The inspiration for this blog post arrived in a really, really strange way.

You know when you hear a word for the very first time, you end up hearing it again like five times in the next three days?

Well in the past two weeks, I’ve had three very strange conversations about square footage, all to do with ways in which the square footage isn’t really square.

Does that make sense?

Yes? No? Probably, once I explain it, but not really?

Yeah, I get it. So let me offer the following three scenarios…

–

What about cubic footage?

I believe I wrote a lengthy blog post about this maybe five or ten years ago, but the conversation came up again this past week, and it got me thinking.

I was called in to evaluate a unique hard loft, and I mean “hard” in the very truest sense of the term when it comes to lofts. This was a converted industrial space, now residential units, complete with fluted concrete pillars, cinder-block and brick walls, and exposed ductwork in the soaring 14-foot ceilings.

My evaluation was looking units that have sold in this building, and this building only.

Seems like the best way to look at value, right? It’s what I always do, and what I would expect nearly all agents to do.

The seller had other ideas, however.

After I presented my CMA and gave him an approximate value, he pulled out a presentation of his own!

He claimed that comparing his unit to others in the building had “some merit,” but then proceeded to look at comparable sales from neighbouring buildings, and make adjustments based on his soaring ceilings.

Did he have a point? Maybe. But his numbers were Trump-esque.

His ceilings were 14-feet high, and I valued his loft at around $930 per square foot, again, based on comparable sales in that building.

He looked at sales in three buildings in the area, none of which were as comparable as, well, you know – his building, and then made an adjustment for CUBIC FOOTAGE!

His argument was simple: other lofts have nine or ten foot ceilings, and his have fourteen-foot ceilings.

So if those other lofts were selling for $850 per square foot, with 10-foot ceilings, then his loft should be an additional 40% premium because of his 14-foot ceilings.

I know what you’re thinking, and my mind was racing like yours is right now, thinking of all the retorts I had, and which made the most sense.

I told him that high ceilings were a feature, not unlike a terrace, a walk-in closet, a BBQ gas line, an exposed brick wall, etc.

I explained that the reason we look at square footage is because it’s the easiest way to level the playing field. We might add/subtract value from a comparable unit for a feature, ie. if a comparable unit has a 200 square foot terrace, we might subtract $40,000, and then, all other things being equal, divide by the square footage to find a comparable value.

The same would be true for high ceilings.

He continued to argue.

“You’re buying space,” he told me. “And you get more space with fourteen-foot ceilings than you do with ten-foot ceilings.”

I didn’t know if I was going to win the argument, considering we were sitting in his condo, with his high ceilings, so I asked him a very simple question:

“What do you do up there?”

“Up where?” he asked.

I motioned above our heads, and said, “Up there.”

He was a bit stunned, not really insulted, but I would like to think perhaps the reality was dawning on him.

“We price condos based on square footage because that’s useable, functional, livable space. You can’t really live up there in the air above your couch.”

He nodded along, and I assumed he was following, but then he said, “Well if you’re buying vacant land, you might price it based on buildable square footage, according to how many storeys you can get zoning for.”

Uh-huh.

My reaction:

I suppose I could have followed up with, “Are you building another storey above our heads?” but I wasn’t looking to be condescending, and while often that drives the point home, I wasn’t sure it would help at this point.

If a loft had 16-foot ceilings, you could, in theory, build a platform for additional square footage. You would have to get approval from the Condominium Board, and likely submit architectural and engineer’s drawings, but it’s not impossible.

In some condos, like the Tip Top Lofts, there are platform areas above existing space, ie. storage areas overtop of the bathroom, or in some cases, a ladder leading to a desk and chair on a platform above the bedroom, but in this case, you’d have to be 4-feet tall, or never stand up.

I had a friend who lived in a bachelor unit in the Kensington Lofts and his bed was on a platform on top of the bathroom ceiling. He had to climb a ladder up and down, and it was not a spiral staircase or anything – it was an actual ladder.

When this property went up for sale, do you think we marketed that space as square footage?

Hell no.

That’s not square footage, and to suggest as much would be false advertising (as though there were such a thing in our line of work, but I digress…).

In the case of the evaluation I described above, the owner wasn’t looking to build additional square footage; he was just looking to argue about value, as though if he could win me over, it meant he would win the market over.

To suggest a 40% premium was warranted for air rights was silly, and I told him as much.

