst, as the 14.1.% drop from March to April trailed the same period for detached.

But two figures stand out here:

1) This is the only segment with a month-over-month drop from May to June, albeit a rounding error at 0.2%

2) This is also the only segment with a June price that trails February, and this one is not a rounding error, but rather 6.9%

Is your condo worth 6.9% less today than in February? Probably not.

But I do believe that it is, in fact, worth less today than in February, whether it’s 6.9% or 1.0%.

The divergence in houses and condos over the past six weeks has been fascinating, and either one of two things is true:

1) The condo market is simply slower to rebound than the housing market, and these numbers will pull more in line with the freehold market

2) The condo market may be experiencing a true slowdown due to increased supply, decreased demand, or both

Only time will tell.

Maybe Thomas knows?

There’s a lot more that I would like to analyze as far as the June TREB figures go, but that might take away from the monumental figure that $930,869 truly is, and I don’t want to do that.

$930,869

Who saw that coming?

One person in a city of three million people?

I mean………….$930,869?

I’m typing it onto the screen right now, and I still can’t believe it. Like, “2019 NBA Champion Toronto Raptors,” in the same way. You saw it, you know it happened, and you’ve had time to absorb it, but you still can’t believe it.

I was on CTV last month, saying how the average Toronto home price had dropped from $910,000 to $820,000, but bounced up back over $860,000, and I figured we’d see $870/$880/$890K when June was said and done.

Who figured I’d come off as the market bear…

Appraiser

at 7:47 am

Unstoppable.

Chris

at 8:11 am

In case you missed it:

“I’m seeing far too much confidence in housing as a result of the strong sales and prices we have been seeing the past six weeks. People are misreading the data. The booming housing market is not proof that even 14% unemployment can’t keep Toronto housing down.

This is a short term demand shock that was caused by the housing market nearly shutting down for 2.5 months. Not unlike the demand shock that hair salons are experiencing today. Thousands of people need a haircut. Hair salons are booked till the end of August.

It does not mean that this level of demand is typical for the hair salon business – it is a demand shock caused by COVID. The same is happening for housing and sooner rather than later, things will cool down in the housing market too. This is not the “new normal””

– John Pasalis

https://twitter.com/JohnPasalis/status/1280542954407505920

Appraiser

at 9:13 am

Funny how LG always knows the answers after the fact.

Chris

at 9:38 am

Funny, you don’t seem to have any issues with LG when he’s positive on RE?

Appraiser

at 9:57 am

Funnier still is how consistently incorrect about the real estate market you are.

What was your prediction again?

Care to explain?

Because as we all know, after the predictions come the explanations.

Chris

at 10:00 am

Probably a similar explanation as you would have as to why your prediction on the stock market turned out wrong.

Caprice

at 9:25 am

A strange comparison, but actually, that DOES prove that 14% unemployment can’t keep Toronto housing down.

Keep peddling, Chris.

Chris

at 9:38 am

Sorry, Caprice, did you misunderstand the link? That’s John Pasalis. Him and I are different people. Hope this clears things up for you!

Caprice

at 9:52 am

I did not. Since it’s JP talking, it must be true! Hallelujah, praise the Lord.

Maybe you can use that post on Friday too.

Chris

at 9:55 am

If I post it again on Friday, will you mix me and JP up again then too?

J G

at 8:19 am

You mean dead-cat bounce?

Chris

at 8:11 am

Scott Ingram took a look at composition yesterday:

“Looks like average price has been bouncing around with the share of high-priced homes. Is consistent with the “mix” story I was talking about when average prices dropped. $2M properties are back, baby.”

https://twitter.com/areacode416/status/1280546759001939968

Certainly doesn’t change Thomas’ win, but interesting nonetheless.

Appraiser

at 9:22 am

Yet another lesson in how using average prices can be deceiving.

More importantly, seeing how robust the $2M+ segment is, betrays the incredible confidence that buyers have in the GTA real estate market.

J G

at 8:18 am

Congrats to Thomas!

