What does it say when the “long weekend” feels a bit too long?

Too much family time? Is there such a thing?

Too much drinking alcohol and eating barbecue? I wish. Please invite me to your cottage next long weekend, okay?

All that damn rain, and the kids getting cabin fever? Yeah, maybe.

Or perhaps some of us have this unhealthy addiction to work. Maybe not so much the work itself, but the physical location, which has a certain familiarity and comfort.

I took a two-week Honeymoon in 2013, and I can honestly say that by about day number-eleven, I felt I was just about ready to start packing. One week wouldn’t have been enough though, and therein lies the problem. My wife and I felt like bandits when we saw all the one-weekers leave, and we stayed behind for another seven days of glory. But a few days later, that wore off, at least for me, it did.

My brother used to have this saying about golf: “I can’t play eighteen holes. I just can’t do it. But I’ll admit, I’m not really satisfied with nine holes. So if you can find a twelve-hole golf course, I won’t just play with you – I’ll become a member!”

So, did any of you feel a sense of relief when you arrived at work on Tuesday morning? Was the three-day long weekend, in the heart of summer, during a pandemic, enough? Or could you just pick up and leave right now, get back home, or up north, or wherever your happy place is?

I take my work home with me. Every night. It’s impossible not to.

My poor wife, honestly. Real estate dominates our lives, and she told me as much this weekend. She knows every one of my clients by name, hears all the stories, and knows which listings we’re bringing out.

This is going to be the busiest August on record in the Toronto real estate market, you can mark my words.

For years, I’ve told people, “The last two weeks of August are the slowest two weeks of the real estate calendar, save for Christmas.” I tell this to buyers who ask what the summer is like, and I tell this to sellers who weigh the pros and cons of listing their house or condo for sale in the summer. But 2020 is different.

If the explosive month of June, which saw the GTA average home price reach an all-time high, is any indication, the summer months in 2020 are going to replace the time we lost in the real estate market at the height of the pandemic. March, April, and May were all affected by the state of emergency, quarantine, and social distancing measures, and these represent three of the busiest months of the real estate calendar.

By the time the TREB stats are released this week, I think we’ll see just how busy a month July was.

This will take us into August, of course, which I believe will simply pick up where August left off.

There are a lot more people heading up north each and every weekend nowadays than we saw in June, but even still, there are less than in previous years. There’s still not enough inventory in some market segments to meet demand, and I have to think that the month of August will reflect this.

So, I for one could not wait to get to my desk on Tuesday morning and get started. We have a slew of listings this month, and buyer activity is the busiest it’s been all year.

“We’ll rest at Christmas.” That’s what I tell my team. And quite often, my poor wife…

As the title suggests, there a lot of questions about the real estate market, both present and future, and I think the TREB stats will help answer these.

For now, here’s what I’m wondering:

–

1) Where will the GTA average home price go?

You must have assumed that this would be the first question on my mind, no?

And with respect to y’all, how could this NOT be the first question that you want answered?

Sure, many of you have other fish to fry. If you’re an investor, you want to know what’s happening with rental prices. If you’re a would-be, first-time home buyer, you’re probably looking at the 416 semi-detached average. But for most of us, we’re looking at the market top down. And there’s no higher peak in real estate than the GTA-wide average home price.

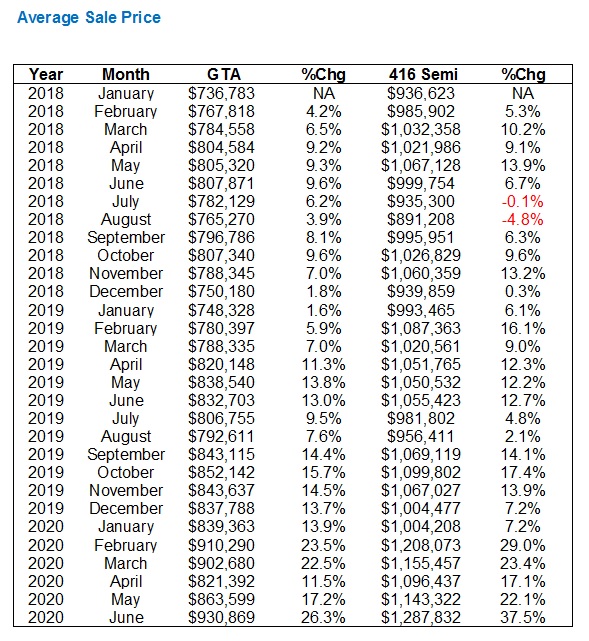

I won’t dig up the skeletons that we left behind before/during/after the real estate market moved through the pandemic, but I will refresh your memory with the following:

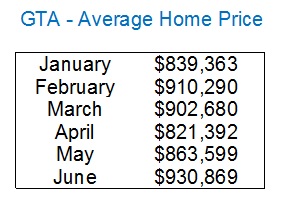

We started the year with an average sale price in January that was in line with November and December of 2019, but then saw the average home price shoot up to $910,290 in February, as the market had absolutely exploded. The state of emergency went into effect on March 17th, and thus the average sale price in March, which was probably on track to push past February’s figure, fell down to just over $900,000.

