You know those parents who feel the need to tell their kids, “Don’t dive into the pool!” for fear that maybe their child will do so in the shallow-end, or have an otherwise untimely accident?

When my mother used to tell me that, “I’d laugh.”

I was the last person the world that my mother needed to worry about in that regard.

Dive? Head-first?

Not a chance.

I’m 40-years-old and I still plug my nose when I jump in the pool.

Yes, I’m that guy. I mean, how do you all avoid the water flushing up your noise and wetting your brain?

Diving. Geez. I never saw the appeal.

When I was 6-years-old and my father sent me to Camp Kawabi, with all the other 7-year-olds, they were all diving from the “Tower.” You know that 10-foot wooden rig on the dock that would sway wildly on windy days? The one that looked like it was eighty-feet-tall when you were 6-years-old?

Yeah, that one. Well, all the kids were doing it, and a part of me wanted to know what it was like.

I had no intention of diving head-first, of course. That was just ridiculous and failed the risk-reward equation miserably. What sort of enjoyment could there be from diving head-first from a tower? Huh?

If I close my eyes, I can still picture the water below as I stood on the edge of that tower on a July day in 1986. The ripples in the water seemed to be a different colour than the water itself, and the sun was reflecting ever-so-slightly.

One thing I can honestly say that I do not remember is exactly how long I stood on the edge before I finally stepped off and jumped. A minute? Five minutes? My memory fails me here.

But I do remember jumping, unintentionally, with the “pin-drop” method, and my feet touched the bottom of the lake. I swear, I never thought I was going to reach the surface of the water. I pumped my little arms and legs frantically for what seemed like an eternity but was realistically only six or seven seconds. When I hit the surface, I thought I had escaped death.

I was 6-years-old.

I’ve never jumped off a ten-foot tower since.

I also don’t believe I’ve ever truly dove into the water. But that’s more on account of how hard it is to do while plugging one’s nose…

In a very sad way, unless you work in the math department at Waterloo and happen to be reading this, I was oh-so looking forward to the TRREB numbers being released this week.

It’s not because I knew what was going to be present in those numbers, but rather for the exact opposite reason: because I didn’t.

I have a good feel for the market, like any active agent. I’ve sold enough properties so far this fall; both houses and condos, with buyers and sellers, to know what’s going on.

But at the same time, I want to know if what I’m feeling is lining up with what the data says. It’s just never a certainty that the market “feel” lines up perfectly with the market data, so I was excited to dive into the TRREB numbers as soon as they hit.

The media is running with one stat today, and it’s the biggest one:

Sales are up 42.3% year-over-year; from 7,791 in September of 2019 to 11,083 in September of 2020.

But is that the story?

Sales, and only sales?

And what does this tell us about the market?

The Globe & Mail added that “prices” were record-setting, which is also true. But this merely refers to the average GTA home price.

So let’s start there first, and then look at what other stories could be told…

In my eNewsletter last month, I wrote the following:

“Personally, I expect a very busy fall, and the stats will show this as we finish September. Remember I said that, and check back here next month for me to pat myself on the back.”

I included this in my October eNewsletter, of course. Which was sent out yesterday, and which you can subscribe to!

I also added the following:

“I expect house prices to rise, condo prices will recover slightly, and by the time we hit November, the average home price in Toronto will be approaching $1,000,000.”

Now how much of this ends up being true, remains to be seen.

Certainly, the GTA average home price increasing last month shows us that, in fact, the price is approaching $1,000,000.

In August, we saw a then-record price of $951,404, which beat out the then-record price of $943,710 in July, which, of course, beat out the then-record price of $930,869 in June. We talked about this a lot in the summer, since the previous high of $920,791 from April of 2017 wasn’t expected to fall by most market onlookers.

So was it surprising to see the GTA average home price further increase to $960,772 in September?

Not if you’d asked me!

In fact, I told most people that the average home price in October would be higher than September. But as we look at the data that follows, I’m 50/50 on whether I revise that prediction.

Simply put, it starts and ends in the condo market, where we’ve spent a lot of our time on this forum over the past few months.

