I’m not good with change.

That’s obvious, right?

So imagine using the same MLS system for twenty years and then having to switch to a new platform?

That’s what happened this month when the Toronto Regional Real Estate Board took away the “Stratus” platform that we’ve been using for twenty years and gave us “Realm.”

Nobody asked for it. Everybody wants Stratus back. But welcome to organized real estate where your opinion doesn’t matter.

I’ll leave it there for now, but I will say that going forward, the way I display screenshots from MLS is going to look very different!

If you’re a long-time reader of TRB then you’ll notice right away, so I want to give you the head’s up.

But let’s dive right back into our condominium investment exercise, and pick up where we left off last time…

–

4) Maintenance fees

This is not going to make or break any investment, but it’s important, and it has weight in the decision.

When I started in real estate in 2004, I would say the average maintenance fees in the downtown core were around $0.70 per square foot. Back then, some buildings had fees under $0.50/sqft.

My first condo at 230 King Street East was 575 square feet and the fees were $299.91 per month. That’s only $0.52 per square foot and the building includes all utilities in the maintenance fees: gas, electric, and water. Plus, I had an owned parking space, so without the space, I’d say that the average fees at that time were probably in the mid $0.40 range.

But that was a long time ago and the cost to run a condominium has changed. Today, I would say the average fees are around $0.85 per square foot. Not only that, most new buildings won’t include any utilities in the maintenance fees.

In terms of analyzing maintenance fees when considering investment properties, if you’re looking at a $499,000 condo with $600/month fees versus a $499,000 condo with $400/month fees, it’s not to say that the former is automatically eliminated. It’s all relative. What if the rent was substantially higher on the condo with the higher fees? What if the discount on the unit was better too?

Having said that, I’m not interested in newer buildings that already have higher maintenance fees. That’s a bad sign, and while it doesn’t mean that the fees are going to get worse, I would say that the probability is higher.

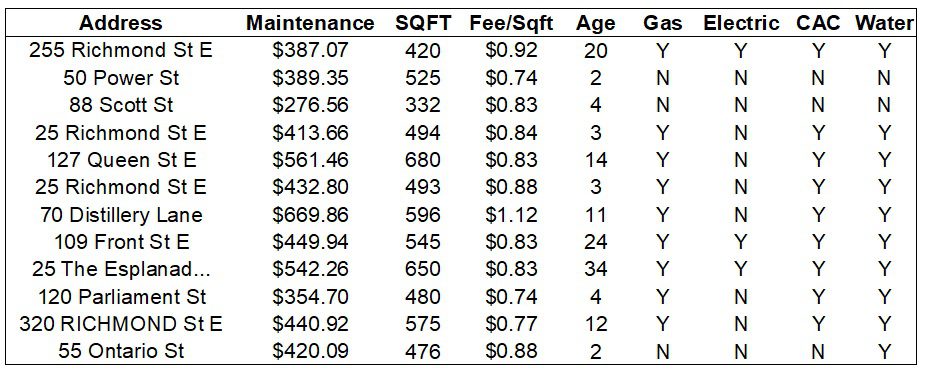

Here are the respective fees for the twelve units, as well as what’s included in the maintenance fees. I’ve also included the age of the building because there’s an assumption that fees increase at a higher rate for newer buildings.

Important to note: the units at 255 Richmond Street East and 70 Distillery Lane both have an owned parking space. This is going to increase the fees. It’s hard to say by how much, but if we assumed it’s $50 per month in maintenance fees on those parking spaces, then the fees would be more like $0.80/sqft for 255 Richmond Street instead of $0.92/sqft per the list, and more like $1.04/sqft for 70 Distillery Lane instead of $1.12.

I’m not interested in a building that’s 11-years-old and already has fees over $1/sqft, without parking, or $1.12/sqft with parking. I’d have a hard time coming around on 70 Distillery Lane.

88 Scott Street has fees of $0.83/sqft and this doesn’t include any of gas, electricity, central air, or water. And the building is only 4-years-old. I don’t like this at all.

