Have you ever eaten at the Mandarin?

It’s an embarrassment of riches, albeit if riches comes in the form of quantity over quality, but nevertheless, your options seem endless, and it’s often a question of where to start.

Traditionally, one might eat salad before the main course. However, there’s nothing to stop you from starting with an iced-cream sundae.

So with two massive news stories hitting the Toronto and Vancouver real estate scenes this week, the question becomes: which one is the crab legs?

Honestly, folks.

Isn’t this a classic example of “much ado about nothing?”

I can already feel cynicism exiting every pore of my fingers as I hammer away at this keyboard, but seriously.

Seriously.

Are we seriously going to act as though this is significant?

$2,000?

In a city where the average home price is $762,975?

Damn, do I ever hate politics.

Let me start from the beginning…

On Monday, in what I consider a blatantly-obvious political move by Ontario Premier, Kathleen Wynne, who’s approval rating is at a whopping 14%, the Liberal government announced that they would “double” the rebate on land transfer tax for first-time home-buyers.

The current rebate is $2,000.

The rebate will take effect on January 1st, 2017.

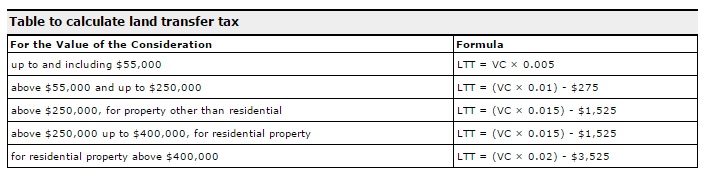

Under the current system in Ontario, which has remained unchanged since 1989, the land transfer tax is payable on a sliding scale that shows as follows:

That chart comes from the Ontario Ministry of Finance website, and I’m assuming since they use the phrase “value of the consideration” rather than something most people would understand, like, “purchase price,” then perhaps this also hasn’t been updated since 1989, or at least since the birth of the Internet.

First-time home-buyers currently receive a $2,000 rebate on their land transfer tax, which is significant for those buying homes in Keswick, Kearney, Kipawa, or Kormak, but really doesn’t mean much to those first-time buyers here in Toronto, paying $950,000 for their 3-bed, 2-bath, semi-detached home.

Yes, I know, many first-time buyers are picking up $380,000 condos too.

But on the whole, can’t we agree that the $2,000 rebate is being made into a MUCH bigger story than it actually is?

I think it’s fantastic, don’t get me wrong. Anything is better than nothing!

House prices in Toronto are nuts; I know that better than anybody!

But let’s not fool ourselves into thinking that Kathleen Wynne is going to make up this $2,000 per-home loss in tax revenue by finding and eliminating redundant and/or inefficient government programs, jobs, expenditures, et al. No, she’s going to find the money somewhere else.

So, in effect, is she not simply bribing the residents of Ontario…with their own money?

Of course, the “second part” of the big announcement on Monday is that land transfer tax on houses over $2,000,000 is going to be increased.

Robin Hood, are you there?

So with the political rant out of the way, let me talk about the real estate angle.

A buyer of a $380,000 condo currently pays:

-$4,175 in Provincial land transfer tax

-$3,525 in Municipal land transfer tax

Let us not forget that up until David Miller took office, there was no municipal land transfer tax. February 1st, 2008, we got hit with the “double tax,” and the city has been adding somewhere around $500 Million per year in tax revenue ever since.

But as far as this would-be buyer of a $380,000 condo goes, I will admit, that the increase from $2,000 to $4,000 for the provincial rebate is somewhat significant.

The buyer, who if he or she were not a first-time buyer, would be on the hook for $7,700 in combined taxes – a ridiculous number, that in my opinion, has zero to do with real estate and/or the “cost” to the Toronto/Ontario governments of transferring ownership, ends up paying only $2,175 for Provincial, and zero for Municipal under the old system, and now would pay only $175 under the new system!

That’s a win for the little guy!

Of course, the hard-working, tax-paying, trying-to-get-ahead couple who sells their $380,000, 1-bedroom condo and buys a “move-up” house for $950,000, still has to fork over $30,200 to the two governments for some god-forsaken reason, but hey – at least the little guy gets his $2,000 back!

Now just for fun, and so one of you can say, “Why would I feel bad for anybody buying a $2 Million house?” Let me illustrate what the new tax will do to a buyer of, say, a $2,200,000 house.

