Nobody wanted to warn me, eh?

No head’s up?

I mean, I suppose it’s my fault. I’ve apparently been living under a rock for the last fifteen years. That, and it turns out that I’m incredibly naive.

I should have seen this coming but for some reason, I decided that my glass would be half-full for a change.

But a small nudge; just a minor warning, would have been appreciated.

Because boy-oh-boy I was not prepared for the veracity, volume, and downright nastiness of these user comments on YouTube.

Remember at the end of 2023 when I wrote that I would be launching a podcast this year?

One TRB reader commented, “Oh great, just what we need, another real estate agent doing a podcast.”

It was sarcastic and playful but he wasn’t exactly wrong. The Internet is littered with content and there’s no shortage of opinions on real estate.

But it’s something I’ve always wanted to do. It’s like a verbal blog and it’s accessed through different mediums and can reach a different audience than those who are accustomed to reading TRB on their phones or computers.

Two weeks ago, I launched this episode: “Why Now Is The Time To Buy A One-Bedroom Investment Condo In Toronto”

The podcast is on Spotify and Apple Music, but the video itself is on YouTube.

We launched the podcast on Sunday and by Tuesday morning there were already forty comments!

If you strip out the Russian bots selling crypto-currency, there were definitely fewer than forty real comments, but the comments from actual users were not what I’ve grown accustomed to on TRB.

In this forum on TRB, the comments are insightful, intelligent, and above all, respectful. When readers disagree with my thoughts or opinions, or those of other commenters, they have no problem sharing alternative viewpoints, but there’s no name-calling and mud-slinging.

YouTube is a different world, man. Wow.

I mean, I get it. I can see it from their perspective.

A real estate broker starts a podcast called “The Last Honest Realtor,” which was supposed to be tongue-in-cheek, funny, ironic, and playful, but seems to be rubbing people the wrong way. Then he goes and puts out a video telling people “now is the time to buy a condo,” when all the media attention is about a weak condo market.

It looks bad, right?

I suppose it all depends.

What causes a person to comment SIX times on the same video? What is it about the content of the video, or the title, or the opinion expressed, that makes somebody so angry?

I have a theory and some of you might not like it. The person who commented six times on my video might not like it. And at the risk of doubling down as the “last honest asshole realtor who is luring people into financial ruin,” let me provide this take:

People who do not want to take financial risk, in the pursuit of financial gain, do not want others to do so either. Above all, they do not want the prospect of financial gain to be real.

Do you see where I’m coming from?

I understand that random YouTube commenters have no idea who I am. To them, I truly am the jerk with an arrogantly titled podcast telling people to buy into a bad market. But I don’t think these people listened to the content of the video, otherwise they might actually be convinced.

And for those that do know me and who have been reading TRB for years, I’ll say this:

I really, truly do believe there are opportunities in the resale condo market that will prove to be spectacular investments in 12-24 months.

If I didn’t, then I wouldn’t have bought one of the condos that I described in that very same podcast.

But before we get to that, how’s this for a headline:

“Toronto’s Condo Market Is Facing Its Biggest Test Since The 1990’s Recession”

Financial Post

July 29th, 2024

Who in their right mind would buy a condo when there are headlines like this out there?

Me.

That’s who.

But did anybody actually read the article?

The problem isn’t in the resale condo market. The problem is in the pre-construction condo market. And if you read the article, do the math, and follow the trail of bread crumbs, you’ll see that this is actually going to create a deficit in the condo market in the near-term.

From the article:

“The GTA condo market is in a state of economic lockdown,” they said.

The problem is prices are too high for investors, which make up 70 per cent or more of presale buyers, and developers can’t lower prices because of high construction costs.

“As a result, new condo sales — the primary driver of new home construction in Canada’s largest market — have dove off a cliff to their lowest level since the late 1990s,” said the report.

Oh, I’m sorry, you’re talking about new condo sales? Pre-construction?

Uh-huh.

Maybe that should have been mentioned in the title of the article?

