I can’t believe we’re talking about this again.

Apologies to those who were looking for something innovative this morning, but right now, I feel like a Hollywood studio…

Remember when Batman came out in 1989?

Starring Michael Keaton as the most unlikely Batman ever, and Jack Nicholson as The Joker, the film represents the “start” of the Batman series for most of us.

Amazingly, Jack Nicholson was not nominated for Best Actor (or Best Supporting Actor…) for his performance, whereas both Heath Ledger (2008) and Joaquin Phoenix (2019) were not only nominated for their portrayals of The Joker, but they both won!

But the 1989 version of Batman was not the first movie in the series. In fact Batman (1943), Batman and Robin (1949), and Batman (1966) all preceded the 1989 classic.

We all saw Batman Returns (1992) with Michael Keaton, which was a good sequel, annd then Batman Forever (1995) with Val Kilmer as Batman, which was good if you were a child but awful if you were a self-respecting adult. Batman & Robin (1997), with George Clooney as Batman, was atrocious.

That should have been the end of it there, right?

But the series was re-started in 2005 with Christian Bale as Batman in “Batman Begins.”

Amazing movie! And “The Dark Knight Rises,” even though it was about five hours, was good.

But then came Robert Pattinson as Batman.

After that, it was Ben Affleck as Batman.

Who’s next?

I thought the same thing about Spiderman, to be honest. Hollywood made a trilogy with Tobey Maguire (2002, 2004, 2007), but then they immediately re-made their re-makes with Andrew Garfield as Spiderman (2012, 2014), before re-making the remake of the remake with Tom Holland as Spiderman (2017, 2019, 2021, 2026).

For the record, I’m not a film fan, and I don’t watch any fantasy.

I just like statistics and looking things up on Wikipedia…

My point to all this is simply that originality is lacking everwhere you look in life, and Hollywood has always been the biggest and brightest example of that.

So am I being unoriginal for writing about “listing for one dollar” yet again?

Folks, we’ve tackled this topic way, way too many times over the years.

Here are a few examples:

May 5th, 2010: “Listing Price: $1.00”

May 7th, 2010: “Listing Price: $1.00” (pt2)

May 25th, 2021: “Does Listing For $1.00 Actually Work?”

September 12th, 2024: “Listing For $1.00: A Strategy Destined For Failure”

The last time we discussed this was a mere six months ago!

But alas, the topic has come up yet again, thanks to a familiar foe of ours known as BlogTO.

Yes, from the authors of articles about food, music, culture, and arts comes an obviously affiliated topic: real estate.

And for a change, they have it wrong:

A bidding war?

Guys, come on!

I don’t tell you how to complain about the cost of living while holding a fresh store-bought coffee, nor do I opine the best ways to find a “safe space” when you’re in dire need.

So tell me that this house is going to spur a bidding war?

Geez.

If I didn’t know any better, I’d say the folks writing these articles know less about real estate than I know about participation ribbons…

Suffice it to say, this house is not going to produce a bidding war.

But you merely need to read the article to see the problem:

“This three-bedroom, three-bathroom home in West Lansing has been on and off the market four times since 2023 without selling.”

Right. So the sellers want too much money and they won’t accept fair market value.

Easy-peasey.

Except the folks who wrote the article think it’s a great idea:

“In this slow real estate market, some realtors are thinking outside the box to get their house to sell.”

No, this isn’t outside-the-box thinking at all. It’s pure lunacy, is what is.

And the end result will be another terminated listing because there’s no chance this property, listed at $1.00, will sell.

In fact, almost no properties listed for $1.00 end up selling.

As much as I want to deny the lack of originality by revisiting this topic today, I want to put one final nail in the coffin before

I’ve written previous blogs about this, but I’ve never provided you with data to demonstrate why this “strategy” of listing for $1.00 doesn’t work.

So today, I’m going to do that.

This past weekend, I left my wife and children at home and checked into a Motel 8 by the airport armed with nothing but a case of Red Bull, a bag of Cheetos, my laptop, and an infatuation with data!

Here was my mission:

Download the data of all properties listed for $1 over the last ten years in each of Toronto, York, Durham, Halton, and Peel, break them down by category, and finally come up with a realistic percentage chance that a $1 listing sells.

Mission accomplished.

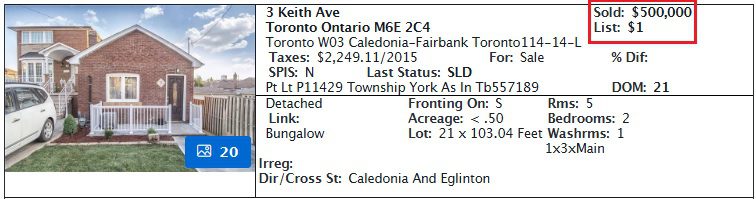

So first and foremost let me say this: there are examples of this “strategy” working.