On a micro level, let’s just look at the following:

Sales:

August, CO1: 342

September, C01: 361

August, C08: 170

September, C08: 169

Those numbers are completely aligned.

In C08, which is the area south of Bloor that is east of Yonge, we saw almost perfect alignment in the sales data from August to September. One sale is all that kept these from being identical.

In C01, we saw a modest 5.6% increase in sales, from 342 to 361, or what many could call a “rounding error.”

Now, what of listings?

New Listings:

August, CO1: 1,178

September, C01: 1,474

August, C08: 609

September, C08: 745

Here is where the data goes off in a completely different direction.

Combined, we saw an increase in sales from 512 in August to 530 in September, or a 3.5% increase.

But combined, we also as an increase in new listings from 1,787 in August to 2,219 in September, or 24.2%.

You don’t need to be a math professor at Waterloo to identify that 24.2% is substantially higher than 3.5%.

And you don’t to be stats major to deduce that, in the context of supply and demand, a 3.5% increase in demand and a 24.2% increase in supply is going to cause a surplus.

Any economics student will tell you that this will, in theory, put downward pressure on price.

Did that happen?

Not really…

Average Sale Price, C01, August: $759,830

Average Sale Price, C01, September: $772,246 +1.6%

Average Sale Price, C08, August: $719,257

Average Sale Price, C08, September: $695,038 -3.4%

Average Sale Price, 416, August: $673,174

Average Sale Price, 416, September: $686,191 +1.9%

We can chalk up the C01 and C08 numbers to suffering from small sample size, but the same can’t be said of the 416 numbers.

Once again, my note from last month about “condo prices recovering slightly” rings true.

So how in the world is this possible?

And how dire do the inventory numbers actually look?

That’s where this gets all the more amazing.

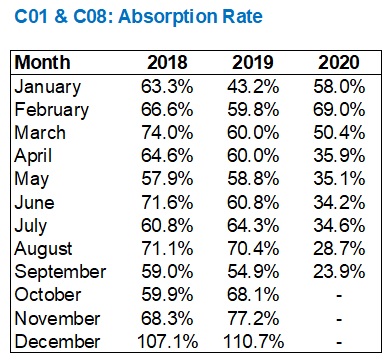

The condo absorption rate, on the heels of a record-low 28.7% in August of 2020, dropped even further last month – to 23.9%:

To be fair, the condo absorption rate has dropped from August to September in both 2018 and 2019 as shown. It seems to reason that with more inventory typically hitting the market in September, the respective increase in sales doesn’t usually catch up.

But we still can’t deny where this grey line sits on the chart above.

And for those who want the actual data, I give you the following:

Pre-pandemic, the condo market was absolutely on fire. And the data shows why.

With a 43.2% absorption rate in January of 2019, you can see how a 58.0% rate in 2020 caused prices to shoot up. This continued well into February when the absorption rate was a decade-high for February at 69.0%.

And now?

23.9%.

Have you ever seen anything like it?