25 Richmond Street has fees of $0.88/sqft and it’s only a 2-year old building, but it does include 3/4 utilities.

On the other hand, 55 Ontario Street also has fees of $0.88/sqft, is also only 2-years-old, but only includes 1/4 utilities.

50 Power Street has fees of only $0.74 per square foot but includes zero utilities and this is a 2-year-old building so I can’t say the fees will go up significantly, but I can’t say that they won’t either.

I’ve always admired both 109 Front Street East and 25 The Esplanade for their ability to keep fees low. Both are at $0.83/sqft including ALL utilities, and these buildings are 24-years-old and 34-years-old respectively. I really favour these buildings when it comes to the list above and the maintenance fee criteria.

I’m also very impressed with 320 Richmond Street East which is a large building with lots of amenities, 12-years-old, including 3/4 utilities, but only has fees of $0.77/sqft. That’s very attractive.

5) Building – age, size, reputation

It’s time to get very subjective!

But instead of telling you what I think about each building, since I’m already offering my opinion in every other section, let me ask for somebody else’s opinion.

I called a colleague at another brokerage and said, “I’m going to give you a building address. I want you to tell me your reaction; the first thing that pops into your head.”

She was game. She asked, “Is this for a blog post?” and I told her that it was. Maybe this is why her answers are a bit saucy, but here goes…

255 Richmond Street East: So hot back in the day. SPACE LOFTS! Should be some deals in here.

50 Power Street: Where the heck is this?

88 Scott Street: Over-priced and full of renters but overseas peeps would love how it looks on a map.

25 Richmond Street East: Probably a ghost town building, half-occupied, feeling lifeless inside.

127 Queen Street: Cool and cute but not the best south views. And kind of scary on the corner too.

25 Richmond Street East: I like this less than when you asked me two seconds ago.

70 Distillery Lane: Beautiful building and amazing views! I have clients in here they love it.

109 Front Street East: Feels like where you would visit your gramma if she lived in a condo.

25 The Esplanade: Also feels like gramma’s and maybe they have a pool, but there would be more bankers living here.

120 Parliament Street: I don’t know where this is, but I hear “Parliament” and I’m not feeling warm and fuzy.

320 Richmond Street East: Oooh La-La! Remember when “The Modern” debuted? Timmy’s across the street is super sketch though.

55 Ontario Street: This sounds like a rental building. Or students. Or Student rentals.

Yeah, she’s as sarcastic as I am.

But maybe, just maybe, this offers some insight?

I polled a few other people in my office and the consensus was that 25 Richmond Street East was a very unexciting, unpopular building, or “lifeless” as my colleague said.

120 Parliament Street, 55 Ontario Street, and 50 Power Street weren’t in good locations, and two colleagues who work with a lot of rental clients said that people often aren’t interested in going here.

Both 109 Front Street and 25 The Esplanade were described as “well-run” and having “mature, professional demographics.”

Here’s a quick look at the basics of each building in terms of size, age, and developer:

I continue to feel no love for:

88 Scott Street

50 Power Street

25 Richmond Street East

120 Parliament Street

55 Ontario Street

Maybe it’s odd that I’m shying away from the newer building, but as I’ve mentioned many times, the prices are higher in these buildings because of what was paid in pre-construction years ago, and I don’t think that should play a factor.

6) Relative Value

This will be both objective and subjective, but the impact will be felt nonetheless.

Simply put, I want to look at the average price per square foot in each building and compare to the asking price per square foot.

Then we’ll see what the discount is, assuming there’s a discount, of course.

The reason this is subjective is that we’re not accounting for the differences with each individual unit, ie. maybe one unit on our list has an A+ view of the lake, or another one has a large terrace, which won’t be reflected in the comparison to the average price in the building.

Having said that, it’s simply a measure and not the measure. Plus, we could then look at each unit individually if we wanted to.