Then things got wild! Down to $821,392 in April, and only $863,599 in May.

Then things got wilder! Up to a whopping $930,869 in June, which was not only well past the February high, but also represented the highest ever average sale price for a given month in the GTA, surpassing April of 2017.

The conversation on TRB was fierce, and I even chimed in with a blog post fully committed to this stat: June 8th, 2020: “Winner, Winner, Chicken Dinner!”

Many of the nay-sayers and market bears suggested that to celebrate only one big month was foolish and premature. But many of the market bulls, or in my opinion, market realists, acknowledged that to see an all-time-high reached during an ongoing pandemic was a testament to the strenth of the Toronto real estate market.

So what next?

That is what we all want to know!

And it’s why this is #1 on my list this month.

–

2) Where will the 416 average condo price go?

As I said before, we all have our own vested interest(s) in the market, and while some of you couldn’t care less about the average 416 condo price, I really, really want to see where this ends up!

2020 has provided a rocky ride, but it’s been more or less bumpy in different market segments.

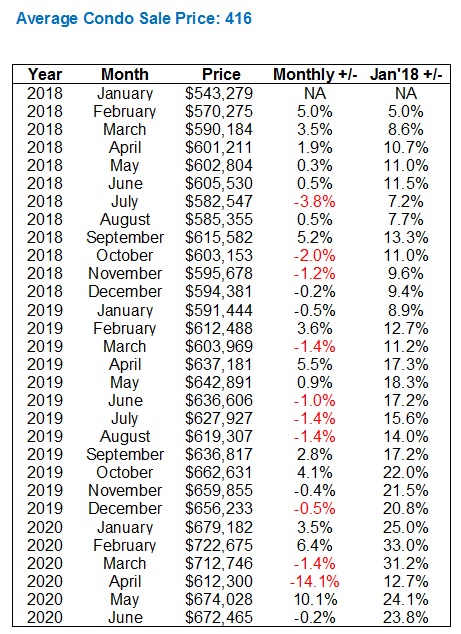

Before I compare condos to the other segments, let’s see where condo prices have gone from the start of 2018:

On paper, had you purchased a condo in January of 2018, you’d be up 33% in a smidge over two years, sitting pretty by February of 2020.

Looking more specifically at the last few months, the average condo price surged to start the year.

All the talk in February was about the dearth of inventory. Every night it was, “Did you see that the small 1-bedroom at 95 Bathurst Street got twenty-one offers?”

The average condo price hit $722,675 in February, which represented an 18.0% increase over February of 2019.

Since then, prices have fallen off. But that’s the same for all segments, no?

Let’s take a look:

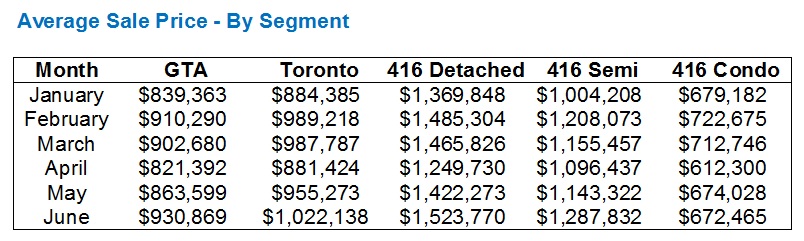

Here’s the average sale price in the GTA as well as Toronto.

Then looking specifically at the 416, we have detached, semi-detached, and condo.

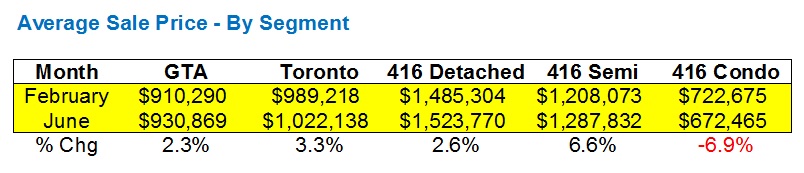

We know that February was the “peak,” pre-pandemic, and that April was the trough. Then in May, we saw prices come back before surpassing February’s peak in June.

But if we look only at February and June, do the numbers, in fact, show that ALL segments have surpassed the peak?

Some of you already jumped ahead, but that’s okay.

Let me highlight it for you:

Yes. That is what the numbers show.

Now to be fair, I would argue that the average downtown condo isn’t down 6.9% since February, just as I would argue that the average east-side semi-detached us up WAY more than 6.6% since February. But more on that later…

So what are we going to see in the July TREB stats?