I explained that true value exists only in the form of what a buyer would pay, and not how a seller values it, or even what a seller pays. Think of the concept of superadequacies; if you spent $25,000 on a feature in your home that you value, but most buyers don’t, then it doesn’t add $25,000 in true value. Commission a bronze statue of yourself to be cast, and then install it on your front lawn. Do you think whatever you paid for the statue should be added to the value of your house?

When looking at 14-foot ceilings in a loft space and comparing to a similar unit with 10-foot ceilings, I would recommend a lump-sum adjustment. This was a 2-bed, 2-bath unit, just under 900 square feet, so I might be inclined to suggest the ceilings add $30,000 – $40,000 in actual value as a feature. The truth is, many buyers won’t care. Many buyers see this as less efficiency for heating in the winter months, and an additional cost.

–

What about triangular footage?

No, really, I’m serious.

Picture a wall in a room, and think back to…….in whichever grade they taught us geometry, and identify the angle.

It’s 90-degrees, right?

All walls are 90-degrees, we know this. This is nothing new.

So when we look at square footage, save for the 1/2-inch baseboards sticking out from the wall, we’re basically looking at the square footage as though it’s all functional, because the walls are at a 90-degree angle.

But what if the walls weren’t?

What if the walls were at a 70-degree angle? Or a 45-degree angle?

I’m not making this up just as an experiment or anything, this is a real conversation I had with a client recently about lofts in converted spaces that have gorgeous original architecture, but often skim functional square footage as a result.

Have a look at this:

Notice the space where the flat-screen TV is?

Notice all the space, from left to right, under the first perpendicular timber column?

Notice how zero of that space is functional?

How in the world would you address price-per-square-foot in a unit like this?

I know, you’re looking at the beautiful stained-glass, and the rare, sought-after timber beams, and thinking that this is a true first-world-problem, and simply an embarrassment of riches.

I’m not denying that this loft is unique, but I am telling you that, having been in this space and many like it, the rooms often lack function.

There’s a reason why the TV is on the floor, right? There’s a reason why it’s under the slanted-ceiling?

That’s complete dead-space, and it’s because of the angle of the wall. The pillar doesn’t help either, but that’s a whole other topic. As a result, the couch is pushed to one side of the room, the TV is on the floor, and there’s a ton of wasted square footage.

So how do you account for this space?

You don’t. On paper, that is. I can almost guarantee that this property was sold from the developer based on square footage, and the existing owner is doing the same. If this unit is, for argument’s sake, 900 square feet, they will undoubtedly market it as such. But where that TV is, say up to the first pillar, is not functional space. In my opinion, the space doesn’t become functional until you’re standing halfway between the two black pillars. So call it five feet from the wall, times twenty-five feet across the length of the condo, and suddenly you’re losing 125 square feeet of actual square footage.

Surely this has to be taken into consideration in the eyes of a buyer, no?

Would you make an offer, at the prevailing “price per square foot” in the building, for this unit? Or would you make an adjustment?

–

What about angular space?

Any fans of The Simpsons in the house?

I haven’t watched this show in at least fifteen years, maybe more. But we all remember the “Fallout Boy” episode, where Millhouse gets chosen to play Fallout Boy in the movie. Remember when they finally wrap the “Jiminy Jillikers” scene, and the producer pipes up and says, “We have to get it from different angles!”

Well, that’s what I always think of when I enter condos with really angular floor plans.

And on occasion, I’ll test my clients to see if they were Simpsons fans when they were younger.

