It’s been a while since I’ve talked about commission, and since it always produces a spirited debate in the comments section, and is often viewed as controversial, I figured it would make for a fun day.

But more importantly than that, I know there’s a lot of confusion and misinformation floating around out there specifically about the intersection of agency and commission.

So let me present a few questions and/or comments I often get from buyers and sellers, and without trying to antagonize anybody, or solicit dissenting opinions, simply explain how agency and commission intersect in these situations…

I’m sure we could come up with a dozen examples of questions, comments, and/or scenarios involving agency and commission.

But these are the ones I’ve encountered the most so far in 2018, so let’s take a look.

–

“I don’t have an agent, and I want to make an offer on this property. But I don’t want to pay the 2.5% commission.”

I’ve heard this line, and I’ve seen this situation, several times before.

The public will see this as a slam-dunk, I’m sure.

If you’re a buyer, and you have no agent, either because you’re conducting your own search, or you are deliberately setting out to purchase through the listing agent, you believe that you are entitled to a 2.5% discount on the price, and/or the listing agent should, or for some people – is obligated, to “throw in” 2.5% of the commission.

In reality, that’s not how things work.

A seller signs a Listing Agreement with the Brokerage, and an overall rate of commission is established.

Then, a second section of the Listing Agreement specifies how much, if any, commission will be paid to a cooperating brokerage. This, of course, is based on the old days when brokerages didn’t cooperate with any other brokerage. They sold everything in-house. So when the idea of a “buyer agent,” and/or a “cooperating brokerage” came along, it was important to specify whether or not the seller was, a) cooperating, b) paying a cooperating commission.

The Listing Agreement is a contract, bear in mind. With two parties privy: the seller, and the listing brokerage. Keep that in mind for later…

So when an unrepresented buyer shows up and says, “I don’t have an agent, I’m not paying the ‘other’ 2.5%,” that buyer is incorrect, first of all, since buyers don’t pay commission. I know, I know – you’ll suggest that they do, through the seller. But for all intents and purposes, and legally speaking, the buyer doesn’t pay.

But secondly, if the buyer says, “I refuse to make an offer unless that 2.5% is subtracted from the total,” then they may very well just not make the offer.

The seller and listing brokerage have formed a contract, say, at 5%. The buyer cannot unilaterally change the terms of that contract.

Can the listing agent waive part, or all, of the 2.5% earmarked for a cooperating agent? Absolutely.

But the buyer has no “right” or no ability to “force” the listing brokerage to waive part or all of that commission.

Now here’s where things get fun.

Every so often, I get a call from a really smart person, usually a lawyer, who says, “I’m going to draft my own offer, and I want you to submit it for me.” Of course, I’ll ask if they want to be represented as a “Client” or a “Customer,” and usually suggest that they choose “Customer,” as I don’t like multiple representation (and because to be honest – these people are never successful in their offers and I don’t want to be on record as giving them “Client” advice, because they always cry foul when their offers don’t win).

These smart people often put a clause in their offer that says something to the effect of, “The Listing Brokerage agrees to reduce the commission payable to the seller by 2.5%+HST.”

And I sigh.

Because so often, these smart people will say, “I’ve bought and sold tons of houses this way, I know what I’m doing, yada, yada.”

And then I have the thankless task of calling them to say, “You do know that, legally, you can’t contract out of a contract, right?”

Other agents get snarky. “What law school did you go to? Didn’t they teach you basic contract law at University of Arizona Online?”

But the bottom line for me is, a seller and a listing brokerage have a contract, and a third-party cannot unilaterally change the terms and conditions of that contract.

As for what I would do in this situation, personally, I’ll come back to this.

But for the people out there that think they have a right to submit an offer through the listing brokerage, and “save” 2.5% in commission that they believe would go to their buyer agent, if they had one, this situation is not as cut and dry as they might think.

Having said that, every buyer is free to try to negotiate with the listing agent and/or listing brokerage. I’m not saying that an agent won’t alter the commission.

