“Sorry, not sorry,” as the saying goes!

I had to pick another song with “heat” or “hot” in the title for today’s blog, simply because of the exceptional response to the music-theme on Monday, wow! I had no clue you guys were so passionate about adult contemporary rock from the year 1984.

Apologies for ever suggesting that Glenn Frey was in the same conversation as Don Henley. You guys put me in my place.

Having said that, how about other options for songs with heat or hot in the title?

I briefly considered, “Here Comes The Hotstepper” by Ini Kamoze, but many of you wouldn’t get the reference.

“Hot Blooded” by Foreigner was an option.

“Hot Child In The City” could have made for a really cheezy and/or witty play on words.

“Hot Stuff” is too vague, although who doesn’t like Donna Summers?

In the end, I wish I had used “Burning Down The House” for Monday’s blog, since it was about houses, whereas today’s blog is about condos.

But at least it allows me to ask this question: who remembers watching “Revenge of The Nerds” on Beta-Max, over-and-over, while your sister babysat you every weekend?

I think I watched parts of that movie a thousand times as a child.

Imagine watching this movie in 2022? It would be so full of cliches, both societal and cinematic, that a young person might believe it’s not even a real movie.

Remember a 30-year-old Ted McGinley, later of “Jefferson D’Arcy” fame from Married With Children, playing a 19-year-old university student and captain of the fraternity, Alpha Betas?

I do.

And I haven’t seen this movie in over three decades.

But I’ll never forget the opening scene in the movie where the Alpha Betas burn down their fraternity house, which is accompanied of course by the Talking Heads’ song, “Burning Down The House.”

Thanks to this movie, I never wanted to go to university as I always thought that a “jock” would throw me out a second-floor window.

I also grew up in fear of being put in a locker thanks to countless movies and television shows, but that’s a topic for another day.

Today’s pop (culture) quiz: what’s a better movie:

1) “Revenge of The Nerds,” 1984

2) “Rock N Roll High School,” 1979

I can’t even get into the latter right now, and the effect that it had on my childhood, but I will say it pains me to know that “Riff Randell” is 71-years-old in real life…

So, is that a folksy-enough intro for today’s discussion on the burning condo market thus far in 2022?

On Monday, we looked at the early returns in the housing market and the results were mind-numbing.

Regular TRB-reader, East Yorker, noted that one of the houses profiled is right down the street from where s/he lives and that the sale price was impressive.

It’s a small city, sometimes!

But even since I ran those stats on the weekend, we’ve seen more sales posted on MLS that defy logic. And that’s just in the freehold market. What about the condo market? That’s what we’re going to look at today.

This time, we’ll look at all condos sold from January 1st through January 24th and posted on MLS.

And we’re looking at all condos in Toronto, not just the 416 or downtown, although I’ll do that breakdown later.

When we ran the numbers in Monday’s blog, there were 342 freehold sales.

Because there are always more condo sales than freehold, and because we have another three days of sales, there is substantially more data: 1,011 condominium sales

So first, we’ll run the same chart as we did on Monday to “trim the fat.”

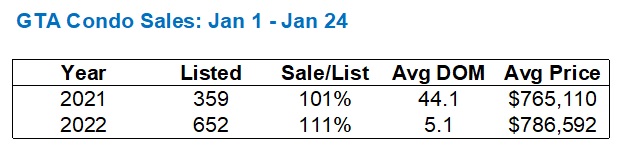

We’re primarily interested in condos that were listed and sold in 2022, since, believe it or not, there was one 2022 condo sale that had been on the market for 309 days. That certainly doesn’t tell the story of the 2022 market, so let’s separate 2021 from 2022:

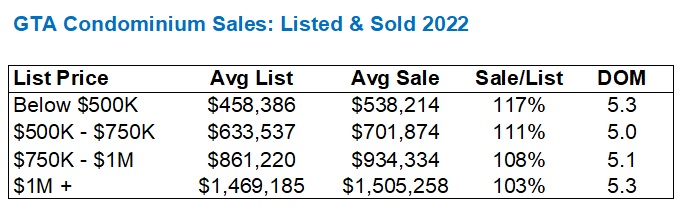

As expected, the data here is quite similar to Monday’s data for freehold, except the juxtaposition is not as stark.

With freeholds, we saw the sale/list ratio increase from 101% to 122% when we separate 2021 from 2022 data.

But with condos, we only see the sale/list ratio increase from 101% to 111%.

Part of this is because condos are inherently cheaper. Let’s say a “starter” home, listed at $899,900, sells for $1,200,000. That’s a sale/list ratio of 133%. But a starter condo, listed at $499,900, would need to sell for $665,000 to achieve the same 133% sale/list ratio, and we don’t typically see condos that under-listed.

