Tell me I’m being cavalier with this statement, but lawsuits are very common in Toronto condos.

The old adage, “If you want to make an omelette, you gotta break a few eggs” might lend a hand here in describing just why condos have lawsuits.

First and foremost, constructing a condominium isn’t easy. From acquiring the land, to zoning, to design and development, pre-sales, construction, registration and turnover, and then working out the “kinks” in the building; there’s a lot that can go wrong, and when things go wrong, legal actions often result.

Secondly, the process of “turning over” the building from the developer to the residents/owners of the newly-formed condominium corporation is something that, respectfully, the resident/owners are rarely ever prepared for. A board of directors, consisting of five people, likely most of whom who have never been in this position before, is now tasked with effectively running the building – a job previously done by a developer who has likely overseen these tasks dozens, if not hundreds of times before.

I remember reading the messages for a condo I had owned back in 2009 posted by the owners in a Facebook forum, and they were asking things like, “When are the security cameras going to be installed in the elevators?” There weren’t going to be any, because the developer didn’t install them. It was as simple as that.

The residents went nuts, and that would that I hate so much – the word should came up so many times, as the residents came up with a laundry list of items that “should” be addressed, or features that “should” be incorporated, when all the while the residents were the legal owners now, as the “turnover” had been completed, so it was no longer the responsibility of the developer.

The residents refused to leave this alone, and I assumed litigation would ensue. Frivolous litigation, but litigation nonetheless. I believe the property manager, and perhaps the legal counsel retained by the condominium corporation, talked these red-faced residents out of it.

But my point to all of this is that many lawsuits are born of the inexperience of the board of directors in newly-formed condos, as well as the residents themselves, all of whom have lofty expectations about how things “should” work.

The third point I would make here is that running a condominium corporation, day-to-day, is anything but easy. In a 500-unit building, you’ve got 500 people to manage, all of whom could help or hinder on a daily basis. There’s staff on site, both part-time, full-time, and contract, from concierge, to cleaners, garbage, window washing, repairs and maintenance, landscaping, etc. There are utilities and major systems such as heating, cooling, water, et al. And there’s the physical structure itself that has to be looked after, whether it’s the slippery sidewalks outside, the garage door that can come down on somebody’s head, the loose railing that can give way when two guys are rough-housing on the party terrace, and you just never know when a resident is going to throw an IKEA night-stand off the 8th floor balcony and have it land on the windshield of a parked car, only to have a lawsuit ensue. True story!

So there are many, many reasons why a lawsuit in a condominium corporation would be “common,” but what does this mean for the various parties involved?

There are two questions to answer:

1) Is this being asked on behalf of a buyer, or a seller?

2) Is the lawsuit against the condo corporation, or on behalf of them?

Think back to that epic cluster fuck at the Printing Factory Lofts, which I wrote about back in January of 2014, HERE.

Essentially, there were major structural problems in the condominium, but the building was a conversion from an existing building (like many lofts) and thus the TARION warranty was anything but straightforward. The condo corporation was suing the developer, and they were 100.00% confident that they would win, but that would take several years, and more importantly – they also needed to fix the problems in the building!

To fix the issues, they needed money. So they were faced with a decision: increase maintenance fees, issue a special assessment, or borrow a massive amount of money and repay it down the line.

They elected to choose the third option, and while this didn’t cost them anything like a $50,000 special assessment would, or a doubling of their maintenance fees would, it meant that all three mortgage insurers – CMHC, Genworth, and Canada Guaranty would not insure mortgages in this building. So buyers now had to put down 20% or more, and this made it very tough for sellers.

The debate on that blog is one of the top on Toronto Realty Blog all time, if not the most hotly-contested. The residents didn’t like that I wrote about the building, because, for some odd reason, they felt that public information should be kept private when it’s their public information. But in the end, we saw what a lawsuit can do to a building. In this case, combined with their insane multi-million-dollar loan from Laurentian Bank, the lawsuit handcuffed this building and its residents for years.

We’ll save the updated debate on the trials and tribulations of Printing Factory Lofts for another day.

