Yes, you read that correctly.

There are an eye-popping 96 units for lease at 21 Widmer Street, in a building with 445 units, where all the units might not even be completed yet, and where many “investors” aren’t even bothering to put the properties up for lease.

22%. Good Lord.

Does this high represent a new low?

I look forward to reading Carolyn Ireland’s excellent real estate recap in every Friday’s Globe & Mail, and while this week’s column was yet another “story from the trenches” about a young couple having a tough time buying a house in competition (isn’t every story these days about the same young couple?), the most interesting part of the column was Christopher Bibby noting that 87 units were for lease at Cinema Tower.

EIGHTY-SEVEN!

As soon as I read this, I logged on to MLS and searched for 21 Widmer Street, and to my elation, that number had increased……to 96.

I don’t know if there’s any sort of “record book” for real estate, be it record highs, or record lows, but I would probably be willing to bet money that no condo in the history of Toronto has had 96 units for lease at any one time.

NINETY-SIX!

For those of you that don’t know, “Cinema Tower” is the second phase of Daniels Corporation’s plan to snob-up the corner of John & Richmond.

When phase one, “Festival Tower,” was being pre-sold, my sarcasm meter was at an all-time high. I hated everything about this project, and everything it stood for, and I still do.

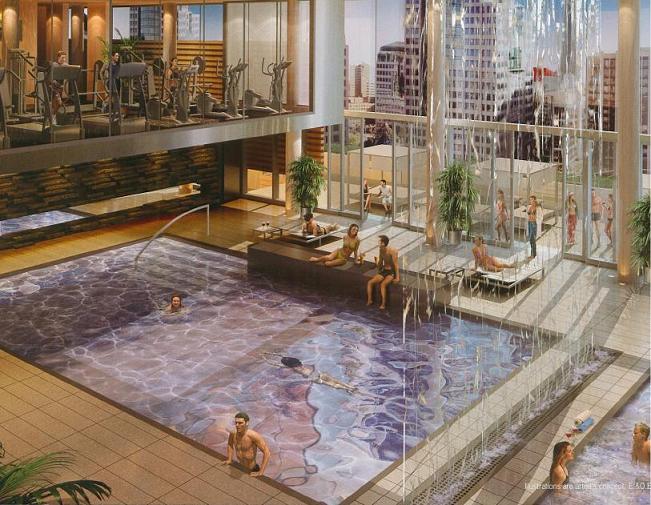

In one of my favourite posts of all time (if I might be so bold as to pick a favourite of my own), back in 2009, I took a look at some of the marketing in the brochures for Festival Tower, such as the pool scene below where everybody is model-good-looking with perfect bodies, and undeniable sex appeal:

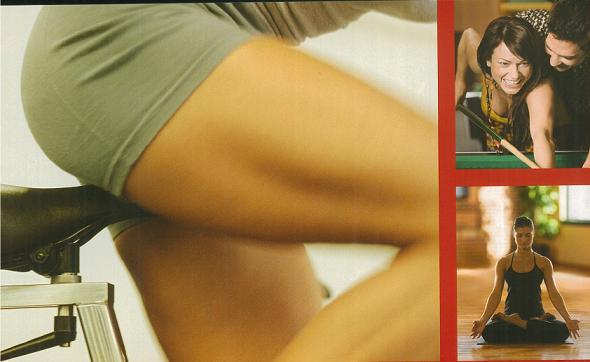

And if you want something less suggestive, and more obvious, here is a look at the people who were obviously going to live at Festival Tower:

Soooooo……let’s see here – great legs, a hot ass with a pointy bicycle seat jammed up it, a girl with her right boob falling out of her dress, and then a yoga chick who isn’t of the “thighs rubbing together” variety, a la LuLu Lemon CEO, Chip Wilson.

I get the message loud and clear: “Hey guys, wanna buy at Festival Tower?”

And that’s just a scanned version of the brochure! The real brochure for Festival Tower basically had sex with you…

Anyways, read 2009’s blog post HERE. Trust me, you won’t be disappointed…

My point to all of this is that “sex and marketing” have been joined together in holy matrimony since the dawn of time, but I believe it peaked with Festival Tower, which was also greatly influenced by the allure of “high society.”

