Why did I choose that photo for today’s blog?

The question isn’t rhetorical. I honestly don’t know.

I typed “math blackboard” into my search and after seeing some unspectacular photos, the one with the sheep popped up.

Then I wondered if this was a sign? Or could it be? Am I calling all condo investors sheep? Or is it me that’s the sheep?

And what do we make of the incorrect calculation on the blackboard?

Am I telling people that their evaluation criteria are wrong, or is it mine that’s incorrect?

Well, in any event, if you’re not a regular reader of TRB and you simply stumbled upon this blog post while researching investment properties in Google, then you’ll have to trust me here; I’m a (somewhat) normal guy with an odd sense of humour who nonetheless is about to provide you with some investing insight that you won’t find anywhere else.

A while back, I read this comment on a TRB post from a long-time reader:

It takes a real man to admit he’s Johnny Chase and not Vinny Chase.

Everybody wanted to be Vince.

Some people were okay with being Eric.

But absolutely nobody wanted to be Turtle or Johnny.

While I would fashion myself a bit of an Eric, I also recognize my incessant talking about the past, naming events by the year, and fondness for nostalgia have rendered me a bit of a Johnny at this point in my life.

But remember that friend of yours who always thought he was Vince but wasn’t? That’s the worst outcome. What do you think that friend is doing today?

It takes a Johnny to know a Johnny, so thanks to blog reader, JOHNNYCHASE for the idea for this blog post. It’s solid.

In fact, I read Johnny’s comment and replied at 5:24pm and by 5:30pm, I had already copied the data for those twelve properties into Excel.

In fact, that evening, after yoga, dinner, and putting the kids to bed, I made myself a rye-and-gingerale and went back to the computer!

That’s how excited I was for this experiment and this blog post. There’s nothing quite like imbibing and doing data analysis.

