Let’s start today’s blog post with a quote:

“This is going to be 2017 all over again.”

~Nobody

That’s right, nobody said this.

And yet, everybody is saying that they did.

First and foremost: we don’t know what this market, here in June of 2022, is just yet. We know that it has declined from February with respect to both prices and sales, but it’s always much easier to define a market several months later, looking back, than it is in that very moment.

And yet, comparisons to 2017 are being made.

For those that don’t recall what happened in 2017, a quick refresher: prices rose dramatically from January through April and then in mid-April the government – all three levels, stepped in and implemented new legislation, across multiple fronts, that essentially stopped the market in its tracks.

What legislation?

It actually doesn’t matter!

Remember the sight of Finance Minister, Charles Sousa, Housing Minister, Chris Ballard, and Premier, Kathleen Wynne standing in front of a podium in Liberty Village set to make a “big announcement?” It almost didn’t matter what they said. The imagery of them standing there, essentially arms-linked, talking about “cooling the housing market” was enough to scare people.

The actual legislation was “Ontario’s Fair Housing Plan,” also called the “16-Point Plan,” which was set to cool the market.

Yes, cool the market.

That was the phrase that was used, over and over

Cool the market.

So what do people do when the government says they want to “cool the market?” They take notice! And buyers, who see the government saying, “We’re going to cool the market,” meaning prices are going to come down, decide not to buy.

The proposed 15% “non-resident speculation tax” drove every foreign buyer away, and it was those buyers, in my opinion, that were a major factor in that early-2017 market.

The average house price in the GTA declined from a high of $920,791 in April down to $863,910 in May, then $793,915 in June.

The average price in the “fall” of 2016 (averaging, Sept/Oct/Nov) was $765,138.

That was a 20.3% increase from the fall through the month of April, and the government acted.

The rest is history.

So here we are in June of 2022 and what’s happened?

Well, the government acted!

The average home price in the fall of 2021 (averaging, Sept/Oct/Nov) was $1,151,649.

This time around, the market exploded about two months sooner, with the absurd “peak” hitting in February at $1,334,554.

That’s “only” a 15.9% increase from the fall, which is well short of the 20.3% increase we saw in 2017.

Unlike 2017 when it was simply ideas that scared people off, through that 16-Point Plan, this time around, it’s interest rates.

I find this a little amusing, to be honest.

We’re sitting at an overnight lending rate of 1.5%, which, when you think about it, is 1.5% from zero!

That’s how low our overnight lending rate is.

And yet, so much of the existing buyer pool was thrown off by the 100-basis-point increase in the past two months that they’re simply paralyzed and can’t make a decision.

That, in my opinion, is why sales were down so dramatically last month. And perhaps that’s a great place to start the analysis of May’s TRREB Stats.

How do you think sales in the month of May fared?

I’ll tell you this: we all remarked, “Things don’t seem to be moving” a few times last month.

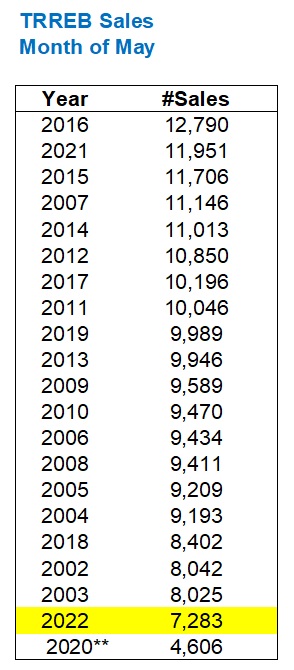

But this chart, of all the months of May dating back to 2002, tells a story:

May of 2020 doesn’t really count, since it was the height of the pandemic.

So, all things considered, this is the lowest number of sales in the month of May since TRREB began tracking the data.

If you’re a market bear, or essentially anybody in the media, this is the figure you want to latch on to!

But where and how these sales dropped, and the effect that it had, is far more important.

