Not a single person knocked on my door on Halloween.

Is that surprising?

I think so.

Maybe I wasn’t paying close enough attention, but did anybody “officially” cancel Halloween this year? I mean, I think many would agree that it probably wasn’t a great idea, given we’re in the middle of a pandemic, with daily cases blowing spring “peaks” out of the water. But there are a lot of people left out there in society that still think the pandemic is a hoax, or that the government is infringing upon their freedoms, and thus I expected some rebels to show up with their children and ask for Smarties.

But not a soul. I think that’s a good thing, right?

On the subject of Halloween, did you notice that the candy has been getting smaller and smaller, every year?

I opened a “package” of peanut M&M’s the other day and there were five M&M’s. That’s it. If this was 1987, I’m pretty sure there were about twenty-five in a pack. We’re now accustomed to getting two micro squares of Aero, whereas we used to get four regular ones.

When did this happen? Well, not all at once, that’s for sure! I think the candy consortium got together in the early-1990’s and conspired to shrink the size of candy and the packets little-by-little, every single year.

But that’s not the only change, of course.

Some of the candies we both loved and hated have mysteriously disappeared!

Remember those awful molasses candies in the orange and yellow wrappers that always seemed to find their way into your pillow-case? The ones that got stuck in your teeth?

These:

What happened to those?

Man, they were whack. Remember when your mother said, “Don’t eat candy before bed,” and you did, and then no matter how much you brushed your teeth, you couldn’t get them out?

Halloween was also when you’d get a chocolate bar that you would never purchase on your own.

Seriously.

Did you ever go to the corner store and one of your friends bought this:

Never. Not once.

Big Turk? No. You never had a friend buy one of these, but you’d get them in your bag at Halloween.

You’d also never really feel the urge to buy a Ring Pop, at least not past like 10-years-old, but you’d wear it proudly at night as you lick it with delight.

Then again, I never would have consumed Twix or Crunchie if not for Halloween. The first time I had a Crispy Crunch was most definitely on Hallow’s Eve.

But wow, looking back, there was some whacky candy that found its way into our bags. Not to mention the old men handing out pears, or the lady putting salted peanuts into “baggies” with a twist-tie to close the top.

I could go on, but I’m risking the “folksy intro” becoming the entire blog post…

Non-Halloween, 2020, is in the rear-view mirror, and thus so is the month of October.

It seems like just yesterday that I was making predictions for the fall real estate market, and now we’re about five weeks from the market slowing down through the December holidays. The fall market always flies by, but this year it was something altogether different.

We started September by sorting through the August TRREB statistics, which showed that the summer of 2020 was quite possibly the busiest and best summer ever in the Toronto real estate market. The trend continued through September and into October in many segments of the market, while others dropped off.

Having just sold a condo, as I wrote this, for $665,000, listed at $699,900, and having spent five days negotiating, with the buyer having walked away twice, I can’t tell you just how tough some market segments are out there, while others are robust. Case in point: I just sold a $3,995,000 listing for $3,980,000 in less than thirty-six hours. This too, in an area where days on market average over sixty.

So how can the market be ice-cold in some segments, and red-hot in others?

That has been the story of the fall, 2020, Toronto real estate market.

So while we have any number of statistics or metrics to analyze today, and we can take different views, or discuss according to different themes, the one I want to go with today is simply “Numbers you need to be aware of.”

These numbers could be good, bad, or be meaningless. But as I look at the October TRREB numbers, it’s these that stand out at me.

–

$968,318

This is the new GTA average home price as of the month of October, and it’s an increase of 0.8% over September.

It’s also an all-time high. A “record,” if you so choose. Or a “peak” for those of you who think that the November price might be lower.

It’s one more thing, however. Something that I find astounding: this is the fifth successive “record month.”

We’ve already beat this horse to death, and I do believe I wrote a back-patting post about this back in the summer when the June average home price surpassed the previous record from April of 2017.

But it’s the month, after month, after month increase that stands out to me. And this isn’t just a post-pandemic bounce-back either. We’re seeing prices now that are higher than the pre-pandemic peak.