No kidding prices are too high for investors!

This is why I have never sold a pre-construction condo, in my entire career.

The article continues:

The percentage of pre-construction condos that are pre-sold is now at less than 50 per cent, the lowest in 20 years or more. Since a project can’t begin construction without at least 70 per cent presales, this is “dramatically” slowing the supply pipeline.

“This reality will result in a sharp pull-back in completions and a stagnating housing stock in the coming years, which is sure to make the affordability situation even worse,” they said.

Sorry, speak into my good ear. It sounded like you just said “make the affordability situation even worse.”

You mean that as nothing gets built in the next 1, 2, or 3 years, then condo completions down the line will be non-existent, and there will be a shortage of condos?

No kidding.

Go to Google right now or when you’re finished reading this article, and type “Toronto condo market” into the search field.

What do you see?

No shortage of articles about how bad the condo market is.

And why would anybody buy a condo now, right? Why would anybody launch a podcast suggesting that now is the time to buy a 1-bedroom condo?

Well, quite simply, because it is.

Have a look at this:

This is an advertisement for a pre-construction condo assignment that’s currently up for sale.

The buyer paid $693,990 for a 427 square foot condo.

That’s $1,625 per square foot.

That doesn’t include the development charges which would probably be around $25,000, but could be substantially more depending on the original APS that was signed.

All told, the net cost of this condo could be upwards of $1,700 per square foot.

Also, the buyer who closes on this condo will also have to front the HST rebated portion and spend 6-12 months waiting to get it back.

That price is absurd.

But again, and I’ll underline it for emphasis, this is why I have never sold a pre-construction condo in my entire career.

This buyer is trying to assign the APS for $579,990. That means the original pre-construction buyer is going to accept a loss of $114,000.

Wow!

Shall I provide you with an underlined statement again? No? Alright.

So when you read headlines that say, “The Toronto Condo Market Is On Its Knees,” maybe, just maybe, there are different segments of the condo market? And maybe not every condo was purchased for $1,700/sqft in pre-construction and features a buyer who is looking at a six-figure loss?

The funny thing is, so much of the media attention on the sluggish condo market over the last two weeks came from one single report from Urbanation.

Let me show you an excerpt from the report and I’m going to bold a few words:

The GTHA new condominium market reported just 1,688 sales in Q2-2024, down 66 per cent year-over-year and falling 70 per cent below the 20-year average.

New condo sales in the first half of 2024 totalled just 3,159 units, a 57 per cent decline from a year ago and 72 per cent below the 10-year average. The real estate firm says the first half of 2024 was the slowest for new condo sales in the region since 1997.

The drop in sales during the second quarter also pushed the total unsold inventory to a record high of 25,893 units, a level that was roughly 10,000 units higher than both the 10-year and 20-year averages.

Only 727 new condo units started construction in Q2-2024, a more than 20-year low that brought the latest four-quarter total down to 9,182 units — a 67% plunge from the 28,026 units that started construction during the annual period ending a year ago in Q2-2023.

Be honest: is this insightful or annoying?

Because if you’re a market bear or you’re the Internet dweller who is afraid that there could be financial opportunities in the resale condo market but you don’t have the capital or the desire to act, then surely you’d find this to be condescending.

But it isn’t. It’s just…..accurate.

“The condo market” is a very broad term and it encompasses multiple segments that could be divided by price, geography, size, or style. But in Toronto, based on the way that condominiums are developed, we have the ability to divide the condo market even further into two vastly different segments that, in my opinion, now represent “night and day” in terms of their differences:

a) Resale Condo Market

b) New Condo Market

Further from the Urbanation report:

“The continued weakening in condo market conditions during the second quarter of 2024 is likely to cause more projects that were slated to launch this year to remain on hold, while others that are struggling to meet sales thresholds for construction financing may ultimately be pulled from the market.”

New condo launches are being paused.

Existing condo projects are being canceled.

