Happy Monday, folks!

There’s nothing quite like discussing the misfortune of others to get our week off to a great start!

An agent in my brokerage, who shall remain nameless, came by my office last week and said, “What’s with all the doom-and-gloom on your blog, man?”

First of all, thanks for reading my blog. As a part-time “full-time” agent, it’s great to know that while you’re not playing tennis or using the word “summer” as a verb, you’re frequenting TRB.

Secondly, there’s no doom-and-gloom on the blog. Am I missing something?

He proceeded to tell me that some of his friends and clients read my blog (which didn’t seem to embarrass him…) and that they’ve asked him what’s going on in the market as a result. His response was of the “Everything is fine here, folks! Sell, sell sell!” variety, which you know I don’t subscribe to.

I enjoy working in any and all markets. Red-hot, white-hot, lukewarm, or tepid. Up, down, sideways. Buyer’s market, seller’s market. I enjoy the challenge of any market, and personally, I enjoy variety.

I also enjoy writing about what’s happening in the market, whether it’s my stories from the trenches, my analysis of real estate statistics, or my predictions or what lays ahead.

Some agents out there do not want anything remotely negative said about the real estate market, and this part-timer who popped by in board shorts last week wondered why I was writing not one, but two blogs about the decline in CREA HPI in various regions across the country.

Um, I dunno, because it’s newsworthy? Because it’s a snapshot of the market? Because it spurs conversation?

Don’t get me wrong, I’m not a market bear. But I am aware of what’s happening in our market, and will always look to remain objective.

So with that preamble out of the way, I am ready for the scorn that will soon be thrust upon me from agents who work the regions that we’re about to discuss.

I wanted to look at a few properties that sold earlier in the year, failed to close, and have since been re-sold.

And again, our goal here today isn’t to shine a spotlight on the financial difficulties of a few unfortunate souls, nor is it to rejoice in a market decline felt by some of our neighbours and colleagues. The goal here is to look at how this happens when it happens.

Here’s our first example:

This property was listed in November of 2021 for $2,500,000 and finally sold in January of 2022 for $2,125,000.

The scheduled closing date was April 27th, 2022.

But that sale never closed.

I am not privy to the details, but suffice it to say, the property was re-listed on May 26th at $2,149,000, which was actually above what the property sold for in January, and amazingly, the property sold on June 11th for $2,150,000.

This property actually sold for a higher price in June than in January.

So it’s not impossible, right?

Unfortunately for the market participants, this was the only example of a property selling for a higher amount that I was able to find.

Here’s another example, and this is more common:

This property was listed for an absolutely silly $699,900 and sold for $1,110,000 on March 1st, 2022.

That’s 158% of the list price.

You might wonder, “How many offers were on this property – to necessitate such an incredible price?”

Well, in actual fact, this property was sold via bully offer. The MLS listing was updated to say that the offer date was moved up!

So the buyers and the buyer agent were being exceptionally agressive.

This sale was scheduled to close on May 27th, 2022.

But it did not!

And on June 8th, 2022, the property was re-listed for $699,900 once again.

And once again, there was a set offer date.

And once again, a bully offer was presented!

Oh boy! History repeating itself, eh?

This bully offer was $185,000 less than the bully offer they’d received three months earlier, but it was clearly “good enough” at the time, so it was accepted.

And here we see a property selling for 16.7% less in June than in March.

Here’s another example:

This property was actually listed for $1,399,900 on February 27th, 2022, with an offer daste scheduled for Monday, March 7th.

The seller clearly didn’t get what he or she was looking for, so that listing was terminated and the property was re-listed for $1,799,000.

Clearly, a buyer out there saw the value and paid $1,760,000 for the house on March 9th, 2022.

This sale was scheduled to close on May 31st, 2022, aka my mother’s birthday!

But my mother was clearly the only one celebrating on that day, because the deal did not close.

In fact, unlike the previous example where the seller waited 12 days after the scheduled closing in order to re-list, this seller re-listed on the very same day the deal was supposed to close!

May 31st, 2022, the property was re-listed for $1,499,000 and the listing clearly showed the seller’s hand:

What can ya do when you live in a shoe? Right??

The brokerage remarks read: “Seller Prefers Fast Closing.”

