Wednesday’s blog spawned a philosophical debate about the role of government, which wasn’t exactly unforeseen, given the topic at hand, not to mention my slightly right-of-centre fiscal views.

So let’s pick up on that theme, and get slightly more specific. Let’s discuss whether or not, or to what extent, the government should monitor, oversee, or limit the action of investors, in order to protect, or promote the “best interests,” of the public.

It’s a massive grey area, and a debate with no clear conclusion, I know. But it’s a topic that I think is going to gain a lot of steam in both Toronto and Vancouver…

I want to start today’s discussion with two interesting quotes – one from an investor interviewed in a CBC.ca article, and one from a blog reader here on TRB.

The CBC article was entitled, “Toronto Real Estate Investors Deny They’re Driving Up The Market.” Read the whole story if you have time.

Here’s an excerpt:

Peter Walsh says that since arriving in Toronto a decade ago, he and his wife have purchased three houses and two condos.

But he rejects the idea that their property investments are contributing to the affordability crisis in the city’s red-hot real estate market.

“I wouldn’t like to think of us as kind of ruining the market for anybody or making it bad for anyone,” says Walsh, who emigrated from the UK and now works full-time as an accountant. “I don’t think I’m driving up the market. I’m just quietly benefiting from it.”

His comments come amid suggestions from some real-estate observers that domestic investors in Toronto are partially responsible for pushing up prices in a housing market with a limited supply, making it a challenge for first-time buyers to purchase a home.

Can you guess which quote it is, that interests me?

It’s this one:

“I wouldn’t like to think of us as kind of ruining the market for anybody or making it bad for anyone.”

No, neither would I.

Neither would most rational people, in my opinion.

Neither would most fiscal conservatives, free-market proponents, or, to be quite honest, those that own their own home.

But if you read the comments on the article (I know, I know, the old adage among journalists “don’t ever read the comments” is ringing in my ears), you would see that a lot of people disagree.

A lot of readers think that Peter Walsh is the devil reincarnated, and that he, and people like him, are doing something wrong.

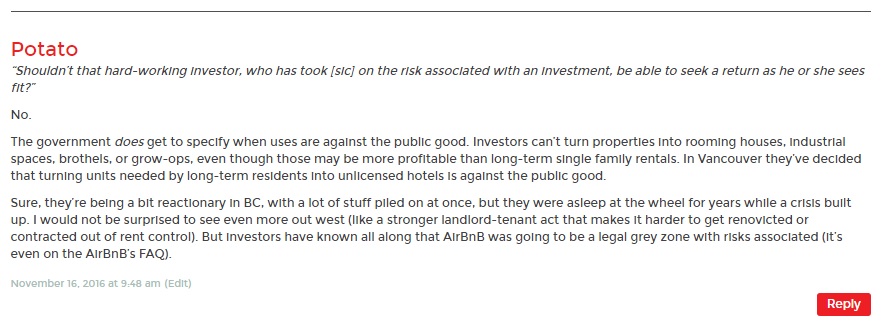

The next quote I want to look at is one from blog-reader “Potato” on Wednesday’s blog:

As an aside, Potato – where have you been? I don’t think I’ve seen a comment under your handle in more than a year! We miss you. And where the heck is Chroscklh or whatever his name was? I miss hearing about his childhood grizzly-bear…

In any event, a resounding “No” was offered by Potato in this comment, in response to my attempt at a rhetorical question.

I feel, for the most part, that investors should be rewarded for the risk they take on, and that they should be free to seek returns as they fit.

Of course, there are always exceptions to the rule.

The returns provided by gambling, for example, might not be legal. I mean, unless you’re betting Pro-Line through the OLG, where the government collects the take, while giving far worse odds than any online casino or sportsbook, might I add.

But as Potato points out, when it comes to real estate, an “investor” can’t result to illegal activities (co-ops, brothels, or even illegal rooming or student housing), and of course we need to consider that the city has already put restrictions on the “uses” of real estate, when it comes to zoning designations. You can’t build a 20-storey building in your backyard, just because that’s what you consider to be the “best return.”

To take things a step further, however, you might read some of the angry comments from the CBC article readers, who believe that real estate should not be available as an “investment,” since it’s where people live!

There’s a school of thought out there that there’s no real harm in “investing” in stocks, but when you’re speculating, buying and holding, and investing in a house, then you’re messing around with people’s lives.

Is that pie-in-the-sky thinking?

Or is there some truth to that?

Who’s job is it to distinguish a fair investment vehicle from an unfair one?

Now as my series of rhetorical, leading, and unanswered questions continues, let me ask you one about speculating.