Yes, without a doubt, this is a bad sign for the pre-construction condo market. But all this does, yet again, is illustrate the fact that a massive deficit in condominiums is on the horizon.

Not only that, we haven’t even begun to talk about prices.

As I noted in my podcast, my Pick5 video, and even the blog that I wrote about the GTA condo market on July 25th, the cost to build condominiums in 2024 is exorbitant.

From Urbanation:

Average asking prices for unsold units declined 2.6% over the past year and by a total of 4.5% over the past two years to an average of $1,361 psf. This demonstrates how sticky new condominium prices have become due to high development and financing costs, and record prices paid for land at the market peak.

If it’s going to cost developers $1,000 or $1,100 per square foot to build a condo, then they have two options:

1) Continue to sell condos in pursuit of profits, which means an average of $1,400/sqft (per the Financial Post article)

2) Don’t sell any new condos.

If developers choose option #1 and buyers are buying, then there’s a “floor” of sorts in the condo market. And if pre-construction units are selling (which they are not, but rather this is for illustrative purposes), then the resale condo market will move as well.

If developers choose option #2, then the deficit of condos in 24-48 months is guaranteed.

But in all of this, one point seems to be missing. One reason for my thesis, if you will, has yet to be examined and/or accepted or rejected by the market bears, and it goes like this:

If the cost to build a new condo is $1,000 per square foot or more, then how in the world is buying a resale condo for $780/sqft a bad investment?

Tell me. Because I would really like to know.

If resale condos are available to purchase for well below replacement cost, and in some cases – half of what pre-construction condos sold for 4-5 years ago (albeit at ridiculous and inflated prices), then again, I ask how a current resale condominium is a poor investment.

But let me come back to that shortly because I’m going to explain with evidence, namely by describing the condo that I purchased.

The last point that I want to make, which might seem obvious in hindsight, is that interest rates are about to decline and it’s going to take an exceptionally well-crafted argument to convince me that resale condominium prices are going to decline as the Bank of Canada overnight lending rate is cut in half.