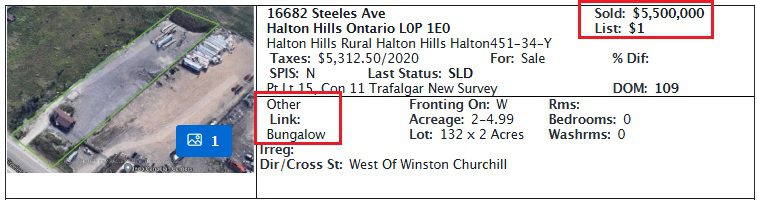

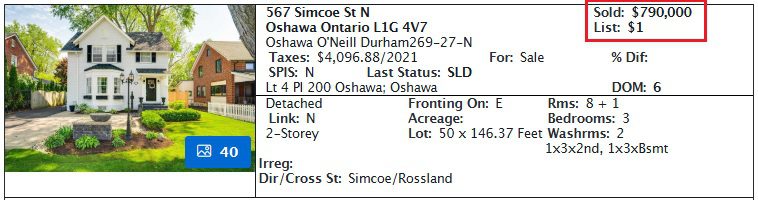

Here’s one from 2015:

Yes, one.

And there are others, no doubt about it.

But when I say this strategy “never has worked and never will,” I’m not talking about isolated incidents. I’m talking about as a matter of standard practice.

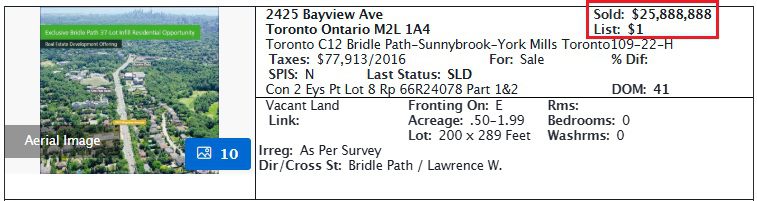

In the commercial real estate world, properties are listed for $1.00 all the time.

But again, that’s a common, often standard practice in the industry. It’s called an “unpriced offering” and it’s essentially putting the property up for bid.

In commercial real estate, it’s up to the buyers to determine value.

I mean, that’s how it works in all markets, in theory anyways. But in commercial real estate, the seller need not price the offering. They just need to post it for sale and whether it’s two weeks or two months later, interested parties can submit letters of intent or offers.

In commercial real estate, the bids can have a much larger spread based on the property type, use, and what the buyer intends to do with it.

If an apartment building was posted for sale for $1.00, the bids would likely fall into a smaller range because the buyer pool would be made up of investors, real estate investment trusts, pension funds, et al, and they would be using similar evaluation criteria.

But if a parcel of raw land was posted for sale for $1.00, the bids could differ dramatically based on what the buyer believes they could do with the site. What could they build? How long would it take? What is their cost? Who would they partner with? How complicated is the process to get from A to B, ie. rezoning, greasing politicians, etc.

In the world of residential real estate, the buyer pool just isn’t as savvy.

Theoretically, the buyer pool could use existing pricing data to figure out what the property is “worth,” but as we’ve discussed on this blog time and time again, many buyers use emotion, hope, faith, naivety, and inexperience as the driving factors in their ability to price properties, and that’s why we often see “dummy offers” on offer night.

Think of a 3-bedroom, 2-bathroom, semi-detached house that’s listed for $999,000 with a scheduled offer date.

Now consider five similar homes all selling in a two-block radius during the last two months for between $1,200,0000 and $1,300,000, with four of those houses also being listed for $999,000 with an offer date.

So when offer date comes on the subject property, who’s submitting an offer for $1,010,000 with two conditions?

And why?

That doesn’t happen in the world of commercial real estate when properties are priced at $1.00.

But if a residential home were priced at $1.00, what would happen?

First and foremost, let me offer the following:

I’m of the mindset that the buyer pool in the residential real estate market doesn’t like $1.00 listings. They already don’t like pricing a $1,300,000 house for $999,000 with an offer date, so they sure as heck aren’t going to like $1.00 listings.

What’s worse than a gimmick

An even larger gimmick.

Not only that, I wonder if the $1.00 listing “cheapens” the offering in the mind of the buyer.

Secondly, I will offer the following:

How is the buyer pool going to find a property listed for $1.00? Who’s searching with that criteria?

Not only that, if and when they do find the listing, won’t most of them think:

a) This is a typo.

b) This is too good to be true.

c) There’s something wrong with this property.

Again, the gimmick factor is going to work against the listing far more often than not.

Alright, so with all that preamble, and a tangential analogy about Batman, let me get to the data.

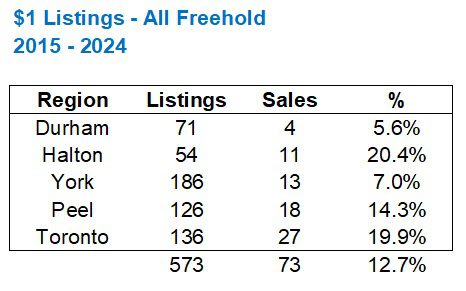

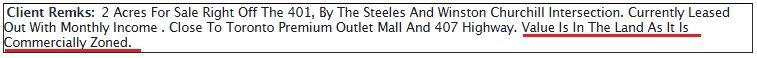

I looked from 2015 through 2024 in the five major TRREB regions: Toronto, Durham, Halton, Peel, and York.