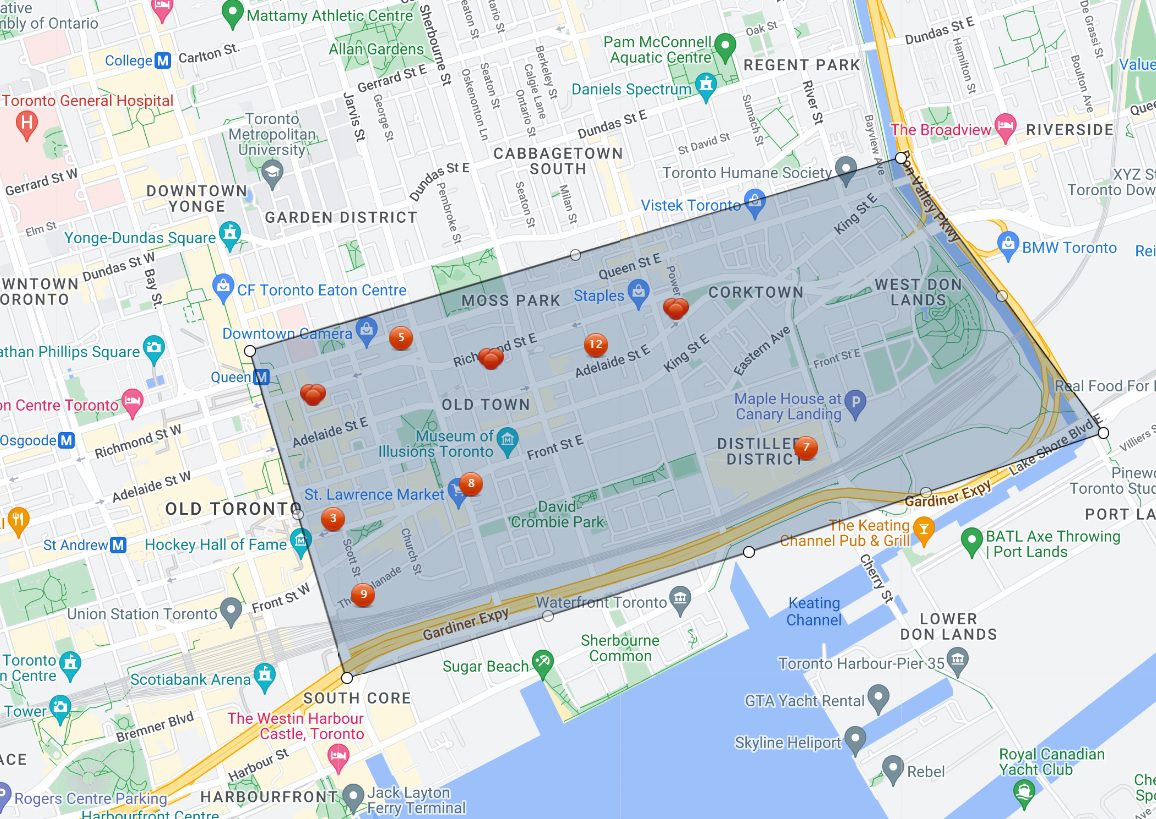

Johnny was right: there were exactly twelve properties listed for sale for $499,000 or $499,900 on the “east side” of downtown at the time of his blog comment.

Here’s my map search from MLS:

Of course, there are all kinds of other neighbourhoods in the downtown core that I would consider, but I think JOHNNYCHASE set the rules for today’s investment property analysis as follows:

Property Type: Condominium

Location: East-side

List Price: $499,000 – $499,900.

And there are twelve properties to consider.

So here’s my plan: let’s evaluate all twelve of these properties today (and possibly tomorrow as I expect this blog post to be long…) according to the criteria that I, myself, would use if I were buying a condo for investment.

There’s a host of criteria to consider, some of which is subjective, some of which is based on financial analysis, and some of which is based on happenstance. But all told, I’ll walk you through these twelve properties as though you were my client and we were looking at options together.

Sound good?

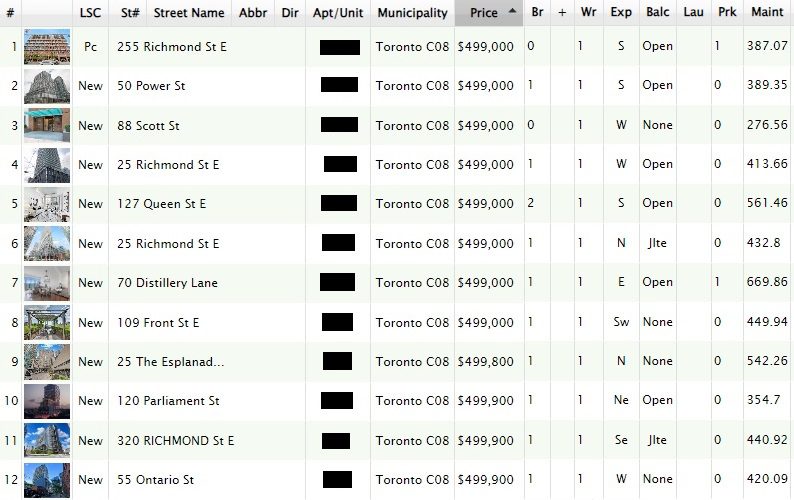

Here are the properties, and because of RECO rules about “unauthorized advertising” and “disparaging a competitor’s listing,” I have to black out the unit numbers…

This is going to be fun. In fact, as I write this, I feel like this could be one of my favourite posts of the year, and I think this could be a helpful resource in the future. So if you’re reading this in 2027, I’ll say this: I don’t expect my criteria has changed at all.

So, first and foremost, before we get into my actual evaluation criteria, there are what I might call “deal breakers” here.

There are situations in which I would not consider purchasing a unit, and these should be stipulated before the evaluation.

The first situation is market-driven.

The second situation is across the board.

1) No properties with “offer nights.”

I know, you think this is ironic, hypocritical, or just downright hysterical.

I’m a real estate agent who lists and sells properties with “offer dates” all the time, and has been doing so for twenty years and writes about it openly on his blog. To the real estate hater, I’m a person who has been “manipulating” the prices and “driving up” the cost of homes, making Toronto “unaffordable.”

Now, with that preamble out of the way, let me say this:

Markets come and go. Markets change. Markets can go up, down, or sideways, and speed up, slow down, or change on a dime.