But I will say that I have never received a competitive offer from an unrepresented buyer, looking to save commission. They’re usually the ones offering 7-10% under the list price, in competition…

–

“I only want to make the offer through YOU, the listing agent.”

I hear this a lot, and it’s somewhat tied to the situation above.

I had a listing a while back, for which the seller did not want to engage in multiple representation (I’ll cover this below).

So an unrepresented buyer called me and said he wanted to make the offer through me, and I told him he could make the offer through a colleague I’d refer.

He said, “No, I will only make the offer through you, because I want to save 2.5% in commission.”

I told him that there would be multiple offers, and I would never seek to “double-end” one of my own listings, and that commission hadn’t entered my thought process.

He told me, “It’s the only thing entering my thought process.”

As an aside, I think you’re better off overpaying for a house you love, than underpaying for a house you don’t. So if 2.5% is going to make or break an $800,000 or $2.5 Million decision for you, I think you’re on the wrong track. But I digress.

I told this buyer, “Go and find an agent; any agent, who isn’t me, and have them present the offer for you.”

He didn’t like this suggestion, because he said, “Then that agent is going to want the commission!”

It’s a similar situation to what I described above. The buyer was adamant that he save the commission.

Now does he have a right to make the offer through the listing agent? No.

Does he have a right to make the offer through the listing brokerage? Yes.

He can, in theory, have the Broker of Record (or manager) present an offer on his behalf, with whatever terms and conditions he wants. He can’t demand that the listing agent him or herself prepare the offer, and represent him.

Now this is where “Client” and “Customer” definitions come into play.

A colleague of mine recently had a situation where a woman wanted to submit her own offer, but kept insisting that the listing agent reduce his commission by 2.5%. She said her offer “reflected this,” albeit this and another $150,000, but that’s because she was out of touch, as these smart folks often are.

My colleague told her she had to sign a Buyer Representation Agreement, either as a “Customer” or a “Client,” and explained both to her.

She chose “Customer,” which meant that the listing agent wasn’t providing any service to her, and she was not a client.

When her offer was rejected, she emailed him and called him constantly, asking what she should to do strengthen her offer, where her offer stood, etc.

He simply told her, “I can’t speak to you. I represent the seller. You made an offer as a Customer. It breaches REBBA rules for me to speak to you.”

She didn’t listen.

Literally days of phone calls and emails, messages left with front desk. “What if I came up $60,000? TELL ME!”

The listing agent sold the property to another buyer, represented by a different brokerage. And yet, she continued to pester him for days thereafter.

This wasn’t about commission, on the listing agent’s part. This was about representation, and fiduciary duties to the right party.

I’m still waiting for her to file a complaint, as these folks often do.

But just consider when you ask for a certain type of representation, you’re going to get it.

–

“As a seller, I refuse to be involved in multiple representation, dual agency, or whatever you want to call it.”

Great. No problem.

Except, it’s not that simple.

Recall that in 2017, there was a lot of talk about “banning” multiple representation, because governments love to intervene in free markets.

At the time, I wrote the following blog post:

“Ban ‘Double-Ending?’ Or Introduce ‘Designated Representation?'”

As is often the case, I think that instead of having the government step into a free market and tell consumers what they can and cannot do, it should be up to the consumer to decide.

I suggested that the Listing Agreement should be edited and updated to include the following:

1) I hereby give my consent for my agent to engage in multiple representation at the brokerage level.

YES ________ NO ________

2) I hereby give my consent for my agent to engage in multiple representation at the agent level.

YES ________ NO ________

It’s so goddam simple, that it bothers me.

It bothers me that this has never really been discussed, and probably won’t be. But I digress…

“Multiple Representation” exists at the brokerage level. If John Smith of ABC Realty has a listing, and Kate Jones of ABC Realty brings an offer on behalf of a buyer-client, this is Multiple Representation. Now if John Smith brings an offer on his own listing, it’s still Multiple Representation.

REBBA doesn’t distinguish between Multiple Representation at the brokerage level, versus the agent level.

And I think that is a major mistake.