Oh, you don’t say?

The seller actually got above the list price, which is shocking. Maybe they sold their couch?

But $1,508,000 is 14.3% less than they’d sold for in March.

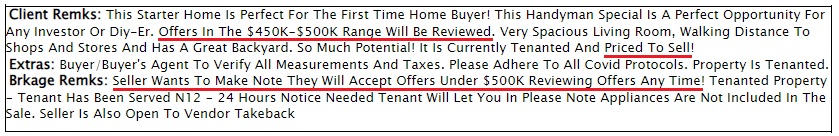

Here’s another:

This property was listed for sale on February 22nd, 2022 for a whopping $649,000. Suffice it to say, that was a tad high!

Re-listed $100,000 lower on March 3rd, 2022, the property sold for over asking at $560,000.

The sale was scheduled to close on June 9th, 2022.

But that sale fell through!

And when the property was re-listed, this is what the MLS remarks showed:

So the property was listed for $529,999, and yet the MLS remarks said that the sellers would consider an offer of $450,000?

I’ve never seen that.

Never. Not once in nearly two decades.

It’s very odd to see one note about “Offers Under $500K” and then another note about “Offers In The $450K – $500K Range.”

In the end, this property sold for 19.6% less the second time around.

Here’s one in the west end:

This property was listed in March for $899,900, and strangely, they didn’t have an offer date and yet it’s clear they weren’t going to take the list price.

Why?

Because it was re-listed higher by $100,000 one month later, and this time, they sold for just under list, at $995,000, on April 13th.

That sale was scheduled to close on June 21st, 2022.

But there was clearly some sort of anticipatory breach, because the property was re-listed on May 6th, 2022, for $899,000. It remained on the market for 25 days.

On June 3rd, in what seems like a desperation move, in my opinion, the house was listed for $750,000, with an offer date, and amazingly, this worked, as they sold for $855,000.

Now, did it really “work?” I guess that depends on your feeling on price expectations.

The June 11th sale came with a June 29th closing.

It sure feels like the sellers needed that quick closing, probably because they had bought another house.

So a $995,000 initial sale turns into an $855,000 sale two months later. That’s a drop of 14.1%.

One more, and we’ll go further out of the GTA this time:

This property was listed for sale on March 7th, 2022, and there was an offer date set for March 14th.

The property sold for $181,100 over the list price, or 124%.

But the sale didn’t close!

And in June, the house was re-listed, rather oddly at $10,000 higher than the previous list price, although there was no “offer date” this time.

As you can see above, the house sold well under the list price.

And that $931,000 initial sale, down to a $700,000 sale three months later, represents a difference of 24.8%.

–

You might be wondering, “Just how common are these situations?”

My team and I combed through close to a thousand listings to find the six properties above. It was labourious, to say the least. But it was kind of like fishing, where you’re so used to getting nothing, then when you finally do get a bite, you seem surprised, even though that was the entire purpose of the exercise…

So what happens in these situations?

Where does the deposit money go? Is the original buyer liable?

Let’s save that discussion for another day…

JF007

at 6:23 am

Interesting read ..so a thousand listings reviewed to get 6 such scenarios so a .6% rate meh would have thought it to be much higher I know quite a few people who are waiting on the sidelines for such things to be more widespread so that things can come down to their price points..time will tell if the contagion spreads or not..

Appraiser

at 7:43 am

And not a single one in the 416. Some contagion.

JF007

at 10:06 am

416 as we saw took a a gradual appreciation route to where it is today it didn’t go as bonkers as suburbs did from Fall’20 to Mar’22..would be interesting to see where things land after the shake up was reading something about a lawyer changing his business model to only deal with above situations as he was saying 6 cases or something every month on his desk..

Appraiser

at 10:15 am

Funny how anecdotes never match reality.

Mxyzptlk

at 9:53 am

“…was reading something about… he was saying 6 cases or something every month… “

That’s a whole lotta “somethings.”

London Agent

at 10:22 am

Curious to know how they feel about their interest rates rising while they wait on the sidelines for prices to fall into their price point.

