The rental market doesn’t get a lot of attention. Or at least historically, it hasn’t.

Who cares about rentals, right?

Tell us about bidding wars, bully offers, and 30% annualized price appreciation!

Only through the last few months has the mainstream media taken notice of the red-hot rental market, and I figure: it’s about time.

Having said that, I’m shocked at the response to the market in the media, specifically the tone they take, and the comments from readers, wow! And while I know that I shouldn’t be shocked at the comments from readers, especially on the article I’m about to present, I just shake my head sometimes. Let’s have a read, shall we?

Here’s the article that ran last week and was in everybody’s news feed:

“Bidding Wars And Soaring Prices: Toronto Renters Face A ‘Perfect Storm” In Tight Market”

Toronto Star

August 20th, 2022

–

When you see “bidding war,” you’re always accustomed to reading an article about the resale market, right? But this is about the rental market, and it’s sad that it took this long, and this hot a market, to get the media to write about the rental market at this length, but it’s also sad that most people simply conclude, “Stuff-and-things should cost less.”

I’m sympathetic to the people profiled in the article, but when somebody says, “We’ve seen 200 places,” and laments that they haven’t secured a rental, you know that the market isn’t the problem, right? We’ve talked about this before. When there’s an article about the “unfair” housing market and a would-be buyer is profiled and says, “I’ve made 28 offers on houses over the last two years, and have come up empty,” that buyer is ignoring the common denominator: himself. Not to mention, prices might have appreciated 30% in the two years he’s been attempting to buy! So when it comes to a renter who has looked at 200 places, I mean, come on. I know the article isn’t an editorial, but there’s zero accountability there.

Here are a few of my favourite comments from the article:

Lots of things should be illegal. Like putting a squirrel down your pants for the purposes of gambling.

But to suggest that the government should “appraise all properties and rentals and set the maximum prices for sale or rent” is a step past socialism and toward communism. Why not just let the government own the properties too, while they’re at it?

Appraise all properties, eh? How many government jobs are we creating there?

Then we have Diane:

There’s my most hated word: should.

“It should not go above asking.”

Says who? Should-what-now?

Apple should not be selling iPhones for $800, but they do, because people pay that. And people offer $2,500 to rent a condo, listed at $2,400, because they want it. LeBron James should play “a game” of basketball for less than $50 Million, but he’s not, because that’s the market value for his services.

Let’s hear from Karen:

The prefab housing wave?

How out of touch am I?

I mean, it’s one thing for me to not know who Rufus Du Sol is, at my advanced age, but for me to not know about the “coming prefab housing wave,” sheesh, I feel so naive!

This wave is “set to hit next year,” which makes me feel even more out of touch. And according to Karen, it’s going to cause housing prices to plummet.

Alright, with my cynical and borderline distracting intro out of the way, let me get to my thesis…

I’ve written a few blog posts about the rental market over the last few months:

July 6th, 2022: “How Is The Downtown Rental Market?”

July 12th, 2022: “Leave Me Alone In The Rental Market Trenches”

July 14th, 2022: “Rental Market Realizations”

In the first post, I showed you what the absorption rate in the downtown market looked like so far this year, from 101% in April, to 91% in May, and to 97% in June. All three articles talk, at some level, about how competitive the rental market is.

If you’re a renter, you’ve simply never had it worse.

You have to expect to compete on most rental condos.

You have to expect to make an offer within 24 hours of that property being listed.

And you might even expect to provide 3, 4, or all 12 months of rent up front.

But as the Toronto Star article explains, renters are paying over-asking more now than ever before. They use the term “bidding war” because it’s sexy and it gets clicks, but that’s not what it is. Simply put, if there’s 12 offers to lease on a condo, listed at $2,195/month, it’s completely reasonable to assume that one would-be tenant will offer $2,300 with 6 months up front.

Completely reasonable based on the free market.

But not reasonable if you ask the Toronto Star commenters who posted notes on the article above.

So just how many condos are being leased over asking?

Last weekend, I set to find out!

Because the Toronto Regional Real Estate Board, to whom we pay fees, does not provide better access to our own data, I painstakingly downloaded an entire month’s worth of condo rental history, fed it into Microsoft Excel, and went to work.

Here are my findings…

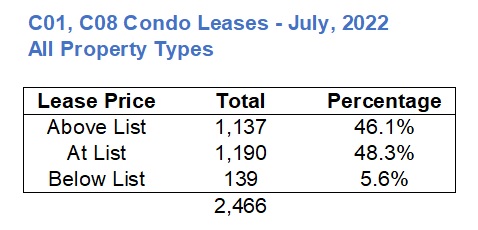

There were 2,466 condos leased in C01 and C08, aka “downtown” in the month of July.

How many of those condos were leased below the list price, at the list price, or above the list price?

Well, have a guess!

Is the Toronto Star article above – with their reference to “bidding wars” and a “perfect storm” simply blowing things out of proportion?

Could 20% of listings go over the asking price?

Could it be 40%? 50%? Or more?

Here are the results:

I don’t know what you expected to find, but my guess was about 25%.