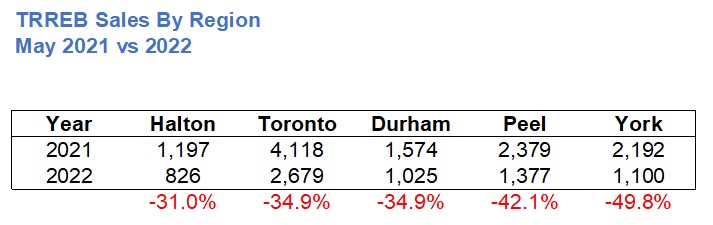

So let’s look at the year-over-year drop in May sales first, and we’ll look by TRREB region:

The overall drop in sales through TRREB was 39.1%, so there’s nothing groundbreaking here, except it seems that York Region has been especially slow.

But does year-over-year matter?

Or should we look at month-over-month as a better indicator, between regions?

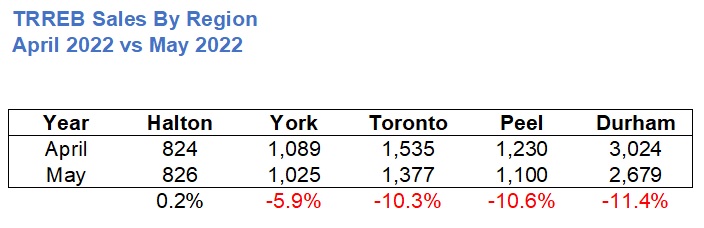

Personally, I think if we want to know what’s happening in the market today, then month-over-month is more telling.

Here’s how that data looks:

Very interesting.

York Region saw the largest year-over-year decrease and yet saw a decline that’s about half that of Durham, Peel, and Toronto on a month-over-month basis.

Sales in Halton Region didn’t change at all.

But how does this translate into pricing?

That’s what everybody truly wants to know.

Sales data can tell you how many people are buying, how quickly or efficiently properties are moving, or even what to expect if you’re a seller.

But how does the decline in sales affect price?

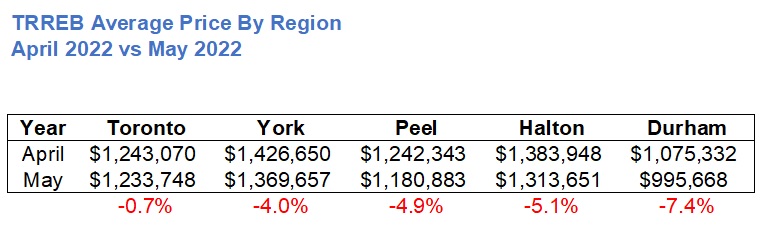

This isn’t what you would have expected, based on the data above:

From April to May, the average home price in the City of Toronto has barely moved, and yet sales were down 10.3%.

There’s a correlation at the end of the line: Durham Region saw the highest month-over-month decline in sales and also saw the highest month-over-month decline in price. But nobody cares to decipher between the 10.3%, 10.6%, and 11.4% declines in sales in Toronto, Peel, and Durham. That’s all the same. What people do care about is price!

Durham Region has been hit really hard in the past few months.

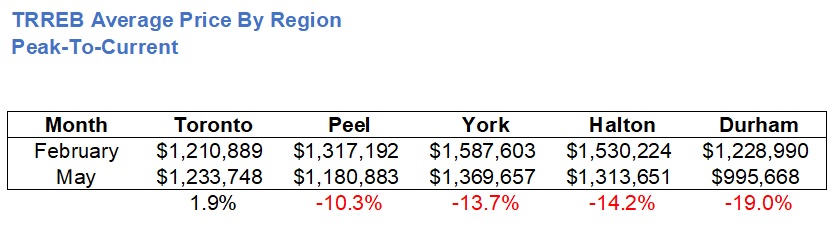

If we consider February to be the market “peak,” as indicated by the overall Average GTA Price, then here’s how the February-to-May data looks:

Call me a homer here, but Toronto seems to be holding up just fine.

Meanwhile, the average home price is down 19% in Durham Region. There’s no explaining our way out of this one. There’s no sample size problem here. Prices are really down in Durham Region. Maybe not everybody’s house is worth 19% less today than in February, but most.