What is the difference between speculating on real estate, and speculating in the stock market?

People often complain that it’s not “fair” for investors to speculate on real estate, since it drives the price up.

But do you remember the early-2000’s “dot-com” boom like I do?

I was in university, following the stock market with great interest, as every “dot-com” quadrupled in value after its initial public offering.

You could literally create a company based on a “dot-com” URL, having nothing but the name, and a business plan, and go to a venture capitalist for millions of dollars.

Somebody could have bookmarked “www.realestate.com” and put together a PowerPoint slideshow about how this “business” would revolutionize the way real estate is sold, put together a fee structure, make projections for revenue and profitability, and then launch an IPO for $200,000,000.

Tell me that isn’t speculative.

Tell me the people buying stocks based on emotion, hysteria, panic, hype, excitement, greed, and hope, aren’t, by the very definition, speculating.

Every single day, in the stock market, people speculate.

Very few people know the true value of a stock, if you’re looking for the intrinsic value of the company, or a P/E ratio that’s based not only on an acceptable multiplier, but a true value of earnings – one that isn’t massaged by accountants, or created by the CEO.

So what the hell do all these people buying stocks really know? Aren’t they simply speculating on what could happen to the stock price?

I guess to be quite honest, I don’t think the whole “speculation” argument for real estate is a valid one, since any investment is a speculation.

Now if you want to go back to the idea that real estate is a different type of investment altogether, because it’s the only one that’s lived in, and for that reason the government should restrict the type of investments allowed, then I’ll entertain that.

After all, the government applies different tax rates to different investments, ie. which returns on which investments are taxed at which rates.

So can they take it a step further and decide which investment vehicles can be utilized altogether?

It seems as though the government in Vancouver is heading in that direction.

As Potato points out, the government ought to be concerned with the “public good.”

The government’s job, at least in theory, is to serve, protect, and promote the best interests of the public, since the government is in fact made up of the public itself.

So in Vancouver, where you have a dire housing shortage, and “investors” are buying real estate, holding it empty, and taking supply out of the housing stock, it looks as though the government has finally stepped in and said “this isn’t going to happen anymore.”

The 15% foreign buyer’s tax was to try and reduce demand, thereby cooling the market. But it was also specifically trying to eliminate those buyers who are most likely to hold the properties empty in the first place.

Now along comes the vacancy tax, and we can see that the government is taking things a step further.

They know there are 10,000 vacant properties out there, and while they think they’ve put measures into place to stop that number from climbing to 11,000, they’re on a mission to whittle that 10,000 number down, or at least collect tax dollars in the process that could (you would hope…) be used for affordable housing.

Is Vancouver’s situation different from the rest of the country?

Or is this idea of restricting ownership of real estate one that should catch on?

I think the one factor the government can never control, never eliminate, or never fully understand (since most governments deal in theory and not reality), is human nature.

It’s human nature to want.

People don’t only have what they need. Even Abraham Maslow knows that.

People want, and then they want more.

People with money are going to want that money to grow.

To grow your money, you need to invest.

And real estate is, and always has been, one of the most popular and most successful investment vehicles on the planet.

So do we really do away with that?

We live in a capitalistic society, in a free-market economy, and in a democracy.

I just don’t know that you can step in and tell people they can only own one house, and continue to call it all three of the above.

Ralph Cramdown

at 8:02 am

Any investment is a speculation? Pish tosh!

Any investment has risks, certainly, which is why people diversify. But to suggest that owning a conservatively managed railroad, bank, residential REIT, or Johnson & Johnson is of the same character as a junior gold explorer, or a biotech company with nothing that’s been approved by the FDA? Nonsense.

Here’s a simple test: Would you buy it if you could NEVER sell, and had to be content with the (hopefully but not necessarily growing) cash flow it generated, and could will the right to that cash flow to your heirs?

My take on GTA real estate “investors?” They all talk incessantly about immigration and how that’s going to continue to drive prices up. Talk about the low cap rates on offer are minimal, and the typical investment hurdle rate is so low — does rent cover PITI with 20% down on a 5/25 (or even 5/30) mortgage? Hey, they may be right, and they certainly have been so far. But “I’ll be able to sell it for more later” versus “it offers competitive cash flows now” is, IMHO, classic speculative behaviour. And you can find all kinds of better ROI in all kinds of places in America on Loopnet. Or REITs.

P.S. I notice you’re now a broker. Please write us a piece on why you did it, your thoughts on the process and what’s changed for you, as much as you’re able to reveal. Thanks.

Ed

at 8:44 am

I too would be very interested on your thoughts of the whys and hows of becoming a broker.

Mike

at 9:24 am

Every investment is speculation.