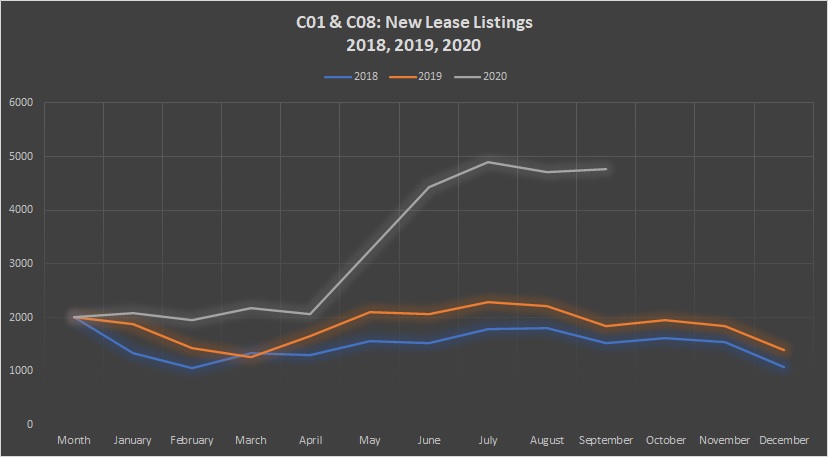

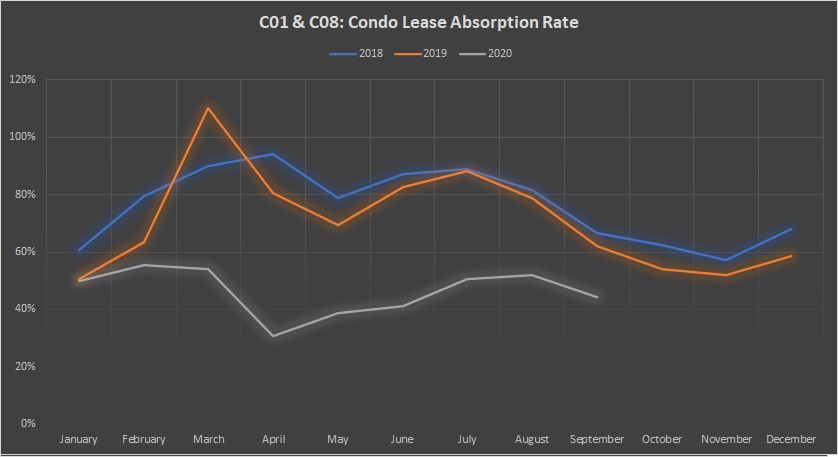

Another area of exploration in the past couple of months has been with respect to the condominium lease market, which has been extremely slow.

Perhaps to nobody’s surprise, the condo lease market did not get any better last month.

C01 & C08 – New Lease Listings:

August: 4,702

September: 4,762

C01 & C08 – Leases:

August: 2,440

September: 2,108

So while we did see 60 fewer new lease listings, we saw 332 fewer condos leased.

The absorption rate dropped from 51.9% in August to 44.3% in September, and yet amazingly, compared to the condo resale market, these numbers look good!

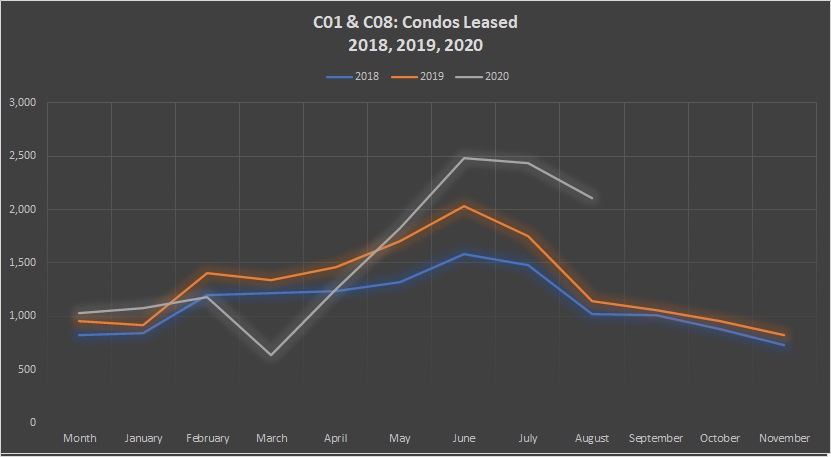

But alas, we must compare apples to apples, and thus comparing September of 2020 to September of 2019 and 2018 is prudent.

Here is where condo lease listings stand, compared to previous years:

And here is condos leased:

Lastly, the absorption rate:

–

So let me propose an interesting question in the spirit of our two good friends, the chicken, and the egg:

Is the saturated lease market slowing down the condo resale market, or is it the other way around?

Some surmise that the would-be investment condo buyers are on the sidelines because they see the weak rental market and fear vacancies.

Others believe that the rental market is slow as a direct result of increased resale listings, from unsold condo inventory.

And when I said that “most” of the media have the story wrong here, I didn’t mean all of them…

This is year-over-year inventory, of course, and if sales were to keep pace, then it’s a moot point.

But sales haven’t kept pace, as we noted. So while numbers like 215% are misleading, since there’s no context here, it’s fair to say that the condo market is weaker today than it was in September of 2019.