I’m writing this blog post in the context of today’s market, more specifically, today’s condo market.

I’m not writing about buying a freehold property in March of 2024, nor am I writing about buying a condo in February of 2022. I’m writing about how to evaluate investment condos in July of 2024 and in this market.

In this market, there’s very little chance of success of selling a condo by listing artificially low and setting an “offer date.” I also see nothing about a property in the downtown core that would necessitate, warrant, or validate the offer date strategy.

As a result, I will not consider any properties with offer dates.

Why would I?

Amazingly, five of the properties on our list of twelve have offer dates:

25 Richmond Street

127 Queen Street

25 Richmond Street

70 Distillery Lane

109 Front Street

Now, I’m not going to simply eliminate these from contention, and from this exercise, because of the offer date. If I were interested in one of these properties, I would call the listing agent and feel him or her out.

If I felt like they understood the current market, were realistic, and were only utilizing this “under list” strategy out of desperation, then it’s possible I could do a deal with them.

But if it’s one of those calls where the listing agent seems to be lost in a time warp and thinks it’s March and not July, and thinks he or she is in the driver’s seat rather than being on the third listing, then I’m moving on. No matter what.

2) No tenanted properties.

This is a hard stop.

Unlike point #1 above, there’s no grey area here. I simply will not purchase a condominium with a sitting tenant.

That tenant could be Mother Teresa’s daughter. I don’t care.

I want to pick my own tenant and I want to start the process on my own, exercise control through it, and create a new relationship with a tenant, rather than pick up where the last owner left off.

Sure, you could say, “David, what if you could get this $500,000 condo for $350,000; would you accept the sitting tenant then?”

Those theoretical examples don’t play out in practice, mainly because the seller and/or listing agent of a tenanted property never see it as an issue.

In the case of our properties above, this eliminates two from contention:

255 Richmond Street

120 Parliament Street

I will still include these properties on the list for the evaluation.

–

So with that out of the way, let’s get to the evaluation itself.

I’ll present a multitude of points but this isn’t necessarily a ranking of importance. Yes, the first one is likely the most important, but if a property ranked high in one criterion but low in eight others, then that has to be taken into consideration.

So let’s start…

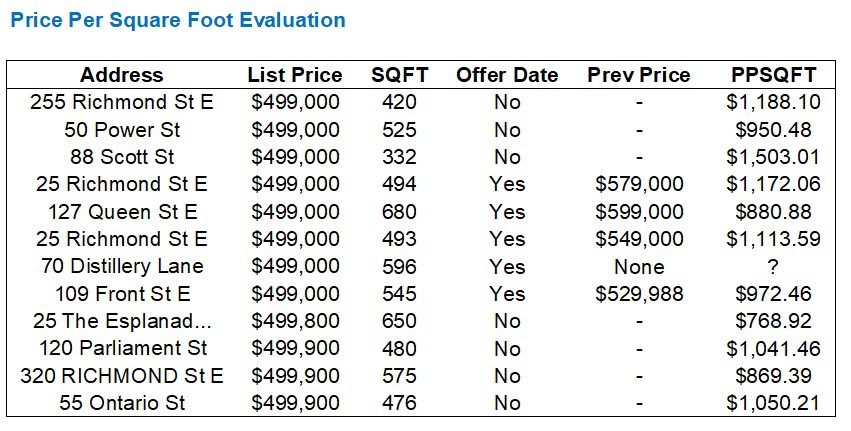

1) Price per square foot.

This kind of goes without saying.

While the old adage, “Location, location, location” could force you to move the price per square foot lower on the list, when it comes to an investment property that is meant to be long-term, there’s no question that the price comes first and foremost.

There are “absolute prices” to consider as well as “relative prices.”

In this case, we started our exercise only looking at $499,000 listings, so it seems to reason that the “relative price,” in this case, the price per square foot, is our chosen price metric.

Let’s look at the twelve listings and their respective prices on a per square foot basis.

Since five of these units have “offer dates,” we’ll consider the previous listing price (ie. before the price was lowered and an offer date was set) as a more accurate indication of the “asking” price:

These prices are all over the place.