You either speculate that the asset is going to go up in value or decrease in value. You don’t buy a railroad or bank stock in the hopes that it remains stagnant.

Yes, there are varying degrees of speculation but that’s the only difference. It’s still speculation.

It kills me when people say ” you shouldn’t look at your house as an investment”. Yes, you need a place to live but you can do that by renting, your hope when buying a house is that one day it will be worth more than you paid for it (interest and expenses included)

Kramer

at 10:40 am

According to Warren Buffett and Ben Graham (Mike, I’m sure you’ll just dump on them too, I mean what the hell do they know? They’re not Mike from the message boards!), investing and speculating are two completely different things.

You are either investing OR speculating.

Investing is buying an asset (property, stock, etc) that is undervalued, below intrinsic value, with a margin of safety built into the price, and the intention of holding it until the value returns to its intrinsic value. Otherwise, you are just speculating… guessing, gambling – not investing.

Most real estate “investing” that we are discussing here is just speculation by this definition.

There’s nothing morally wrong with speculating (99% do it… guess what “the 1%” do?). But there is more risk. It can be dangerous. And worst of all, if things go your way, you can think that it is because you made a “wise investment” decision, when the truth is, it could have gone the either way just as easily.

Read “The intelligent Investor” by Ben Graham to get indoctrinated. Learn it, love it, lead a happy life. You will see the matrix, I promise… and you won’t get fooled again.

Mike

at 10:59 am

Kramer,

Smart men indeed, but with a checkered past in manipulating words and phrases. So I looked it up on the Oxford dictionary for you: “Investment in stocks, property, etc. in the hope of gain but with the risk of loss”

https://en.oxforddictionaries.com/definition/speculation

You might be more of a Cambridge man so I’ve included their definition as well.

the activity of guessing possible answers to a question without having enough information to be certain

http://dictionary.cambridge.org/dictionary/english/speculation

Mike

at 11:00 am

Kramer,

Smart men indeed, but with a checkered past in manipulating words and phrases. So I looked it up on the Oxford dictionary for you: “Investment in stocks, property, etc. in the hope of gain but with the risk of loss”

You might be more of a Cambridge man so I’ve included their definition as well.

the activity of guessing possible answers to a question without having enough information to be certain

Mike

at 11:23 am

Kramer,

As for the book recommendation, thanks but I have read it. My business partner used it as the basis for his thesis and we used a lot of the principals in our quant program. I actually enjoyed his book on Securities Analysis better and have a copy here on the shelf behind me.

If you’re looking for a good read in a similar vain, try Andy Kessler’s Running Money a great insight on how everything ties together.

Kramer

at 12:29 pm

I’ll give it a read, thanks for the reco.

Appraiser

at 8:16 am

Real estate investing has been around a very long time and complainers typically have very little sympathy for investors during a down-turn.

But apparently there will be hell to pay for those taking personal financial risks and displaying the audacity of making money at it!

Chris Morten

at 8:57 am

If you truly believe in the free-market and want to avoid hypocrisy then you must advocate for the complete shut down of the government mandated CMHC. Its very existence is a massive market distortion which allows people to obtain financing and buy houses that they would not be given sufficient credit for in a free market. If you want to find out what real estate is really worth without government intervention then shut it down completely. But I do not think you do really believe this so stop kidding yourself and spare us.

Kyle

at 9:31 am

I think it’s massively ignorant and naive to paint real estate investors as “driving up the market”, including the subject of the article Peter Walsh. Like most real estate stories, this one is very one-sided and panders to the bitter, entitled bears looking for an outlet to blame for why he can’t afford the house he thinks he deserves. Yes some real estate investment reduces supply (e.g. empty homes), but the vast majority of investors are adding supply to an ever tightening market. Toronto has a fixed amount of land and as demand increases the only way to keep prices from spiraling upwards is to continue to add more density and supply. IF: Land bankers didn’t speculate on land assemblies, Developers didn’t speculate on new projects, Investors didn’t speculate on units in these projects allowing the required # of pre-sales to get financing there would be far less supply and prices/rents would be WAY higher than they are now. Yes those people are profiting from it, and well they should for taking the risks (and lets call a spade a spade, this is what truly pisses off the bears). If the objective is to keep prices and rents affordable, the Government should be encouraging more investment and density rather than discouraging it, otherwise they are the ones actually reducing the supply and causing higher prices.

Mike

at 11:14 am

Kyle,

I would agree with you in that investors are barely making a dent in the overall GTA housing market and that as a whole we need investors to in order to grow the city. The term investor is a very broad term, there is a huge difference between active investors, someone who buys a property and rents it out and a passive investor, who buys a house, lo or building and lets it sit idle.