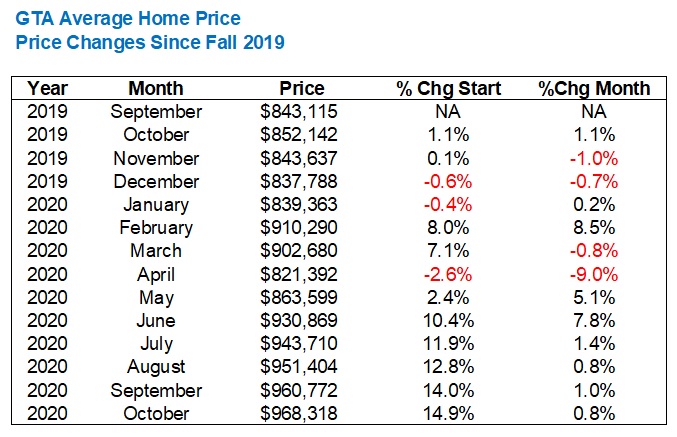

Since last fall, here’s how the numbers look:

Looking at the month-over-month increase might seem pointless. Going from $960,772 in September to $968,318 sounds like a rounding error, but if we were to experience a 0.8% to 1.2% increase every month, I think it goes without saying that this level of growth would be tremendous on an annualized basis.

The growth in average home price in the second-half of 2019 was incredibly slow. If we included July and August, we’re going from $806,755 in July, to a depressed $792,611 in August, then to $843,115, 852,142, and $843,637 in the three busy fall months.

But the growth in average home price this summer and fall is something entirely different. There’s no yo-yoing here. Just a straight, upward line, each and every month.

I almost can’t wrap my head around $968,318. It’s just wild.

And this is happening as condo prices are dropping.

About that…

–

$668,161

This is the average 416 condo price in October of 2020.

It’s down 2.6% from September, and if you want to throw out the volatility of month-over-month statistics, don’t.

I had a conversation with a condo seller earlier this week which contained the words, “Your condo is worth less this month than it was in September.” He didn’t like that at all, since it was in early-September when we first spoke, and when he said he wanted to “Wait and see if the market comes back.”

There’s no crystal ball here, folks. Flip a coin, honestly.

But I’ll tell you this: condo prices will not be higher in November than they were in October. There is no chance of that.

And in the downtown Toronto market right now, the market isn’t quite lining up with the statistics.

Let’s run the same chart for the 416 condo market as we did above:

The month-to-month fluctuations make no sense.

Condos in September were not ‘worth’ 1.9% more than they were in August. In fact, I would say that a $600,000 sale in August, thirty days later, might have been a $590,000 sale. Or less.

Inventory in September absolutely skyrocketed and sales became tougher to attain.

So while I don’t want to sound like Donald Trump here and demand ballot-counting stop in states where I’m ahead, but demand that we count MORE ballots in states where I’m behind, I will say that the increasing monthly average home price may or may not be indicative of the market, but the monthly changes in average condo price are most certainly not accurate.

As for the decline since the “peak” in February, is it fair to say that your average condo is down 7.5%?

Consider a $1,200,000 hard-loft that sold in February. Is that property down 7.5% and worth $1,110,000 today? Maybe, but I’m not necessarily convinced.

Consider a $725,000, 1-bed, 1-bath, 598 square feet, no parking, that sold in King West in February amid 19 offers. Is that condo worth $670,625? No. Not even close.

In fact, I think that condo could be worth less than $650,000, since it was purchased for a massive premium at the time when inventory was non-existent and even crap in CityPlace or Fort York was getting 4-6 offers.

Hindsight is 20/20, but I didn’t have a single buyer in that frenzy. I sold two condos to investors in early-2020, both of whom are looking long term, and both of whom have probably seen a 5% drop in value on their units since February.

But that $668,161 figure above is one you want to keep in mind as we move through November and December. I will be shocked if that number isn’t in the $650’s by month’s end, and since December is depressed every year, I think the figure released in the new year will be even lower.

–

10,563

If you’re a real estate agent reading this, you simply must recognize this number right now.

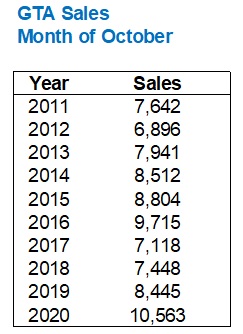

It’s the number of sales in the month of October, 2020.

A lot’s been made of this number in the media, where you can’t always trust if the statistic being given is representative of the story being told.

