After seeing a multitude of freehold homes with “offer dates” set for next week end up selling via bully offer this past weekend, a few of my clients have expressed frustration with our system of selling properties, or lack thereof.

Once again, I was asked about the concept a true auction format here in Toronto.

I’ve written about this many times before, but as I’m sure the posts are buried somewhere in the TRB archives, let’s take a look at what happened in Australia this past weekend on something they call “Super Saturday.”

I’ve never been to Australia, and while there are literally thousands of places about which a person might quip, “I’d love to go there,” Australia is one that is near the top of my list.

Venice? Meh.

Rome? Enh.

Paris? Maybe. But is their tower really better than our tower?

I’ve been a few places of interest.

I climbed to the top of Mount Kilimanjaro in Africa. I’ve been to base camp at Mount Everest in Nepal/Tibet.

But when push comes to shove, I’d honestly rather rest at our family’s modest vacation home in Idaho than see the sites in Germany, Argentina, or Greece.

Perhaps that makes me boring. A little lazy even.

But for some reason, if I were to plan a true “trip,” as opposed to my prefered Idahoian “vacation,” I think Australia would be an awesome place to explore.

Call me crazy, but I feel a connection to Australia, as I do with the United Kingdom, because they’re part of the Commonwealth. I know that’s bizarre, and that the Commonwealth isn’t really a “thing” anymore, or at least not of any importance. But I feel as though the Brits and the Aussies are like us in many ways, and perhaps it all stems from the same origin.

I also had a huge crush on Poppy Montgomery back when “Without A Trace” was a hit show. Maybe that factors into my soft spot for Australia…

There are over 200 countries in the world, and when I look outside of our borders to see how other people live, breathe, and work, I often find myself looking at the United Kingdom and Australia first, and strangely, that’s before I look at our neighbours to the south. We’re just in really different places right now, although that’s a topic for another day.

So when I look at international real estate, steering clear of the click-bait in the Monaco’s of the world, of course, I look at the UK and Australia for comparisons.

If you haven’t heard about how real estate is sold in England, you’d better catch up – fast!

In 2015, I wrote an article on TRB called: “Gazumped!”

Perhaps not the most search-engine-friendly title, but the article went on to explain what exactly “gazumping” is, and how it wreaks havoc in the UK’s real estate market.

Read the article if you have time, but perhaps a quick example is warranted.

If I sell a house tonight to buyers for $1,450,000, with a May 31st closing date, then they would provide a deposit cheque – say $75,000, and that cheque would be held in trust as “consideration” for the transaction, up until the closing date, and the balance would be paid to the seller on that date. The deal is “firm,” and thus neither buyer or seller can change his or her mind, and/or get out of the transaction, short of some sort of fraudulent misrepresentation or act of God.

Now let’s say on May 29th, a would-be buyer for the home says, “Damn, I can’t believe I missed that house! I wasn’t in the market back in March when the house first sold!”

What if that buyer could offer $1,451,000, and somehow steal the property from the buyer who had contracted to purchase it two months earlier?

GAZUMPED!

True story, no exaggeration.

And that is how the British real estate market works.

The entire market is a set of dominoes. One person gets gazumped, and it sets off a chain reaction of buyers and sellers, trying to get in or out of other deals.

Oh, and it bears mentioning that in England, they only have multiple representation!

That’s right. Here in Ontario, we’ve heard rumblings about potentially doing away with multiple representation and/or dual agency. But in the UK market, you MUST buy your home through the listing brokerage via multiple representation.

I suppose any system, in any country, is going to have its pros and cons, right?

As I said at the onset, many people in Toronto are frustrated with the current “system,” if you could call it that.

The bully offers taking down properties on Saturday night at 11pm are not ideal for buyers.

And what do we make of houses listed for $999,900, sitting on the market for 14 days, where the seller won’t actually entertain anything under $1,200,000? Isn’t that false advertising?

In times like this, buyers look outside our system to see how other people are doing it, and as the saying goes, the grass is often greener on the other side.

The UK model doesn’t work, so let’s not even go there.

But the argument often goes toward the Australian “model,” whereby houses are sold via auction.

Auctions aren’t unique to Australia, by the way. HERE is a 2013 blog post I wrote about an auction for a house in Victor, Idaho, but the auction comes with more catches than Kevin Pillar…

But when the words “real estate” and “auction” are strung together, people get warm and fuzzy like the koala bears that Australians keep as pets.

First and foremost, have a look at this website:

https://www.realestate.com.au/auction-results/nsw

We here in Toronto are waiting for TREB to allow us to publish sold data, and in Australia, you have a site like this one which publishes the results of all the auctions in the country.

That link goes to the results for Sydney & New South Wales, but you can click on the other areas below.

“Super Saturday” in Australia refers to a date when a slew of properties are up for auction, and presumably, sell.

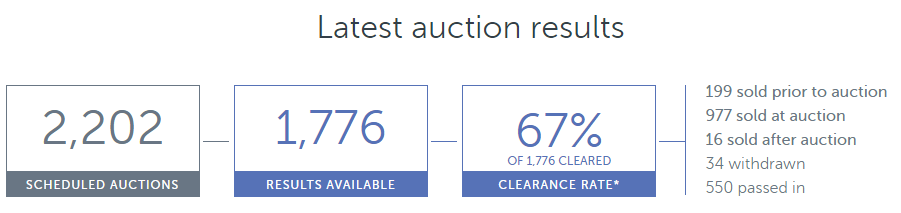

Posted on Sunday morning are the “clearance rates” for all the properties available at auction, like the following:

Now what does this terminology mean?