However, making a prediction is one thing, but to go out and actually purchase a property (ideally freehold) in April is quite another 🙂

Clifford

at 8:47 am

Condos will rebound IMO….this detached run up will just make them more unaffordable and push people back to buying condos. Virus or no virus, condos are here to stay. I’m living in one and have no issues. It’s only the house people that make condos seem unliveable right now but that’s how they always felt pre-virus.

That said, I will be selling my primary residence (condo).

Professional Shanker

at 11:51 pm

Selling your condo why, to move to a detached property?

Clifford

at 1:19 pm

Moving to a precon townhouse I bought last year.

Thomas

at 8:50 am

Yay! My five minutes of fame. And David took a commission out of that too! 😉

Professional Shanker

at 10:06 am

But didn’t you also predict a drop of at least 20% from Feb levels later in the year? Are you still sticking by that once the “mortgage deferral cliff” happens.

Thomas

at 4:33 pm

Yes, I still think there will be a correction in winter 2020\spring 2021.

Fearless Freep

at 6:49 pm

No, Thomas, don’t make another prediction. You gotta go out on top, like Garbo. Retire from prognostication now!

Thomas

at 8:03 pm

Sound advice ????

Caprice

at 9:18 am

David, nothing wrong with bragging, a victory lap and a tire burnout. I recall you also called April as the bottom and took some flak for it then.

Thomas, Congratulations.

Potato and Jeff, LOL

Kyle

at 9:40 am

Who saw this coming? The Bulls on this board did, that’s who. While we may not have nailed the month, we all saw a very quick recovery and return to the hot pre-pandemic market once retrictions began to lift. Appraiser called the bottom, and Mark reiterated a few times he saw a V-Shape recovery coming.

And not only did we see it coming, we as they say in billiards, “called our shot”, and have said over the last few months that market participants aren’t the ones being impacted financially by the pandemic, at least not in a material size.

Meanwhile the bears continued to cling to their already oft-debunked empty theories about Airbnb, and household debt levels. And continue to come up with new empty theories about Non PR students and various government cliffs. The reality is the bears have no clue about real estate. Not te slightest and i feel bad for anyone who listened to their nonsense over the years. As has been the case for decades, the bears can’t explain the past, they deny the reality of the present and continue to make up empty theories about the future.

If nothing else, it should be crystal clear that Toronto RE is resilient, laying waste to the absurd notion that household debt is “too high” and has made Toronto RE massively vulnerable to shocks. The truth is people who are buying houses can afford those houses full stop, regardless of what the average debt to income ratio is relative to history. People buying now, are qualifying at more than double current market rates.

Such bivariate analysis has and always will be pure garbage. Real estate is local and complex, and in Toronto using average incomes to determine the health of the market is just plain stupid.

Chris

at 9:54 am

Who saw it coming was Thomas, a self professed bear!

Kyle

at 9:59 am

Yes he did see it, the same ways as the Bulls saw it…

“The more important thing is how the decision to buy a home affects the thought process of a person. Most people would have planned for a while before making the decision to go for it and at that stage it takes a lot to make them reconsider it (a pandemic isnt enough unless it affects them personally).”

Chris

at 10:02 am

Now let’s see if the other parts of his prediction turn out correct as well!

Kyle

at 10:07 am

As much as i have the Bears pegged for being pessimistic, their never ending hope and optimism that some future event could finally make their dreams come true (probabilities be damned), is absolutely indomitable.

Chris

at 10:38 am

Honest question for you, Kyle, since you haven’t really waded into it the way others here have. You clearly consider Toronto real estate prices to be rational and justified. Do you feel the same about equity markets? Or are you of the opinion that these are overvalued?

Kyle

at 10:51 am

I’m not an active equity investor. My holdings are all managed for me. But if you’re asking would i reallocate any of my real estate assets to equity right now? Hell no!