But is it weaker than it was in August of 2020?

It depends on what metric you used.

To suggest that the condo market is stronger:

1) 416 average condo price up 1.9% from $673,174 in August to $686,191 in September.

2) C01/C08 sales up from 512 in August to 530 in September.

To suggest that the condo market is weaker:

1) SNLR down from 28.7% to 23.9%, August to September

2) Condo lease absorption rate down from 51.9% to 44.3%, August to September.

Those would be the two arguments, and in the end, I suppose price is still the be-all and end-all.

So in the midst of Bloomberg showing a headline about “weakness in the condo market,” and touting a year-over-year increase in new listings of 215%, does the modest increase in 416 average condo price carry weight?

My “gut” on this tells me that, despite the increase in 416 average condo price, the downtown condo market is weaker in September than it was in August. We can make numbers say anything we want, and as I’ve shown above, we can create both bullish and bearish arguments with ease. But in my gut, it feels slower out there. And while units are still selling, we’re seeing the odd “offer night” actually work (crazy, right?), and I’ve actually lost in competition on a condo with a buyer, I’m still feeling a bit of weakness out there.

But then, what of the freehold market?

Eek, I think I’m at my word count here.

Pick this up again on Friday?

Appraiser

at 7:08 am

In February condo prices were galloping ahead at an annualized rate of 18% due to ultra-low inventory. A pace that was arguably not very healthy.

An increase in listings accompanied by an increase in price indicates that equilibrium has still not been achieved in the condo market.

Verbal Kint

at 7:34 am

Just tell us what you bought this year.

Appraiser

at 9:17 am

Since you asked so nicely Verbal:

Spouse and I own one condo apartment that was purchased brand new from the builder (Tribute Homes) ~4 years ago, which long-time readers here may recall. All other investment properties and principal residence are low-rise residential.

Generally don’t like condos because of the monthly common element fees, as well as other fears regarding special assessments etc., similar to that which David has recently chronicled here.

Spouse talked me in to it the purchase. The original plan was to move into the condo within 10 years. And yes, I am fully aware of John Lennon’s famous line about how life happens while you are making other plans.

In the mean-time, the condo has increased in value by over 50+%, the rent is $600 more per month than we budgeted for 4 years ago, and the unit is cash-flow positive. The tenant just renewed for another year with no increase in rent (call it a Covid discount). So far my better half’s judgement is looking pretty good.

All of our other tenants are long-term and are paying below market rent.

I would only consider another low-rise property as an investment.

And right now, low-rise is no bargain.

Professional Shanker

at 11:52 am

So even the resident TRB bull wouldn’t buy into condo bubble we witnessed over the past couple years!

Kudos on on the low rise residential play (land!). Are these Toronto or the hated and often bashed on the blog 905 area?

Appraiser

at 8:14 am

All of them.

Appraiser

at 8:31 am

905.

Chris

at 8:20 am

“But in my gut, it feels slower out there.”

You’re not alone in that assessment, David.

“Don’t just look at stats. Talk to condo sellers and they will tell you it is a ‘buyers’ market. in the 416. Prices are soft – down 5%.”

– Jamie Johnston, Remax Condo Plus

https://twitter.com/remaxcondosplus/status/1313561966900805632

“Anecdotally, the condo market taking a big crap right now is causing a very high level of anxiety for people. Getting a lot of calls from people panicking can’t sell, what do I do? What do I do? Or do I do?”

– Mortgage Jake

Chris

at 9:09 am

Interesting interview with Shaun Hildebrand of Urbanation, discussing condo supply and demand, and the risk of weakness spreading to the rest of the market.

“Expect a double-digit condo price drop by 2021: Urbanation president”

https://www.bnnbloomberg.ca/video/expect-a-double-digit-condo-price-drop-by-2021-urbanation-president~2050311

Appraiser

at 9:36 am

@ Chris, @ JG, @etc. :

I don’t get the obsession with condos and condo investors. There is a lot more going on out there if you care to pay attention.

Or do you guys just pray for future schadenfreude ?

P.S. @ Chris – have you learned nothing about prediction-making yet?