To steal from my 2009 post again, let me detail just ONE of the many, many “scenes” they had outlined in their marketing material:

Handsome, 30ish, investment banker awakes in his king-sized bed at Festival Tower to the sound of his alarm clock. he bolts upright and punches his speed dial to the Resident Services Director. “Dana? Can you have the restaurant send up coffee, eggs over easy, and a multi-grain roll?” He hangs up and dials the doorman. “Hello, Sylvio. I’m running a bit late this morning. Can you have my car in front by 8:30? Great. Thank you.” One more number, “Hey, George. My double-breasted blue suite, is it ready?” I need it tonight. Perfect. You can leave it with the concierge and I’ll get it later. Thanks.”

What BS.

And you know what? It worked!

The first people who bought at Festival Tower made $100K on paper once the second release took place. It was those who bought late in the game (isn’t it always?) who ended up scrambling to break even.

And that brings us to “Cinema Tower,” which was about as obvious a Part II as the movie “The Hangover” once it took in $50M the first weekend.

Now if you read my blog regularly, you know I believe that there hasn’t been any money to be made in “investing” in pre-construction condos since the mid-2000’s. Once you pay your ridiculous (and often hidden) closing costs, your land transfer tax, your occupancy fees for when your unit is finished but the building isn’t, your cost of ‘upgraded’ finishes, your legal fees, and eventually your Realtor fees, there isn’t a lot of money to be made, unless the market goes up 12% per year.

So what are people looking to sell their units for at the new Cinema Tower?

Oh, you know – just a mere $1,000 per square foot, without parking and locker.

That’s right, try a 539 square foot, 1-bedroom condo for $539,900.

Is it just me, or does it smell like paint thinner and airplane glue in here???

What the HELL are these people thinking?

And by “these people,” I guess I mean anybody that had anything to do with this project, and those that continue to proliferate its existence.

If I had a client come to me today and say, “David, I’m looking to buy a tiny 539 square foot condo, and I really like this place at Cinema Tower for $529K,” I don’t even know where I would start with that person. The reprogramming could take days.

Because what many, many people seem to be missing here is that there really, truly isn’t anything special about this condo. It’s just ANOTHER CONDO.

The value proposition in Toronto has been completely thrown out the window. When the allure of high society, shapely-bicycle-bums, and sexy pool parties begin to take precedence over logic, reason, and proper valuation, then we end up with something like Cinema Tower, and even its older brother, Festival Tower.

What is so special about these buildings that they’re worth almost DOUBLE what you can get next door, up the street, or down the block, figuratively speaking?

The toilets aren’t made of gold or anything.

Even if the finishes were something out of a Bridle Path estate, I still can’t comprehend $1,000/sqft in this market.

The whole thing makes no sense.

And the fact that 96 units are for lease is telling us something.

It says that these 96 people are ALL investors, who purchased the units in pre-construction, with illusions of grandeur in their heads. If they weren’t investors, and were users, they’d be living in the units, and not offering them for lease.

There’s also dozens of listings on Craigslist and Kijiji, some duplicates, and some new.

So once the units are finished, and the “occupancy phase” is entered into, the investors can either leave the units vacant, and lose money each month when they pay the building an “occupancy fee,” or they can try to recoup that money by leasing the units out.

I’m willing to be that 80% of this building was bought by investors, and that number might be low.

My wife’s cousin’s boyfriend (say that three times fast…) is in commercial real estate, and the other night at dinner, I asked him, “What percentage of units bought in pre-construction in the downtown core in 2013 would you say were bought by actual end-users?”

He said, “Probably 10-15%.”

So now you have an opinion from a residential agent, and a commercial one, and I’m wondering if the 96 people who have their units for lease right now at Cinema Tower ever stopped to think about how much competition they’d have when it comes time to resell the units.

When this building gets registered, what if there are 150 units on the market? What then?

It would be just like it is now – when there are fourteen units listed for lease at $1,800. Take your pick, if you’re a potential lessee. You have all the leverage.

And just to throw another log on the fire here – David Mirvish and Frank Gehry want to construct three 80-storey condominiums next door, and bring 3,000 pre-construction condos to market. I shudder to think about the prices they’ll ask for in pre-construction, but if we’ve learned anything from Cinema Tower, it’s that there will probably be a lineup of people with chequebook in hand…

AndrewB

at 7:52 am

I actually think, crazily enough, that the Mirvish project won’t sell. There are a lot of projects in Toronto that aren’t selling. I myself went with resale because I wanted to see what I was buying, and pre con was ridiculously expensive. I’m sure I’m not alone here. I’m trying to picture how 80% of the units will be sold and secured to start building.

