As much as I’d love to show you my blog video on Berczy Park in the St. Lawrence Market neighbourhood today, perhaps I’ll have to push that back to Friday.

This story hit the proverbial wire last night, and everybody in my industry is talking about it.

Plus, my accountant, and my lawyer, and all my friends who work in finance.

The shock-value of this story is real, but could this “ruling” actually last through an appeal, and change the way real estate is sold?

I’ve seen the story in a few places now, but I first read about it in the Calgary Herald, in an article entitled, “House Buyer Beware: Landmark B.C. Court Ruling Will Shake Real Estate Industry.”

The story, in a nutshell:

1) The C.R.A. was owed money by the seller of a property, who was not a legal resident of Canada.

2) The C.R.A. came after the buyer of the property, after the seller had absconded (probably back overseas).

3) The buyer of the property sued the notary for not determining the seller was a non-resident, and/or not holding back sale proceeds to account for capital gains tax owing.

Here’s the juicy part of the story, as it appears in the Calgary Herald:

Douglas Todd – Vancouver Sun – 3.27.2017

A B.C. Supreme Court ruling will send shock waves through the arm of the Canadian real-estate market that is powered by foreign capital, say immigration lawyers.

The ruling targets a weakness in Canadian laws that often leads foreign owners of real estate in cities such as Metro Vancouver and Toronto to claim they are “residents of Canada for tax purposes” when they are not.

The landmark B.C. decision requires notary public Tony Liu to pay his client more than $600,000 because Liu failed to adequately determine whether the Vancouver house his client was buying for $5.5 million had been owned by a tax resident of Canada.

As a result, the Canada Revenue Agency did not get paid, at the time of the sale, the 25 per cent capital gains tax it charges non-resident sellers of Canadian property on any profit they make on the sale.

So the CRA later demanded the buyer pay the $600,000 in tax. The buyer, in turn, sued Liu, arguing Liu failed to discover the seller was not a tax resident of Canada.

The CRA considers people who don’t live in the country at least six months a year and don’t pay income taxes here to be foreign property investors and speculators and thus subject to capital gains taxes.

The B.C. decision is a stark warning to real estate agents, notaries and lawyers who fail to ensure that sellers of properties are truly tax residents of Canada, said David Lesperance, a tax and immigration lawyer based in Toronto.

“This truly is a game changer,” said Vancouver immigration lawyer Richard Kurland.

“It’s a precedent. Real estate agents can now get a knock on the door from the taxman, asking for the (capital gains) taxes that should have been collected by Ottawa, because the agent failed to make adequate inquiries.”

Wow.

Game-changer, indeed.

But is this really going to hold up on appeal?

I know, I know – you’re going to tell me to shut up. Stop being cynical for just two minutes, and think about the “benefits” of this ruling.

But this is just so far out to lunch, that I don’t think anybody can celebrate yet. I think we have years of appeals ahead of us, as is often the case with any “landmark” ruling.

Check out the entire ruling if you have time, and/or are a nerd like me. You can find it HERE.

What I find really interesting is the summary of claims from the defendant, and then the response from the defendant.

Below are two excerpts from the lengthy B.C. Court judgment:

The plaintiffs allege:

a) they entered into a contract on November 3, 2014 to purchase real property in Vancouver for the sum of $5,560,000;

b) CEIR was a creditor of the registered owners of the property and had conduct of sale pursuant to an order of this Court (the “Court Order”);

c) pursuant to an “engagement letter” dated November 10, 2014 and on the letterhead of the defendants, the plaintiffs retained the defendants to complete the conveyance of the title to the property to them;

d) the engagement letter included provisions that the defendants would “negotiate appropriate closing undertakings with solicitor/notary for the Seller” and would “make inquiries as to the residency status of the Seller pursuant to the Income Tax Acts [sic] as required”;

I observe that all parties understood it was the residency of the registered owners of the property that was relevant.