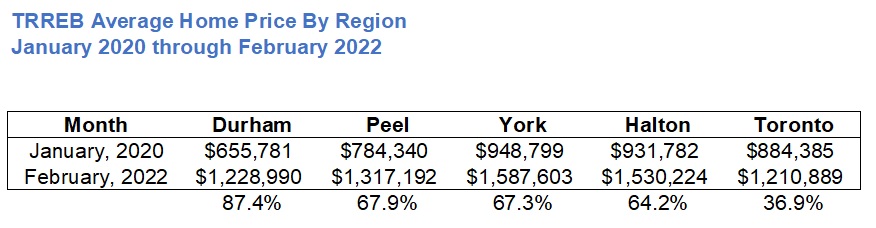

But maybe the larger problem here was the massive appreciation that preceded this “minor” drop?

Minor, you ask?

Yeah, well, a 19% drop in three months is huge! But if you look at the levels of appreciation from the start of 2020 through that so-called “peak” in February, suddenly the decline seems tame:

How do we make sense of all this?

TRREB average home price is down 9.1% from February to May, but the City of Toronto is up 1.9% in that time?

Durham Region is down 19.0% in that time?

But Toronto was “only” up 36.9% from January of 2020 through February of 2022, while Durham was up 87.4% in the same time period?

How you choose to look at this, and what conclusions you draw, is entirely going to depend on where you live.

We have a habit, subconscious or deliberately, of seeing what we want to see.

Somebody that bought a house in Durham Region in 2019, 2020, or 2021 is going to say, “I’m not moving any time soon, so I don’t care if prices dipped in the last two months because I’m still up huge,” and that’s a correct statement. That’s entirely how I would look at it.

Those who bought in Durham Region in February can say one of two things:

1) “I can’t believe I’m down 19% on paper, this is financial run.”

2) “I love my house, I never intended to sell in two months, and when I go to sell in seven years, I’ll have made money.”

That’s the truth of it, folks.

Nobody day-trades real estate.

And while I understand that nobody wants to hear their house is worth less today than when they bought it in February, we need to rid ourselves of this inherent “right” to always be on the upswing in this real estate market.

The market has gone up, pretty much, every single year for a quarter-century. I say “pretty much” because there the average Toronto home price dipped modestly in 2018, having gone up every single year since 1996.

We’re spoiled. We always have been.

But when we expect house prices to up, not just every year, but every single MONTH, that’s when we’ve lost sight of what a “market” truly is.

Markets fluctuate. All markets.

I attended the Toronto Sports Card Expo on Friday afternoon with my Dad, and I overheard a dealer talking to a customer who was trying to sell his 1986-87 Patrick Roy rookie card, graded “Gem-Mint 10/10.”

The dealer, looking at his iPhone, presumably at www.vintagecardprices.com, was telling the customer, “The Patrick Roy has dropped a lot in the last year. It’s not doing well.”

He’s not wrong.

Cards graded a “10” were selling for over $10,000 last year, but are now trading in the $7-8K range.

But you know what?

Pre-pandemic, this was a $3,000 card.

So if that seller has owned the card for more than a few years, and he’s looking at getting “only” $8,000 for his card, wanting $10,000 like it was last year, when all the while, he paid $1,500 for it, then perhaps that’s short-sighted.

When we saw month-over-month appreciation of 7.6% and 7.7% in January and February in the GTA real estate market, we all said that it wouldn’t last. We all knew that it would come back to normal.

The Bank of Canada has now raised interest rates 0.25%, 0.50%, and 0.50% in March, April, and May.

Whether they increase the rate further in July, the market has already responded.

I don’t honestly believe that buyers are suffering from a change in affordability, but rather I think that any time there is a monumental change in monetary policy and/or significant legislative announcements, the market is going to retreat.

In September, the active buyers who find themselves in that market will only have ever known their 4.59% or 4.89%, 5-year, fixed-rate mortgages, and unlike buyers in this current market, who lament the 2.99% rate they lost, or the 1.99% rate that their friend got last year, those September buyers will have their eyes looking forward.

That’s why I believe that this market dip will be short-lived.

We saw fewer new listings in May than we did in March.