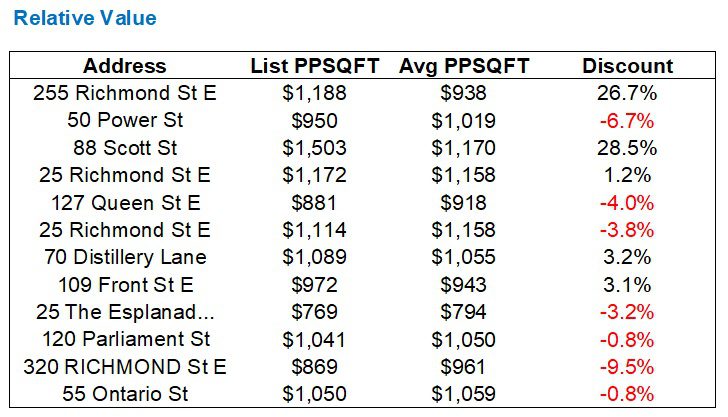

Here’s the data:

Right off the bat, we can see that 255 Richmond Street East and 88 Scott Street are both priced at massive premiums, compared to the “going rate.”

The price per square foot, on average, increases as units get smaller. So considering the unit at 88 Scott Street is only 332 square feet, it’s likely going to be priced higher than the average, which is made up of units ranging from 278 square feet all the way up to 4,503 square feet. Nevertheless, I think it’s become quite apparent by now that we have zero interest in this unit regardless.

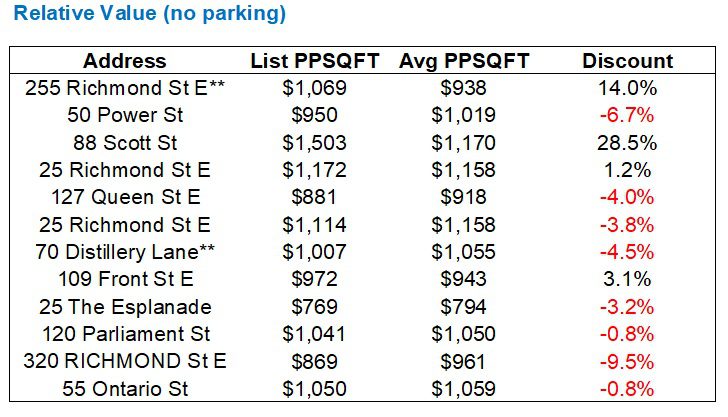

If you go back to Criteria #2 on our list, you’ll recall that 255 Richmond Street East and 70 Distillery Lane both had parking spaces. To compare apples-to-apples, since the other ten units on our list do not have parking, let’s see how the data changes when we back out $50,000 for parking:

255 Richmond Street East is still being offered at an inflated number, but the value at 70 Distillery Lane now looks very good by comparison.

The problem with the unit at 70 Distillery Lane, however, is twofold:

1) It’s now listed at $649,000, not $499,000.

2) It does have a parking space, and I don’t want to buy a condo with a parking space.

So while the on-paper value for this unit, with the parking space backed out theoretically, and comparing to the average price per square foot in the building now looks good, we have to remember that this is simply an exercise.

From the list above, I’m exceptionally interested in 320 Richmond Street East, which has also ranked high in previous criteria.

7) Previous Purchase

Do we really care what the current owner paid for the unit?

What if they simply overpaid? How does that have anything to do with our evaluation?

Well, maybe it doesn’t. But nevertheless, it could provide a look into the concept of a “deal” in today’s market.

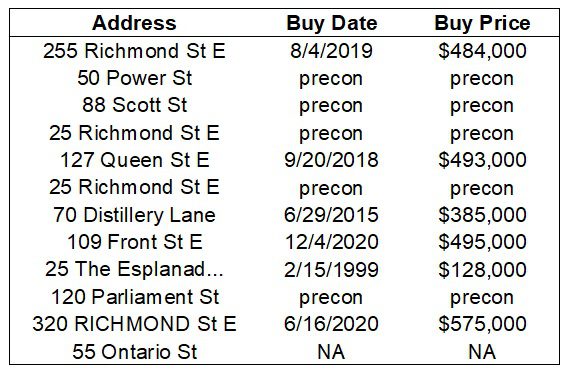

Here are the previous sale prices for the twelve units:

Obviously, one unit jumps out at you.