e) the defendants sent a draft statutory declaration concerning the residency status of the registered owners of the property to the lawyers for CEIR which was BLG, who “refused to sign the statutory declaration as to the residency of the Registered Owners, saying that this was a court ordered sale and their client was neither the vendor nor the owner of the property, and therefore not in a position to make any representations with respect to the property or any issues relating to it”;

f) one of the registered owners was not a resident of Canada at the time of the purchase of the property;

g) “Contrary to the terms of the Engagement Letter, the Defendant Tony Liu Notary Corporation proceeded with the conveyance of the Property despite not having any indication as to whether the Registered Owners were residents or non-residents of Canada for tax purposes under the Income Tax Act”; and

h) by letter dated February 23, 2015, the Canada Revenue Agency (CRA) advised the plaintiffs that no certificate of compliance with s. 116 of the Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.) had been obtained in relation to the purchase of the property and accordingly the plaintiffs were obliged to pay withholding tax which was assessed at $695,000.

—-

In their response to civil claim the defendants made admissions the effect of which is that the following facts are not in issue:

a) the plaintiff’s entered into the contract of purchase for the property as alleged;

b) CEIR had conduct of the sale pursuant to the court order;

c) the identity of the registered owners of the property, one of whom was not a resident of Canada at the time of the purchase of the property;

d) pursuant to the engagement letter the plaintiffs retained the defendant notary corporation to convey title to the property to them;

e) the engagement letter included a term that the defendant notary corporation was “to make inquiries as to the residency status of the Seller pursuant to the Income Tax Acts [sic] as required”; and

f) title to the property vested in the plaintiffs on November 17, 2014.

The defendants also allege that they conducted a title search on November 10, 2014 of the property which showed:

a) the mailing address of the registered owners was the address of the property;

b) the registered owners had owned the property for more than 12 years; and

c) “there was a history of mortgages [against the property] in favour of financial institutions in Canada”.

These are the alleged “indication” that the registered owners were residents of Canada at the relevant time.

So the defendants did attempt to ascertain whether or not the registered owners were residents, as per the last section (a, b, and c).

The mailing address of the owners was, in fact, the address of the property.

The registered owners had owned the property for more than 12 years.

And financial institutions had loaned on this property.

But was that enough?

Did they go far enough?

As the courts have ruled, they did not!

And frankly I’m shocked by this ruling, which I think is so exceptionally punitive, that I just can’t imagine it’s not overturned on appeal.

I get it. I understand.

People are fed up with foreign buyers in Canada, whether it’s Toronto or Vancouver.

And just about every government, at every level, in every country, needs money.

Combine the two, and we get new taxes, like the 15% foreign buyer’s tax in Vancouver.

But now we’re also going to have the C.R.A. go after the buyer of a property, when they can’t go after the seller, who owes them money.

And this court case shows that the buyer can sue their notary, real estate agent, or lawyer, and that the courts may in fact side with the buyer.

But what are the further implications of the C.R.A.’s stance that they can come after the buyer when they can’t track down the seller?

How could this apply to, say, HST?

When houses are built here in Toronto, most builders do what is referred to as a “substantial renovation,” to save on the HST.

But ultimately it’s up to the C.R.A. to determine what is a “new build” and what is a “substantial renovation,” and the former comes with HST implications.

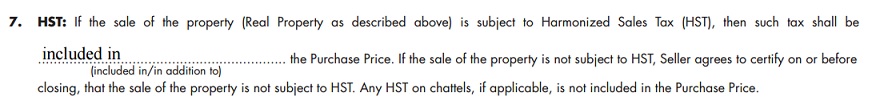

Section 7 of the standard OREA “Agreement of Purchase & Sale” contains the following section:

That can read “included in” or “in addition to.”

So if you’ve purchased a home, and the APS says “included in,” then that means even if the C.R.A. determines that HST should apply (after the fact), then it’s included in the sale amount, and thus the buyer doesn’t have to pay in addition.

If the C.R.A. determines that HST should apply, for a house that sold for $1,300,000, then they would suggest that house actually sold for $1,150,442, and there was 13% HST, for a total of $1,300,000.

Then the C.R.A. comes after the developer for that $149,558.

But by the same logic with respect to the capital gains tax for foreign buyers, if the C.R.A. wasn’t able to get that $149,558 from the developer/seller, would they then come after the buyer?

Who knows.