Under the old system, that buyer, who dare I say may have earned his or her way to the point of being able to buy for $2,000,000, and should not be criticized or ostracized, would pay a whopping $80,200 in combined land transfer tax.

Under the new system, that buyer has the privilege of paying $89,200.

I told you the Liberals would find a way to get that “lost” $2,000 back!

And how long until the municipal government follows suit?

So I guess my problem with the “new rebate,” in addition to the increase in land transfer tax for properties over $2 Million is quite simply this: uninformed buyers out there are reading the headlines, and thinking this makes a difference.

But it doesn’t.

To steal a theme from Colin Jost on Saturday Night Live:

“Thank goodness for this new $2,000 tax rebate, because that means I can finally afford a home,” said by nobody, anywhere, ever.

Not a single person in the city of Toronto woke up on Tuesday morning and said, “With this new rebate, I’m now in a position to afford to buy.”

Not one.

It’s $2,000.

It’s great, and “every penny counts,” and all that.

But I see this as a political move rather than a move to actually help first-time home buyers, and I fear it’s just setting people up for disappointment, especially as the media takes hold of the story, and uses the words “first-time buyer” along with “help” and, even worse, “affordable.”

Up next: Kathleen Wynne gives back $4 per month on every hydro bill to chase the senior vote…

For those of you still reeling over the 15% “foreign buyer’s tax” that Vancouver instituted this past summer, maybe you weren’t ready for what followed…

Don’t forget, the City of Vancouver was effectively given powers to tax vacant homes back in July, and this was what we thought was coming, but instead, after all the talk about “vacancy taxes,” out of nowhere we got the 15% foreign buyer’s tax.

We thought that was it.

We thought that the 15% tax, which was a massive overreaction, and had to be somewhat impulsive in nature, given it came out of nowhere, was instead of the vacancy tax.

It turns out, the 15% tax was basically like eating crab legs at the Mandarin, before you take down a plate of Kung Pao chicken.

A vacancy tax……..and a foreign buyer’s tax?

What the hell is going on out in Vancouver?

The tax, which was initially reported to be a 1% tax, still seems somewhat unclear.

Other reports have said that “if you lie about vacancy,” the fine could be $10,000 per day.

And the best part (I mean “best” in the very-most cynical nature, in case that wasn’t obvious…) is that the tax is going to include houses posted for lease on AirBnB.

What a gong-show.

Vancouver Mayor, Gregor Robertson, estimates that there are 10,800 vacant homes, and 10,000 homes that are “not fully used.”

What the hell does that last part mean?

Are we going to send out inspectors to ensure that there’s a body in every bedroom?

I understand there’s a housing “crisis” in Vancouver, but does anybody think that the 15% foreign buyer’s tax, plus the vacancy tax, plus the fines for avoiding the tax, plus the tax being instituted on investors thinking outside the box by renting on AirBnB, plus the idea of houses being “not fully used,” all together, is just a wee bit overzealous?

And in all of that, believe it or not, what gets me the most is the AirBnB issue.

I understand that the government is trying to avoid providing a loophole, since a property-owner could simply list his or her vacant property on AirBnB, maybe rent it one week per year, and avoid the tax.

But what about the true investor?

What about the person who buys a condo, and instead of renting the unit for $2,000 per month, decides to actively manage the property, rent it for days or weeks at a time, and pull in $3,600 instead?

Shouldn’t that hard-working investor, who has took on the risk associated with an investment, be able to seek a return as he or she sees fit? Since when is it the government’s job to tell people how to invest, and in what?

I know this opens the door to a grey area.

But then why not get really specific, and combine the two taxes?

Ready for this idea?

A vacancy tax for foreign buyers.

There’s a winning combination that avoids pissing off anybody in the Province who can vote. And isn’t that what all this is about? It’s not about people; it’s about politics.

Of course, the tax is going to cost $4.7 Million to set up, with a $1.5 Million cost to enforce every year, and since those are just estimates, then we can assume the true cost, as is with anything in government, will be higher.

And who will be appointed the Vacant Home Czar? There’s a position that will be in high demand!

So as was the case with the $2,000 Ontario land transfer tax rebate above, I think there’s both the story that people want us to see, and then the true conclusion that one should eventually reach.

The foreign-owner, who is keeping the property vacant, holding it long term, will simply see the $30,000 tax on the $3,000,000 house as yet another cost of doing business.