Sales are down but inventory hasn’t skyrocketed.

I’ll tell you what: if we see 26,000 new listings in the month of June, then I’ll change my mind about this market. Barring that, I believe that sales will increase from last month, inventory will remain essentially the same, and the sales-to-new-listings ratio, as a result, will increase. That means a tighter market in June than in May and I expect that trend to continue into the summer.

This doesn’t mean prices will increase, however.

This means that the market will balance.

And that, my friends, is what I mean by “normal.”

At least, the new normal.

At least, for now…

J G

at 8:19 am

“ Whether they increase the rate further in July, the market has already responded.”

Willing to wager $5000 rate will increase in July, and I dont think any smart person will bet against me.

“That’s why I believe that this market dip will be short-lived”

So you don’t think price in say, Durham will NOT drop another 10% over the next 6 months (on top of the 19% drop already)? I think that’s entirely possible.

Keith

at 8:38 am

David, I recall a story you’ve told here before about investing during the 2000’s tech boom/bust and your broker told you not to worry when the stock had gone below what you paid because it was only a paper loss. You took him to task for that logic on your blog many years later. How is your advice to those in Durham any different?

David Fleming

at 11:30 am

@ Keith

These two situations are entirely different, and before you call BS, hear me out.

1) A house is a home. You live in it. The ONLY reason a person buys shares of a company is for investment, thus it’s reasonable to check the value every single day. A house is an investment, yes, but it’s a primary residence first and foremost (excluding those who actually buy for investment, but that’s a fraction).

2) Shares of stock can go to zero. Companies can go bankrupt. Real estate does not and can not go to zero. My broker, who sold me Nortel Networks at $50 in 2000, told me when it hit $45, “You’d be a fool to sell now.” At $30, he said, “It’s going to come back.” But companies can go to zero. It happens all the time. Or they can be bought out by larger companies. This is completely different than real estate. All markets fluctuate, but the entire purpose of getting into the equities market is to buy/sell/profit, and thus by-the-minute valuations are valid. The same can’t be said for real estate.

3) There’s something to be said for the fact that a house/condo is “real” and shares of stock are not. There are different classes of shares, stocks can be ‘split’ to affect prices/valuations, and there is no emotional component to buying/selling equities (or at least there shouldn’t be).

I appreciate the comment, question, and comparison. But I respectfully disagree that a long-term home buyer, raising a family, need be concerned about a decline in value in the same way that an equities investor would be.

JL

at 12:04 pm

With marginal price fluctuations I would buy into that argument – you can’t expect to always “buy at the bottom”. But I’m not sure someone buying a $million+ home would agree that a drop of a few hundred thousand in a couple of months is something they can just brush off because in x years it will come right back up. That’s still money they have to finance for years to come that they otherwise wouldn’t have had to or could have spent elsewhere.

Not to suggest that people should “time the market” when looking for a home, but there are many stories coming out now about people regretting getting caught up in the frenzy and overspending (both in terms of stretching themselves and ignoring the underlying intrinsic valuations). Kudos to those who had the courage to call the Jan-Feb craziness for what it was (while it was unfolding).

Marty

at 4:16 pm

This was a great read. Loved the opening about not mattering what the government announcement was.

ChT

at 2:21 pm

A very accurate explanation of how the two are very different. And I agree with you a hundo P.

Alexander

at 9:59 am

Nobody knows what the mortgage rate will be in 6 and 12 months time, so it is hard to predict the housing prices trajectory as well. I would say in 2022 and Q1 2023 Bank of Canada rate decisions are going to be more influenced from the south than usual. And really hope those decisions are going to be less politicized than it happened in 2021 and Q1 2022. Otherwise everybody will be in such trouble that the housing market will be the last of our worries.