But this is a prime example of where a buyer, with a little bit of market knowledge, and advice and guidance from a competent and experienced real estate agent, lawyer, and mortgage broker, would not purchase a condo in the building. And while units did sell, please read the sentence above to explain why…

Lawsuits in condominiums affect buyers and sellers in the same way most of the time. A “bad” lawsuit isn’t good for the buyer, who doesn’t want to buy in the building, and isn’t good the seller, who obviously wants to sell. A “not-so-bad” lawsuit, once again, means the buyer need not fret, nor should the seller.

So where do you start looking, if you’re a buyer, concerned about potential litigation?

In the condominium’s Status Certificate.

Keep in mind, anybody can order a Status for any unit. You don’t have to be a lawyer, real estate agent, or resident. Websites like www.condocafe.com and www.statuscertificate.com are the two most common sources in Toronto.

The Status Certificate is usually several hundred pages, but there’s a “summary” that’s about six pages.

On the second page, you’ll always see this section:

When I list a condominium for sale, I always pre-order the Status. I also print a copy and highlight relevant sections, such as the amount of money in the reserve fund, whether the fees are going up or not, whether there’s a special assessment or not, and of course, all five points in the above section.

You want to see “No, Not, Not, No, and No” in those five sections.

When you do see one of the sections has information other than the pre-printed, boiler-plate text, you want to dive a little deeper.

There’s an argument to be made here that all lawsuits in condominiums require the advice of a lawyer, and there’s an argument to the contrary that suggests perhaps those with some common sense could opine.

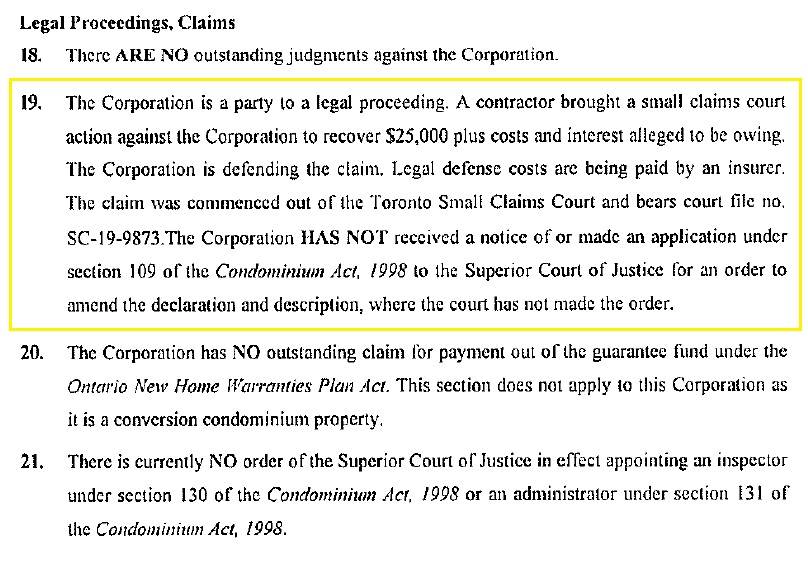

Take this one, for example:

I see the amount: $25,000, and honestly, I’m not moved.

$25,000 is a lot of money in some contexts, such as, well, if you spent that tomorrow on clothes. But in the context of a downtown Toronto condominium that has $3,000,000+ in the reserve fund, that has $150,000,000 in insurance, and that has an operating budget every year around $2,000,000, this amount is nominal.

The words “small claims” should also tell you something about this suit.

The money, the claim, the plaintiff – it doesn’t add up to a concern, in my opinion.

Now perhaps those last three words, “in my opinion” are flawed. I’m not a real estate lawyer. But I am an agent who reads just as many status certificates as most lawyers do, and I also possess enough common sense to deduce that $25,000 is insignificant in this context. Take this for what you want.

