When we last spoke, I had just obtained a bully offer on my listing for a whopping $1,600,000, and had emailed the 55 other showing agents that we intended to work with the offer that evening.

Saturday evening.

Welcome to life as a real estate agent, folks!

With my daughter exclusively eating pizza crusts only, and my son shoving six pizza squares into his mouth all at once, to the point of choking, I knew I wasn’t long for this outdoor pizza party.

A crowd of real estate ghosts probably would have started betting on how long it would take for the first call to come in after that email went out. I think three minutes would have been my bet. I can’t imagine a world in which it takes more than ten. At the same time, with 55 showings on the property, you could set the over/under for number of agents calling during the course of the night at, say, 8.5.

It took five minutes for my phone to ring, and I know this because I was counting.

I looked at my wife, she smiled, my daughter said, “Bye daddy,” and I went inside to take the call.

“Some Saturday night you’re having,” the agent on the other end of the line mused.

No buyer agent likes having to make this call on a Saturday night, and nobody likes losing a solid option for their buyers because of a bully offer coming in over the weekend. As a listing agent who moves the offer date, I pride myself on not wasting people’s time. So I’ll do anything I can to help that agent see that his or her potential offer is not worth presenting. It’s the least I can do as a colleague and professional.

Keep in mind, there are only so many rules about what a real estate agent can and cannot do or say in the process of negotiating in multiple offers. In this case, the only thing I cannot tell other agents are the terms and conditions of the offer in hand. But do you know what I can do? Or what many other agents do? I can speak in euphemisms, hypotheticals, and what-if scenarios. I can do and say almost anything, and this is where many agents prosper while other agents wither away.

Many agents, both novice and veteran, simply freeze in this situation and don’t act with any purpose or strategy.

In a situation like this, where a bully offer has been registered, and a buyer agent asks the listing agent, “Should I bother bringing you $1,400,000?” those listing agents often reply, “Well, you can bring it, or not, totally up to you,” and give the other agent zero insight whatsoever. These listing agents are so afraid of making a mistake, or have such an incredible ego, that they simply decide not to act on anything. They stand pat. And in the process, they lose the opportunity to work with these agents, but also to gain their trust and respect.

How to speak to other buyer agents when they call about your bully offer is crucial, not only in the context of this transaction but in terms of how people see you going forward. Yes, there are 60,000 real estate agents in the city, but only a few thousand that really transact. Over time, you learn who you want to work with and who you don’t, and you come to expect to be dealt with by certain agents in both bad ways and good.

The agent that called me said, “I’ll be honest, my buyers’ max pre-approval is $1,500,000, and I don’t even know that I could get them to that number. So if you have more than $1.5M, I’m out.”

This is where many agents say, “Sorry, can’t help you there,” and leave that agent out to dry. Maybe the agent thinks that this person is fishing, and they don’t want to give up their position. But why? If you did give up insight to the price, so what? You’re going to motivate that agent to bring a competitive offer! And you simply can’t be afraid of losing this agent, right? You don’t need to solicit an offer that’s $100,000 below the one you have in hand, when that offer is already maxed out, right?

I told her, “I’m the one who moved up the offer date and ruined everybody’s Saturday night, so I’ll tell you that, yes, we have over $1.5M, so let your buyer know, enjoy your Saturday night, and good luck out there!”

She thanked me profusely, and added, “This is such a refreshing call,” and that made me really happy. Here I gained a friend and potential ally down the line.

Two slices of pizza later, another agent called me.

“I could get you, like, $1.3M, maybe $1.325M,” she said, which was really, really surprising. “My clients are investors,” she said, “And they need for any house they buy to be a deal.” I wondered how that logic could possibly be more flawed, but I didn’t have time to waste, so I sent her packing, and headed outside for another slice of the Neopolitan New York Genoa Salami.