The Canadian government is spending money like it’s going out of style. Apparently they spent $14,000 on one television, so anything is possible.

Bottom line for buyers and their agents: a new standard clause is coming.

Something like:

“The Seller hereby states that he or she is a legal resident of Canada with respect to Section 116(5) of the Income Tax Act, and that no capital gains will be owing upon completion of this sale.”

Something like that. I’m not a lawyer, but I think a TEAM of them will be putting their heads together to come up with some verbiage to protect buyers, and as an extension, agents, lawyers, and notaries.

Something tells me this is not the last we’ve heard of this story…

Ralph Cramdown

at 9:10 am

Yeah, no.

It isn’t an accident of the legislature that the CRA put the onus of collecting the tax on the buyer. People are always trying to cheat the taxman. The taxman knows this. It is easy to abscond with money, but hard to abscond with a house (don’t laugh — it’s been done). So they put the onus on the new owner of the house. Fair? Maybe not. But is it fair that your employer (if you’re not self-employed) has to deduct taxes off your paycheque and remit them to the government, making their otherwise simple payroll system complicated? Same deal. The tax system is designed this way because if it was the other way, more people would cheat and get away with it.

The facts of this case are pretty funny. Borrowers default on their mortgage on a Vancouver house worth $5.5 million. If I asked you to complete the sentence “I’ve got a mortgage with _____,” then I’d say “Royal Bank” would be an odds-on favourite. “CE International Resources Holdings LLC” would probably be a lot further down the list.

Be that as it may, the notary knew that it was his job to check the residency of the sellers, because it was right there in his contract with the buyers… and I’m guessing that it wasn’t the buyers who wrote that contract. So he asks the other side’s lawyers (BLG) to certify that the owners are residents, and they tell him to get stuffed, because they work for the mortgage holder, not the owners. So what does the notary do? He lets it slide, and hopes things work out. And they don’t.

And you think some Bay Street hotshots are going to be able to craft some boilerplate to contract buyers out of the Income Tax Act, by having sellers PROMISE that they don’t owe any tax, maybe with their hands on their hearts, and maybe you check behind their backs to make sure that their fingers aren’t crossed on their other hands? Good luck with that one.

Ralph Cramdown

at 10:47 am

So if you google “CE International Resources Holdings LLC,” you get this other oddball court case that starts off as an arbitration in New York about a deal to buy and sell some rare earth minerals worth about US$8,000,000 that goes bad, splits off into some arguing about what a US court can compel Deutsche Bank to produce about accounts in Singapore, generates a summons in CE International Resources Holdings LLC, of Connecticut, USA, v. S.A. Minerals Ltd. Partnership, of Thailand; Tantalum Technology Inc., of the British Virgin Islands; Yeap Soon Sit, of Thailand; and Deutsche Bank International Trust Co. (Cayman) Limited. of the Cayman Islands, at the Grand Court of the Cayman Islands… and finally ends up in a BC courtroom attempting to enforce the arbitration award against Mr. Yeap Soon Sit, who seems to have been cited in contempt of court in several jurisdictions.

If you google Yeap Soon Sit, you get a phone book listing in Vancouver, for 6570 Marine Crescent. If you google that address, you get stale real estate listings asking $7.5mm, from as recently as February.

Hunter S. Thompson said “when the going gets weird, the weird turn pro.” A shell company that trades in rare earth minerals (maybe legit, maybe at inflated prices to get money out of certain countries with currency controls), subpoenas a customer in all of the best tax havens, and holds mortgages in Vancouver. You cannot make this stuff up.

Nothing to see here, folks. Move along.

Max

at 5:37 pm

Ralph, you have my attention.