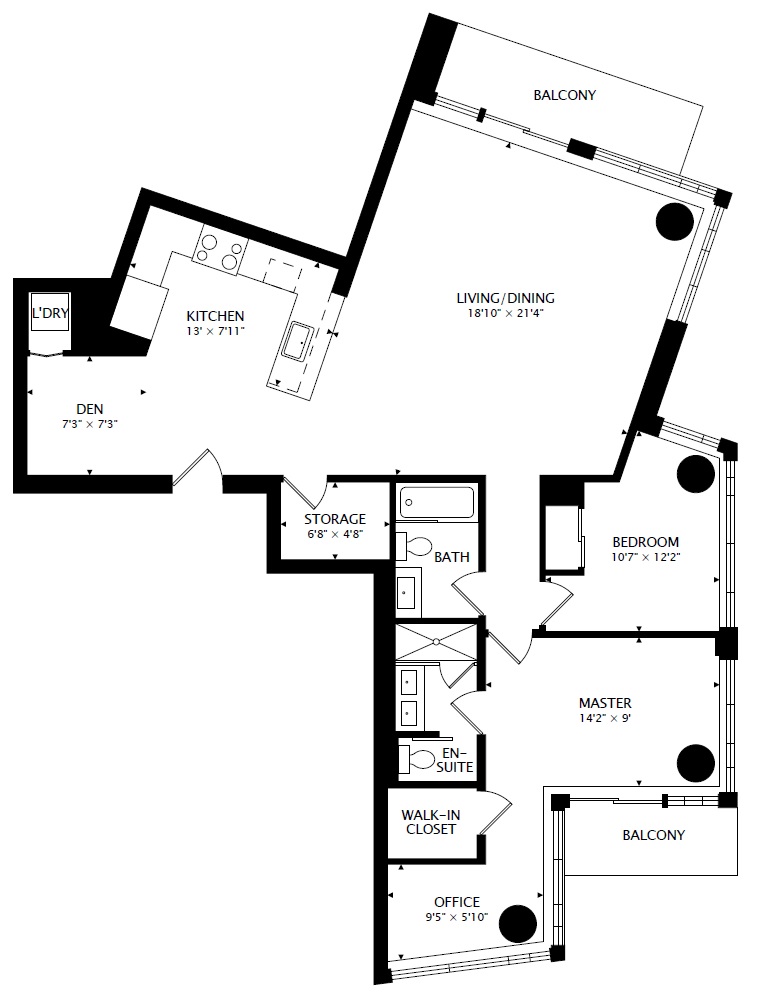

Case in point, this awful layout:

Okay, where do we start?

Perhaps at the front of the condo.

So the den has no real issues here, with a perfect 45-degree right angle on the left side, except that because the kitchen is tilted on an axis, it basically flows right into the den.

So you don’t really have a den. You have a kitchen-den, with a weird layout.

The living room offers a similar situation. If you stand in front of the bathroom, at a slight angle, the room looks square. Except that it’s not, and you’re going to feel it, as the angled kitchen, and square den, confuse the hell out of your eyes. Trust me – I’ve sat on the couch in this layout before many times, and it’s like a fun house.

Most people end up placing their TV on that 120-degree angle wall in the southeast corner of the room, and then tilting their couch on an angle.

Goddam angles. It’s all about ANGLES!

The smaller bedroom only has one corner that’s a right-angle, and the others are all out of whack. Add in that brutal pillar, and you create a dead space in the corner, which also blocks out most of the natural light in the room.

The master bedroom has no odd angles, but does have a pillar – the third such pillar thus far in the condo.

And lastly, the “office,” which for some reason is accessed through the master bedroom, gives us one more angled wall, one more pillar, and a room that 99% of people end up using as a closet.

If I were marketing this property, I would probably play on the fact that with all the angles, you end up with multiple exposures, most notably: southeast, northwest, south-south-west, north-north-east, south-north-west-west, Kanye-north-west, south-west-airlines, north-jupiter-pluto, and fifty-four-forty. Hey, if you got it, flaunt it!

–

Any other square footage oddities that you’d like to share?

I’m all ears…

Appraiser

at 9:46 am

The only thing I know of that is sold by the cubic foot is natural gas, which your potential client in the high-ceiling loft is plenty full of.

Real estate millennial

at 9:49 am

I definitely took some things out of context last blog post my apologies. The first one with extra ceiling height is funny homeowners are hilarious. You’re also probably one of the few realtors who knows what super-adequacies are, which is great.

Ceiling height over 10 feet usually fits into the law of diminishing returns the extra height usually has little to no bearing on the market. In appraisal we’ll attempt to isolate the one variable and see how that differs by percentage to the comps. I’d also look into his mpac tax assessment and see if properties of a similar size pay similar taxes. The city uses a regression analysis and if the change in value is only a couple percent you know the market doesn’t care about the extra 4 feet. (Not because the assessment value is right but the formula they use takes into consideration the extra height and can be measured in the delta)

The biggest thing homeowners forget is that banks are buying your property not actual consumers, as we have very few cash buyers here. The lending criteria for the appraisal to secure financing is stringent. In a slowing market (transactions down over 20% since the peak) deviating to much from recent comparables will simply just kill the financing.