About eight minutes later, another agent called and said, “I bet you got over $1.5M,” and before answering (since he could be fishing…) I asked him where his clients stood. He said they had just lost out on a house on Symington Avenue and bid $1.425M but they “might have had some gas left in the tank.” I told him we were way beyond that, and he said they would probably push to the high-$1.4M range, but that was a stretch.

No to sound like a broken record here, but many listing agents in this position tell that agent to paper the offer. You would be absolutely sick to know what type of ego most agents have, and how much they enjoy screwing with buyers and buyer agents. We all run our businesses differently, and personally, I will never be the agent who receives 42 offers on a listing and then emails all the agents in a bulk-email to say, “You all have one more chance to improve your bids. Please submit you final bids by 6:00pm.” That catches up with you eventually.

So I told this agent that high-$1.4M’s wouldn’t be close, and he thanked me for my time and my honesty, and probably went back to watching PGA golf.

After we had cleaned up the pizza party, but before bath time, the agent that had called me during the week and said his clients “might” go to $1.5M called and said he would bring me an offer. He added, “I don’t know that we’ll win, but I’m bringing it regardless.” I was thinking, based on our conversation, that he would bring something in the high-$1.4M range, and maybe push to $1.5M eventually, or even push past it, if he was bluffing earlier in the week.

He eventually put $1,400,000 on paper, but asked for an immediate closing date because his clients had an interest rate on hold. He said they would have no problem closing and then renting the property back to my clients. I told him the number wasn’t even close, and he said he would get back to me, but ultimately never did.

I cleaned the kitchen and talked on the phone while my wife got the kids ready upstairs, and I fielded three more calls from agents, mostly just touching base. The one really interesting call was from an agent who said, “I”m just calling to let you know that my buyers aren’t interested.” I have honestly never had somebody call me to say their client was not bringing an offer. Usually, if you’re not bringing an offer, you just don’t bring an offer! No other action needed! But this guy said, “If you don’t end up accepting the offer, let me know, I’ll work with you. Let’s do a deal!” He was on another planet. I think he might have felt that we would negotiate on the $1,149,000 list price.

By the time I got upstairs for Peppa Pig before bed, another agent called me.

“I think I can bring you $1.2M she said,” and when I reminded her that the property was listed at $1,149,000, she said, “I meant $1.4M. Sorry! I’m at a 20-year-old’s birthday party and we’re a bottle of champagne in!”

I wondered if: a) she was a bottle of champagne in on her own, and, b) if this 20-year-old’s birthday party was the very definition of a COVID super-spreader event.

I told her that $1.4M wasn’t even close, and she said, “Don’t worry, I’m going to bring you the winning ticket.”

To her credit, she put $1,507,000 on paper, but that wasn’t even close to the $1,600,000 offer we had.

But do you know what was close?

The $1,615,000 offer that magically appeared around 8:30pm.

This agent and I had talked briefly and he said, “I’m going to assume you wouldn’t be working with a bully on a Saturday night unless it had a ‘6’ in it.” To that, I simply said, “Good assumption.”

That was all he needed, and like a squirrel with a nut, he took that little nugget of information and scurried off to prepare his offer.

The offer was great at $1,615,000 but it was not accompanied by a deposit cheque. I knew this agent, he’s been around a while and he’s got a good name. But ultimately, it would be up to the seller in the end; would they risk accepting a pre-emptive offer without a deposit, and with banks closed on Sunday, having to wait until Monday to get the cheque?

Rarely does a buyer fail to show up with a deposit cheque, but it can happen. Our scheduled offer date was on Monday and here we were, on Saturday night, considering foregoing our offer night and selling the property right then and there. So even with a low level of risk that the buyer wouldn’t show up with the deposit on Monday, that risk had to be factored in.

I told the agent, “Your offer is great, but you know I have to call the other agent and let her know that she’s competing. She may want to improve, she may not.”

He understood, and said that his clients were maxed at this price and knew that the other offer might “come back in over the top,” but that he would stand by and wait.

I sent the agent with the $1,507,000 offer packing, and then I called the “first horse to the trough,” with the $1,600,000 offer.