Ralph Cramdown

at 9:10 am

” The issue in the arbitration involved liability under two contracts and claims of fraud against Mr. Yeap. The first contract was an Amended Purchase Contract in which SAM sold to CEIR approximately 125,000 lbs. of rare metals (or syncons). CEIR was required to, and did in May 2009, make a provisional payment of 90% of the purchase price, which amounted to $4,376,561. The second contract was a 2011 Sales Contract in which TTI purchased from CEIR approximately the same amount of syncons for a price of $8,055,000. The syncons were never delivered by SAM to CEIR and TTI never paid the purchase price to CEIR.” – http://www.courts.gov.bc.ca/jdb-txt/SC/13/18/2013BCSC1804.htm

I’m going to sell your Connecticut shell company some rare earths for $5mm from my Thailand company, and buy them back from you two years later for $8mm using my BVI company. Except, whoops, your 90% deposit disappears, no minerals change hands, and your shell company takes me and mine to arbitration (as specified in the contracts) in New York. And wins. And tries to go after my assets in Singapore, BVI and the Caymans, but doesn’t have much luck. But gets the judgment enforceable in BC, where maybe I own an expensive Vancouver house?

I’ve read about import/export deals using the wrong valuations to move money out of China (and other places, presumably). I’ve also read about fake lawsuits used as a reason for the “loser” to be able to move money out of China. Or maybe it’s just a straightforward case of one guy promising to do one of those things for another guy, and ripping him off. But it doesn’t look like the work of honourable men. And both sides in the dispute seemed to have significant assets in Vancouver (one, a house, maybe, and the other held a mortgage on a different house, which they had to power-of-sale).

Completely missing from all this is the identity of the original owners of one of the houses, from the tax case, “one of whom wasn’t a Canadian resident,” who got a mortgage from sketchy-offshore-shell-LLC and then stopped paying it.

Vancouver is really starting to look like Casablanca, or Mos Eisley, pick your movie metaphor. And the BC courts happily let these guys sue each other, because no matter how obvious it is that absolutely everybody is skirting Anti Money Laundering laws, they got an arbitration award in New York, and we gotta respect that.

Condodweller

at 10:45 am

This is fascinating stuff your average Canadian wouldn’t normally come across unless they happen to find themselves a counterparty to a situation like this. What gets me is that greed has no bounds. I mean on one hand you have a guy who is avoiding taxes and moving his/her money out of China and another who is presumably getting paid well for facilitating it yet feels the need to rip off the other guy. Not to mention that in China, this is probably the sort of stuff you get killed for. Unless the rip off and the lawsuit is part of the ploy as you suggest.

Frances

at 4:50 pm

Ralph, that’s fascinating. And good for you to have sorted all that out -thanks.

Boris

at 11:22 am

Taxation is theft.

Condodweller

at 4:23 pm

And free health care is slavery…

Boris

at 7:20 pm

If the doctor is compelled to work for no compensation, yes.

crazyegg

at 2:07 pm

Hi All,

Current title insurance that is included in the buyer’s lawyers fees probably does not cover taxes outstanding.

As such, there may be another kind of legal insurance fee which will be payable by the buyer.

Title insurance was a game changer, as it basically got the lawyer off the hook for anything he missed regarding titles.

NET/NET: I don’t foresee this new ruling to change buying habits.

Regards,

ed…

M M

at 2:26 pm

Off topic question: David, can we get a comment about Tarion? Only one newspaper covered it, but it was on its front page today. I’d think it’s a big deal.

Condodweller

at 4:20 pm

Something tells me we may have to wait until Monday for David’s Berczy video until Monday 🙂

Condodweller

at 4:21 pm

We really need an edit feature on these posts. This is what happens when you multitask and change things on the fly….

Jack

at 12:57 pm

Interesting. Is it really so difficult for a notary/lawyer to find out if the seller is a resident of Canada in the eyes of CRA? If so, then I hope CRA will implement a mechanism to make it easier in the future, in the interest of everybody — buyers, sellers, agents, lawyers and CRA itself.

Ralph Cramdown

at 1:09 pm

NOAs since the seller(s) bought the property oughta do it.

(ducks)

Jack

at 3:40 pm

So CRA can provide a simple service: For a small fee, answer the question “Is so and so a resident of Canada as far as you, CRA, are concerned?” It would save CRA the expense of trying to recover the tax later on.

Doesn’t seem like a difficult problem, especially compared with many other challenges in real estate markets.

A

at 6:16 pm

The standard under section 116 of the ITA is reasonable inquiry… it is messy though from a practical persepctive.

Marc bastle

at 5:59 am

Better hold off buying that house for now Dave. You may need the down payment for legal fees.