Chris

at 9:40 am

@ Appraiser

I don’t get the obsession with the Dow Jones Industrial average, and DJI investors. There is a lot more going on out there if you care to pay attention.

Or do you just pray for future schadenfreude?

P.S. @ Appraiser – have you learned nothing about prediction-making yet? Still waiting on that bull-trap to materialize.

Chris

at 9:44 am

And in case you hadn’t noticed, today’s blog post is on the topic of condos.

Appraiser

at 10:33 am

Great time to be renewing a mortgage.

“Another Record Low 5-year”

“Just when you think 5-year fixed rates might have bottomed, the floor drops more. The lowest 5-year fixed rate in Canada is now down to 1.44% in Ontario. It applies to high-ratio default insured purchases only.

That’s just 107 basis points above the benchmark 5-year government yield, a very small markup by historical standards. Over the long-run, this “spread” is closer to 150 bps for typical discounted mortgage rates.”

https://twitter.com/RateSpy?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Bal

at 2:16 pm

I gave up….lol….with these low-interest rates I will never see house prices coming down…

KD

at 3:01 pm

Something else to factor in: 1 bedroom rent in August fell 13.8% in Toronto, 7.9% in Vaughan, 3.9% in Etobicoke, 3.5% in North York, 2.2% in Oakville, and 1.4% in Markham & Burlington. However it was up 12.8% in Kitchener, 11.4% in Barrie, 10.7% in Hamilton, and 3.1% in Scarborough.

Appraiser

at 8:15 am

Rents are falling from incredible heights.

Pragma

at 3:05 pm

Somewhere between 40-60% of condos in Toronto are investor owned (our data collection is weak!). If just end users decide to jump back in that’s not enough to support the market. You need investors to jump back in as well.

For the last two years I don’t think it was “investors” buying, it was speculators(who thought they were savvy investors, and mostly from the surrounding GTA area). Condos have been cash flow negative for ~2 years and the yields make no sense for an investor. This weakness will shake out all those speculators; rents are dropping, cashflow is becoming even worse, and now your equity is starting to erode as well. The market will find support when condos make sense as an investment. In a zero rate world maybe that’s 3-4% yield target? We could easily see condos dropping by 20-30% in order to achieve that yield. But if supply keeps increasing and rents keep dropping that bottom could be further out than you think. And markets never just reach fair value and stabilize, they have lots of momentum! We overshot on the upside and we’ll likely do the same on the downside.

planner

at 6:04 pm

Definition of an “investor” – a failed speculator….

Appraiser

at 8:54 am

It should be obvious to most analysts that ultra-low immigration and foreign student levels are undermining the rental market to the greatest degree at present.

Most new arrivals rent before they buy. Those conditions will not last forever.

The tide is already turning.

https://www.theglobeandmail.com/canada/article-international-students-to-be-allowed-into-canada-as-long-as-they-have/

Bal

at 9:07 am

Agreed…they are opening the borders slowly….

Chris

at 9:18 am

As I showed you the other day, permanent resident numbers declined in July from June, and were almost 70% below last year’s level. So long as unemployment is high and the pandemic is ongoing, re-opening to immigration will be political suicide. Probably part of the reason why TD Economics has stated it will be years before we return to pre-covid levels.

As for international students, most post secondary institutions have already determined that the winter semester will also be conducted online. So, not much reason for them to travel here until September 2021, assuming the fall 2021 semester is back to in-person learning.

Bal

at 10:32 am

Chris- last week I think there was news on CP24 that students from the USA allowed to come Canada as well as close family. Today I think now International students are allowed from all over…also spouses…grandparents..closed loved ones…..this news I just ready today

Bal

at 10:32 am

Read*

Chris

at 11:05 am

“Canada is likely to keep its border with the United States closed to all but essential travel until the COVID-19 pandemic abates, which could be several more months.

Last year, 10,780 Americans chose to make Canada their permanent residence, with roughly half, 5,095 coming in the first half of 2019.