JF007

at 10:45 am

true..David’s analysis few blogs back attests to it..that as prices come down a few notches rates go up and consequently EMIs but i think people think about monthly costs after they ensure they have enough to put 20% down and that’s where the desire to see prices to come down to begin with different matter that with lower prices they probably still can’t manage the mortgage due to higher borrowing cost..

Bal

at 10:49 am

.maybe losing deposit is worth for buyers if they can find a cheaper house….

David

at 11:28 am

Buyers are still liable for the difference in the selling price, plus any additional costs incurred by the seller.

Bal

at 1:06 pm

do you really think all Sellers are going to court hassle without knowing if they will even win

Condodweller

at 12:47 pm

According to David, it’s an open and shut case. Why wouldn’t they sue for the difference? They had a signed contract. At the very least I would assume they can get the deposit.

Sirgruper

at 7:38 pm

Yes and in response to condodweller, a lawsuit is expensive and time consuming. Expect to pay over $50,000+ in legals that you may not get fully back. The other problem occurs if the Buyer becomes insolvent or has lots of debt, the Buyer may be behind the game.

Derek

at 11:31 am

You can click on “Sold Below Bought” on HouseSigma and scroll through them. Here’s a Toronto one. Hopefully, it’s the first, last and only one.

Buy/sell history for 94 Runnymede Rd, Toronto (Detached)W5662822

2022-06-17 $1,475,000

2022-03-28 $1,800,000

W5548227

J G

at 10:47 am

Here’s another one – https://housesigma.com/web/en/house/J6Em7bnEnbj7XBeq/47-Dunstall-Cres-Scarborough-M1E3M5-E5593009

2022-02-10 -> $1,256,100

2022-05-09 -> $980,000

Appraiser’s response -> anecdotal!

Condodweller

at 1:38 pm

anecdotes are the canary in the coal mine…

Mxyzptlk

at 2:28 pm

I’d say “can be” rather than “are.”

sunshine

at 4:24 pm

in the same thread of conversation is preconstruction condos, the rising interest rates coupled with price moderation and increasing closing costs. I wonder if there is any way to track people who walk away from their deposits, or end up assigning the condo for less than they paid going forward. David highlights the risk of preconstruction regularly on this blog, and the current rising interest rate environment may be a serious risk to some investors…

JF007

at 8:43 pm

Think bigger concern would be how long people would remain locked in and the condo won’t be built …read an article last week on cp24 and globe on 5000 cancellations potentially including projects that sold in 209 and haven’t put shovel in ground cuz just between 2021 and 2022 construction costs have gone up by 20% and coupled with rising rates lot of projects are no longer feasible even at over $1000 psqft rates.

Condodweller

at 1:37 pm

This is exactly what happened back in 89. Many projects were canceled but I wasn’t following RE closely then and don’t know what happened to the owners and their pre-sold condos that weren’t built.

Jenn

at 6:48 pm

David how come you don’t out the jerkface from your office who talked smack to you? That would show him!

David Fleming

at 2:28 pm

@ Jenn

I”m flattered that you have my back, but I often subscribe to the saying, “Two wrong’s don’t make a right.”

Man, I’m getting old…

Sirgruper

at 7:50 pm

David

This issue comes up every time there is a negative turn in the market and to me the biggest problem is insufficient deposits. Just had a Durham closing that the deposit was 3% and the value dropped 20% and the Buyer was knee deep in debt. What does the Seller do? The agent who did the transaction said, “That’s the way its done here” which is a ridiculous answer to me. These rules of thumb are fine and good until a bad market. I always tell Sellers that the deposit is important and the size of the deal and the length of the closing is very important. A 5% deposit in a stable or upward market is fine for a 30 day closing but would you take 5% for a 4 month closing in this market? Also, the deposit on a first bid might be 5% but in a bidding situation, the deposit rarely goes up with the purchase price. No good security reason for the deposit not to increase as well. Just my pet peeve along with why do agents choose the end of the month to close. Busiest day for banks, movers, lawyers and there often is no benefit to the parties or a negative to the Buyer and the Seller. Any good reason that you know of other than tradition or the cynical last day to be paid commission?

Peter

at 4:52 pm

Hello!! I would be interested in what happens when a sale doesn’t close and then sells for less? Is the seller still entitled to the original price and have to go to court to settle it or how does it work?