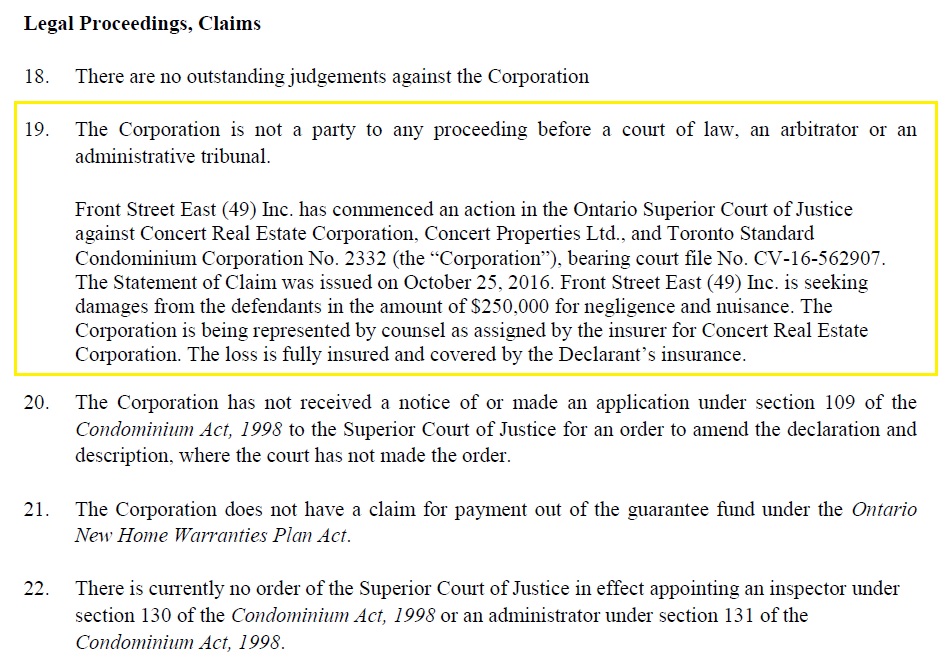

How about another one?

Here we see the amount: $250,000, and that’s enough to pique our interest.

We don’t actually know what this lawsuit is about, but it looks like one development is suing a developer as well as an existing condominium corporation, in this case, TSCC 2332, which is The Berczy at 55 Front Street.

Damages are for “negligence and nuisance,” so read into that what you will. It’s very vague, and we’d have to read the court filing to know exactly what happened. It could be scaffolding that fell down and made a mess, or it could be a pipe that burst and delayed construction at another site. Who knows.

But note the last sentence: the loss is fully insured and covered by the Declarant’s insurance.

So if you’re looking to buy into this condo, do you really care about this lawsuit?

The amount is $250,000, which is a good chunk but in a building with several million dollars in the reserve fund, this is still a minor amount. More importantly, the loss is insured.

I wouldn’t worry about this lawsuit if I were a buyer.

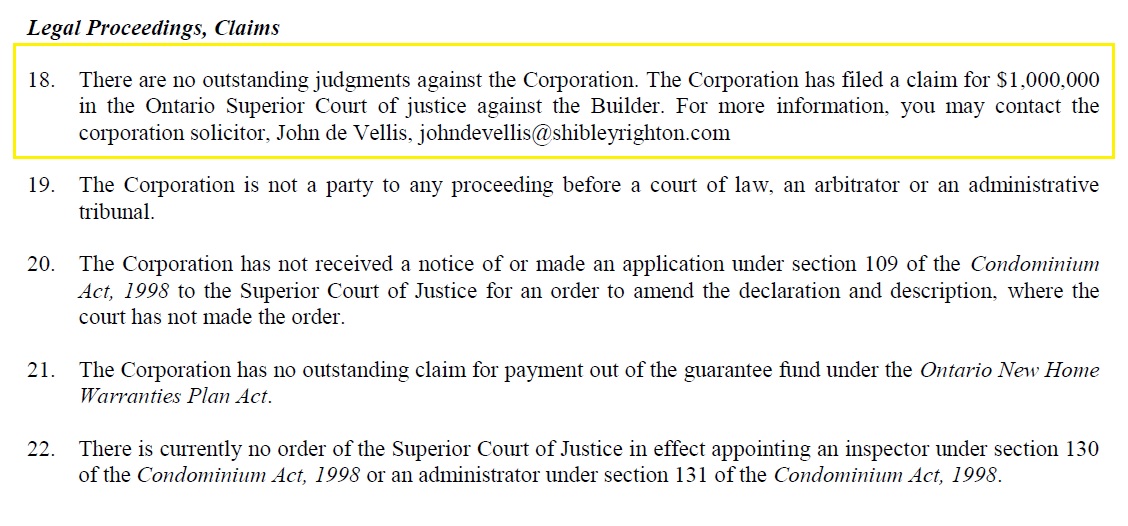

How about this one:

The corporation is suing the builder for $1,000,000

That is a big number!