I was low. Way low.

A full 46.1% of condos leased in the downtown core in the month of July were leased above the asking/listed price.

The highest was 125%. That was for a 1-bedroom unit, listed at $2,000 which leased for $2,500/month.

There are all kinds of examples of condos being leased for 120% or more more, and while this would have been considered shocking once, it’s now become commonplace.

In fact, and don’t shoot the messenger here, but there are now “offer dates” for some rental listings. Call the listing agent and the landlord greedy and evil, if you want. But at least it gives prospective tenants seven days to get inside for a look, whereas many condos are leased after mere hours on the market, many sight-unseeen.

So what type of condo listing sees the highest proportion of leases over the list price?

Here’s the data for bachelor units:

The sample size is smaller here with only 182 bachelor condos leased, out of 2,466 in total, but I think the data set is enough to provide a conclusion.

55.5% of bachelor condos were leased over the list price, compared to 46.1% of all condos leased.

Only two total units leased under the list price, and that’s two more than I would have expected!

Here’s the data for 1-bedroom units:

Here we see 43.5% of units being leased over the list price, which is 12% less than bachelors, but only 2.6% less than the overall average.

It’s interesting that only 4.4% were leased under list, which is actually less than the overall average of 5.6%.

Here is the 2-bedroom data:

8.7% of 2-bedroom condos lease under the list price, which is substantially more than 1.1% figure for bachelor condos, and still double that of the 4.4% for 1-bedroom units.

But the data for ‘at list’ as well as ‘above list’ are only a few points off the overall average.

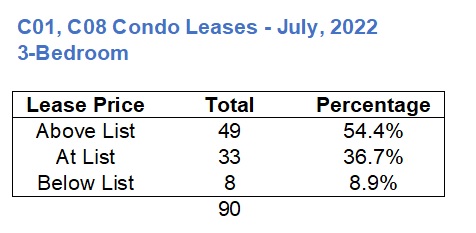

Surprisingly, the largest condos on the market were even more competitive:

The sample size here is low as well, with only 80 units leased, but 49 of them were leased over the asking price!

I suppose the higher the cost, the lower the price sensitivity for the tenant?

If you’re renting for $5,500 per month, what’s another $300 to secure the condo?

Here’s the overall data, showing, as we saw above, that bachelors and 3-bedrooms were the most competitive:

It’s important to note that 3.1% over the list price on a bachelor is less in both absolute and relative terms than 3.5% over the list price for a 3-bedroom unit, but to that price-sensitive tenant, it’s actually more.

Now, we know that those percentages are being dragged down by the units that lease for the list price or below.

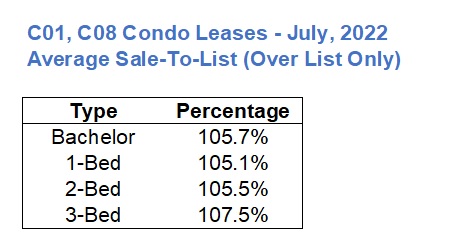

What I want to know is: when people pay over list, how much over are they going? Specificially, if we were to only look at units that leased over the list price, how would these percentages change?

Here’s how:

For starters, all the percentages go up.

But I think it’s important to realize that when prospective tenants are offering over the list price, on average, it’s quite a lot!

You might say that 5.7% over list on a bachelor isn’t a lot, but just think about it: for a $2,000/month bachelor, offering 5.7% over list is offering $2,114.

That is why rent prices are going up! This is just the average, too. It doesn’t mean that people aren’t offering more than 5.7% over asking.

Look at this:

Can you imagine being the would-be tenant who went to see this property, listed at $1,950/month, submitting an application and an offer at that price, only to see somebody else offer $2,300/month?

When something like this happens, the media grabs on and runs with it.

Of course, as we saw with the 182 bachelor condos that leased, 79 of them went for the list price. But nobody is going to write an article called, “Balanced Market Opportunities Abound For Prospective Renters.”

Not when this sort of thing is happening:

And that’s to live on Bay Street!

Ah yes, come for the sights, the sounds, the ambiance of……………..Bay Street.

Come to think of it, which areas of the downtown core are seeing the highest sale-to-list ratios?

Here’s an interesting chart:

Again, you might not think that 2.5% above list is significant, but remember that this includes all leases, including those at list or below list. If you’re a tenant out there, you know there’s a high percentage chance that if you see a condo, listed for $2,395/month, you might have to offer $2,500 to have a chance at success, and that’s if your credit score and income are high enough.

Bonus points for anybody that noticed there’s one listing missing from the 2,466 in total, but why include an area with only one listing? Or, maybe I was just seeing how closely you guys were following…

–

All told, the rental market in Toronto has never been hotter, and while it always calms down in the fall, I expect the momentum to carry through.

The tough part to swallow about this rental market is that with the downturn in the resale market, high inflation, high interest rates, and general discomfort in the market, most condominium developers are putting their projects on hold. This means that a 2-3 year outlook for condo completions is bleak, and therefore the rental market is going to be even tighter down the line…

Appraiser

at 9:19 am

Clearly the major problem with the rental market isn’t housing supply, it’s blind-bidding!