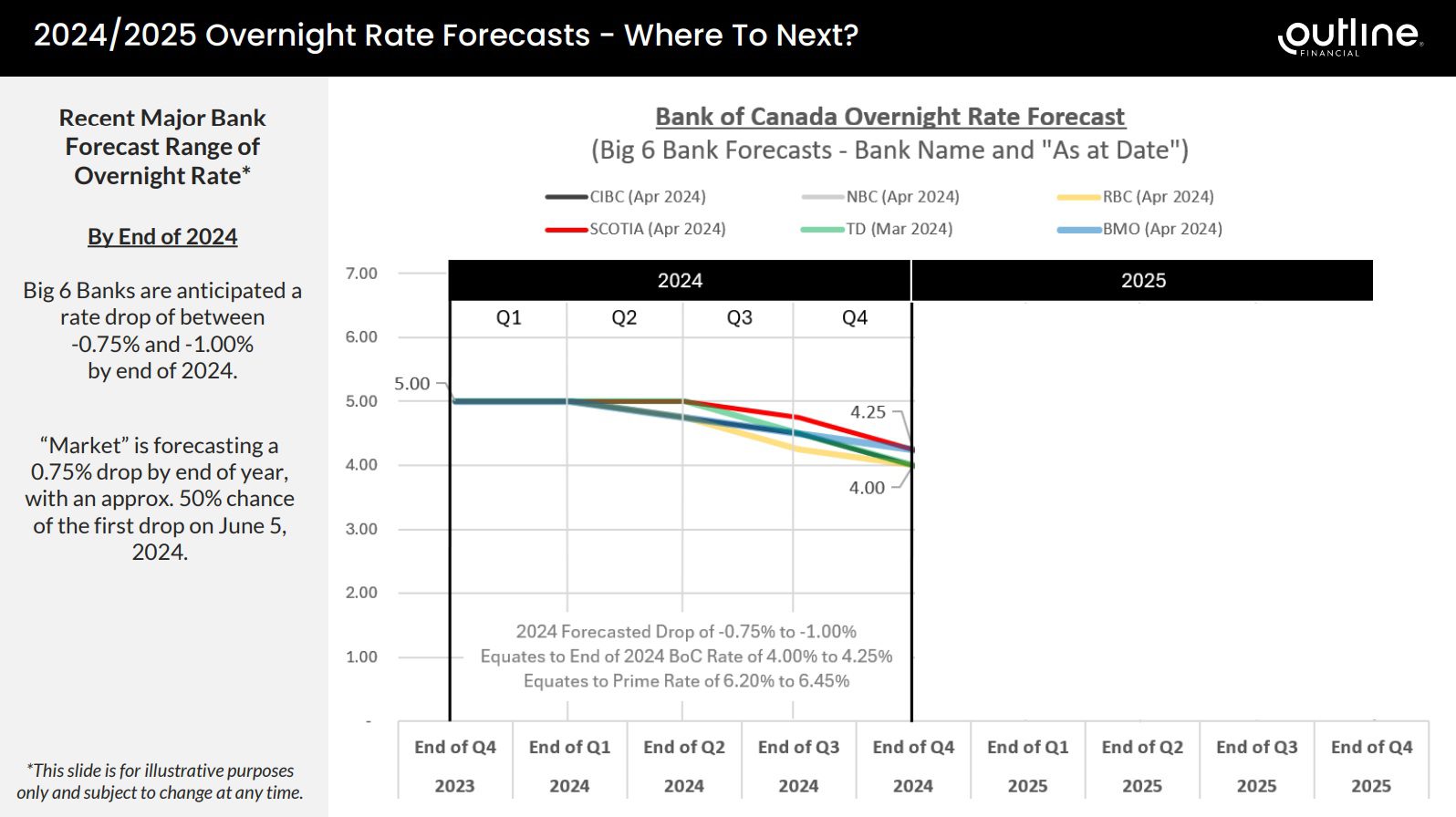

Recall this graphic that I showed you in the spring from our friends at Outline Financial:

These are the forecasts by the Big-Five banks, plus NBC, as they stood in April.

TD, RBC, and NBC predicted a 100 basis point cut by the end of 2024, while Scotia, CIBC, and BMO predicted a 75 basis point cut.

We saw a 0.25% cut on June 5th.

We saw a 0.25% cut on July 24th.

The Bank of Canada has announcements scheduled for September 4th, October 23rd, and December 11th.

It is widely expected that we will see 0.25% rate cuts on both September 4th and October 23rd.