We went from $25,000 to $250,000, and now we’re up at $1M!

But again, the condo is suing the developer. So it’s not like the previous cases where the condo was the one being sued.

If you’re looking to buy into this condo, does this bother you? At worst, the case goes nowhere, and the condominium corporation spends legal fees chasing this. At best, the condominium corporation gets an influx of $1,000,000, and that might keep the fees from increasing for years.

I’d want to know what the lawsuit is for, because if it’s for the parking garage that’s caved in, and requires $6 Million to fix, then we have a problem! But in cases like this, where the “what” isn’t spelled out, it’s often for breach of duty or something non-tangible.

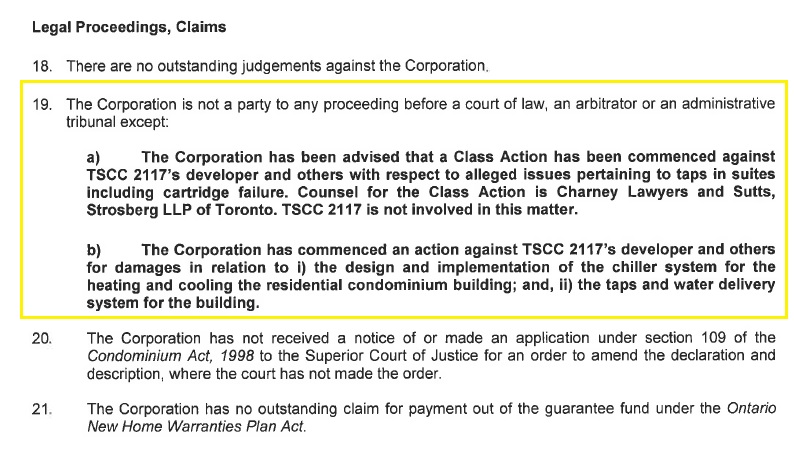

How about this one?

This was a doozie, folks!

You can Google it if you’d like, but this suit went on for a while and involved multiple condominiums as part of a class action.

Now again, the condo is not the one being sued, but rather they are doing the suing.

As with the case above, I might be inclined to argue that the downside here is limited to lost legal fees, but of course, there’s always a chance of a counter-suit.

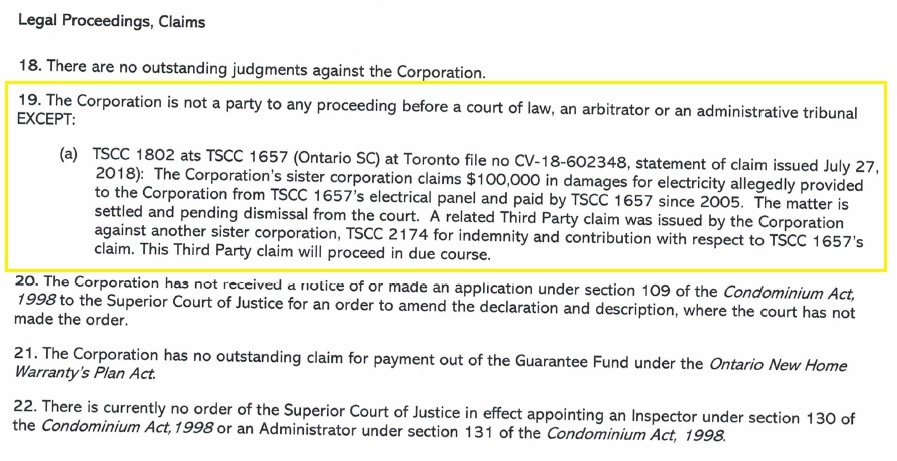

One more here:

If you’re the type to simply look at the number first, then fine: here we have a $100,000 legal action, which isn’t that big a deal.