I told her, “There’s another offer and it’s extremely competitive. I don’t want to grind you and the buyers, nor do my sellers and I want to seem greedy but do you want to improve your offer?”

She said yes.

Any good agent would.

She submitted her offer predicated on the idea that she was not competing. Once another offer is registered, regardless of the terms and conditions, I have to notify her. What she does after that is up to her. However, an agent in my position can say, “You’re going to want to improve, trust me,” and be aloof. Or, say, “You’re beat, the other offer is higher.” Again, there are no hard-and-fast rules here, only that an agent in my position cannot disclose the terms and conditions of the other offer.

In this case, because she was the first person to offer, I feel a sense of duty to allow her to improve, but I choose not to say, “The other offer is higher,” merely that the other offer is extremely competitive. I do this because it’s not fair to the agent who submitted $1,615,000.

A half-hour later, she came back at $1,630,000, and with the deposit cheque in hand, and being the “first bully,” my sellers decided to accept her offer.

The agent with the $1,615,000 offer was incredibly gracious in defeat. I don’t recall an agent so pleasant, in fact. He told me that his buyers were tapped out and that they wouldn’t go higher, and said, “Classy move by your sellers. The other buyer agent has a deposit, they have us beat on price, and they were first. I totally understand.”

It doesn’t always work that way. Most losing agents complain about something. They just have to. But this agent was classy and professional, and I look forward to working with him again.

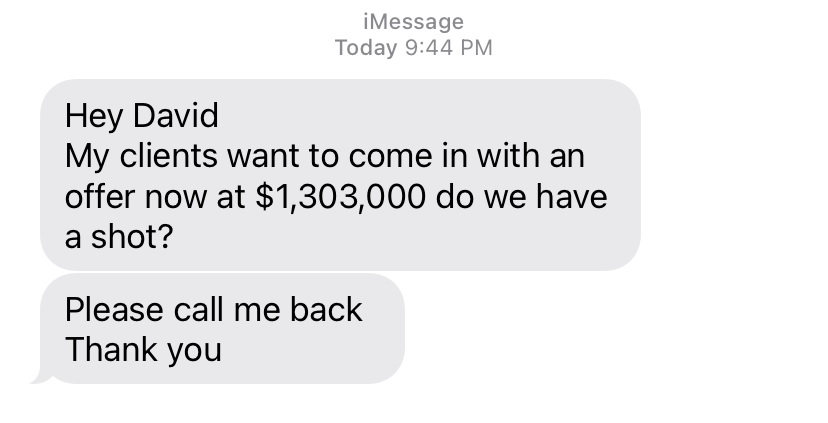

As soon as I hung up with him, I got this text message:

Waiting almost four hours to get in touch is one thing, but underestimating the market value of the house to that extent is another thing altogether.

I know some of you may come to his defence and say, “You told us that you valued their house at $1,275,000 on paper, and felt it was worth $1,350,000, or upwards of $1,400,000 back in January, so what’s wrong with this?”

Well, it’s April.

And it’s a bully offer on a Saturday night at 10pm.

I called my clients and congratulated them, and by 10:15pm, we had a completed Agreement of Purchase & Sale.

They were lovely. So grateful and thankful, both of my time and my wife’s!

“Sorry to ruin your Saturday night,” they said in a text. “Go save what’s left of it and enjoy!”

I wrote back, “Don’t worry, the only thing I missed out on tonight was a Grey’s Anatomy marathon that’s currently going on in the master bedroom, and this was much more fun!‘

Real estate spouses understand. This is literally a whole other blog post, but behind every successful real estate agent is an incredibly understanding, patient, and supportive spouse.

My wife was asleep by the time I went upstairs, so I did what any man in my position would do: I poured a scotch and sat down to re-organize my 1952 Parkhurst hockey card set, from numerical order to highest-to-lowest grade.

The next morning, I felt amazing about the price we got.