Sirgruper

at 9:19 am

Thanks for the analysis and review of the law Chief Wiggum:). MPAC kind of does value all properties anyways. Most tenants try not to give up their apartments as they are all paying under-market rents if they have rented for any period of time. So the turnover is low. As a landlord, if I only get one shot to rent and may be stuck with that rent (subject to minimal government dictated increases), I have to hold out for the highest rent. It’s a clear consequence of rent controls.

David

at 11:37 am

Paying months up front should not be a major consideration given that tenants can apply to the LTB to recoup that amount (except for the last month deposit) as soon as they move in.

Also, if I know that I am a AAA tenant (great credit score, solid verifiable income, and good references), why am I engaging in a bidding war? I tell my landlord that if they want to risk $40,000 worth of annual rent for an extra $50 or $100 a month, that’s their choice.

This is completely different from a buy/sell situation where it’s a one-and-done transaction – and the consideration is paramount.

JF007

at 1:16 pm

Will correct you…

If the landlord didn’t advertise that they want months of rent in advance and it’s the tenant who is offering months of rent in advance as part of their offer to lease, they don’t have a leg to stand on at LTB…precedent in favor of landlords has already been set by a Ontario Supreme Court ruling think back in 2014..look at link below

https://www.rentalhousingbusiness.ca/ontario-tenants-can-offer-rent-up-front/

David

at 1:40 pm

Thanks! Didn’t know that…it was also confirmed recently (post COVID) in Wang v Yu, 2021 CanLII 150802 (ON LTB)

JF007

at 7:11 am

????????

Ace Goodheart

at 12:40 pm

RE: communism: There is a trend in the housing “dialogue” currently towards a more communist style of allocation of housing resources.

Consider the very left leaning “housing fairness” groups, run by University Profs, who are advocating for a yearly percentage tax on all houses “assessed” at more than a million dollars.

For a two million dollar house, this would be $10,000.00 per year in “housing fairness”.

The idea is, the only people who own houses, bought them more than 20 years’ ago, and have ridden up the prices to the current levels. They should be made to pay for their good fortune.

All these taxes, and rent controls, and maximum price controls are, is a regressive tax system.

For maximum rent controls, who do you think that would hurt the most? The person who bought their building 25 years’ ago for $40,000.00 and now rents out units on a mortgage free property?

Or the person who bought last year for $2,000,000.00 and has a huge mortgage?

It is a regressive tax. Landlords with little equity who paid high prices, are the ones who pay the most in percentage relative to the value they paid and relative to the equity they actually have.

The same with the “housing fairness tax”. If you actually did buy your house 25 years’ ago for like $60K and you have no mortgage, then the $10,000 per year tax on a house assessed at $2,000,000.00 is actually a 0.5% tax on a paid for $2,000,000.00 house.

However if you bought your $2,000,000.00 house last year, with a $400,000 down payment and a big mortgage, and you now lost about half that equity in the housing downturn, the 1% tax on your “housing fairness” turns into a $10,000 per year tax on $200,000.00 worth of equity.

That is actually a whopping 5% tax on your entire equity.

So the person who hardly has any equity at all, pays ten times the yearly housing fairness tax, as does the person who has a fully paid for home.

They also pay tax on money that was already taxed (their $200,000 down payment) and for which they have not achieved any capital gain at all (they actually lost $200,000 in equity).

These are all regressive taxes on land owners. They tax people with the least ability to pay them, the most.

Mxyzptlk

at 12:54 pm

Okay, you make some good points, however nothing you cite is even remotely “communist.”

Appraiser

at 9:34 am

“Average Toronto Rent Now $525 More Expensive Than it Was a Year Ago”

“But it isn’t just Toronto that’s seen prices soar. Rent prices across the GTA as a whole climbed 3.3% from June to July, rising to a new average of $2,482. This followed the 3.1% jump seen in June, and the sizeable 5.7% hike in May.”

https://storeys.com/toronto-rent-500-more-expensive-than-year-ago/

Alexander

at 11:21 am

Well, it is not very surprising with exodus during COVID when you could not find tenants and prices were plummeting for the city condos and raising 30-40% in suburbs detached houses. Now the exodus wave is returning and detached houses are not so in demand. I did not have a single viewing in the month of August for my (rental) detached house at Allen and Glencairn and expecting the market to be dead for another 2 weeks or so. It is like a pendulum, nothing to be excited about. Considering how much interest you have to pay those days I feel renting is still a bargain. Still feel it is not the right time to buy a condo as an investment with new government tenant-oriented policies popping up every six months, uncertainty in mortgage rates for a year or two and overall direction of monetary policies.

JF007

at 8:41 pm

Such a misleading article…but idiots included a chart in it that shows that from Jan’20 till Jul’22 the avg rent has increased by only $73 from $2409 to $2482 which is mere 3.03% still below rate of inflation i suppose…

Seeshhh…and then they say believe main stream media…BS

https://www.cp24.com/news/here-s-how-much-average-rental-prices-were-across-the-gta-in-july-1.6042212