But the Vancouver-resident, who’s pockets aren’t as deep, will have his or her hand forced by the new tax, the potential fines, and the government’s questionable decision to selectively distinguish between daily and yearly rentals via AirBnB or MLS.

And in the end, the combination of a 15% foreign buyer’s tax and a vacancy tax, has the potential to eliminate 100% of foreign purchases in the city, (which of course, has the potential to massively drive up demand in areas like Richmond, but I digress), and send Vancouver prices spiraling downward.

Not a bad thing, says anybody who doesn’t own a house.

But for those with their wealth built on housing gains over the past decade, wiping out billions of dollars of net worth among city residents probably isn’t the best way to drive the local economy.

Two days, two stories, and a lot of misinformation and misunderstanding, in my opinion.

The Ontario land transfer tax rebate is a pittance, and will have would-be buyers getting excited over nothing. It’s a political move, by a group that’s held power for thirteen years but can feel the public’s discontent and wants to start gaining favour.

The Vancouver government’s decision to institute a vacancy tax, after a massive foreign buyer’s tax, will end up having more of an effect on local owners and investors than it would the actual foreign buyers that are silently being targeted.

A good day for real estate? Sure.

But a bad day for politics, no question about it.

Potato

at 9:48 am

“Shouldn’t that hard-working investor, who has took [sic] on the risk associated with an investment, be able to seek a return as he or she sees fit?”

No.

The government does get to specify when uses are against the public good. Investors can’t turn properties into rooming houses, industrial spaces, brothels, or grow-ops, even though those may be more profitable than long-term single family rentals. In Vancouver they’ve decided that turning units needed by long-term residents into unlicensed hotels is against the public good.

Sure, they’re being a bit reactionary in BC, with a lot of stuff piled on at once, but they were asleep at the wheel for years while a crisis built up. I would not be surprised to see even more out west (like a stronger landlord-tenant act that makes it harder to get renovicted or contracted out of rent control). But investors have known all along that AirBnB was going to be a legal grey zone with risks associated (it’s even on the AirBnB’s FAQ).

jeff316

at 3:31 pm

Well put!

Ed

at 10:57 am

Love this! One of your best posts imho.

RPG

at 11:02 am

David, did you just wake up from a 200-year nap? This is what governments do. They spend the first half of their terms doing what they want, then the second half tailoring useless policies to their voter base. Just wait for Wynne and her crooked government to announce $10 daycare subsidies on the same day as they award $500 million contracts to their friends with no tender process, and create new positions for themselves with bloated salaries. And they’ll get another four years come 2018 because there’s nobody to run against them.

Steve

at 11:04 am

While the intent is understandable , the vacancy tax is the Dumbest Tax and won’t work practically . Let’s wait to see the details but it’s so easy to find loopholes . Other countries have thought about implementing such a tax and they are ineffective or impossible to police

Let’s say I am one of those foreigners who wants to maintain an empty property . I sign a lease to rent out my $2m property for say $100 a month ? Does that mean I am now not exposed to the tax ? Fine , I’ll just rent it to a friend …

mike

at 1:08 pm

Steve,

You could rent it to a friend for whatever you’d like, as long as they actually live there. That’s what they mean by “fully used”that David was questioning.

Example, you live in China and want to get some money into a safe political environment so you chose Vancouver. You notice the new tax and want to get around it so you rent the apartment to your friends son who goes to McGill. The Student spends reading week and the summer in your Vancouver property. Neigbours complain that the house is sitting empty 8-months a year and you receive the fine because it’s not being “fully used”.

However if you rent the property to your wife’s friend who’s daughter goes to UBC and lives in the house during the school year then that is one less person looking for lodging in Vancouver and the governments goal has been satisfied.

I’m not so sure how hard it will be to enforce. BC has a long history of using data collected from hydro meters for law enforcement purposes and they’re pretty well versed in the electrical consumption per-capita.

Steve

at 6:33 pm

Then this is an issue. So as a landlord, I need to also ensure that the property is fully used ? That’s not fair

Let’s say I am a local and have some spare cash and buy an apartment as an investment. I list it for rental on mls and find a tenant willing to pay $2000 . He is a professional international Bank executive . Every month , the rent arrives on time . Due to tenants’s work and travel schedule , he lives in the condo very seldomly and may be away for months at a time . You’re telling me as a landlord who has rented his property out to a qualified and genuine tenant that I may still be exposed to a vacancy tax ? That is so unfair

mike

at 7:06 pm

I think it would be hard to enforce the fine if it went to court and impossible if you were able to provide proof that you had a tenant that traveled a lot.