I believe we’ll see a modest uptick in that $672,465 figure, but not yet anywhere near $722,675. Condo prices will recover, but not this summer.

–

3) What’s happening with downtown condo inventory?

I honestly don’t know.

Some days, I think there’s an absurd amount of inventory coming out. Then other days, I wonder why the hell I can’t find anything for my clients.

If I had more time, I’d love to strip out all the assignment sales and similar garbage from MLS to get a sense of what actual resale condo listings are like, but again, topic for another day. I’d hate to be looking to unload an assignment today. Thankfully, I don’t sell pre-construction to my clients…

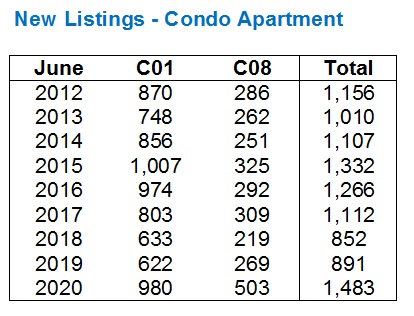

Let’s look at new listings in C01 and C08 through the first six months of 2020, and compare this to the same period in 2019:

Your eye is going to go where it wants to go, but I’ll tell you how I look at this…

Starting in January, we see that new condo listings were down 8.7% from 2019. This isn’t a huge drop, but perhaps with increased demand, it was enough to push the market upwards.

Then in February, during a time when I would have thought inventory was down, we actually saw a modest uptick.

Same story for March, which was affected by COVID in the last two weeks of the month, but we still saw a 24% increase in listings.

Listings plummeted in April, as expected.

And it took some time for listings to ramp back up, since you would think that by May, the market was “back.”

Now here we are, looking at the June figures, and a massive 66.4% increase in new condo listings over 2019.

That’s shocking. I certainly didn’t expect to see that, and while we know this represents a LOT of condo-sellers who were going to list in March/April/May, but had to hold off due to COVID, I don’t know that anybody could have predicted an 82% increase in new listings from May to June.

Then again, maybe 2019 was just a down year?

If you think I’m trying to create an argument, I’m not…

2018 and 2019 stick out here like sore thumbs. Excluding 2018 and 2019, the other seven years in the chart above average 1,170 new listings per year.

Nevertheless, the 1,483 new listings we saw this past June is still the high point.

So do you chalk up the increased in June to the decline we saw in April/May during COVID, or is it something else?

–

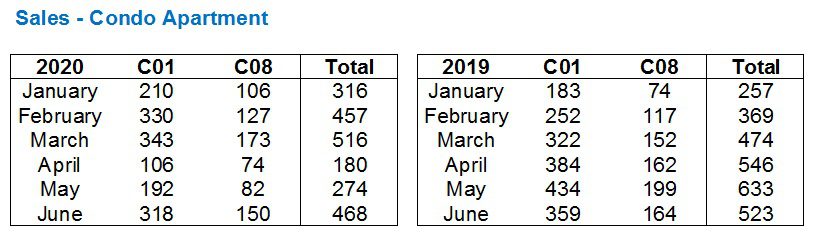

4) What’s happening with downtown condo sales?

Yes, three of my first four burning questions are with respect to condos, but that’s what makes these BURNING! I need to know!

Looking at downtown condominium inventory tells only half the story.

What’s happening with sales?

Have a look:

Condo sales were up in January, February, and even March, despite losing two weeks due to the pandemic.

Sales plummeted thereafter.

Down 67%, year-over-year, in April, sales recovered slightly in May, only down 56.7%.

June sales were only down 10.5% from the same period in 2019.

So how is that for a trend? With the gap between the year-over-year sales decline shrinking, does it mean the condo market is coming back?

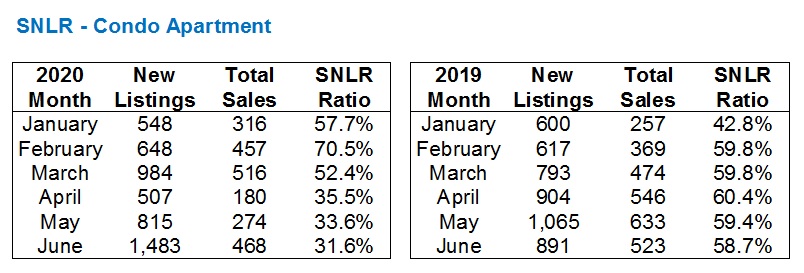

Well, before I make that call, I’d want to compare sales to new listings, aka our “SNLR Ratio.”

Have a look:

Eek.

Sales are down, listings are up, and the SNLR is as low as I think I’ve seen it in a long, long time.