The second point to note is that the lawsuit was filed by the “sister corporation,” and we know that all families fight, right?

This looks like a case of two buildings that likely have a “shared facilities agreement,” and the utilities weren’t apportioned properly. There was a building in the King East area that was getting free water from the neighbouring building for over a decade! Once this was discovered, the neighbouring building wanted back-payment for the full amount, but of course, that would have bankrupted the condo corporation, so it went to court.

This is a similar case, since TSCC 1657 has apparently been giving free electricity since 2005!

The matter is settled and pending dismissal from the court, but alas, there’s a third-party claim! Oh joy!

In the end, this isn’t something I would get tripped up over, and having just sold a condo in this building via bully offer, I’d say that the buyer who gave us their very strong bid wasn’t concerned either.

What is concerning, however, is a case I want to tell you about on Wednesday. I think the subsequent discussion might take us in places we never thought we’d go.

Stay tuned!

Verbal Kint

at 7:05 am

Bar stool lawyer has seen as many status certificates as some real lawyers. Also, went to the Royal Ontario Museum a few times as a kid, so has seen as many hieroglyphs as some real Egyptologists.

Appraiser

at 7:45 am

I always wondered what happened to Ralph Cramdown.

Angry, bitter, big chip on shoulder.

Law Clerk

at 11:02 am

@ Verbal

I happen to work in a law office so let me educate you. Our lawyers never review status certificates. The paralegals, law clerks, and interns do. I know they often don’t read past the six-page summary.

Nice try to undermine the author though!

Sirgruper

at 10:28 pm

David. I’ve been a real estate lawyer for over 30 years. I would agree with your analysis. Lawyers should be reviewing the Status Certificate and not just the first 6 pages. To do it properly you need to understand your client’s use and also review the declaration, rules, reserve study, facilities agreements, financial statements etc. It’s not so simple and can take 30 minutes to an hour. Same with title searches. A lawyer who cares about quality work will always review these in detail. I love that you order the Status before hand. It simplifies the process and helps your seller to receive unconditional offers.

johnny chase

at 10:43 am

every developer carries a cost for lawsuits in their proforma. They expect it.

Chris

at 4:11 pm

Tribunal decision today has upheld rules limiting AirBnB in Toronto:

“The city’s zoning bylaw amendments that would limit short-term rentals to properties that are the principal residence of the landlord…

…adjudicator Scott Tousaw said: “One fact is indisputable: each dedicated short-term rental unit displaces one permanent household. That household must find another place to live.”

https://www.thestar.com/news/gta/2019/11/18/provincial-tribunal-upholds-toronto-bylaws-for-airbnb-other-short-term-rentals.html

peter

at 9:26 pm

Hey David! Love reading your blogs and Pick 5! What ever happened to the Printing Factory? Did that mess ever get settled?

Libertarian

at 9:22 am

You mention an IKEA night stand….who can forget the chair thrower a few months back.

https://www.youtube.com/watch?v=4m3H1Zwe3rc

Does the victim sue her only or the condo as well?

Appraiser

at 11:52 am

“Vancouver index finally up in October” ~Teranet

“For Vancouver it was a first monthly rise in 15 months, consistent with a strong revival of home sales since August.”

“For Toronto the index was up (4.1%), year over year.”

Given that the Teranet HPI is based on closed transactions, it is somewhat of a laggard in comparison to the MLS, which reports firm transactions. However, the index is otherwise fairly accurate and reliable.

https://housepriceindex.ca/2019/11/october2019/

Chris

at 12:23 pm

One very slightly positive month after 14 months of negatives does not a trend make. The 0.17% growth in Vancouver’s price index from Sept. to Oct. now takes that city to -6.17% year-over-year, and -7.26% from peak value attained in July 2018.

Appraiser

at 5:47 pm

Still behind the curve I see. Naturally.

Chris

at 7:53 pm

Still unable to formulate a substantive rebuttal, I see. Naturally.

If Vancouver’s +0.17% month-over-month HPI change is a cause for celebration, by your logic Toronto’s -0.16% change should equally be cause for concern.

Surbhi

at 11:07 pm

Hey, can you please give some insight on 36 lisgar lawsuit that’s against urban corp?