Toronto real estate is very easy to analyze with two very simple questions – “What’s happening to the right tail of the income distribution?” and “How does that affect Supply and Demand?”. That’s it, that’s all that matters. That’s what drives the medium and long term trajectory of Toronto RE. All the stuff you Bears pin your hopes on, never result in much more than a bit of short term noise to the trajectory of prices. Individual stocks are far more difficult and in my opinion far more risky.

jeanmarc

at 10:58 am

You cannot short RE due to supply and demand. But you can short the hell out of a stock (i.e TSLA). That’s why Musk sold out his short shorts the other day and crashed his website.

https://www.foxbusiness.com/markets/tesla-red-satin-short-shorts

Chris

at 11:04 am

Not exactly what I was asking. If I recall correctly, you’ve stated that you own your principal residence but don’t have additional real estate investments. I wouldn’t expect you to off-load your home to pile into Tesla stock. Even taking out a HELOC for the sake of stock picking seems unlikely.

Rather, my question is more broad and hypothetical in nature. Do you feel that equity markets as a whole, are overvalued, given the current global macroeconomic climate?

I know others here, like appraiser, certainly feel they are. And I would actually tend to agree with him on this one. The fact that the NASDAQ is up almost 29% YoY and the S&P500 up 6% in the midst of a pandemic-induced recession, which shows no signs of easing, is pretty wild.

J G is certainly riskier in his picking of individual stocks, but even lower risk broad-based funds like VBAL.TO have nearly regained their pre-pandemic highs.

Thomas says the Canadian RE market is too big to fail, and government will pull out all the stops to save it. Perhaps he’s right. Would the same be said of the American equity market, and the lengths the US Fed is going to, in order to shore up confidence in those assets?

Kyle

at 11:06 am

@ jeanmarc

That’s a great point, which is another reason that stock prices are difficult to analyze. Large players can manipulate it up and down.

There are also tonnes of cases of black swan events taking a stock’s value to zero, it actually doesn’t take very much. As high as the FAANG stocks are flying they all could just be one: accounting scandal, data breach, PR F’up, or worst of all disruption to their business model away from disaster.

Kyle

at 11:11 am

@ Chris

Like i said i don’t actively manage my equity portfolio, so i haven’t been following valuations that closely. If i were to guess i think US Equities are going to hurt in 2021, cause the way they are managing the pandemic down there is quite possibly the worse example of leadership in all history.

jeanmarc

at 11:18 am

@Chris

The equity markets are going to hover around the numbers right now (give or take a 1,000 points in either direction) given that the US has not gone into lock down mode and mostly open.

If Trump wins in November, the market will continue to go up. AMZN will hit $4000 (J G will love it) and TSLA will be $2000. AAPL will climb over $500, MSFT will reach $250. It’s mostly the tech (NASDAQ) will be driving the market. Again, only if Trumps wins again.

BTW, I do own AAPL (as I see the 90million iphone users will replace to go to 5G eventually). New airpods 3 and watch 6 coming out as well. Apple sells out everything it makes. Lots of kool-aid drinkers out there!

As for RE, I am happy where I am. RE will always be a stable. I agree that the gov’t will not allow it to crash as it is a huge driving force of the economy and for most ppl, it’s their principal residence.

Chris

at 11:23 am

You’re not going to find much disagreement to that assessment, Kyle!

But the decline of the American equities and their economy due to horrendous management of the pandemic is going to impact us up here as well.

There will invariably be some positives, such as people and businesses coming north of the border to avoid the chaos in the USA.

But, as our largest trading partner (5x our second largest), there will be negatives as well. We’re inextricably linked to the American economy. If they hurt, we do too, unfortunately.

Chris

at 11:28 am

@jeanmarc

So is everything just too big to fail at this point? Equity markets, real estate markets, bond markets, etc.? Hardly even sounds like capitalism anymore.

Kyle

at 11:57 am

Trading refers to goods. When it comes to Toronto RE, i don’t see much sensitivity from less goods exports, i do see lots of sensitivity from people coming to Toronto instead of US to take on high paying jobs. Especially now that Trump has shut down visas

Throughout this pandemic, while there have been plenty of low paying jobs shed, there continued to be growth in higher paying jobs:

Small sample:

https://dailyhive.com/toronto/12-companies-hiring-over-100-jobs-toronto-july-2020

https://dailyhive.com/toronto/companies-hiring-jobs-toronto-june-2020

https://dailyhive.com/toronto/companies-hiring-jobs-toronto-may

Also recently a Sr employee from Alphabet tweeted that the Sidewalk Labs experiment was really about creating a beach head and establishing an alternative tech hub outside the US. For when shit hits the fan down there (like it is now). As this plays out we’ll continue to see the right tail of the income distribution grow as a result of it. and with it RE prices.