Remember that new the 1,483 new listings we saw in June is the highest point in the last nine years (data is incomplete prior to 2012). And even though sales are “only” down 10.5%, year-over-year in June, when combined with a massive spike in new listings, the SNLR goes from 58.7% to 31.6%.

This is a far cry from February when the SNLR was above 70%. Remember when I talked about how hot February was, in spite of the “modest” 8.7% decline in new listings? Well, with a huge increase in demand, we saw that 70.5% SNLR, and thus 15-20 offers on 1-bed, 1-bath condos in King West became the norm.

So here we sit, looking back at June numbers, with a 31.6% SNLR, that’s dropped 2% from May, and 4.1% from April.

Will that trend continue in July?

I’m predicting that it won’t. I’m predicting this metric is closer to 40%, which is still historically low, but shows that the condo market is turning around.

–

5) What’s happening with entry-level freehold?

Define “entry level,” I suppose.

I just spoke to clients about a detached house on a 43-foot lot in Alderwood, sub-$1.4M, and how they’d be looking at a 22-foot semi-detached on the east-side as a comparison.

“Entry level” means many different things, to different buyers, and in different areas.

My insight as to “entry level freehold” has always come from the price of 416 semi-detached homes. I know that not all semi-detached homes are entry-level. There are $2M semi’s in Playter Estates, and $3-4M semi’s in The Annex. But as far as an overall measure goes, this is a good one.

Here’s a look at where the average 416 semi-detached price has gone since the start of 2018, and a how it stacks up against the GTA average:

A whopping 37.5% increase since the start of 2018.

And even if you want to suggest that the Jan/Feb prices are depressed, which they are, we’re still looking at something around 25-28% from the spring of 2018.

This significantly out-paces the GTA average.

And for what it’s worth, detached is up a mere 18.7% from January of 2018. That’s a little more than HALF of the 37.5% increase for semi-detached.

As we noted in Point #2 above, the average semi-detached sale is up 6.6% over February!

Where will we see the July number come in?

I can’t fathom that this $1,287,832 figure rises above $1,300,000. But it can’t really go down, can it?

–

That’s it for me today, folks!

If you have a more burning question, then I’d love to hear it!

Predictions welcome too, of course. Just be careful. The Internet has a long memory…

Chris

at 8:01 am

“…to see an all-time-high reached during an ongoing pandemic was a testament to the strenth of the Toronto real estate market.”

The S&P500 is near its all time high. The NASDAQ blew past its previous all time high mid pandemic. Are these testaments to the strength of equity markets? Or are unprecedented levels of monetary and fiscal stimulus maintaining asset values?

“If you’re wondering why house prices haven’t corrected, and why CMHC’s bearish forecasts are looking embarrassingly wrong, look no further than the Bank of Canada. The printing presses are running in overdrive, monetizing fiscal debt at an unprecedented pace. The Bank of Canada’s balance sheet has grown by more than 400% since the pandemic, while Canada’s M2 money supply has expanded by more than 10% this year. Furthermore, the banks holdings of Canada Mortgage Bonds has grown by more than 30X.”

– Steve Saretsky

The same can be said of equity markets. I don’t view their resilience as testament to their strength, so much as Jerome Powell and the gang maintaining asset values. Great for my portfolio, but not so sure how sustainable or good for society as a whole it is.

Appraiser

at 8:31 am

Blah Blah Blah!

Bottom line: I would have been right, if I wasn’t so damn wrong.

Chris

at 8:43 am

“I would caution against being caught in a bull trap though.” – Appraiser, on equity markets

https://torontorealtyblog.com/blog/join-the-conversation-qa-session-episode-2/#comment-118577

Since you made that statement:

S&P500 +19.80%

DJI +12.29%

NASDAQ +30.86%

TSX +16.11%

Bottom line, you would have been right, if you weren’t so damn wrong.

Appraiser

at 9:50 am

Oops – someone forgot to mention that the TSX is still down -9% from the peak in February, while the Dow Jones is negative -10%.

Must have been an innocent oversight.

Chris

at 9:56 am

Oops – someone forgot to mention that 416 condo is still down 6.9% from the peak in February.

Must have been an innocent oversight.

Do you still not see the parallels? Or do you want to keep playing this game all day?

Pragma

at 9:00 am

I’ve been very bearish on condos for about two years now. I believe 60% of condos in Toronto are held by “investors”? Buying them for yield stopped making sense about two years ago but the equity gains helped paint over that. The rental yield is only going to get worse over the next year and the significant decline in prices over the last few months will only create a feedback loop.

All the tailwinds that carried condo prices over the last few years have disappeared or are in full reverse:

– rate cuts are marginal at this point

– our economy is not going back to where it was for a few years, we’re looking at high unemployment till late 2021/2022

– Immigration will drop SHARPLY. 2020 is going to be 20% of the numbers compared to 2019. High unemployment will keep that number low through 2021.