From $769 per square foot all the way up to $1,500+ per square foot.

How in the world is somebody supposed to compare and contrast?

Well, that’s why we have many evaluation criteria and price is simply our starting point.

From the list above, I really do not like the prospect of paying $1,500/sqft at 88 Scott Street. This building and location will score much higher in other areas, but I have no interest in a 332-square-foot unit for $1,500/sqft.

Likewise, the two units at 25 Richmond Street are too pricey for my liking. This is simply the result of pre-construction “investors” paying high prices initially and now needing to recoup their costs, but I don’t think that should have any effect on market value.

In fact, I have a theory that I’m running with, and one I’ve discussed in previous blog posts:

In fifteen years, nobody will care who-paid-what in pre-construction, how much the builder’s break-even per square foot was, or what sold for what in 2024. I believe that the massive gap in price per square foot, building to building, will shrink over time.

What this means is that while I recognize the $869/sqft one is paying at Richmond & Sherbourne is different from the $1,503/sqft that one is paying at 88 Scott Street, I don’t expect this gap to exist in fifteen years. This is a major point in my investing criteria and one that I believe many, if not most, would agree with. Having said that, some believe in the “power of new,” and that’s their prerogative.

$1,050 per square foot for Ontario Street seems rich, as does $1,041 per square foot for Parliament.

$1,188 per square foot at 255 Richmond Street seems absolutely outlandish, but we’ll come back to that in the next section.

We can’t really evaluate 70 Distillery Lane, which is a 596 square foot condo, priced at $499,000 with an offer date, and it’s never been listed before. But if I’m being honest, by the time I finished this blog post, the “offer date” for this condo had already come and gone, and the unit was re-listed for $649,000. That’s $1,089 per square foot, and despite this being an awesome building, in a great location, I’m not feeling $650K for this unit.

Right now, I’d be primarily interested in:

127 Queen Street East

320 Richmond Street East

109 Front Street East

But I’m also biased by other considerations which I can’t really separate from the price exercise. You’ll see these play out in the next sections.

2) Parking

This isn’t the “second most important” consideration on my list, but rather the logical next criteria that flows from the considerations above.

Namely, the units at 255 Richmond Street and 70 Distillery Lane come with owned parking spaces.

But I don’t want to purchase a condo with a parking space.

Why?

Doesn’t that seem counter-intuitive, you ask? Considering developers are charging $80,000 for parking spaces in new condos and only offering spaces to the buyers of the highest-priced units?

Maybe there’s an argument to be made that an owned parking space is worth a fortune in twenty years.

But for my investment criteria today, I consider the following:

1) Most tenants looking for small, 1-bed, 1-bath condos in the downtown core do not own a car. They can’t afford to. That’s why they’re renting a small, 1-bed, 1-bath condo. I think that the owned parking space, when advertised on a rental listing, could work against me, and limit the tenant pool.

2) There are maintenance fees charged on parking spaces. So while a $2,000/month condo might rent for $2,150/month with parking, if the associated maintenance fee for that space is $50/month, and the cost to carry $50,000 worth of mortgage is $300/month, then the math doesn’t make any sense.

If we assumed that a parking space was worth $50,000, then the unit at 255 Richmond Street, without parking would be, theoretically, $449,000, and thus $1,069 per square foot, which still leaves me exceptionally uninterested.

And the unit at 70 Distillery Lane, without parking, would theoretically be $600,000 (after their re-list at $649K), or $1,007 per square foot. If this unit actually didn’t come with parking and was $600K, and, and, and, and a bunch of other criteria which you’ll read about below, I might consider it.

3) Location

When you’re looking at a condo for yourself versus an investment, the criteria can change.

Nowhere is this more evident than when it comes to the location.

Case in point, many investors will say, “Well, I wouldn’t live there, but it’s fine for investment.”

And I’m not talking about some investment mogul eating caviar in his Bridle Path home, saying he wouldn’t live at Yonge & King. I’m talking about the hypothetical of, “If I were looking to buy a 1-bed, 1-bath condo in the downtown core, would I live in this building or this location?”

Having said that, I wouldn’t purchase an investment property in a location that I didn’t like.