Daniel

at 10:03 am

Not sure if it qualifies as an oddity, or just a stupidity, but in real estate development there are no standardized definitions for square footage. Generally speaking, there are three different measures – gross constructable area (which usually includes all indoor and outdoor space, above and below grade), gross buildable area (generally considered to be the floor area as measured from the building envelope in) and gross floor area (which is the GBA with deductions. The deductions vary depending on the zoning bylaw but generally they exclude penetrations in the slab like elevator banks and vertical ducting). While there is some mutual understanding of how each of these is measured, there are lots of differences in interpretation.

Now, before anyone gets @ me, when it comes to leasing space there are BOMA standards, however, these aren’t really the same as the figures used in the development process.

Real estate millennial

at 10:57 am

Gross floor area minus those deductions will give you useable floor area. Each metric is used to measure a different aspect. Which is important because of how commercial property is built, leased and sold. The design bid-build process requires a closed bid process from various companies and has to be awarded to the lowest bid. In order to estimate properly you need the different metrics – finished space is more expensive, below grade requires different concrete mixes changing the cost and etc. Your GBA is used pertaining to zoning by laws determining how large the building envelope can be and likelihood of attaining a variance if desired or needed. Usable area is used in lease or sale of the space and where you’d apply the cap rate. That was a long winded way of saying commercial is more complex and each metric speaks to a different user of the information. Low density residential is much more straight forward.

daniel b

at 1:30 am

think you maybe missed my point. Take one drawing set and give it to different developers, CM’s, cost estimators, and you’ll get different numbers for each of the floor areas because different groups define the areas differently.

Gord McCormick

at 11:18 am

Our Board here in Ottawa does not allow us to publish square footage, I believe primarily for the potential for inaccuracies and legal issues. The situations you detail above are excellent examples of where square footage is not liveable space. Great examples, as always!

Libertarian

at 3:05 pm

I don’t blame the loft guy for trying to get more money. I’m sure there’s some buyer agent with a client out there who would fall for it! Especially because condos are on fire. But more importantly, because of what George Carlin said about dumb people.

Appraiser

at 3:54 pm

“The Fed on Wednesday left its overnight benchmark lending rate in a target range of 2.25 percent to 2.50 percent.

The slight downgrade in the Fed’s language around rate increases included a change in its description of economic growth from “strong” to “solid,” and it noted that market-based measures of inflation compensation have “moved lower in recent months.”

https://www.cbc.ca/news/business/fed-interest-rates-1.4999021

“The Fed’s policy decision was unanimous.”

Well it was a nice little run there for the U.S. economy, but the major goosing from an unprecedented tax break for corporations that Trump introduced is starting to wear thin.

Rate hikes look to be in the rear view mirror for a while.

Housing Bear

at 10:32 am

Big announcement yesterday. BOC will probably stop rate hikes now too which is good for recent buyers (although I think they have probably already hiked far enough to cause some serious pain). The bigger thing from that announcement, and the one making me question my position a lot more was Powell changing his tune on QT and even suggesting QE4 is on the table if need be. Mortgage rates can go up even if central banks are holding or cutting rates. QE puts a crap ton more money in banks reserves to lend back out and drives down comparable yields meaning that banks can keep their mortgage rates closer to CB rates.

Big questions. 1) Why the sudden 180 by the FED – Are they now slaves to the stock market or do they see something nasty coming down the pipeline?.- Tough call 2)Would Powell use QE before a recession hits the US. – I dont think so. 3) Does Canada go into recession before the US – I think so

Even if the questions above all fall in favor of supporting our RE markets, I am still certain housing values in Canada will fall in real terms but maybe not so much in nominal terms. IE your million dollar house will still sell for around a million dollars Canadian. Its just that 1 million Canadian will only buy you half of what it use to. Or if today you could trade your house or $1000 000 CAD for 500 000 Tim Horton coffees soon you will only be able to trade the house or $1000 000 CAD for 250-300 000 Tim Horton coffees.

Mxyzptlk

at 11:41 am

Why will C$1m “only buy you half of what it use to” at least at Tim’s? Will the world coffee crop collapse? I don’t get it.

Housing Bear

at 12:22 pm

Not necessarily half, and coffee was just an example, it would actually apply first to all goods that we need to import, which in turn would raise input costs, hopefully wages, and eventually Canadian made goods.