Year-over-year, sales in October are up 25.1%. That’s the number that the media is running with.

But I’ve seen some people point out that sales dropped on a month-over-month basis by 4.7%. From 11,083 last month to 10,563 this month.

So what’s the real story here?

Well, as I see it, there are two stories, which can be used for two different arguments…

The 25.1% increase in sales, year-over-year, actually understates just how massive those 10,563 sales in the month of October really were.

Here’s October sales over the last decade:

So we’re a decade high, but we’re actually an all-time high.

And with the average sales from 2011 through 2019 being 8,058, the 10,563 in 2020 is all the more impressive.

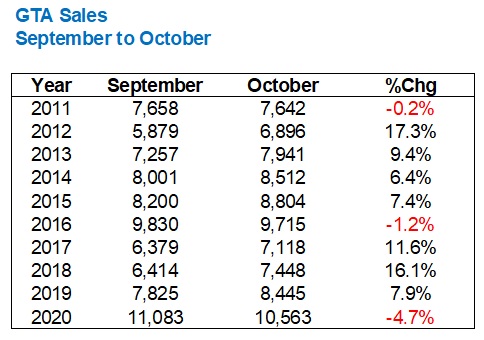

No what about that 4.7% drop in sales from September to October? What usually happens this time of year?

Here’s an illustration:

In the nine years leading up to 2020, only twice have sales in September actually dropped in October.

Did you think that would be the case?

Most people think that September is the peak of the fall market! All those amped-up buyers, fresh off a summer vacation, ready to hit the ground running. And all those sellers who spent the summer getting ready for this moment!

In reality, sales are almost always lower in September than October.

Why?

Is this because October is a better month?

No.

It’s because September has Labour Day, which can often fall as late as September 7th, meaning the fall market doesn’t begin until September 8th.

Then factor in all the back-to-school buzz, sellers that don’t want to list until the second week of September, and suddenly you realize that October absolutely, positively, should be a better month.

So how surprising that in 2020, sales actually dropped, especially when you consider that this year, we did, in fact, see a Labour Day on September 7th.

So what do we make of the sales data?

The 25.1% year-over-year increase in sales is absolutely meaningless, so I’m not surprised this is the figure that the media is running with.

The all-time high of 10,563 sales is incredibly impressive and hard to ignore.

But the drop in sales from September to October, coupled with the late Labour Day, shows me that the market may have slowed last month.

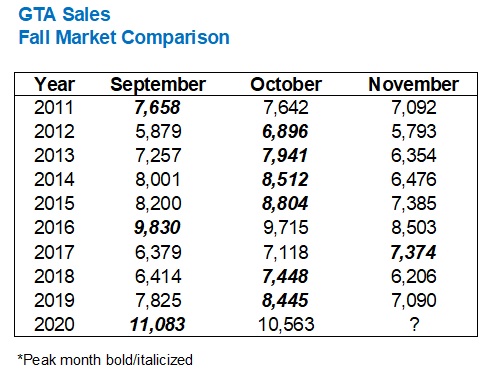

So how about a look into what may be ahead for November?

Sales almost always drop off from October to November, with only one year in the last nine where November represented the “peak.”

Let’s check back here next month and see how the month finished up.

–

It’s supposed to be twenty degrees this weekend.

Enjoy it, folks!

We’ll be shoveling snow before you know it.

Geez, where did 2020 go?

Ed

at 8:47 am

Where did 2020 go?

To hell in a handbasket.

Appraiser

at 8:48 am

Five price-record months in a row!

All-time sales record for October!

Ho-hum. The silence of the bears is deafening.

Meanwhile. Detached homes are on a tear all around the GTA. Very low inventory. In clear contrast to condos.

https://twitter.com/HannyElsayed

The two solitudes?

Chris

at 9:06 am

lol. Now who sounds like Donald Trump….?

Chris

at 9:12 am

Let it be known that the above “Chris” is not me, the bearish commonly posting “Chris”.

Bal

at 9:27 am

It is strange…so does

that mean anyone can post using name Bal …it is not that I am sharing great experiences here….????????????but it is odd…i thought each name is assigned with the email ID..

Chris

at 9:36 am

I believe anyone could use any name. There have been at least 3-4 Chris’ since I’ve been here, though one changed to Christoper to differentiate themselves. Even just the other week, appraiser claimed someone posted as him.