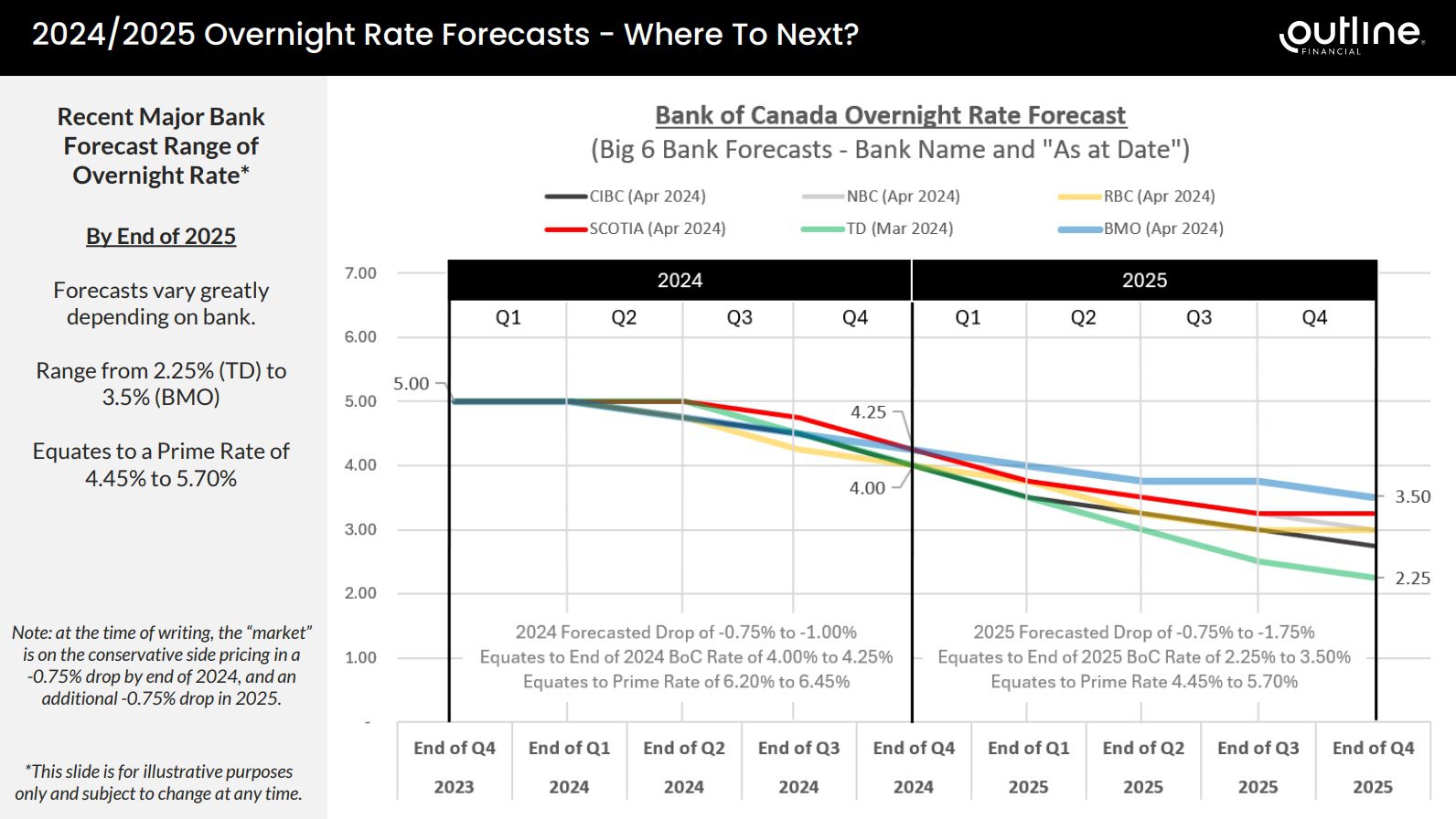

Here is the other slide from April showing the forecasts from the six lending institutions through the end of 2025:

TD Bank is forecasting a cut from 5.00% all the way down to 2.25%.

And if you read last Monday’s blog post, you’ll see that market predictions have become even more optimistic since this slide was published in April.

There are now predictions of an overnight lending rate of 2.50% by mid-2025.

So let me summarize:

We have seen two interest rate cuts in two months and there are 5-8 more on the way within the next 12-18 months.

Call me crazy, but everything I know about economics, financial markets, and real estate tells me that the real estate market is going to explode in early-to-mid 2025.

I’m generally not a risk taker. I’ll admit that.

And I understand those who don’t have the interest, risk tolerance, wherewithal, or proverbial “stomach” to take a risk in a real estate market that is being absolutely pulverized with negative headlines.

But I see a downtown Toronto condo market that’s in a lull. It’s “asleep” as many have put it, and I also see interest rates coming down substantially, new condominium starts hovering around zero, and an unreasonable disparity between resale condominium prices and pre-construction that will not exist in five year or more.

Oh, and unfortunately, I also see a handful of would-be condo sellers who are desperate.

Not all. And not many. But a handful.

And if you look long and hard enough, there are some exceptional deals out there.

Like the one that I got…

(TO BE CONTINUED – SEE YOU THURSDAY…)

Appraiser

at 8:13 am

“Sell when everyone is buying; buy when everyone is selling”

Graham (the real deal G-money)

at 8:59 am

Just turn off the YouTube comments. No good comes from them.