The idea in very simple terms is this. If say housing or assets in general, were 25-30% overvalued vs consumer goods and currency. Rather than letting the price of the over inflated assets fall which could result in existing debts being worth more than their underlying value (very deflationary) , you allow the price of everything else to increase to bring balance (currency devaluation). If you take currency out of the equation for a second, say historically long term an average GTA house is worth 100 donkeys, but today GTA houses are going for 130 donkeys. Instead of letting housing prices fall, you raise the price of donkeys to a point where 100 donkeys again buys you an average GTA house.

To expand, say a donkey costs 10 bucks in Canadian currency. That means that an average GTA house would cost $1300 in Canadian dollars (130 donkeys x $10) when historically it should only cost $1000 (100 donkeys x $10). If you devalue the currency by about 25%, then the donkey would now costs $13 per. 100 donkeys x $13 now equals the value of an average gta home ($1300) and the value of donkeys to average GTA housing is now back to its historical balance. Note, the house is still worth the exact same in Canadian dollars. Which is $1300. Its just that $1300 buys you 25% less donkeys, coffee, gas, etc.

Mxyzptlk

at 12:58 pm

Yes, of course coffee (well, Tim’s, which isn’t really *coffee*) was only an example (and a humorous one, at that) but do you really expect the Canuck buck to drop that precipitously in the near-to-mid-term? If it were in the US$1.05 range (see 2011) it could certainly do so, but from US$0.75 to under fifty yankee cents? Hard to imagine. Here’s hoping you’re wrong (no offense).

Housing Bear

at 1:40 pm

I don’t think currency devaluation will be used to fully bring inflated assets back in balance with everything else we buy. This strategy only really works if we can make sure wages increase proportionately and its still risky because you dont want the masses to lose faith in the currency. We have had low 60c loonies before (Trudeau 1 for example) . Just my big take away from Powell’s speech yesterday is that this strategy is going to be used more than i thought it would be, unless of course there is some serious negative economic news about to hit. Global economy is looking weak, China has been slowing and just did a bail out of their banks, Brexit, Italy, Germany all looking wobbly, Canada looks like it is tipping into recession and several other economies look shaky. Housing prices here will still fall but maybe not as much as I thought they would, still trying to wrap my head around it all, but was definitely a big announcement. By revisit my strategy I mean maybe I am too cash and short term debt heavy. Maybe jump back into housing market earlier.

Christopher

at 4:04 pm

I recall running into some major descrepencies in the reported square footage for regular rectangle shaped condos. How does the selling agent properly verify the square footage?

Alexander

at 10:28 pm

Developers are charging extra for 9 or 10 ft ceilings, so people familiar with those calculations can give us a shout. I personally would pay more for 10′ ceiling apartment, but have to think twice about getting 14′ one because of the heating. But it would certainly be nice to have though.

Appraiser

at 11:13 am

“Canada is going through its biggest surge in international immigration on record with almost 100,000, or about a quarter, of those landing in Toronto in the year through July. That helped send rents for purpose-built units up 17 percent in the third quarter over the same period the prior year, according to research firm Urbanation Inc. Companies including GWL Realty Advisors Inc. and Tricon Capital Group Inc have also been expanding in the sector.”

https://www.bloomberg.com/news/articles/2019-01-31/sun-life-unit-bets-on-toronto-home-rentals-warehouse-boom

Housing Bear

at 1:44 pm

Yup, and despite this YOY retail sales, auto sales and mortgage growth are all down. Means an even big drop on per capita basis.

Looks like we might be tipping into recession.

Appraiser

at 5:38 pm

Recessions are not the end of the world. We’ve had them and survived every time.

But the word tends to scare the hell out of some people. So frightening.

paul

at 3:22 pm

you forgot westjet exposure LOL

Appraiser

at 5:36 pm

TREB MEDIA STATEMENT:

“TORONTO, ONTARIO – January 31, 2019 – The Toronto Real Estate Board (TREB) applauds Toronto City Council for moving forward with Mayor Tory’s “Housing Now” plan.

The “Housing Now” initiative is an excellent first step for City Council to take with regard to housing supply. Using surplus City land is an opportunity to get immediate results.

TREB strongly believes that governments at all levels should be focused on increasing the supply of housing and facilitating an appropriate mix of housing types and tenures. By moving forward with Mayor Tory’s “Housing Now” plan, City Council has taken an important step in addressing one of the biggest challenges facing the City of Toronto.”