In the first six months of this year, that rate of new arrivals from the United States dropped by 24 per cent, to 3,870.”

https://www.cimmigrationnews.com/covid-19-canada-u-s-border-to-remain-closed-until-situation-vastly-improves/

While restrictions are easing on some groups, I’ll be curious to see the impact this actually has on the number of arrivals. I suspect it will take quite some time before we approach pre-COVID levels.

Appraiser

at 12:23 pm

@BAL The BNN Bloomberg headline is misleading. Here’s what Mr. Macklem actually said:

“We will also watch for signs that housing markets are being driven higher by speculation that prices will keep rising,” Tiff Macklem said in a speech Thursday. “And we will watch whether people buying houses are taking on outsized debt relative to their income.”

“But if too many Canadian households start to become dangerously over-leveraged, policy-makers have several macroprudential tools they can use. Our experience with the mortgage-interest stress test shows how effective these tools can be.”

https://www.bnnbloomberg.ca/path-to-economic-recovery-filled-with-risks-macklem-1.1505447

Caprice

at 10:43 am

“…re-opening to immigration will be political suicide.”

Wishful thinking on your part…

https://www.cicnews.com/2020/10/q3-2020-all-time-biggest-quarter-for-express-entry-1015998.html

Chris

at 10:51 am

Invitations to apply for immigration =/= immigration

As for public support:

https://www.cbc.ca/news/politics/canadians-favour-limiting-immigration-1.5177814

And this was before a global pandemic and the accompanying recession and spike in unemployment.

Chris

at 11:00 am

” COVID-19 has hardened Canadian views on immigration

Perhaps most revealing is the respondents’ answers when asked if immigration levels should be increased after the pandemic to make up for the immigrants who could not make it to Canada during the lockdown.

Only a small proportion of respondents indicated that immigration numbers should be increased. A majority of respondents felt the number of immigrants should actually be reduced because of the impacts of COVID-19. Looking farther ahead, only 22 per cent of Canadian respondents felt immigration would be an important part of Canada’s economic recovery.”

https://theconversation.com/covid-19-has-hardened-canadian-views-on-immigration-146512

As I said, political suicide.

Appraiser

at 10:44 am

Too bad you didn’t bother to read the article. Your mind is already made up.

Appraiser

at 10:48 am

@Chris.

Chris

at 10:48 am

Please elaborate.

Bal

at 11:06 am

Did anyone read the article on BNN…….Macklem puts dangerously over-leveraged Canadians on notice…..it is interesting

Professional Shanker

at 6:35 pm

Cdn central bankers make the same statements regarding highly levered consumers every month, yet they do nothing to address it as they can’t prick the easy money bubble they were the architects of.

daniel b

at 11:10 am

every investor is a speculator. RE works much the same as stocks, with growth vs value being a fundamental divide in assets. Do you want to buy value RE (e.g. rental properties in brockville) that provide good yield at current levels, or do you want to buy growth where there’s not much current yield but you believe you’ll get future growth in income and asset value. Value buyers are speculating as well, they’re speculating that it’s better to buy current yield than to pay for growth.

Either can be wrong in their speculation however there is no fundamental difference in the fact that each investor is taking a position on where they think relative performance of growth vs value. Growth investors have performed much better across all asset classes in recent years, whether that continues to be true is anyone’s/everyone’s guess.

Jimbo

at 2:32 pm

https://www.cbc.ca/news/canada/new-brunswick/newell-family-new-brunswick-1.5754059

Imagine thinking work from home means you can move to a new province….. Hopefully their house is paid off and they don’t think wages are as high outside of Ontario, my goodness.

Bal

at 4:34 pm

Even though I was born and grew up in the city…but I always wanted to live in the small village….but due to my work I could not….wish I have the option to work from home for forever…oh boy…i will run to the country.lol….just beautiful small house surrounded by the farms…..damn I am daydreaming at work now….lol

Jimbo

at 5:19 pm

Every time I get posted I will try to live a little outside of town (provided town doesn’t already have a population of 5,000) to get that little bit of land.

Fredericton is a nice area but it is a culture shock coming from Ontario. I haven’t found an area outside of Ontario equivalent to Keswick, stouffville, port Perry etc. Closest is the Nova Scotia valley about 90 minutes from Halifax.