There are a lot of properties in Vancouver that sit empty where the grass get’s over grown and the lights are always out. This makes it desirable for undesirables. You get kids partying, squatters and the like. Not great when you’re the only person who actually lives on your street, which happens quite a bit.

Kramer

at 12:10 pm

When I first heard the rumours of a tax break for virgins last week, I thought:

“Wait a minute, this is actually pretty interesting… this is all interconnected”:

1. Removed the loophole for foreign owners to not pay capital gains tax on investment properties – i.e. addressed foreign investor concerns without generating a shock wave that would cripple things (ahemm, Vancouver). NET: FAIR MOVE.

2. Give domestic virgin buyers more of a tax break to better compete – which is important for the overall market: NET: HEY IT’S SOMETHING.

3. Made it a bit tougher to qualify for for mortgages, essentially requiring more down payment or taking on less mortgage given rates are only going to go UP from here. i.e. Padded the already present backstop of (relatively) tight mortgage rules that has protected our market from meltdowns in the past. NET: RESPONSIBLE.

No one change crippling or mega-boosting or unfair, but all put together, a little nudge to the responsible and a leg up for local buyers who need a home to live in and raise a family vs any offshore currency hedging activities.

I am not one for messing with free markets, so these little pushes and pulls meant to strengthen our market are welcome in my opinion. This market is a giant tanker cruising along at a pretty high speed … small nudges to the steering wheel… put it on a slightly less dangerous course.

————-

As for the Wild West (Vancouver)… good lord… not even going there… except on vacation.

Joel

at 12:29 pm

Instead of a vacancy tax they could charge income tax on what the property could rent out for. Even if they lowballed it and said $1000 a month for a 1 bed condo and moved up from there.

This could at least collect some taxes.

As for the land transfer tax in Ontario I don’t have a problem with helping out first time home buyers at a small increase to those purchasing luxury homes. The best way to address this and I know that it is something you have mentioned before if to increase property tax for everyone. The City can easily assess how much additional money they would get from a nominal raise in property taxes and have no way of know how many homes will be sold each year and the amount of transfer tax they will get from that.

Hmmm...

at 12:40 pm

I think your rates are wrong. You don’t apply the 0.5% increase to the entire $2.2 million – only the amount above $2,000,000. Therefore, the increase would be $200,000 * 0.5% = $1,000.

The real increase is on non-residential properties that moves up 0.5% for everything above $400,000.

Libertarian

at 2:25 pm

Funny how you mention the Mandarin and crab legs. I had that exact meal this past weekend! Definitely quantity over quality, but hits the spot just the same.

I find it ridiculous that the federal government and our provincial government essentially enacted contradictory policies. I thought that Trudeau and Wynne are best buddies, who do everything the same. They revised CPP. But just goes to show you, all that matters is getting elected. Wynne is in trouble, so she bribes some voters. Trudeau is only a year in, so he can do what he thinks the country needs.

I’m just worried that RPG’s comment below is accurate…Wynne will win again in 2018 because Patrick Brown and the PCs do not inspire confidence from anyone.

Kyle

at 3:07 pm

At the end of the day, all this Governmental dickering isn’t going to address the real issue…not enough supply to keep up with demand.

mike

at 3:47 pm

I’m thinking the exact opposite; government dickering is going to create supply.

Vancouver has a massive deficit of rental units, if only 10% of the 10,000 vacant homes follow the law that’s 1,000 rental units back on the market. It’s not a 100% cure but its a start.

As for the LTT rebate for first time home owners, I don’t think the intent of that was to ever address any real issue, just redistribute wealth in that they’re taking the rich and giving it to those less-rich. That always plays well for governments trying to get re-elected.

The new rules set down by the Fed’s have worked their way into higher lending rates by TD and RBC, the nations two larges banks. On an $800,000 mortgage that increase will work out to $120 a month or $1,440 a year. Not enough to kill someone’s home ownership dream but it’s still early days and economic policies take time to work their way into the system so rates can still move up.