But the bigger takeaway here is that a larger delta between list price and sale price exists with freehold than with condos. Buyers are far more likely to bid way over the list price for houses than condos, and I would argue that listing agents have less risk when they under-price houses than condos.

There’s an old adage among real estate agents: “You can never list too low.”

I’ve heard this time and time again.

If I have a listing coming out for which I hope to achieve $1,700,000, what do I list that house at? $1,499,900? No, not low enough. How about $1,399,900? In this market, sure. How about $1,299,900? That’s really low, and it would make both myself and the sellers uncomfortable, but I wouldn’t rule it out. How about $1,199,900? That’s crazy to me, and yet lots of agents are doing it. And perhaps that’s the better way to achieve $1,800,000 instead of $1,700,000.

So when it comes to the condo market, we’re just not seeing the same sale/list ratios as we did with freehold properties.

As for the days on market, we saw an average of 5.1 DOM for condos listed/sold in 2022, compared to 4.8 for freehold (Monday’s blog). It’s a nominal difference; a borderline rounding error, but I might suggest that there are more bully offers in the freehold market, and that could lower the average DOM. I would also suggest that more tenanted condos being listed, and sitting on the market, might skew the data.

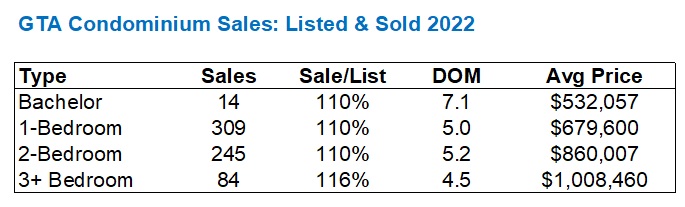

In terms of the breakdown of what’s selling, here’s a look at the size of condos:

The only real difference here is that marginally more 1-bedrooms and marginally more 2-bedrooms have sold from the 2022 listings than the leftover 2021 listings. I don’t know that there’s any real conclusion here.

Although the differece in sale/list ratio from properties listed in 2021 and sold in 2022, versus those listed and sold in 2022 is only 101% versus 111%, when we break down the properties into below-list, at-list, and over-list, we see a huge contrast:

Again, maybe this goes without saying.

76% of condos listed in 2022 have sold above the list price, compared to only 25% selling above list from those listed in 2021, but those are the “leftovers.” Of course they’re not selling over list! The average days on market is 44.1.

But it’s important to note, however, that you’ve got a 3/4 chance of paying over list for something listed this year.

Now, let’s leave behind the 359 units selling this year that were listed last year, and focus only on 2022.

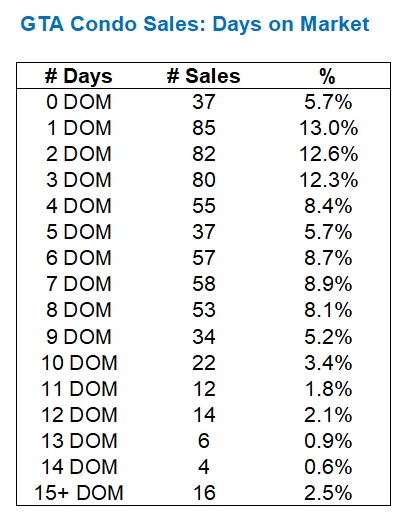

As we did on Monday, I want to look at the days on market for those properties that have sold:

In Monday’s blog, we saw that 30.7% of freehold properties had sold between 0-2 days on the market.

With condominiums, that figure checks in at 31.3%. Almost no difference.

The one big difference, however, seems to be with respect to the period at 6,7 days. With freeholds, we saw 31.8% of properties selling at 6-7 days, which represents the typical “offer night” listing period. With condos, that figure is only 17.3%.

Perhaps there are a lot of condos being listed without offer dates and thus we’re seeing fewer sales at 6-7 days.

The next chart is one that I found to be very interesting. I would have thought that the smaller condos are selling for a higher percentage over list, as was the case with freehold. The data tells another story…

110% across the board for bachelor, 1-bed, and 2-bed units.

That is shocking!

Is the market efficient? Can we call it that?

There are obviously highs and lows here, but to see these averages come out at the same rate is shocking.

For days on market, we can chalk up the 7.1 DOM for bachelor units to small sample size, and note that overall, we’re still seeing around 5 DOM, as was the case with the freehold sector.