The unit at 320 Richmond Street, being offered for sale at $499,000, was purchased four years ago for $575,000.

I think there are two natural reactions to this:

Pessimistic: “Wow, this speaks volumes about today’s market! It’s so bad out there! Why would anybody buy right now?

Optimistic: “Looks like some people need to sell and there are opportunities well below market out there.”

Which camp do you fall into?

8) Layout & Functionality

While one of our criteria is simply price per square foot, we also want to understand whether these condos are functional, or not.

Some of these condos are newer and smaller, and some are older and larger. It all comes out in the wash when we consider price, value, maintenance fees, etc.

But I do want to know how these units are laid out and how a tenant would live in each.

This is subjective, but again, I’ll provide a letter-grade for each:

Grade A

320 Richmond Street is a 575 square foot unit with a large living room, combined kitchen/dining, massive bedroom with a walk-in closet, and 9-foot ceilings.

70 Distillery Lane is a square plan with zero wasted space.

Grade B:

109 Front Street is a fair layout but the odd angles in the space make furniture placement difficult and force a somewhat awkward “living area.”

25 The Esplanade is a large, open-concept space with great kitchen, living, and dining. But the “bedroom” in all these layouts consists of a bed in a small solarium with no closet.

127 Queen Street is the only unit on our list which is a two-bedroom, but both are inset bedrooms without windows and both feel like dens accessed from the foyer. The living/dining/kitchen space is great.

50 Power Street has a passable floor plan, although I don’t love when the living, dining, and kitchen are all one room, meaning you basically have to sacrifice living or dining.

Grade C:

One 25 Richmond Street East is small, but passable.

255 Richmond Street is the only true bachelor unit on our list, and for what it is, it’s not terrible. But compared to the rest of the units that have actual bedrooms, this can’t be graded higher.

Grade D:

The other unit at 25 Richmond Street East has a long hallway at the front of the unit which eats up square footage, and the result is an extremely small “living/dining” area next to the kitchen.

55 Ontario Street also has a long hallway, with an inset bedroom, and this creates a tiny living/dining/kitchen.

Grade F:

120 Parliament Street might provide one of the worst layouts I’ve seen in a long time.

88 Scott Street is a 332 square foot unit. What more do we need to say?

9) Condition

It goes without saying that a newer unit is likely in better shape and requires less renovation/upgrades than an older unit.

While I don’t love the micro-appliances or builder-grade finishes in some of the newer units, there is no denying that they’re in better shape than the older units.

We don’t need a list here, but notes should be made about:

25 The Esplanade – original bathroom and kitchen. This needs a massive renovation.

255 Richmond Street – all original finishes, twenty years old.

109 Front Street – not original, but showing some age

The rest of the units in good shape, and the two mid-age units, 320 Richmond Street East and 127 Queen Street East, are in exceptional shape considering their age. These were well looked-after, and 320 Richmond Street seems to have been upgraded since it was last purchased.

10) Leverage

You might argue that this should be numero-uno on the list, considering the goal here is to make the “best investment” which will involve paying the least amount possible.

But just as I tell my buyer-clients who are looking for their first home or their forever home, “It’s better to overpay for a property you love than to underpay for a property you like.”

When it comes to an investment property, there’s no emotional attachment like there would be with a family home, nor does it matter how close you are to your friends or family, or what school district you’re in. But I wouldn’t purchase a condo in a building that I don’t like just because it was a superior deal.

As we identified early on, five of these units were under-priced and listed with “offer dates,” so I don’t know that these sellers are thinking, “This market sucks, I need to cut and run.”