Two lawyers own a 2-bedroom semi at Yonge and Lawrence that might sell for $1.4mm and want to move up to a 4 or 5 bedroom detached in the area you’re going to be looking for something over $2mm, now you have the added expense of the increased LTT and higher interest rates. Do you want to tell me that this couple are not going to be more price sensitive? They might might make good money but that money only goes so far and since the bank and government are now taking a larger share where do you think that extra money is going to come from? Keeping monthly and down payments the same, the move from 2.64% to 2.94% takes $200,000 (or almost 10%) out of your purchasing power. All because banks can no longer buy bulk insurance on its 25-year mortgages. That’s not going to impact housing prices?

Kyle

at 3:57 pm

“That’s not going to impact housing prices?”

Nope it’s not, because if those two lawyers don’t buy it there is still an ever growing army of other qualified purchasers waiting to snap it up.

mike

at 5:21 pm

Ah yes, the infinite army of buyers who some how are not affected by decrease in spending power. Brilliant.

Please, please, please tell me where this “growing army” is going to come from?

BillyO

at 5:31 pm

China, India, Iran, Russia. In that order.

Kramer

at 6:10 pm

Bingo! That and all the local people trying to get in who cannot combined = an army of buyers in waiting.

I know people who have $1mm budet sitting idle because they keep getting beat by $150k each weekend.

Mike the data is not in your favour. You’re speculating a massive trend reversal. Maybe you should start forecasting why rates or unemployment are going to rise significantly in the next 2-3 years if you want to prove your bearishness.

Julia

at 7:01 pm

And this is why I’m all for taxing non-residents. Real estate is not JUST an investment. Some value should be placed on sense of community and that’s hard to do when every 5th house on the block is overgrown with weeds and rented out. I would much rather have an owner, who is invested in community living next door than a profit driven foreigner who is looking to park his/her money.

mike

at 8:40 pm

Billy O

Not sure if you’ve been to Iran, Russia or India but they’re not really the bastions of wealth that you might think they are. First off, the Harper government stopped allowing people to buy their way into the country, now everyone must qualify equally. So the day’s of someone from one of those countries dropping $250,000 and getting into this country are over. Most who come here are looking for a better life, some have money but most do not. Since 2005 (through to 2015) Toronto has welcomed 955,531 new immigrants, so that averages about 86,000 per year (http://canadaimmigrants.com/immigrants-in-toronto/). Take that number and apply the average family household number for Toronto, 2.3, and you get 37,000 new households a year. Of that lets say that 20% of them can afford a house in their first 3-years, so 7,400. That works out to o.2% of the population of Toronto alone, never mind the surrounding GTA. Even at 80% being able to afford a home in the first 3-years (time enough to establish a credit history) you’re still less than 1% of the population. Far from an army and not likely something that will move the market. As for foreign buyers, a lot have left the market because of the capital gains exemption being lifted to foreign home buyers since they can now buy in the US and face the same tax consequences and not have the currency volatility.

Kramer

Your friends sitting on that million, is it in cash? If not then they might have to pay the higher rate as mentioned about RBC and TD. When RBC’s rate was 2.64% they were paying $3,219.51/month at 2.94% they’re now going to be paying $3,347 not a huge difference on a monthly basis but it represents about a $50,000 loss in purchasing power.

I don’t need to show data to back up the higher interest rates, these guys have done it for me:

National Bank

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/special-report-21oct2016.pdf

National Post on Scotiabanks thoughts

http://business.financialpost.com/personal-finance/mortgages-real-estate/scotiabank-curbs-mortgages-in-vancouver-toronto-as-prices-soar-were-a-little-concerned

CMHC

https://www.cmhc-schl.gc.ca/odpub/esub/64319/64319_2016_B02.pdf?fr=1477507344385

Kyle

at 10:38 pm

“That’s not going to impact housing prices?”

“Please, please, please tell me where this “growing army” is going to come from?”

MIRACLE OF MIRACLES!! Mike, this is very unlike you to actually be asking questions, when you have no idea what you’re talking about….TWICE NO LESS!….big change from your typical response of BS’ing and pontificating when you’re clearly clueless. I feel like this is a huge breakthrough for you. And i’m glad you took that advice i gave you.

To answer your question the army of buyers will continue to come from the same places they’ve come from over the last decade, despite previous far more material attempts at dickering by the government.

mike

at 9:03 am

I tried to post this last night but for some reason it’s not posting, might be all the links to back up my statements so I’ve removed them.