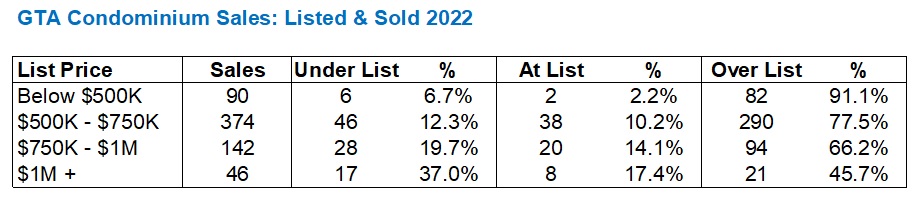

In the next chart, we look at the percentage of listings selling over below list, at list, and above list, broken down by price range:

This is one chart where the freehold data and the condominium data are the same.

The lower the price, the higher proportion of properties selling over the list price, and vice versa. Keeping in mind that these are all properties listed and sold in 2022.

The funny thing is, I wonder how in the world a property listed below $500,000 sells below the list price in this market. Those six listing agents have some explaining to do!

Last, but not least, we saw this chart on Monday as well, looking at the average sale/list ratio by list price range:

No surprise here, the lower the list price, the higher the sale/list ratio.

Although I’d be remiss if I didn’t mention yet again, just how much lower the sale/list ratios are with condos than with freehold.

Now, what about downtown?

Is C01 & C08 “hotter” than the rest of the city?

No, apparently not!

In fact, while the prices are all higher, the sale/list ratios are lower than the market average! This means if we separated C08/C08 from all other areas, the contrast would be even larger.

Who’d have thought, eh?

As for the “big sales,” let’s take a look at a few.

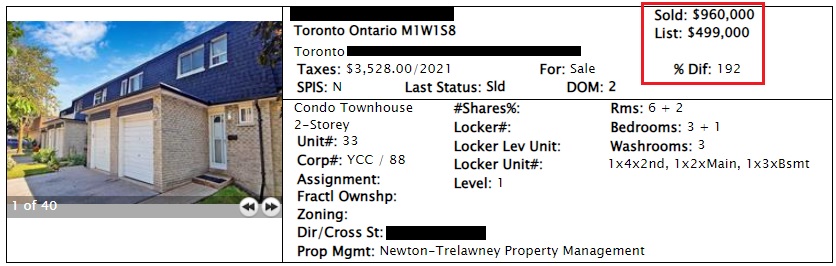

The largest sale/list ratio in the city went to a condo in Scarborough:

Wowzas!

192% of the list price?

I had an agent tell me last night that his buyer was frustrated that I priced our listing so low. It only sold for 113% of the list price, for what it’s worth, but he said after his client lost, the client told him, “This is the listing agent’s fault for pricing the property so low.”

Go figure.

Good thing he’s not looking for condo townhouses in Scarborough…

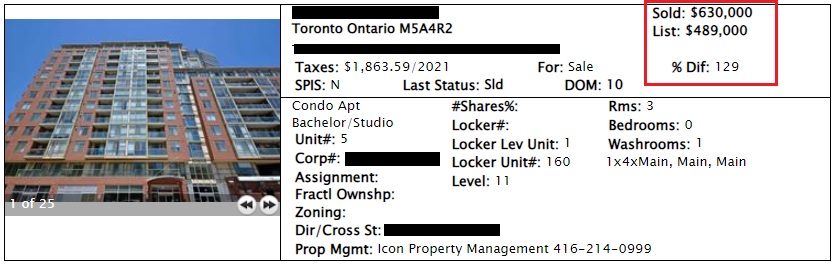

The highest sale/list ratio so far in the downtown core is this one:

It’s still “only” $1,207 per square foot, although that’s a lot in this price range. But somebody really threw the boat at this one!

As for the price point that I find the most interesting; $499,900 listings, which downtown listing saw the highest sale price? How high was it?

Not that high…

Only 129% of list? Psssh!

In all seriousness, there’s absolutely nothing to justify this price. No previous sales, no price-per-square foot metric, nothing.

I wonder if this will appraise? Unlikely.

–

So there you have it, folks!

The condo market is red-hot but not as hot as the freehold market, it would seem.

And as for the downtown core, while prices are way up, it doesn’t seem like we’re seeing sale/list ratios through the sky, although there will always be outliers like the one above. But overall, so long as buyers understand the market, it’s a lot easier to be accurate than it is in the freehold market.

One final question:

In the music video for The Talking Heads‘ “Burning Down The House,” is there, or is there not, a house on fire?

Only one way to find out…

Kyle

at 7:11 am

What about Buster Poindexter?

Condodweller

at 9:34 am

How about Hot in the city by another favorite of mine Billy Idol?

https://youtu.be/PinBVYKQGeM

White wedding is one of the best songs for me.

Condodweller

at 9:43 am

I actually thought hot in the city was a Note Cocker song, but the one I had in mind was Summer in the city, which has hot town and heat in the lyrics so it might work. Perhaps not in these cold days. It’s going to be -22C° on Friday.