Chris

at 1:36 pm

Our trade with the USA is heavily in goods, e.g. oil, lumber, automobiles, etc., but it does encompass services as well.

Further, a reduction in the trade of goods does not just mean a Fort Mac roughneck loses his job, and that’s the end of the story. White collar workers in the company are liable to suffer employment or income loss as well. As are other businesses they do business with, such as legal firms, accounting firms, etc.

This is then exacerbated by those seeing lower revenues/incomes reducing their own spending, impacting industries completely unrelated at first glance to the export of a barrel of crude to America.

Our economies are deeply linked. Not much getting around that.

Certainly, plenty of lower paying jobs have been shed. But plenty of high paid employees and self-employed individuals have also lost jobs or suffered reduced income.

https://economics.cibccm.com/economicsweb/cds?ID=11049&TYPE=EC_PDF

Bit dated at this point, as much has changed since early May, but this CIBC report sheds some light on the impact. There are higher paying and lower paying jobs both adding and reducing employees, though it appears reductions outweigh additions in both segments.

As for migrating tech hubs, if anything the Silicon Valley types seem to be moving away from hubs of any sort, to a more widely distributed remote working environment. Tough to say if this will be a lasting phenomenon or will go by the wayside once Covid is under control.

If nothing else, at least Biden looks likely to win in November. That should help ease some of the chaos south of the border. Hopefully.

Professional Shanker

at 12:03 am

@Crhis

So is everything just too big to fail at this point? Equity markets, real estate markets, bond markets, etc.? Hardly even sounds like capitalism anymore.

Just when you think something is priced to perfection and nothing will take it down what usually inevitably happens – a price correction occurs.

-2017 detached

-2020 Condos – remains to be seen how deep – I have been a huge bear on TO condos dating back to 2019, not detached though.

-Bitcoin

-Cannabis

-Cobalt/Lithium

-US suburbs (2008).

The notion that the gov’t can save everything is a fallacy. They can temporarily support prices through liquidity across of a myriad of assets but not over a more prolonged period of time.

Old fashioned capitalism is broken though…..at least as of June 2020.

Chris

at 8:45 am

Shanker, agreed.

The USA, having the de facto global reserve currency is in a better position to support those “too big to fail” assets. But even there, there will presumably eventually be a limit to their support.

Question is how long it goes on, and to what quantum?

J G

at 1:37 am

Don’t hate on the FAANGs just because you’re a passive investor Kyle. As mentioned, they absolutely outperformed Toronto RE by any metric.

Accounting scandals? Lol ok, Amazon and Apple are not Enron and Nortel. They’ve been making money hand over fist for past 10+ years.

Would I sell my FAANGs to buy an investment property right now (esp. a condo)? Hell no!!

Well, maybe when Amazon hits $5000 and 416 condo drops another 12%.

Professional Shanker

at 11:35 am

JG – you have become the Appraiser of the S&P.

The valuation of FANNG + others (Teledoc, Tesla, Nikola) obviously point to a potential valuation bubble, great and sustainable FCF positive companies can get overvalued based on retail order flows, similar to RE when you get amateur investors piling in (2017 GTA detached).

Given the choice of investment from today to 2 years from now, I believe that RE speculation will provide superior returns to that of FANG/Nasdaq index.

Long term, I would always invest in equities over RE, even though the last 20 year period of RE investing in Toronto is likely on par (including the implied leverage a RE investor would take).

J G

at 1:47 am

Also Kyle, you use the term “individual stocks” like it’s casino gambling.

These are 1T companies that’s produces goods and services most people in the world use constantly! (iPhone, online shopping)

Btw, you do know why FAANGs have been killing it for the past 10 years right? (Other than the obvious tech advancement/consumer shift) It’s because they are the ONLY tech companies making money hand over fist, it’s that simple. All other medium and small companies are not making money.