Billy O

Not sure if you’ve been to Iran, Russia or India but they’re not really the bastions of wealth that you might think they are. First off, the Harper government stopped allowing people to buy their way into the country, now everyone must qualify equally. So the day’s of someone from one of those countries dropping $250,000 and getting into this country are over. Most who come here are looking for a better life, some have money but most do not. Since 2005 (through to 2015) Toronto has welcomed 955,531 new immigrants, so that averages about 86,000 per year (the Canadian Magazine of Immigrants which pulled the statistic from the Gov. Canada website). Take that number and apply the average family household number for Toronto, 2.3, and you get 37,000 new households a year. Of that lets say that 20% of them can afford a house in their first 3-years, so 7,400. That works out to o.2% of the population of Toronto alone, never mind the surrounding GTA. Even at 80% being able to afford a home in the first 3-years (time enough to establish a credit history) you’re still less than 1% of the population. Far from an army and not likely something that will move the market. As for foreign buyers, a lot have left the market because of the capital gains exemption being lifted to foreign home buyers since they can now buy in the US and face the same tax consequences and not have the currency volatility.

Kramer

Your friends sitting on that million, is it in cash? If not then they might have to pay the higher rate as mentioned about RBC and TD. When RBC’s rate was 2.64% they were paying $3,219.51/month at 2.94% they’re now going to be paying $3,347 not a huge difference on a monthly basis but it represents about a $50,000 loss in purchasing power.

I don’t need to show data to back up the higher interest rates, these guys have done it for me:

National Bank

Check out David’s blog post from October 26th

CMHC

My post on the October 26th blog post to Appraisers post about CMHC has the link to the report where CMHC expects the market to soften and rates to increase.

mike

at 9:06 am

Kyle,

why don’t you post something, anything, that backs up your claims?

I mean governement dickering has caused a more than 30% decrease in the Vancouver market in less than 90-days. Well publicized; do you have anything to back your claim that its not working?

Kyle

at 10:37 am

As Appraiser has astutely pointed out in a previous post. You’re not really interested in data and evidence, you simply enjoy arguing your nonsensical hypotheses. Something i and everyone else is tired of, so i won’t waste my time indulging you.

I’ve already mentioned there have been multiple rounds of rule tightening by the government over the last several years, from reducing max amortizations, increasing the minimum down payments, eliminating insurance on $1M+ homes, mandating higher lending quality and increasing insurance premiums. And guess what? The army of buyers has never been bigger than it is today. If you think these latest changes are suddenly going to start shrinking the number of buyers, well that’s your prerogative. I’m just happy that you sort of took my advice to ask questions when you don’t know something, instead of pretending and spouting like you do.

mike

at 11:41 am

Again, what army?

The army that was in Vancouver until government rule change caused the market to drop more than 30%?

We’ve had a 15-year bull run in Toronto real estate, that followed a pullback that took less than a year to drop house prices to a level where it to 12-years to return. You’ve yet to show me any data or evidence that this is going to continue.

Do you think that we’re not going to see a foreign buyers tax here in Ontario like the one in BC, if so why? I mean it’s free money from people who are ineligible to vote; have you ever seen a government that doesn’t like free money?

Kramer

at 4:22 pm

Still so much demand… rates still so low.

Those who were unqualified (by today’s new standards) were likely not the ones tossing in top-3 offers.

But now they are “responsibly” tossing in top-3 offers on houses a “level down”… driving up those prices.

So is it really just putting buyers where they “should be”? Sounds responsible. Sounds like more padding on the default backstop. Sounds like it will HELP things as rates increase.

Demand is just so large. Supply is just so low. Toronto… it’s so hot right now… Toronto.

mike

at 5:23 pm

Supply is low because people people just don’t want to sell. Anyone who sells is forced to pay RE fees, and 4%LTT only to buy into a market that’s everyone is calling over inflated.

Kramer

at 6:06 pm

So how is this government tinkering going to create supply then?

Why are more people going to want to sell? If you already own you don’t get the extra $2K. If you already own then refinancing makes you subject to tougher mortgage rules. Sounds to me like supply will stay where it is as a result of the tinkering.

Or do you just mean it’s going to reduce demand? Reducing demand and creating supply is not the same.

If you think the tinkering is going to reduce demand that much, I would disagree. Did you hear prices are up 20% vya? Did you hear about the rental crisis? Did you hear about “immigration”? Did you hear there is insatiable demand for frigging OSHAWA????

mike

at 6:25 pm

The government tinkering affects people’s ability to afford a home or move up on the housing ladder. Higher costs and more restrictive rules decrease demand. Lower demand, increased supply: first five minutes of economics class right there.