Joe Q.

at 9:27 am

Going on the “public MLS” (realtor.ca) this morning and mousing over 21 Widmer St gives me 120 listings (for sale or for lease). Rents seem to go for around $2-$3 per sq ft per month. Even looking at the optimistic case ($3 per month / $36 per sq ft per year) at $1,000 per sq ft purchase price gives a price-to-rent ratio of about 27. One wonders why anyone would buy. Of course, “things have changed” etc.

I also noted that many (or most?) of the listings use images from the condo brochure. Photos of the actual units seem to show them vacant.

Darren

at 9:51 am

This is a perfect example of what’s wrong with the market in Toronto David. I believe that the correction on condos is going to be quite painful for many people.

I built the sales office for a place near where you are talking about (I forget the name of it) and before we even finished the sales office they had a VIP event for investors. We were told that they sold 80% that day. I saw the results of stuff like this in the early 90s and it’s looking like a repeat.

BillyO

at 10:00 am

The ‘investors’ that used to buy then flip seem have switched it up and now buy then rent out for a bit and reevaluate selling afterwards. Most of the agents that’s specialize in pre con are advising this approach for their ‘investor’ clients. I suspect we will see more of situations like this where there are a ton of leases up rather than so many units up for sale.

Joe Q.

at 10:45 am

The question is whether their units are getting rented out, and if so, for how much? If not, do they even care?

David, any way of finding out whether these units are actually getting leased, and if so, whether the owners are getting their asking “rent” or not? What is the average DOM for these rental listings?

Mike

at 11:09 am

update: its now 119 for sale or lease

FroJo

at 11:45 am

Yup, lifestyle porn sells (not being condescending, for it works on me too). Reminds me of that Gene Hackman line from The Firm: “I used to Caddie for young lawyers off from work on weekdays… and their wives. I’d look at those long tan legs and just knew I had to be a lawyer. The wives had long tan legs, too.”

FroJo

at 2:27 pm

David, I just read your badass 2009 piece. Brilliant!

Tom Smith

at 5:25 pm

TD Bank just lowered the boom on its mortgage clients and that pretty much tells you what they think of this real estate market in Canada. Especially condos.

http://www.mortgagebrokernews.ca/news/td-mortgage-clause-change-176155.aspx

Alex

at 2:05 pm

Why do people pay $1000 for a handbag or purse when they could buy the same thing for $30 minus the designer label? Some people are just dumb.

AndrewB

at 7:33 am

The irony is if you don’t “look the part” everyone will think your bag is fake anyways lol.

Floom

at 2:22 pm

After reading this article, I have shorted Toronto’s condo market. I did this by digging a giant hole – a negative condo.

David Fleming

at 11:01 pm

@ Floom

I have to admit – that was witty! Made me LOL, as I sit here, with my dog…

Paully

at 2:37 pm

When reading articles and stories like this one, I have to shake my head and wonder how the real estate bulls can continue to ignore the build-up of condo inventory in the city. I don’t see how this could be positive, and there has to be a day of reckoning for valuations. As an investor, you may have deep pockets and be willing to wait for your rent or sale price. Unfortunately, the price that you get will ultimately be influenced by how willing your neighbours are to hold their line on price/rent. The most desperate vendor sets the market bar lower, just as the most desperate buyer in a multiple-offer sets the bar higher. So everyone doesn’t have to panic, if only a few there goes your valuations. The only unanswered question is “When?”

Rob Fjord

at 4:31 pm

brochure not too far from the truth, toronto condos are filled with single ladies who couldnt resist the nest building urge. condos around liberty village are pretty good pick up grounds.

Paully

at 9:32 pm

On the topic of marketing, I recall a Seinfeld bit where he says that there are really only two messages in modern advertising:

1) Use this product/service, and you will look like a bikini model

or

2) Use this product/service, and you will get with a bikini model

Pretty much sums it up.

WEB

at 12:02 am

All those foreign investors better get their condos sold in TO before the Canadian dollar drops to the 70s…. Hmmm….what happens when all the hot money gets the hell out of dodge…..

lui

at 11:14 am

You would have think since there is more condos flooding the pre construction markets and less suckers,opps I meant buyers builders would tend to above the rest and have fit and finishes and actually have a livable condo during the PDI but no its the same crap thats been going on for a decade where owners who move in during the preoccupancy phase have to deal with unfinished amenities,workers and construction materials everywhere and BS from property management.

Cliff

at 10:41 pm

The resale prices in this condo are actually more expensive than if you bougnt through the builder. Outrageous.

hank

at 2:58 pm

Reading this now, a year later. How are things looking for all you guys?

Amazing how smart people feel by being pessimistic.