I think Vancouver’s issue and which brought about the tax discussed on Wednesday wasn’t meant to stop investors but to act as a deterrent to passive investors at a time when there is a lack of supply. I don’t believe all this hype about “foreign investors” driving up prices; I think they are a part of the market, a small part but an important part.

Jason

at 10:15 am

I certainly agree that individual amateur landlords should have the right to invest in real estate, should they choose to, and they are not to blame for soaring prices.

But should they? No – it is a misallocation of capital that harms both landlords and tenants.

We can see this by imagining a condo building in which all the units are owned by individual landlords and comparing that to a purpose-built rental building owned by a REIT, which is in turn owned by individual investors in the same proportion.

A landlord/investor would realize the following benefits by owning the REIT instead of the individual unit:

— Diversification: When you own a single unit in a single building, there’s a much higher degree of risk in terms of the tenant from hell, vacancy, local market conditions, acts of God, etc. With a REIT you’re much better diversified, especially if the REIT owns many properties over a wide geographical range. You get to take advantage of the only free lunch in investing.

— Liquidity: With a REIT you can sell at any time, quickly, and at a much lower cost. You can even sell your investment in any proportion. No such luck with an individual condo unit.

— Economies of scale and passiveness: As an investor in an individual unit, you need to micromanage everything, from leasing to maintenance/repairs to taxes/accounting. With the REIT everything is centrally managed, in an efficient manner (a full-time maintenance guy can be hired to take care of many buildings, which is more cost effective than hiring contractors on demand). Maybe some people enjoy this sort of work, but not me.

On the other side, a tenant would realize the following benefits by renting in the REIT-owned building instead of a condo owned by an individual investor:

— Lower risk of getting kicked out: Renting from an individual landlord exposes you to the risk of being evicted due to the unit being sold or the landlord moving in (due to a variety of circumstances in someone else’s life you can’t control such as divorce, marriage, kids, death, job loss, money troubles, relocation, etc.). I’m not willing to expose my family to this risk. As a tenant in a rental building there’s still a chance of getting kicked out if the building is torn down or repurposed, but the chance is much lower.

— Rental buildings offer a standard of professionalism: With an individually owned unit, maybe you’ll luck out and your landlord will be a sweet grandmother who bakes you cookies every week. Or maybe you’ll get the amateur landlord from hell who’s deceitful, lazy, and/or incompetent. Again, not a risk to which I want to expose my family.

So no, I still don’t think the government should intervene with amateur landlords. However, individually owned investment property is a lose-lose for both landlords and tenants.

Condodweller

at 2:00 pm

I suspect the reason people buy homes for investment vs REITs is the same as why they buy stocks vs ETFs/mutual funds. A DIY investor can save the management fees and keep more in their pocket in theory as long as they do proper research and due diligence.

The major negative is for renters as you mentioned being kicked out though that is somewhat mitigated by the rules.

As far as diversification goes, I always said owning a home to live in plus investment properties with no other investments is pretty risky for owners but most readers here are hardcore RE bulls and would disagree with proper asset allocation.

I’m curious, would you advocate for leveraged buying of REITs in lieu of a property purchase. Leveraged purchase of RE with seemingly continuous price increases is a pretty potent drug but I do feel individual ownership has the benefit of eliminating the risk of management misconduct/incompetence.

Jason

at 7:48 pm

I wouldn’t recommend leveraging REIT’s as there’s usually already a certain amount of leverage built into them.

Note that I made the comparison above between REIT’s and directly property investment mainly for its simplicity (comparing an investment property to a portfolio of stocks and bonds is much less direct). And also to show how a property owned by an individual landlord is an inferior product from a tenant’s perspective. I’m not intending to advocate a 100% (or more with leverage) allocation to REIT’s. While this would be much more diversified than direct property investment, it would still be ridiculously under-diversified due to its focus on a single asset class.

crazyegg

at 12:09 pm

Hi All,

DAVID: “I just don’t know that you can step in and tell people they can only own one house, and continue to call it all three of the above.”

That’s what the Canadian government and the chartered banks have been trying to do for the last few years already.

Getting a mortgage for an investment property with an A Lender has become increasingly difficult with government and charted bank regulations.

I’ve said this many times before: It is easier for a kid with no equity working at McDonalds to get a mortgage his first home that a seasoned investor to get a mortgage for an investment property.

The male, pale and stale dudes who are running the show have need to adapt to today’s reality:

* A Lenders need to acknowledge that that condos less than 500SF are the new norm.