– WFH is here for another year at least. (and no I’m not a believer that this is a permanent shift, but it will have momentum for a year or two)

-all that inventory that had been converted to short term rental is coming back

– all at a time where the number of condo and apartment completions in Toronto is going to hit a new record level

The rising level of inventory is an ominous sign considering that banks just gave blanket deferrals to anyone who applied. The banks will be much more discerning when the 6 months runs out.

The only bullish argument that I will make is that the all this money printing will lead to rampant inflation, but at best 2 to 5 years away, and then you’ll just want to hold any asset versus cash. But I’m not convinced inflation is around the corner just yet.

Chris

at 9:19 am

Agreed on most counts.

On your last paragraph, the potential re-emergence of inflation seems to be the big debate these days. I think we’re already witnessing asset price inflation from the absurd levels of monetary stimulus that have been pumped into economies around the world.

But overall inflation remains subdued, and I wouldn’t bet on it rearing up anytime soon. If it does, we could be in for a real bad scenario.

Appraiser

at 9:03 am

Unofficial TRREB July data from LG:

“Toronto Area home sales in July were up 28% over last year with prices up 17% and inventory falling to just 1.4 Months”

Average price at an all-time new record of $949,000 !

Appraiser

at 9:04 am

Link: https://twitter.com/johnpasalis?lang=en

Chris

at 9:08 am

“But comparing sales year over year right now is a bit misleading because COVID has effectively pushed the traditional spring market out two months from May to July.

Average prices are also skewed up slightly because a higher share of low-rise homes sold this year vs last year.”

– John Pasalis

Meanwhile, LGJP also reporting that condo rents dropped 12.34% YoY.

Bal

at 9:24 am

something is not right here…do you really believe that the way house prices and stock market is going is healthy…No way…everything need a balance and right now we are out of balance…Semi house which was was selling for 800,000 in May and the same house is now going for 925,000….How is this healthy? Amazon, Tesla, shopify, wayfair stock is going crazy..how on earth this all the healthy? I think we all need to think where is disconnect…

Chris

at 9:39 am

Nope. As, I said above, my equity portfolio is doing well, despite the pandemic showing no signs of slowing across the globe. But unlike some of the commenters here, I chalk my sustained asset values up to monetary stimulus, rather than the strength, resilience, or un-stopability of the market.

The Globe and Mail were, in my estimation, correct the other day when they said that this is great, if you’re already rich. But that doesn’t seem to be sustainable long term from an economic or societal standpoint.

Appraiser

at 11:19 am

Of course it stands to reason that your entire imaginary “portfolio” was purchased during the dip, right?

Chris

at 11:24 am

Appraiser, you really need to learn how to read.

Nowhere did I say I bought the dip. While some certainly profited handsomely from calling the bottom, I just kept my portfolio the exact same throughout. And have done quite well by doing so.

Kyle

at 9:50 am

@ Bal,

If you want to understand what’s happening in the real estate market, i would caution you away from using subjective terms like “healthy”. That is the intellectual lazy path that Bears have used with zero success for decades. It implies that things are not where they should be based on their own beliefs of what is “healthy”. And then they continue on with that belief perseverance for years on end.

If you want to understand what’s happening you need to dig deeper and understand what’s driving the growth. And the questions you should be asking is – are those drivers sustainable or not?

Chris

at 10:08 am

So, from your perspective, what’s happening and what is driving the growth in equity markets? Would you describe it as “healthy” and are these drivers sustainable? Would you say things are where they should be?

Kyle

at 10:21 am

Like i said i don’t follow the equity markets. So i don’t know what’s driving it, nor do i pretend to.

But i do understand real estate markets and that quote from Steve Saretsky that you posted is pure nonsense. Activities that ensure liquidity and continuous markets among financial intermediaries does absolutely nothing to change the supply and demand for housing. Claiming these as the reason for rising house prices is just plain asinine.

Chris

at 10:41 am

Humour me. What do you think is driving equity markets? Do you think it’s healthy and sustainable? I’m sure you at least pay a modicum of attention to the stock market.

You honestly believe that the Bank of Canada’s actions have had no impact on demand for real estate? Their holdings of mortgage bonds alone has swollen from $513M to $8.1B in five months.

Hypothetically, what do you think would have happened to mortgage originations and subsequent demand for real estate had our central bank not taken these actions to ensure liquidity? What would have happened to interest rates and our overall economy had their total asset balance not shot up from $121B to $546B?

The parallels, at least in my opinion, between the real estate market and the equity markets are clear. If you believe one is reasonable, it should stand to reason you believe the other is too; if you feel one is overvalued and supported by stimulus, you should feel the other is as well. I’m in the latter group.