The concept of “double-ending” for the most part applies to the listing agent providing a buyer to his or her own listing. Most people don’t care if the buyer-agent is another agent, registered with the same brokerage. In fact, some brokerages have thousands of agents. So how can you “ban” multiple representation? I’m getting off topic here…

To the point – a seller does not want to engage in “Multiple Representation,” is this possible?

Yes and no.

A seller can tell his or her listing agent, verbally, “Do not bring me any offers from you, personally.”

But is there a place in the Listing Agreement where this topic is covered?

No.

Now, if an unrepresented buyer calls the listing agent and says, “I want to make an offer on your listing,” can, or should, the agent refuse?

Here’s where it gets tricky.

The listing agent has a fiduciary duty to the seller. So how is rejecting a potential buyer, out of hand, acting in the best interest of the seller?

I suppose this raises the question, “Can the seller opt out of his own best interest?”

Who can decide best interest at this point?

What if that unrepresented buyer wanted to make a spectacular offer?

It’s a grey area. Completely contradictory.

The listing agent has to listen to his seller’s instructions, but also has to act in his seller’s best interest, and in this case, those seem to conflict.

–

“As an agent, I would n-e-v-e-r show properties to my buyer clients that aren’t paying a 2.5% commission.”

Well, you’d better!

Otherwise you’ll be disciplined by RECO, and for good reason.

Call me naive, and tell me this is sappy if you want to, but in order to be successful in this industry long-term, and have a career, you need to consistently put the interests of your clients first. You must always think about them, before yourself. You must do what’s right for them, and trust that in the long-run, what goes around, comes around.

Not every agent thinks that way, but not every agent makes enough to actually live on.

In the Real Estate Business Broker’s Act (REBBA 2002), there is a Code of Ethics.

Section 19 details the following:

Properties that meet buyer’s criteria

19. If a brokerage has entered into a representation agreement with a buyer, a broker or salesperson who acts on behalf of the buyer pursuant to the agreement shall inform the buyer of properties that meet the buyer’s criteria without having any regard to the amount of commission or other remuneration, if any, to which the brokerage might be entitled. O. Reg. 580/05, s. 19.

I think it’s worth noting that there is a specific section of the Code of Ethics that deals with this topic, meaning it is an issue.

If a buyer is hiring an agent to look out for his or her best interests, and show that buyer properties that meet his or her criteria, then that agent must show the buyer all properties. End of story.

Regardless of the seller, listing brokerage, location, commission, or even circumstance (ie. something like, “I don’t want to show that property to my buyer because I have to pick up the keys way out at the listing brokerage in Mississauga”).

What happens if the agent does not comply?

Well, then that agent could be disciplined.

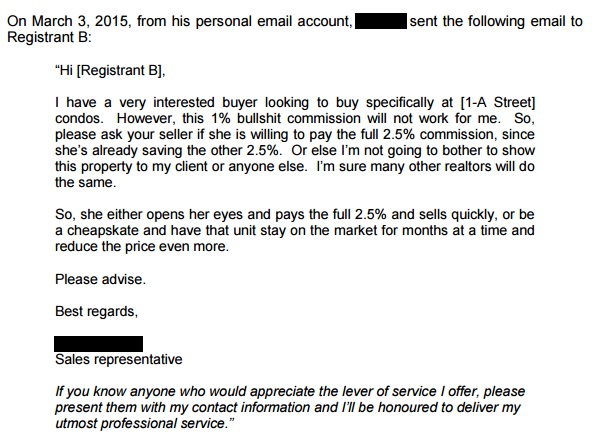

Here’s a Real Estate Council of Ontario (RECO) Discipline Decision.

All discipline is available to the public, FYI.

Putting this in writing is clearly a poor decision by this agent. It’s mind-boggling how somebody could do something like this, in today’s day and age.

But the irony of this agent’s footer – suggesting “utmost professional service,” should also be noted!