* Rental income should be considered at 100% when accessing the lender’s total income. Hell, I have a greater chance of losing my job and becoming unemployed than having my rentals vacant for even 1 month.

I see real estate investors as providing an essential service in the form of rental housing.

Canada continues to shoot itself in the foot. Rental shortage anyone? Gee I wonder why…

Regards,

ed…

Condodweller

at 1:37 pm

“I feel, for the most part, that investors should be rewarded for the risk they take on, and that they should be free to seek returns as they fit.”

I would agree with this. Government does have rules in place to protect the majority for the most part and they continue to add new rules to keep things in check even though their effectiveness is questioned. Investors provide much needed rentals and prop up the construction sector providing many jobs.

Do investment properties take away from home ownership? I know roughly 50% of condo buildings are rented out but I don’t know what percentage of SFHs are rented. I doubt high SFH prices are due to investors driving up prices.

I really don’t understand where the animosity comes from towards investors the only thing I can think of is sour grapes or they are an easy lightning rod for frustration.

Kramer

at 2:36 pm

It is absolutely frustration and sour grapes from people who are not in yet. Anyone who didn’t get a taste of the 20% YOY.

With such a high increase in average price, it is SO CLEAR how much more “that dream house” now costs because they decided (or had) to wait one more year… it is so clear that they waited to save $10,000 more down payment, but the house just went up $100,000…

And this is not a share of Apple shooting up in value, or a hydro facility in Argentina… it’s a house, something that many people here in Toronto feel deeply that they need, or at least want. No one gets pissed that a share of apple is now very expensive… because there are other stocks to invest in.

So, if there is any chance that this “need” just became out of reach because of investor speculation, and that now those speculators are saying “it’s OK, you can just RENT your dream from me”… well, they are pissed.

Still lots of interesting things to buy out there. Just have to be brave if you truly NEED to own… If you truly NEED to own… then buy in Mimico… or near St. Clair and Keele… or wherever you can that you can stomach. If you don’t truly NEED to own, then rent that hip place in Leslieville where all your cool friends live.

In either case, no sympathy here. No one’s crying for the people who can’t afford to buy in NYC.

Joel

at 5:35 pm

I have no problem with people purchasing investment properties, but I work as a mortgage broker and see over 25% of my clients purchasing investment properties.

With that many people buying it creates a much bigger demand and reduction pf supply, which raises the costs.

I think the number of Ontarions (sp) that own rental properties is greatly underestimated.

Kramer

at 7:13 pm

Well, it creates huge demand… supply is what it is… and supply is low because relatively few people want to leave a great city where the jobs are. So it creates a large disparity between supply and demand… and an imbalanced market.

They have tried to reduce demand… clearly it hasn’t worked. The more they try to reduce domestic demand (like with mortgage rules that mainly impact first time domestic buyers), the more of a leg up foreign investors will have. So they have to tread carefully.

You can increase supply a few ways… create conditions where more people need to sell (i.e. do something stupid like double property taxes overnight… that would increase supply)… or organically create more supply by building more.

Tinker tinker tinker… the market will sort itself out.

Condodweller

at 10:21 am

I wouldn’t jump to the conclusion that the changes haven’t helped. Individually they don’t seem like much but when you add them all together I’m sure they had an effect. Which is exactly what we want. We don’t want them to kill the market which will negatively impact existing home owners. Perhaps the changes haven’t reduced much demand yet, but I am hearing that there are less participants in multiple offer situations which if continues, will slow down both demand and prices.

Kramer

at 4:13 pm

You’re right they have to have had some impact, and could continue… and absolutely right don’t want to kill the market. Hopefully just steering it gently onto a more “responsible” trajectory.

Appraiser

at 9:26 am

Is it just me, or does it not seem that the bears have come out of hibernation since the mortgage rule changes?

#DeeplyinvestedinwrongthesisgetoveritallreadythisisTO…(yesI’mstilllaughingallthewaytothebank).

Potato

at 12:45 pm

“As an aside, Potato – where have you been?”

Around, just busy and usually binge-reading a bunch of blogs when I can, which is usually long after the discussions have happened. I just happened to read that post as it was fresh, and couldn’t believe there were no comments on it when I got there.

Bob

at 10:10 am

>And real estate is, and always has been, one of the most popular and most successful investment vehicles on the planet.

>So do we really do away with that?

>We live in a capitalistic society, in a free-market economy, and in a democracy.

Funny thing is, 200 years ago, people made the same arguments you’re making to defend real estate investing to defend the slave trade.

Emery Didriksen

at 12:18 pm

Several poker players all over the globe have dreamt of turning into a poker online pro. You want a attractive chick, then perform the component as well– you ought to gown sexy.