Kyle

at 11:20 am

Do you actually think the buyers (i.e. demand) in the last 4 months have a clue what the BoC has been doing? “Hey Honey, the Bank of Canada is buying mortgage bonds at an unprecedented pace, this is the moment we’ve been waiting for to pull the trigger on that house purchase” , said no home buyer ever.

“Hypothetically, what do you think would have happened to mortgage originations and subsequent demand for real estate had our central bank not taken these actions to ensure liquidity?”

What would have happened is that the demand would still have been there, but there would have been a lot more friction when people went to close.

Like i said, i don’t pretend to know why Equity markets are going up, it could be a bunch of things that have nothing to do with the an improvement in the underlying fundamentals of the companies that make up the indices. For example, long only asset managers need to be fully invested, and when fixed income markets have no room to grow, money has to find a home. Such factors would have absolutely no relevance to Toronto real estate.

Chris

at 11:37 am

“Do you actually think the buyers (i.e. demand) in the last 4 months have a clue what the BoC has been doing?”

Nope, which is why that’s not what I said. Good strawman argument though, with a humorous pseudo-quote to boot!

“there would have been a lot more friction when people went to close.”

Exactly. Credit presumably would have tightened and lenders would have originated fewer and/or smaller mortgages, which would have meant fewer buyers able to buy, either the home they wanted or at all. I think this friction would have been present before closing, but that’s a small detail.

This all sounds like less demand to me. Aspirational demand from people unable to obtain a mortgage is pretty irrelevant, and least in the present.

I’m asking for your opinion as to what is driving equity markets. None of us know for certain, but I’m sure we all have our opinions, so what is yours? Is it sustainable and healthy? Do you feel valuations are where they should be? If not, why?

Chris

at 11:48 am

And this is just to speak of the BoC’s purchasing of mortgage bonds, to say nothing of the impact that their massively expanded balance sheet has had on other aspects of the economy, such as interest rates, fiscal stimulus, etc., and how this cascades into both demand and supply for real estate.

Kyle

at 2:14 pm

“Exactly. Credit presumably would have tightened and lenders would have originated fewer and/or smaller mortgages, which would have meant fewer buyers able to buy, either the home they wanted or at all. I think this friction would have been present before closing, but that’s a small detail.”

Who’s using strawman arguments now? Removing a structural issue such as a credit crunch is NOT creating demand. It is simply allowing the demand that exists to fulfill itself.

If the BoC continues to increase their balance sheet, demand does not increase further. They could 100X their balance sheet from here and demand does nothing. Suggesting this is what is driving demand is asinine.

Chris

at 2:47 pm

That’s not so much a strawman argument as it is simply you and I disagreeing on a point. But that’s an aside, and I said I’d try not to nitpick you, so moving on…

If demand is unable to be fulfilled due to an inability to acquire financing, then that demand is irrelevant. Someone aspiring to own a home, but who can’t access credit to buy, is not a buyer and is not providing any demand for real estate. They can hope and pray all they want, and maybe one day in the future they will be able buy a home, at which point they will add to demand. But until then, the demand they may harbour for real estate is aspirational and nothing more.

Hence, ensuring liquidity and keeping yields low both directly and indirectly impacts real estate, as it helps to turn aspirational demand into actual demand, among many other cascading consequences. Aspirational demand doesn’t move prices; actual demand does.

If the BoC expanded their balance sheet 100X more, it would absolutely have an impact on interest rates, liquidity, credit availability, demand for real estate, the prices paid for it, etc. To suggest otherwise is asinine.

And as you forgot to answer, I’ll once more ask, what is your opinion on equity market valuations? Is it sustainable and healthy? Do you feel valuations are where they should be? If not, why?

Elle O'lelle

at 12:28 pm

Think about it this way.

It isn’t that those stocks or houses are worth more.

It’s that your money is worth less.

Chris

at 12:37 pm

Not really. Inflation was 0.7% in June, after readings of -0.4% in May and -0.2% in April.

Professional Shanker

at 2:39 pm

Bingo – Central banks have been purchasing bonds driving down yields which is making cash (i.e savings and hoarding cash) a less attractive investment.

Your money when compared to asset values (equities, homes) is most certainty worth less post covid than it was pre-covid and this is all to do with central banks purchasing bonds (corporate, mortgage, you name them).

Same monetary factors at work driving up RE and Equities.

The move in Gold says it all.

Chris

at 2:50 pm

Shanker, that’s more asset price inflation than overall inflation. There’s clearly been asset price inflation. Much less so inflation in the CPI.

Appraiser

at 2:42 pm

I can’t fathom how LG can caution that the data might be misleading. Other than to continue to masquerade as an unbiased observer.

Not when sales volumes AND average prices are up substantially.