This agent was fined by RECO, not only for refusing to show the listing, but also for six other RECO violations, about abuse and harassment, language, professionalism et al, which are all basically the same thing. RECO often operates in the same way a Grade-6 student does a book report; take a section of the curriculum, and look for an application in the text. But that too is a topic for another day…

So what can an agent do, in a situation where he or she doesn’t want to work for the specified commission?

Well, there are OREA forms to address that.

Do you know those discount brokerages that offer $1.00 in commission on MLS? That’s how much the brokerage is offering in commission. The listing will say something to the effect of “Seller May Be Willing To Offer Up To 2.5% Renumeration. Use Form 202.”

So if you’re a buyer agent, go for it. Use Form 202.

But do not refuse to show the property to your buyers!

I’d be remiss if I didn’t put in one more word on this topic – to the sellers who feel they are “saving” money by not offering a buyer-agent commission. I know you already don’t like what I’m saying, but that’s just how it is.

A few weeks ago, I showed a property to my buyer clients that was offering $1 in commission, but whereby the seller was offering “up to” a 2.5% commission.

The property was priced well below fair market value, with an offer date.

But that was the wrong strategy to have in this case!

On offer night, I had the only offer. Even though this property was well, well under fair market value, I still was the only agent to come to the table.

Many buyer agents are afraid of dealing with FSBO’s, “Mere Postings,” or discount brokerages. Either because they’re afraid of not getting paid, or afraid of not getting paid their definition of a “full” commission, as per the agent above who was disciplined.

This strategy blew up spectacularly in the seller’s face. And for the life of me, I have no idea how he or she could have thought it was a sound, logical strategy.

–

“I’ve included a clause here that essentially says before closing, we’ll amend the purchase price to reflect a reduction of 2.5%+HST. I’m throwing in my commission.”

Can this clause be included in an Agreement of Purchase & Sale?

Yes.

Can the buyer agent insist it’s included?

No.

This is a term of an offer, and like any other term of an offer, the seller can reject it.

I choose to reject this term, or rather advise my sellers to reject it, because it clearly seeks to circumvent Canada Revenue Agency guidelines.

I had eight offers on a property a while back, and a commercial agent from Sudbury was representing one of the buyers. He was a part-time lawyer, part-time business owner, and part-time commercial agent. Yep. That’s who you want representing you on the purchase of your largest asset…

The agent included a clause to this effect, and said, “I’m doing this for my buyer because he’s a good guy, I don’t need to be paid,” etc.

That was really nice and all, but I wasn’t going to advise my seller to put himself at risk, nor was I going to risk my real estate license, and the good standing of my brokerage.

When I told the agent that we wouldn’t consider his offer as it was, because of this clause, he said, “Well I’ve done it before!”

I simply said, “Not with my brokerage, you haven’t.”

Any agent, buyer, or seller can do as he or she sees fit. Those that want to break the rules, can, and will. Those that recognize the value of good standing, won’t.

It helped that this offer was well under asking, among seven competing offers, for a house that sold 15% over asking. But as I said before, that’s always how the “smart” offers play out.

–

Well, that was a long post, folks!

Brevity has never been my strong suit.

I hope this was informative, and keep in mind – I don’t write the rules. I strictly try to play by them.

As a consumer, you’re free to conduct yourself however you’d like, just like some of the folks from the stories above.

And all agents are to act in accordance with the Real Estate & Business Broker’s Act, and the REBBA Code of Ethics.

Some light reading for you HERE and HERE, if you are so inclined.

Ralph Cramdown

at 9:28 am

I think the trenchant question here is, if you were going to “refuse to consider the offer as it was” because of an inspection clause, or a gotta-sell-my-other-house-first clause, or a mere $100 deposit, would you find a way of excluding that offer before the presentation, or would you tell all the other agents about it, and treat it as a live offer?

It seems you said there’s be a presentation of offers, but claim you (sorry, your clients) could exclude the one offer with a commission reduction beforehand, so as not to have to tell the other agents about the reduction, as would have been mandated by the rules. Your clients may well have netted a higher price from another buyer with that extra offer in competition, with or without possible resultant commission reductions from other agents.