Christopher

at 10:06 am

Something about TRB is attracts all of the Christopher’s

Bal

at 10:35 pm

Yes Bal!

Andrew

at 9:44 am

Long lost Halloween memory:

Bowls of pennies by the front door of many homes for kids collecting money for UNICEF.

Chris

at 9:53 am

Employment data out today:

“Canada’s economy added just 83,600 jobs in October, the fewest since April, as the country suffers through a second wave of coronavirus cases and fresh lockdowns.

The numbers mark a sharp deceleration from 378,000 jobs added in September, and average monthly employment gains of 395,000 since the recovery began in May.”

https://www.bnnbloomberg.ca/canadian-jobs-recovery-fizzles-in-october-on-renewed-closures-1.1518044

Meanwhile, south of the border, they added 638k jobs, compared to 672k last month, with the unemployment rate falling to 6.9%.

“Our labor market scorecard gives Oct non-farm payrolls report a grade of 95.2 (100 is perfection), almost topping August’s record high of 96.8. That speaks volumes about the robustness of the (USA) labor market”

– BMO Economics

Appraiser

at 1:07 pm

More Canadians working from home: Statistics Canada.

“Among those who worked at least half their usual hours, the number of Canadians working from home increased by approximately 150,000 in October, while the number working at locations other than home was little changed. Working from home continues to be an important adaptation to COVID-19 health risks, with 2.4 million Canadians who do not normally work from home doing so in October.”

Interesting in that I was previously under the impression that the WFH trend was heading in the other direction. Is work from home is becoming more widespread & permanent?

Might explain some of the money being splashed around on detached dwellings of late.

https://www150.statcan.gc.ca/n1/daily-quotidien/201106/dq201106a-eng.htm

Chris

at 4:26 pm

I’ll be surprised if WFH isn’t here to stay, at least partially, for most workers who are able to do their job remotely. Employees enjoy the flexibility and lack of commute, and employers benefit from the lower office expenses.

Not sure if I’d chalk up home spending to eight months of WFH though. I think the cumulative ~$300B in announced government support and tax deferrals (as of August, likely higher now) probably had a larger impact. Especially when the extent of lost income was $23B.

https://home.kpmg/xx/en/home/insights/2020/04/canada-government-and-institution-measures-in-response-to-covid.html

Appraiser

at 5:37 pm

So you are of the belief that those who have been receiving government support during the pandemic have not been buying essentials, but rather they been funneling the money in to real estate?

Chris

at 6:06 pm

Given the extent of government programs, I would argue almost all Canadians have received some form of support.

You’re thinking far too narrowly, focused too much on the hospitality employee for example, who hasn’t had any work because their restaurant closed and has gone on CERB.

But what about other employees who have not suffered lost work or income thanks to TWS and CEWS? What about businesses that have taken up the offer of $40,000 interest free loans and $10,000 grants through CEBA?

Once again, household transfers, like CERB, alone have injected $56B to patch an earnings loss of $23B. All announced programs as of August amounted to $300B, or ~$8,000 per Canadian.

So are you of the belief that these government supports have been spent exclusively on buying essentials, and have not contributed to asset valuations?

Chris

at 1:05 pm

“Jobs are coming back in Canada, thanks to subsidies

By many measures, Canada’s labour market seems to be rebounding even faster than America’s; in September Canadian employment was only 3.7% beneath its pre-pandemic peak, while in the United States jobs remained 7.1% scarcer, calculate economists at TD Bank. Yet the country has not quite overhauled Uncle Sam in the quest for a V-shaped recovery from the spring slump. That may be because, as in Europe, many of its jobs remain propped up by the government.

Overall, the 16% of GDP Canada has spent stimulating the economy is even bigger than the United States’ massive package of 14% of GDP.

Despite this, most forecasts, including those of the IMF and the Bank of Canada, show that Canada will return to its pre-pandemic level of GDP only after the United States does. The disparity between the labour-market statistics and GDP may reflect the fact that unproductive jobs are being propped up by government subsidies. In September 1.7m employees, or about 8% of Canada’s pre-pandemic labour force, were benefiting from the Canada Emergency Wage Subsidy programme, which contributed an average of more than C$1,000 per employee to firms’ monthly payroll costs.