I looked specifically at freehold listings.

Here’s what the data shows:

First and foremost, 573 listings over a decade isn’t a lot.

But secondly, a success rate of 12.7% isn’t a lot either.

Now, here’s where many of you say, “David, hang on – you said ‘never will work’ and it clearly does to the tune of 12.7%!”

But this is all freehold listings.

That includes vacant land, which shouldn’t really fall into the same category as Becky and Tim’s rowhouse in Leslieville.

For example:

But vacant land isn’t the only property “type” included within the freehold category of MLS that shouldn’t fall under the BlogTo headline of “Look At This Genius Seller For Listing His Roncesvalles Home For A Dollar!”

In fact, there are four such types which I feel don’t belong:

- Vacant land

- Rural

- Farm

- Other

I mean, when you’re selling a property and it’s categorized under “other,” I think it’s safe to say that this isn’t Todd’s cool-guy loft in Queen West.

Here’s an example of “other,” and keep in mind that this is listed as a freehold:

Other.

It’s a detached bungalow from the photo, it looks like vacant land to me.

This isn’t Skylar’s condo at Theatre Park, listed for $1.00 because she wants to trick the market and solicit twenty-six offers and have the price bid up past fair market value.

This is basically commercial land.

Oh, wait, if you look at the listing you’ll see that it actually is:

Alright, so what happens if we exclude vacant land, farms, rural, and properties with the “other” designation?

Well, the data set changes substantially!

As a result, the success rate changes as well:

We went from a success rate of 12.7% with all freehold listings down to only 6.6% when we remove vacant land, farm, rural, and “other.”

But we need not merely stop there!

In fact, if we looked at every single one of these sales, we would see that most aren’t really “homes.”

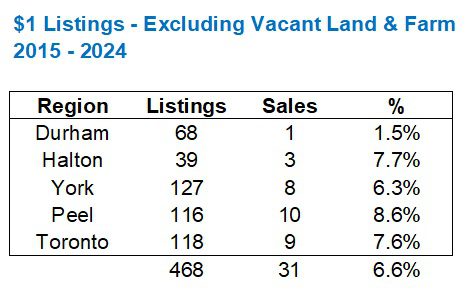

And even those that are actual homes usually have some sort of asterisk, like this one:

Yes, it’s a house.

But it’s a power of sale and this simply isn’t the same thing as some “revolutionary, outside-the-box thinking real estate agent” who’s being lauded on BlogTo or a similar symbol of journalistic excellence.

In the end, when you strip out the freehold properties that aren’t actually houses, and you remove power of sales and other specialty situations, your success rate is closer to 1.0%.

Who’s going to take that on?

You’ve got to be really desperate or really naive to put your eggs in a basket with a 1% success rate.

Success can happen. I won’t say it’s impossible.

Here’s an example:

But again, this is in the extreme minority.

Not only that, this was the first and only time the house was listed for sale.

In the case of the house featured in the BlogTO article, it was being listed for $1.00 only because they were previously listed three times, without success.

So when I say, “never going to work, never has,” I mean that if you are:

a) Lost on pricing

b) Unwilling to accept fair market value

c) Into your third, fourth, or fifth listing

d) All out of bright ideas

If you’re all those things, and you want to list at $1.00, well good luck.

Because that 1.0% chance I reserved above isn’t for properties and sellers who meet the preceding criteria.

A gimmick is designed to be an “attention grabber.”

Well these listings certainly grab attention; just not from active buyers looking to transact in the real estate market…

Derek

at 9:46 am

Me at the open house: “You think they’ll take 75 cents, conditional on financing and home inspection?”

David Fleming

at 11:11 am

@ Derek

Best line from our weekend open house:

“Ooooh, that basement. I mean, seriously, don’t let perfection get in your way….right?”

Marina

at 11:13 am

I think the $1 pricing is supposed to imply that the seller is open-minded and they don’t really know how much they can get on the house and they will let the market decide.

Which is a load of hooey.

Everyone knows what they want for their house. There was an old lady down the street that was selling her house before going to a retirement community. She was telling everyone how she had no idea how much her house was worth, and how things have changed, and oh my goodness she just hoped she would get an offer and she’d take it, etc. Two weeks later she was ranting about how some “bozo” offered 100k under market and “how dare he think I’m stupid just because I’m old”.

So the $1 pricing is basically advertising that you are going to play games. And who has time for that?

Ace Goodheart

at 12:51 pm

Interesting thing – blog.to has begun posting a disclaimer at the top of their real estate stories, that these stories are actually paid content.

Today they posted a story about a pretty little white 2.5 storey semi and how great a deal it is.

But if you look at the top, it’s paid content.

It’s an ad. Paid for perhaps (they don’t say) by the listing Brokerage?

Derek

at 12:50 pm

Well whatever, February numbers don’t mean anything anyway.

Laurie

at 1:12 pm

I’m always tempted to offer $2 so they can say they sold for 100% over list. (And, so the agent can chase me saying ‘I want my $2’).

Also, pretty sure Affleck came before Pattinson…

Derek

at 1:39 pm

I understood that reference.