JF007

at 10:00 am

think this would be a waiting game between buyers and sellers who buckles first if the listing continue to remain low as sellers can wait out and don’t have to close something soon market will start plateauing off if not it could possible go down further..will it drop say 87% in Durham back to Jan 2020..fat chance..

to give you some insight have been tracking 3-4 detached properties in my neighborhood..mkt hit the peak sometime in Feb/early march houses were fetching north of 2.5 million..and then crickets..while 3 out of the 4 just kept relisting to finally terminate after 3 months of trying to sell..one property owner went bonkers–2.6, 2.5, 2.2, 2.4 and finally 1.99 to sell for 1.8 after months and reason for this was that the seller had to close their next home quite soon and the market was aware of the same so he just got waited out..and this after the seller refused an off the market transaction for 2.2 million in late Feb..

so someone living in their homes and not having to move wouldn’t be bothered but folks who have to close soon after buying in say late march could be in a bind on account of lower appraisals n such..interesting times ahead

416echelon

at 11:49 am

…will it drop say 87% in Durham back to Jan 2020. Haha!

Actually if prices have increased by 87%, they only need to drop by 46.5% to return to the previous baseline. Math doesn’t lie.

J G

at 12:14 pm

And it has already declined 19%! We’ll see what happens over the summer..

Appraiser

at 11:23 am

Thorough and thoughtful analysis. Beats anecdotes every time.

gattu

at 6:48 pm

“I don’t honestly believe that buyers are suffering from a change in affordability”.

David, this is an overly optimistic belief. Most people measure affordability based on monthly mortgage payments. A first time buyer 3 months from now this fall, may not care to look in the rear view mirror, as you have rightly pointed out. But on a typical $1 mm variable rate mortgage, the monthly mortgage payment is up $800 to $1000 vs last fall. Will your hypothetical first-time buyer in Fall 2022 be able to pay 20-25% higher each month? Or will sellers have to lower prices to make the home acceptable to buyers? Or will they split the difference. I don’t know, but neither do you.

gattu

at 10:28 pm

In stock markets, there are two kinds of investors (1) those that focus on a company’s intrinsic value, based on analyzing a business and its free cash flow (2) those that analyze momentum and sentiment, looking for clues to future market direction based on past trading data.

In a Toronto real estate context, while David’s posts are always a fun read, I have long placed his market predictions in the latter bucket. Curiously awaiting the next post on this blog.

Vancouver Keith

at 6:49 pm

Some thoughts on interest rates. At the beginning of the year, the BOC rate was 0.25%. That’s an emergency level. 1% – 2%, the markets consider to be stimulative. We have the highest inflation in decades, the current BOC rate is stimulative.

2% – 3%, is considered neutral. The stock market going down 8 of the last 9 weeks, that was the market pricing in a 3% BOC rate. You need to watch that number, but also the commentary. Right out of the pandemic, the inflation rate surged, it was characterized by the word “transient.” Look up the comments by the deputy Governor of the Bank of Canada from last Thursday. The words used were “getting ahead of inflation before it gets entrenched. Transient. Entrenched.

The primary tool to contain inflation is the BOC rate. Powell and Macklem have already said that containing inflation is job one. They are willing to risk recession to do so. Keep a close eye on the inflation number, if it doesn’t ease or continues to persist (war in Ukraine, supply chain issues, wages starting to rise) the BOC rate will increase. Bond rates are rising, where mortgage rates (not variable) are determined.

The markets are ready for a 3% BOC rate. If it goes above that, stock markets will move decidedly into bear territory. As for mortgage rates, we haven’t seen inflation like this in decades, and we haven’t seen a sustained correction, much less a proper real estate crash in a very long time. There is a liquidity based tipping point on the cost of money for buying houses. Is this the year it happens? Stay tuned.

Seth

at 12:22 am

Very insightful post David. Quick question about the stats. Noticed there’s a discrepancy in the May 2022 sales #s in the ‘May 2021 vs 2022 table’ (table 1) compared to the ‘April 2022 vs May 2022’ table (table 2). The #s by region are mis-aligned.

e.g. Halton May 2022 sales is 826 in both tables.

e.g. Toronto May 2022 sales is 2,679 in table 1 vs. 1,377 in table 2. I believe you used the Peel sales figure in this table instead of the Toronto figure.

JG

at 3:56 pm

If this is 2017 all over again, heck, I am going to double down on my property purchase plans just so I can look forward to another 70-120% increase in values over the coming next few years

🙂

(insert sarcasm)