Kyle

at 8:04 am

Like i said, they have been doing well, but so too were many other high flying stocks that once had their hey day. Any stock and i mean any stock can be cancelled or taken down very quickly by one unforeseen event or they could face gradual erosion by increased competition or change in consumer acceptance.

At the end of the day Alphabet, Twitter and Facebook all have the same model. They use their platforms to collect data from users and then they use that data to sell targetted marketing back to them. There’s more competition from other platforms with newer more novel front ends, like Pinterest and Instagram, so who knows if they can stay on top. And as more and more people catch on to what these companies are doing, you don’t think they will start pushing back against having their personal behavioural data used against them? There already is a Facebook advertising boycott and Twitter’s toxic environment will eventually cause their traffic to wane. Apple has been losing share to Samsung, nevermind the onslaught of newer players from China like Huawei, Xiaomi and OnePlus.

If you want to concentrate your investments in a handful of tech stocks, you do you. Personally, i like to consider the odds, 10+ years in the grand scheme is nothing. Show me a tech stock that has continued to climb for 25+ years, MSFT that’s pretty much it.

Thomas

at 9:44 am

There is no doubt that I got lucky with my guess but I wouldn’t have gone farther than fall 2020. My reasoning has been and is still rather simplistic. I was (and still) in the market looking for a starter home. And that also gives me in the peculiar position where I was a ‘loser’ a couple of blogs ago to a ‘winner’ today (It has been a topsy turvy month for me :D) What I saw in February was madness. People were paying way over what similar homes sold for a month or two prior. That pent up demand had to find a way out. I expected Canada to do a better job at managing the pandemic too. In fact, Canada did much better than I expected. The more important thing is how the decision to buy a home affects the thought process of a person. Most people would have planned for a while before making the decision to go for it and at that stage it takes a lot to make them reconsider it (a pandemic isnt enough unless it affects them personally). So, they will keep looking and get frustrated as they spend more time searching. Of course, COVID has had it effects too but they have been offset by government policies. I believe that COVID has accelerated the demand for detached homes as people are trying to move away from condos.

My comments on this blog have always been in the bear category and that is because I hold a strong opinion that this market isn’t a healthy one (I am not talking about people in RE business). I will now try to explain the reasoning around the second part of my prediction. Sure, I might look like a fool by Sping 2021 but that isnt new to me. The government cannot afford the RE market to crash nor can it afford to let it heat up so badly especially in the midst of a pandemic. Australia already extended the mortgage deferral and may be Canada will soon follow. But the correction will happen especially as the wider economic impact of COVID takes shape. I expect that to happen by Spring 2021. Why Spring 2021? Because I will be damned if CMHC pulled out their numbers out of thin air.

How would the price changes shape up? Here is my ‘opinion’. Condos will fall first. There will be some decent deals to made in the 1M and above market after that. Homes under 1M might not have much of an impact at all. If there is an impact, it will manifest after the condo and 1M+ changes. Condo inventory is still rising and will likely continue to rise. 1.5M+ homes still take longer to sell (of course location matters but I am talking mostly about 905). At least anecdotally, I have started seeing this pattern. But it could very well be because I want to see it that way!

I hope that made a good award acceptance speech 😉

Chris

at 9:58 am

Personally, I think the recent strength in many assets is misleading. Both RE and many equity indices seem entirely disconnected from the poor economic reality. Meanwhile, the pandemic continues to accelerate around the world. As shanker said the other day, we’re barely in the third inning of covid.

Derek*

at 10:18 am

Congrats Thomas! Don’t push your luck lol 🙂

jeanmarc

at 10:49 am

It’s great to read all the predictions and who wins. At the end of the day, the true winners are those who had the “balls” to buy in April. Same goes when the stock market is tanking and trying to find the bottom of a sinking ship back in mid March.

Professional Shanker

at 12:03 am

Based on sales volumes in April – not that many backed it up….

J G

at 11:41 am

To be honest Toronto RE is not performing that great relative to other RE markets in Ontario, especially in the last 3-4 years.

For example:

Ottawa – June 2020: 558k, June 2019: 456k, June 2017: 392k

22% again in 1 year or 42% gain in 3 years.

Windsor – June 2020: 406k, June 2019: 335k, June 2017: 267k

21% again in 1 year or 52% gain in 3 years.