But doing your bit in the fight against tax evasion was a really good peg to hang your story on. And telling your clients that Revenue might come after them was icing on the cake.

jeff316

at 1:23 pm

Agreed. Lots of pretzelmaking to straighten the logic in this one.

David Fleming

at 2:41 pm

@ Ralph

Respectfully, I think you’re making a lot of assumptions, and jumping to conclusions.

Perhaps I didn’t explain this fully.

I have absolutely no issue with a buyer agent throwing in commission. A little, a lot. Part, or all.

The issue arises when an agent makes an offer, with a 2.5% commission, seeking to have the offer accepted as such. But then wants the unilateral option a few days before closing of reducing the purchase price, which has already been reported by TREB.

If the agent takes a commission for a service provided, and then months later, seeks to reduce the commission in the act of service to zero, then this does circumvent CRA rules.

I don’t believe that myself, my brokerage, or the seller need to put ourselves in the position to be helping somebody evade income taxes.

Here I am, trying to be responsible, looking out for a client, and you’re turning this into some conspiracy to keep commissions high.

Sometimes, the easiest answer is the most obvious.

Katie

at 9:03 pm

Oh wow, David and Ralph in the same thread! All we’re missing is Kyle, Chris, and Condodweller and it’s the full Dream Team!

Curt Knight

at 7:44 pm

The even bigger issue with throwing your commission in on a deal after the fact in a competing situation is this circumvents RECO rules to disclose commission reductions. I ran into this myself. A realtor was looking to buy our listing for themselves. They sent us the Registrants statement signed by their broker at our request that said they will be receiving a commission. They were competing against 6 other offers. They ended up winning and then after the fact sent us an amendment to include the commission in the deal. If there was a reduction in commission we have an obligation to disclose this to the other 6 offers. By amending this after the fact we would be exposing ourselves and the brokerage to potential RECO complaints if one of those other buyers found out that there was a commission reduction that we did not disclose. We obviously refused to sign the amendment. I received a call from the other broker of record saying “come on Curt this is just how we do it, I know you haven’t been a broker very long”. I said that may be how other brokerages do it but not how we operate.

J

at 10:24 am

It seems the real estate industry has put in place an ingenious system to thwart competition in commission among brokerages and agents.

If I understand correctly, this post suggests that it’s really not feasible for buyer agents to forgo or reduce their commissions on their own accord.

Although seller agents can choose to reduce the coop commission, there’s a disincentive for them to do so. While buyer agents are technically required to show suitable properties without regard to commission, it’s impossible to prove when this sort of violation has occurred (unless the agent is dumb enough to spell it out in an e-mail). Also, the hefty coop commission incentivizes buyer agents to encourage their buyers to put forward sky high bids (and the buyer agent doesn’t simply get a lower commission with a lower bid; they potentially go home empty handed).

Seller agents can of course choose to reduce their own commission rate while maintaining the coop rate at 2.5%. But I don’t think a decent seller agent would be too happy about getting less commission than the coop agent, when they’re the one doing more of the legwork and footing the bill for marketing and other selling costs.

I would be happy to pay a top-notch agent an hourly rate of $300/hour + out of pocket expenses to eliminate some of the conflict of interest, but alas, the system simply doesn’t allow for it.

I’d be curious to know whether the real estate industries in other provinces or countries have different systems in place that perhaps do a better job of encouraging competition, and if so what the effect on buyers and sellers might be.

Jennifer

at 12:15 pm

Exactly this. It’s such an archaic system. It’s ripe for disruption but it seems any time you try and disrupt by offering lower fees they get a bad rep that it is somehow lesser service (think red pin). Paying 5% at the current average sale price of houses is astronomical and does not correspond with the value received. Prices have gone up 30-50% in the last little while, the commission should be down to 4% if not 3%. If agents are not making enough to earn a living, well maybe it’s time to get a new job. There are only so many sales in a year.