It was nice to see this message from an agent who had shown the property earlier in the week:

In the end, I can’t say that the house wasn’t “worth” $1,630,000, since there was a runner-up at $1,615,000.

There have been times in the past where one buyer absolutely blows everybody else out of the water. One of these instances, in fact, I will write about in a couple of weeks once that deal closes. Oh, it’s a doozie, folks! It’s going to blow the lid off real estate and calls for the “open bidding system” will be louder than ever! But let’s shelve that for now…

This house was probably “worth” $1,350,000 on January 1st of this year. What it would have sold for is anybody’s guess. Had I listed this house for sale on January 1st and taken offers one week later, I would have loved to top $1,400,000.

By April, that number that I would “love to top” was up $100,000, or about 7%. I don’t know that the real estate market had risen by 7% overall, or in the freehold market, or in this location, but I do believe that 3 1/2 months, the potential sale price of this house was up by $100,000.

To get $1,630,000 for this house is one of the fluffiest feathers I’ve stuck in my cap in a long time. Another colleague of mine told me during the week, “I can see you wanting to get $1,500,000 for this place for sure, but $1,550,000 is, like, your ‘fuck yeah’ price, in a sense that $1,600,000 would be, like, your ‘what the fucking fuck’ price, ya know?”

What the fucking fuck. I don’t know if a professor at Harvard Business School could have said it more eloquently.

So what then is another $30,000 on top of that?

It’s really, really tough for buyers out there to try and determine what is “reasonable” in this market. But no matter what price is paid, if you’ve got somebody right behind you, $15,000 back, you can’t doubt what you paid, because you weren’t alone.

The cynics will suggest that it should take an army of buyers willing to pay the same price to make that price reasonable, but I disagree. Because for every property with multiple offers, there will always be what I call “born losers.” These buyers will always offer a price that is certain to lose, sometimes because they’re wishful, sometimes because they’re naive, sometimes because they have poor representation, but always because they’re not real buyers in this market.

If you have ten offers on a house, there’s going to be the winning bid, one or two that just lost, and then everybody else. Cynics can’t argue that the “true value” or a “reasonable price” is the price that would be paid by everybody.

I’m happy as hell for my clients who sold their home for a ridiculous amount of money, but I’m also happy for the buyers who just beat out another offer, and who are going to move into an absolutely beautiful home in two months, in a wonderful community, surrounded by other growing families.

What an ending!

Oh, and by the way, who did shoot J.R. Ewing?

And if anybody reading this spent eight months in 1978 waiting for that cliffhanger to end, can you tell the rest of us what it was like?

jeanmarc

at 7:49 am

Congrats to the buyers. I am sure they are relieved. My beef here is how would any serious potential buyer know the ceiling for a home given the list price? The blind bidding makes it even more irrational in this market.

jeanmarc

at 7:56 am

Kudos to the sellers (and David) for getting that kind of money for a semi on a busy street. I would be on cloud nine myself.

Jeff316

at 1:03 pm

Any serious potential buyer sets their own ceiling based on their needs, finances, and circumstances.

Appraiser

at 8:27 am

The pace of sales in April has accelerated to 597 per day from 550 earlier in the month.

For perspective, sales in March were an all-time high of 504 per day.

Preliminary monthly sales data to April 23, 2021: 10,008 Freehold & 3,732 Condos.

For a total of 13,740 sales in 23 days!

Condodweller

at 9:11 am

Congrats on the deal! Considering how hot the market has been I guess $350k over isn’t that bad.

I just can’t get over these prices considering I’ve been around long enough that 1.6 might have bought you a house on the Bridal Path but most likely in Forest Hill in the 90s (it’s not important enough to look up).

You mean 1988? My parents were watching Dallas in the 80s. It’s funny how I remember irrelevant details but I think it was on Thursday nights with Dynasty. Maybe I remember because my family “only” had one TV and that was the one night I couldn’t watch TV. BTW, sometime did make a pretty good dance version of the Dynasty theme music.