But many of these units are vacant:

50 Power Street

88 Scott Street

25 Richmond Street

320 Richmond Street

55 Ontario Street

And it looks like two of the units were bought by investors who now want to exit the space:

255 Richmond Street

320 Richmond Street

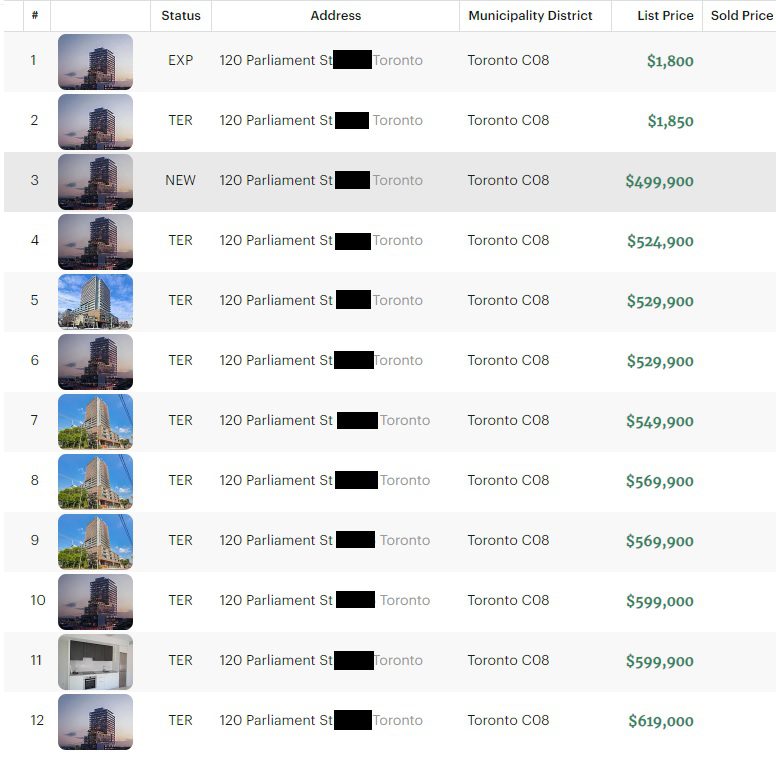

But when we look at a particular listing history, this could lend some serious insight into the perceived leverage that a buyer could have.

Then again, it could also be a turn-off.

Case in point:

That’s our first look at the new “Realm” platform that replaced Stratus, and I hate it. This is a great example of being more concerned with something looking pretty rather than the functionality and user experience, but I digress…

In any event, looking at this listing history, you could come to two conclusions:

1) “Wow, they’ve had this thing forever! They probably want to get rid of it!”

2) “Wow, this unit clearly isn’t selling, isn’t popular, and the fact that nobody has bought it tells me maybe there’s something wrong with it.”

You decide.

Consider that this unit, at $499,900, is still priced at a whopping $1,041 per square foot. So do we care that it was up for sale for $619,000 last year? Does that make us think, “Oh, wow, they’re being much more negotiable now,” or does it make us realize they were simply way over-priced at nearly $1,300/sqft to begin with?

I don’t want to go through all twelve of these listings and give you my thoughts on the price flexibility or the leverage a buyer could have, but rather look to sum this up in the next section.

Conclusion:

While we looked at and evaluated all twelve properties, I did mention at the onset that I wouldn’t consider tenanted properties or properties listed with an offer date.

So as we go through each unit and analyze their attractiveness from an investment standpoint, let’s start with those with offer dates.

The two units at 25 Richmond Street both had “offer dates” and were listed for $579,000 and $549,000 previously. Neither are truly “available” at $499,000, but regardless, I have zero interest in these – even if they were listed for $499,000. I don’t like the price per square foot, maintenance fees, buildings, locations, floor plans, or value propositions. There’s nothing I like about these options.

The unit at 70 Distillery Lane was re-listed at $649,000 after its offer date, so this is clearly cut from the list. It also had a parking space, which I didn’t want. I love this building, but this particular unit is being offered at a premium because of the lake view, and that’s not something I want to pay for. If I had an end-user client who wanted a parking space, I would be happy to sell this unit.

The unit at 127 Queen Street was previously listed at $599,000 and it did not sell on its offer night. Although even at $599,000, this is still only $881 per square foot, there are better options.