Similar stats can be found for some others like London. I know people with multiple investment properties in these cities, and they are certainly making more percentage wise in the past few years. Also, the mortgage is much smaller 🙂

Professional Shanker

at 12:05 am

but the aggregate gains are smaller too!

J G

at 6:54 am

Of course but you’re putting in a lot less!

Not all re investors have 200k sitting around.

Anyway, if you have gotten in 3-4 years ago, I’m pretty sure you’d be really happy. Back in 2016/17 everyone was so focused in Toronto that other cities in Ontario actually provided better % returns.

Joel

at 11:51 am

Sad that I missed that blog and the guessing!

We really are seeing a crazy market right now and I think there are a few things conributing.

The market was shut down as mentioned in the post by Pasalis. This has kept 3 months of buyers on the sidleines ready to come out.

People are working from home and may be for the foreseeable future or forever. If you have a 1+ den and you and your partner are both working from home, now looks like an amazing time to get a 3 bed semi with a yard. The more time people spend in their homes the more value there is attributed to them.

If you can work from home and save $300 a month on commuting, or get rid of a car and not have to spend the money on suits and costs associated with being downtown that savings can go a long way in terms of mortgage.

With super low mortgage rates right now that $1000 a month you are saving can get you an extra $275,000 in mortgage. If you were ready to upgrade before, now looks like a very attractive time to do so. Selling your 1+den for $750,000 and moving to a 1.4 semi isn’t going to have that much of a difference on your budget.

No more convenience of walking to work while downtown, it becomes an annoyance that you don’t have the space. Depending on how work culture changes this could be a big trend and may even push the 905 market up as young families leave the city proper for more space.

Chris

at 12:45 pm

Ben Rabidoux took a look at this:

https://twitter.com/BenRabidoux/status/1280503227038027776

905 detached was the one segment of the GTA market that saw a year over year increase in sales in June.

Appraiser

at 10:00 am

Remember to ask Ben how many clients had their HELOCS pulled by their lender since March, as per another of his empty theories…

Waiting.

Chris

at 11:19 am

I’d suggest you ask him yourself, but I don’t think he’d be willing to answer any of your questions, given his comments on you the last time around.

Anyways, the link above shares data, not a theory.

Ilona

at 1:01 pm

It’s a boomerang, short term demand spike as a result of rock bottom sales for two months. Have you walked along your local main street lately?

Fearless Freep

at 7:03 pm

Ah yes, more “anecdata.”

Appraiser

at 8:00 am

“What you’re seeing and what you’re reading is not what’s happening…it’s fake news”

Donald Trump or Evan Siddall when he sees the latest TRREB data ?

Chris

at 8:38 am

Donald Trump from more than two years ago:

https://www.bbc.com/news/av/world-us-canada-44959340/donald-trump-what-you-re-seeing-and-what-you-re-reading-is-not-what-s-happening

Obviously.

Kyle

at 10:08 am

Evan Siddall is an embarrassment to himself and he’s tainting CMHC with the same stench of embarrassment. After making his shitty forecast that was A) factually wrong and B) widely panned by anyone who actually has a clue about RE, he then doubles down by having CMHC publish a report reiterating his shitty forecasts. Seriously that just smacks of denseness and bruised ego.

Chris

at 12:04 pm

Evan Siddall didn’t personally write the report which included those forecasts. CMHC employs a team of over 100 economists to analyze the national real estate market. These are almost certainly the people who write the Housing Market Outlook, not the CEO.

Ben Myers and Steve Cameron had a good interview with a CMHC analyst the other day. Worth a listen, as she goes into more detail about their forecasts and methodology, among other things.

https://player.fm/series/2614924/266475991

Kyle

at 1:01 pm

I didn’t say he wrote the report. I said he himself made a shitty forecast during his testimony to the HoC Finance Committee in May, but then had CMHC put out a report doubling down on his shitty forecast a few weeks later.

“The report comes just weeks after CMHC CEO Evan Siddall predicted up to an 18 per cent decline in average home prices across the country over the next 12 months, a data point which prompted a skeptical realtor community to characterize the forecast as “panic inducing.””