Ed

at 9:18 am

A great number for that street no doubt. But I’m not entirely shocked considering what a comp sold for 2 streets away only days before. The comp was on a better street but IMO your clients’ house was nicer.

Seeing that the comp sold for $1.66 did this raise your sellers’ expectations?

J G

at 9:49 am

Google broke $2400 USD today after earnings, almost 10-fold increase over the last 10 years. Was this house only worth 163k 10 years ago?

Amazon is coming up tomorrow, currently $3450 per share, rumours of 25 or 30 to 1 split 🙂

Condodweller

at 11:20 am

That’s easy to say with 20/20 rearview. What’s the 10y average return of your portfolio? People like to conveniently leave out their losers when they brag about their winners. I’m having a sense of deja vu here, I think I said something to this effect to a similar post of yours before.

I had a colleague who took a 50% loss on google about 10 years ago. I have been saying since about $400 that I need to get some and I finally had an order in a few years ago for $1000 when it pulled back from $1500 to $1000 and I missed it by a few $$.

BTW are you using 20x leverage because if not, RE still has not been a bad bet. Anyhow, I don’t think you are going to convince appraiser to sell his properties and buy google.

Chris

at 11:34 am

If we assume J G’s portfolio is relatively similar to the NASDAQ composite index, the 10 year return has been ~390%. For GOOG specifically, it’s ~786%.

If we’re discussing real estate in the context of an investment, the maximum leverage is 5x. TQQQ is a 3x leveraged ETF following the NASDAQ 100.

I don’t think J G is trying to convince appraiser to sell his properties. His point, as I take it, is to highlight other assets that have outperformed Toronto real estate. And you typically should compare investments to alternatives. If you have a mutual fund that went up 5% but the overall stock market went up 10%, would you be happy with your returns?

Anyways, this is somewhat similar to the point I’ve raised; what we’re experiencing is widespread asset price inflation, presumably as a result of wildly loose monetary and fiscal policy. Whether you own real estate, stocks, bitcoin, NFTs, rolexs, whatever, they all have shot up in value.

DDofG

at 8:36 pm

Anyone over let’s say 40 years old who has a portfolio resembling the NASDAQ is taking on oodles of risk. And why are we all assuming that stock pumpers tell the truth about their investment gains? Geez, even your best friends are bullshitting you.

J G

at 11:41 am

What is the overall return on a RE investment including all carrying and transaction cost? Mortgage interest, property tax, insurance, repairs, renovation, utilities, land transfer tax, and of course good old realtor fees.

With stocks all I have to pay is the $7 each to buy and sell.

My portfolio is mostly concentrated on FAANGs, Canadian banks, and ETFs like XSP.TO. I don’t use leverage.

jeanmarc

at 12:04 pm

It’s called diversify. I used the stock market to build up my “equity” back in the late 1990s and bought my first property (almost outright). Then went from there. There is also a saying that a home is a liability until you sell it. But we all need a place to live.

jeanmarc

at 12:20 pm

Stock splits are always never positive as it increases the number of shares. AAPL took a hit since last fall’s split and only recovered in the past month after another dip down to $116. Long term is good but I would reduce my position once it pops and then get back in at a lower price. I am sure you are aware 🙂

Condodweller

at 12:21 pm

Mine has been about 300%/year with about $150,000 so far in expenses using a $650k selling price currently which of course goes down each year as the overall return has to be divided by the increasing number of years. Keep in mind that the expenses are deductible.

Geoff

at 1:05 pm

I don’t remember JR but I do remember waiting an entire summer to learn if Captain Picard was going to be a borg forver.

Marty

at 3:27 pm

I don’t rally recall the deal here either, if truth be known. It was 1978.

I mean, I remember the hype, but my parents at the time used to say “we don’t watch soap operas in the daytime, we are certainly not going to watch them at night”.

But then I think mom watched Falcon Crest (1981-90), so seems they changed their tune. Plus Lorenzo Lamas was pretty handsome.