One option available to those who want is listing on MLS at a flat fee, selling privately, and hiring lawyers to prepare and review the APS at an hourly rate (and paying an agent you possibly saw other houses with, maybe on a per house basis or something). For those so inclined, it is not that hard to schedule viewings, hold an open house, hire a stager/inspector and prep a house for sale, etc. But the boards keep sale prices such a secret and they make you think you need an agent when you really don’t because a lawyer can do the same thing (advise you of all the legal risks, etc) and often times better.

Have a read: https://www.economist.com/business/2012/05/05/the-great-realtor-rip-off

J

at 12:59 pm

Thanks for sharing, Jennifer.

I think one of the disincentives with the DIY route is that you potentially save “only” up to 2.5% + HST assuming you want to offer the standard coop commission to attract as many buyers as possible. And you still have to incur the same legitimate expenses that seller agents incur, while also investing a lot of your time. So almost all buyers just end up caving in and going the standard full service route.

If on the other hand the buyer paid the buyer agent’s commission and/or if the split were more reasonable (such as 4:1% or 4.5:0.5%) then competition in commission would be much better facilitated.

By the way, sold prices are now available via several web sites and apps, so data access has become less of an issue recently.

Housing Bear

at 1:01 pm

TREB has managed to block most of them. Housesimga is blocked unless you sign up with on of their agents.

J

at 1:07 pm

Strangely I can still access sold prices on HouseSigma (although I have also read elsewhere that others have been blocked). I’m still able to look them up on a couple web sites as well.

Housing Bear

at 1:16 pm

For me it says i need a premium account. To get a premium account I need to sign up with one of their agents.

Not Harold

at 2:22 pm

You see similar dynamics with investment banking fees: rather high fees for reasonably standard work.

Higher prices are most resilient in areas where the client engages in few transactions. So IPO fees are higher than M&A fees and trading has been competed down to close to $0 for everyone from Jane Schmoe with $5k to Mr Hedge Fund Billionaire (hedge funds do pay for some services but that gets very, very complicated. at any rate they’re paying tenths or hundredths of a percent, not 5%). Companies just want the IPO to go very well and don’t want to risk such an important transaction to save 1 or 2% of the total deal. They do negotiate (hard) on bond and M&A fees and even build internal teams if they have lots of transactions.

You see this in real estate too. Condo developers aren’t paying out 5% – they hire their own sales people and as David has mentioned aren’t always enthusiastic about buyer’s agents. Commercial real estate sales sees lots of in-house work for both buyers and sellers and many transactions are carried out by investment banking divisions of banks instead of by realtors. Which makes sense when a REIT or an insurance company is selling a $3B office building to a pension fund.

Any effective competition in Canada is most likely to come from US firms like Redfin or Zillow rather than local firms. Canada is just a small and fragmented market that makes it hard to build a big enough business as a disruptor. Is coming to Canada worth the pain and protectionist impulses (Americans are stealing jobs from local realtors!!!)? Maybe eventually but overall it’s best to be pessimistic.

Housing Bear

at 1:13 pm

Personally I think the data should be opened up, but I am fine with the commission system. Sure some of them have been making stupid money recently but they take a lot of risk and there have been periods in time where it was hard from the to scrape by. Also remember, every buyer eventually becomes a seller, and once you are selling the system really works in your favor. Last year when it was still a big time sellers market I was able to get my agent to agree to 1.5%. At first she wanted the full 2.5% but considering she knew the thing would sell in a week with multiple bids, she caved as soon as i threatened to list with someone else. We still offered the buyer side 2.5% because we wanted as many buyers to show up as possible. Anyway, she did a great job, staging and other basic atheistic recommendations really made the place shine. She earned her cut and I got a great price.

Just when you are a buyer, understand how the system works, and do not let a crappier agent convince you to throw out a stupid fomo offer.

Ashley

at 1:18 pm

What about an unrepresented buyer who wants to submit an offer and will sign a Buyer Rep Agreement but wants a buyer rebate? I’ve seen this happen more commonly as a way for buyers to “save” some of the commission by getting it is a rebate from the co-op commission.

sitting pretty

at 2:20 pm

David, I see your condo is for sale and you’re holding back offers. Hope you write about your experience with this strategy!