There is no rental crisis, there are anecdotal stories about people putting in multiple bids for rental condos but the vacancy rate in rental markets remain unchanged for the last 5-years. https://www.cmhc-schl.gc.ca/odpub/esub/64459/64459_2015_A01.pdf?fr=1479338178411

YoY results are not in yet because the changes have only just taken place and are only now starting to take affect.

Immigration rates in Toronto have remained the same YoY for the last 40-years. The GTA has more housing starts than anywhere else in the Western World.

Oshawa and other parts of the 905 are seeing a boom because that’s all people can afford. If you bought a house in Parkdale in 2006 you might have paid $140,000 for it, it’s now worth over a million but it’s small and your kids are getting too big for bunk beds. So you think you’ll cash out and find yourself a bigger place. Where are you going to look? Parkdale? Nope, too expensive. Riverdale? Nope way too expensive. So you have to look further out. The last ten years Oshawa has made a huge effort to clean itself up and revitalize downtown and as such their bringing in new families looking for affordable housing, good schools and a safe place to raise their kids. Plus, buying outside of Toronto means you only pay half the LTT, that’s a big draw.

Kramer

at 7:32 pm

Actually lower demand reduces price and at those lower market prices producers decrease production and supply decreases. That’s the first 5 minutes of economics smart guy. Unless you live in a world where when demand drops production ramps up.

mike

at 8:38 pm

Actually what you’ve described is the next five minute in economics class.

As demand decreases, supply increases with precipitate reduced production to lower supply or lower prices to simulate demand.

Kramer

at 9:02 pm

Oh you’re now referring to a temporary EXCESS of supply from demand decreasing. As oppose to “supply increasing” or “creating supply” as you were referring to. You’re all over the map dude!

mike

at 10:29 pm

At no point did I mention an creating supply but that supply would increase and that the current market was a factor of high demand and a lack of supply.

” Supply is low because people people just don’t want to sell”

“The government tinkering affects people’s ability to afford a home or move up on the housing ladder. Higher costs and more restrictive rules decrease demand. Lower demand, increased supply”

Never did I mention that the government intervention was going to create supply but excess supply and supply increased supply as you’ve just mentioned are exactly the same thing.

WarnerBro

at 10:07 pm

How would people selling and then buying in the same market increase supply? Supply can only be increased by (1) building new units, or (2) people selling and moving elsewhere. More people are coming to Toronto than are leaving, and until that changes, new builds are the only answer.

mike

at 10:34 pm

Supply increases because demand decreases. Fewer people buying houses mean houses sit longer on the market meaning those looking for a house have more selection.

As Kramer pointed out, as demand decreases prices will drop. Those who are looking to sell will continue to list their houses (think about people downsizing who don’t want to have to exit at the bottom of the market) and the market will shift from the current sellers market to a buyers market.

Kramer

at 1:52 am

Well agree to disagree.

I understand your perspective, but for me, supply increases (or is created, whatever you want to call it) – IF MORE PEOPLE START SELLING.

– Supply increases if people cannot afford their mortgages because rates skyrocket and hence MORE people sell.

– Supply increases because unemployment spikes and MORE people have to sell.

– Supply increases because immigration shifts to emigration and hence MORE people sell.

– Supply increases because of rapid expansion and hence MORE developers list new homes.

For real estate, supply doesn’t change because of demand… Price does. Take my buddy, Fred, who does’t currently want to sell his house. If demand goes down, is that going to make him decide to sell his home? No. Is the value of his home going to go down? Yes.

Same thing on the other side… does demand for a house change because there is less supply? No, price does. My other buddy Johnny is looking to buy a house. Did he enter the market to buy a house because houses are in short supply? No, he entered the market because he needs a house to live in. Will price tend to increase because they are in short supply? Yes.

I do not believe the tinkering will increase supply, because I do not believe that the tinkering’s impact on demand and resulting change in price will cause droves of people selling their homes who otherwise wouldn’t be.

Definitions aside. Let’s move on in disagreement.

Will the tinkering impact demand and hence price? It has to, to some degree… the degree could be completely unnoticeable (i.e. detached house prices might go up 9.0% in the next 12 months instead of 9.1% because of the tinkering)… Or the degree could be significant. It would appear that you are saying the impact on demand and hence price will be significant. That is your opinion. I don’t believe it will be significant, and it will certainly not turn this into a buyer’s market.