Libertarian

at 1:22 pm

I said this the last time you wrote about this and I’ll say it again now….What prompted someone to bid $1.6 for this house? Did their agent suggest it? If you think most people will bid around $1.4, why are you going over by $200K?

And why does that second agent suggest to their buyer to go over that bid?

I get it that people don’t want to lose, but people are throwing around money like it’s monopoly. Must be nice to have that kind of money lying around.

As someone mentioned the other day, when will the banks say no to one of these deals? The CEOs are telling the government to do something, but their mortgage departments are letting this happen.

jeanmarc

at 2:21 pm

You mean, in stock market terms, who will be the “bag holder” when the RE market goes south?

Libertarian

at 3:38 pm

No, nothing about a crash. I don’t think there will be a “crash”.

It just seems that people now expect prices to go up forever and interest rates to stay low forever, so they don’t care if they’re overspending on a house. Using this example, the buyer thinks – “let’s pay $1.63 because in a few years it’ll be worth more anyway. ”

That’s a huge risk to be taking on. Why not start your bidding at $1.45? Don’t you want to save yourself 200K? Couldn’t they have gotten a better house for $1.63? Everytime this happens, it becomes the norm, so now everyone is going to bid $400K over? Sellers should increase their list price because buyers are coming in so much higher – who cares what the comps are.

And the last thing, I asked this of David last month, if he represented a buyer for this house, would he have told his client to bid $1.63?

jeanmarc

at 5:04 pm

As a buyer, you need to ask yourself what is reasonable and how much you are willing to pay.

Winners:

.banks/lenders

.real estate agent commissions

.real estate lawyers

Losers:

.the buyer who has to pay that $600K-$800k+ mortgage (good luck paying that down – 40+ year mortgage/sell your soul??)

If people don’t think that the RE prices are way over inflated now, I guess they have lots of monopoly money available.

jeanmarc

at 5:09 pm

Winners (cont.)

.MPAC

.Ontario Gov’t (land transfer tax)

.Municipal Gov’t (land transfer tax) – double for the 6ixth

Sirgruper

at 12:22 am

Real estate lawyers get paid the same generally whether it’s 1.4M or 1.6M. Too many lawyers working on volume.

JL

at 9:33 am

That might actually be a pretty good test of whether a property is “overpriced”: would David (or any selling agent) have recommended that their hypothetical buyer pay the price they obtained as the seller.

At some point, supposedly, the advice would be “pass on this one, there are better deals out there”.

Marty

at 3:20 pm

Bravo!

OK, my take-aways:

**This is literally a whole other blog post, but behind every successful real estate agent is an incredibly understanding, patient, and supportive spouse.**

As a never-married single male quite a few years older than David, what’s left for me, do you think?

**My wife was asleep by the time I went upstairs, so I did what any man in my position would do:**

Now, don’t get me wrong, my mind did not go to anything weird, or racy, and certainly not obscene. But this line did have me captivated for a second.

This was a very good 2-part column, David.

jeanmarc

at 10:52 pm

Given the hot RE market, increased complaints to RECO.

https://ca.yahoo.com/finance/news/bad-things-happening-ontario-real-080000554.html

Keith

at 1:10 am

The real estate agent has a fiduciary duty to get the highest price for the seller that they possibly can. Of course, then the seller becomes a buyer, and the tables are turned in a hot market. Imagine selling in good faith, then losing out in bidding wars while the market passes you by. Risky business.

Condodweller

at 9:23 am

This is true. Having said that though, I think the industry, or the regulatory body rather, needs to somehow work ethics into the equation.

Linda

at 9:58 pm

Wait this was all done within 15minutes? with deposit cheque?

Re: a bully offer on a Saturday night at 10pm.

I called my clients and congratulated them, and by 10:15pm, we had a completed Agreement of Purchase & Sale.

Linda

at 10:17 pm

Nevermind found part 1.

So counter offers given 7 hour period.