Not to mention an ALL-TIME high.

LG is media-savvy though, and they love him.

Appraiser

at 8:14 am

Also does anyone recall that the ‘meticulous data analyst’ pronounced recently that he was “seeing to much confidence in the market”

What the hell does that even mean?

Appraiser

at 12:58 pm

Excellent number-crunching once again David.

Bal

at 1:58 pm

sorry i don’t want to get into a bull vs bear debate. All i know for the fact that housing market is going higher due to lower interest rates. I can bet if the bank of Canada increase the interest rates today, this so called demand will disappear….This so called demand is only due to the fact the interest rates are so low. Maybe i don’t have much knowledge of real estate or stock market…but some stuff doesn’t make any sense. I think due to the lower interest rates speculation activity is increasing…many people only buying to flip and many to rent out..

Appraiser

at 2:59 pm

Hey Bal, did you mean bears vs. realists? A nod to our gracious host, not a slight dear reader.

The central bank chairs and the smart money says that interest rates are going to be very low for a very long.

You can fight against that current all if you wish. Best of luck.

It’s the same with the the GTA housing crisis.

If you truly believe that the relevant authorities will promptly implement all of the right policies to solve the scourge of chronically low housing supply, then maybe the market will find equilibrium.

I don’t buy it.

Appraiser

at 3:03 pm

P.S. the market is going bonkers!

Appraiser

at 3:09 pm

Realists be all

https://tenor.com/view/molly-ringwald-dance-breakfast-club-gif-9307574

Professional Shanker

at 3:10 pm

Rural is bonkers….esp cottage country.

J G

at 4:03 pm

When it come to stocks you’re the bear and I’m realist.

All I know is I own Amazon, Apple, FB, along with bunch of other techs. They have been outperforming the Toronto RE for the last 10 years.

The bulls talk like Toronto RE is the best investment option ever, when it’s clearly not.

Bal

at 4:36 pm

I got some shares of Amazon , wayfair and google…All doing damn good…lol

jeanmarc

at 9:21 pm

JG

Time to load up again on the dip. The hedge funds will have a ball when they push this sucker up again after the split. Remember Apple was $700 back in 2014 when it did a 7 to 1 split. Don’t forget all the kool-aid drinkers sucking up all the iphones, ipads, iwatches, macbook pros and those airpods being used in front of the tv (john tory, doctors, etc.). PE is 32 so awesome time to get more.

J G

at 4:05 pm

APPLE $438! 4-to-1 split coming.

This thing was $320 back in Feb, did you pick up any when it crashed into the low $200s?

jeanmarc

at 9:24 pm

September is Apple’s big event introducing the iphone 12 5G. Never ending cycle of upgrading. Imagine all of those 90 million iphone users eventually replacing their phones with 5G. 3 Trillion won’t be too far behind.

J G

at 9:54 pm

Thanks for reminder. I thought about buying more last Thursday but hesitated. Stupid me!

jeanmarc

at 10:01 pm

Depending on when the US stimulus package gets approved, expect this and other techs to move even higher. Whenever there is a stock split, the cheaper price means more investors able to afford the share price. There is lots of cash sitting on the sidelines.

J G

at 4:09 pm

What I don’t understand is, all your bulls talk like Toronto RE is the best investment ever. Why don’t you go out and buy an investment condo right now? And then post the purchase agreement as proof?

Otherwise, you’re just like stock pumper on the internet trying to drum up for positions you already hold, there are plenty of those.

Bal

at 4:35 pm

Okay Okay Appraiser….calm down…lol@ realists…Joke of the day…I am not planning to fight anything. The real estate market has been screwed up since 2009 ( when low interest rates era started). Only logic i understand is that as people cannot get anything into their savings, they feel it is easy to make money in real estate and stock market due to how the way markets are going insane and everyone is jumping in, even people like me who are not investors. I don’t buy your supply logic. I think we have enough supply but if every person wants to hold 2 to 4 properties then yes supply is limited. I know that interest rates are going to stay low for a long time…until this party is gonna keep going…

Appraiser

at 8:55 pm

Helped my daughter and son-in-law buy a brand new Great Gulf 2,700 SqFt detached two-storey home in Bradford, for under $900,000 last weekend.

It closes late September, 2021 (if it’s not delayed). They have a freehold townhouse in Bradford to sell before it closes, that they bought about 2 years ago – that has already appreciated by over $100K.

Both have great jobs and bright futures and are under 30 years old. I like their chances that their existing home continues to appreciate, while the new house price stays nicely locked-in; and incidentally also continues to appreciate until closing. Their equity and future down-payment are growing every day.

Oh, and everybody is sleeping very well at night.

J G

at 9:31 pm

Congrats to both of them.

1) It’s their primary residence, not an investment property. I’m definitely for buying as long as they can afford it.