What would turn this into a buyer’s market?

Rates completely skyrocket to obscene levels, just for an extreme example:

– Supply will increase because more people won’t be able to afford their mortgages and hence MORE people will sell their homes.

– Demand will decrease because LESS people will be able to afford homes with skyrocketed mortgage rates.

– Price will find it’s equilibrium between supply and demand… lower.

– Way less buyers, and way more sellers. Hence likely a shift to a buyer’s market. Though chances are you’re not one of the few buyers, and almost everyone loses.

What else would? Obscenely skyrocketing unemployment:

– Supply will increase because more people lose their jobs and MORE people are forced to sell their homes.

– Demand will decrease because more people lose their jobs and LESS people will be able to afford a home.

– Price will find it’s equilibrium, lower.

– Way less buyers, and way more sellers. Hence likely a shift to a buyer’s market.

I believe that it would take extreme examples to turn this into a buyer’s market. Events that decrease demand significantly AND increase supply significantly. Tinkering does not apply.

But yes, the tinkering will impact demand and price, to either a minuscule degree or a larger degree. Place your bets!

Kramer

at 10:14 am

Thanks CMHC for strengthening my point.

Tested: Prolonged depression, huge increase in unemployment, rapid increases in interest rates, oil price shocks, even a damned earthquake.

Why test these? Because they would DO BOTH:

– INCREASE SUPPLY (MORE people would start selling)

– DECREASE DEMAND (LESS people would be buying)

Way more sellers, way less buyers… buyer’s market = potential price drop of 30%.

AND THEY SPECIFICALLY SAY ALL OF THESE SCENARIOS HAVE A VERY REMOTE CHANCE OF TAKING PLACE.

So… if you think that TINKERING is going to break the camel’s back and cause armageddon… I would say you are in the minority of opinion.

Ralph Cramdown

at 10:17 am

One thing that definitely impacts supply is… supply. In a tight market, buyers who also have a home to sell buy first, but in a soft market they sell first. So both homes are on the market at the same time in the latter situation, but only one at a time in the former. This tends to exacerbate swings in inventory.

mike

at 8:42 pm

For some reason it’s not letting me post my reply, maybe it’s the links embedded that back the numbers used so I’ve stripped them out

Billy O

Not sure if you’ve been to Iran, Russia or India but they’re not really the bastions of wealth that you might think they are. First off, the Harper government stopped allowing people to buy their way into the country, now everyone must qualify equally. So the day’s of someone from one of those countries dropping $250,000 and getting into this country are over. Most who come here are looking for a better life, some have money but most do not. Since 2005 (through to 2015) Toronto has welcomed 955,531 new immigrants, so that averages about 86,000 per year. Take that number and apply the average family household number for Toronto, 2.3, and you get 37,000 new households a year. Of that lets say that 20% of them can afford a house in their first 3-years, so 7,400. That works out to o.2% of the population of Toronto alone, never mind the surrounding GTA. Even at 80% being able to afford a home in the first 3-years (time enough to establish a credit history) you’re still less than 1% of the population. Far from an army and not likely something that will move the market. As for foreign buyers, a lot have left the market because of the capital gains exemption being lifted to foreign home buyers since they can now buy in the US and face the same tax consequences and not have the currency volatility.

Kramer

Your friends sitting on that million, is it in cash? If not then they might have to pay the higher rate as mentioned about RBC and TD. When RBC’s rate was 2.64% they were paying $3,219.51/month at 2.94% they’re now going to be paying $3,347 not a huge difference on a monthly basis but it represents about a $50,000 loss in purchasing power.

I don’t need to show data to back up the higher interest rates, these guys have done it for me:

National Bank

https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/special-report-21oct2016.pdf

CMHC

https://www.cmhc-schl.gc.ca/odpub/esub/64319/64319_2016_B02.pdf?fr=1477507344385

Cool Koshur

at 3:07 pm

First this $2000 rebate is a joke. This is inflated news by this govt to showcase that they are doing something for first time home buyers.

Second, as far as Vancouver vacancy tax is concerned, this is another poor conceived action. How are they going to prove house is empty or partially used. In other words this is a introduction of one house policy per family. I will be worried if I am going on a vacation now, else vacancy tax. It is just ludicrous