When it comes to real estate, you can almost guarantee the old adage, “if it looks too good to be true, it probably is” remains on point.

On Tuesday morning, a client emailed me about a massive price reduction on a property we had seen together, and ultimately rejected.

It sounded bizarre to me.

The property, previously priced at $1,388,000, was now at $1,090,000.

My client said, “Either they’re desperate, or there are issues with the building.”

I would have thought the exact same thing, but this didn’t smell right to me.

Now ordinarily, I would merely assume this is the old, “If I can’t sell it for what I want, I’ll reduce the price to something stupid-low, then hold an ‘offer night’ and hope people line up to bid.” But in this case, there was a reason why this absolutely, positively, couldn’t be the case: the building was a commercial property.

You have read oh-so-many blogs by now about the stupidity on display when an agent, with a stale listing at, say, $1,500,000 for three months, decides to list at $1,199,900, with an “offer date,” in hopes that clueless buyers will flock to the listing to bid, without noticing that the property was just for sale for $1.5M.

As you’ve read, I don’t believe that the “list low, hold back offers” strategy can work after you have already listed at your target price.

You can try that strategy first, but once you set the price at your target, fair market value, or both, the price is already out there! Buyers know! Agents know, and you can’t undo what you’ve done.

But alas, people try.

And that gives us blog posts like this one from March: “Another Bright Idea”

So in the case of this commercial property, I was forced to assume that it was reduced in price by $300,000 because it was a fire-sale. There was no other explanation.

In the wide-world of stupidity that we live in, there’s no way a seller of a commercial property, and/or the listing agent, could misunderstand the market so much that they think this doomed-to-fail strategy in the residential market, could work in the far-tougher commercial market.

Right?

Wrong!

I looked up the listing, and in fact, there is an “offer night.”

I shook my head so hard it actually hurt.

This just demonstrates how many people don’t understand the “list low, hold back offer” strategy.

Because for this to work, what do you need?

What is the one thing that must be present in order for this strategy to work?

Anybody?

It’s demand.

More specifically, a deficit caused by a disproportionate amount of demand, in relation to supply.

If you take a $1,000,000 house and price it at $799,900, you may end up with 12 bidders, and you may very well sell for $1,050,000 as a result of all that action.

But that’s because of three things:

1) It’s a house.

2) It’s an under-priced house.

3) Houses worth $799,900 to $1,000,000 are lacking in supply, in relation to demand.

How many of those things are present in the case of our commercial property described above?

Zero.

Well, to be fair, maybe point #2 applies. This property is worth more than the $1,090,000 list price, no doubt.

But how much is it actually worth? What would somebody pay? How quickly should it sell?

Those are all questions that are not nearly as easily answered in the commercial real estate market as the residential market.

And so to see this “strategy” employed is just mind-boggling.

The demand for run-down, over-priced commercial properties with massive design flaws just isn’t there right now. So to think that you can under-list this property, hold an offer date, and have any modicum of success is so incredibly misguided.

On Tuesday, I also saw a freehold listing that was listed, oh, well, a wee bit low.

When you see a 4-bed, 7-bath house that looks like it’s just shy of $2 Million suddenly listed for $1,389,000, you sort of take notice.

And that’s exactly what happened when I saw this property on MLS.

“What……..the eff……….are they doing?” I wondered.

I mean, why just under-list when you can super-duper-under-list?

Check out the listing history here:

So they came out at $2 Million and that didn’t work.

They came back out at just shy of $1.9 Million, and that didn’t work.

So now comes the “fail-proof” plan that everybody thinks is going to save the day when they refuse to accept that they are over-priced: list low.

Yup.

Failproof!

If I could describe what they’re doing in a poorly-animated gif image, I think it would look something like this:

Yes, that’s right.

The Kings of Crunk themselves, it’s Lil’ John and the East Side Boys with their epic 2002 hit, “Get Low.”

Get Low, Get Low, Get Low!

Oh, they got low alright!

They dropped the price $500,000 from $1,879,000 to $1,389,000.

Now that’s low!

But what in the world is the expectation here? Do the sellers think that people are going to see the house at $1,389,000, fall in love, and tell their agent, “I simply must have this house. I’m wiling to pay a half-million-dollars over the listing price for it”?

There’s just no way.

In fact, don’t tell Lil’ John this, but there is such a thing as “too low.”

Now that the property is at $1,389,000, who is going to see it?

Buyers looking for $1.4 Million?

Buyers looking under $1.5 Million?

Are $1.9 Million buyers actually going to see this house? I mean, presumably, they’ve already seen it, and disregarded it. But even if they did see it at $1,389,000, are they going to be enticed by the opportunity to get involved in this mess? I just don’t believe there’s a buyer out there in this price point that’s going to say, “That looks like fun, I think I’ll join the fray.”

Maybe this sounds like arguing out of both sides of my mouth.

Maybe when I describe the $1,000,000 house being listed for $799,900, with 12 bidders showing up, resulting in a $1,050,000 sale price, that to suggest this detached house above dropping the price $500K is a poor strategy, is hypocritical.

But it’s not. You simply have to see the difference.

I can’t stress this enough – you only get one chance to show the market your price, and if you come out high, and then decide to price low and try to hold back offers, you’re screwed. It’s not going to work. I’ve seen it work a few times, in fact, one of my colleagues did this and I laughed when it did, but ninety-nine times out of one-hundred, we get what I wrote about in the March, 2019 blog post linked above. The house doesn’t sell, then the price is raised again, then maybe even lowered one more time, and it goes on, and on, and on.

This ridiculous $1,389,000 listing is going to be terminated, mark my words.