Condodweller

at 9:44 am

Joe Cocker damn it

Condodweller

at 9:45 am

Here’s the link

https://youtu.be/6Hxz6qJi-9k

Murasaki

at 8:45 am

It’s pretty good but I much prefer the original 1966 version by the Lovin’ Spoonful, one of whose founding members, Zal Yanovsky, was a Toronto boy.

David Fleming

at 2:30 pm

@ Condodweller

Rebel Yell or White Wedding?

Condodweller

at 4:14 pm

Rebel yell is good but white wedding, always. White wedding had a million versions of mixes. Just Google White wedding club mix etc. The shotgun version was one of the most popular but I always liked the 12 inch versions and various mega mixes.

https://youtu.be/2xaduNLx7Zs

Murasaki

at 8:48 am

“Promises Promises” from his Generation X days is much better than any of his solo stuff, which is great, but the GenX debut album is an absolute classic.

Mike Stevenson

at 12:40 pm

I’ll go with Fire and Ice by Pat Benatar as a reminder that there are 2 extremes.

And speaking of Donna Summer, let’s go with Last Dance to describe this housing blow off.

David Fleming

at 2:27 pm

@ Mike Stevenson

Alright, alright. That’s a good burn.

But if I’m going to describe this housing market, and I’m going to use Donna Summer, then I’ll go with her 1989 hit song, “This Time I Know It’s For Real.” 🙂

Mike Stevenson

at 11:59 pm

Love it! And you just taught me that Donna Summer had a huge hit that late into the decade, age 41. I had no idea.

Libertarian

at 2:29 pm

Since all the comments are about music, how about “Hot N Cold” by Katy Perry. I could watch Katy Perry sing anything.

David, I would have gotten your Ini Kamoze. Your comment the other day was about liking all types of music, but nothing was mentioned about ’90s-’00s club/dance/house music. I listen to all types of music, but that is by far my favourite.

David Fleming

at 2:40 pm

@ Libertarian

I love early 1990’s dance. C&C Music Factory was LITERALLY a “music factory,” cranking out hit after hit. They’re still included in most of my playlists for running or working out. Marky Mark & The Funky Bunch. Black Box. Amber. EMF. Corona. Real McCoy. Crystal Waters. La Bouche. 2 Unlimited. Robyn S. Right Said Fred.

Then there’s late-90’s and early 2000’s club/house. I was in my club phase from 1999 to 2001. Every Friday night in downtown Toronto, different place. Darude: Sandstorm. Basement Jaxx: Rendezvous. DJ Jean: The Launch. Yomanda: Synth & Strings. DJ Jurgen: Better Off Alone. That last one just gave me goosebumps. I remember listening to that on my CD Discman on the way to my 2nd Year “stats” exam in 1999.

Condodweller

at 4:59 pm

@David I forgot that you used to work in a club. You know about all the best music then. My clubbing days also ended in the early 2000s but more like late 90s. There are probably dozens of bands I don’t even know the names of. Funny you should mention EMF. I recently had to look up Unbelievable.

Then of course add to this all the European music and dj mixes. Like Ecuador by Sash, lots of Italian music.

Then it went all downhill from there with all the boy bands and various teen idols. That’s what makes you turn to the blues ☺️. Some of the current “music” doesn’t even have instruments. How can you have a band without guitars and drums?? Real drums.

You’re right, these high energy mixes are awesome to get you through a workout or make you run those extra kms.

P.S. I just remembered one of the great European ones. Check out Safri duo.

Ok, you want to increase your running distance? Find an endless path like the big loop and load this playlist:

https://youtube.com/playlist?list=RDEMK7wo4cx5djRGZodlfoM2Pg&playnext=1

Start running and just listen to the music and tune everything else out and see what happens.

Julia

at 7:38 pm

Ahhh how I miss my late 90s music! It was all about Blur, The Pixies, L7, Smashing Pumpkins, Mud Honey and The Jesus and Mary Chain for me! Head On is still one of my absolute favourite songs!

Murasaki

at 8:53 am

Don’t forget Echobelly, who were (and still are) criminally underrated.

Phil P

at 10:08 am

You forgot Happy Mondays! “Step On” might be my favourite song from the early-90s dance era..

Marty

at 12:00 pm

The KLF does not get enough dance cred. 1989-92 roughly. 3am Eternal, Justified and Ancient, Last Train to Trancentral etc.

Sirgruper

at 6:41 pm

Let’s not forget the Boss – “I’m on Fire”

Asim Chughtai

at 1:48 am

Here’s the link

https://www.asimchughtai.com/