The unit at 109 Front Street was previously listed for $529,988, so their $499,00 listing – with an offer date, doesn’t show that they’re being unreasonable about the price. I really like this location, this building, the maintenance fees, and the popularity with renters. I would consider this, outside of the offer date.

So that’s a summary of the five units with offer dates.

As for the tenanted units:

255 Richmond Street is tenanted and I would not consider this unit as a result. However, this unit seems to be over-priced, in my opinion. The unit has a parking space, which I don’t want, and it’s also a bachelor layout. The finishes are old and dated and it’s only 420 square feet.

120 Parliament Street is also tenanted but I didn’t like this price per square foot, building, location, or layout. In fact, that layout haunts me.

As for the remaining units:

88 Scott Street is probably last on my list. A tiny 332 square foot unit priced at $1,503 per square foot, I say, “Good luck!”

50 Power Street and 55 Ontario Street are out of consideration because I don’t like price per square foot, relative value, or locations.

25 The Esplanade is out because this unit needs a massive renovation and I’m not looking to undertake that right now.

What does that leave?

320 Richmond Street.

This location is not fantastic. It’s on the northeast corner of Sherbourne & Richmond, which is one block south of Moss Park, but it’s also only two blocks north of King Street, and the downtown relief subway line will be passing right by here.

The unit is 575 square feet.

The unit is priced at only $869/sqft. That’s 9.5% below the building average, and this was highest on our list.

The current owners paid $575,000 for the unit in 2020.

The maintenance fees for this unit are only $0.77 per square foot and include everything but electricity, and the building is 12-years-old.

The unit is in mint condition. You could eat off the floors. Trust me. The decor is updated too.

The layout is fantastic. The kitchen does not have micro appliances and there’s room for a dining table and a sizeable living room. The primary bedroom easily fits a King Sized bed and there’s a walk-in closet.

And if you were to offer these folks, say, $460,000, I think they would accept it.

I know this from experience, of course.

Because I bought it for $460,000.

I hope that you enjoyed this two-part series on evaluating downtown Toronto condos as investment properties.

I’m happy to answer any questions you may have.

For more information on the purchase itself, refer back to last week’s two-part blog series as well!

Francesca

at 8:22 am

Sounds like you made an excellent choice David and really did get the unit for an awesome price! As someone who has purchased both one bedroom and two bedroom condos, albeit to live in not as investments, I can attest that many factors do come into play when evaluating each unit and deciding which one is worth buying. I remember looking at more than 15-20 units each time before deciding because there were so many variables to consider. If I saw a unit that was being sold after a short time I would also want to question why are they selling so soon, as often one doesn’t make a profit or loses money in less than 2-5 years. Are they selling because they can’t afford their mortgage anymore, because they are moving to another city for a job, divorce or is it something more worrying like bad neighbors or board members or something that is actually wrong with the unit or building that isn’t obvious. This is when doing some investigation might help. This is more of an issue if one plans to live there vs renting it out. Good luck with finding your tenants, which knowing how you are, you have probably already found!

T

at 9:15 am

Is “rent control” a factor in deciding on an investment condo? Given two similar units, perhaps consider buying the one built after 2018?

DAF

at 8:21 pm

Love the suspense, the build up, the plot twists, the entrance of unusual suspects onto the stage…and then the denouement. Well done!

Jimbo

at 9:02 pm

I really enjoyed both parts. Thank you for providing how you viewed the process.

I do find it odd how you view maintenance fees. I have never lived in a condo, and I don’t work in real estate. So, I think you have the upper hand in how to look at them. However, shouldn’t the fees represent the cost of future repairs and maintenance. Wouldn’t low fees for longer encourage lower reserves once planned maintenance is contracted? Are condo’s built with a 100 year lifespan, or has that changed over the last 20 years?

I don’t mean for the above to come across as anything other than curiosity. I think my thought process is you should include approximate special assessment costs per square foot and probability based on historical fees, reserve fund amount and building age. When purchasing can you see what big ticket items a building has taken care of over the years and when they anticipate to take care of future costs?

Appraiser

at 7:33 am

Putting your money where your mouth is.

Well done!