No matter how great a deal I could receive on a pre-construction infill townhouse development north of the Markham border, I’m simply not interested.

When grading “location” in general, keep in mind that this is extremely subjective. After all, I’m a guy who always preferred King East to King West, even though King West is more popular and more expensive.

So with these letter grades, take it with a grain of salt if you so choose…

Grade A

88 Scott Street is the best location of the bunch – for investment. If I were buying and living in a condo, I would have zero interest in living here for many reasons, notably that it’s primarily renters with few owner-occupiers, the building is too large, the building is on Yonge Street and is too busy, and I would prefer to live in a “neighbourhood”. But again, I’m not looking for myself. I’m looking at how a prospective renter would view the location.

25 The Esplanade is also an “A” because it’s just east of Yonge Street, just south of Front Street, steps to Union Station, and this has always been a popular location for renters – especially those working in the financial district.

109 Front Street is also an “A” because it’s in the literal heart of the St. Lawrence Market neighbourhood, situated right next door to the market itself, and there are countless amenities right outside your door.

Grade B

70 Distillery Lane could get an “A” because it’s situated right atop the gorgeous Distillery District, and there are all kinds of amenities within a 2-minute walk. But so much of my location criteria depends on the walking distance to Yonge Street or Bay Street, where we assume a large proportion of downtown renters are going to work. The Distillery is an awesome area in the summer, and people love to visit, but not every tenant wants to live here.

25 Richmond Street is very centrally located, close to Yonge Street, and this would be popular with renters. But it’s also on a busy street and on a somewhat lifeless block. I personally don’t like this location but renters will simply like where they see it on a map.

Grade C

255 Richmond Street is east of Jarvis and 320 Richmond Street is at Sherbourne, so both are a bit further out than you’d like. I wanted to give these both a “B-” because I wouldn’t consider them to be true “C’s” but I feel as though that would show my bias.

55 Ontario Street is not an exciting location and it’s in the middle of nothingness, but it’s near 255 Richmond Street and 320 Richmond Street, so it falls in this category.

120 Parliament Street is near Ontario Street, also unexciting, but not a “D” though.

Grade D

50 Power Street is sort of “in the middle of nowhere.” It’s not Corktown, it’s not The Distillery, it’s not the St. Lawernce Market, and I don’t think renters who work downtown are going to “target” this location. While it’s not far from 120 Parliament Street, it’s next to the on-ramp to the DVP (off Adelaide Street) as well as a gas station, and there’s a homeless encampment across the street (the other side of the dog park), so I don’t think this is a sought-after location for renters.

127 Queen Street has always been a great building on a bad block. While this area has improved over the years, the “sketch factor,” as one of my clients recently put it, is very high.

–

Location isn’t everything when it comes to an investment property.

Neighbourhoods change, after all. Areas can be gentrified, cool restaurants can pop up (from what I’ve been told…), and trends can come and go. On the flip side, a building located on a quiet corner could always see three massive towers built across the street and next door.

But location is important both in terms of where renters will want to live, today, tomorrow, and down the line, as well as how a property appreciates over time.

We’re getting a bit long in the tooth here and this is a lot to digest, so let me come back to this…

(TO BE CONTINUED….)

Serg

at 8:11 am

“The question isn’t rhetorical. I honestly don’t know.”

Right… what could be common between “Lamb” and “investment condos”?!

Ed

at 9:24 am

Brad Lamb, condo king.

Sirgruper

at 9:31 am

Brad?

Marina

at 12:29 pm

I also prefer the east side to the west. Most people are either east side people or west side people. We live close to Yonge st, but it is still the east side.

I also think for most people, even for an investment, they want to like it. It’s one thing if you have a portfolio of ten condos, but if you only plan to have 1 or 2, you want to like it, the building, the location, whatever. In the same way I wouldn’t buy stock in a company I don’t like, I don’t want to buy an investment property I don’t like.

And yes, I do have a list of “do not buy” companies, even if they are supposed to be a good deal or whatever. Some for political reasons, and some because they “wronged” me in the past and I hold a grudge.

Blank

at 6:47 am

EVALUTATE

Is this a spelling mistake In the title ?