2) Not sure if Bradford counts as GTA. But I posted a few days ago that many other Ontario RE markets have done better than GTA over the last 3 years percentage wise. Including Ottawa And Windsor, which has gained about 20% yoy and 40-50% over last 3 years.

3) Buying outside of GTA also supports my WFH narrative, location will matter less going forward. I guess you do agree with me haha

4) Not sure if you re implying owning Apple and Amazon stocks causes me to have sleepless nights. If so, I’m only sleepless because those beasts have made me so much money!

Chris

at 9:01 am

“These are the risks when you buy a home before selling your current home – in a moment the market can turn and you’re trying to sell in a frozen market. And this is not a rare event, this happened in 2008, 2017 & 2020 – 3 times in 12 years.

The Big risk is that you own a home and have committed to buying a second and if prices happen to fall 20% overnight – like they did in 2017 in some parts of the GTA then you’ve lost 20% on your home and 20% on the home you don’t even own yet. That alone is enough to not just wipe out most people’s life savings but also force them into bankruptcy.

That’s why if I was ever planning on buying a new home but also needed to sell my current home, the probability of me buying first then listing my home is 0%. I would rather rent for a year, patiently wait for the right house vs risk losing everything because of bad timing.”

– John Pasalis

https://twitter.com/JohnPasalis/status/1248627292240097284

Appraiser

at 12:41 pm

One of these days @Chris you will learn to think for yourself, maybe.

Chris

at 12:51 pm

Somehow when you quote John Pasalis, Scott Ingram, Urbanation, Ben Myers, etc., it’s all well and good. When anyone else does it, it’s “learn to think for yourself!!”

Such a childish attitude, as per usual.

Ed

at 3:09 pm

Boy oh boy Chris, you are a whiny one.

Chris

at 3:18 pm

Ed, you contribute nothing to these discussions whatsoever.

You just pop your head up every now and then to make some snide comment, or try to use disabilities/disorders as an insult, then slink away.

I’d rather be whiny than be you.

Ed

at 3:28 pm

Well it appears that you have succeeded on both counts.

Chris

at 3:32 pm

Good one, Ed. Any other gems you want to add? Maybe some more insults related to disabilities? Or are you ready to slink away once more, having done nothing but dragged the level of discourse down?

Fearless Freep

at 4:39 pm

Can we start calling him “Mr. Ed,” because he’s about as insight/intelligent as a horse?

Fearless Freep

at 4:41 pm

*insightful*

Chris

at 4:58 pm

I don’t mind those who disagree with me.

Kyle and I rarely agree, but I will admit he often brings up good points and presents a valid perspective. Kramer is similar, when he’s actively posting. As much as Appraiser can be immature, he too can be a source of insightful content, at least most of the time… skullets come to mind as an exception.

Ed’s comments in recent months have offered little beyond discriminatory insults and crass complaints. Frankly, contributions better suited to a YouTube comment section.

Ed

at 6:31 pm

Ya know what it is about you Chris that makes you so annoying.

You will try to debate the smallest detail that by no means can be proven right or wrong .

But instead of just expressing opinions on why one feels one way or another (and there is nothing wrong in that) you will dig down as deep as you can to find a quote by someone who feel is an authority on the subject and smugly feel that this has proven your point.

That is why appraiser said to think for yourself, and he is right.

Chris

at 6:51 pm

Just to recap, on this blog post Kyle, Appraiser, Bal, J G, Pragma, Shanker, myself and others have touched on real estate and stock market valuations, asset price and CPI inflation, the impact of Bank of Canada bond buying on demand for real estate, and buying a home before selling your current one.

Meanwhile, your contribution has been to complain about whining, and then proceed to whine yourself for a few paragraphs.

No insight. No intelligent commentary.

Truly a shining example of the old saying, “better to remain silent and be thought a fool than to speak and to remove all doubt”.

Ed

at 7:06 pm

Chris, get a life.

Try to limit yourself to 2-5 comments per day.

Meet some real people.

You are still annoying and getting quotes to back up your viewpoint only makes you more annoying.

Chris

at 7:15 pm

Ed, I could not care less about your opinion.

You’re a joke. Slink away.

Derwanker

at 7:29 pm

My bet is August prices for freehold is going to make new records. I’m looking to sell my dt detached and move to surrounding burbs near the city, but there are so few listings. Downtown detached is still hot, so if anything looks like a condo exodus.

Frances

at 11:17 pm

As someone with a 416 condo who had hoped to be able to make the leap to an entry-level freehold this is all pretty depressing. I guess my main hope for the condo market is that those other poor schmucks who can’t afford to move up to a semi-detached home in Toronto will be stuck looking for condos and that demand will drive the prices up a little. As far as I am concerned 2020 is a washout though.