Derek

at 10:01 am

David, are you calling it? Resale condos have bottomed?

Ace Goodheart

at 11:09 am

Calling inflation numbers has become easy.

You ask one question:

To what extent does the USA, through its military, banking system and industry, control the global economy?

The more control, the less inflation.

You can pick and choose inflationary periods and match them up with loss of USA control- the 1970s oil shock is one example.

COVID 19 is another (a virus shut down the world economy and the USA lost control).

So is the USA gaining control again (and everything gets cheaper for us, and more expensive for anyone who is not aligned with the USA?)

That in turn determines interest rates.

Nobody

at 1:59 pm

If you can find a deal then sure. Given your network you are well placed to find a rare actual value property.

With rates, economy, and a coming glut of condos with “challenges” to close I believe we’ll see very interesting opportunities over the next 12-36 months. Pressure in real estate takes a while to build, people are reluctant to give up and default on a mortgage/declare bankruptcy/sell below their mortgage value.

For more people real opportunities will take a while to appear. Still so many owners and developers not accepting the verdict of the market and hoping that another rate cut will bail them out. After all Toronto only had a few months blip in 08 and in 17. It’s not a stupid argument although global conditions have changed just as local ones have deteriorated so my judgment is we won’t get bailed out a 3rd time.

The complete lack of new product from 26 through 30 is going to be devastating for affordability and should strongly reward people who can take advantage of near term discounts or hold for 4+ years.

Marty

at 4:35 pm

Can’t wait for the Thursday conclusion!

Sirgruper

at 4:45 pm

OK. I’ll bite. Firstly, I agree that you are in an excellent position to invest and you should buy what you know. You can find the best product and actually get paid (reduction of cost for tax purposes:)) to buy. I also agree with your thesis and although you may be early, anyone who says they know timing are kidding themselves.

That said, you are buying in an older building that will over the next 10 years have roof replacements, balcony work etc, and therefore will be considered less desirable to newer product. Regardless, when you buy, what do you have? An asset that you have to rent and look after and what is your income yield? 4% likely if all cash. Now you have a tenant that you can only increase rents at below inflation no matter your increased costs. You can leverage but since you can’t borrow for 4% your return goes down.

Next, this is not the only investment product around. Is this a better investment than a bank stock with a 5+% dividend that is more tax effective? There are no throw away Land Transfer Tax costs or commissions of any import on sale. If you like real estate (rhetorical) why not a commercial property. With the same skill, you can find a commercial property with a 6-8% cap rate. Commercial property will also give you the appreciation lift and you can pass on increased costs through Additional Rents and you are not stuck with cap increases set by government or residential tenancy straight jackets.

You probably will do very well and I hope you do. Its just one of many investments out there and I’m not sure given the headaches of residential real estate rental, it would be my first choice.

Ace Goodheart

at 6:09 pm

This post sets out every reason why I would never buy a condo.

There just isn’t enough upside, and the hassle of owning it is not worth the rather meagre ROI

Like he said, buy a bank stock and sleep through the next ten years. When you wake up, you’ll have earned around 6-7% per year including dividends. Put it in your TFSA and you don’t even need to declare the income.

There is just so much hassle involved in owning that, from empty home tax filing to monthly rent collection and maintenance requests, bad tenants, tenants who sublet, yearly income tax filing and all the rest of it, just to earn a 4% return that you could get on a GIC.

It makes no sense

Good luck with it.

David Fleming

at 9:50 pm

@ Ace Goodheart

Including “appreciation,” I expect to make a 35-40% yearly ROI over the next five years.

But I put appreicaiton in quotations becuase the unit was so under-valued and under-sold that I’m simply going to recapture the loss that the owner gave up.

OSCAR LUTGARDIS

at 10:00 pm

Lmfaoooo

“35-40% yearly ROI”

🫵🤣

David Fleming

at 10:47 pm

You know, I could have just sat back and said nothing.