“Sold prior to auction” obviously refers to properties that were listed for sale, whereby the seller was provided with an offer, or offers, and decided to forego the auction.

“Sold at auction” needs no explanation, but keep in mind that these auctions come with a reserve price, so the bidding must meet or exceed that price for the property to sell.

“Sold after auction” refers to properties that either didn’t get bids, or did, but were “passed in,” and a deal was worked out.

“Withdrawn” refers to properties taken off the market by the seller.

“Passed in” is where things get interesting. This is where a property receives bids, but the high bid at the end of the auction fails to meet the seller’s reserve price. The property is then “passed in” to negotiations between the seller and the high bidder, overseen by an agent.

The “Clearance Rate” above is the sum of all the properties sold, withdrawn, or passed in. Only properties remaining on the market for sale are “not cleared.”

The acceptable Clearance Rate varies by area, and of course, current market conditions.

By way of comparison, Australian Capital Territory (ACT) had a 74% clearance rate last weekend, but Western Australia had only a 29% clearance rate.

Another two very important statistics would be:

1) Percentage of Properties Sold at Auction

2) Percentage of Properties Passed In

The entire goal of an auction is to sell properties at that auction.

Sure, properties sold both before and after the auction are important as well, and perhaps you could add those to the “sold at auction” for a total sales number. But if the idea behind the auction is to sell properties with a gavel, then I like the “sold at auction” number.

Secondly, the percentage of properties “passed in” is tremendously important. This is a good measure of whether buyers are willing to meet sellers’ expectations.

A further useful statistic would be the percentage of passed-in properties that end up sold, but I’m guessing that data isn’t available. This would also help provide insight into the market, specifically whether or not sellers, and their unmet expectations, become more reasonable.

So let’s look at the above stats for Sydney and New South Wales.

Their “Clearance Rate” is 74%, but is that really important to us, or is that just the auction house making up a number? Considering that they’re “clearing” properties that are withdrawn, I don’t think it’s something to brag about, so I’d rather come up with my own analysis.

233 of the 1,602 properties sold prior to auction, so that leaves 1,369 that went to auction.

529 of 1,369 properties were sold at auction. That’s 38.6%.

291 of 1,369 properties were passed in. That’s 21.3%.

So roughly 60% of properties are getting significant action.

But what do you make of the fact that 21.3% properties – one in five, results in a final bid price that’s below the seller’s reserve price?

Again, we don’t really know how to evaluate that number, so let’s see how Sydney & NSW compares to Victoria:

The clearance rate is 2% higher, so we’re working within the same band.

199 of the 2,202 properties sold prior to auction, so that leaves 2,003 that went to auction.

977 of 2,003 properties were sold at auction. That’s 48.8%.

550 of 2,003 properties were passed in. That’s 27.5%.

Roughly 76% of properties in Victoria are getting significant action, and across the board, the numbers are higher.

And when it comes to those properties withdrawn – only 1.5% of the 2,202 came off the market, compared to 8.3% in Sydney & New South Wales.

I figure you’d have to analyze data for every area in the country to draw conclusions on what are percentages of sales at auction, properties withdrawn, and properties passed-in are “acceptable.”

Now as for the website itself – www.realestate.com.au, you can scroll down and see every property and its corresponding status, sorted by suburb.

And you even know the result for each property. Which sold at auction, which was withdrawn, which sold before or after the auction, and which was passed-in. So as a buyer, you know which properties are tied up, which are gone for good, and which might come back into play.

As for the auction itself, well, this is where things get VERY interesting.

Auctions are conducted in person, in front of the house, and the streets throughout the country look like this on Saturday:

We could spend a whole week’s worth of blog posts looking at how to bid, what happens before and after the auction, qualifications, etc.

And logistics is another topic altogether.

But let’s consider that auctions are not exactly government-mandated in Australia, but rather they’re borne out of desire. The market participants are accustomed to it, and take it as given, just as the British accept “gazumping” as an every-day part of their market, and as we here in Toronto accept bully offers.

I’m sure if time was infinite, we could all sit down and figure out how to take the best parts of all three “systems,” and perhaps a few others, and put together a structure that would work best for all here in Toronto.

But you know what?

Even then, there would be those opposed.

Call it pessimistic, but you can’t call it untrue: the grass is ALWAYS greener on the other side…

Julia

at 6:38 am

I don’t know when you started putting your post up earlier in the morning, but thank you! Just realized I am reading this at 6:30 and you didn’t used to have them up this early.

KD

at 8:54 am

Very interesting. You might also wish to discuss the “advertising fees” Australian sellers normally pay. These can be substantial and usually come without a sale guarantee.

See https://www.localagentfinder.com.au/blog/advertising-costs-when-selling-a-house/

Craijiji

at 10:23 am

Commission is lower (typically 2-3%) so this is a wash.

Appraiser

at 11:54 am

Not a wash if you don’t sell.

Craijiji

at 2:08 pm

If you read the article, you’ll notice a few things. One is that some agents would build this cost into commission, and another would be that they have a don’t sell/don’t pay arrangement. It’s pretty simple, shop around.

Sandra

at 5:30 pm

In some territories (provinces), the sellers are allowed to bid up their own properties. Agents have also been known to ‘plant’ fake bidders amongst the audience. It’s not without its problems.