In this respect Canada looks more like Europe, where job-support schemes have obscured labour-market weakness but not falls in output.”

– The Economist, Nov. 5, 2020

https://www.economist.com/the-americas/2020/11/05/jobs-are-coming-back-in-canada-thanks-to-subsidies

J G

at 11:02 am

416 condo less than $650k? Sounds about right, HouseSigma has it at $642 last month and dropping further in November.

The argument about variable mortgages – most people have that, not just condo investors. I’m also enjoying the savings on my mortgages and putting them into… yep you guessed it, FAANG!

Professional Shanker

at 11:31 am

Did you put all of money into Exxon in 2008? Diversification is important but you can’t get rich quick doing that.

Peddling FAANG is no different than buying pre construction condos over the past 5 years, at one point valuation of the underlying asset becomes an issue, not saying 2020 is peak tech considering the pandemic we are in.

Bal

at 1:46 pm

I put money in Exxon and looking very bad????…i also put money in weed which is looking a bit better????

J G

at 11:10 am

https://www.680news.com/2020/11/02/condo-investors-are-trying-to-tear-up-purchase-contracts-as-rental-prices-drop/

Bal

at 2:41 pm

Something I failed to understand…if rent is dropped but interest rates are dropped …so these two should offset each other…no?

Bal

at 2:55 pm

For example, if the rent of your condo decreased from 2200 to 1800…on other hand monthly mortgage payment is also decreased due to the lower interest rates….so investors still be in the good position but if they only bought to flip…then they might be in trouble.

Professional Shanker

at 3:19 pm

yes there is an offset on interest accruing on the mortgage but many investors in recent years would be cash flow negative and close to income statement break even after factoring out principal repayment on the mortgage. They were banking on the continued capital appreciation of their “investment” condos, which was a great strategy up until March 2020.

To be clear mortgage payments likely would not reduce, but interest accruing on the mortgage would if someone went variable. Not sure what the majority of investors/speculators do – Appraiser care to wade in here, variable or fixed rate?

Bal

at 4:47 pm

Okay got it…Thanks.

Appraiser

at 5:32 pm

No need to put all of the eggs in one basket. Some variable, some fixed, some hybrid. Call it loan hedging.

Condodweller

at 9:21 pm

I also saw this article as well as another one that showed a 10% increase in assignments. I’d be curious how much of a discount assignments are going for compared to purchase/current market prices. It wouldn’t surprise me if there are deals to be had as people looking to assign their units might be in a must sell situation.

Appraiser

at 6:08 am

Canada Expands Citizenship to Foreigners: Bloomberg

“Canada announced plans last week to make it easier for the more than 1 million temporary students, workers and asylum seekers now living in the country to become permanent residents, giving them a path to citizenship.”

“International students who tend to be a younger population, who tend to be right at the outset of their careers having a longer period within their lifespan to contribute and they are a very attractive pool that we’re going to look very closely at,” Mendicino said.

https://www.bloomberg.com/news/articles/2020-11-04/canada-expands-citizenship-to-foreigners-in-bid-to-stem-exodus

Chris

at 8:18 am

These people are already living in Canada. Their status changing to citizen is unlikely to materially increase their demand for housing, at least in the short to medium term.

This is simply to try and staunch the bleed of temporary residents.

“After recording a net increase of 190,952 temporary residents last year, the first six months of 2020 has seen a net decrease of 18,221, according to Statistics Canada data.”

Jimbo

at 11:14 am

I think a lot of people are looking at the market and asking did it make sense to buy in February 2020? If they answer yes than it is a no brainer to buy now at a depressed rate. You bank on the Jack of demand and eat some monthly carrying costs with the idea summer 2021 will be different and prices will return.

As a first time buyer and you know the space will work for 5 years maybe you are getting a gift.

I don’t have this sentiment but many out there do and they see the value Toronto has when everything is open and in full swing.

Bal

at 4:46 pm

Depressed rate? maybe condo…nothing else…everything else is going for over asking

Condodweller

at 9:15 pm

For me, there is no surprise in the GTA average prices. It’s about a 1.5% annual increase from the 2017 highs which given the drop in mortgage rates since then is nothing to write home about.

The downtown condo prices are definitely something to watch but again not entirely unexpected given the environment. As I mentioned before, what is a bit surprising to me is just how resilient the prices have been with all the negatives out there.