But I want it out there. I want it on the record.

Read part-two on Thursday and you’ll see why.

Sirgruper

at 11:47 pm

Truly hope you’re right and look forward to the math. That said, sht happens. People that bought office towers in nyc in 2018, Detroit property owners in the 50’s. Ya just never know. And clearly you are using leverage which if you are right, the roi will be great, but if too early, not so much. Looking forward to Thursday and I applaud the bravery of putting your money where your blog is.

Ace Goodheart

at 7:57 am

Interesting.

I’ve found with real estate that it’s a minimum ten year play if you want a good return.

And you need a “swan style” event to get up to 35% – 40% over a five year period.

Are you talking 35 -40% per year, or aggregate?

If you buy a bank stock you get close to, or more than that in total returns over five years if you reinvest the dividends.

I’m not seeing that kind of return on a condo. It might be worth 100k more in five years, maybe 150k. I don’t see the kind of upside you see, particularly in an older building that will need expensive work done to it.

And what happens if the tenant decides not to pay you? A year or more in the tribunal? And they might not even evict them (there’s a housing crisis so maybe the tenant gets to stay for free because evicting them wouldn’t be fair to them).

Appraiser

at 7:17 am

What other investment can you buy where you borrow money from the bank and someone else makes the loan payments for you?

Libertarian

at 11:17 am

Are you serious? That question must be a joke. All these years commenting on this blog and you still say stuff like this. Please stop talking about investments. After all, the rest of us don’t talk about the appraisal business.

As for the other comments in this chain, I’m with Sirgruper and Ace. Being a landlord doesn’t interest me in the least bit. Much easier ways to earn a better return. But as they stated, David probably got a great deal on this, perhaps even a steal, so he will make money. Congrats David. That’s now a condo for each of your kids, correct?

Appraiser

at 11:44 am

I’ve been investing in real estate for over 30 years and retired happily because of it. Putting my money where my mouth is has paid off handsomely.

But thanks for the “friendly” advice.

P.S. All these years and still so bitter – sad.

Libertarian

at 12:56 pm

You have misinterpreted my comment. I’m not sad or bitter. Here, I’ll use plain language.

You asked – What other investment can you buy where you borrow money from the bank and someone else makes the loan payments for you?

Did you know you can borrow money from the bank and buy dividend stocks? Every 3 months they pay out those dividends to you, which you can use to pay down the loan. So to use your timeline of 30 years, if you borrowed money and bought shares of RBC 30 years ago, you’d be even richer than you are now.

You should put a disclaimer in all your comments that the only thing you know is real estate, so any comments about investing should be taken with a grain of salt.

Derek

at 2:15 pm

This is a pretty funny exchange. If you would have answered his first post with the 3rd paragraph of your last post and full stopped, you two would still be besties!!

OSCAR LUTGARDIS

at 2:50 pm

💀 😂 😆

Imagine not even knowin about dividends and trying to be out here givin investment advice lmao

Good on ya for dispensing some knowledge Lib lol

Adrian

at 9:01 am

Generally I agree with your thesis I would just add one caveat. It takes a long time for a project to go from launch to completion. We are scheduled to have a large number of completions in 2025-2026 which should result in increased supply. These projects all started before the issues in the condo market. You’re right that no one is building now and probably won’t be for a while. But that will result in a dearth of supply in 2028-2029. So as a long term investment I think today is a great time to buy but I think there’s still a risk that rent growth is depressed for the next 2-3 years due to oversupply as well as the government’s plans to limit NPRs. For me, population growth is the biggest unknown but it says something that the intention, at least, is to slow growth.

QuietBard

at 9:52 pm

So you got smoked in the youtube comments section on one of your videos and your response was to write a blog post on it? How are those folks gonna see this comeback if they only watch the videos (by watch I mean read the title and then draw all the conclusions and insights you were going to make without actually sitting through a 30 minute conversation)? Unless your video will cover the same topic. I always said I wasnt sure how the podcast and blog would coexist together.