Juan

at 2:33 pm

For the scenario of bypassing a buyer’s agent + commission. Wouldn’t the correct method be to submit an offer at whatever you think the sale price of the unit will be – 2.5% (or 2% if you want to be a bit more competitive).

IE. If a house is for sale listed at 1,000,000, and you think to win in competition you would need to bid 1,200,000. Then submit an offer through the listing agent (or their brokerage) for 1,175,000 and let the listing agent and the seller determine between themselves what the commission split will be in.

David

at 3:51 pm

Sorry, it was buried in there, but I had to call it out…but the University of Arizona Online – it’s the Harvard of online education!!

Daniel

at 4:24 pm

David, you were probably having a really great week before you posted this, right? It’s just a massive invitation to give the haters a forum AND a voice!!

Or you’re just looking to start a fire.

Alexandru Bejinariu

at 4:35 pm

Wonderful post, truly enjoyed reading it!

Joel

at 8:18 pm

I am not sure why anyone would have a problem with multiple representation in the same brokerage. If you are working with a competent brokerage that has listings in your neighbourhood, one would assume they also have many of the buyers in that neighbourhood as well.

I fully understand why someone would approach an agent to get a reduction in commission. If you were double ending a $1 million house that is $50,000 in commission, or about what the average Canadian makes in a year. As prices go up the commission don’t reflect reality of the amount of work put in. Take a small town where homes sell for $150,000 – $200,000. These agents are putting in significantly more work and time for much less pay. A teacher makes the same in Toronto as they do anytown Ontario for the same work, but a real estate agent makes 10X here. This is hard for many people to grasp and they are looking to save some money any way possible.

Geoff

at 12:09 pm

I think we need to remember that most realtors don’t make any money, so we’re talking about the top 10-15% here. Also I don’t understand why teachers in small town Ontario get paid the same as big city Toronto. In those towns, those teachers are basically making 4-6X what Toronto teachers make, in terms of purchasing and spending power.

XoXoXo

at 11:08 pm

This is one of those blog posts where information is shared, questions are answered, and protocol is explained. But the commenters turn it into an extra salty bitchfest instead.

Yeah realtors make a lot of money. What else is new. If you don’t like it then go get your real estate license.

jeff316

at 10:50 am

It is, but it is also a blog post where a representative from a profession that makes a lot of money roadblocks consumer leverage to maintain the self-benefiting status-quo. I think his straight-up delivery is commendable, but the outcome is open to saltiness.

crazyegg

at 4:54 pm

Hi All,

Very entertaining read that I’m sure most readers can relate to!

As an aside, if any Buyer is so keen to save the juice on an MLS listing, just take out an ad on Kijiji and your inbox will be full in 1 hour -)

Regards,

ed…

Kyle

at 7:05 am

Great article David! Thanks for sharing this from your well of experience.

And I must say, very well played. Your description of those “smart” guys who have never transacted in their life, but somehow think they know better than anyone else and have it all figured out is so on point. And then as if on cue the “smart” commenters who clearly have an axe to grind with organized real estate come out to share their “smarts”.

Katie

at 8:29 am

Are you looking to further alienate the public? I’m not sure how this post and its condescending tone will help you win over the public’s trust. RECO’s mandate is to ensure that trading in real estate helps to build and sustain the public’s trust. You are single-handedly undoing any of those efforts and shooting yourself in the foot in the process. It’s this attitude of entitlement that turns people off. NOT the commission.

Tianna Roja

at 1:43 pm

Missing your bookshelf posts!

or George ?

at 7:17 pm

Oooh show us the illustrations too! Do you mean eaven the ones on the cover are Carroll’s?

Tee Blake

at 3:01 am

I’m a mortgage broker and my client has just received an invoice from the buying agent for 0.5% + HST. Seller paying 5% commission giving 3% to listing agent and 2% to co-operating brokerage. Why are the buyers demanded to pay commission on closing date?