Chris

at 1:07 pm

The logical series of events is that the CMHC team of economists and analysts drafted the report containing the forecasts, which Siddall then presented to the Finance Committee, after which the report was published to the general public in it’s entirety.

Seems highly unlikely that Siddall made up the forecasts himself before or during this testimony, and then directed a report be crafted that reinforced his own personal predictions.

Kyle

at 1:25 pm

You can assume that if you want, but the way he rabidly defended it, something he doesn’t do for any other CMHC reports, would indicate the opinions were his.

Chris

at 1:29 pm

Yes, I think I will continue to assume that the forecast was prepared by the 100-odd team of economists and then presented by the CEO, rather than the CEO coming up with some number himself and then demanding a report be made to back him up. The former seems far more plausible than the latter.

Suggest you listen to the interview I linked to above. She’s quite informative.

Bal

at 1:13 pm

Chris – I lost the hope and i don;t think RE will ever come down…I think i need to smoke some weed and i mite need to give some to all these anyalyst who are analyzing all wrong…lollol

Chris

at 1:17 pm

Haha you do you, Bal!

Kyle

at 1:22 pm

LOL Bal, i think some of those Analysts are already smoking something…crack.

Thomas

at 1:41 pm

Dont lose hope yet Bal! Not yet!

Thomas

at 1:38 pm

Isnt it still too early to say that the report is ‘factually wrong’?

Kyle

at 1:45 pm

I was referring to Evan Siddall being factually wrong when he testified saying that 20 percent of mortgages would be in arrears (i.e. 1 in 5 homes would be in default). He quickly back-pedaled after everyone told him, how incredibly stupid such a statement was. The following day he then said he meant 20% of mortgages would be deferred.

Also the report calls for sales and prices to decline and not return to pre-pandemic levels till 2022, so yeah you can file that report in the garbage.

Crofty

at 3:51 pm

I’m waiting for Siddall to retire from CMHC so he can cash in by writing a book along the lines of Hilliard MacBeth’s laughable “When the Bubble Bursts: Surviving the Canadian Real Estate Crash,” which it must be admitted succeeded in getting its author on BNN, CBC, CTV, Global, etc. etc. etc. way back in 2015 (yes, his pathetic tome was published more than five years ago!). Although I’m sure that many of the folks following this blog are *just waiting* for MacBeth and his ilk to be *right*. Like the proverbial broken clock.

condodweller

at 2:45 pm

I don’t think there needs to be any qualifying. This is why we nailed down the criterion for winning. I punted since there wasn’t much to do during the lock down. I do recall saying it’s a crapshoot and to live up to my label as a bear, which I’m not, I used a negative scenario which fortunately hasn’t happened. The bets were dispersed along the timeline so someone was going to win.

I find it funny that all bulls try to position the bears as wanting the RE market to crash. I certainly don’t, but some of us are concerned about ever increasing prices and wonder just how high it can go.

I would really like to see some research/polls on where all the money is coming from for people buying at these prices. I mean, a few years ago it was attributed to parents using their own equity or downsizing to help the kids with the down payment. How long can that be sustained? Now, we are hearing about all the high paying tech jobs supporting people buying. Last time I looked, the average annual salary in Toronto was about 50k. To qualify for an average home these days both spouses/partners need a salary close to 200k. What percentage of potential buyers have a family income of 400k? There is a major disconnect somewhere in my mind.

One option I suppose, is the stock market. If someone invested in the tech stocks, or just Apple or Amazon, errrr…..check that… gambled on Apple or Amazon as putting all one’s money in a few stocks is not investing. But nonetheless, that’s one way of making money quick to be able to afford these down payments. But again, how many would have to have done that successfully to bring the average home price up?

I don’t want to dampen your celebration David, but why is 930k such a great number? I mean the recover from the April lows is pretty incredible, but in absolute terms that’s what, about a 2.2% over the Feb high?

Bijan

at 9:52 pm

Do you mean combined salary of 200k or combined salary of 400k? You definitely don’t need 400k income to afford a $930k house. You can definitely afford it with 200k income and a reasonable down payment.

condodweller

at 12:21 am

200K.