Because do you think the sellers will take, say, $1,650,000 for it? Not on your life! Not after we saw them out just shy of $1.9 Million.

But you’re also mistaken if you think that when the highest bid comes in at $1,650,000 on their even more ridiculous “offer night,” that the listing agent and seller won’t talk down to the bidders, as if to say, “Ha! This house is worth more than that, you dummy!”

You can’t have it both ways.

You can’t fail miserably at selling the house at your price, then drastically under-price, get bids that aren’t in line with your expectations, and then point the finger at the buyer pool.

The $1,389,000 price was too low, and in my opinion, taken from thin air. It serves no purpose, has no strategy behind it, and is just too damn low.

Now what if the price were even lower?

What if the price were……………..one dollar?

Have you seen this before? I’m sure you have.

I’ve gone on record saying that this doesn’t work, but let me now put some stats in front of you just to drive that point home.

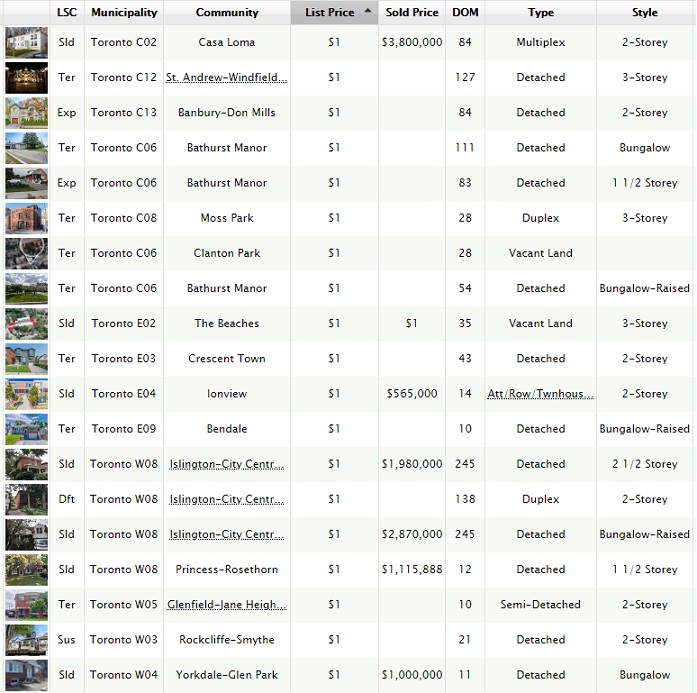

In the past two years, there have been 19 freehold properties listed at $1 in Toronto.

Guess how many of them successfully sold?

No, it’s not zero.

I think that’s what many of you were thinking. Or hoping.

It’s six.

See below:

Now of those six properties that sold, however, there are some caveats.

One of them sold for $1, which is obviously not what happened. Properties just don’t sell for $1.

Two of the properties above, in the same area, next-door to each other, were being sold by a commercial firm that routinely lists on MLS, while simply putting the properties out for tender.

One of the properties was sold as part of a portfolio sale, again, by a commercial firm.

So that leaves only two actual residential properties, sold by owners who live in the homes, that were successfully listed at $1, and sold.

Two residential properties, in two years, in all of Toronto.

So the next time you hear somebody – at the water cooler, at your aunt’s birthday, or in line for beer at the Blue Jays game, talk about “listing for one dollar,” you can sleep easy knowing that you’re not missing out on the next ingenious real estate fad.

Despite what some folks will say, pricing real estate is still a skill, and one that few in our industry possess.

To know what a property is actually worth, and to understand how a property could be under or over-priced to maximize potential sale value, is a tremendous asset in this market.

The two examples described above – the commercial property, and the house reduced by a half-million-dollars, are fantastic examples of where the “list low” strategy is misunderstood, misused, and fantastically misplaced.

Can’t wait to write a follow-up to this disaster-in-waiting in a few months…

Verbal Kint

at 7:25 am

Oh, you ‘specialize’ in commercial now, too?

If you can do a deal for a parking spot in Peterborough, you’ll be able to tell everyone that you’ve sold everything, everywhere!

ChT

at 7:59 am

Thank you for your invaluable contribution to this blog and especially this topic. Now go and get a life! Loser.

Derek

at 10:07 am

That house is in my vicinity . I predict $1.666M.

Dave

at 10:04 pm

1/100 seems a bit low. This strategy is not optimal, but the odds aren’t that bad. A bit of hyperbole for the blog is understandable of course. I agree with the way you think, mostly based on logic but willing to entertain reality when it’s hidden from logic. In this case I think you’re letting your logic take the lead. Your exact improbable scenario just took place tonight. I would never aim for this strategy, but people are a bit less rational and a bit more competitive than you might want to believe.

Condodweller

at 11:58 am

I believe for buyers, especially ones with no TO RE market knowledge, a $1 list price is better and less confusing than any other below value amount.

Listing a property for $1 sends the message to buyers that hey, I am not giving you an asking price, you come up with whatever you think it’s worth and make an offer accordingly. There is no ambiguity there.

OTH if you list your house let’s say $150k below value, I would expect you to take something close to that. Most likely that’s not going to happen. Even if I offered $200k above I still might not get the house. I would actually prefer the first option as it’s clear you are not going to sell me the house for $1.

To me, any amount below the value you would sell for is equally bad. Whether it’s $1,000,000, $1,090,000, $1,200,000 makes no difference.

JL

at 2:30 pm

Agreed. It sets misleading/confusing expectations, especially for those without RE knowledge, but occasionally even for those with it, as evidenced by some of the stories David has shared with us.

Izzy Bedibida

at 2:31 pm

I could not agree more. This game is getting silly and out of hand.